Why Florida Drivers Are Paying Too Much for Car Insurance

Low cost auto insurance Florida is not just a search term—it’s a survival strategy for drivers facing some of the highest premiums in the nation. If you’re looking to cut your car insurance costs in the Sunshine State, here’s what you need to know:

Quick Facts: Florida Car Insurance

- Florida’s average car insurance costs are 68% higher than the national average.

- Minimum required coverage: $10,000 Personal Injury Protection (PIP) + $10,000 Property Damage Liability (PDL).

- Average costs: $77/month for minimum coverage, $307/month for full coverage.

- Some of the most affordable providers offer minimum coverage rates starting around $322 per year.

Living in Florida means enjoying sunshine and beaches, but also some of the most expensive car insurance in America. This isn’t by chance. Florida’s unique no-fault insurance system, frequent hurricanes, and high number of uninsured drivers all contribute to high premiums.

The good news is that understanding why rates are high puts you in control. Whether you’re in Jacksonville, Naples, or Tampa, there are proven strategies to reduce your costs without sacrificing protection.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group. For over three decades, we’ve helped thousands of Florida drivers find low cost auto insurance Florida options that actually protect them. Our agency shops across more than 40 carriers to ensure you’re not overpaying.

Understanding Florida’s Unique Car Insurance Landscape

If you’ve ever wondered why your Florida car insurance bill is so high, you’re not alone. The Sunshine State’s car insurance landscape is unlike almost anywhere else in America, and understanding why is the first step toward finding low cost auto insurance Florida options.

Florida’s No-Fault System and High Premiums

Florida operates under a “no-fault” insurance system. This means after an accident, you turn to your own insurance company first, regardless of who was at fault. To drive legally, you must carry:

- Personal Injury Protection (PIP): A minimum of $10,000. This covers 80% of your medical expenses and 60% of lost wages, protecting you, resident relatives, and certain passengers.

- Property Damage Liability (PDL): A minimum of $10,000. This pays for damage you cause to someone else’s property, like their car or fence.

One surprising fact is that Florida doesn’t require Bodily Injury Liability (BI) coverage, which pays for injuries you cause to others. We strongly recommend this coverage, as you could be personally liable for hundreds of thousands of dollars in medical bills without it. For complete details, you can check Florida’s official insurance requirements.

So, why are Florida’s premiums 68% higher than the national average? It’s a perfect storm of factors:

- Severe Weather: Hurricanes and tropical storms cause widespread vehicle damage from flooding and debris, leading to frequent, costly claims.

- High Population Density & Tourism: More cars on the road in cities like Miami and Orlando simply means more accidents.

- Uninsured Drivers: With over 20% of drivers uninsured, the rest of us pay more to cover the gap through our own policies.

- Frequent Litigation & Fraud: Despite being a no-fault state, Florida sees a high volume of lawsuits and fraudulent claims, driving up legal and claim costs for insurers.

- Market Challenges: The high-risk environment has caused some insurance companies to leave the state. This reduces competition and often leads to higher rates from the remaining carriers.

Understanding these challenges is the first step toward beating them. Finding low cost auto insurance Florida isn’t impossible—it just requires the right strategies.

How Your Driver Profile Impacts Your Florida Insurance Rates

Your car insurance premium is a carefully calculated number based on factors that create your unique insurance fingerprint. Understanding how insurers view your profile is key to finding low cost auto insurance Florida. Once you know what they’re looking at, you can take steps to improve your rates.

Key Factors That Determine Your Premium

Insurers assess your risk based on several key factors. A clean driving record is paramount; accidents, tickets, and DUIs will significantly increase your rates. Your credit-based insurance score also plays a major role, with better credit leading to lower premiums. Other critical factors include your age and driving experience (younger drivers pay more), the vehicle you drive (safer, less expensive cars cost less to insure), your ZIP code (urban and coastal areas have higher rates), and your annual mileage. For more details, the Insurance Information Institute explains what determines the price of an auto insurance policy.

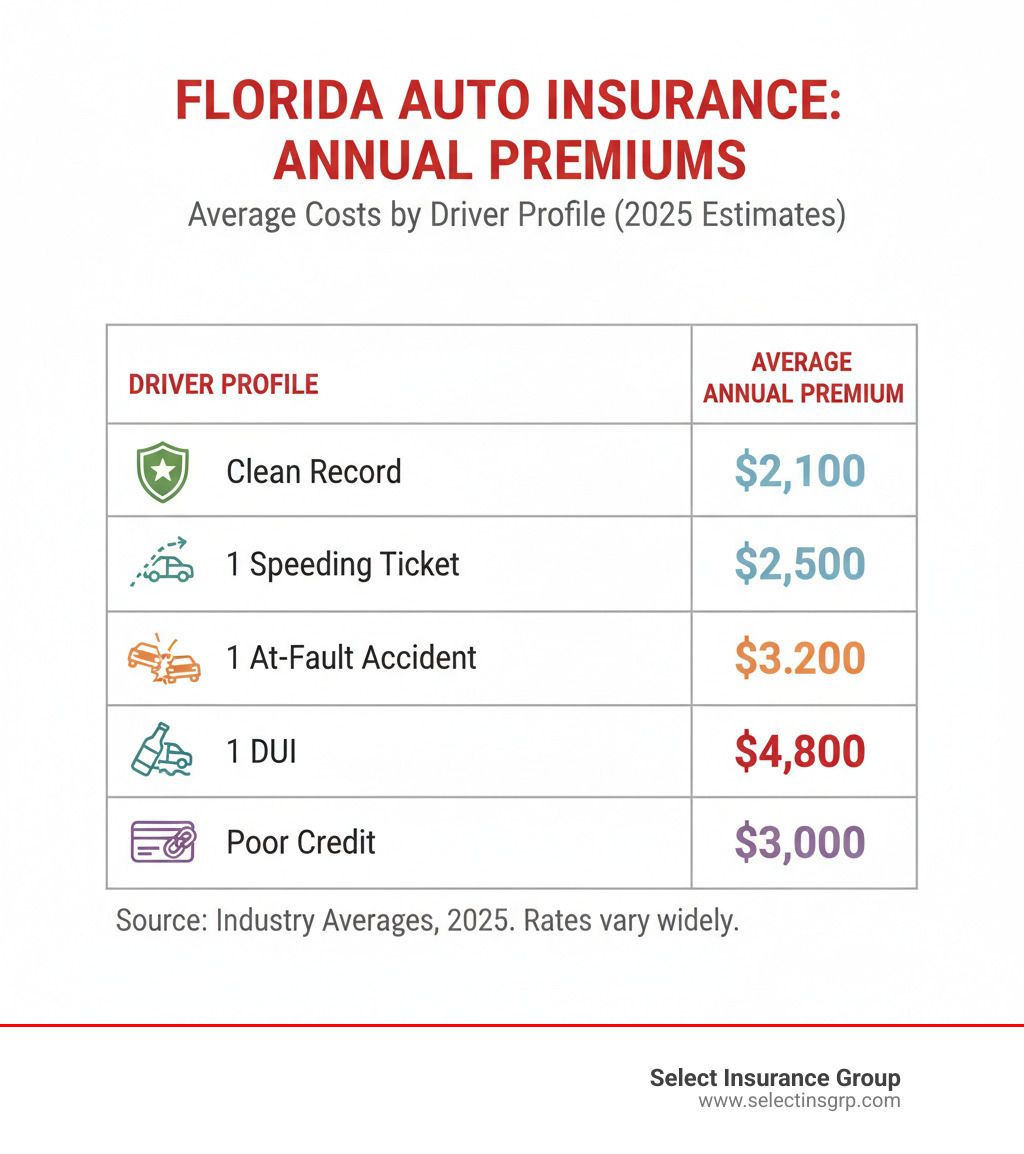

Average Costs for Different Florida Driver Demographics

To know if you’re getting a fair deal, it helps to see what others are paying. Rates are highest for young drivers, who might pay over $600 annually for minimum coverage even with a clean record. Premiums typically drop significantly by your 30s, potentially to around $322 per year. Senior drivers often enjoy the lowest rates, averaging around $267 annually.

However, your record has a huge impact. An at-fault accident can raise minimum coverage rates to around $460 per year, while a DUI can push them even higher, with some drivers seeing their rates double. Similarly, poor credit can result in premiums comparable to those for high-risk drivers, even with a clean record.

These numbers are averages, but they provide a solid benchmark. You can explore more details about Florida Auto Insurance and how we help drivers find affordable coverage. Your driver profile matters, but many of these factors are within your control.

Your Guide to Finding Low Cost Auto Insurance Florida

Finding low cost auto insurance Florida doesn’t have to be overwhelming. With the right approach, you can significantly reduce what you’re paying without leaving yourself exposed.

Minimum vs. Full Coverage: What Do You Really Need?

The first big decision is choosing your coverage level.

- Minimum coverage is the cheapest option, requiring just $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL). However, it’s risky: it won’t pay to fix your car and may not cover all the damage you cause to another vehicle. It’s generally only suitable for older, low-value cars that you could afford to replace out-of-pocket.

- Full coverage costs more but provides crucial protection. It adds collision (fixes your car after an accident) and comprehensive (covers theft, weather damage, etc.) coverage. We also strongly recommend Uninsured/Underinsured Motorist coverage, as over 20% of Florida drivers are uninsured. If you have a newer car, a loan, or significant assets, full coverage is essential.

Proven Strategies and Discounts for Lowering Your Premiums

No matter your coverage level, you can lower your costs. The most powerful strategy is to compare quotes from multiple insurers annually. As an independent agency, we do this for you, shopping across more than 40 carriers.

Here are other effective ways to save:

- Increase Your Deductible: Raising your deductible from $500 to $1,000 can lower your premium. Just be sure you can afford the higher out-of-pocket cost.

- Bundle Your Policies: Insuring your auto and home with the same company can lead to substantial discounts. Learn more about our Florida Home Insurance options.

- Maintain Good Credit: A strong credit history can significantly reduce your insurance rates in Florida.

- Ask About Discounts: Most drivers qualify for discounts they aren’t receiving. Ask about savings for being a good driver, a good student, having multiple cars, vehicle safety features, low mileage, or completing a defensive driving course.

- Use Telematics: Usage-based programs monitor your safe driving habits and can reward you with lower rates.

An experienced independent agent can help you uncover every possible savings opportunity.

Frequently Asked Questions about Florida Car Insurance

Navigating Florida car insurance can bring up a lot of questions. Here, we address some of the most common inquiries to help you find low cost auto insurance Florida.

What are the absolute minimum car insurance requirements in Florida?

Florida law requires a minimum of $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL). These minimums keep you legal but offer very limited protection. The $10,000 PDL may not cover the full cost of a modern vehicle if you’re at fault, leaving you personally liable for the difference. For full details, refer to the Florida Department of Highway Safety and Motor Vehicles.

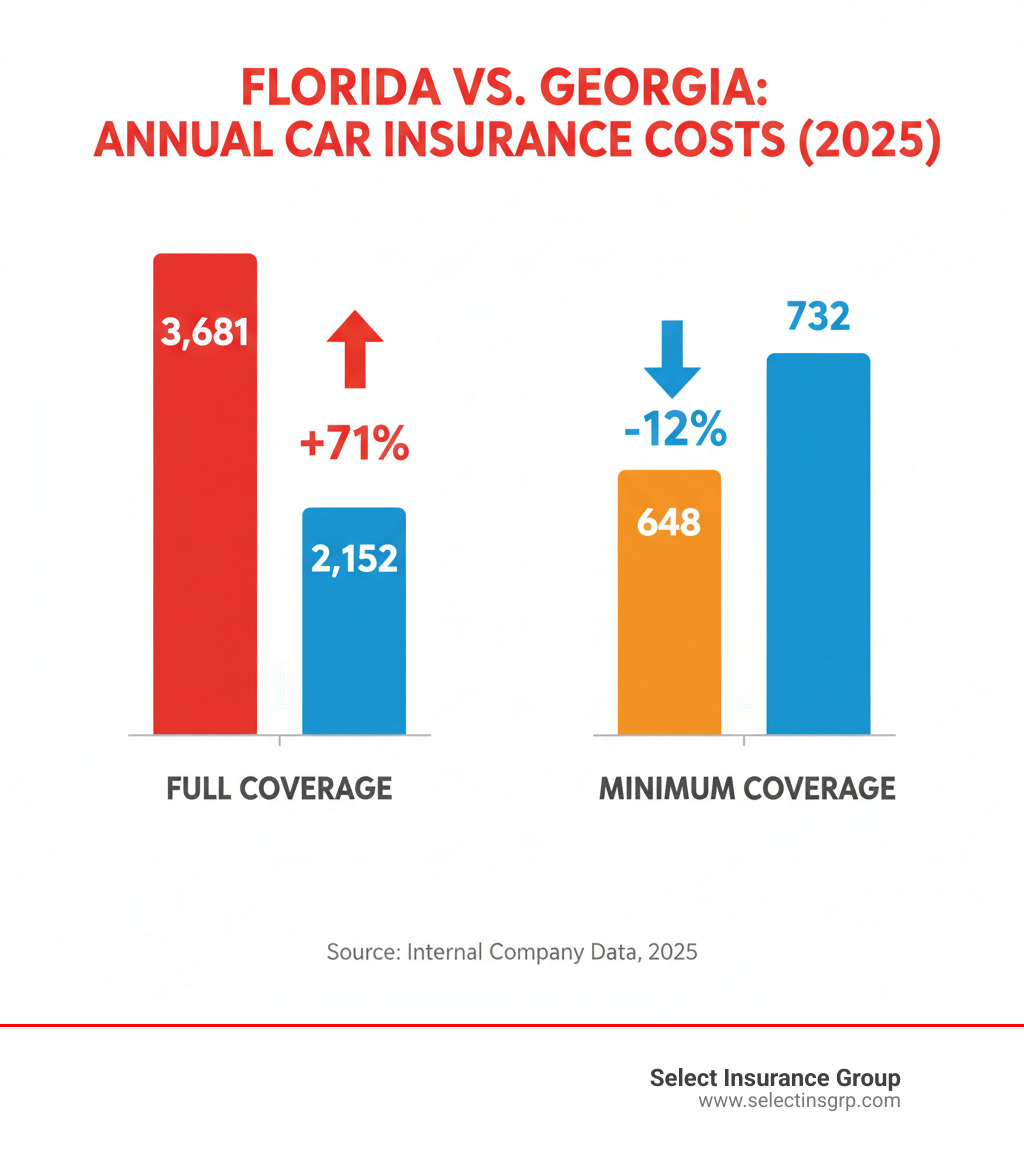

Is car insurance in Florida more expensive than in neighboring states?

Yes. On average, full coverage in Florida is 68% higher than the national average and significantly more expensive than in states like Georgia or Alabama. This is due to Florida’s unique risks, including severe weather, high litigation rates, and a large number of uninsured drivers. While minimum coverage costs can be comparable, full coverage premiums reflect Florida’s higher-risk environment.

Do I need bodily injury liability coverage in Florida?

While not legally required for all drivers, we strongly recommend bodily injury (BI) liability coverage. BI pays for injuries you cause to others in an accident. Without it, you could be held personally responsible for hundreds of thousands of dollars in medical bills, lost wages, and other damages, putting your personal assets at risk. Skipping BI coverage is a gamble not worth taking. For more insights, the Insurance Information Institute offers helpful information.

Conclusion: Take Control of Your Florida Car Insurance Costs

You now understand why Florida car insurance is so expensive and what you can do about it. Finding low cost auto insurance Florida is about making informed, strategic decisions.

By understanding how your driving record, credit, and vehicle affect your rates, you can take control. Strategies like comparing quotes annually, bundling policies, adjusting deductibles, and claiming all available discounts can lead to significant savings.

Navigating these options alone can be overwhelming. That’s the value of an independent insurance agent. At Select Insurance Group, we work for you, not a single insurance company. With over three decades of experience and relationships with more than 40 carriers, we shop the market to find you the best combination of protection and price. We know the Florida landscape and can find savings you might not find on your own.

Your car insurance should provide peace of mind, not financial stress. Ready to see how much you could be saving? Contact an expert at Select Insurance Group today for a personalized quote. You deserve affordable, reliable coverage, and we’re here to help you find it.