Why Understanding Truck Insurance Costs Matters for Your Bottom Line

Average truck insurance cost is a critical expense that can make or break your trucking operation’s profitability. If you’re looking for a quick answer, here’s what commercial truck insurance typically costs:

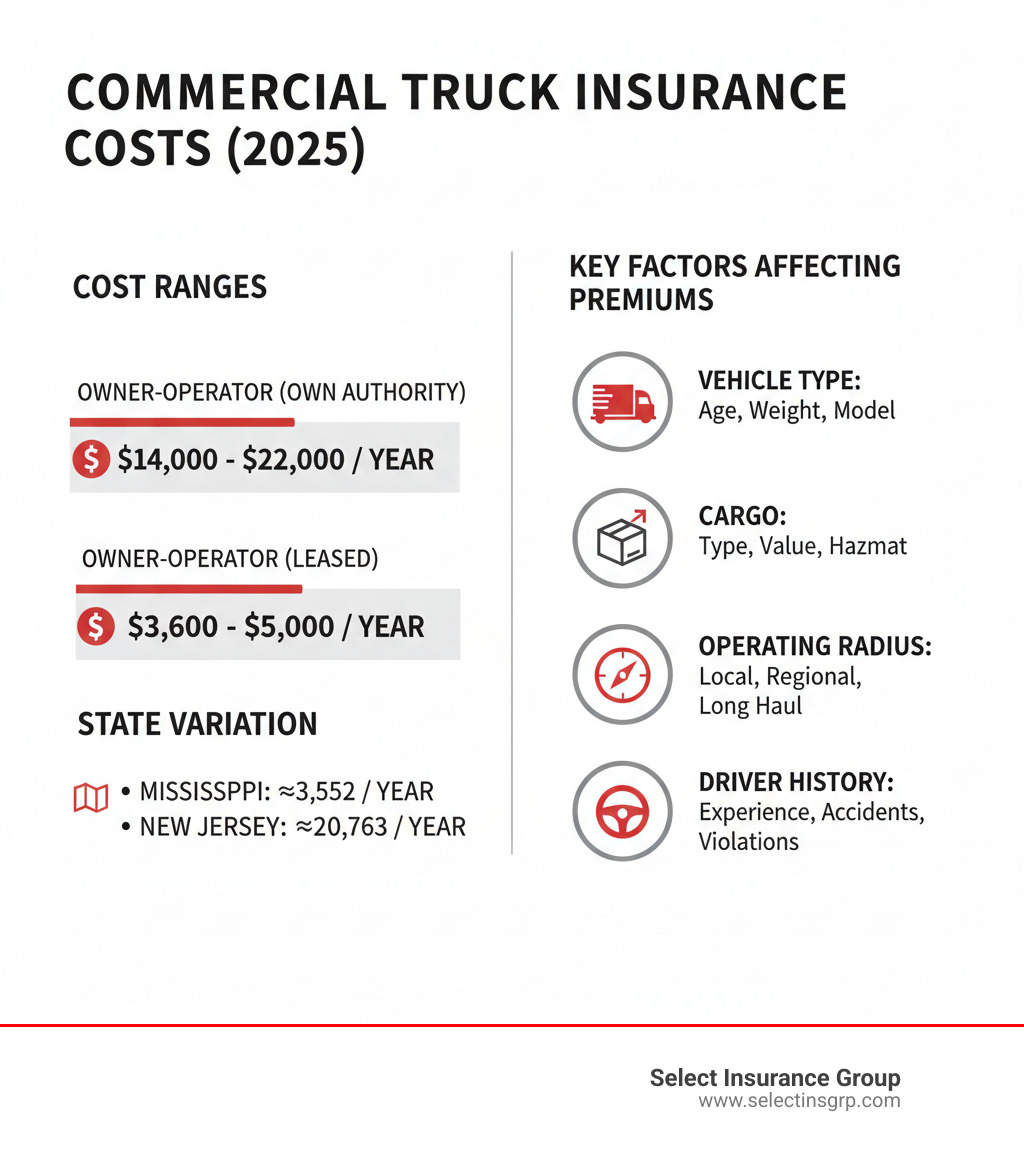

Quick Cost Overview:

- Full Coverage Range: $8,000 to $22,000 per year

- National Monthly Average: $746 to $954 per month

- Owner-Operators (Leased): $300-$400 per month ($3,600-$5,000 annually)

- Owner-Operators (Own Authority): $1,167-$1,833 per month ($14,000-$22,000 annually)

- State Variation: Mississippi averages $3,552 annually, while New Jersey averages $20,763

Commercial truck insurance is one of the largest operational expenses for trucking businesses. Whether you’re an owner-operator in Georgia or manage a fleet in the Carolinas, understanding these costs is essential for protecting your livelihood without overpaying.

According to industry data, sixty-six percent of truckers identify insurance costs and liability as the second biggest challenge they face. This is understandable, considering a single truck accident can cost an average of $148,279, and rising litigation continues to push premiums higher.

The good news is that while costs vary based on factors like operating radius, cargo, and driving history, there are proven strategies to reduce your premiums. The key is understanding what you’re paying for and why.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group. For over three decades, I’ve helped trucking businesses across the Southeast steer the complexities of truck insurance costs. My team and I work with owner-operators and fleet managers to identify premium drivers and implement strategies to bring those costs down.

Breaking Down the Numbers: What is the Average Truck Insurance Cost?

When trucking business owners ask about the average truck insurance cost, there’s no single answer. Your operation is unique, and your insurance costs will reflect that. However, we can provide some solid benchmarks.

Annually, commercial truck insurance premiums typically range from $3,552 to $20,763. Monthly, most truckers hauling general freight pay around $746 to $954. A comprehensive policy often falls between $8,000 to $12,000 per year per truck. These are national averages; your actual cost will depend on many factors.

Owner-Operator vs. Leased-On: A Cost Comparison

How you structure your business is the single biggest factor in your insurance cost.

If you operate under your own authority (with your own USDOT number), you are responsible for primary liability coverage. This independence comes at a price: typically $1,167 to $1,833 per truck, per month ($14,000 to $22,000 annually).

If you’re leased to a motor carrier, they provide primary liability coverage while you’re under dispatch. This dramatically lowers your costs to $300 to $400 per truck, per month ($3,600 to $5,000 annually). However, you’ll still need non-trucking liability and bobtail coverage for when you’re not under dispatch.

How Different Coverage Types Affect Your Bill

Your policy is a bundle of different coverages. Understanding each helps you build the right protection.

- Primary Liability: This federally mandated coverage is your largest expense. It covers damage to others when you’re at fault. Limits start at $750,000 for interstate operations, but many contracts require $1 million.

- Physical Damage: This protects your truck and includes collision and comprehensive (theft, hail, etc.) coverage. It typically runs $1,000 to $3,000 annually, depending on your truck’s value.

- Motor Truck Cargo Insurance: This covers the freight you’re hauling. For $100,000 in coverage, expect to pay $400 to $1,200 annually. The cost rises with the value and risk of the cargo (e.g., electronics vs. gravel).

- General Liability: This protects your business from non-driving incidents, like a slip-and-fall at your office. It typically costs $500 to $800 annually.

- Non-Trucking Liability and Bobtail Coverage: For leased operators, these policies cover you during personal use or when driving without a trailer. They usually cost $350 to $480 annually combined.

- Trailer Interchange Coverage: This protects non-owned trailers you pull under interchange agreements. Budget $600 to $1,000 per trailer.

Understanding these different types of coverage can help you tailor your insurance policy to fit your specific needs, ensuring you have comprehensive protection without overpaying.

Average Truck Insurance Cost by Vehicle Type

The type of vehicle you operate influences your insurance premium. The main factors are vehicle value, repair costs, and damage potential in an accident.

| Truck Type | Average Annual Insurance Cost | Key Cost Factors |

|---|---|---|

| Tractor-Trailer (Semi-Truck) | $7,000 to $12,000 | Primary Liability: $5,000-$7,000 Physical Damage: $1,000-$3,000 |

| Box Truck | $3,000 to $6,000 | Lower damage potential, shorter routes |

| Hot Shot Truck | $5,000 to $7,000 | Time-sensitive freight, smaller configuration |

| Dump Truck | $6,000 to $10,000 | Heavy loads, construction zone operations |

| Tow Truck | $7,000 to $15,000 | High-risk operating environments |

These figures are a starting point. In the next section, we’ll explore other key factors that influence your premiums.

Key Factors That Drive Your Truck Insurance Premiums

Ever wonder why your insurance quote differs from another trucker’s? Insurers use a process called underwriting to assess dozens of variables and predict your risk. Understanding these factors is the first step toward managing your average truck insurance cost.

Your Business Operations

The structure of your business shapes your premiums. Operating under your own USDOT authority means higher premiums because you shoulder all the risk. Being leased to a carrier significantly reduces your insurance burden. Your operating radius also matters; long-haul routes crossing multiple states are riskier than local routes. Even specific routes, like congested urban corridors or mountain passes, carry higher risk. At Select Insurance Group, we find custom Business Auto Insurance solutions that match your operational profile.

Driver Profile and History

Your drivers are your biggest insurance factor. A clean driving record is crucial for keeping premiums low. Accidents, speeding tickets, and other violations signal higher risk and increase rates. CDL experience is also vital; seasoned drivers are lower risk than new ones. Driver age plays a role, with drivers under 25 typically facing higher rates. Strong hiring practices that prioritize experienced, safe drivers can significantly impact your bottom line. Helping your drivers drive safely pays off.

Cargo and Vehicle Details

What you haul and what you drive directly impact your average truck insurance cost. For Motor Truck Cargo insurance, cargo type is key. High-value or hazardous goods cost more to insure than general freight. Hauling hazardous materials, as defined by the nine classes from the FMCSA, requires specialized coverage with much higher limits and premiums. Your truck type, age, and weight also matter. Newer, more expensive trucks cost more to replace, while heavier trucks pose a greater liability risk.

Location, Location, Location

Geography plays an outsized role in insurance costs due to varying state regulations and legal climates. Navigating Commercial Truck Insurance Costs Across States requires understanding these regional differences.

New Jersey is the most expensive state, with average annual premiums around $20,763, followed by Louisiana at $19,736. These states have high traffic density and complex legal systems. On the other end, Mississippi has some of the lowest premiums at $3,552 annually, thanks to less congested roads and a more favorable regulatory environment. Even within a state, urban routes cost more to insure than rural ones.

For our Southeast clients, we understand these nuances. Whether you need Florida Truck Insurance, Georgia Truck Insurance, or coverage in South Carolina, we know how local conditions affect your rates.

Actionable Strategies to Lower Your Insurance Premiums

Understanding what drives the average truck insurance cost is the first step. Now, let’s focus on what you can do to lower it. Many factors can be proactively managed to reduce premiums without compromising protection.

Improve Your Safety Program

A strong safety record is your best tool for lowering premiums. Insurers reward a demonstrated commitment to safety.

- Invest in ongoing driver training that emphasizes defensive driving and safety protocols.

- Implement and enforce clear safety policies. Build a culture where safety always comes first.

- Incentivize clean driving records. Fewer accidents and violations directly translate to lower premiums. Helping drivers drive safely protects your bottom line.

- Perform regular vehicle maintenance and conduct thorough pre-trip and post-trip inspections to prevent accidents caused by mechanical failure.

Optimize Your Policy Structure

Smart financial decisions about your policy can lead to significant savings.

- Increase your deductibles for physical damage coverage to lower your premium. Just ensure you can afford the out-of-pocket cost if you file a claim.

- Bundle multiple policies (commercial auto, general liability, etc.) with one provider to earn discounts.

- Pay your premiums annually instead of monthly. This can save you 13-15%.

- Review your coverage needs periodically with your agent to ensure your policy aligns with your current business operations.

Accept Technology

Technology is a powerful tool for reducing insurance costs. Insurers are taking notice and offering discounts for its use.

- Telematics systems provide data on driver behavior (speeding, harsh braking) that can be used for coaching and proving safe operations to insurers.

- Share Electronic Logging Device (ELD) data. Some programs offer substantial discounts for sharing this verifiable safety data.

- Install AI-powered dashcams. They provide crucial evidence in accidents, protecting you from fraudulent claims and helping to lower premiums.

Compare Your Options

Shopping around is essential for controlling your average truck insurance cost. Rates vary dramatically between providers.

We recommend getting quotes from at least three to five different carriers. Doing this yourself can be time-consuming. This is where working with an independent agent like Select Insurance Group is beneficial. We work with over 40 carriers, so we do the heavy lifting for you, comparing options to find the best rates and coverage for your needs. We know what to look for when considering when comparing quotes and understand the nuances of the trucking industry.

The easiest way to start? Get a quote from us. We’ll shop the market on your behalf.

Understanding the Must-Haves: Federal and State Requirements

Certain coverages are non-negotiable. Federal and state regulators mandate them to ensure you can meet your financial responsibilities in an accident. Understanding these requirements is crucial for compliance and budgeting your average truck insurance cost.

What is the Average Truck Insurance Cost for Minimum Coverage?

Minimum coverage typically refers to liability insurance, which pays for damages and injuries you cause to others. This is the foundation of every commercial truck insurance policy.

- For trucks over 10,000 lbs carrying non-hazardous freight, the federal minimum is $750,000.

- For trucks under 10,000 lbs carrying non-hazardous materials, the minimum is $300,000.

- For trucks transporting hazardous materials, the minimum skyrockets to $5,000,000.

Beyond federal rules, shippers or brokers may require higher limits. Intrastate carriers must follow their state’s minimums, which can sometimes exceed federal guidelines. Each state we serve—including Florida, South Carolina, North Carolina, and Virginia—has specific requirements. While meeting minimums may seem cheaper, a single serious accident can easily exceed these limits, leaving you personally liable for the difference.

What Standard Policies Typically Exclude

Knowing what your policy doesn’t cover is as important as knowing what it does. Common exclusions include:

- Intentional acts: Insurance covers accidents, not deliberate harm.

- Normal wear and tear: Gradual deterioration is a maintenance issue, not an insurance claim.

- Unauthorized drivers: If a driver not listed on your policy has an accident, coverage may be denied.

- Specific high-risk cargo: Some materials may be excluded unless you add a special endorsement.

- Employee injuries: These are covered by Workers’ Compensation insurance, not your commercial auto policy.

- Damage to your own property: You need a separate commercial property policy for this.

- Business interruption: Lost income from downtime requires specialized coverage.

- Fines and penalties: Regulatory fines are your responsibility, not your insurer’s.

Understanding these exclusions helps you identify coverage gaps. At Select Insurance Group, we review these details with every client to ensure there are no surprises.

Frequently Asked Questions about Truck Insurance Costs

We talk to trucking business owners every day, and certain questions about average truck insurance cost come up repeatedly. Here are the answers to some of the most common concerns.

Why is commercial truck insurance so expensive?

Commercial truck insurance is expensive because the risk is incredibly high. A single accident can cause catastrophic damage due to a truck’s massive size and weight. Key factors driving costs include:

- High Damage Potential: Accidents involving large trucks often result in severe injuries and extensive property damage, leading to substantial medical and repair bills.

- Cargo Value: The goods you’re hauling can be worth hundreds of thousands of dollars, and that value needs to be insured against loss.

- Expensive Repairs: Commercial trucks require specialized parts and labor, making repairs far more costly than for passenger cars.

- Litigation Costs: Accidents frequently lead to complex lawsuits with massive settlements. The average truck accident settlement is $148,279, but many cases reach multi-million dollar verdicts.

Insurers price policies to cover these significant and genuine risks.

Which states have the cheapest and most expensive truck insurance?

Your location has a huge impact on your insurance costs. State regulations, traffic density, and legal climates create wide variations.

- Most Affordable: Mississippi consistently offers the lowest rates, with an average local premium of just $3,552 annually. Lower traffic and a favorable legal environment contribute to this. Wyoming is another budget-friendly state at around $4,927.

- Most Expensive: New Jersey has the highest rates in the country, with an average local premium of $20,763. This is due to congested roads, frequent accidents, and a plaintiff-friendly legal climate. Louisiana is close behind at $19,736.

For our clients in the Southeast, costs fall in between. Florida averages $12,872 for local routes, while Georgia is around $15,200.

How much does cargo insurance for $100,000 in coverage typically cost?

For $100,000 in cargo coverage, you can expect to pay between $400 and $1,200 annually.

The cost varies based on what you haul. General freight like building materials will be on the lower end of that range. High-value or theft-prone cargo, such as electronics or pharmaceuticals, will cost more to insure. Perishable goods also carry additional risk and can increase your premium.

Your operating radius and routes can also play a role, as long hauls through high-crime areas increase the risk of theft. If you need higher limits, such as $1 million in coverage, the annual cost typically jumps to $5,000 to $10,000. It’s crucial to accurately declare your cargo’s value to ensure you’re properly covered in the event of a claim.

Conclusion

We’ve covered the many factors that determine the average truck insurance cost, from your business structure and vehicle type to your drivers’ records and home state. While you can’t control every factor, many are within your power to manage.

Investing in safety, maintaining your fleet, embracing technology, and optimizing your policy structure are proactive steps that can significantly lower your premiums. Understanding the difference between paying $3,600 as a leased operator and $22,000 with your own authority gives you the power to make informed decisions for your business.

At Select Insurance Group, we’ve spent over three decades helping trucking businesses across the Southeast. We don’t believe in one-size-fits-all insurance. By working with over 40 carriers, we shop the market on your behalf to find the right policy at a competitive rate for your business in North Carolina, South Carolina, Georgia, Florida, or Virginia.

We know that sixty-six percent of truckers identify insurance costs and liability as the second biggest challenge they face. You don’t have to tackle it alone. We’re here to help you understand your options and find coverage that protects your livelihood without breaking your budget.

Ready to take control of your insurance costs? Contact Us today for a personalized quote. Let’s put our experience and carrier relationships to work for you.