Why Finding Cheap Auto Insurance Orlando Florida Requires a Local Strategy

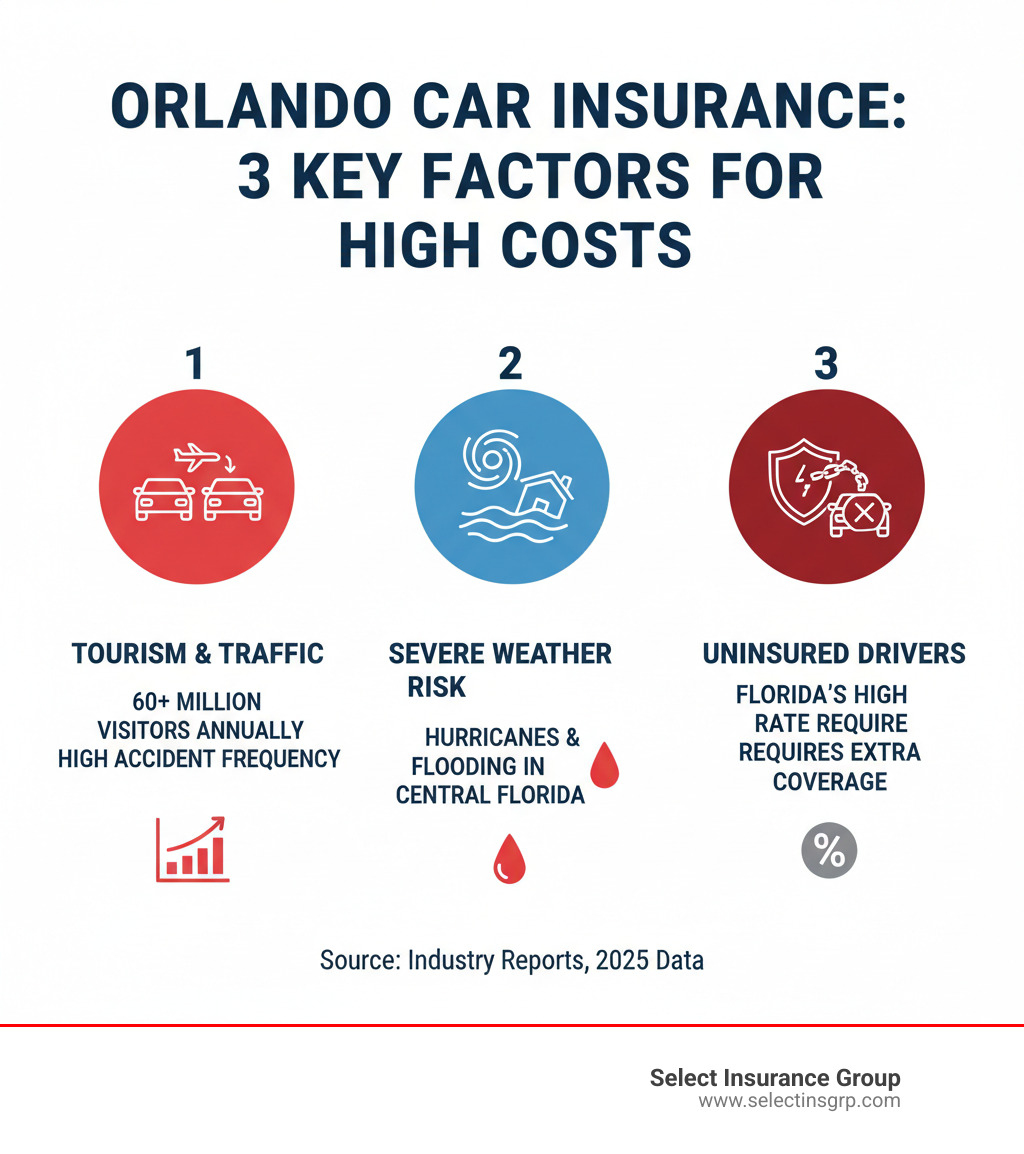

Cheap auto insurance orlando florida is a top search for Central Florida drivers for good reason. Orlando’s heavy tourism, congested highways like I-4, severe weather, and a high rate of uninsured drivers make auto insurance here more expensive than in most of the country.

Quick Answer: How to Get Cheap Auto Insurance in Orlando

- Compare quotes from multiple carriers to find the best rate.

- Maximize all available discounts (good driver, multi-policy, etc.).

- Increase your deductible for an immediate premium reduction.

- Maintain a clean driving record and good credit.

- Work with an independent agent who shops dozens of carriers for you.

- Bundle policies like home and auto for significant savings.

- Review your policy annually to ensure your rate is still competitive.

Florida’s average car insurance cost is 68% higher than the national average, with the state averaging $3,682 annually in 2024. Orlando drivers face extra challenges as the “Theme Park Capital of the World,” attracting over 60 million visitors annually and creating busy roads that increase accident risk.

The good news is that with the right strategy, you can lower your premium without sacrificing coverage. As an insurance professional with over 30 years of experience, I’ve helped thousands of Florida drivers find affordable options by shopping across more than 40 carriers. This guide will show you how to get the lowest rates in Orlando.

Understanding Why Orlando Auto Insurance Is Expensive

If you’ve wondered why your cheap auto insurance orlando florida search returns high numbers, there’s a reason. Florida is one of the priciest states for auto insurance, with 2024 average annual costs of $3,682—about 68% higher than the national average. This is due to several factors that make insuring vehicles in the Sunshine State more expensive.

Orlando faces its own unique challenges. As a hub for theme parks, the city draws over 60 million visitors annually. This leads to packed roads, often with tourists unfamiliar with the area, which increases accident frequency. More accidents mean more claims, driving up premiums for everyone.

Beyond tourism, several other factors contribute to high costs:

- Traffic Density: The sheer volume of cars, especially on corridors like I-4, creates a high-risk environment for collisions.

- Severe Weather: Hurricane season (June-November) brings high winds, torrential rain, and flooding, all of which can cause widespread vehicle damage. Insurers price this risk into comprehensive coverage.

- Uninsured Drivers: Florida has a high rate of uninsured drivers. When they cause an accident, insured drivers’ policies often have to cover the costs, pushing premiums higher for everyone.

For more details on statewide factors, see our page on Florida Auto Insurance.

Key Factors Influencing Your Premium

While Orlando’s environment sets a baseline, your personal premium depends on your unique profile. Understanding these factors can help you lower your rate.

- Age: Drivers under 25 typically pay more due to a statistical likelihood of being in more accidents.

- Driving Record: A clean record is the most powerful factor for lowering your rate. Tickets and at-fault accidents will increase it.

- Credit Score: In Florida, insurers use a credit-based insurance score to predict claim likelihood. Better credit generally means lower premiums.

- Vehicle Type: The cost to repair or replace your vehicle directly impacts your premium. Luxury and sports cars cost more to insure than standard sedans. Vehicles with high safety ratings may earn discounts.

- ZIP Code: Insurers analyze data by neighborhood. Areas with more theft or accidents have higher rates.

- Annual Mileage: The more you drive, the higher the risk. A short commute or working from home may qualify you for a low-mileage discount.

How Location and Weather Drive Up Costs

Orlando’s specific environment creates insurance challenges. I-4 is consistently ranked among the nation’s most dangerous highways due to a mix of commuters and tourists, leading to a higher claim frequency in Central Florida. This high rate of payouts is passed on to customers as higher premiums.

Urban areas like Orlando always cost more to insure than rural ones because the concentration of vehicles and people increases risk. Even within the metro area, rates vary between downtown and quieter suburbs.

Hurricane season is another major factor. Storms bring risks of flying debris, fallen trees, and flooding, all of which can total a vehicle. This risk is priced into comprehensive coverage. Flood risk is a particular concern in many parts of Central Florida, even away from the coast. Insurers know which areas are prone to water damage and adjust rates accordingly.

Florida’s Minimum Insurance Requirements and Risks

Before searching for cheap auto insurance orlando florida, understand Florida’s laws and the serious risks of driving without coverage.

Florida is a “no-fault” state, meaning your own insurance pays for your initial medical bills and lost wages after an accident, regardless of who is at fault. This system is designed to provide quick access to medical care.

However, driving without insurance is illegal and has severe consequences. If caught, you face:

- Fines from $150 to $500 for a first offense.

- Suspension of your driver’s license, vehicle registration, and license plates.

- An SR-22 requirement, which flags you as a high-risk driver and leads to much higher premiums for at least three years.

- Full personal liability if you cause an accident. You would be responsible for all medical bills, car repairs, and other damages, which could lead to financial ruin.

The potential savings from skipping insurance are not worth the catastrophic risk. For official details, visit Florida’s Department of Highway Safety and Motor Vehicles.

What Coverage is Legally Required in Orlando?

To drive legally in Orlando, you must have two types of coverage:

-

$10,000 Personal Injury Protection (PIP): This is the core of the no-fault system. It pays for 80% of your medical expenses and 60% of your lost wages up to the $10,000 limit, no matter who caused the accident. It covers you, your passengers, and certain pedestrians or cyclists.

-

$10,000 Property Damage Liability (PDL): This covers damage you cause to someone else’s property, such as their car, a fence, or a building. With modern vehicle repair costs, this $10,000 limit can be exhausted quickly in a single accident.

While not legally required, other coverages like Bodily Injury Liability and Uninsured Motorist are strongly recommended by most insurance professionals. The state minimums keep you legal, but they often don’t keep you fully protected from major financial loss.

Your Ultimate Guide to Finding Cheap Auto Insurance Orlando Florida

Finding cheap auto insurance orlando florida can feel overwhelming, but it’s possible to find affordable rates without sacrificing necessary coverage. You just need the right approach.

The single most important strategy is to shop around. Rates for identical coverage can vary by hundreds or even thousands of dollars per year between companies. Each insurer uses a different formula to assess risk, so what’s expensive with one might be affordable with another. You won’t know until you compare.

This is where using an independent agent is a game-changer. Instead of filling out the same forms on multiple websites, an independent agent does the work for you. At Select Insurance Group, we work with over 40 carriers, allowing us to pull dozens of quotes and present you with the best options side-by-side.

Finally, insurance shopping isn’t a one-time task. You should review your policy annually. Life changes like moving, paying off a car, or another year of safe driving can qualify you for lower rates. Your current insurer won’t automatically lower your premium, so it’s crucial to shop around each year to ensure you’re still getting the best deal.

1. Maximize Every Available Discount

You could be leaving money on the table by not asking about discounts. Insurance companies offer many ways to lower your premium, but you often have to be proactive. Here are some of the most common discounts to ask about to get cheap auto insurance orlando florida.

- Good Driver Discount: Maintain a clean record for 3-5 years with no accidents or violations to earn one of the biggest available discounts.

- Good Student Discount: If a young driver on your policy maintains a B average or higher, you can often get a rate reduction.

- Multi-Policy Bundling: Insuring your car and home with the same company can lead to significant savings on both policies. If you’re looking for Florida Home Insurance, bundling is a must.

- Homeowner Discount: Even if you don’t bundle, simply owning a home can sometimes qualify you for a lower auto rate.

- Anti-Theft Devices: Factory or after-market alarms, GPS trackers, or engine immobilizers can earn you a discount.

- Defensive Driving Course: Completing an approved course can make you a safer driver and lower your premium.

- Pay-in-Full Discount: Paying your entire premium upfront for six or twelve months usually costs less than paying in monthly installments.

- Safe Driving Apps: Many insurers offer telematics apps that monitor your driving habits. Safe driving can earn you discounts of 10% or more.

- Multi-Car Discount: Insuring more than one vehicle on the same policy almost always results in savings.

- New Car Discount: Newer vehicles, especially those with advanced safety features, may qualify for a discount.

Never assume discounts are applied automatically. When you work with us, we proactively search for every discount you qualify for to find you the most affordable rate.

2. Adjust Your Policy for Immediate Savings

Beyond discounts, you can make strategic adjustments to your policy for immediate savings. These changes can be a smart path to cheap auto insurance orlando florida, as long as you understand the trade-offs.

One of the fastest ways to lower your premium is to increase your deductible. The deductible is what you pay out-of-pocket on a claim before insurance pays the rest. Raising your deductible from $500 to $1,000, for example, will lower your monthly premium. However, you must be sure you can comfortably afford the higher deductible if you need to file a claim. If you have an adequate emergency fund, this is a great option.

Next, evaluate your collision coverage. This pays to repair your own car after an accident. If you drive an older car with a low market value, you might be paying more in premiums than the car is worth. For example, if your car is worth $3,000, paying $600 a year for collision coverage may not be cost-effective. If you can afford to replace the vehicle yourself, dropping collision coverage can save you a significant amount.

Similar logic applies to comprehensive coverage, which covers theft, vandalism, and weather-related damage. Given Orlando’s hurricane risk, think carefully before dropping this. However, for a low-value vehicle, you might decide the premium isn’t worth the potential payout.

Finally, review your coverage limits. While we advocate for more than the state minimums, ensure your limits align with your current financial situation and assets. An insurance professional can help you find the right balance between adequate protection and affordability.

Understanding what’s on your auto policy declarations page (the summary of your coverages) is the first step to finding savings.

3. Improve Your Driver Profile for the Best Rates

You have significant control over your insurance costs. While you can’t change Orlando’s traffic, you can improve how insurers view you as a driver. These long-term strategies deliver lasting savings on your cheap auto insurance orlando florida premiums.

Maintain a clean driving record. Your driving history is your insurance report card. Every ticket or at-fault accident can increase your premium, while a clean record qualifies you for significant good driver discounts. Practicing defensive driving not only keeps you safe but actively builds a profile that insurers reward.

Improve your credit score. In Florida, insurers use a credit-based insurance score to help set your rates. Statistically, people who manage their finances responsibly tend to be more careful drivers. By paying bills on time and keeping debt low, you are also working toward lower insurance costs.

Choose your vehicle wisely. The car you drive has a major impact on your premium. Before buying a new vehicle, get an insurance quote. Cars with high safety ratings, advanced safety features, and lower repair costs are cheaper to insure. High-performance sports cars or vehicles frequently targeted for theft will cost much more. A practical vehicle choice can save you hundreds of dollars a year in premiums.

Focusing on these three areas creates fundamental improvements that keep your rates low year after year.

Beyond the Minimum: Smart Coverage Choices

Meeting Florida’s minimum insurance requirements keeps you legal, but it doesn’t always keep you protected. A $10,000 limit can be exhausted quickly in a serious accident, leaving you personally responsible for tens or even hundreds of thousands of dollars in damages. This could put your home, savings, and future earnings at risk.

Investing in better coverage is about protecting your assets and buying peace of mind. You can drive knowing one bad day won’t derail your financial future.

Optional Coverages Orlando Drivers Should Consider

These optional coverages are essential for a complete safety net on Orlando’s roads.

- Bodily Injury Liability (BI): Pays for injuries you cause to others. Without it, you are personally liable for medical bills and legal settlements. Essential for protecting your assets.

- Uninsured/Underinsured Motorist (UM/UIM): Protects you when you’re hit by a driver with no insurance or not enough insurance. Given Florida’s high rate of uninsured drivers, this is crucial.

- Collision Coverage: Pays for damage to your own car from a collision. Required by lenders for financed vehicles, but wise for any car you can’t afford to replace out-of-pocket.

- Comprehensive Coverage: Covers non-collision events like theft, vandalism, fire, and storm damage. Highly recommended in Central Florida due to hurricane risk.

- Medical Payments (MedPay): Provides an extra layer of medical protection for you and your passengers, often covering deductibles and copays that PIP doesn’t.

- Rental Reimbursement: Helps pay for a rental car while your vehicle is being repaired after a covered claim.

What Your Orlando Auto Policy Typically Won’t Cover

It’s also important to know what your policy excludes.

- Normal Wear and Tear: Insurance covers sudden and accidental damage, not routine maintenance or aging parts.

- Intentional Damage or Racing: Deliberately damaging your car or using it for racing is not covered.

- Business Use: A standard personal policy does not cover you while driving for services like Uber, Lyft, or DoorDash. You need a commercial policy for this. See Florida Business Auto options to ensure you’re covered.

- Personal Belongings: Items stolen from your car, like a laptop or phone, are typically covered by your homeowners or renters insurance, not your auto policy.

Frequently Asked Questions about Cheap Auto Insurance in Orlando

What are the absolute minimum car insurance requirements in Orlando?

To drive legally in Orlando and all of Florida, you must carry $10,000 in Personal Injury Protection (PIP) to cover 80% of your own medical bills and $10,000 in Property Damage Liability (PDL) to cover damage you cause to others’ property. While these are the legal minimums, they offer very limited protection in a serious accident.

What is the fastest way to get a lower car insurance rate in Orlando?

The fastest and most effective way to find cheap auto insurance orlando florida is to compare quotes from multiple carriers. Rates for the exact same coverage can vary by hundreds or even thousands of dollars per year. Working with an independent insurance agent is the quickest way to do this, as they can shop dozens of companies on your behalf in minutes, saving you time and money.

How much can I save by bundling my auto and home insurance?

Bundling your auto and home insurance with the same provider is a simple and effective way to save. Most carriers offer a multi-policy discount that can reduce your total premium by 5% to 25%. For a typical Orlando household, this could mean saving several hundred dollars per year. Bundling also simplifies your life with one company, one bill, and one point of contact. If you’re shopping for Florida Home Insurance, be sure to ask about bundling.

Conclusion

Finding cheap auto insurance orlando florida is achievable despite our city’s challenges of high traffic, tourism, and severe weather. By using the right strategies, you can significantly lower your premiums.

This guide has shown you how to take control of your insurance costs. The key is to maximize discounts, adjust your policy wisely, maintain a good driver profile, and understand which coverages truly protect your financial future. However, the single most powerful tool is comparison shopping.

This is where Select Insurance Group excels. With over 30 years of experience and relationships with more than 40 carriers, we do the heavy lifting for you. We compare rates and uncover discounts to find the perfect balance of protection and affordability for Orlando drivers.

Don’t overpay for auto insurance. Let our team of experts shop the market on your behalf and show you how much you can save.

Find the best rates with an Orlando insurance expert and see how working with an independent agency can transform your insurance experience.