The Path to Getting SR22 Insurance Without a Car

Getting sr22 insurance without a car is possible through a non-owner SR-22 insurance policy. Here’s how it works:

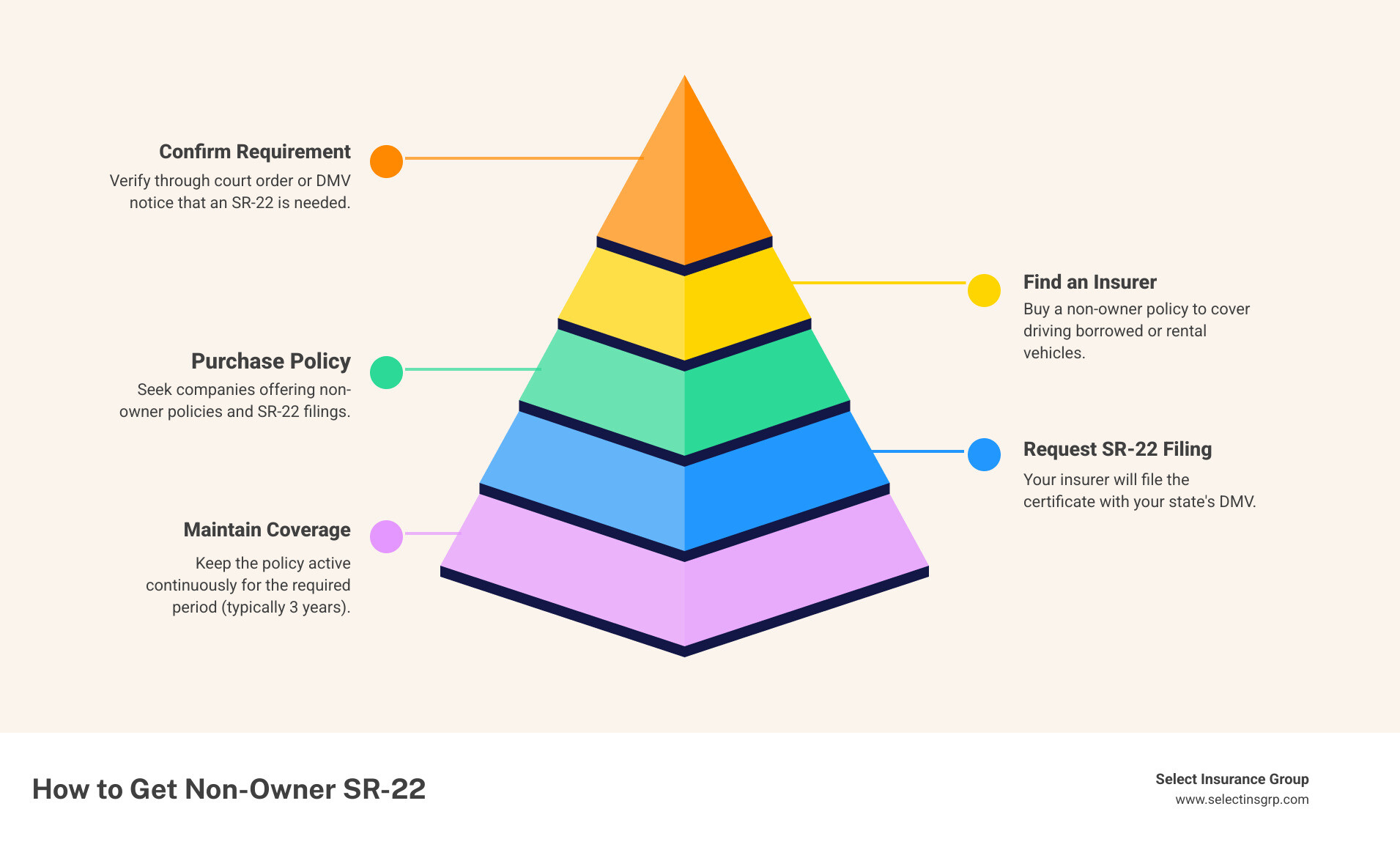

Quick Answer: Steps to Get SR-22 Without Owning a Car

- Confirm your requirement – Verify through court order or DMV notice that you need an SR-22

- Find an insurer – Look for companies that offer non-owner policies and SR-22 filings

- Purchase a non-owner policy – This covers you when driving borrowed or rental vehicles

- Request SR-22 filing – Your insurer files the certificate with your state’s DMV

- Maintain continuous coverage – Keep the policy active for the required period (typically 3 years)

Needing an SR-22 to get your license back without owning a car can feel like a catch-22. The answer is non-owner SR-22 insurance.

This policy provides liability coverage when you drive borrowed or rental cars, fulfilling state requirements for license reinstatement.

While many assume they’re stuck, this is a common requirement with a straightforward solution. The filing fee for an SR-22 is typically just $15-$25, added to your non-owner policy cost. While your driving record affects your rates, getting covered is more affordable than most expect.

I’m D.J. Hearsey, founder of Select Insurance Group. For over 30 years, my team has helped drivers steer complex situations like this. We specialize in finding competitive rates from more than 40 carriers to make getting sr22 insurance without a car as smooth as possible.

What is an SR-22 and Why is it Required?

An SR-22 isn’t insurance; it’s a certificate of financial responsibility. It’s a document your insurer files with the state DMV to prove you carry the minimum liability insurance required by your state’s financial responsibility laws. It essentially vouches that you are covered.

An SR-22 is ordered by a state or court following serious driving incidents. We’re talking about DUI or DWI convictions, reckless driving, or getting caught driving without insurance. Multiple traffic offenses in a short period can also trigger an SR-22 requirement, as can an at-fault accident when you didn’t have insurance. Often, an SR-22 is simply the key to license reinstatement after a suspension or revocation.

The purpose of an SR-22 is to monitor high-risk drivers. If your policy lapses, your insurer is required to notify the state, which can lead to your license being suspended again. It’s the state’s way of keeping tabs on you.

If you want to dig deeper into how SR-22s work, we’ve put together a comprehensive guide: SR-22 Insurance: What Does It Do?.

SR-22 vs. FR-44: What’s the Difference?

It’s worth understanding the difference between an SR-22 and an FR-44.

An SR-22 is the standard proof of liability that most states require, confirming you carry at least the state’s minimum coverage.

An FR-44 is similar but requires much higher liability limits. Only two states, Florida and Virginia, use the FR-44, reserving it for more serious offenses like certain DUI convictions.

For official Florida definitions and requirements, see the Florida Highway Safety and Motor Vehicles overview of FR-44 and SR-22.

If you’re dealing with a requirement in Florida, knowing which one you need is crucial, as the cost difference can be substantial. We work with clients throughout Florida and understand these specific requirements. Learn more about Florida auto insurance options.

Why You Need an SR-22 Even if You Don’t Own a Car

A common question is why an SR-22 is needed without a car. The requirement follows you, the driver, not a vehicle. The state is concerned about your financial responsibility whenever you get behind the wheel of any car.

This is where getting sr22 insurance without a car becomes necessary. Your driving record has flagged you as high-risk, and the state wants assurance you’re covered no matter whose vehicle you operate. This applies when you borrow a friend’s car, use a family member’s vehicle, or rent cars.

Most often, people need an SR-22 without a car for license reinstatement. The state requires you to maintain continuous insurance coverage to regain your driving privileges, even if you don’t currently own a vehicle. The mandate ensures that when you do drive, you’re fulfilling your legal obligations and protecting others on the road.

The Solution: Understanding Non-Owner SR-22 Insurance

The solution is non-owner SR-22 insurance, a product designed for drivers who need an SR-22 but don’t own a car.

A non-owner policy provides personal liability coverage that follows you as a driver, rather than being tied to a vehicle. When you add an SR-22, your insurer files the certificate with the state, proving you have the required coverage whenever you drive a non-owned car.

For example, if you borrow a friend’s car and cause an accident, your non-owner SR-22 policy would provide liability coverage for the damage and injuries you caused to others. The coverage follows you, the driver.

A non-owner policy usually acts as secondary coverage. If the car owner has insurance, their policy is primary. Your policy then adds protection and ensures you meet SR-22 requirements.

This arrangement solves the problem of fulfilling a state’s SR-22 requirement for license reinstatement without needing to own a vehicle. Getting sr22 insurance without a car becomes a manageable process.

What Non-Owner SR-22 Insurance Covers (and What It Doesn’t)

It’s vital to understand what a non-owner policy covers and what it doesn’t.

What you’re covered for: The core of a non-owner SR-22 policy is bodily injury liability and property damage liability. If you cause an accident, your policy pays for injuries to other people and damage to their property, up to your policy limits. Your policy will meet your state’s minimum liability requirements, which the SR-22 certifies. Depending on your state, you might also have uninsured/underinsured motorist coverage or personal injury protection (PIP).

What you’re not covered for: This is crucial. Your non-owner policy will not cover damage to the car you’re driving. That would fall to the car owner’s collision coverage. Your policy also won’t cover your own injuries unless you have PIP in a no-fault state. Since you don’t own a vehicle, there is no collision or comprehensive coverage.

In short, non-owner SR-22 insurance covers your liability to others, fulfilling your legal requirement. It does not cover the car you are driving or your own injuries. Understanding this is key to making smart driving decisions.

For a more detailed breakdown, take a look at our comprehensive guide: SR22 Insurance Without a Car: What You Need to Know.

Your Step-by-Step Guide to Getting SR22 Insurance Without a Car

Getting sr22 insurance without a car is a manageable process when broken down into steps.

1. Confirm the requirement. You will receive an official court order or DMV notice spelling out what’s required and for how long. Don’t act until you have this document.

2. Find the right insurer. Not all companies offer non-owner policies or SR-22 filings. Select Insurance Group works with over 40 carriers that specialize in this coverage. With 30+ years of experience, we find competitive rates for you. Get A Quote and let us help.

3. Purchase the policy and request the filing. When buying your non-owner policy, tell your agent you need an SR-22. They will add the filing to your policy.

4. Your insurer files the SR-22. This is done electronically with your state’s DMV, usually within 24 to 72 hours. The official filing goes directly from the insurer to the state.

5. Maintain continuous coverage. This is the most critical step. Most states require three years of continuous coverage. A lapse of even one day will likely cause your license to be suspended and reset the clock on your requirement. Pay your premiums on time.

Key Requirements for Getting SR22 Insurance Without a Car

To qualify, you’ll need to meet a few basic requirements.

You’ll need a valid driver’s license, or be in the process of reinstating one. An insurer will need your license number. A non-owner SR-22 policy is often the key to getting a suspended license reinstated.

You cannot own a vehicle. If you have a car registered in your name, you need a standard owner’s auto policy with an SR-22 filing.

You also can’t have regular access to a household vehicle. If you have unrestricted access to a car owned by a spouse, parent, or roommate, most insurers will require you to be listed on that vehicle’s policy. Non-owner coverage is for occasional driving of borrowed or rental cars.

When you’re ready for a quote, have your driver’s license number, current address, and details about your driving history and SR-22 requirement on hand.

What Happens if You Need an SR-22 in a State Where You Don’t Live?

Needing an SR-22 in a state where you no longer live is a common situation. Out-of-state SR-22 filings are possible. For example, if you live in Florida but need an SR-22 for North Carolina, your Florida-based insurer can file the form with the North Carolina DMV.

The key is finding an insurer licensed in the state requiring the SR-22. The company must be authorized to do business there. As Select Insurance Group is licensed in Florida, the Carolinas, Virginia, and Georgia, we can handle these filings seamlessly within those states.

You must remain compliant with the original state’s laws for the entire SR-22 period. If your policy lapses, your insurer will report it to the requiring state, and the consequences will follow you. We can help you sort through these complexities. Contact Us if you have questions.

Cost, Providers, and Common Misconceptions

Let’s break down the costs and common misconceptions about getting sr22 insurance without a car.

The filing fee for the SR-22 form is a one-time charge of $15 to $25, paid to your insurer. This is separate from your premium.

The policy cost depends on several factors. Your driving record is the primary one, as the reason for the SR-22 places you in a high-risk category. Your state, chosen coverage limits, age, location, and credit score also affect your premium.

While a non-owner policy with a clean record might average $380 annually, an SR-22 requirement increases that cost because it signals higher risk to insurers.

For a deeper dive into the numbers, our guide on How Much Does Non-Owner SR-22 Insurance Cost? breaks it all down.

How Much Does a Non-Owner SR-22 Policy Cost?

Where you live makes a huge difference in cost. Here are some average annual costs for non-owner SR-22 policies:

| State | Average Annual Non-Owner SR-22 Cost |

|---|---|

| Florida | $668 |

| Iowa | $179 |

| Texas | $483 |

| California | $490 |

| New York | $400 |

| Georgia | $350 |

These are averages. Your actual rate depends on your specific situation, the insurer, and your driving history.

If your SR-22 is for a DUI, expect higher rates, with a national average around $646 per year for a non-owner SR-22 policy.

However, you can find more affordable options. The key is to shop around, which we do for you at Select Insurance Group across over 40 carriers. You can also save by maintaining a clean driving record, bundling policies, keeping a good credit score, and paying your premium annually or semi-annually.

It’s worth noting that getting sr22 insurance without a car is typically less expensive than an SR-22 policy for a vehicle owner, as it doesn’t cover physical damage to a car.

Common Misconceptions About Getting SR22 Insurance Without a Car

Let’s clear up some common myths about getting SR-22 insurance without a car.

Myth: You can’t get an SR-22 without a car. False. Non-owner SR-22 insurance exists specifically for this situation.

Myth: An SR-22 is a type of insurance. False. It’s a certificate your insurer files to prove you have insurance.

Myth: It’s impossibly expensive. False. While rates are higher for high-risk drivers, non-owner policies are generally affordable, and shopping around helps find manageable rates.

Myth: The requirement is permanent. False. SR-22 requirements typically last for three years. Once you complete the period without lapses, the requirement is lifted.

Understanding these realities makes the process less intimidating. For more insights, check out our South Carolina auto insurance resources.

Frequently Asked Questions about Non-Owner SR-22s

Here are answers to some of the most common questions about non-owner SR-22s.

How long do I need to carry a non-owner SR-22?

The duration varies by state and offense, but it’s typically three years. For more serious violations, it could be five years or more. The official notice you receive from the court or DMV will specify the exact length.

Continuous coverage is mandatory. If your policy lapses, your insurer must notify the state. This can lead to license suspension and often resets the clock on your requirement, meaning you have to start the entire period over again. It is critical to avoid any gaps in coverage.

What happens if I buy a car while I have a non-owner SR-22?

If you buy a car, you must notify your insurer immediately. You are no longer eligible for a non-owner policy and will need to switch to an owner’s policy for your new vehicle.

It is critical to ensure the SR-22 filing is transferred to the new policy without any gaps. Your insurer will handle this, but you must coordinate with them to prevent a lapse in your SR-22 status, which could lead to license suspension.

We handle these transitions regularly and can ensure a smooth switch to keep you compliant.

Can I get a non-owner SR-22 from any insurance company?

No, not all companies offer it. Many mainstream insurers don’t handle SR-22 filings, and some don’t offer non-owner policies. High-risk insurance specialists are your best option.

This is why working with an independent agency like Select Insurance Group is so valuable. We simplify the search for you. We work with over 40 carriers that provide non-owner SR-22 policies and have competitive rates for high-risk drivers.

Instead of spending hours calling multiple companies, Contact Us and let us do the heavy lifting. We’ll find the right coverage for you quickly and efficiently, making getting sr22 insurance without a car a much easier process.

Get Back on the Road with Confidence

Getting sr22 insurance without a car is a clear, manageable path to reinstating your license and moving forward. A non-owner SR-22 policy is the solution, designed to prove your financial responsibility to the state when you drive a borrowed or rental car.

While you’ll need to maintain continuous coverage (typically for three years) and your rates will be higher, the requirement is temporary and doable.

Driving responsibly is crucial. This is your chance to rebuild your driving record and demonstrate your commitment to safety. Every clean month behind the wheel helps.

At Select Insurance Group, we’ve helped drivers in your exact situation for over 30 years. We shop over 40 carriers across Florida, the Carolinas, Virginia, and Georgia to find you competitive rates.

We’re not here to judge your past; we’re here to help you steer your future. We’ll walk you through every step of the process.

Ready to move forward? Find the right North Carolina auto insurance policy for your needs or reach out to us directly. Let’s get you back on the road with confidence, properly covered, and ready to put this chapter behind you.