Why Understanding Minimum Motorcycle Insurance Virginia Requirements Matters Now More Than Ever

Minimum motorcycle insurance Virginia law requires every rider to understand what’s legally required before hitting the road—especially with major changes taking effect in 2024 that eliminate a popular but risky option.

Here’s what you need to know right now:

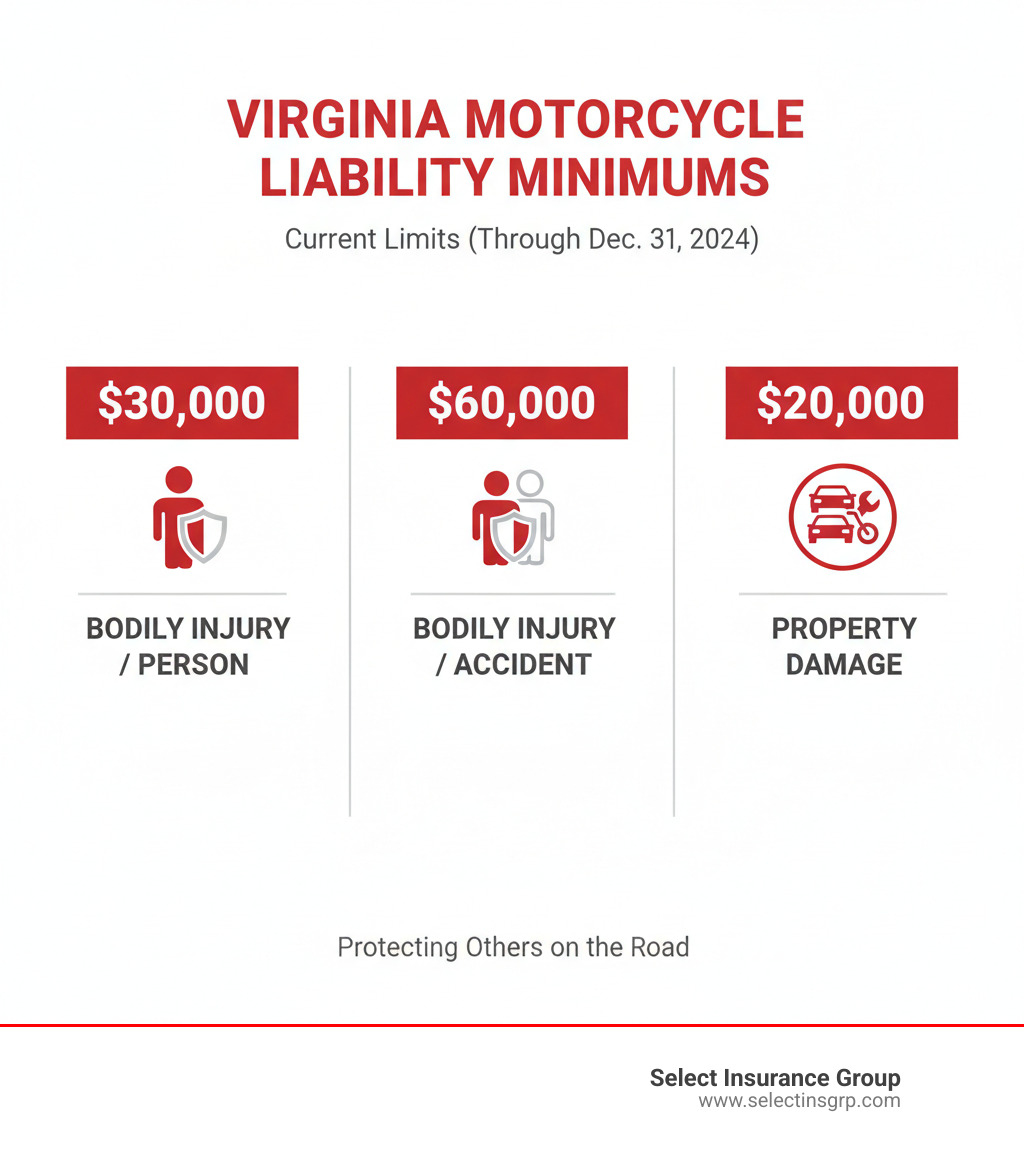

- Current Minimum Liability Limits (through December 31, 2024): $30,000 bodily injury per person / $60,000 per accident / $20,000 property damage

- New Minimum Liability Limits (starting January 1, 2025): $50,000 per person / $100,000 per accident / $25,000 property damage

- Big Change (July 1, 2024): Virginia is eliminating the $500 Uninsured Motor Vehicle (UMV) fee option—insurance will be mandatory for all motorcycle registrations

- Penalties for riding uninsured: Up to $600 in fines, license suspension, registration suspension, and mandatory SR-22 filing for three years

Virginia’s motorcycle insurance laws exist for legal compliance, financial protection, and peace of mind. As with auto insurance, the minimum coverage protects others when you cause an accident—but it doesn’t protect you, your bike, or your medical bills. Many riders mistakenly believe their car insurance covers their motorcycle, but standard auto policies do not cover two-wheeled vehicles. You need a separate motorcycle-specific policy.

The stakes are higher for motorcyclists. The NHTSA confirms riders are far more likely to be seriously injured in an accident, leading to medical bills that can quickly surpass minimum coverage. If you cause an accident and damages exceed your policy limits, you are personally responsible for the difference, which could put your assets, wages, and financial future at risk.

I’m D.J. Hearsey. For over 30 years, I’ve helped Virginia riders steer these complex requirements. At Select Insurance Group, we’ve seen how underinsured accidents can ruin a family’s finances—and how the right coverage provides the freedom to ride with confidence.

Understanding Virginia’s Current Motorcycle Insurance Requirements

Virginia law requires liability insurance for motorcycles. This coverage protects other people when you’re at fault in an accident. It’s not about protecting you or your bike; it’s the legal minimum you need to register your motorcycle and ride in the Commonwealth.

Liability insurance breaks down into two essential parts:

Bodily Injury Liability pays for injuries to other people when you cause an accident, including their medical bills, lost wages, and pain and suffering.

Property Damage Liability covers damage to other people’s property—like their car or a fence—in an accident you’re responsible for.

When you register your motorcycle with the Virginia DMV, you’ll need to certify that your bike meets these insurance requirements. The DMV takes this seriously, wanting proof that every vehicle has this basic level of financial protection.

What Are the Minimum Liability Limits?

Through the end of 2024, the minimum motorcycle insurance Virginia requires is “30/60/20” coverage: $30,000 for bodily injury per person, $60,000 for total bodily injuries per accident, and $20,000 for property damage per accident.

These minimums are increasing on January 1, 2025, because the old limits no longer cover the rising costs of medical care and vehicle repairs.

Here’s how the numbers compare:

| Coverage Type | Current Minimum (through 12/31/2024) | New Minimum (effective 01/01/2025) |

|---|---|---|

| Bodily Injury per Person | $30,000 | $50,000 |

| Bodily Injury per Accident | $60,000 | $100,000 |

| Property Damage per Accident | $20,000 | $25,000 |

These requirements are spelled out in Code of Virginia §46.2-472, which establishes the legal framework for motor vehicle insurance in the state.

The Uninsured Motor Vehicle (UMV) Fee: A Risky Option Ending Soon

For years, Virginia offered a risky way to ride without insurance: paying a $500 Uninsured Motor Vehicle fee to the DMV. This fee provided zero coverage. It was simply permission to ride uninsured, leaving you personally liable for every dollar of damage if you caused an accident—from medical bills and totaled vehicles to legal fees.

Since motorcycle accident costs can easily reach six figures, this fee was a gamble that could lead to bankruptcy. It offered nothing but personal liability and financial risk.

The good news is this dangerous option is going away. Virginia is eliminating the UMV fee, making real insurance coverage mandatory for all riders. It’s a long-overdue change that will protect riders from devastating financial mistakes.

Big Changes in 2024: How SB 951 Affects Virginia Riders

A major legislative shift, Senate Bill 951 (SB 951), is fundamentally changing motorcycle insurance in Virginia. If you’ve been paying the $500 UMV fee to ride uninsured, you need to prepare for this change.

Effective July 1, 2024, the Uninsured Motor Vehicle fee option is eliminated. From this date, liability insurance is mandatory for all motorcycle registrations. When you register or renew, you must provide proof of insurance to the DMV. The old option to pay a fee instead of carrying insurance is gone.

This is a positive change. I’ve seen too many riders who chose the UMV fee face financial ruin after an accident. It’s a heartbreaking and preventable situation.

What Happens if You’re Uninsured After July 1, 2024?

The state is serious about enforcement. If caught riding without the minimum motorcycle insurance Virginia law requires after July 1st, you face fines up to $600, plus suspension of your driver’s license and motorcycle registration. This means you can’t legally drive or ride at all.

Here’s where it gets even more complicated: you may be required to file an SR-22 certificate for three years. An SR-22 is proof of financial responsibility that your insurance company files with the DMV. The problem? Insurance companies charge significantly higher premiums for riders who need an SR-22. So you’ll be paying fines, reinstatement fees, and higher insurance costs for the next three years.

To get your license and registration back after a suspension, you’ll pay substantial reinstatement fees. If your insurance policy terminates, you must get new insurance immediately, deactivate your license plates, or surrender them to avoid automatic penalties.

Preparing for the New Mandatory Insurance Law

If you’ve been using the UMV fee, start shopping for a policy now. Don’t wait until the last minute and risk a coverage gap that could trigger these penalties. Give yourself plenty of time to compare options. Even if you already have insurance, this is a perfect opportunity to review your policy and ensure it meets upcoming requirements—remember, minimums increase on January 1, 2025.

Different insurance companies offer dramatically different rates. That’s why we shop over 40 carriers on your behalf, using our 30+ years of experience to find you competitive rates.

Secure your coverage before July 1, 2024 to avoid any gaps. A single day without coverage after this date could trigger expensive penalties. This change is pushing riders toward something they should have been doing all along—protecting themselves and others. Get a Quote from us today, and let’s make sure you’re ready to ride legally and safely.

Why the Bare Minimum Motorcycle Insurance in Virginia Isn’t Enough

Meeting Virginia’s minimum motorcycle insurance requirements keeps you legal, but it rarely provides enough protection. I’ve seen many riders face financial ruin because they assumed state minimums were sufficient. The truth is, these limits haven’t kept pace with today’s costs.

A serious motorcycle accident can result in medical bills well over $100,000. If you cause a crash with the current $30,000 bodily injury limit and the bills are $120,000, you are personally responsible for the $90,000 difference. The same applies to property damage. Repairing a modern vehicle can easily exceed the $20,000 minimum limit, leaving you to pay the rest.

When your limits are exhausted, injured parties can sue you for your personal assets, including your home, savings, and future wages. The right coverage can prevent this financial catastrophe.

Uninsured/Underinsured Motorist (UM/UIM) Coverage: Your Financial Safety Net

While liability insurance protects others, Uninsured/Underinsured Motorist (UM/UIM) coverage protects you. It’s critical for riders, as Virginia law requires it to match your liability limits.

Consider what happens if an underinsured driver hits you. Their minimum policy might not cover your medical bills and lost wages. Or in a hit-and-run, you’d be left paying for everything. Uninsured/Underinsured Motorist (UM/UIM) coverage is designed for these exact situations. It pays for your medical expenses, lost wages, and other damages up to your policy limits when the at-fault driver has little or no insurance.

Essential Optional Coverages to Consider

Beyond liability and UM/UIM, several other coverages are crucial for comprehensive protection:

- Collision Coverage: Pays to repair or replace your motorcycle after an accident, regardless of fault. It’s essential if you have a loan on your bike or couldn’t afford to replace it.

- Comprehensive Coverage: Protects your bike from non-collision events like theft, vandalism, fire, weather damage, or hitting an animal.

- Medical Payments (MedPay): Covers medical bills for you and your passengers regardless of fault, ensuring immediate payment for treatment.

- Custom Parts & Equipment (CPE): Protects your investment in aftermarket parts, as standard policies offer limited coverage (often $1,000 or less). Some of our carriers include up to $3,000 in CPE at no extra cost, with higher limits available.

- Roadside Assistance: Covers towing, jump starts, and fuel delivery if you’re stranded. It’s an inexpensive add-on for significant peace of mind.

For more details on building a policy custom to your needs, visit our Virginia Motorcycle Insurance page. We provide honest guidance to help you get the protection you need.

Penalties, Costs, and Other Virginia Motorcycle Laws

As of July 1, 2024, riding uninsured in Virginia has serious consequences. Penalties include fines up to $600, suspension of your license and registration, hefty reinstatement fees, and a mandatory SR-22 certificate for three years, which will significantly increase your insurance premiums.

The Virginia DMV doesn’t mess around with compliance. If your insurance terminates, you must act immediately to avoid penalties. The Virginia DMV safety page provides more information on legal requirements.

Factors That Affect Your Insurance Costs

Minimum motorcycle insurance Virginia premiums vary widely based on several factors:

- Riding History: Your age, experience, and driving record are critical. A clean record means lower rates.

- Type of Motorcycle: Sport bikes with high-performance engines typically cost more to insure than cruisers or touring bikes.

- Location: Urban areas like Richmond or Northern Virginia usually have higher premiums than rural counties due to more traffic and higher theft rates.

- Coverage Choices: Higher limits and optional coverages like collision and comprehensive increase your premium but offer far better protection. A higher deductible can lower your premium.

- Discounts: Completing a motorcycle safety course, bundling policies, or being a member of a riding organization can earn you significant discounts.

While some data suggests an average cost of $1,260 annually for minimum coverage, your premium is unique. We shop over 40 carriers to find the best rate for your specific situation.

Key Virginia Riding Laws to Know

Beyond insurance, Virginia has specific laws for rider safety:

- Helmet Law: All operators and passengers must wear a helmet. No exceptions.

- Eye Protection: You must wear a face shield, safety glasses, or goggles, unless your motorcycle has a windshield.

- Passenger Rules: Any passenger must also wear a helmet and be able to reach the footrests.

- Lane Splitting: Riding between lanes of traffic, known as lane splitting is illegal, as is lane filtering at stoplights. It’s considered reckless driving.

- License Endorsement: You must have a motorcycle classification (M, M2, or M3) on your driver’s license, which requires passing written and riding skills tests.

Frequently Asked Questions about Minimum Motorcycle Insurance Virginia

Here are answers to the most common questions I hear from riders at Select Insurance Group.

Can my standard auto insurance policy cover my motorcycle?

The straightforward answer is no, your standard auto insurance policy does not cover your motorcycle in Virginia. Many riders make this costly assumption. Auto policies are for four-wheeled vehicles and don’t account for the unique risks of motorcycles. You need a separate, motorcycle-specific policy to be covered.

Think of it this way: you wouldn’t expect your homeowner’s insurance to cover your car, right? Same principle applies here. Different vehicles require different policies, just as we create custom solutions for Virginia Business Auto needs.

Are there specific insurance requirements for carrying a passenger?

Virginia doesn’t require separate insurance for passengers; your standard Bodily Injury Liability extends to them. However, state minimums can be exhausted quickly in an accident involving a passenger. The $30,000 per person limit (or the new $50,000) may not be enough to cover multiple injured parties.

This is why many policies include Guest Passenger Liability and why Medical Payments (MedPay) coverage is so valuable. MedPay covers medical expenses for both you and your passenger regardless of who’s at fault. If you regularly carry passengers, I strongly recommend adding MedPay. It’s inexpensive and provides peace of mind by covering their medical bills.

How do Virginia’s requirements compare to neighboring states?

If you enjoy riding across state lines, this is an important question. Virginia’s current 30/60/20 minimums are lower than some neighbors. Maryland, for example, already requires 50/100/25—the same limits Virginia will adopt in 2025. North Carolina and Tennessee have requirements closer to Virginia’s current minimums.

The key takeaway is that if you ride out-of-state, you should ensure your coverage meets the requirements of all states you travel through. Different states also have different legal systems (at-fault vs. no-fault), which can affect how claims are handled. This highlights why carrying more than the bare minimum is a wise choice for any rider who explores beyond Virginia’s borders.

Secure Your Ride and Your Future

We’ve covered the key changes to minimum motorcycle insurance Virginia laws. With the UMV fee eliminated as of July 1, 2024, and higher minimums starting January 1, 2025, insurance is mandatory and the bare minimum is riskier than ever.

The reality is that state minimums protect others, not you. Relying on them is a gamble you can’t afford to take, considering the high cost of accidents. Coverages like Uninsured/Underinsured Motorist protection, Collision, and Comprehensive are essential parts of a smart protection strategy.

At Select Insurance Group, we understand riding is about freedom, not financial worry. For over 30 years, we’ve helped riders across Virginia, Florida, the Carolinas, and Georgia find the right coverage. We shop over 40 top carriers to find you competitive rates and provide customer service you can count on.

The changes happening this year are an opportunity to review your coverage and ensure you’re truly protected. Whether you’re a weekend warrior on the Blue Ridge Parkway or a daily commuter, you deserve coverage that matches your lifestyle.

Ready to get started? We’d love to help. If you have questions or want to talk through your options, Contact Us anytime.

Get your personalized Virginia motorcycle insurance quote today and ride with confidence, knowing you’re covered for whatever comes your way.