Why Every Owner-Operator Needs the Right Truck Insurance

Owner operator semi truck insurance is specialized commercial coverage designed to protect independent truckers who own and operate their own semi-trucks. Here’s what you need to know:

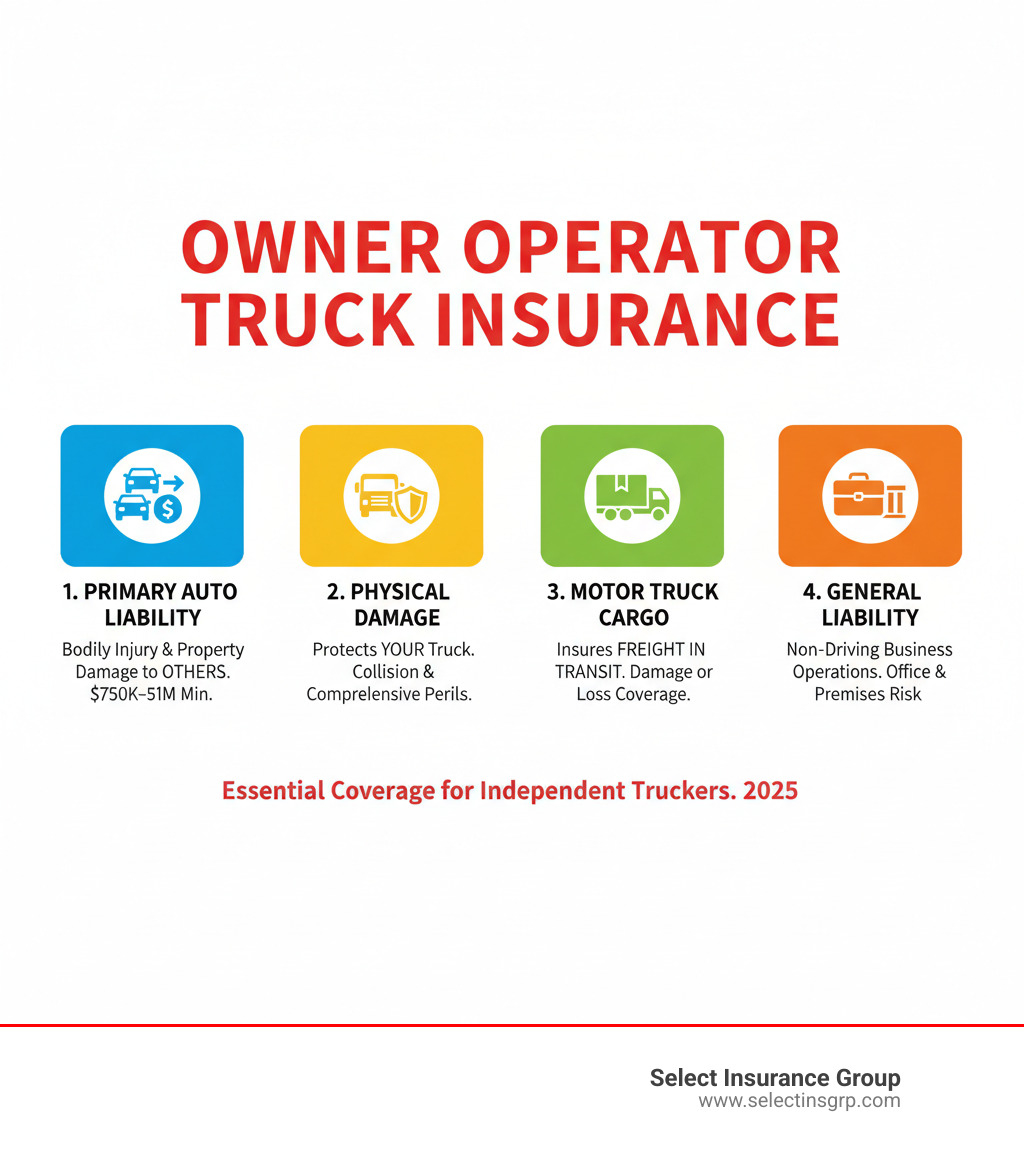

Quick Answer: Essential Owner Operator Semi Truck Insurance Types

- Primary Auto Liability – Covers damage to others ($750,000 minimum required by FMCSA, $1 million recommended)

- Physical Damage – Protects your truck from collision, fire, theft, and weather damage

- Motor Truck Cargo – Covers freight you’re hauling if damaged or lost

- General Liability – Protects against non-driving business risks

Your coverage needs depend on your operating model:

- Own Authority: Full insurance responsibility, $14,000-$22,000/year average cost

- Leased to Carrier: Reduced coverage needs, $3,600-$5,000/year average cost

If you’re an owner-operator, your truck isn’t just transportation—it’s your business, your income, and your livelihood all rolled into one 80,000-pound package. A single serious accident or lawsuit could destroy everything you’ve worked for.

That’s why owner operator semi truck insurance isn’t optional. It’s the financial safety net between you and bankruptcy. But navigating the insurance landscape can feel like driving through fog without headlights—complicated regulations, confusing coverage types, and premiums that vary wildly depending on how you operate.

The stakes are high. The Federal Motor Carrier Safety Administration (FMCSA) requires minimum liability coverage of $750,000 just to operate legally. Most shippers and brokers demand $1 million. And that’s just one type of coverage you need.

Whether you’re hauling under your own authority or leased to a motor carrier makes a massive difference in your insurance responsibilities—and your costs. Owner-operators with their own authority can expect to spend $1,167-$1,833 per month on insurance, while those leased to carriers typically pay only $300-$400 per month. That’s a difference of up to $17,000 per year.

This guide breaks down everything you need to know about owner operator semi truck insurance—from mandatory coverages and federal requirements to smart strategies for reducing your premiums. We’ll explain the difference between operating under your own authority versus leasing to a carrier, decode common policy exclusions, and show you exactly what factors influence your rates.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group, and I’ve spent over three decades helping truckers across the Southeast steer the complexities of owner operator semi truck insurance to find coverage that protects their business without breaking their budget. Let’s make sure you’re properly covered so you can focus on what matters—keeping your wheels turning and your business profitable.

Understanding the Fundamentals of Truck Insurance

When you’re behind the wheel of your rig, the last thing you want is to worry about what happens if something goes sideways. That’s exactly where owner operator semi truck insurance comes in—not as just another expense, but as the foundation that keeps your business standing when life throws you a curveball.

What is Owner-Operator Truck Insurance and Why is it Essential?

Think of owner operator semi truck insurance as specialized protection built specifically for independent truckers like you. Unlike standard auto insurance, this coverage understands that your truck isn’t just a vehicle—it’s your office, your income source, and your future all wrapped into one.

Here’s the reality: as an owner-operator, you’re wearing every hat in your business. You’re the driver, the accountant, the dispatcher, and yes, the risk manager too. One serious accident could trigger a lawsuit that doesn’t just dent your budget—it could wipe out everything you’ve built. Medical bills from injuries, property damage claims, legal fees, and lost income while your truck sits in a repair shop can add up faster than miles on your odometer.

That’s why this coverage isn’t optional—it’s your business necessity and your financial safety net. It stands between you and financial ruin, absorbing costs that could otherwise destroy your operation. More than that, it gives you something priceless: peace of mind. When you know you’re properly protected, you can focus on what you do best—delivering loads safely and keeping your wheels turning profitably.

The right owner operator semi truck insurance protects your livelihood so a single bad day doesn’t become a career-ending catastrophe.

Key Types of Mandatory Coverage

Let’s break down the essential coverages that form your protection plan. These aren’t optional add-ons—they’re the core elements that keep you legal, protected, and in business.

Primary Auto Liability is the heavyweight champion of truck insurance. This is what the Federal Motor Carrier Safety Administration (FMCSA) requires before you can legally operate. It covers bodily injury and property damage you cause to others in an accident. If your truck causes a collision, this coverage pays for injured parties’ medical expenses and repairs to damaged vehicles or property. The FMCSA sets the minimum at $750,000, but smart owner-operators carry $1 million because that’s what most shippers and brokers demand. This is typically part of your broader Commercial Auto Insurance policy.

Physical Damage Coverage shifts focus from protecting others to protecting your most valuable business asset—your truck. This coverage has two components. Collision coverage pays for repairs or replacement when your truck gets damaged in an accident with another vehicle or object, regardless of fault. Comprehensive coverage handles everything else—fire, theft, vandalism, weather damage, falling objects, or that deer that jumps out of nowhere. Annual costs typically run $1,500-$4,000, which is a bargain compared to replacing a truck out of pocket.

Motor Truck Cargo Insurance protects the freight you’re hauling. Even with your best efforts, cargo can get damaged, lost, or stolen during transit or while loading and unloading. This coverage steps in to provide freight protection for those situations. The FMCSA may require as little as $5,000 in cargo coverage, but specific contracts often demand much higher limits depending on what you’re hauling. Expect to pay $400-$1,200 annually for this protection.

General Liability Insurance covers non-driving risks that come with running a trucking business. This handles situations where you’re not actually behind the wheel—like when someone slips and falls at your business location, or you accidentally damage property at a loading dock while on foot. It can even cover claims like libel, slander, or copyright issues related to your business advertising. For $500-$800 per year, you get broad protection against everyday business exposures that have nothing to do with your truck moving down the highway.

Together, these four coverage types create a comprehensive shield for your operation, protecting both your assets and your ability to earn a living in this demanding industry.

Own Authority vs. Leased-On: A Tale of Two Insurance Scenarios

The world of owner operator semi truck insurance changes dramatically based on your operating model. Are you running completely independently, or are you leased to a larger motor carrier? This distinction isn’t just about how you get loads; it fundamentally alters your insurance responsibilities and, crucially, your costs.

Think of it like this: operating under your own authority means you’re the captain of your own ship, responsible for every aspect of your business—including all the insurance. Leasing to a carrier is more like being part of a fleet, where some of those insurance responsibilities are shared.

Understanding which path you’re on is essential for Owner Operator Insurance with Own Authority and DOT Number decisions that protect your business without overpaying.

| Insurance Aspect | Operating Under Your Own Authority | Leased to a Motor Carrier |

|---|---|---|

| Primary Liability | ✅ You must carry it ($750,000-$1M) | 🚫 Usually covered by carrier |

| Motor Truck Cargo | ✅ Required by you | 🚫 Typically carrier’s responsibility |

| Physical Damage | ✅ Your responsibility | ✅ Your responsibility |

| Non-Trucking Liability | 🚫 Not needed | ✅ Essential for personal use |

| General Liability | ✅ Recommended | ✅ Recommended |

| FMCSA Filings | ✅ You handle BMC-91, MCS-90 | 🚫 Carrier handles these |

| Average Annual Cost | $14,000-$22,000 | $3,600-$5,000 |

| Monthly Cost Range | $1,167-$1,833 | $300-$400 |

Operating Under Your Own Authority

When you operate under your own authority with your own DOT Number, you’re running a completely independent trucking business. This means full responsibility for all insurance requirements—and there’s no way around it.

You’ll need to carry Primary Auto Liability coverage, which is the big-ticket item. The FMCSA requires a minimum of $750,000, but most shippers and brokers won’t even look at you unless you have $1 million in coverage. This protects others if you cause an accident that results in bodily injury or property damage.

Motor Truck Cargo insurance is another must-have. You’re responsible for the freight you’re hauling, and if something happens to it—whether it’s damaged in an accident, stolen, or lost—you’re on the hook. Coverage amounts vary based on what you haul, but expect minimums around $100,000.

You’ll also need Physical Damage coverage for your truck, General Liability for non-driving business risks, and you’ll be responsible for all FMCSA filings like the BMC-91 and MCS-90 endorsement.

The trade-off? Higher premiums. Owner-operators with their own authority typically spend between $14,000 and $22,000 annually on insurance—that’s roughly $1,167 to $1,833 per month. But you also have complete control over your business, your contracts, and your earning potential.

Leased to a Motor Carrier

If you’re leased to a motor carrier, you’re operating under their authority, and this changes everything about your insurance picture. The carrier becomes primarily responsible for most of the major coverages.

The carrier’s Primary Liability policy typically covers you while you’re hauling their loads. They handle the FMCSA filings and maintain the required cargo insurance. This is a huge financial relief and why leased-on operators pay significantly less for insurance.

However, you’re not completely off the hook. You’ll still need Physical Damage coverage to protect your truck—that’s your asset, and the carrier won’t cover it. This includes both collision and comprehensive coverage.

Most importantly, you’ll need Non-Trucking Liability (also called Bobtail insurance). This covers you when you’re using your truck for personal reasons or driving without a trailer—times when the carrier’s primary policy doesn’t apply. Think of it as your personal liability coverage for the truck.

General Liability is still recommended to protect against slip-and-fall incidents and other non-driving business risks.

The big advantage? Lower premiums. Leased-on owner-operators typically spend just $3,600 to $5,000 annually—roughly $300 to $400 per month. That’s a difference of up to $17,000 per year compared to operating under your own authority.

The trade-off is less independence. You’re working under someone else’s authority, which means less control over the loads you take and potentially lower per-mile rates. But for many owner-operators, especially those just starting out, the reduced insurance costs and administrative burden make leasing an attractive option.