Why Smart Orlando Drivers Are Rethinking Their Insurance Costs

Navigating Orlando’s busy roads can make auto insurance orlando feel like an expensive necessity. If you’re looking for coverage, here’s what you need to know right away:

Quick Answer: Getting Auto Insurance in Orlando

- Minimum Required Coverage: $10,000 Personal Injury Protection (PIP) + $10,000 Property Damage Liability (PDL).

- Average Challenge: Orlando rates are high due to millions of annual visitors, heavy I-4 traffic, hurricane risk, and a high number of uninsured drivers.

- Your Next Step: Compare quotes from multiple carriers to find rates that fit your budget.

- Potential Savings: Most drivers can save $50+ per month by shopping around and claiming available discounts.

As Florida’s largest inland metro, Orlando presents unique insurance challenges. The mix of local commuters and tourist traffic contributes to congestion, accidents, and higher premiums. However, you don’t have to accept sky-high rates. Understanding your cost drivers and knowing where to find competitive quotes puts you in control.

I’m D.J. Hearsey, founder of Select Insurance Group. With over three decades of experience, I’ve helped thousands of Orlando-area drivers find affordable auto insurance orlando that protects what matters. This guide will help you make informed decisions.

Important auto insurance orlando terms:

- Auto Insurance Agents in Orlando FL

- Auto Insurance Companies Orlando FL

- Auto Insurance Quote Orlando FL

Florida’s Minimum Car Insurance Requirements in Orlando

Before shopping for auto insurance orlando, you must understand Florida’s legal requirements. Florida is a “no-fault” state, meaning your own insurance pays for your initial medical bills and lost wages after an accident, regardless of who was at fault.

To drive legally in Orlando, you must carry two coverages:

- Personal Injury Protection (PIP): A minimum of $10,000. This is the core of the no-fault system, covering 80% of your medical expenses and 60% of lost wages up to your limit.

- Property Damage Liability (PDL): A minimum of $10,000. This pays for damage you cause to another person’s property, like their car or fence.

The uncomfortable truth is that these minimums are rarely enough for a serious accident. A single ER visit or major car repair can easily exceed $10,000, leaving you to pay the rest.

Driving without insurance in Florida results in immediate penalties: fines of $150 to $500, suspension of your driver’s license and vehicle registration, and the requirement to file an SR-22, which marks you as high-risk and increases future premiums. You can learn More on Florida’s minimums on our detailed guide page.

Mandatory vs. Optional Coverage

Let’s clarify what’s required versus what’s recommended for true protection.

Mandatory coverages are $10,000 in PIP and $10,000 in PDL. Driving without them is illegal.

Optional coverages are where you protect your finances. Bodily Injury Liability (BI) isn’t required by law, but it’s crucial. It covers others’ injuries if you cause an accident, protecting you from lawsuits that could threaten your savings and assets. Uninsured/Underinsured Motorist (UM/UIM) is also vital, covering your costs when you’re hit by a driver with little or no insurance.

Other key options include Collision (repairs your car after a crash), Comprehensive (covers theft, weather damage, etc.), Medical Payments (MedPay) (helps with co-pays and deductibles), and Rental Reimbursement (pays for a rental car during repairs).

| Coverage Type | Category | Description |

|---|---|---|

| Personal Injury Protection (PIP) | Mandatory | Covers your medical expenses and lost wages, regardless of fault. Required minimum: $10,000. |

| Property Damage Liability (PDL) | Mandatory | Pays for damage you cause to others’ property. Required minimum: $10,000. |

| Bodily Injury Liability (BI) | Optional* | Covers medical expenses and legal fees if you injure others. *Effectively mandatory if you have a car loan or assets to protect. |

| Uninsured/Underinsured Motorist (UM/UIM) | Optional | Protects you when hit by drivers with no insurance or insufficient coverage. |

| Collision Coverage | Optional | Pays for damage to your vehicle from collisions, regardless of fault. |

| Comprehensive Coverage | Optional | Covers non-collision damage: theft, vandalism, weather, falling objects. |

| Medical Payments (MedPay) | Optional | Additional medical coverage for you and passengers, including deductibles and co-pays. |

When getting an auto insurance orlando quote, an agent should help you choose options based on your vehicle’s value, financing, and personal risk tolerance. For official state information, see the Official Florida requirements page.

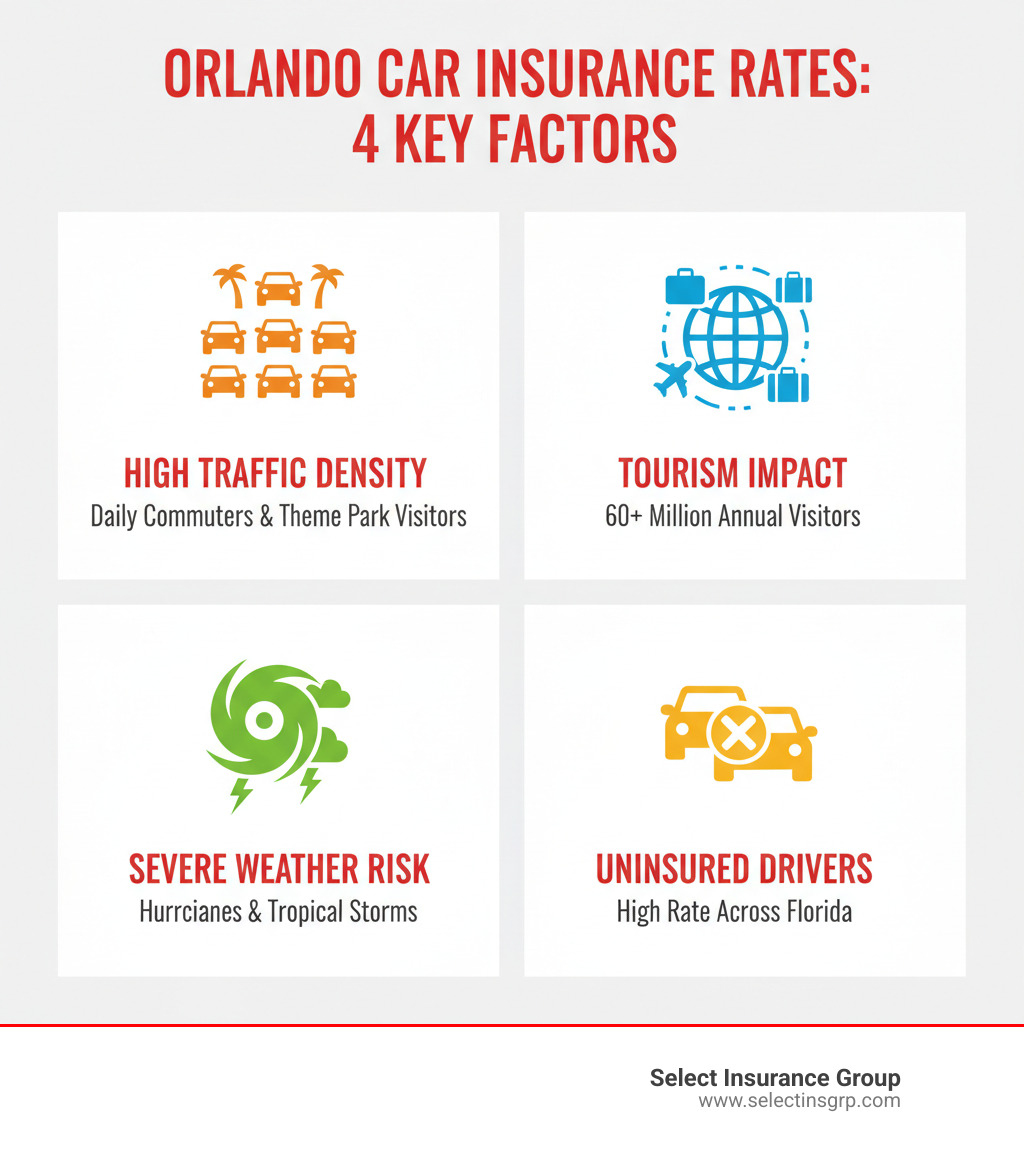

Why Are Orlando Car Insurance Rates So High?

If you’ve shopped for auto insurance orlando, you’ve likely seen high rates. This isn’t random; it’s driven by a unique combination of local factors:

- High Traffic & Tourism: As Florida’s largest inland metro and a top tourist destination, Orlando’s roads are packed. Congestion on major arteries like Interstate 4, combined with over 60 million annual visitors who are often unfamiliar with the area, leads to a higher frequency of accidents.

- Severe Weather: Hurricanes, tropical storms, and intense thunderstorms are a constant threat, causing widespread vehicle damage from flooding, wind, and debris. This high risk of comprehensive claims is factored into all premiums.

- Uninsured Drivers: Florida has one of the nation’s highest rates of uninsured drivers. This forces insurance companies to build that risk into your policy, as you’re more likely to be hit by someone with no coverage.

- Litigation Environment: Florida’s legal system can make it easier to file large personal injury lawsuits after an accident, and these potential costs are passed on to consumers through higher premiums.

Understanding these factors is the first step toward finding ways to lower your personal costs.

Key Factors That Influence Your Personal Premium

While Orlando’s environment sets a high baseline, your individual premium depends on personal factors. Insurers assess your specific risk based on the following:

- Driving Record: A clean record is your best asset for lower rates. Tickets, at-fault accidents, or a DUI will significantly increase your premium for years.

- Vehicle Type: Sports cars and luxury SUVs cost more to insure due to higher repair costs and theft risk. Vehicles with advanced safety features may earn you a discount.

- ZIP Code: Rates vary by neighborhood based on local claims data for theft, accidents, and traffic density.

- Age: Drivers under 25 face higher rates due to statistical risk, but these costs typically decrease with age and a clean record.

- Credit Score: In Florida, insurers use credit-based scores to predict risk. A better credit score can lead to significant savings.

- Annual Mileage: The more you drive, the higher your risk of an accident. A long daily commute will result in a higher premium than working from home.

- Coverage & Deductibles: Higher liability limits and more coverage options increase your premium but offer better protection. Choosing a higher deductible lowers your monthly cost but increases your out-of-pocket expense for a claim.

Many of these factors are within your control. Ready to see how they affect your rate? Get an auto insurance quote in Orlando and let’s find a policy that fits your needs and budget.

A Complete Guide to Auto Insurance Orlando Coverage Types

State minimums are just a starting point. Real protection requires more than the bare minimum. When people talk about “full coverage,” they generally mean a combination of liability, collision, and comprehensive policies. This trio creates a strong foundation, but your auto insurance orlando policy can be customized further to match your life.

For a deeper dive, see our Ultimate Florida auto insurance guide.

Essential Optional Coverages

These coverages are often the difference between a manageable incident and a financial disaster.

- Bodily Injury Liability (BI): While technically optional, this is one of the most critical coverages. It pays for injuries you cause to others, protecting your assets from potentially devastating lawsuits.

- Uninsured/Underinsured Motorist (UM/UIM): Protects you when you’re hit by a driver with no insurance or not enough insurance to cover your medical bills and lost wages.

- Collision Coverage: Pays to repair or replace your vehicle after a crash with another car or object, regardless of fault. Lenders require this for financed or leased vehicles.

- Comprehensive Coverage: Your defense against non-collision events common in Orlando, like hurricane damage, flooding, theft, and vandalism. Also required by lenders.

- Medical Payments (MedPay): Works with PIP to cover the remaining 20% of your medical bills, plus deductibles and co-pays.

- Rental Reimbursement: Covers the cost of a rental car while yours is being repaired after a covered claim, keeping your life on track.

What Your Policy Typically Won’t Cover

It’s just as important to know what your auto insurance orlando policy excludes:

- Wear and Tear: Insurance covers sudden events, not routine maintenance like new brakes or engine trouble from age.

- Intentional Damage & Racing: Deliberately damaging your vehicle or using it for racing (on a track or the street) is not covered.

- Business Use: Your personal policy likely won’t cover you while driving for services like Uber, Lyft, or DoorDash. You need a rideshare endorsement or a Commercial vehicle policies.

- Personal Belongings: Items stolen from your car, like a laptop or phone, are covered by homeowners or renters insurance, not your auto policy.

Actionable Strategies to Lower Your Car Insurance Bill

Many Orlando drivers overpay for auto insurance orlando. You have the power to lower your bill without sacrificing protection. Here are the most effective strategies:

- Shop Around: This is the single most impactful step. Rates for identical coverage can vary by hundreds of dollars between carriers. We compare over 40 companies for you, often saving customers $50+ per month.

- Increase Your Deductibles: Choosing a higher deductible (e.g., $1,000 instead of $500) will lower your premium. Just ensure you can comfortably pay that amount out-of-pocket if you file a claim.

- Improve Your Credit Score: In Florida, a better credit score can lead to significantly lower insurance rates. Pay bills on time and manage debt to see the benefits.

- Maintain a Clean Driving Record: Safe driving is the foundation of low rates. Avoiding tickets and at-fault accidents will keep your premiums down year after year.

- Review Your Coverage Annually: Life changes like moving, buying a new car, or paying off a loan can affect your needs and qualify you for new discounts. Don’t set your policy and forget it.

These strategies put money back in your pocket. Let us help you Find cheap auto insurance in Orlando.

Opening Up Discounts for Auto Insurance in Orlando

Don’t leave money on the table. We make it our mission to find every discount you qualify for, including:

- Multi-Policy (Bundling): Combine your auto policy with home, renters, or commercial insurance for savings of up to 20% or more.

- Good Student: Most insurers offer discounts for students who maintain a B average or better.

- Safe Driver: Earn rewards for being accident-free for 3-5 years. Completing a defensive driving course can also lower your bill.

- Anti-Theft Devices: Alarms, GPS trackers, and other security features can reduce your premium.

- Paid-in-Full: Paying your entire premium upfront instead of in monthly installments often comes with a discount.

- Low Mileage: If you work from home or don’t drive much, let your insurer know. Fewer miles mean lower risk and lower rates.

- Telematics Programs: Allow an app to monitor your safe driving habits (like braking and speed) to earn discounts based on your real-world behavior.

When we work on your auto insurance orlando policy, we dig through every available discount to ensure you get the best possible price.

The High Cost of Driving Uninsured in Orlando

Let’s be frank: skipping auto insurance orlando coverage is a risk you can’t afford. In Florida, there is no grace period if your insurance lapses. The moment your policy is inactive, you are driving illegally, and the consequences are severe.

If you’re caught driving uninsured in Orlando, you face:

- Immediate Penalties: Fines between $150 and $500, plus immediate suspension of your driver’s license and vehicle registration.

- SR-22 Requirement: To restore your driving privileges, you’ll have to file an SR-22 certificate. This labels you a high-risk driver, causing your future insurance premiums to skyrocket for three to five years.

- Impound Fees: Your vehicle may be impounded, leading to towing and daily storage fees that add up quickly.

Worst of all is the personal liability for damages. If you cause an accident while uninsured, you are personally responsible for every dollar of the other party’s medical bills, vehicle repairs, and lost wages. A serious accident can easily lead to claims of $100,000 or more.

Without insurance, that money comes directly from you through garnished wages or seized assets, potentially leading to bankruptcy. I’ve seen families lose everything over this one mistake. The temporary savings are not worth the catastrophic risk. Your auto insurance orlando policy is your financial safety net.

Finding the Right Insurance Agent in Orlando

When navigating auto insurance orlando, the right agent makes all the difference. They are your local guide, helping you avoid costly wrong turns. But not all agents work the same way.

- Captive agents work for a single insurance company. They can only offer you products from that one carrier.

- Independent agents, like us at Select Insurance Group, work for you. We partner with over 40 different carriers to shop the market on your behalf.

Working with an independent agent means you get the best of all worlds. Instead of you filling out endless forms, we take your information once and find the best options from our extensive network. With over 30 years of experience in Florida, we know which companies offer the most competitive rates for your specific situation in Orlando.

You’ll speak with licensed professionals who understand local challenges—from I-4 congestion to hurricane risks—and how they affect your rates. If you need to file a claim, we’re here to guide you through the process and advocate on your behalf. You’re not just a policy number; you’re our neighbor.

We have local expertise ready to serve you. You can Find an Orlando agent on our website or connect with our teams at our East Orlando agency or South Orlando agency. We are real people in your community, ready to help you find the right auto insurance orlando coverage.

Conclusion

We’ve covered the essentials of auto insurance orlando, from Florida’s requirements and the factors driving high costs to the full range of coverages that offer real protection. We’ve also shared proven strategies to lower your bill.

The key takeaway is that while Orlando rates can be high, you are in control. By understanding your policy, shopping around, and claiming every available discount, you can save significantly—often $50 or more per month.

That’s where Select Insurance Group comes in. With over 30 years of experience and access to more than 40 top-rated carriers, we do the hard work for you. As an independent agency, our loyalty is to you, not an insurance company. We listen to your needs and find the best combination of coverage and price.

The roads of Orlando aren’t getting any less busy. Drive with the confidence that comes from having the right partner and the right protection.

Ready to take control of your auto insurance orlando costs? Contact our West Orlando insurance agency today for a personalized quote! Let’s find you coverage that fits your life and your budget.