Why Getting the Right Auto Insurance Quote Matters in Orlando

When you’re looking for an auto insurance quote orlando fl, here’s what you need to know right away:

Quick Answer: How to Get an Auto Insurance Quote in Orlando

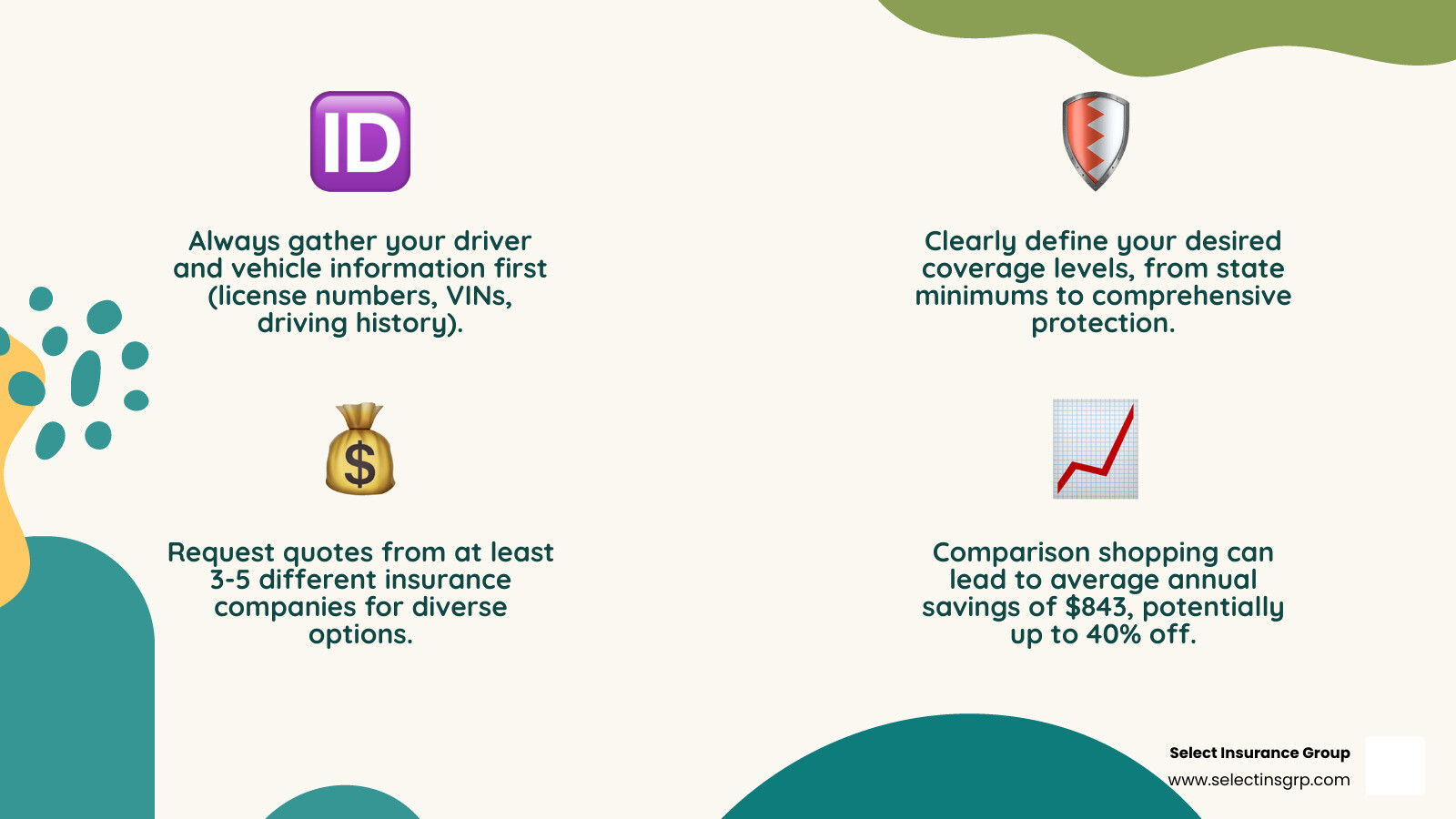

- Gather your information – Driver’s license, VIN, current policy details, and driving history

- Compare at least 3-5 companies – Research shows this can save you $843 annually

- Use consistent coverage levels – Apply the same limits and deductibles across all quotes

- Work with an independent agent – They shop 20+ carriers to find your best rate

- Apply all eligible discounts – Multi-policy, safe driver, good student, and vehicle safety features

Orlando drivers face unique challenges. With over 60 million visitors a year, our roads are packed with tourists navigating busy corridors like I-4. This heavy traffic increases accident risk and drives up insurance costs—the average Florida driver pays $243 per month for full coverage, well above the national average.

However, identical coverage can cost $200 per month with one insurer and just $120 with another. That’s why comparison shopping is critical. When you compare quotes from multiple carriers, you’re not just finding a lower price—you’re potentially saving hundreds of dollars every year while ensuring you have the protection you need.

The consequences of driving uninsured in Orlando are severe, including fines from $150 to $500, license suspension, and an SR-22 requirement that makes future insurance much more expensive. Florida’s minimum requirements include $10,000 in Personal Injury Protection (PIP) and $10,000 in property damage coverage, but this is rarely enough.

I’m D.J. Hearsey, Principal Agent and CEO of Select Insurance Group. With over 30 years of experience, my team and I help Orlando drivers find affordable, comprehensive coverage by shopping 20+ carriers for every auto insurance quote orlando fl request. We deliver transparent comparisons and personalized service that puts your needs first.

Understanding Orlando’s Auto Insurance Essentials

Navigating Orlando’s roads is challenging enough; understanding your auto insurance shouldn’t add to the stress. Here’s a breakdown of Florida’s unique insurance requirements and why they matter for Orlando drivers.

Florida is a “no-fault” insurance state (see no-fault insurance). This means your own insurance policy is the first to pay for your medical expenses and lost wages after an accident, regardless of who was at fault. This system is designed to speed up claims and shapes the coverage you’re required to carry.

Minimum Coverage Requirements

To drive legally in Florida, you must have two types of coverage:

- Personal Injury Protection (PIP): You must carry at least $10,000 in PIP. It covers 80% of your medical bills and 60% of lost wages up to the limit, regardless of fault.

- Property Damage Liability (PD): You also need a minimum of $10,000 per accident. This pays for damages you cause to someone else’s property, like their car or fence.

Surprisingly, Bodily Injury Liability (BI), which covers injuries to others, is not required for most Florida drivers. However, going without it is a significant financial risk.

The average cost for full coverage in Florida is about $2,912 annually ($243 per month), but your rate in Orlando will depend on your specific circumstances.

Consequences of Driving Uninsured

Driving without insurance in Orlando is a costly mistake. The penalties include:

- Fines: Between $150 and $500.

- Suspension: Your driver’s license and vehicle registration will be suspended.

- SR-22 Certificate: You may be required to file an SR-22, which labels you as a high-risk driver and dramatically increases your insurance premiums for three years.

Beyond legal trouble, if you cause an accident without coverage, you are personally liable for all damages and injuries. A serious crash could lead to financial ruin.

Recommended Coverage for Orlando Drivers

Florida’s minimums are not enough to protect you from the financial fallout of a serious accident. We strongly recommend a more robust policy for Orlando drivers.

- Uninsured/Underinsured Motorist (UM/UIM): This is critical in Florida, where many drivers have no insurance or only the minimum. It covers your medical bills and lost wages if an uninsured or underinsured driver hits you.

- Bodily Injury Liability (BI): Though not always required, BI is essential for protecting your assets. If you injure someone in an accident, it pays for their medical costs. Without it, your savings and home could be at risk. We recommend limits of at least $100,000 per person and $300,000 per accident.

- Collision Coverage: This pays to repair or replace your car if you hit another vehicle or object.

- Comprehensive Coverage: This protects your car from theft, vandalism, fire, storms, and other non-collision events. It’s vital during Florida’s hurricane season.

- Higher Liability Limits: The cost to increase your liability limits is often minimal but provides significantly more protection.

With over 60 million visitors annually, Orlando’s roads are filled with drivers unfamiliar with the area. This increases your risk, making comprehensive coverage like UM/UIM and higher liability limits your best defense.

Key Factors That Influence Your Auto Insurance Quote in Orlando, FL

When you shop for an auto insurance quote orlando fl, you’ll find that rates vary based on how insurers calculate risk. Here are the key factors that determine your premium.

- Driving Record: A clean record with no accidents or violations will result in lower rates. Insurers typically look back three to five years, so recent speeding tickets, at-fault accidents, or a DUI will increase your premium.

- Vehicle You Drive: The make, model, safety ratings, repair costs, and theft statistics for your vehicle all play a role. Sports cars and luxury vehicles often cost more to insure, as do some newer electric vehicles with specialized parts.

- Vehicle Age: Newer cars are typically more expensive to insure because of their higher value. However, very old cars may also have higher rates if they lack modern safety features. If your older car is paid off, you might save money by dropping collision and comprehensive coverage.

- Safety Features: Features like anti-lock brakes, airbags, electronic stability control, and modern driver-assistance systems can earn you discounts because they reduce accident risk.

- ZIP Code: Insurers analyze local data on accident frequency, theft, and vandalism. Living in a neighborhood with higher incident rates often means paying more for coverage.

- Credit Score: In Florida, your credit-based insurance score is a significant rating factor. A higher credit score generally leads to lower premiums, as it correlates with a lower likelihood of filing claims.

- Age and Driving Experience: Young, inexperienced drivers have the highest accident rates and pay the highest premiums. Rates typically decrease significantly by the mid-20s as drivers gain experience.

- Coverage Limits and Deductibles: The amount of coverage you choose directly impacts your cost. Higher liability limits increase your premium but offer far greater protection. A higher deductible (what you pay out-of-pocket) will lower your monthly premium, while a lower deductible will increase it.

A Step-by-Step Guide to Comparing Orlando Auto Insurance Quotes

Finding the right auto insurance quote orlando fl is manageable with a clear plan. Follow these steps to find coverage that fits your life and budget.

Step 1: Gather Your Driver and Vehicle Information

Before you start, collect these essential details to ensure your quotes are accurate and comparable:

- Driver’s license numbers for all drivers on the policy.

- Vehicle Identification Numbers (VINs) for all cars being insured.

- Current policy declaration page to see your current coverages, limits, and discounts.

- Driving history for all drivers, including any accidents, violations, or claims in the past 3-5 years.

- Estimated annual mileage for each vehicle.

- Basic personal information like dates of birth and your current address.

Step 2: Determine Your Ideal Coverage Levels

Think beyond Florida’s minimums ($10,000 PIP and $10,000 property damage) to what protection you actually need. “Full coverage” typically includes collision, comprehensive, and higher liability limits, often with Uninsured/Underinsured Motorist protection. This is wise if your car is new, valuable, or financed, or if you have assets like a home to protect.

Your deductible is what you pay out-of-pocket on a claim. A higher deductible (e.g., $1,000) lowers your premium, while a lower one (e.g., $500) raises it. Choose an amount you can comfortably afford.

Consider optional coverages for added peace of mind:

- Roadside Assistance: Helps with flat tires, dead batteries, or lockouts.

- Rental Car Reimbursement: Covers a rental car while yours is being repaired after a claim.

- Gap Insurance: Pays the difference between your car’s value and what you owe on your loan if it’s totaled.

- Medical Payments: Supplements PIP to cover additional medical costs.

For personalized guidance, check out our insights on Auto Insurance Quotes in Orlando, FL.

Step 3: Request Your Free Auto Insurance Quote in Orlando, FL

Now it’s time to get your quotes. The most efficient way to do this is by working with an independent insurance agent.

Instead of filling out forms on multiple websites, an independent agent shops the market for you. At Select Insurance Group, we work with over 40 carriers. When you request an auto insurance quote orlando fl from us, we compare dozens of options to find the most competitive rates for your specific needs. It’s like having a personal shopper for insurance.

While online quote tools on insurer websites offer quick estimates, you only get a price from one company. To truly compare, you must repeat the process multiple times, and you might miss out on discounts an experienced agent would find.

Comparing several quotes is essential. Our research shows that drivers who compare at least three companies save an average of $843 annually. We’ve seen identical coverage cost 40% less with one carrier versus another. Don’t just renew your policy without checking for a better deal.

Ready to see what you could save? Visit our Get a Quote page. We’ll get to work finding you the best rates from our network of over 40 carriers.

Open uping Top Discounts for Orlando Drivers

Most insurers offer numerous ways to lower your premium. Knowing what discounts are available is key to maximizing your savings on an auto insurance quote orlando fl.

Common Ways to Save on Your Policy

Ask your agent about these common discounts to ensure you’re getting all the savings you deserve:

- Multi-Policy Discount: Bundling your auto insurance with a home or renters policy from the same company can save you 15-25%.

- Good Student Discount: If a young driver on your policy maintains a “B” average (3.0 GPA) or higher, you can get a significant discount.

- Safe Driver Discount: A clean driving record with no accidents or tickets for three to five years will earn you lower rates.

- Vehicle Safety Features: Cars with anti-lock brakes, airbags, and advanced driver-assistance systems often qualify for discounts.

- Anti-Theft Devices: Alarms, immobilizers, or vehicle recovery systems can reduce your premium.

- Multi-Vehicle Discount: Insuring more than one car on the same policy typically results in savings.

- Pay-in-Full Discount: Paying your entire six-month or annual premium upfront can earn you a small discount.

- Other Discounts: Ask about savings for completing a defensive driving course, having low annual mileage, or staying with the same insurer for several years (loyalty discount).

How to Get the Best Auto Insurance Quote in Orlando, FL

Finding the best rate requires a proactive approach. Here are a few tips:

- Ask About All Discounts: When getting a quote, be specific and ask about every discount you might qualify for. A good agent will help you identify all opportunities.

- Review Your Policy Annually: Life changes like getting married, moving, buying a new car, or improving your credit score can impact your rates. Get a fresh auto insurance quote orlando fl each year to ensure you’re not overpaying.

- Maintain a Clean Driving Record: This is the single most effective way to keep your premiums low over the long term. Safe driving pays off.

- Improve Your Credit Score: A better credit score can lead to lower insurance rates, in addition to other financial benefits.

Frequently Asked Questions about Auto Insurance in Orlando

Shopping for insurance can be confusing. Here are answers to some of the most common questions we hear from people seeking an auto insurance quote orlando fl.

What is the average cost of car insurance in Orlando, FL?

The average cost of full coverage car insurance in Florida is around $2,912 per year, or $243 per month. This is higher than the national average due to factors like heavy traffic and hurricane risk. However, this is just an average. Your actual auto insurance quote orlando fl will depend on your driving record, vehicle, ZIP code, coverage choices, and credit score. The only way to know your cost is to get a personalized quote.

What is the fastest way to get an auto insurance quote?

For speed, you have two main options:

- Online Quote Forms: These are fast and available 24/7 on insurer websites. The downside is you only get a quote from one company at a time and may miss out on personalized advice or discounts.

- Calling an Independent Agent: This is the most efficient and thorough approach. You provide your information once, and an agent shops it across dozens of carriers for you. At Select Insurance Group, we compare over 40 carriers to find you the best options, saving you time and often finding a better rate.

For either method, have your driver’s license numbers, VINs, and current policy details ready to speed up the process.

Do I need more than the minimum required insurance in Florida?

Yes, absolutely. Florida’s minimums—$10,000 in PIP and $10,000 in Property Damage—are dangerously low for a real-world accident. A single ER visit or moderate car repair can easily exceed these limits, leaving you to pay the rest out-of-pocket.

Without adequate Bodily Injury Liability coverage, your personal assets (home, savings) are at risk if you’re sued after causing an accident. Furthermore, Florida has a high rate of uninsured drivers. If one of them hits you, Uninsured Motorist coverage is your primary protection for medical bills. The small extra cost for higher limits and broader coverage provides crucial financial protection and peace of mind.

Conclusion: Take the Next Step to Secure Your Savings

Navigating auto insurance in Orlando is simpler when you know the key steps. We’ve covered why state minimums aren’t enough, how factors like your ZIP code affect your rates, and why comparison shopping is essential.

Orlando’s roads are unique, with over 60 million tourists annually increasing traffic and accident risk. This makes proper coverage a necessity, not a luxury.

The most important takeaway is that comparison shopping is necessary. When identical coverage can vary by hundreds of dollars between carriers, you owe it to yourself to explore your options. Drivers who compare quotes save an average of $843 annually—money that belongs in your pocket.

We also can’t overstate the importance of choosing coverage beyond the state minimums. Higher liability limits and Uninsured Motorist coverage protect your financial future from the devastating costs of a serious accident.

At Select Insurance Group, this is our expertise. For over 30 years, we’ve helped drivers find coverage that fits their lives. We don’t work for an insurance company; we work for you. By shopping your policy with over 40 carriers, we provide transparent comparisons and straightforward advice to protect what matters most.

Think of us as your insurance advocate. We do the hard work of finding the right protection at the best price, so you can focus on your life. Whether you’re new to Orlando or a long-time resident, we’re here to make the process easy.

Don’t spend another day overpaying for insurance or driving with inadequate coverage. Let us show you what’s possible when you have an independent agency on your side. We’re ready to help you find the perfect auto insurance quote orlando fl.

Ready to see how much you can save? Contact Us today to start the conversation. If you’re in the western part of the city, we can also help you Find the best coverage in West Orlando.

Your peace of mind is just one quote away.