Why Non-Owner Car Insurance Matters for Drivers Without a Vehicle

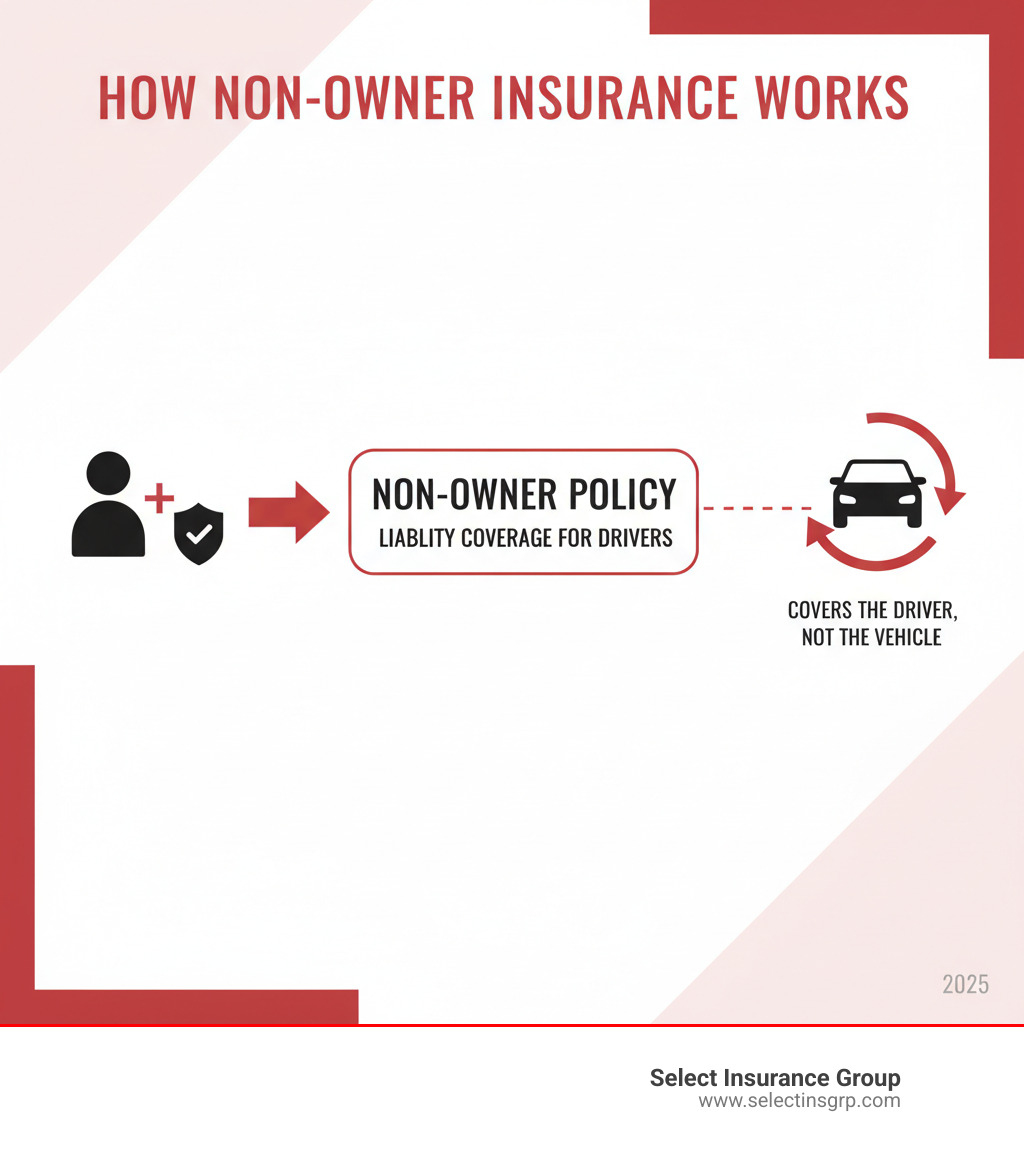

Non owners drivers insurance is a liability policy for licensed drivers who don’t own a vehicle but drive occasionally. Instead of insuring a car, this policy follows you, providing financial protection when you borrow, rent, or use shared vehicles.

What Non-Owner Car Insurance Covers:

- Bodily injury liability: Covers medical costs for others you injure in an at-fault accident.

- Property damage liability: Pays for damage you cause to someone else’s property.

- Legal defense costs: Protects you from lawsuits related to accidents.

- Uninsured/underinsured motorist protection: Optional coverage if you’re hit by a driver with inadequate insurance.

What It Doesn’t Cover:

- Damage to the vehicle you’re driving

- Your own medical expenses (unless you add optional coverage)

- Vehicles owned by household members

- Business-related driving

If you borrow a friend’s car and cause an accident, their insurance might not be enough. Non-owner insurance acts as a financial safety net. These policies typically cost around $421-$474 annually – far less than daily rental insurance fees or an uninsured lawsuit.

This policy is secondary coverage, kicking in after the car owner’s primary insurance is used up. It’s ideal for frequent renters, car-sharing users, or anyone needing to maintain continuous insurance history to keep future rates low.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group. With over 30 years of experience, I’ve helped countless drivers in the Southeast find the right non owners drivers insurance to stay protected on the road.

Non owners drivers insurance vocabulary:

What is Non-Owner Car Insurance and Who Needs It?

Think of non owners drivers insurance as coverage that follows you, not a specific car. It’s for licensed drivers who don’t own a vehicle but occasionally drive by borrowing, renting, or using a car-sharing service.

This coverage provides personal liability protection if you cause an at-fault accident in someone else’s vehicle. Because the policy is tied to you, it’s often called a “named non-owner policy.”

It acts as secondary coverage. The car owner’s insurance pays first, but if damages exceed their limits, your non-owner policy covers the rest. This can save you from huge out-of-pocket costs or lawsuits.

Who should consider a non-owner policy?

Non owners drivers insurance is a smart choice in these situations:

-

Frequent renters: Rental agencies charge $10-$15 daily for liability insurance. If you rent often, an annual non-owner policy is usually cheaper and provides consistent protection.

-

Regular borrowers: When you borrow a car, you’re relying on the owner’s insurance. If their limits are low and you cause a serious accident, your non-owner policy protects your personal assets.

-

Car-sharing users: Services like Zipcar or Turo include some coverage, but your own policy offers an extra layer of security that travels with you.

-

Drivers between vehicles: If you’ve sold your car but haven’t bought a new one, a non-owner policy prevents gaps in your insurance history. Insurers often charge higher premiums after a coverage lapse, so maintaining a policy shows you’re a responsible driver.

-

Drivers needing an SR-22 or FR-44: If your state requires proof of financial responsibility to reinstate your license, a non-owner policy is an affordable way to meet that requirement without owning a car. We help drivers with these requirements in Florida, the Carolinas, Virginia, and Georgia.

For more details, check out our low cost auto insurance Florida page.

When is non-owner insurance not necessary?

This coverage isn’t for everyone. You probably don’t need it if:

-

You’re a truly occasional driver: If you only borrow or rent a car once or twice a year, the annual cost may not be justified.

-

You drive a household member’s car: If you live with someone and regularly drive their car, you must be added as a listed driver on their primary auto policy. A non-owner policy won’t provide proper coverage in this case.

-

You drive a company car: Your employer’s commercial auto insurance should cover you for work-related driving. Non-owner policies are for personal use only.

-

You already own a car and have insurance: Your existing auto policy likely extends liability protection when you occasionally drive other cars. Check with an agent to confirm your policy’s specifics.

-

You’re already listed on someone else’s policy: If you’re an occasional driver on another person’s policy, you don’t need a separate non-owner policy.

Understanding Your Coverage: What’s Included and What’s Not

Non owners drivers insurance protects you as a driver, not the car you’re driving. This distinction shapes what is and isn’t covered.

Your non-owner policy is designed to protect your financial future from liability claims when you’re driving a borrowed or rented car. It is not designed to pay for repairs to the car itself. Understanding these limitations helps you make informed decisions.

What a typical policy covers

The core of your non owners drivers insurance is liability protection, your financial shield when you’re at fault in an accident.

-

Bodily injury liability: This is critical. It covers medical bills, lost wages, and pain and suffering for others if you cause an accident. These costs can be substantial, so solid coverage is essential.

-

Property damage liability: This pays for repairs to another person’s car, or for damage to other property like fences or buildings.

-

Legal defense fees: If you’re sued after an accident, your policy typically covers attorney and court costs, which can be staggering.

-

Uninsured/underinsured motorist protection: This optional coverage is a safety net if you’re hit by a driver who lacks adequate insurance to cover your injuries.

-

Medical Payments (MedPay) or Personal Injury Protection (PIP): These optional coverages help pay for your own medical expenses after an accident, regardless of fault, since standard liability only covers injuries to others.

What a typical policy excludes

Knowing what’s not covered is just as important. A non-owner policy is not a comprehensive solution for every situation.

The biggest exclusion is damage to the vehicle you’re driving. If you crash a borrowed car, your non-owner policy won’t pay to fix it. That falls to the owner’s collision coverage (if they have it), and you may be responsible for their deductible.

Your policy also won’t include collision or comprehensive coverage. This means theft, vandalism, hail, or other physical damage to the car isn’t covered by your policy. Your personal belongings inside the car are also not covered by this policy; you’d need to file a claim with your homeowner’s or renter’s insurance.

Other common exclusions include towing and roadside assistance, use of vehicles owned by household members, and any business-related driving.

| Covered by Non-Owner Policy | Not Covered by Non-Owner Policy |

|---|---|

| Bodily Injury Liability to others | Damage to the vehicle you are driving (borrowed or rented) |

| Property Damage Liability to others’ property | Collision coverage for the non-owned vehicle |

| Legal Defense Costs (if sued) | Comprehensive coverage (e.g., theft, vandalism, fire) for the non-owned vehicle |

| Uninsured/Underinsured Motorist (optional) | Your own personal injuries (unless optional MedPay/PIP is added) |

| Medical Payments/Personal Injury Protection (optional) | Damage to your personal belongings inside the non-owned vehicle |

| Towing and roadside assistance for the non-owned vehicle | |

| Vehicles owned by household members (you should be listed on their policy) | |

| Commercial or business-related driving |

Understanding these boundaries sets realistic expectations. A non-owner policy is designed to protect you from liability claims, and it does that job well. It is not a substitute for the comprehensive coverage a vehicle owner should carry.

The Financials of non owners drivers insurance

Let’s talk about money. The good news is that non owners drivers insurance is surprisingly affordable and can save you money in several ways.

How much does non owners drivers insurance cost?

Non owners drivers insurance typically costs much less than traditional car insurance. Insurers are only covering your liability as a driver, not a physical vehicle, which means lower risk and lower premiums.

On average, a non-owner policy costs around $421 to $474 annually, or about $35 to $40 per month. Compare that to rental car liability fees of $10 to $15 per day, and the savings add up quickly. If you rent cars frequently, a non-owner policy can easily pay for itself.

Your actual cost will depend on your driving record, the coverage limits you choose, and your location. Rates vary by state and even zip code. You can explore state-specific information on pages like our South Carolina Auto Insurance section. Your age and driving frequency can also influence the rate, but it remains a budget-friendly option.

How non owners drivers insurance affects your rates

A non-owner policy is a smart financial move that protects your future insurance rates. Insurers dislike gaps in coverage history, which they view as high-risk. A lapse can lead to significantly higher premiums when you eventually buy a car.

A non-owner policy maintains your continuous insurance history. This demonstrates responsibility and can qualify you for continuous coverage discounts later. Think of it as building good insurance credit. This is especially important if you’re between vehicles, ensuring you won’t face penalties for lapsed coverage when you’re ready to buy again.

Non-Owner Policy vs. Occasional Driver

It’s important to know the difference between a non-owner policy and being listed as an occasional driver.

If you live with someone and regularly drive their car, you should be listed as an occasional driver on their policy. This is often an insurer requirement and provides comprehensive coverage for that specific vehicle.

A non-owner policy is for driving vehicles not regularly available to you, like rentals or a friend’s car. It’s your personal liability safety net that follows you.

- Coverage Scope: An occasional driver has primary coverage under the car owner’s policy, including for damage to the car. A non-owner policy provides secondary liability coverage only and does not cover the car you’re driving.

- Cost: Adding an occasional driver raises the premium on an existing policy. A non-owner policy is a separate, standalone policy with its own low premium.

At Select Insurance Group, we can help you determine the right approach for your situation, leveraging our access to over 40 carriers to find the best fit.

How to Get a Policy and Handle State Requirements

Getting non owners drivers insurance is straightforward. You’ll need a valid driver’s license and to not be the registered owner of any vehicle.

Application process

- Confirm Eligibility: You need a valid driver’s license and must not own a car.

- Find a Provider: Not all companies offer non-owner policies. An independent agency like ours saves you time by shopping over 40 carriers to find the best rate. You can also research insurers using the NAIC’s Consumer Information Search tool.

- Get a Quote: You’ll provide basic personal and driving information. Our agents can walk you through this and help you compare options.

- Purchase and Maintain: Once you choose a policy, keep your coverage continuous to protect yourself and build a positive insurance history.

State-Specific Considerations: SR-22 and FR-44

For some drivers, non owners drivers insurance is essential for meeting state requirements. If you have serious violations like a DUI or driving without insurance, your state may require an SR-22 or FR-44 certificate.

This certificate is filed by your insurer with the DMV to prove you have the minimum required liability coverage. If you don’t own a vehicle but need to file an SR-22 or FR-44 to reinstate your license, a non-owner policy is often the only way to meet this legal requirement.

We specialize in helping drivers with these filings in Florida, the Carolinas, Virginia, and Georgia. For instance, we can guide you through North Carolina Auto Insurance options that meet your state’s specific SR-22 needs.

Steps to Take After an Accident

If you have an accident in a non-owned vehicle, follow these steps:

- Ensure Safety: Check on everyone involved and move to a safe location if possible. Seek medical attention for any injuries.

- Call the Police: A police report is an invaluable official record for the claims process.

- Exchange Information: Get contact and insurance details from all drivers, the vehicle owner, and any witnesses.

- Document Everything: Take photos of the scene, vehicle damage, and relevant road signs.

- Don’t Admit Fault: Let law enforcement and insurers determine responsibility.

- Notify the Vehicle Owner: Their primary insurance will likely be the first to respond, so they need to know immediately.

- Contact Your Insurer: Report the accident to us at Select Insurance Group right away. We’ll guide you through the claims process and explain how your secondary coverage applies.

Frequently Asked Questions about Non-Owner Insurance

Here are answers to the most common questions we hear about non owners drivers insurance at Select Insurance Group.

Does non-owner car insurance cover rental cars?

Yes, this is a primary reason people buy it. Your non-owner policy provides liability coverage when you rent a car, protecting you if you cause injury or damage to others. This can save you money compared to buying the rental agency’s expensive daily liability insurance.

However, your non-owner policy will not cover damage to the rental car itself. For that, you can purchase a Collision Damage Waiver (CDW) from the rental company or check if your credit card offers rental car coverage as a benefit.

Can I get a policy if I have a bad driving record?

Yes, you can get non owners drivers insurance with a challenging driving history. While accidents, violations, or a DUI/DWI will result in higher premiums, it doesn’t disqualify you. As an independent agency with access to over 40 carriers, we can shop around to find a policy that fits your budget.

In fact, if your record requires you to file an SR-22 or FR-44, a non-owner policy is often the ideal solution. We specialize in helping high-risk drivers in Florida, the Carolinas, Virginia, and Georgia meet these state requirements.

Does the policy cover anyone else who drives?

No. A non owners drivers insurance policy covers the named insured only. It is an individual policy that protects you and does not extend to a spouse, partner, or other family members. If others in your household also need this type of coverage, they must each purchase their own separate non-owner policy.

Conclusion

If you frequently borrow, rent, or share cars, you’re taking on significant financial risk. Non owners drivers insurance is essential protection that shields you from costly lawsuits and financial hardship.

For a small monthly cost, you gain peace of mind, protect your assets, and maintain a continuous insurance history, which saves you money on future policies. If you need an SR-22 or FR-44 to reinstate your license, a non-owner policy is your most direct path forward.

At Select Insurance Group, we’ve spent over 30 years helping drivers in Florida, the Carolinas, Virginia, and Georgia find the right coverage. With access to over 40 carriers, we shop for you to find a policy that fits your life and budget.

Drive confidently, knowing you’re covered no matter whose car you’re in.

Ready to get protected? Get a personalized auto insurance quote today and let’s find the perfect policy for you.