Why Classic Car Owners in North Carolina Need Specialized Insurance

Classic car insurance NC protects vintage and collector vehicles with specialized coverage that standard auto policies simply can’t match. If you own a classic car in North Carolina, here’s what you need to know:

Quick Answer: Classic Car Insurance NC Essentials

- What qualifies: Vehicles typically 20-25 years old, limited production models, or cars with appreciating value

- Key benefit: Agreed Value coverage pays the full insured amount (no depreciation) if your car is totaled

- Cost: $200-$600 annually—up to 40% less than standard auto insurance

- Requirements: Secure storage, a separate daily-use vehicle, and good driving record

- Usage: Pleasure driving, car shows, and exhibitions only (not daily commuting)

- Where to start: Independent agents can compare 20+ carriers to find your best rate

Your classic car is more than just a second vehicle in your garage—it’s a prized possession that represents both sentimental and financial value. Whether you’re restoring a hot rod, maintaining a collectible race car, or preserving a historical antique automobile, standard auto insurance won’t adequately protect your investment.

The Tar Heel State has a thriving classic car community, from the Outer Banks cruises to the Charlotte AutoFair and the NASCAR Hall of Fame. Classic car owners across North Carolina need insurance that understands the unique value these vehicles hold.

The problem with standard auto insurance is simple: it uses Actual Cash Value, which accounts for depreciation. If your pristine 1965 Ford Mustang is totaled, a regular policy might only pay what a beat-up version is worth at today’s market value—not what you’ve invested in restoration or what it’s truly worth to collectors.

Classic car insurance works differently. It uses Agreed Value coverage, where you and your insurer agree upfront on your car’s value. If the worst happens, you receive that full amount—no arguments about depreciation or market conditions.

As D.J. Hearsey, founder of Select Insurance Group with locations across the Southeast including North Carolina, I’ve helped countless classic car enthusiasts protect their investments through specialized Classic car insurance NC policies. With access to over 40 carriers and three decades of industry expertise, my team understands the unique needs of Tar Heel State collectors.

Simple Classic car insurance NC word guide:

What Makes a Car “Classic” for Insurance in North Carolina?

Defining a classic car isn’t always as straightforward as you might think. While many people picture a shiny, chrome-laden beauty from the 50s or 60s, the insurance world has specific criteria. For Classic car insurance NC purposes, a vehicle typically needs to be between 20 to 25 years old. However, this isn’t a hard and fast rule. Some insurers might consider a car a classic if it’s 15 years old or older, especially if it’s a limited production model, an exotic auto, or a vehicle that is appreciating in value due to its unique design or rarity.

For example, a 20-year-old car that was mass-produced might not qualify, while a 10-year-old limited-edition sports car with a unique design and appreciating value could. The key is often whether the vehicle is considered an investment that holds or increases in value, rather than depreciating like a standard daily driver. We work with specialized carriers who understand these nuances and can help determine if your cherished vehicle fits the bill.

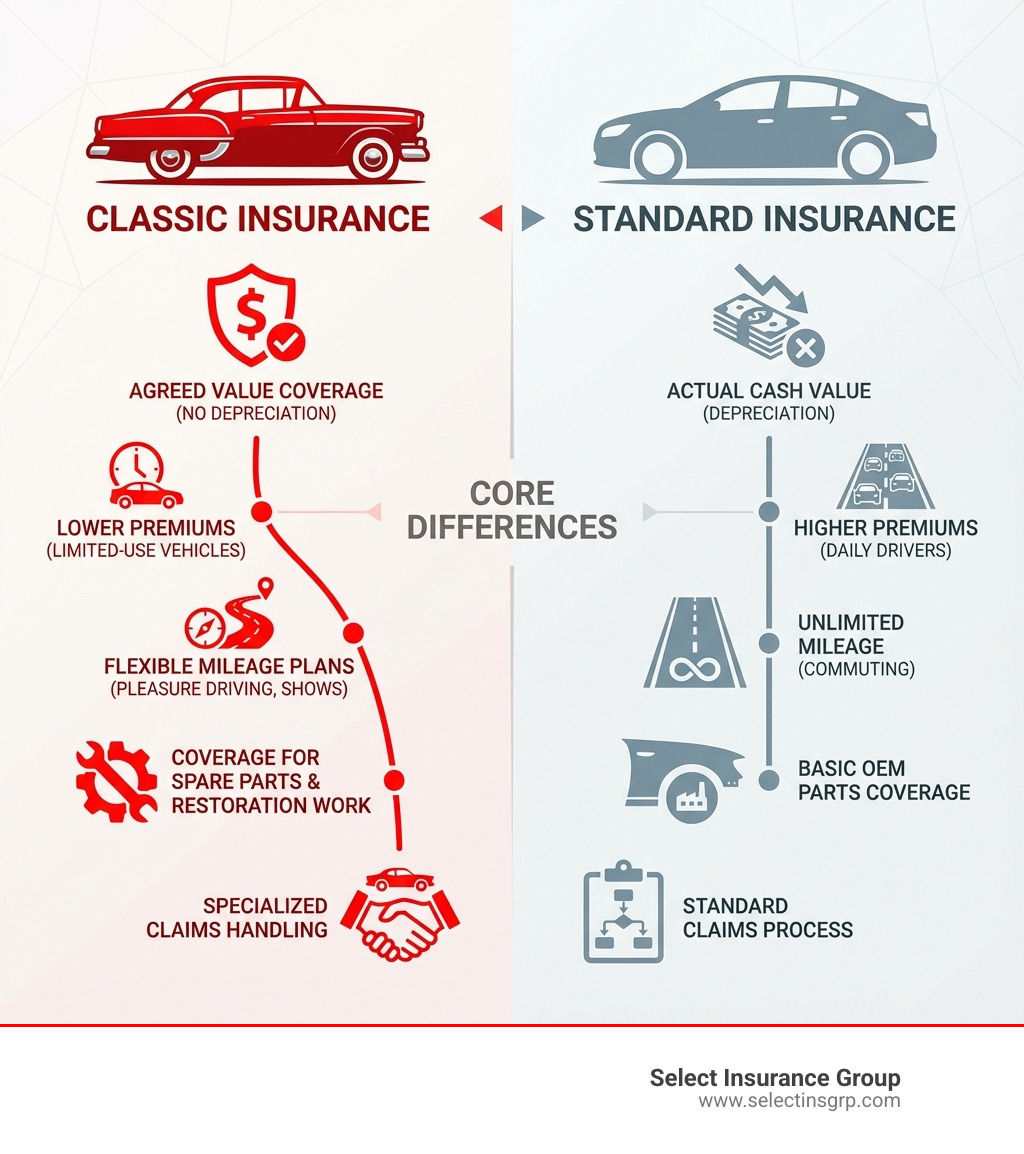

How Classic Car Insurance Differs from a Standard NC Auto Policy

The fundamental difference between Classic car insurance NC and a standard NC auto policy lies in how your vehicle’s value is determined and the purpose for which it’s insured. Standard policies are designed for daily use vehicles and account for depreciation, meaning the payout in a total loss is based on the Actual Cash Value (ACV) at the time of the claim. This is often significantly less than what you might have invested in your classic.

Classic car insurance, on the other hand, operates on an “Agreed Value” basis, which we’ll dig into more deeply later. This means we agree on your car’s value upfront, and that’s the amount you receive in a total loss, without depreciation.

Another significant difference is cost. Because classic cars are typically driven less frequently and for specific purposes, the risk is lower for insurers. This translates into significantly lower premiums. In fact, classic car insurance premiums can be up to 21% lower than daily driver insurance, and some sources suggest savings of up to 40% compared to a regular auto policy. This affordability makes specialized coverage a smart choice for protecting your investment.

Furthermore, classic car policies often come with usage limitations, such as mileage restrictions, and specialized claims handling that understands the unique needs of vintage vehicles, including sourcing hard-to-find parts and working with specialized repair shops.

Types of Vehicles Typically Covered

When it comes to Classic car insurance NC, the definition of a “classic” can be quite broad, extending beyond just antique roadsters. Our specialized policies can cover a wide array of unique and valuable vehicles. These typically include:

- Antique Cars: Often considered vehicles that are pre-1980, or older than 45 years.

- Classic Cars: Generally 20 years or older, but not yet antique, that are maintained in original or restored condition.

- Muscle Cars: High-performance American cars, typically from the 1960s and 70s.

- Hot Rods and Street Rods: Highly modified vehicles, often with custom engines and bodywork.

- Collector Trucks and SUVs: Vintage trucks and utility vehicles that have been restored or maintained as collector’s items.

- Exotic and Luxury Models: Newer, high-value vehicles that are limited production or have an appreciating value, such as a 2011 Porsche 911.

- Restorations in Progress: Vehicles currently undergoing restoration, protecting your investment as it transforms.

- North Carolina Motorcycle Insurance can also be custom for classic motorcycles, ensuring your two-wheeled treasure is equally protected.

Essentially, if your vehicle is cherished, rare, or appreciating in value, and not used as a daily driver, there’s a good chance we can find a specialized policy to protect it.

Qualifying for Classic Car Insurance NC

Getting Classic car insurance NC isn’t quite the same as insuring your everyday sedan. There are specific criteria that both you, the driver, and your vehicle must meet to qualify for these specialized policies. These requirements are in place because classic car insurance offers unique benefits like Agreed Value coverage and lower premiums, which are predicated on a different risk profile than standard auto insurance.

Eligibility and Driving Record Requirements

First and foremost, classic car insurance is not for your primary mode of transportation. A key requirement is that you must maintain an insurance policy on a regular-use vehicle in addition to your classic car insurance policy. This means your classic car cannot be your only means of transportation.

As for the driver, most insurers prefer a good driving record. If you’ve had excessive speeding violations, reckless driving, or other serious infractions in the last three years, you might not qualify for classic auto insurance. This is because a clean driving history indicates a lower risk of accidents, which helps keep premiums down. While there isn’t typically a specific age requirement for the driver, experience behind the wheel and a responsible driving history are certainly beneficial. We’ll always help you assess your eligibility based on these factors.

Understanding Mileage and Usage Restrictions

One of the main reasons Classic car insurance NC is more affordable is due to its usage limitations. These policies are designed for occasional use, not daily commuting. Your classic car should be primarily used for:

- Pleasure driving: Enjoying a sunny weekend drive along the Outer Banks or through the Uwharrie National Forest.

- Car shows and club events: Attending local and regional classic car gatherings.

- Parades and exhibitions: Showcasing your vehicle at community events.

- Tours: Participating in organized classic car tours.

Using your classic car for errands, commuting to work, or other routine daily tasks will likely violate your policy terms. While some policies have strict annual mileage limits (often around 2,500-5,000 miles), many specialized carriers now offer flexible mileage plans, with no fixed mileage restrictions, as long as the usage remains recreational. The general guideline is that most collector cars should be driven less than 5,000 annual miles to maintain their value and qualify for these preferred rates.

Storage and Restoration Requirements

Where you keep your classic car is just as important as how you drive it. To qualify for Classic car insurance NC, most insurers require adequate, secure storage. An enclosed structure, such as a private garage or a dedicated storage unit, is usually preferred because it protects your vehicle from theft, vandalism, and environmental damage. Some policies may also accept carports or other secure, enclosed spaces, but a locked, private garage offers the best protection and is often a prerequisite for the best rates.

What about projects? Can you get classic car insurance if your vehicle is undergoing restoration in NC? Absolutely! Many policies include restoration coverage, protecting your investment throughout the restoration process. This is vital because a car undergoing restoration can still be vulnerable to damage, theft, or fire. Whether it’s in your garage, at a specialized restoration shop, or being transported, we can help you find coverage that safeguards your project at every stage, ensuring your investment is protected as it transforms into its former glory.

Understanding Your Coverage: Agreed Value and Policy Options

When you own a classic car, you’re not just insuring a piece of metal; you’re protecting a passion, a piece of history, and often a significant financial investment. That’s why understanding your coverage, especially the concept of Agreed Value, is paramount. This specialized approach provides financial certainty and ensures that your unique vehicle, with its specialized parts and craftsmanship, is adequately protected.

| Coverage Type | How Value is Determined | Payout in Total Loss | Key Characteristic |

|---|---|---|---|

| Agreed Value | Value agreed upon upfront by you and insurer (often with appraisal) | Full agreed-upon amount | No depreciation applied |

| Stated Value | You state a value, but insurer may pay less based on market value or ACV | Up to stated value, but insurer has final say | Can be misleading, may still depreciate |

| Actual Cash Value (ACV) | Market value at time of loss, considering depreciation | Market value minus depreciation | Standard for daily drivers |

What is ‘Agreed Value’ and Why is it Crucial?

‘Agreed Value’ coverage is the cornerstone of Classic car insurance NC, and it’s why these policies are so important for collectors. Unlike standard auto insurance, which uses Actual Cash Value (ACV) and applies depreciation, Agreed Value means that you and your insurance provider agree upon your car’s true value at the beginning of the policy term. This value is often determined through a professional appraisal or by using industry-leading valuation tools.

Why is this so crucial? In the unfortunate event of a covered total loss, you will receive the full, agreed-upon amount, no questions asked. There’s no haggling over depreciation, no unexpected deductions, and no worries that the payout won’t cover what your car is truly worth. This provides immense peace of mind, knowing your investment is fully protected. It recognizes that classic cars often appreciate, or at least hold their value, unlike modern vehicles.

Typical Coverage Options Available in NC

Just like standard auto policies, Classic car insurance NC offers a range of coverage options, but with a specialized twist custom for unique vehicles. When we help you craft your policy, we’ll discuss:

- Liability Coverage: Protects you if you’re at fault for an accident, covering bodily injury and property damage to others. This is a fundamental requirement for any vehicle on the road.

- Collision Coverage: Pays for damage to your classic car resulting from a collision with another vehicle or object, regardless of fault.

- Comprehensive Coverage: Protects against non-collision incidents such as theft, vandalism, fire, flood, falling objects, or animal impacts. This is especially important for cars that are stored for extended periods.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who has no insurance or insufficient insurance.

- Spare Parts Coverage: Classic cars often require rare and expensive parts. This specialized coverage protects your investment in spare parts and accessories, whether they’re on the car or stored separately.

- Roadside Assistance: Many classic policies include specialized roadside assistance, often with flatbed towing to ensure your prized possession is transported safely to a qualified repair facility, not just any tow yard.

We understand that every classic car and owner is unique. Our goal at Select Insurance Group is to help you find comprehensive coverage that fits your specific needs and budget. To learn more about how we can protect your classic, visit our dedicated page on Classic Car Insurance in NC | Select Insurance Group.

What Happens if Your Classic Car is Totaled?

The thought of your cherished classic car being totaled is enough to make any collector wince. However, with the right Classic car insurance NC policy featuring Agreed Value coverage, the financial outcome is far less painful than with a standard policy.

If your classic car is declared a total loss after a covered accident or incident, you will receive the full Agreed Value that was established at the beginning of your policy. There’s no depreciation applied, no lengthy negotiations over market value, and no unpleasant surprises. This guaranteed payout ensures that your financial investment is fully recovered, allowing you to replace your vehicle or pursue another classic car dream.

Additionally, many classic car policies offer you the right to keep the salvage of your totaled vehicle. This can be invaluable if you have sentimental attachment to the car or if parts are rare and can be used for future projects. Furthermore, specialized classic car insurers often allow you to choose your own repair shop, ensuring that experienced mechanics who understand vintage vehicles handle any repairs, rather than being forced to use a generic repair facility. This commitment to specialized care and financial certainty is what sets classic car insurance apart.

Costs, Discounts, and Finding the Right Agent

One of the pleasant surprises for many classic car owners is how affordable specialized Classic car insurance NC can be. While protecting your passion is invaluable, it doesn’t have to break the bank. Understanding the factors that influence your premiums and knowing where to look for discounts can help you secure comprehensive coverage at a competitive price.

Key Factors Influencing the Cost of Classic Car Insurance NC

Several factors come into play when calculating the cost of your Classic car insurance NC policy. These elements help insurers assess the risk associated with your specific vehicle and usage:

- Vehicle Value: This is perhaps the most significant factor. The higher the Agreed Value of your classic car, the higher your premium will generally be.

- Storage Location: Where your car is stored plays a big role. A secure, enclosed garage typically results in lower premiums than a carport or driveway, as it reduces the risk of theft or damage.

- Driver’s Age and Record: A mature driver with a clean driving history usually qualifies for better rates. As we mentioned, serious driving infractions can make it difficult to qualify.

- Mileage Plan: Policies with lower annual mileage limits often have lower premiums, reflecting the reduced time the vehicle spends on the road.

- Deductible Amount: Choosing a higher deductible (the amount you pay out-of-pocket before your insurance kicks in) will typically lower your premium.

- Location: Your geographic location within North Carolina, from urban areas like Charlotte to coastal towns like Wilmington, can affect rates due to varying risks like theft rates or weather patterns.

Available Discounts to Lower Your Premiums

We love helping our clients save money, and Classic car insurance NC often comes with several opportunities for discounts:

- Bundling Policies: One of the easiest ways to save is by bundling your classic car policy with your home, regular auto, or other insurance policies. We can help you bundle property and save an average of 5% on auto in most states!

- Car Club Membership: Many insurers offer discounts to members of recognized classic car clubs or organizations, recognizing their commitment to responsible ownership and vehicle care.

- Safety Features: If your classic car has modern safety upgrades or original features that improve safety, you might qualify for a discount.

- Anti-Theft Devices: Installing approved anti-theft devices can significantly reduce your premium, as theft is a major concern for classic car owners.

- Multiple Classic Cars: If you’re a true collector with more than one classic vehicle, insuring them all with the same provider can often lead to multi-car discounts.

Always ask us about potential discounts; we’ll explore every option to ensure you get the best possible rate.

How to Find the Best Provider for Classic Car Insurance NC

Finding the right provider for Classic car insurance NC is crucial, and it’s where an independent insurance agency like Select Insurance Group truly shines. Here’s why:

- Independent Agents: We aren’t tied to a single insurance company. This means we can shop around and compare policies from multiple specialized carriers, ensuring you get the best coverage and value. With over 40 carriers in our network, we do the legwork for you.

- Access to Multiple Carriers: This extensive reach allows us to find niche policies that perfectly match your unique classic car and your specific needs, something a single-carrier agent might not be able to offer.

- Specialized Knowledge: We understand the intricacies of classic car insurance – from Agreed Value to restoration coverage and usage restrictions. Our 30+ years of experience mean we speak the language of collectors.

- Customer Service Reviews: We pride ourselves on superior customer service. When choosing an agent, always look for those with strong client testimonials and a reputation for responsiveness and expertise. Whether you’re in Charlotte or elsewhere in NC, we’re here to help.

The best provider isn’t just about the lowest price; it’s about the right coverage, the right value, and an agent who understands your passion.

Frequently Asked Questions

We know you have questions, and we’re here to provide clear, straightforward answers about Classic car insurance NC.

Can I use my classic car for occasional pleasure driving?

Yes, absolutely! This is one of the primary permitted uses for vehicles covered by Classic car insurance NC. Policies are designed to allow for occasional pleasure driving, which includes weekend drives, trips to the beach, or simply enjoying the open road. However, “occasional” is key. Your classic car should not be used for daily errands, commuting to work, or any other routine transportation needs. It’s for enjoying your prized possession, not for replacing your daily driver.

Do I need a separate policy for my daily driver?

Yes, this is a fundamental requirement for most Classic car insurance NC policies. Insurers offering classic car coverage typically require you to have a separate, standard auto insurance policy for a primary, daily-use vehicle. This confirms that your classic car is indeed a recreational vehicle and not your main mode of transportation. Proof of this primary vehicle insurance is usually necessary for eligibility.

What if my classic car is used for business purposes?

Generally, standard Classic car insurance NC policies are designed for personal, recreational use and typically exclude commercial use. If you intend to use your classic car for business purposes – perhaps for chauffeuring services, promotional events, or as part of a commercial fleet – you will likely need specialized commercial auto insurance. These policies are structured differently to cover the increased risks associated with business operations. We can certainly help you explore options for North Carolina Commercial Insurance or North Carolina Business Auto if your classic car serves a commercial role.

Conclusion: Protect Your Passion in the Tar Heel State

Your classic car is more than just a vehicle; it’s a testament to automotive history, a labor of love, and a tangible investment. Protecting that passion requires more than a standard auto policy – it demands the specialized coverage that only Classic car insurance NC can provide.

We’ve explored how these policies differ, emphasizing the critical importance of Agreed Value coverage, which guarantees your car’s true worth in the event of a total loss, free from the pitfalls of depreciation. We’ve also highlighted the eligibility requirements, usage limitations, and storage necessities that allow for significantly lower premiums, often saving you up to 40% compared to insuring it on a regular policy.

At Select Insurance Group, we understand the unique bond you share with your classic car. With over 30 years of experience and access to more than 40 top carriers, we are uniquely positioned to help you steer the complexities of classic car insurance. Our team will work with you to tailor a policy that not only meets all the specific needs of your cherished vehicle but also fits your budget.

Don’t leave your prized possession vulnerable to the limitations of standard insurance. Let us help you find the peace of mind that comes with knowing your classic is fully protected.

Learn more about North Carolina Auto Insurance and get a quote for your classic today. We’re here to ensure your journey with your classic car in the Tar Heel State is nothing but smooth cruising.