Why Non-Owner Auto Insurance Matters for Drivers Without Cars

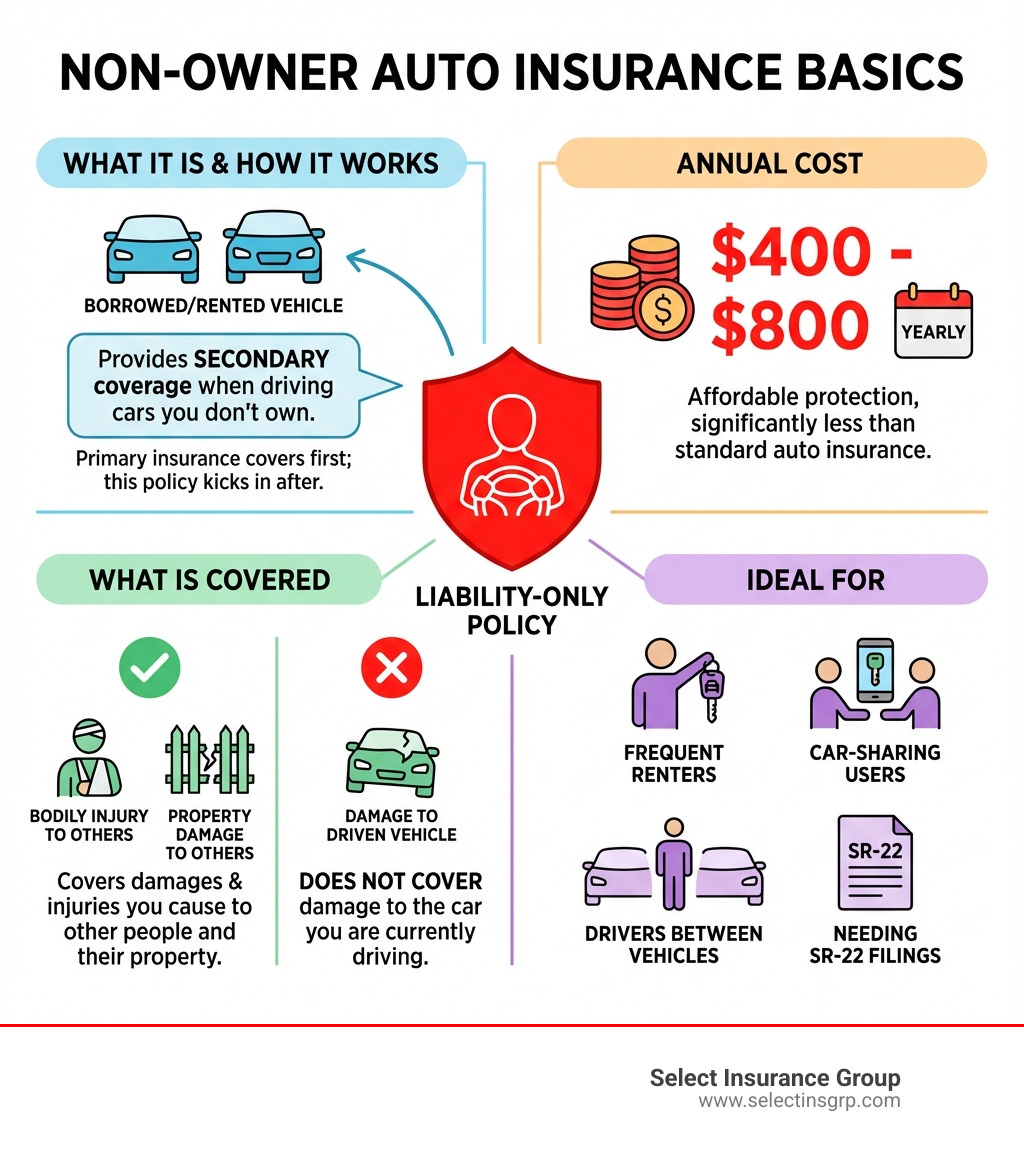

Non automobile owners insurance (commonly called non-owner car insurance) provides liability coverage for drivers who don’t own a vehicle but still drive occasionally. Here’s what you need to know:

Quick Answer:

- What it is: A liability-only policy that covers you when driving cars you don’t own

- Who needs it: Frequent car renters, car-sharing users, drivers between vehicles, or those needing SR-22 filings

- What it covers: Bodily injury and property damage you cause to others

- What it doesn’t cover: Damage to the car you’re driving or your own injuries

- Average cost: Around $400-$800 per year (significantly less than standard auto insurance)

You’re at a friend’s house for dinner, and they ask you to run to the store in their car. A few blocks away, another driver runs a stop sign, and you swerve to avoid them—barely missing a collision. That close call gets you thinking: If I had hit something, whose insurance would pay? Am I even covered?

The reality is simple: When you drive someone else’s car, their insurance covers you first. But what if their coverage isn’t enough? What if you cause $50,000 in damages and their policy only covers $25,000? That’s where non-owner auto insurance steps in—it acts as secondary coverage to protect you from paying thousands out of pocket.

This type of policy makes financial sense if you regularly rent cars, use car-sharing services like Zipcar, or frequently borrow vehicles from friends and family. It’s also required if you need to file an SR-22 form to reinstate your driver’s license but don’t own a car.

Three key benefits:

- Financial protection – Covers liability beyond the car owner’s limits

- Continuous coverage – Prevents gaps that lead to higher future rates

- Legal compliance – Satisfies SR-22/FR-44 requirements without owning a vehicle

I’m D.J. Hearsey, founder and CEO of Select Insurance Group, with over three decades of experience helping drivers across the Southeast find affordable coverage—including non automobile owners insurance for clients who need protection without the premium costs of standard policies. Let me walk you through everything you need to know to make the right choice for your situation.

Non automobile owners insurance helpful reading:

What is Non-Owner Auto Insurance?

So, what exactly is non automobile owners insurance? Simply put, it’s a type of car insurance that covers you, the driver, rather than a specific vehicle. It’s designed for licensed individuals who don’t own a car but still find themselves behind the wheel of borrowed or rented vehicles. Think of it as a personal umbrella of liability protection that travels with you.

This policy is almost always a liability-only policy. This means its primary function is to protect you financially if you cause an accident while driving a car you don’t own. It covers the costs associated with injuries to other people (bodily injury liability) and damage to their property (property damage liability). It does not cover damage to the car you’re driving or your own medical expenses.

A crucial aspect of non automobile owners insurance is that it typically acts as secondary coverage. When you borrow a friend’s car, for example, their personal auto insurance policy is the primary coverage. If you get into an accident, their policy pays out first. However, if the damages exceed their policy’s limits, or if their policy has certain exclusions, your non-owner policy steps in to cover the remaining costs, protecting you from significant out-of-pocket expenses. This is particularly important for scenarios involving “permissive use,” where you’re driving a car with the owner’s permission. While the owner’s insurance will generally extend to you, having your own non-owner policy offers an extra layer of financial security.

To learn more about this type of coverage, explore our resource on More info about non-owner auto insurance.

Who Needs Non-Owner Auto Insurance?

While it might sound niche, many people can benefit significantly from non automobile owners insurance. If any of the following scenarios sound familiar, this coverage might be a smart choice for you:

- Frequent Car Renters: Do you often rent cars for business trips, vacations, or just for fun? Rental car companies offer their own insurance, but it can be surprisingly expensive, costing $10-$15 per day just for liability. A non-owner policy can cover your liability for an entire year for a fraction of that cost, often as little as $50 annually for an endorsement or around $400-$800 for a standalone policy. This makes it a much more economical long-term solution.

- Car-Sharing Service Users: Services like Zipcar or Turo are fantastic for urban living, but their insurance offerings can vary. A non-owner policy ensures you have consistent liability coverage whenever you hop into a shared vehicle, protecting you from potential shortfalls in their provided coverage.

- Frequent Car Borrowers: If you regularly borrow vehicles from friends, family members (who don’t live with you), or neighbors, a non-owner policy provides crucial protection. While the car owner’s policy is primary, your non-owner coverage acts as a safety net if their limits are exhausted in an accident you cause.

- Drivers Between Vehicles: Perhaps you just sold your car and are waiting to buy a new one, or you’re temporarily without a personal vehicle. A non-owner policy allows you to drive borrowed or rented cars during this transition period without a gap in your insurance history.

- Maintaining Continuous Coverage: Insurance companies often offer discounts for continuous coverage. If you let your policy lapse because you don’t own a car, you might face higher premiums when you eventually buy a vehicle. A non-owner policy helps you avoid these coverage gaps, potentially saving you hundreds or even thousands of dollars in future premiums. Brief lapses can be very costly, with rates increasing by an average of 25% for 1-30 days and 40% for over 30 days.

- Drivers Needing an SR-22 or FR-44: If your driver’s license has been suspended due to a serious driving infraction (like a DUI or driving without insurance), your state may require you to file an SR-22 (or FR-44 in Florida and Virginia) to prove you have minimum liability insurance. Since these forms certify your financial responsibility, not an owned vehicle, a non-owner policy is often the only way to meet this requirement if you don’t own a car.

Who Doesn’t Need Non-Owner Auto Insurance?

While non automobile owners insurance is incredibly useful for certain situations, it’s not for everyone. Here are some scenarios where you likely don’t need this specific type of coverage:

- Car Owners with Existing Policies: If you own a car and have a standard auto insurance policy, your existing liability coverage usually extends to vehicles you rent or occasionally borrow. This means your own policy acts as primary or secondary coverage in those situations, making a separate non-owner policy redundant for many.

- Drivers Listed on a Household Policy: If you regularly drive a car owned by someone you live with (a spouse, parent, roommate), you should typically be listed as a driver on their auto insurance policy. Most insurance companies expect all licensed drivers residing in a household to be on the policy for any vehicles kept there. A non-owner policy is generally not designed for vehicles regularly available to you through a household member.

- Infrequent Drivers: If you truly rarely drive—perhaps once or twice a year, and always in a vehicle where you’re confident the owner has robust primary coverage—the cost-benefit might not justify a non-owner policy. However, even occasional drivers might appreciate the extra peace of mind.

- Drivers of Company Cars: If your employer provides you with a company car that you use solely for business purposes, it should be covered by the company’s commercial auto insurance policy. You generally wouldn’t need a personal non-owner policy for that vehicle. However, some individuals might consider a “drive other car” endorsement on a personal policy for additional protection when driving non-company vehicles for personal use.

Understanding Your Coverage: What’s Included and Excluded

Understanding what your non automobile owners insurance policy covers and, just as importantly, what it doesn’t cover, is key to making an informed decision.

At its core, non-owner car insurance is about protecting you from liability. Here’s what you can expect to be included:

- Bodily Injury Liability: This is the cornerstone of non-owner coverage. If you cause an accident while driving a borrowed or rented car, and other people are injured, this coverage pays for their medical expenses, lost wages, and pain and suffering, up to your policy limits.

- Property Damage Liability: Similarly, if you damage another person’s car, a fence, a mailbox, or any other property in an accident you cause, this coverage will pay for the repair or replacement costs.

- Uninsured/Underinsured Motorist Coverage: Some non-owner policies offer this optional but valuable coverage. It protects you if you are injured in an accident caused by a driver who either has no insurance or insufficient insurance to cover your medical bills.

- Medical Payments (MedPay) / Personal Injury Protection (PIP): Depending on your state, your non-owner policy might offer MedPay or PIP as optional additions. These coverages pay for your own medical expenses and, in some cases, lost wages, regardless of who was at fault in an accident. This is a crucial addition as basic non-owner liability does not cover your own injuries.

For a deeper dive into liability coverage when you don’t own a car, check out our guide to liability insurance without a car.

What Are the Limitations?

While non automobile owners insurance offers vital protection, it’s crucial to be aware of its limitations. This policy is highly specialized and doesn’t function like a standard auto insurance policy for a car you own.

Here’s what it typically doesn’t cover:

- No Collision Coverage: This is a big one. Non-owner insurance will not pay for damages to the borrowed or rented vehicle you are driving if you are at fault in an accident. If you ding a rental car or total your friend’s sedan, you’ll be on the hook for those repair costs unless you have other coverage (like a Collision Damage Waiver from a rental company or physical damage coverage from the car owner’s policy).

- No Comprehensive Coverage: Similarly, non-owner insurance won’t cover damages to the car you’re driving from non-collision events like theft, vandalism, fire, or natural disasters.

- No Coverage for the Borrowed/Rented Car: To reiterate, the primary focus is on liability to others. The car itself is not insured under your non-owner policy.

- No Coverage for Your Own Injuries: Unless you’ve added Medical Payments or Personal Injury Protection to your non-owner policy (where available), it will not cover your own medical bills if you are injured in an accident you cause.

- No Coverage for Personal Belongings: Any items you have in the borrowed or rented car (e.g., your laptop, luggage, phone) are not covered by your non-owner auto insurance. Your homeowners or renters insurance policy might offer some protection for these items.

- Excludes Business Use: Personal non-owner policies are generally not designed for commercial driving or for vehicles used for income generation (e.g., ridesharing, delivery services). If you use a vehicle for business, you’ll need a commercial auto policy or specific rideshare endorsements.

- Excludes Household Vehicles: As mentioned, if you frequently drive a car owned by someone you live with, you should be listed on their policy. Non-owner policies typically exclude vehicles that are regularly available to you or owned by a household member.

Comparing Standard Auto Insurance vs. Non-Owner Auto Insurance

To help clarify the differences, here’s a quick comparison between a standard auto insurance policy (for a car you own) and non automobile owners insurance:

| Feature | Standard Auto Insurance | Non-Owner Auto Insurance |

|---|---|---|

| Policy Type | Covers a specific owned vehicle | Covers the licensed driver |

| Primary Coverage | Liability, Collision, Comprehensive, etc. | Liability (Bodily Injury & Property Damage) |

| Covers | Your owned vehicle, your liability to others, your own injuries (with MedPay/PIP), roadside assistance, rental reimbursement (with optional add-ons) | Your liability to others (secondary to owner’s policy), sometimes your own injuries (with MedPay/PIP), uninsured/underinsured motorist |

| Doesn’t Cover | Typically excludes business use for personal policies | Damage to the car you’re driving, your own injuries (unless MedPay/PIP added), personal belongings, business use, vehicles owned by household members |

| Best For | Car owners, individuals needing full protection for their vehicle | Frequent renters, car-sharing users, frequent car borrowers, drivers needing SR-22/FR-44, maintaining continuous coverage |

The Cost and Process of Getting Non-Owner Auto Insurance

One of the most appealing aspects of non automobile owners insurance is its affordability compared to a standard auto policy. Since there’s no specific vehicle to insure against physical damage (collision and comprehensive), the premiums are significantly lower.

The average annual cost for a non-owner policy typically ranges from $400 to $800. Some sources even suggest an endorsement can cost as little as $50 annually. This is a stark contrast to the average cost of full coverage for an owned vehicle, which can run into thousands. For frequent renters, this is a massive saving compared to paying $30 per day for physical damage coverage from a rental counter.

However, like all insurance, the exact price you’ll pay depends on several cost factors:

- Driving Record: A clean driving record is your best friend here. Accidents, tickets, or serious violations will increase your premiums, sometimes substantially.

- Location: Insurance rates vary significantly by state, and even by zip code within a state. Factors like local accident rates, population density, and state-specific regulations all play a role. For example, some data shows non-owner policies in Florida averaging $925 annually, while Alaska can be as low as $168.

- Coverage Limits: The higher the liability limits you choose, the more your policy will cost. While state minimums exist, we generally recommend higher limits to truly protect your assets.

- Age: Younger, less experienced drivers typically face higher premiums than older, seasoned drivers.

- Continuous Insurance Discount: Maintaining continuous coverage, even with a non-owner policy, can prevent lapses that would otherwise lead to higher rates when you eventually get a standard policy. This long-term saving can make the annual non-owner premium well worth it.

- Credit Score: In many states, your credit-based insurance score can influence your premiums. A higher score generally leads to lower rates.

- Marital Status: Married individuals often receive slightly lower rates than single drivers.

How to Get Non-Owner Auto Insurance

Getting non automobile owners insurance is a straightforward process, but it requires a few steps:

- Possess a Valid Driver’s License: This is a fundamental requirement. You must have an active, valid driver’s license to obtain any auto insurance policy, including a non-owner one.

- Finding a Provider: Not all insurance companies openly advertise or even offer non-owner policies online. While many major carriers provide it, you might need to call them directly or work with an independent agent. As Select Insurance Group, we shop over 40 carriers to find the best rates for our clients, including those seeking non-owner coverage in Florida, the Carolinas, Virginia, and Georgia.

- Getting a Quote: Once you’ve identified potential providers, you can request a quote. This can often be done online, over the phone, or in person with an agent.

- Information Needed: Be prepared to provide personal identifying information, including your name, address, date of birth, driver’s license number, and sometimes your Social Security Number. Your driving history will also be a key factor in determining your premium.

We have more information about getting insurance without owning a car that can help you steer this process. Always remember to check specific requirements with your state’s insurance department.

Key Scenarios Requiring Non-Owner Auto Insurance

There are specific situations where non automobile owners insurance isn’t just a good idea, but a necessity or a highly strategic move:

- SR-22/FR-44 Filings: This is perhaps the most common reason why someone without a car would need insurance. If your license was suspended due to a DUI, an at-fault accident without insurance, or another serious driving offense, your state may mandate an SR-22 (or FR-44 in Florida and Virginia). This document certifies to the state that you have the minimum required liability insurance. Since it’s a certification of you having insurance, not a vehicle, a non-owner policy is the perfect solution to fulfill this requirement and get your license reinstated. We have a dedicated resource for getting SR-22 insurance without a car.

- Avoiding a Lapse in Coverage: Many people don’t realize the long-term financial impact of letting their auto insurance lapse. Even a short period without coverage can categorize you as a higher risk driver in the eyes of insurers, leading to significantly higher premiums when you eventually buy a car and need a standard policy. A non-owner policy, even if you don’t drive frequently, can be a cost-effective way to maintain continuous coverage and secure better rates in the future.

- Frequent Car Rentals: If you rent cars multiple times a year, the cost of purchasing the rental company’s liability insurance each time can quickly add up. As we noted, these daily charges can be substantial. A single non-owner policy can cover your liability for all your rentals throughout the year, making it a savvy financial move for the regular traveler or business professional.

Frequently Asked Questions about Non-Owner Insurance

We understand that non automobile owners insurance can be a bit confusing, so let’s address some of the most common questions we hear.

Does non-owner insurance cover rental cars?

Yes, absolutely! This is one of the primary benefits of having non automobile owners insurance. If you rent a car and cause an accident, your non-owner policy will provide liability coverage for injuries to others and damage to their property.

Here’s how your policy typically applies:

- Liability Coverage: Your non-owner policy acts as secondary liability coverage. This means if the rental company provides any basic liability (which is often minimal), or if your credit card offers some coverage, your non-owner policy would kick in to cover anything beyond those limits. This is a huge advantage, as it protects your personal assets from potentially massive claims.

- Cost Comparison: Consider the savings! Rental company liability insurance can easily cost $10-$15 per day. If you rent cars just a few times a year, a non-owner policy, with its annual cost, quickly becomes the more economical choice. For example, if you rent a car for 30 days out of the year, paying $10/day for rental company liability would be $300. A non-owner policy for $400-$800 for the entire year looks quite appealing!

However, it’s crucial to remember a key limitation: your non-owner policy will not cover physical damage to the rental car itself. For that, you would typically need to purchase a Collision Damage Waiver (CDW) from the rental company or rely on coverage provided by some credit cards.

Can I get a policy if I need an SR-22?

Yes, emphatically yes! This is a cornerstone function of non automobile owners insurance. An SR-22 (or FR-44 in Florida and Virginia) is not an insurance policy itself, but rather a certificate your insurance company files with your state’s Department of Motor Vehicles. It’s proof that you have the minimum required liability insurance.

If you’re a high-risk driver who has had your license suspended due to a DUI, an at-fault accident without insurance, or other serious violations, the state will require an SR-22 for your license reinstatement. But what if you don’t own a car? That’s where a non-owner policy shines. It provides the underlying liability coverage that allows your insurer to file the SR-22 on your behalf, enabling you to get your driving privileges back. Without it, you could be stuck unable to drive legally.

What happens if I borrow a car from someone I live with?

This is a common question, and the answer is important: non automobile owners insurance is generally not intended for vehicles owned by someone you live with.

Here’s why:

- Household Member Exclusion: Most non-owner policies contain exclusions for vehicles that are regularly available to you or owned by a member of your household. Insurance companies expect that if you live with someone and frequently drive their car, you should be listed as a driver on their primary auto insurance policy.

- Being Added to Their Policy: If you regularly drive a car owned by your spouse, parent, or roommate, the safest and most appropriate course of action is for them to add you as a named driver on their existing policy. This ensures you have primary coverage and avoids any issues in the event of an accident.

- Occasional vs. Regular Driver: Non-owner insurance is best suited for truly occasional borrowing from individuals outside your household, or for renting cars. If you’re using a household member’s car frequently, being added to their policy is the standard and correct way to ensure proper coverage.

Your Guide to Financial Protection on the Road

Navigating insurance can feel like a maze, but understanding specialized policies like non automobile owners insurance empowers you to make smart choices for your financial well-being. This guide has illuminated the critical role this coverage plays for drivers who don’t own a vehicle but still need robust protection on the road.

The benefits are clear: from providing a vital safety net against significant liability claims that exceed a car owner’s policy, to strategically maintaining continuous coverage that saves you money in the long run, and fulfilling essential legal requirements like SR-22 filings, a non-owner policy offers unparalleled peace of mind. It’s not just about avoiding trouble; it’s about making a smart financial choice that protects your assets and your driving future.

At Select Insurance Group, we understand the unique needs of drivers across Florida, North Carolina, South Carolina, Virginia, and Georgia. With over 30 years of experience, our team is dedicated to helping you find custom insurance solutions that fit your lifestyle and budget. Whether you’re a frequent renter, a diligent borrower, or simply looking to maintain your insurance history, we’re here to guide you.

Don’t leave your financial security to chance. Let us help you explore your options and secure the protection you deserve.