Understanding Non-Owner Auto Insurance: A Simple Solution for Drivers Without Cars

Is there such thing as a non owner auto insurance? Yes. Non-owner auto insurance is a real insurance product designed for licensed drivers who don’t own a vehicle but need liability coverage when they drive borrowed or rented cars.

Quick Answer:

- Yes, non-owner auto insurance exists and is offered by most major insurance companies

- It provides liability coverage for bodily injury and property damage when you drive vehicles you don’t own

- It does NOT cover damage to the car you’re driving or your own injuries (in most cases)

- You might need it if you: frequently rent cars, use car-sharing services, borrow vehicles regularly, or need to file an SR-22 without owning a car

- It typically costs $200-$1,200 annually, which is 5%-15% less than standard auto insurance

Imagine you borrow a friend’s car for a quick errand. A near-miss accident makes you wonder: Am I actually covered if something happens? This is a common concern for anyone who rents cars, uses car-sharing services, or borrows a vehicle. Many drivers assume they’re protected, only to find costly gaps when it’s too late.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group. With over three decades in the industry, I’ve helped countless drivers across Florida, Georgia, the Carolinas, and Virginia determine if non-owner auto insurance is the right solution for their needs. This guide will walk you through everything you need to know.

What is Non-Owner Auto Insurance and How Does It Work?

Now that we’ve established is there such thing as a non owner auto insurance (yes!), let’s dive into what it actually does.

A named non-owner policy is an insurance policy that names you, the driver, as the insured person rather than insuring a specific car. Think of it as coverage that follows you, not a vehicle. It’s driver-focused coverage that protects you in permissive use situations—when you have permission to drive someone else’s vehicle, like borrowing a car for a weekend trip or using a car-sharing service.

Your non-owner policy typically acts as secondary insurance, working with the primary coverage already on the vehicle. If you’re curious about how this works when you lend out your own car, check out What happens when you let someone else drive your car?

Let’s look at how non-owner insurance stacks up against a standard auto policy:

| Feature | Standard Auto Insurance | Non-Owner Auto Insurance |

|---|---|---|

| Primary Focus | Covers a specific vehicle you own | Covers the individual driver, not a specific vehicle |

| Coverage Type | Liability, Collision, Comprehensive, MedPay, PIP, etc. | Primarily Liability, often with MedPay, PIP, UM/UIM |

| Vehicle Covered | Your owned car(s) | Borrowed, rented, or car-sharing vehicles |

| Property Damage | Covers damage to your car and others’ property | Covers damage to others’ property only |

| Collision/Comp | Included (if purchased) | Not included (does not cover damage to the car you drive) |

| Cost | Generally higher, covers vehicle value and risk | Generally lower, covers driver liability risk only |

| Who Needs It | Car owners | Drivers who don’t own cars but drive frequently |

How it acts as secondary coverage

Understanding the “secondary coverage” concept is key. When you’re driving a borrowed vehicle and cause an at-fault accident, the insurance hierarchy works like this:

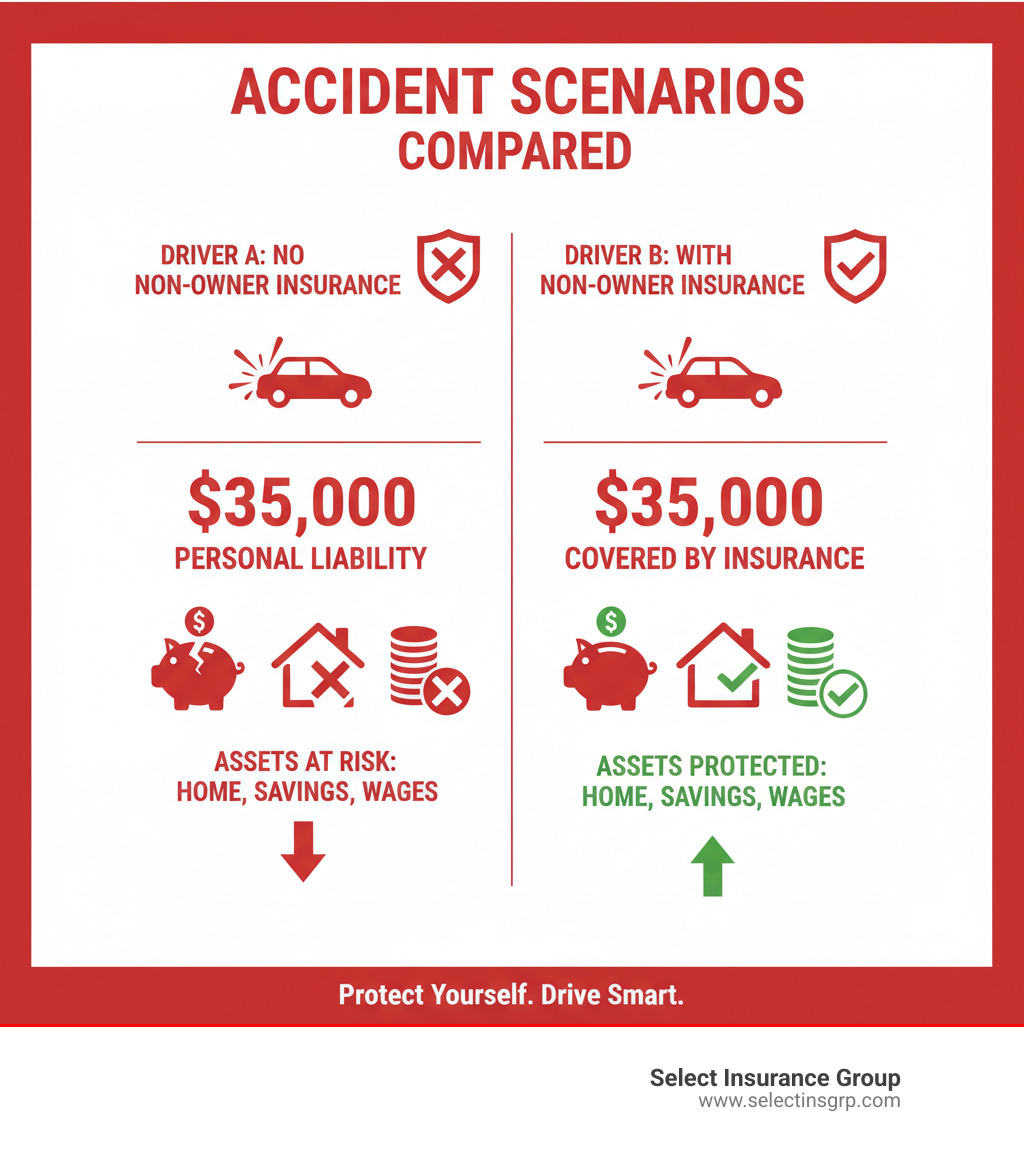

First, the primary policy limits on the car owner’s insurance are used. Their policy pays for bodily injury and property damage up to its maximum. But what if you cause $75,000 in damages and the owner’s policy only covers $50,000? That’s where your non-owner policy saves you.

Your policy steps in to cover the excess damages—the $25,000 gap that would otherwise come from your personal assets. Without this secondary protection, a serious accident could put your home, savings, and financial future at risk.

How it differs from standard auto insurance

The main difference is that a non-owner policy insures the person, not a specific vehicle. Your friend’s Honda, your dad’s truck, a rental car—your non-owner policy is portable protection that goes wherever you go.

Crucially, there’s no comprehensive or collision coverage. If you back the borrowed car into a pole or it gets keyed in a parking lot, your non-owner policy won’t pay to fix it. This is the biggest distinction: your non-owner policy does not cover damage to the car you’re driving.

What it does cover is your liability to others. You get bodily injury and property damage liability protection. Many policies also offer optional medical payments (MedPay), personal injury protection (PIP), or uninsured/underinsured motorist coverage to protect you and your passengers.

The upside is a lower cost. Because the insurer isn’t covering the value of a vehicle, your rate is typically 5%-15% cheaper than a standard policy for similar liability limits. You get the protection you need without paying for coverage you don’t.

Who Needs Non-Owner Coverage and Why?

Now that we’ve established is there such thing as a non owner auto insurance, do you actually need it? For certain drivers, it’s essential for maintaining continuous coverage, which keeps your insurance history clean and future rates competitive. A gap in coverage can increase your future premiums by about 10%.

Beyond the financial benefits, it provides peace of mind. If you cause an accident in someone else’s car, you could be personally liable for damages that exceed the owner’s policy limits. A non-owner policy protects you from that risk.

Common situations that warrant non-owner insurance

Here are the real-world scenarios where this coverage is most valuable:

- Frequent car renters: A non-owner policy is often much cheaper than buying liability insurance from the rental counter every time you rent a car.

- Regular users of car-sharing services: Services like Zipcar or Turo provide basic liability coverage, but it’s often minimal. A non-owner policy offers more robust protection.

- Individuals who often borrow cars: If you regularly borrow cars from friends or family (outside your household), this policy protects you if the owner’s insurance limits are too low.

- Drivers needing an SR-22 or FR-44: If you need to file an SR-22 or FR-44 certificate to reinstate your license but don’t own a vehicle, a non-owner policy is the standard solution to meet state requirements.

- People between vehicles: A non-owner policy prevents a lapse in coverage when you’ve sold a car but haven’t bought a new one yet, which helps keep your future rates down.

- Employees who use personal vehicles for work: A personal auto policy may not cover work-related driving. In these cases, you or your employer may need non-owned auto coverage. For more on this, see our guide: Why non-owned automobile insurance is important for businesses.

When you probably don’t need it

This coverage isn’t for everyone. You likely don’t need it if:

- You own a vehicle and have standard auto insurance: Your existing policy typically extends liability coverage when you occasionally drive other cars.

- You live with someone and regularly drive their car: You should be listed as a driver on their standard policy, not get a separate non-owner policy.

- You rarely drive at all: If you only drive a few times a year, the cost may not be justified by the minimal risk.

- Your employer provides a fully covered company car: If your employer’s policy covers you for both business and personal use, you may not need additional coverage. Always verify the policy details.

Understanding Your Coverage: What’s Included vs. Excluded

Knowing what a non-owner policy covers—and what it doesn’t—is crucial to avoid expensive surprises after an accident.

What does a non-owner policy typically cover?

The heart of a non-owner policy is liability protection. This is your financial shield when you’re at fault in an accident while driving someone else’s car. It includes:

- Bodily injury liability: Covers medical bills, lost wages, and other costs for people injured in an accident you cause.

- Property damage liability: Covers repairs to the other party’s vehicle or property that you damage.

- Legal defense: Typically covers your legal fees if you’re sued after an at-fault accident.

Many policies also allow you to add optional coverages for greater protection:

- Medical Payments (MedPay) or Personal Injury Protection (PIP): Covers your medical expenses and those of your passengers, regardless of who is at fault.

- Uninsured/Underinsured Motorist (UM/UIM): Covers your medical bills and lost wages if you’re hit by a driver with little or no insurance.

We always encourage clients to choose the highest liability limits they can reasonably afford for the best protection.

What are the limitations and exclusions?

Understanding what a non-owner policy doesn’t cover is just as important. These are fundamental to how this type of insurance works.

- The borrowed or rented car itself is not covered. This is the most critical exclusion. If you damage the car you are driving, your non-owner policy will not pay for the repairs. That responsibility falls to the car’s owner.

- Your own injuries are not automatically covered. Unless you add MedPay or PIP to your policy, you are responsible for your own medical bills.

- There is no roadside assistance. You’ll need to pay out-of-pocket for services like towing or a flat tire change.

- Vehicles owned by people in your household are not covered. If you regularly drive a car owned by a spouse, roommate, or parent, you must be listed on their primary policy.

- Commercial use is generally excluded. A personal non-owner policy likely won’t cover you for activities like rideshare driving or deliveries. Businesses need specialized commercial coverage.

A non-owner policy is laser-focused on protecting you from liability to others. It is not a substitute for comprehensive vehicle coverage.

Cost, Process, and Is There Such Thing as a Non Owner Auto Insurance Policy in Your State?

Non-owner auto insurance is surprisingly affordable, especially compared to the financial risk of driving uninsured.

Most drivers pay between $200 and $1,200 annually for a non-owner policy, which is typically 5% to 15% less than a standard policy with similar liability limits. Your specific premium depends on your driving record, age, location, and chosen coverage limits. For example, if you’re in Florida, you can explore options for Low Cost Auto Insurance Florida.

How much does non-owner insurance cost?

Insurers look at your individual risk profile to determine your rate. Key factors include:

- Driving history: A clean record means lower premiums. Accidents and tickets will increase your rate.

- Location: Urban areas with more traffic and higher accident rates typically have higher premiums than rural areas.

- Age and experience: Drivers under 25 generally pay more. Rates tend to decrease with age and a safe driving history.

- Coverage limits: State minimum limits are cheapest but offer less protection. Higher limits cost more but provide better security for your assets.

- Continuous coverage: A non-owner policy is a great way to avoid a lapse in your insurance history, which can help keep your future premiums lower.

How to get a non-owner policy

Getting a non-owner policy is straightforward, but it usually requires speaking with an agent.

- Contact an insurance agent. Most carriers don’t offer instant online quotes for these policies. You can Get a Quote by reaching out to our team.

- Provide your information. You’ll need your driver’s license and be ready to discuss your driving habits and history.

- Compare quotes. An independent agency like ours saves you time by shopping your coverage across over 40 carriers to find competitive rates.

Are there specific state regulations for non-owner insurance?

The answer to “is there such thing as a non owner auto insurance policy in your state?” is almost always yes, but details vary.

Every state sets its own minimum liability requirements for auto insurance, which also apply to non-owner policies. A local agent can ensure you meet your state’s legal standards.

If you need to file an SR-22 or FR-44 certificate after a license suspension, a non-owner policy is often the most affordable way to do so. We handle these filings regularly for clients who don’t own vehicles.

For business owners, rules for hired and non-owned auto liability are more complex. This coverage protects your business if an employee has an accident while driving their personal vehicle for work. We understand the specific requirements in each state we serve, including Florida Business Auto, Georgia Business Auto, South Carolina Business Auto, North Carolina Business Auto, and Virginia Business Auto.

Frequently Asked Questions about Non-Owner Auto Insurance

Here are answers to the most common questions we hear from clients at Select Insurance Group.

What happens if I have an accident in a borrowed car with my non-owner policy?

This is exactly what a non-owner policy is for. First, the car owner’s insurance acts as the primary coverage and pays for liability claims up to its limits. Your non-owner policy then acts as secondary coverage, paying for any liability costs that exceed the owner’s policy limits. This protects your personal assets from being used to cover the shortfall. Your policy will not cover damage to the car you were driving.

Can I get an SR-22 with non-owner insurance?

Yes. This is one of the most common reasons people buy a non-owner policy. If your state requires you to file an SR-22 or FR-44 certificate to prove financial responsibility but you don’t own a car, a non-owner policy is an affordable and accepted way to meet that requirement. Your insurance company can file the certificate with the state on your behalf, allowing you to reinstate your driving privileges.

What should I do if I buy a car after getting a non-owner policy?

You must contact your insurance agent immediately to switch to a standard owner’s auto insurance policy. Your non-owner policy is only for driving cars you don’t own and will not cover your new vehicle. Before you drive your new car, call your agent to get it properly insured with a new policy that includes liability, comprehensive, and collision coverage. Once the new policy is active, you can cancel the non-owner policy. Maintaining continuous coverage with the non-owner policy may even help you get a better rate on your new standard policy.

Find the Right Coverage for Your Driving Needs

So, is there such thing as a non owner auto insurance? Absolutely. It’s a vital financial protection tool for many drivers who don’t own a vehicle but still need liability coverage.

With a non-owner policy, you gain peace of mind knowing you have liability coverage that protects your personal assets, acts as a secondary safety net, and helps maintain your insurance history to keep future rates low—all for less than a traditional policy.

Navigating insurance options can be overwhelming. The rules vary by state, and figuring out if you truly need this coverage requires a look at your specific situation. That’s where our expertise at Select Insurance Group makes a difference.

For over 30 years, we’ve helped drivers across Florida, Georgia, the Carolinas, and Virginia find the right coverage. As an independent agency, we shop over 40 carriers to find you competitive rates and superior service. We take the time to understand your driving habits and concerns to find the right fit.

Whether you’re a frequent renter, a car-sharer, need an SR-22, or are simply between vehicles, we can help you determine if a non-owner policy is your smartest move. Don’t leave your financial future to chance.

Ready to get started? Contact us for your North Carolina auto insurance needs or reach out for a personalized quote in any of our service areas. We’re here to ensure you’re protected and confident, no matter whose keys you’re holding.