Why Finding the Best Motorcycle Insurance Matters for California Riders

The best motorcycle insurance does more than meet legal requirements—it protects your investment, health, and financial future. The right policy provides peace of mind, whether you’re a daily commuter or a weekend adventurer.

Key Coverage Types You Need:

- Liability (required by law in most states)

- Collision (covers your bike in accidents)

- Comprehensive (theft, vandalism, weather damage)

- Uninsured Motorist (protects you from uninsured drivers)

California-Specific Facts:

- Minimum required coverage: $15,000/$30,000/$5,000

- Average monthly cost: $27 for minimum liability, $66 for full coverage

- California allows legal lane splitting (the only state that does)

The average motorcycle policy costs about $33 per month nationwide. However, rates vary dramatically based on your age, riding history, bike type, and location. In California, full coverage averages $792 annually while minimum coverage is about $320 per year—both higher than national averages.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group. For over three decades, we’ve helped riders find the best motorcycle insurance by comparing quotes from over 20 carriers. Our team is committed to finding coverage that balances protection with affordability for your unique needs.

Know your best motorcycle insurance terms:

Understanding Motorcycle Insurance Costs

The first question most riders ask is, “What will this cost me?” In California, the average cost is $27 per month for minimum liability ($320 annually) and $66 monthly for full coverage ($792 annually). These rates are higher than the national average, but they are just a starting point. We’ve helped countless riders find rates well below these figures by understanding the factors that drive premiums.

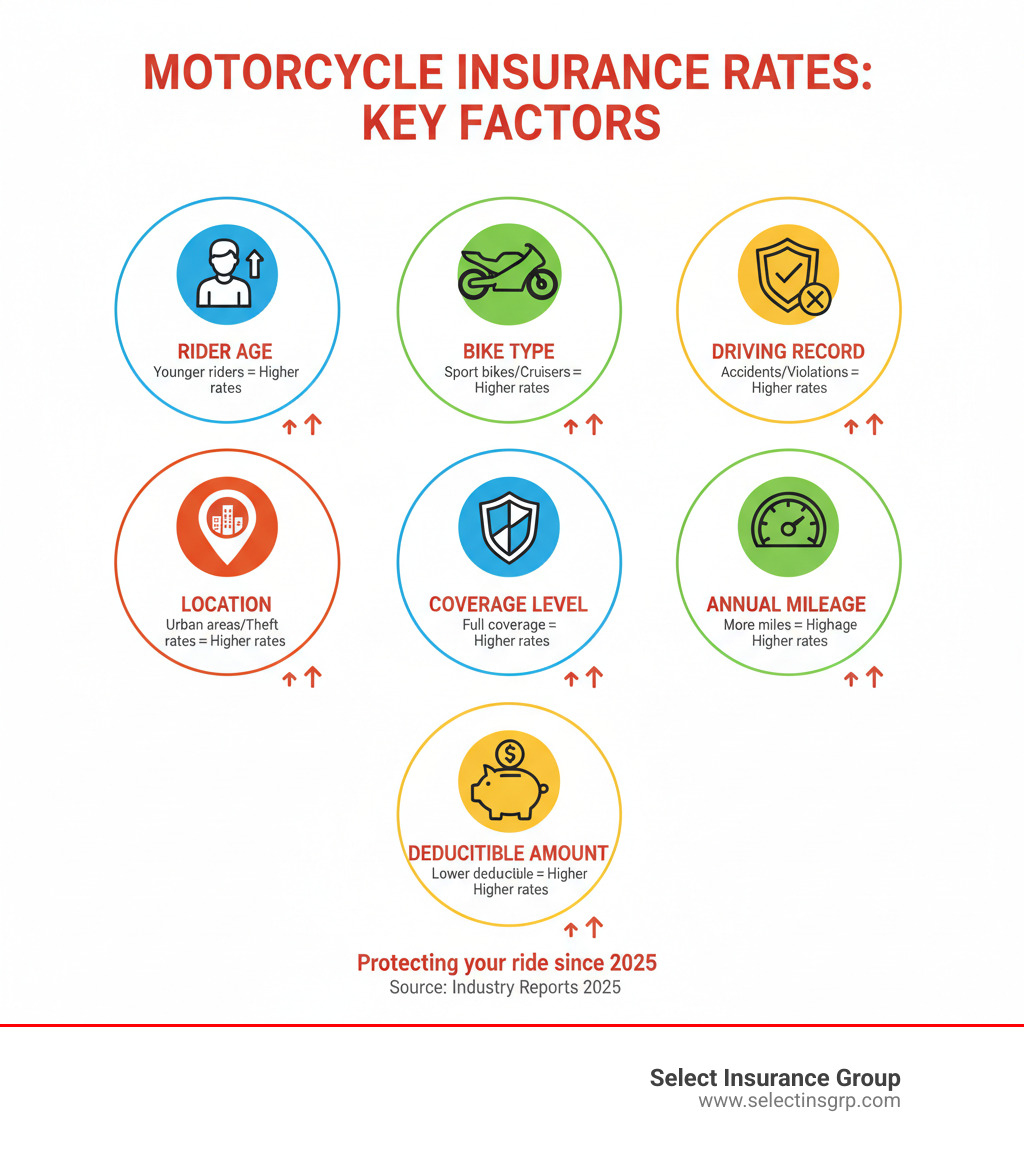

What Factors Influence Your Premium?

Insurance companies measure risk to determine your premium. Here are the key factors we’ve seen affect the final price over our three decades in the business:

- Your age and experience: Newer riders under 25 are seen as higher risk, while riders over 50 with years of safe experience often qualify for better rates.

- Your driving record: This is a major factor you can control. Accidents, tickets, and DUIs will raise your rates. A clean record keeps more money in your pocket.

- The type of motorcycle you ride: A high-performance sport bike will cost more to insure than a cruiser due to higher accident statistics and repair costs.

- Where you park your bike: Urban ZIP codes with more traffic and higher theft rates typically have higher premiums than rural areas.

- How much coverage you choose: Minimum liability is cheaper than full coverage but leaves you more financially exposed.

- Your deductible: A higher deductible (the amount you pay out-of-pocket) lowers your monthly premium. Ensure you can afford the deductible if you need to file a claim.

- How many miles you ride: If you only ride on weekends, you may qualify for lower rates. Some carriers offer pay-per-mile options for low-mileage riders.

Average Motorcycle Insurance Costs in California

Here are the average costs for motorcycle insurance in California to give you a baseline:

| Coverage Type | Average Monthly Cost | Average Annual Cost |

|---|---|---|

| Minimum Liability | $27 | $320 |

| Full Coverage | $66 | $792 |

These are statewide averages. Your personal rate will vary based on the factors mentioned above. The good news is that we’ve seen full coverage rates as low as $42 per month and minimum liability starting at just $7 monthly for riders with the right circumstances. That’s why getting personalized quotes is so important.

At Select Insurance Group, we shop your information across more than 20 carriers to find the best rate for your specific situation. The best motorcycle insurance isn’t just about the lowest price—it’s about getting the coverage you need at a price that keeps you on the road.

How to Find the Best Motorcycle Insurance for Your Needs

The best motorcycle insurance isn’t always the cheapest; it’s the policy that provides real protection without breaking the bank. Choosing bare-bones coverage to save a few dollars can lead to financial disaster after an accident. Your insurance should protect your investment and your freedom to ride.

When comparing policies, look beyond the price and read the fine print. What’s covered, what’s excluded, and what happens if an uninsured driver hits you? These details matter. Optional add-ons can make the difference between a minor inconvenience and a major financial headache.

Key Components of the Best Motorcycle Insurance Policies

Understanding the core components of a policy helps you make informed decisions.

- Liability Coverage: This is legally required in California (15/30/5 minimums) and covers the other party’s medical bills and property damage when you’re at fault. We recommend higher limits, as costs from an accident can quickly exceed the minimums.

- Collision Coverage: This covers repairs to your own bike if you hit another vehicle or object, regardless of who is at fault. Without it, you pay for repairs out of pocket.

- Comprehensive Coverage: This protects you from non-collision events like theft, vandalism, fire, or hitting a deer. It’s essential for newer or high-value motorcycles.

- Uninsured/Underinsured Motorist Coverage: This is crucial protection. It covers your expenses if you’re hit by a driver with no insurance or not enough insurance. We consider this essential.

- Medical Payments (MedPay): This covers medical expenses for you and your passengers after an accident, regardless of fault, providing immediate access to funds for treatment.

Specialized Coverage Options to Consider

Consider these add-ons, especially if you’ve customized your bike or ride with passengers.

- Guest Passenger Liability: This is vital if you carry passengers. It covers their injuries if you’re at fault in an accident, protecting you from personal lawsuits.

- Custom Parts and Equipment (CPE): Standard policies won’t fully cover custom paint, chrome, or performance upgrades. Some insurers include a base amount (e.g., $3,000) with options to increase it up to $30,000. Look for replacement cost coverage to avoid penalties for depreciation.

- Safety Apparel Coverage: This protects your investment in helmets, jackets, and other gear if they are damaged in a covered accident.

- Roadside Assistance: This provides towing and on-site help if your bike breaks down, which is invaluable when you’re stranded.

- Total Loss Replacement: If your new bike is totaled, this coverage helps you replace it with a brand-new model at full MSRP, not its depreciated value. It’s typically for bikes one or two model years old.

At Select Insurance Group, we shop over 40 carriers to build a policy that includes exactly what you need. The best motorcycle insurance is one that lets you ride with confidence, knowing you’re truly protected.

California Motorcycle Laws & How to Save Money

Riding in California offers an unparalleled experience, but it comes with specific legal responsibilities. Understanding state laws and knowing how to lower your insurance costs are both essential for every rider. If you’re riding in another state, for example, more info about Virginia motorcycle insurance might be useful.

Minimum Insurance & Legal Requirements in California

California has clear rules for motorcycle safety and financial responsibility.

- Liability Insurance: You must have at least 15/30/5 coverage ($15k bodily injury per person, $30k per accident, $5k property damage). We recommend higher limits for better protection.

- Proof of Insurance: You must carry proof of insurance at all times while riding to avoid fines, license suspension, or impoundment.

- Helmet Laws: All riders and passengers must wear a U.S. DOT-approved helmet.

- Lane Splitting: California is the only state where lane splitting is legal, but riders must follow CHP guidelines for safety.

- Motorcycle License: You need a valid motorcycle license or endorsement. You can check with your state motor vehicle department for specifics.

Proven Strategies to Lower Your Insurance Costs

Here are proven ways to reduce your premiums without sacrificing protection.

- Bundling policies: Combining your motorcycle insurance with your auto, home, or renters policy can lead to significant discounts, often 5% or more.

- Taking a safety course: Completing an approved course, like one from the Motorcycle Safety Foundation (MSF), can earn you a discount of up to 10% and make you a safer rider.

- Maintaining a clean driving record: Avoiding accidents and violations is one of the best ways to keep your premiums low.

- Choosing a higher deductible: This lowers your monthly premium, but make sure you can afford the deductible amount in an emergency.

- Anti-theft devices: Installing approved anti-theft systems can earn you a rate break, a smart move in urban areas.

- Mature rider discounts: Many insurers offer discounts (often 10%) for experienced riders aged 50 and older.

- Paying your premium in full: Paying annually instead of monthly can save you money by avoiding installment fees.

- Low-mileage discounts: If you’re an occasional rider, ask about low-mileage or pay-per-mile options.

- Rider group discounts: Membership in organizations like the Harley Owners Group (H.O.G.) can qualify you for special rates.

Combining several of these strategies can lead to real savings while keeping you fully protected on California’s beautiful roads.

The Process for Getting Your Insurance Quote

Getting a motorcycle insurance quote is a straightforward process. Gathering the right information upfront ensures you receive an accurate premium estimate, not just a ballpark figure. If you’re in the Georgia area, More info about our services in Georgia can help you get started with local expertise.

Steps to Getting an Accurate Quote

To get an accurate quote, have the following information ready:

- Personal information: Your full name, date of birth, address, and driver’s license number.

- Motorcycle details: Your bike’s year, make, model, and Vehicle Identification Number (VIN). Also, list any custom parts or modifications.

- Desired coverage levels: Have an idea of whether you want minimum liability or full coverage with add-ons like custom parts protection.

- Driving history: Be honest about any accidents, tickets, or claims from the past few years, as they will affect your final rate.

Once you have this information, you can get quotes online, over the phone, or in person. At Select Insurance Group, we shop over 40 carriers for you, saving you the time and effort of repeating your information.

Comparing Quotes to Find the Best Motorcycle Insurance Rate

Many riders make the mistake of choosing the lowest price without reviewing the policy details. The cheapest quote isn’t always the best motorcycle insurance for your needs.

- Look beyond the price: The cheapest quote may lack crucial coverage like custom parts protection or roadside assistance. A slightly higher premium can offer significantly better protection.

- Check coverage limits: State minimums (15/30/5 in California) may not be enough to cover costs in a major accident. Higher limits provide greater peace of mind.

- Understand deductibles: A low premium might come with a high deductible. Make sure you can comfortably pay the deductible out-of-pocket if you need to file a claim.

- Review company financial strength: You need an insurer that is financially stable. Organizations like A.M. Best rate companies on their ability to pay claims. You can Learn about A.M. Best ratings to check a provider’s stability.

- Check customer reviews: Satisfaction scores and reviews give you insight into a company’s claims process and customer service.

Working with an independent agency like Select Insurance Group simplifies this process. We compare options from multiple top-rated carriers, helping you find the optimal balance of comprehensive coverage and competitive cost—the best motorcycle insurance for your unique situation.

Frequently Asked Questions about Motorcycle Insurance

After three decades in the insurance business, we’ve heard just about every question imaginable. Here are straightforward answers to some of the most common ones we receive from riders.

Does motorcycle insurance cover a passenger?

Yes, but you need the right coverage. Guest passenger liability coverage pays for a non-family passenger’s medical expenses if they are injured in an accident where you are at fault. Some policies specifically include this protection.

If another driver is at fault, their insurance should cover your passenger’s injuries. But if you are responsible, this coverage is essential to avoid paying expensive medical bills out-of-pocket. Depending on your state and policy, this may be part of your standard bodily injury liability or a separate add-on. If you regularly ride with a passenger, we highly recommend confirming you have this coverage.

Are my custom parts and gear covered?

Yes, your custom parts and gear can be covered, but you’ll typically need an add-on for Custom Parts & Equipment (CPE). You’ve invested time and money in your bike, and this coverage protects that investment.

Many insurers automatically include a baseline of accessory coverage (e.g., $2,000-$3,000) if you have comprehensive and collision, with options to purchase more. It’s important to understand the difference between actual cash value (which deducts for depreciation) and replacement cost coverage. The latter is a better option for heavily customized bikes as it pays to replace parts at their current cost.

Don’t forget your gear. Some insurers offer specific coverage for safety apparel and helmets, paying to replace damaged gear after a covered loss (minus your deductible).

Do I need insurance if I only ride occasionally?

Yes, you absolutely need insurance, even for occasional rides. California law requires at least the minimum liability coverage of 15/30/5 to operate a motorcycle on any public road. Riding without insurance can lead to fines, license suspension, or impoundment.

If you ride infrequently, consider a pay-per-mile insurance option. These policies charge a low base rate plus a small fee per mile, which can save occasional riders significant money.

Many seasonal riders consider canceling their policy during winter, but we advise against it. A gap in coverage can lead to higher premiums later. Instead, ask about a lay-up policy, which allows you to reduce coverage to comprehensive-only during the off-season. This protects your bike from theft or damage while in storage and maintains your continuous coverage discounts, which is the smartest way to keep rates low long-term.

Conclusion: Ride with Confidence

The open road is calling, and you deserve to answer with complete peace of mind. Finding the best motorcycle insurance is about protecting your bike, your finances, and your freedom to ride.

We’ve covered the essentials of motorcycle insurance in California, from average costs and premium factors to crucial policy components like liability, collision, and specialized add-ons for custom parts or passengers. You’ve also learned smart strategies to lower your costs, such as bundling policies, taking a safety course, and maintaining a clean driving record.

California’s unique riding environment demands coverage custom to your needs. The “best” policy isn’t a one-size-fits-all solution; it’s the one that fits your bike, budget, and lifestyle.

At Select Insurance Group, we’ve spent over three decades helping riders find that perfect fit. We shop over 40 carriers to find you the optimal combination of coverage and value. Our team understands you’re not just insuring a vehicle—you’re protecting a passion.

We’re here to answer your questions and guide you toward coverage that lets you ride with genuine confidence. Whether you’re a weekend cruiser or a daily commuter, we’ll help you find protection that works.

Don’t leave your ride to chance. Get your personalized motorcycle insurance quote today and find how the right coverage can transform your riding experience.