Why Virginia Riders Need Affordable Motorcycle Insurance Now More Than Ever

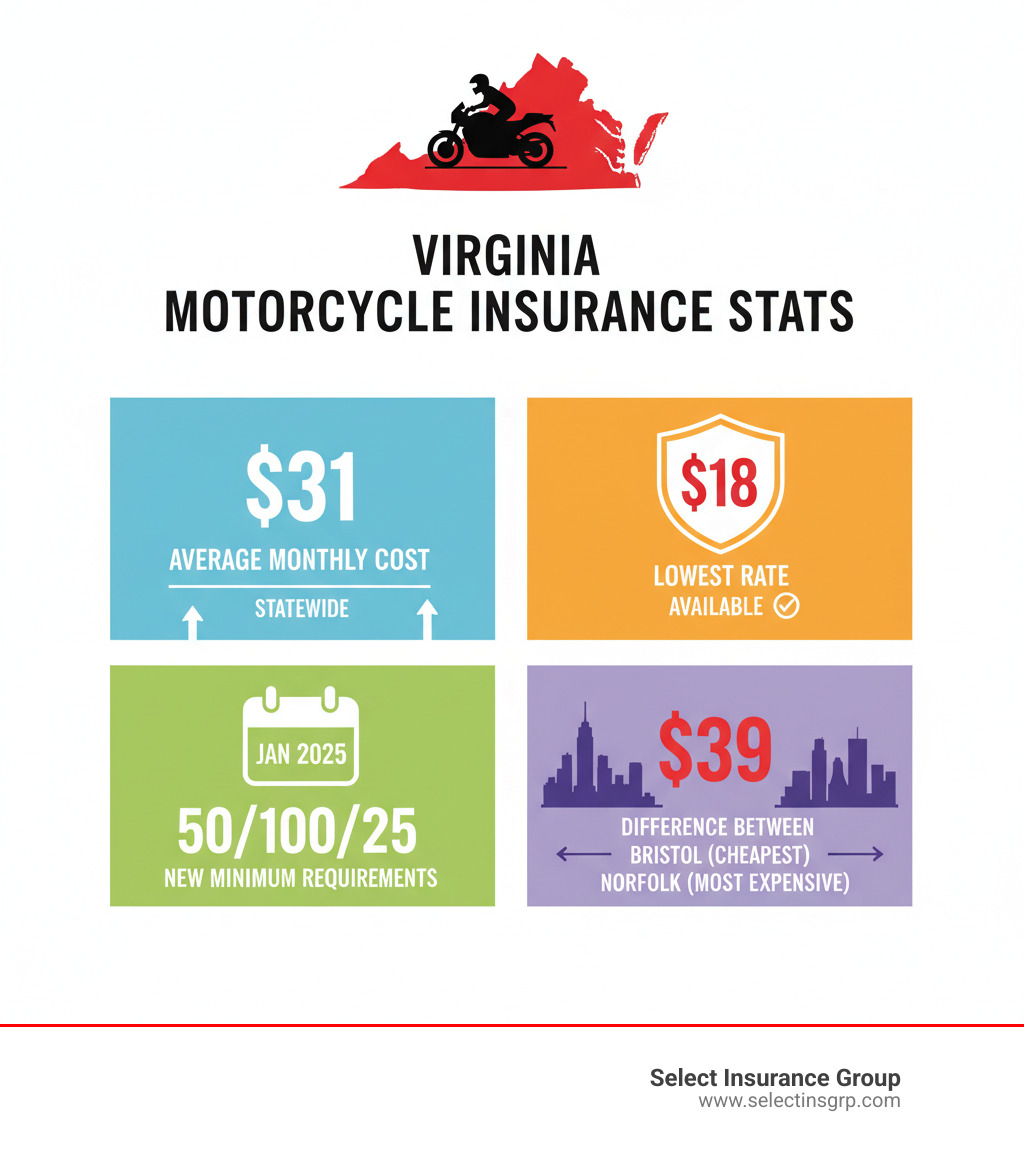

Cheapest motorcycle insurance virginia is available for as low as $18 per month for full coverage, with some carriers offering highly competitive rates. Here’s what you need to know:

- Average Cost: $31/month ($366/year) for full coverage in Virginia

- Cheapest Full Coverage: As low as $18/month (41% below state average)

- Cheapest Liability-Only: As low as $11/month

- 2025 Requirement Change: Minimum coverage increases to 50/100/25 on January 1, 2025

- City Variation: Rates range from $26/month (Bristol, Harrisonburg) to $65/month (Norfolk)

Virginia’s insurance landscape for motorcyclists changed on July 1, 2024, when the state eliminated the option to pay an uninsured motor vehicle fee. Now, every rider must have coverage. With new, higher minimums taking effect January 1, 2025, understanding your options is critical.

The good news? Virginia motorcycle insurance doesn’t have to be expensive. Comparison shopping can save you up to 76% on average. Whether you’re cruising the Blue Ridge Mountains or commuting through Richmond, finding affordable coverage starts with knowing what drives your premium and which carriers offer the best rates for you.

I’m D.J. Hearsey, founder of Select Insurance Group. For over 30 years, I’ve helped riders across Virginia find the cheapest motorcycle insurance virginia has to offer while ensuring they have the protection they need. My team compares rates from over 40 carriers to find you the best combination of price and coverage—because affordable doesn’t have to mean inadequate.

Understanding the Cost of Motorcycle Insurance in Virginia

If you’ve ever wondered why you’re paying what you’re paying for motorcycle insurance, you’re not alone. The pricing is based on real factors that you can often influence. Let’s pull back the curtain on what determines your premium in Virginia.

Average Premiums in the Commonwealth

Virginia riders pay an average of $31 per month or $366 per year for full coverage motorcycle insurance, which is slightly less than the national average of $33 monthly.

However, averages are just a starting point. Your actual premium depends on many factors, from your bike to your address. While some riders pay more, those who shop around and use discounts often pay significantly less.

Full coverage costs more than liability-only because it protects your bike from damage and theft, not just the damage you cause to others. Understanding the difference is key to balancing your budget and your needs.

Finding the Most Affordable Rates

While $31 per month is the state average, the cheapest motorcycle insurance Virginia riders can find starts at just $18 per month for full coverage. That’s 41% below the state average—real money for gas, gear, or your next road trip.

For riders needing only liability coverage, rates can be as low as $11 per month. While this meets state minimums, we always recommend considering if it truly protects your financial situation.

Your age, riding experience, and motorcycle type are major factors. Younger riders and those on high-performance sport bikes typically face higher premiums due to statistical risk. However, some carriers offer competitive rates for these profiles, with potential savings of hundreds or even thousands of dollars annually.

| Coverage Type | Average Monthly Cost | Cheapest Available |

|---|---|---|

| Liability-Only | $27 | $11 |

| Full Coverage | $58 | $18 |

The gap between what some riders pay and what you could pay is often dramatic. That’s why at Select Insurance Group, we shop your policy across over 40 carriers. We’ve seen countless times how comparing options can save riders hundreds of dollars annually. The Virginia motorcycle insurance market is competitive, and that works in your favor when you explore it.

Virginia’s Motorcycle Insurance Laws: What Every Rider Must Know

If you love riding in Virginia, you need to understand the rules. The state’s insurance laws have changed significantly, and staying informed is about protecting yourself and others on the road.

Current Minimum Liability Requirements

As of July 1, 2024, motorcycle insurance is mandatory in Virginia. The state eliminated the uninsured motor vehicle fee, meaning every motorcycle must be properly insured.

Currently, Virginia requires minimum liability coverage of $30,000 per person for bodily injury, $60,000 per accident for bodily injury, and $20,000 for property damage (30/60/20).

Liability coverage pays for the other person’s medical bills and vehicle repairs if you’re at fault; it does not cover your own injuries or bike damage. Virginia also requires Uninsured/Underinsured Motorist coverage to protect you if the other driver lacks adequate insurance.

For more details, our guide on Virginia liability covers the topic in depth.

Important 2024 and 2025 Law Changes

The mandatory insurance rule was just the start. A bigger change is coming that will affect every rider’s wallet.

Starting January 1, 2025, Virginia’s minimum requirements will increase to $50,000 per person for bodily injury, $100,000 per accident for bodily injury, and $25,000 for property damage (50/100/25).

This means if you carry minimum coverage, you’ll need to upgrade your policy. While higher limits mean higher premiums, finding the cheapest motorcycle insurance Virginia offers is still possible with comparison shopping. The upside is that these higher limits provide better protection for everyone, as medical and repair costs have risen dramatically.

Virginia also requires proper licensing, including written and practical tests. The Virginia motorcycle safety programs through the DMV are excellent resources for all riders.

Don’t wait until the end of the year. Review your policy now to get ahead of the 2025 changes and ensure you’re compliant and protected.

How to Find the Cheapest Motorcycle Insurance Virginia Offers

Finding the cheapest motorcycle insurance virginia isn’t about cutting corners—it’s about smart shopping and understanding what drives your premium.

Key Factors That Influence Your Premium

Insurers look at your specific situation to assess risk. Understanding these factors can help you find lower rates.

- Age and Experience: Younger riders (under 25) typically pay more due to higher statistical accident rates. Premiums decrease with age and safe riding experience.

- Driving Record: A clean record free of tickets, at-fault accidents, or DUIs is your best path to lower rates.

- Motorcycle Type: High-performance sport bikes cost more to insure than cruisers or touring bikes. Smaller, less powerful bikes generally have the lowest rates.

- Location: Your ZIP code matters. Insurers analyze local theft rates, traffic density, and accident frequency.

- Annual Mileage: Riding less can lead to lower premiums, as it reduces your time on the road and potential for accidents.

- Coverage and Deductibles: Higher coverage limits increase your premium but offer better protection. A higher deductible lowers your premium but means more out-of-pocket cost if you file a claim.

- Credit Score: Many insurers use credit scores to gauge financial responsibility, which can influence your premium.

How to get the cheapest motorcycle insurance virginia rates with discounts

Discounts can dramatically reduce your premium without sacrificing coverage. Always ask about every discount you might qualify for.

- Bundling Policies: Combining your motorcycle insurance with your Virginia Home Insurance or auto policy is often the biggest money-saver.

- Motorcycle Safety Course: Completing a recognized safety course makes you a safer rider and earns you a discount.

- Clean Driving Record: Insurers reward safe riding habits with good driver discounts and claim-free renewal bonuses.

- Anti-Theft Device: Installing a disc lock or GPS tracker can lower your comprehensive coverage costs.

- Payment Method: Paying your premium in full or setting up automatic payments can often qualify you for a discount.

- Memberships and Status: Belonging to a motorcycle association (like H.O.G.), being a homeowner, or being a mature rider (over 55) can open up special discounts.

- Multi-Bike Discount: Insuring more than one motorcycle with the same company will earn you a discount.

How Your City Affects Your Insurance Cost

Your insurance rate can swing by as much as $22 per month (nearly $264 a year) depending on your city.

Norfolk is the most expensive city for motorcycle insurance in Virginia, averaging $65 per month for full coverage. This is due to higher traffic, theft rates, and accidents.

In contrast, riders in Bristol, Harrisonburg, Staunton, and Winchester enjoy some of the lowest rates, averaging just $26 per month. These areas have less congestion and lower crime rates.

This variation is based on local data. A rider in rural Southwest Virginia will likely pay less than one in Northern Virginia or Hampton Roads. That’s why a personalized quote based on your exact location is crucial. We compare rates from over 40 carriers to find the best option for your specific situation and location.

Choosing Coverage Beyond the State Minimum

Meeting Virginia’s minimum insurance requirements keeps you legal, but it’s just a starting point. State minimums don’t offer comprehensive protection for you, your passengers, or your bike.

Minimum liability only protects other people if you cause an accident. It won’t cover your medical bills or repair your bike. If you’ve invested in your motorcycle, protecting that investment makes sense.

Recommended Coverage Options for Virginia Riders

Consider these options when shopping for the cheapest motorcycle insurance virginia offers to ensure you’re fully protected.

- Collision Coverage: Pays to repair or replace your motorcycle if you’re in a crash, regardless of fault. It’s essential if you’re financing your bike or if it has significant value.

- Comprehensive Coverage: Protects your bike from non-collision events like theft, vandalism, fire, hail, or hitting an animal.

- Medical Payments (MedPay): Covers medical bills for you and your passenger after an accident, regardless of who is at fault.

- Uninsured/Underinsured Motorist (UM/UIM): This is critical. It protects you if you’re hit by a driver with little or no insurance.

- Custom Parts & Equipment (CPE): Insures your aftermarket additions, like a custom exhaust or paint job, that standard policies don’t cover.

- Roadside Assistance: Provides peace of mind with services like towing, flat tire changes, and fuel delivery if you’re stranded.

- Trip Interruption: Reimburses you for expenses like hotels and meals if your bike breaks down far from home on a long trip.

- Other Options: Ask about Safety Riding Apparel coverage, Guest Passenger Liability, and Total Loss coverage for new bikes.

The reality is that motorcycle accidents, while less common than car accidents, often result in more serious injuries and higher costs. The Insurance Information Institute’s motorcycle crash statistics make this clear. Choosing coverage beyond the minimum isn’t about being pessimistic—it’s about being prepared and protecting what matters most.

Special Considerations for Military Members

If you’re active military or a veteran, you may qualify for exclusive discounts. Some insurers partner with military-focused organizations to offer special rates, often 5% or more.

When getting a Virginia Motorcycle Insurance quote, always mention your military affiliation. At Select Insurance Group, we ensure our military clients receive every available discount. Your service deserves recognition, and saving you money is one way we can honor it.

Frequently Asked Questions about Cheap Motorcycle Insurance in Virginia

We get questions from riders every day about finding affordable coverage. Here are straight answers to the most common ones.

What is the average cost of motorcycle insurance in Virginia?

The average Virginia rider pays about $31 per month ($366 per year) for full coverage. However, this is just an average. By shopping around, riders can find full coverage for as low as $18 per month or liability-only for as little as $11 per month. Your actual rate depends on your age, riding history, bike type, and location, so getting a personalized quote is essential.

What are the new motorcycle insurance requirements in Virginia for 2025?

Starting January 1, 2025, Virginia’s minimum liability requirements will increase to $50,000 per person for bodily injury, $100,000 per accident for bodily injury, and $25,000 for property damage (50/100/25). This is a significant increase from the current 30/60/20 limits, so you will need to update your policy to remain legal.

Is it cheaper to insure a motorcycle than a car in Virginia?

Yes, in most cases, motorcycle insurance is cheaper than car insurance. This is because motorcycles typically cause less property damage in an accident, are often less expensive to repair or replace, and are frequently used seasonally, reducing overall risk. While factors like age and bike type can affect the price, insuring a motorcycle generally costs less than insuring a car.

Let Us Help You Find the Best Rate for Your Ride

Finding the cheapest motorcycle insurance virginia offers is about getting the right protection at a price that fits your budget. We’ve covered average costs, premium factors, and the important 2025 law changes. We’ve also shown why minimum coverage often isn’t enough and how discounts can significantly lower your costs.

Comparing rates from over 40 carriers in Virginia can be overwhelming. That’s where we come in.

I founded Select Insurance Group over 30 years ago to help people find excellent coverage without the headache. My team works with more than 40 carriers to shop the market for you, finding the best combination of price and protection. Our loyalty is to you, not a single company.

Whether you’re a new rider, a veteran cruiser, or just want to ensure you’re not overpaying, we can help. We understand the Virginia market and enjoy helping riders get the affordable coverage they need.

You deserve to ride with confidence. Let us handle the comparison shopping while you focus on the open road.

Get your personalized Virginia motorcycle insurance quote today and find out how much you could save. We’re ready to help you find the best rate for your ride.