Why You Need Liability Protection Even Without Your Own Vehicle

Getting liability insurance without a car is possible through a non-owner car insurance policy. This specialized coverage protects you when driving borrowed or rented vehicles, even if you don’t own one yourself.

How to Get Non-Owner Liability Insurance:

- Contact insurance carriers that offer non-owner policies (many major insurers do)

- Provide your driver’s license number and basic information

- Select your coverage limits (typically starting at state minimums)

- Pay your premium – often $200-$350 per year for low-risk drivers

What It Covers:

- Bodily injury liability if you cause an accident

- Property damage to others’ vehicles or property

- Uninsured/underinsured motorist protection (in some policies)

What It Doesn’t Cover:

- Damage to the car you’re driving

- Your own injuries

- Vehicles you have regular access to

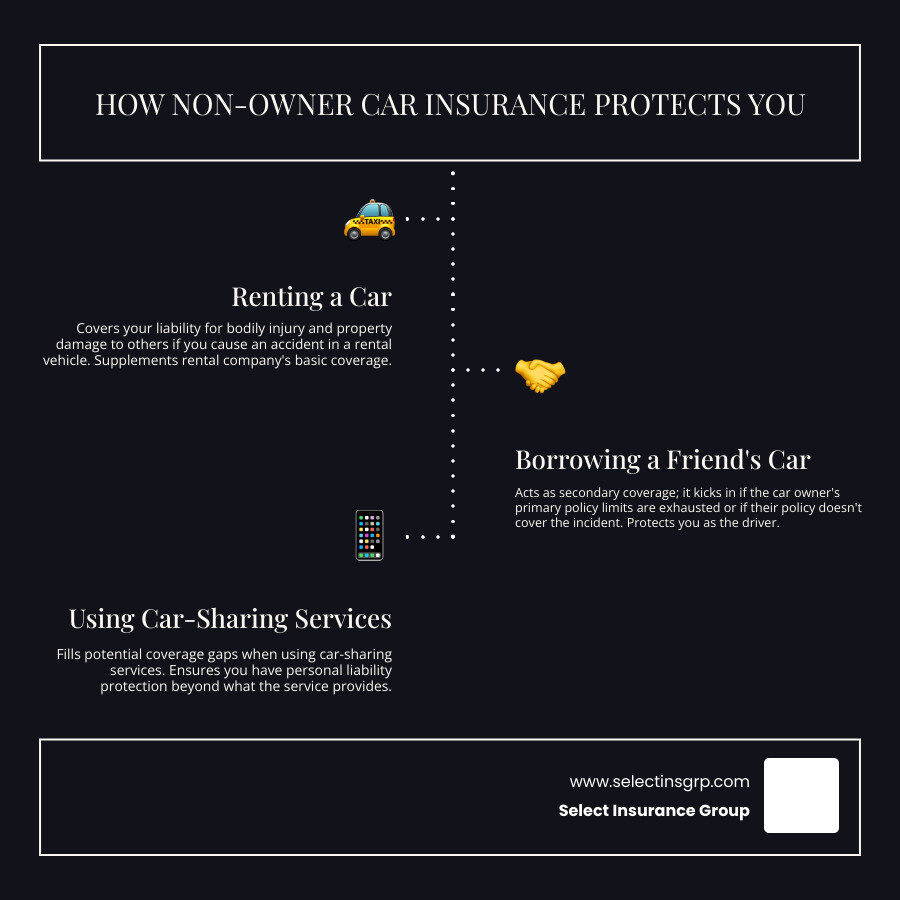

You might be wondering why anyone would need insurance without owning a car. The reality is simple: if you frequently rent cars, borrow friends’ vehicles, or use car-sharing services like Zipcar, you’re exposed to significant financial risk every time you get behind the wheel. A single at-fault accident could leave you personally liable for tens of thousands of dollars in medical bills and property damage.

The good news? Non-owner car insurance offers an affordable solution that protects your assets and provides peace of mind for a fraction of what traditional auto insurance costs.

I’m D.J. Hearsey, Principal Agent and CEO of Select Insurance Group, and over three decades of helping drivers across the Southeast steer complex insurance needs, I’ve seen countless situations where getting liability insurance without a car saved clients from financial disaster. Whether you’re maintaining continuous coverage between vehicles or simply don’t need to own a car in your urban lifestyle, understanding your options is the first step toward proper protection.

Understanding Non-Owner Car Insurance

A non-owner car insurance policy—also called a named non-owner or operator’s policy—insures you as a driver, not a specific vehicle. Unlike traditional auto insurance that attaches to a car, non-owner insurance attaches to you and follows you into any vehicle you’re driving. It acts as your personal safety net when you borrow or rent a car.

Crucially, it works as secondary coverage, meaning it activates after the car owner’s primary insurance is exhausted or if their policy doesn’t cover the incident. This supplemental layer provides financial protection against liability claims if you injure someone or damage their property. It’s an affordable way to stay protected without the expense of insuring a vehicle you don’t own.

To help you see where non-owner insurance fits in the bigger picture, here’s how it compares to other coverage types:

| Feature | Non-Owner Car Insurance | Traditional Auto Insurance | Permissive Use Coverage |

|---|---|---|---|

| Primary Purpose | Covers the driver for liability when driving non-owned vehicles. | Covers a specific vehicle and its listed drivers for various risks. | Extends the vehicle owner’s policy to an occasional, unlisted driver. |

| What’s Covered | Bodily Injury & Property Damage Liability (yours to others). May include Uninsured/Underinsured Motorist, MedPay. | Liability, Collision, Comprehensive, Medical Payments, etc. (for the insured vehicle). | Liability (yours to others) under the vehicle owner’s policy. |

| Ideal User | Drivers who frequently rent/borrow cars, need SR-22/FR-44, or want continuous coverage without owning a vehicle. | Vehicle owners who drive their own car regularly. | Infrequent borrowing of a friend/family member’s car, relying solely on their policy. |

| Cost | Generally less expensive than traditional auto insurance. | Varies widely based on vehicle, driver, and coverage. | Typically no additional cost to the borrower, but owner’s premiums reflect risk. |

| Covers Damage to Car You’re Driving? | No | Yes (with Collision/Comprehensive) | No (unless owner’s policy has Collision/Comprehensive, but it’s their policy that pays). |

What a Non-Owner Policy Typically Covers

The foundation of a non-owner policy is liability protection, which shields your assets if you cause an accident. Your policy will include Bodily Injury Liability (covering medical expenses, lost wages, and pain and suffering for others) and Property Damage Liability (paying for repairs to other vehicles or property).

A non-owner policy helps you meet state minimum liability requirements, but we recommend choosing higher limits. State minimums are often low—sometimes just $25,000 per person for injuries—and a serious accident can easily exceed that, leaving you personally liable for the difference. A non-owner car insurance policy provides liability coverage that protects you from these financial risks, similar to how General Liability Insurance protects businesses.

Many policies also offer valuable add-ons. Uninsured/Underinsured Motorist Coverage helps pay your medical bills if you’re hit by a driver with little or no insurance. Medical Payments (MedPay) or Personal Injury Protection (PIP) can cover your own medical expenses after an accident, regardless of fault. These additions create comprehensive protection that travels with you.

What a Non-Owner Policy Does NOT Cover

It’s important to understand the limitations of non-owner insurance. It’s designed to cover your liability to others, not the physical car you’re driving or your personal belongings.

The biggest limitation is that damage to the borrowed or rented car isn’t covered. If you back into a pole or get sideswiped, your non-owner policy won’t pay to fix the vehicle you’re driving. This is why rental companies offer a Collision Damage Waiver.

Similarly, Collision coverage and Comprehensive coverage aren’t part of non-owner policies. Collision covers damage from hitting another vehicle or object, while comprehensive covers theft, vandalism, and other non-collision events. Since your policy isn’t tied to a specific vehicle, these coverages don’t apply.

Your personal property isn’t covered either. If your laptop is stolen from the borrowed car, you’ll need to look to your homeowners or renters insurance for protection.

A crucial point is that non-owner insurance doesn’t cover vehicles in your household. If your spouse, parent, or roommate owns a car that you regularly drive, you should be listed as a named driver on their traditional policy. Non-owner insurance is specifically for vehicles you don’t have regular access to.

Finally, if you drive a company car for work, your employer’s commercial auto insurance should cover you. Non-owner insurance isn’t meant for this situation.

Who Needs This Type of Liability Coverage?

More people than you might expect benefit from a non-owner insurance policy. Car ownership isn’t always practical, but the occasional need to drive remains.

Here are the people who benefit most from getting liability insurance without a car. If you travel frequently for work or pleasure and rent cars regularly, a non-owner policy can save you money over the rental company’s liability coverage.

If you’re an occasional borrower of friends’ cars, your non-owner policy acts as a valuable safety net. If the car owner’s policy limits are exhausted in a serious accident, you’re not left personally liable for thousands of dollars.

If you’re a city dweller who relies on public transit, a non-owner policy ensures you’re covered for occasional driving needs without the expense of a full auto policy.

Car-sharing services like Zipcar and Turo are convenient, but their included insurance is often minimal or has high deductibles. A non-owner policy supplements this coverage, giving you broader liability protection.

If you’re maintaining continuous coverage between vehicles, a non-owner policy is a smart financial move. A gap in your insurance history can lead to higher premiums later. A non-owner policy keeps your record clean and your future rates lower.

Fulfilling Legal Requirements like SR-22/FR-44

One of the most critical reasons for getting liability insurance without a car is to meet legal requirements for license reinstatement. If your license was suspended or revoked (e.g., for a DUI or reckless driving), your state’s DMV will require proof of financial responsibility to reinstate it. This proof is an SR-22 certificate or an FR-44 certificate.

An SR-22 is not insurance itself, but a certificate your insurer files with the state to prove you have liability coverage. An SR-22 certificate may be required as proof that you meet minimum insurance requirements while working toward license reinstatement. An FR-44 is similar but is required in Florida and Virginia for more serious violations and mandates higher liability limits.

If you don’t own a car, a non-owner policy is essential. It provides the necessary liability coverage to satisfy these state mandates. While SR-22 and FR-44 filings increase premiums significantly (50% to 300%), a non-owner policy is still the most affordable way to comply without insuring a vehicle.

This driver-specific liability focus is similar to how Business Auto Insurance covers employees driving company vehicles, ensuring the person behind the wheel has proper protection for their personal driving needs.

Your Guide to Getting Liability Insurance Without a Car

Let’s walk through the practical steps of obtaining this coverage. Getting liability insurance without a car is often simpler and more affordable than many people imagine. This guide covers qualifying for a policy, understanding costs, and the purchasing process.

Key Requirements for Getting Liability Insurance Without a Car

Before getting quotes, ensure you meet the basic requirements for a non-owner policy.

The most important requirement is having a valid driver’s license. The policy covers you as a driver, so you must be legally allowed to drive. You might still qualify with a suspended license if you’re seeking an SR-22 or FR-44 filing for reinstatement.

You also must not own a vehicle registered in your name. This policy is specifically for people who do not own a car.

You can’t have regular access to a household car either. If you live with someone who owns a car and you drive it regularly, you should be added as a named driver on their policy. Non-owner insurance is for occasional borrowing or renting, not consistent access to a specific car.

Finally, a clean driving record helps. It makes finding coverage easier and keeps premiums reasonable. If you have accidents or violations, you can still find coverage, but expect to pay more.

Factors That Influence Your Premium

Getting liability insurance without a car typically costs less than traditional auto insurance, but several factors affect your premium.

Your driving history is the biggest factor. A spotless record might result in a premium as low as $200 per year. A DUI or the need for an SR-22 or FR-44 filing can increase your premium by 50% to 300%.

Your age matters. Younger drivers, especially those under 25, typically pay more due to higher statistical risk.

Your location and ZIP code impact rates. Urban areas with more traffic and accidents cost more to insure than rural areas.

The coverage limits you select will also affect your premium. State minimums are cheapest, but higher limits offer substantially better financial protection for a modest increase in cost.

An SR-22 or FR-44 filing signals higher risk to insurers, which increases your premium. The filing itself usually costs $15 to $30, but the impact on your rate is the bigger expense.

On average, most people pay around $285 per year for minimum liability coverage through a non-owner policy—an affordable price for the protection it provides.

How to Purchase a Policy for Getting Liability Insurance Without a Car

The purchasing process is straightforward. You can contacting insurance carriers directly, but many don’t advertise non-owner policies prominently.

A better option is working with an independent insurance agent. At Select Insurance Group, our 30+ years of experience means we work for you, not a single insurance company. We shop over 40 carriers to find the most competitive rates and the right coverage for your specific situation.

This is crucial for non-owner policies, as carrier offerings vary. We know which carriers are best for SR-22 filings, frequent renters, or other unique needs.

When you’re ready for a quote, have your full name, address, driver’s license number, date of birth, and driving history available. Be honest about any tickets or accidents for the most accurate rate. Mention if you need an SR-22 or FR-44 filing.

We’ll also discuss appropriate coverage limits, as state minimums are often insufficient for serious accidents. The process can take less than an hour, with coverage often starting the same or next business day. Getting liability insurance without a car is simple with experienced guides.

Frequently Asked Questions About Non-Owner Policies

We know that getting liability insurance without a car can bring up a lot of questions. Let’s tackle some of the most common concerns we hear from clients every day.

Does non-owner insurance cover damage to a rental car?

This is probably the most important thing to understand about your non-owner policy: it covers your liability to others, not physical damage to the car you’re driving. If you rent a car and accidentally back into a pole, your non-owner insurance won’t pay a dime to fix that rental vehicle’s crumpled bumper.

What your policy will cover is the damage you cause to someone else’s car, their property, or their medical bills if you’re at fault in an accident. Think of it as protecting your wallet from lawsuits and claims, not protecting the rental car itself.

So what do you do about damage to the rental vehicle? You have two main options. First, the rental company will offer you a Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW) when you pick up the car. This waives your responsibility for damage or theft, though it can add $15-30 per day to your rental cost.

Second, check your credit card rental benefits. Many credit cards provide secondary coverage for rental car damage when you decline the rental company’s waiver and pay with that card. This can be a real money-saver, though it’s typically secondary coverage, meaning it only kicks in after other insurance has been exhausted.

What happens if I buy a car?

Exciting news if you’re buying your first car or getting back into vehicle ownership! Your non-owner policy will need to be converted to a standard owner’s auto policy that covers your specific vehicle.

Here’s the silver lining: maintaining that non-owner policy means you’ve kept a continuous coverage history, and insurance companies love that. Gaps in coverage are red flags to insurers, often resulting in higher premiums. By keeping your non-owner policy active, you’ve proven you’re a responsible driver who values insurance protection.

When you switch to a traditional policy, this continuous coverage history can help you secure lower rates on your new policy. It’s like having a good credit score, but for insurance. We recommend giving us a call as soon as you start car shopping so we can line up your new policy to start the day you take ownership. That way, there’s no gap, and you drive off the lot fully protected.

Can I get this if I live with someone who owns a car?

This question comes up all the time, and honestly, the answer isn’t always straightforward. The key factor is regular access.

If you live with a spouse, parent, or roommate who owns a car, and you have regular access to drive that vehicle, most insurance companies will require you to be listed as a named driver on their traditional auto insurance policy. This is important because if you’re driving that household car regularly but aren’t listed, the insurance company might deny coverage if you have an accident. That’s a financial disaster waiting to happen.

However, if you truly never drive their car—maybe you rely entirely on public transportation or they simply don’t allow you to drive it—you may still qualify for a non-owner policy. This would cover you when you rent cars or borrow vehicles from friends or family outside your household.

The word “regular” is doing a lot of work here. Even if you only drive the household car once a month, that could be considered regular access. When in doubt, be upfront with your insurance agent about your living situation. We’d rather help you get the right coverage from the start than see you face a denied claim down the road.

Secure Your Peace of Mind on the Road

You’ve made it this far, and I hope you’re feeling more confident about getting liability insurance without a car. It really is a straightforward solution to what might have seemed like a complicated problem. Whether you’re renting cars frequently, borrowing from friends occasionally, or working to meet legal requirements after a license suspension, a non-owner policy gives you that crucial financial protection and, perhaps more importantly, genuine peace of mind.

Here’s what we’ve covered: Non-owner car insurance is an affordable way to maintain liability coverage when you don’t own a vehicle. It protects you from potentially devastating financial consequences if you cause an accident while driving someone else’s car. It’s perfect for city dwellers who’ve ditched car ownership, frequent travelers who rent regularly, or anyone maintaining continuous coverage to keep their rates low down the road. And if you need an SR-22 or FR-44 filing, it’s often the most practical path to getting your license back.

The truth is, accidents happen. Even the most careful drivers can find themselves in an unfortunate situation. Without proper coverage, you could be personally liable for medical bills, vehicle repairs, and legal fees that stretch into tens of thousands of dollars. A non-owner policy shields your assets and your future for what often amounts to less than a dollar a day.

At Select Insurance Group, we’ve spent over three decades helping drivers just like you steer these waters. We’re independent agents, which means we work for you, not for any single insurance company. We shop over 40 carriers across Florida, the Carolinas, Virginia, and Georgia to find you the best rates and the right coverage for your specific situation. Our team understands that your insurance needs are as unique as your driving habits, and we’re committed to finding solutions that truly fit.

The smart choice is to act now, before you need the coverage. Don’t wait until you’re standing at a rental counter or borrowing a friend’s keys to wonder if you’re properly protected. Take the next step today and secure your liability coverage.

Ready to get started? Get a Quote from our experienced team. We’ll walk you through your options, answer any remaining questions, and help you find the right auto insurance policy for your needs. Because whether you’re driving your own car or someone else’s, you deserve to feel confident and protected on every journey.