Why Your Custom Truck Needs More Than Standard Insurance

Custom truck insurance is specialized coverage designed to protect modified vehicles and their aftermarket parts—something standard auto policies often fail to adequately cover. If you’ve invested in performance upgrades, custom paint, or lift kits, you need a policy that recognizes the true value of your truck.

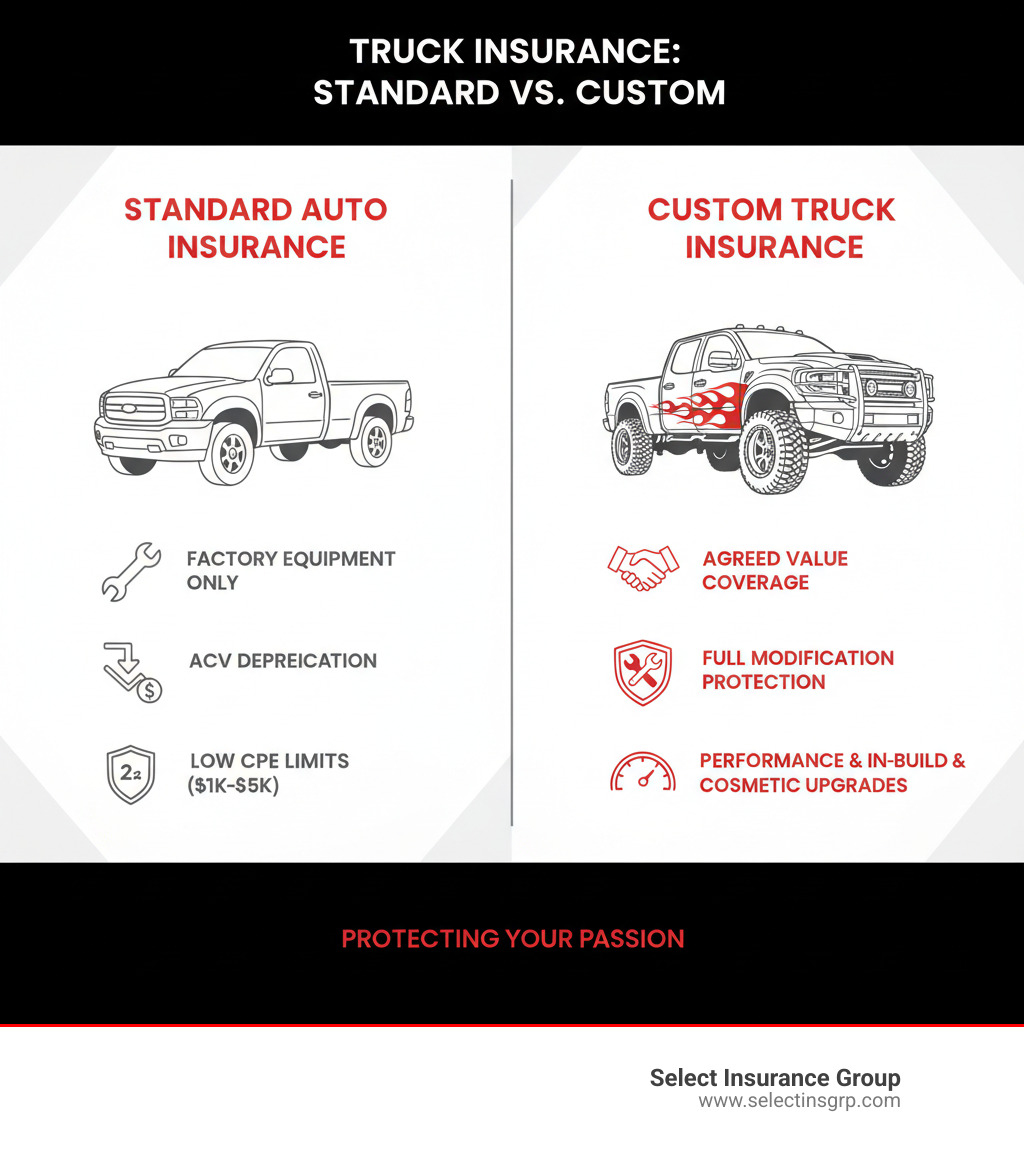

Standard auto insurance policies are built for factory-stock vehicles. They use Actual Cash Value (ACV), which includes depreciation and ignores the thousands of dollars you’ve spent on modifications. While some policies offer a Custom Parts and Equipment (CPE) endorsement, the coverage limits are often capped at $1,000 to $5,000—not nearly enough to cover a serious build.

To properly protect your investment, you need a policy that offers Agreed Value coverage, ensuring you get the full, pre-approved value of your truck if it’s totaled. It’s also critical to disclose all modifications to your insurer, as failing to do so can lead to denied claims or policy cancellation. Finally, whether you use your truck for pleasure or business will determine if you need a personal or commercial policy.

Your truck is more than just transportation; it’s a significant financial and personal investment. It deserves insurance that works as hard as you did to build it.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group. For over 30 years, I’ve helped truck owners across the Southeast find custom truck insurance solutions that protect their passion projects. I’ll walk you through what you need to know to get the right coverage.

Custom truck insurance basics:

Why Standard Insurance Falls Short for Your Modified Truck

Picture this: you’ve spent countless hours and thousands of dollars on performance parts, a lift kit, and a perfect paint job. Your truck is a testament to your vision. But your standard auto insurance policy likely sees it as just another used pickup, and that gap can be costly.

The biggest issue is Actual Cash Value (ACV). Standard insurers use ACV to determine your truck’s worth by subtracting depreciation from its original value. This calculation completely ignores the $15,000 you invested in custom wheels, suspension, and engine upgrades. If your truck is totaled, you’ll get a check based on its depreciated book value, leaving you to cover the cost of your modifications out-of-pocket.

Even policies with a Custom Parts and Equipment (CPE) endorsement offer limited help, with caps typically between $1,000 and $5,000. This won’t come close to replacing high-end custom work.

Furthermore, failing to disclose every single modification to your insurer can have severe consequences. An insurer can deny your claim for undisclosed parts or, worse, void your policy entirely for material misrepresentation. This could leave you with no coverage at all and make it difficult and expensive to get insured in the future.

Understanding Valuation: The Core of Your Coverage

To get the right protection, you must understand how insurers value your vehicle. There are three main methods:

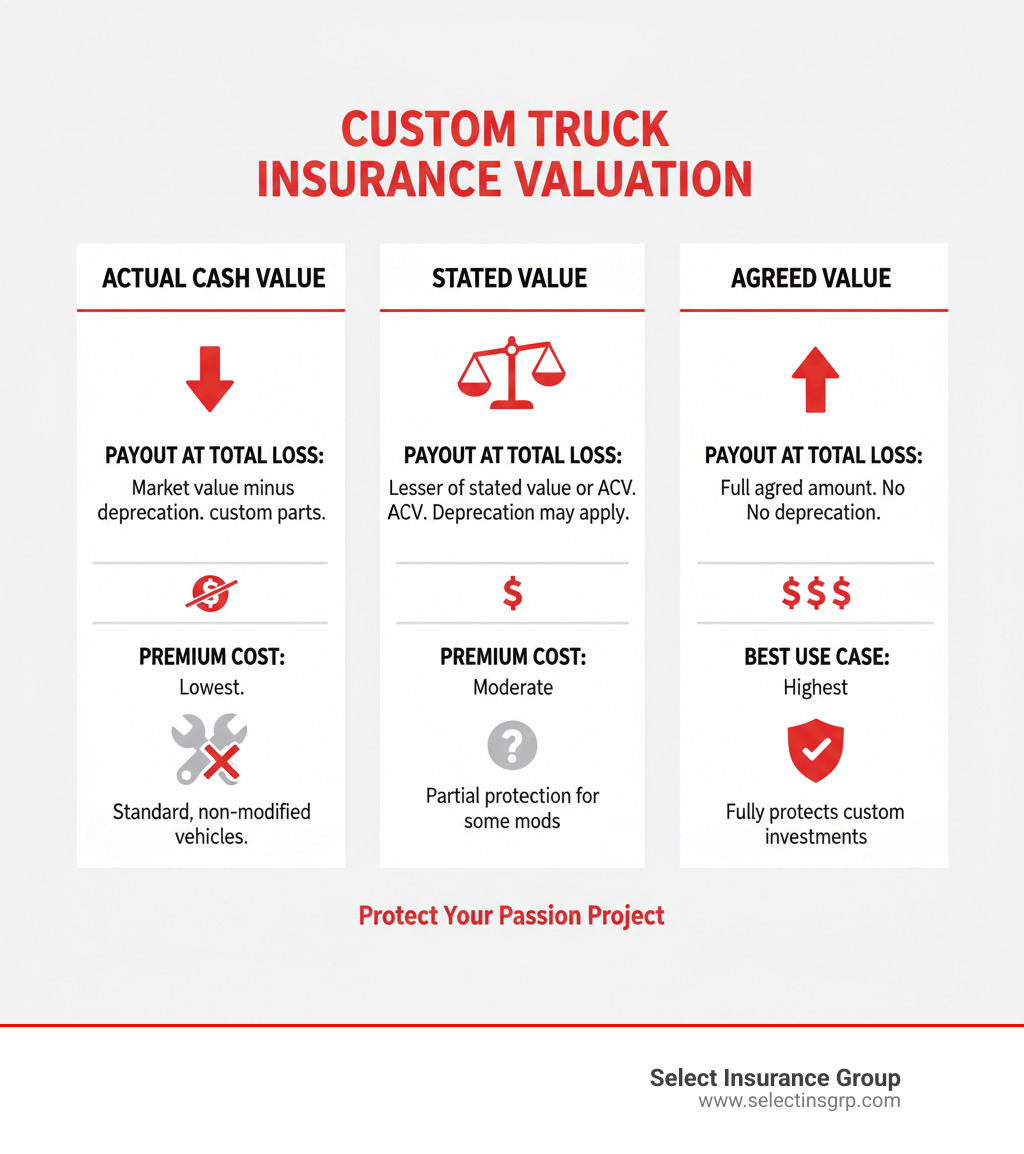

- Actual Cash Value (ACV): The default for standard policies. It pays the vehicle’s market value minus depreciation at the time of loss. This is the worst option for a custom truck.

- Stated Value: You “state” the value of your truck, including mods. However, in a total loss, the insurer pays the lesser of the stated value or the ACV. It offers a false sense of security, as depreciation can still reduce your payout.

- Agreed Value: The gold standard for custom vehicles. You and the insurer agree on the truck’s value upfront—including all modifications. If the truck is totaled, you receive that full agreed-upon amount, minus your deductible. No depreciation, no arguments. This is the only way to truly protect your investment.

While Agreed Value policies cost more, the premium is a small price for the peace of mind that comes with knowing your unique build is fully protected. The key is full disclosure: document every part and every hour of labor, take photos, and share everything with your agent. Transparency is the only way to ensure your custom truck insurance works when you need it most.

Building Your Ideal Custom Truck Insurance Policy

Once you understand the need for specialized coverage, the next step is to build a custom truck insurance policy that fits your vehicle and how you use it. This involves assessing your modifications and selecting the right endorsements to provide comprehensive protection.

How Modifications Impact Your Custom Truck Insurance Premiums

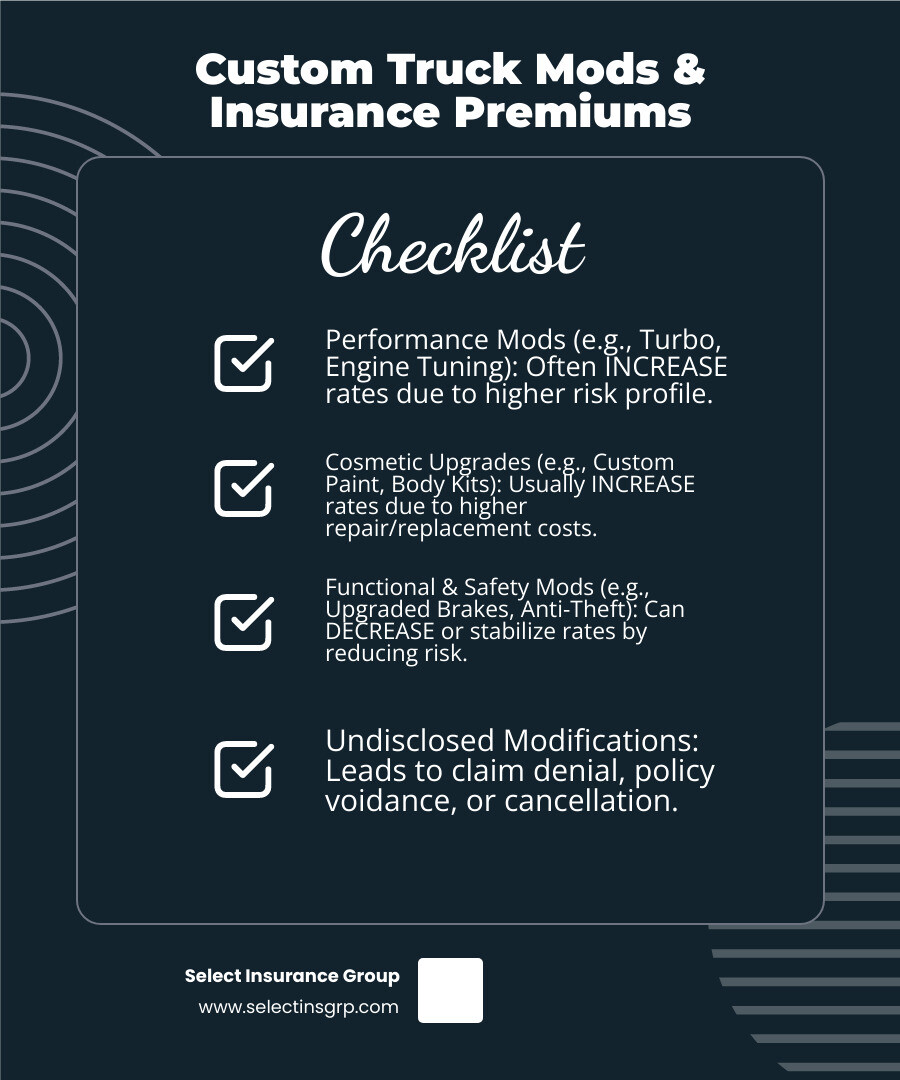

Not all modifications affect your premium equally. Insurers evaluate changes based on how they alter your truck’s value, performance, and risk.

- Performance Modifications: These usually increase premiums. Upgrades like turbochargers, engine tuning, or aggressive lift kits change the truck’s performance profile, increasing the perceived risk of an accident.

- Cosmetic Upgrades: Custom paint, body kits, and high-end interiors significantly increase the truck’s value and repair cost. While they don’t make the truck more dangerous, the higher potential payout for a claim leads to higher premiums.

- Functional & Safety Modifications: These can sometimes lower your premium or have a neutral effect. Upgraded brakes, improved lighting, heavy-duty bumpers, and anti-theft systems reduce risk, which insurers view favorably.

Essential Coverages and Endorsements

A robust custom truck insurance policy should include specialized coverages that standard policies lack:

- Agreed Value Coverage: As discussed, this is non-negotiable. It guarantees you receive the full, pre-determined value of your truck in a total loss, with no depreciation.

- Custom Parts & Equipment (CPE): A specialized policy will offer much higher CPE limits than a standard one, or better yet, roll the value of your parts into the total Agreed Value.

- Spare Parts Coverage: Protects your investment in spare parts stored off the vehicle, often with a set limit (e.g., $500).

- Vehicle Under Construction Coverage: Provides comprehensive-only (fire, theft, vandalism) protection for your truck while it’s being built or restored. Some policies automatically increase the insured value as you make progress.

- Automatic Coverage for Newly Acquired Vehicles: For collectors, this feature automatically extends coverage to a new vehicle for a limited time (e.g., 30 days), giving you time to formally add it to your policy.

Personal Hobby vs. Commercial Hauler: Choosing the Right Policy Type

Does your custom truck hit the weekend car show circuit, or does it haul equipment for your business? The answer is critical, as it determines whether you need a personal or commercial custom truck insurance policy.

Using a truck for business on a personal auto policy is a recipe for disaster. Personal policies contain a “business use exclusion,” meaning any claim that occurs while you’re working can be denied. Don’t risk having your coverage evaporate when you need it most.

Insurance for Your Personal Custom Truck

If your truck is a true hobby vehicle, a specialty collector policy is your best bet. These are often more affordable than standard insurance because insurers know you’re not using it for a daily commute. They are designed for enthusiasts who cherish their vehicles.

Typically, you’ll need to have a separate daily driver, store the truck in a secure garage, and maintain a clean driving record. These policies offer flexible mileage plans and, most importantly, the Agreed Value coverage needed to protect your investment.

If you’re in the Southeast and looking for personal coverage for your custom truck, we’ve got you covered in Florida, North Carolina, and South Carolina.

When You Need Commercial Custom Truck Insurance

If your truck earns its keep in any way—hauling tools, making deliveries, or operating for-hire—you must have commercial custom truck insurance. This is non-negotiable for protecting your business and personal assets.

Commercial use includes transporting goods, running a towing or dump truck operation, or even using it for a side job. Depending on your business, you may also need to manage federal and state compliance filings to prove you have adequate coverage.

Key commercial coverages include:

- Motor Truck Cargo: Protects the goods you are hauling.

- Physical Damage: Covers your truck from collision, theft, and vandalism.

- Non-Trucking Liability: Provides coverage when using your truck for personal, non-business purposes (for owner-operators leased to a carrier).

- Bobtail Coverage: Covers your truck when you’re driving without a trailer for business reasons.

- Trailer Interchange: For when you’re hauling trailers owned by others.

Specialized programs exist for unique needs. For example, some insurers, like The Hartford, offer policies for businesses that manufacture or install custom truck equipment. We work with commercial truck owners across North Carolina, Virginia, South Carolina, Florida, and Georgia to steer these complex requirements.

Frequently Asked Questions about Custom Truck Insurance

Navigating custom truck insurance can bring up a lot of questions. Here are answers to some of the most common concerns we hear from truck owners.

Do all modifications automatically increase my insurance premium?

No, not all of them. Insurers assess each modification’s impact on risk.

- Safety and security upgrades like better brakes or anti-theft systems can actually reduce risk and may not increase your premium, or could even lead to a discount.

- Performance modifications such as turbochargers or engine tuning increase the potential for speed and accidents, which typically raises your premium.

- High-value cosmetic changes like custom paint or interiors increase the truck’s replacement and repair cost, which will also usually result in a higher premium.

The key is to be upfront about every change. Transparency ensures you get the right coverage.

Can I get coverage for a truck I’m still building or restoring?

Yes. Many specialty insurers offer “Vehicle Under Construction” coverage. This is a comprehensive-only policy that protects your project from fire, theft, vandalism, and other disasters while it’s stored or being worked on. It doesn’t cover driving-related accidents but protects your growing investment. Some of these policies even feature an automatic increase in the insured value to keep pace with your build, ensuring your new parts are covered as you install them. Just be sure to keep detailed records and receipts.

What’s the difference between “Agreed Value” and “Stated Value” coverage?

This is a critical distinction that can impact your payout by thousands of dollars.

-

Agreed Value: You and the insurer agree on your truck’s exact worth—including all modifications—before the policy begins. If the truck is totaled, you receive that full amount, minus your deductible. There is no depreciation. This is the recommended coverage for any custom vehicle.

-

Stated Value: You “state” what you believe your truck is worth. However, if the truck is totaled, the insurer pays the lesser of your stated amount or the vehicle’s actual cash value (ACV) at the time of the loss. This means the insurer can still apply depreciation, and you may receive significantly less than you expected.

For any custom truck insurance policy, Agreed Value is the only way to guarantee your unique investment is fully protected.

Conclusion

Your custom truck is a testament to your vision, hard work, and a significant financial investment. It deserves protection that a standard, one-size-fits-all policy simply cannot provide.

The key takeaways are clear: standard insurance falls short by using Actual Cash Value, which ignores your modifications. To truly protect your build, you need an Agreed Value policy, and you must be transparent about every upgrade. Whether your truck is a personal hobby or a commercial workhorse will determine the specific type of policy you need.

These details are the difference between peace of mind and financial devastation after an accident. At Select Insurance Group, we’ve spent over 30 years helping truck owners across the Southeast protect their passion projects. We shop more than 40 carriers to find the right custom truck insurance solution at a competitive rate.

Your truck is unique. Let’s make sure your insurance is too.