Why Every Trucker Needs Protection for Their Payload

Cargo insurance for truckers is a specialized policy that protects motor carriers and owner-operators from financial loss when the goods they’re hauling are damaged, stolen, or destroyed. Here’s what you need to know:

- What it covers: Damage or loss to freight from collision, fire, theft, and other risks.

- Who needs it: For-hire truckers and anyone hauling property for others under a bill of lading.

- Why it matters: Most shippers and brokers require it, making it essential for securing business.

- Typical cost: $400–$1,800 annually, with monthly options from $35–$150.

- Standard limits: $100,000 is common; high-value loads may require $250,000 or more.

Truckers assume huge financial responsibility for the cargo they haul. Without the right insurance, a single accident or theft could be financially devastating. Motor truck cargo insurance covers your liability for lost or damaged cargo, protecting your business and reputation.

Beyond covering the cargo, this insurance can pay for cleanup expenses, lost freight charges, and legal fees. Most importantly, shippers and brokers require proof of coverage before awarding contracts.

The good news is that cargo insurance is affordable. Costs vary based on your freight, coverage limits, and history, but options exist for every budget. Understanding your policy is the first step toward protecting your livelihood.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group. For over 30 years, I’ve helped truckers across the Southeast secure cargo insurance for truckers that balances comprehensive protection with affordable pricing. Through our 12 locations in Florida, Georgia, the Carolinas, and Virginia, we leverage relationships with over 20 carriers to get our clients the coverage they need at rates they can afford.

The Foundation: What is Motor Truck Cargo Insurance and Why is it Essential?

Picture this: You’ve just loaded $80,000 worth of electronics when a collision destroys the cargo. Who pays? Without cargo insurance for truckers, that financial burden falls on you.

Motor truck cargo insurance (or freight insurance) is designed to protect for-hire truckers from this exact scenario. It covers your liability for goods that are damaged, lost, or destroyed while in your care, custody, and control under a Bill of Lading. A single incident without coverage could wipe out months of profit or even shut down your operation.

Beyond protecting your bottom line, cargo insurance for truckers protects your professional reputation. Most shippers and freight brokers won’t work with you unless you can prove you carry substantial cargo coverage. They need assurance their goods are protected, and you need to show you’re a reliable carrier. In today’s industry, it’s your ticket to securing good business.

Who Needs Motor Truck Cargo Insurance?

If you’re hauling freight for others for-hire, you need this coverage. It’s designed for for-hire truckers, owner-operators, and motor carriers transporting goods under a Bill of Lading.

It doesn’t matter what you drivea box truck, cargo van, flatbed, car hauler, tractor-trailer, dually pickup for hot shot loads, or even a dump truck. If you transport someone else’s property for compensation, you have a legal liability that standard policies won’t cover. We’ve helped truckers across the Southeast secure the right coverage, including those in Georgia Commercial Insurance markets.

Cargo Insurance vs. Other Trucking Policies

It’s easy to confuse trucking insurance policies. Heres a simple breakdown to avoid surprises during a claim.

Commercial Auto Liability protects other people when you cause an accident. It pays for their injuries and property damage.

Physical Damage insurance protects your own truck and trailer if they get damaged in a collision, fire, or are stolen.

Motor truck cargo insurance protects the goods you’re hauling for your clients. It covers your liability for their property while it’s in your care.

You need all three for complete protection. They work together to cover different aspects of your operation. To see how these policies fit together, explore our Business Auto Insurance options.

Decoding Your Policy: Standard Coverages and Common Exclusions

Understanding what your cargo insurance for truckers policy covers—and what it doesn’t—is critical. Don’t get caught by surprise during a claim.

Most policies define “in transit” broadly to include loading, unloading, and temporary storage. A key distinction is whether your policy is “all-risk” or “named perils.” An all-risk policy is more comprehensive, covering everything except what’s specifically excluded. A named perils policy only covers the specific risks listed, like fire or collision. Always ask your agent which type you have.

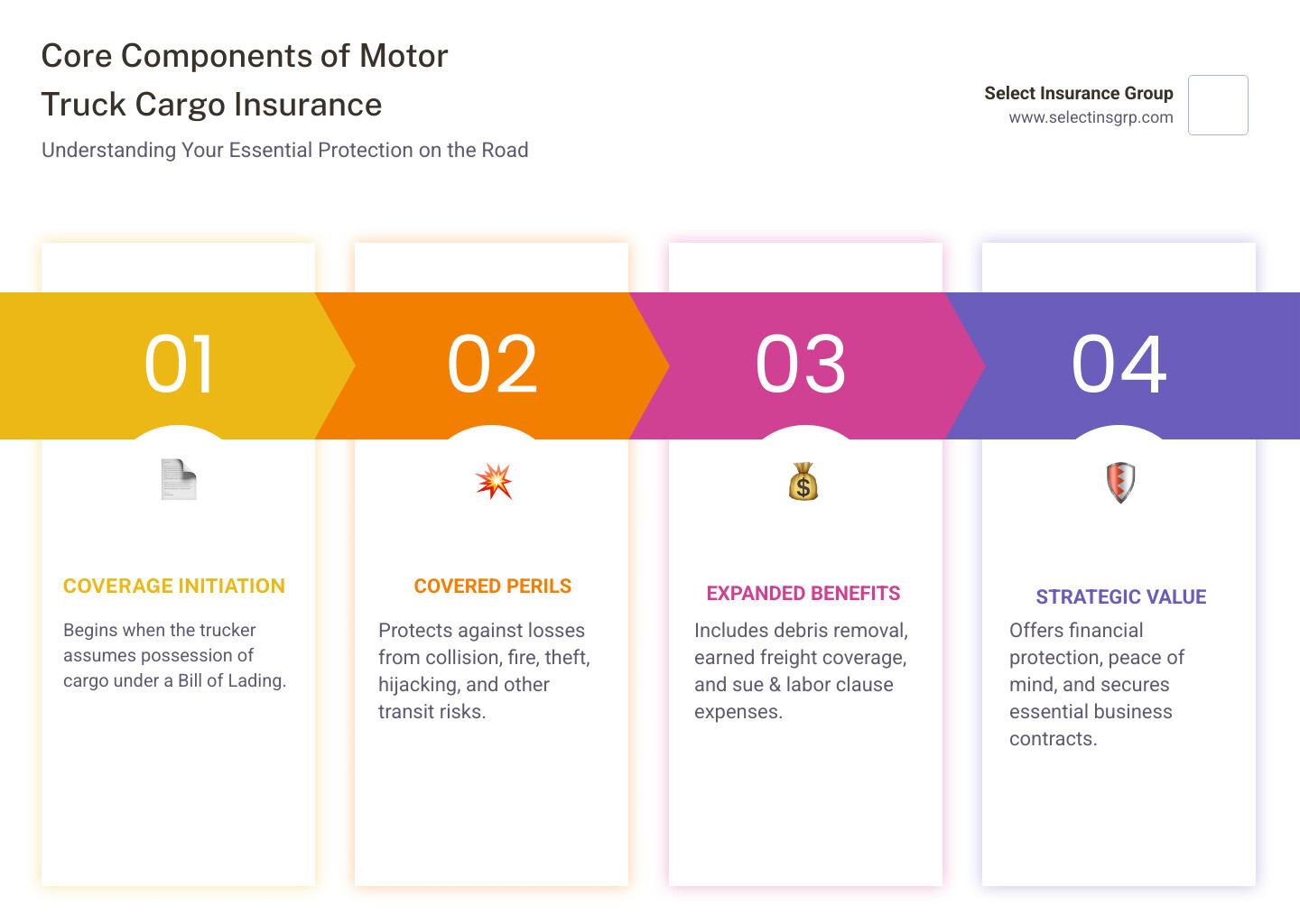

Key Coverage Components of Cargo Insurance for Truckers

A solid motor truck cargo insurance policy goes beyond just replacing damaged goods. The foundation is physical damage to cargo from collision, fire, theft, or hijacking. A good policy also includes:

- Debris removal: Covers cleanup costs if your load spills, often up to $10,000.

- Pollutant cleanup: Handles expenses if a hazardous material from your cargo spills, typically up to $10,000.

- Earned freight coverage: Reimburses you for the freight charges you lost due to a covered incident, usually up to $10,000.

- Sue and labor clause: Covers expenses you incur to prevent further damage after an incident, plus related legal costs.

- Reloading expense: Helps with costs to move cargo to another truck, often up to $5,000.

Other potential coverages include fire department service charges, reward coverage for stolen property, and legal defense expenses. We help truckers throughout Florida Commercial Insurance markets understand these valuable components.

Common Exclusions to Be Aware Of

Knowing what isn’t covered is just as important. Common exclusions include:

- Valuables: Art, jewelry, precious metals, and cash are almost always excluded.

- Restricted or illicit substances: This includes contraband and often certain pharmaceuticals, tobacco, or alcohol.

- Live animals: Hauling livestock requires its own specialized coverage.

- Property owned by the insured: This insurance protects your client’s goods, not your own.

- Cargo not on the bill of lading: The policy only protects what’s officially documented.

- Extended storage: Coverage usually stops if cargo is stored for more than 72 hours.

- Other exclusions: Explosives, radioactive materials, the shipping container itself, inherent vice (natural spoilage), and damage from improper packing are typically not covered.

Specialized Coverage: Reefer Breakdown, Theft, and More

Some types of cargo require extra protection, and specialized endorsements are essential.

Refrigeration breakdown coverage is a must-have if you haul temperature-sensitive goods like produce or pharmaceuticals. This endorsement protects against spoilage from a sudden and accidental mechanical failure of your reefer unit. It won’t cover breakdowns from poor maintenance, so keeping your unit serviced is key. For a box truck with a reefer, $100,000 in coverage may cost $2,500 to $3,500 per year.

Theft and hijacking protection is standard, but the details matter. Clarify with your agent if there are conditions, such as the truck being left unattended.

Other endorsements to consider include infidelity or dishonesty coverage (for losses caused by an employee) and hired auto cargo coverage (for loads you haul in a rented or leased truck). We help truckers in South Carolina Commercial Insurance build policies that match their unique needs.

The Bottom Line: Calculating the Cost of Cargo Insurance for Truckers

When truckers ask what cargo insurance for truckers will cost, the answer is: it depends. Most truckers pay between $400 and $1,800 per year, which is roughly $35 to $150 per month for a standalone policy.

Why the wide range? Insurers calculate your premium based on several factors. The type of cargo is the biggest factor; high-value electronics cost more to insure than gravel. Your coverage limits, loss history, and driving record also play a major role. A clean record means lower rates. Finally, your location and business history can influence the cost. New owner-operators may see slightly higher rates until they build a track record.

The Role of Deductibles and Coverage Limits

“Deductibles” and “coverage limits” are two key terms that determine your policy’s cost and protection.

Your deductible is what you pay out-of-pocket before your insurance kicks in. For general freight, deductibles are often around $1,000. For higher-risk reefer cargo, they can be $2,500 to $5,000. Choosing a higher deductible will lower your premium, but you’ll pay more if you have a claim.

Your coverage limit is the maximum amount your insurer will pay for a single loss. For general freight, $100,000 in cargo coverage is the industry standard and what most brokers expect. However, high-value loads, like those on hot shot or auto haulers, often require $250,000 or even $300,000 in coverage.

Finding the right balance is key. When you’re ready to see what works for your operation, Get a Quote from us, and we’ll walk you through the options.

Cost Examples by Truck Type

To put it in context, here are some real-world annual premium examples for cargo insurance for truckers:

- Small commercial van ($100k coverage): $500 to $1,000

- Box truck with a reefer unit ($100k coverage): $2,500 to $3,500 (includes reefer breakdown)

- Hot shot dually truck ($250k coverage): $1,500 to $2,500

- Large multi-unit auto hauler ($250k coverage): $2,500 to $3,500

These examples show how costs vary by operation type and cargo value. That’s why we provide a personalized assessment for every trucking business to find the right coverage at the right price.

Taking Action: The Claims Process and Finding Your Best Policy

Knowing what to do after a cargo loss can turn a chaotic situation into a manageable one. Just as crucial is finding the right cargo insurance for truckers policy in the first place.

Steps to Take When Filing a Cargo Claim

If something happens to your cargo, take a breath and follow these steps to ensure a smooth claim process.

- Ensure Safety First. Before making calls, make sure the scene is secure.

- Call Your Agent Immediately. Prompt notification is often a policy requirement and gets the process started.

- Document Everything. Use your phone to take photos and videos of the damaged cargo, your truck, and the accident scene.

- File a Police Report. This official report is essential for claims involving theft, vandalism, or a major accident.

- Notify the Shipper and Receiver. Keeping everyone informed is professional and helps maintain business relationships.

- Protect Cargo from Further Damage. Salvage what you can. Your costs may be reimbursable under the “sue and labor” clause.

- Organize All Paperwork. Keep your Bill of Lading, receipts, and invoices ready for the adjuster.

- Cooperate with the Adjuster. Answer questions honestly and provide documents promptly to speed up the process.

How to Find the Best Cargo Insurance for Truckers

Finding the right policy doesn’t have to be a maze. Here’s how to secure comprehensive coverage at a fair price.

First, know what you need: what commodities you haul, their value, and your clients’ coverage requirements. This helps you ask the right questions.

Next, work with an independent agency like ours. We shop over 40 different carriers on your behalf, comparing not just prices but coverage details and service. Our long-standing relationships help us find you the best value.

Consider bundling your cargo insurance for truckers with Commercial Auto Liability and Physical Damage. Insurers often offer discounts for multiple policies, and it simplifies your insurance management.

Finally, look beyond the premium. Review the policy’s limits, deductible, and especially the exclusions to ensure it covers your specific risks. A cheap policy that doesn’t cover what you haul is no bargain.

At Select Insurance Group, we help truckers across the Southeast, including Florida Commercial Insurance, Georgia Commercial Insurance, South Carolina Commercial Insurance, and North Carolina Commercial Insurance, find coverage that provides real protection.

Ready to explore your options? Get a Quote from us today, or Contact Us for a personalized consultation.

Frequently Asked Questions about Trucker Cargo Insurance

Over my three decades in insurance, I’ve heard nearly every question about cargo insurance for truckers. Here are the most common ones we get at Select Insurance Group.

Is cargo insurance legally required for truckers?

While motor truck cargo insurance isn’t federally mandated like liability coverage, you can’t do business without it. Most shippers, freight brokers, and logistics companies require it to protect their goods. So, while not required by law, it’s absolutely required for business. No coverage means no contracts.

What is the difference between a “named peril” and “all-risk” cargo policy?

This distinction can save you thousands.

A “named peril” policy only covers losses from risks specifically listed in the policy, like fire or collision. If a risk isn’t on the list, it’s not covered.

An “all-risk” policy is broader. It covers everything except for what is specifically excluded. Because it offers more comprehensive protection and fewer surprises at claim time, we generally recommend all-risk policies to our clients.

Can I get cargo insurance for a single trip?

Yes. Short-term or per-load cargo insurance is a great option for certain situations. If you land a one-time opportunity to haul a high-value load that exceeds your standard policy limit, single-trip coverage can protect that specific haul. It’s a flexible, cost-effective way to say “yes” to lucrative opportunities without committing to a higher annual premium.

Protecting Your Business Mile After Mile

Every mile you drive is your livelihood on the line. Cargo insurance for truckers isn’t just another expense; it’s the foundation that allows you to operate with confidence, knowing your business can weather the storm of an unexpected accident, theft, or breakdown.

Without adequate motor truck cargo insurance, a single incident could be financially devastating and damage your professional reputation. The right coverage protects your ability to secure contracts, build client trust, and grow your business. It proves you’re a professional, giving both you and your clients valuable peace of mind.

At Select Insurance Group, we’ve spent three decades helping truckers across the Southeast find policies that provide real protection without breaking the bank. With relationships spanning over 40 carriers and locations throughout Florida, Georgia, the Carolinas, and Virginia, we’re here to find the right fit for you.

If you’re operating in North Carolina and need comprehensive protection, we’re ready to help. Find the right commercial insurance policy in North Carolina and let’s get you covered for the road ahead.