Why Florida Drivers Pay More—And How to Pay Less

Cheap car insurance Florida is a top search for drivers in the Sunshine State, and for good reason. Florida is one of the most expensive states for car insurance, with average annual premiums reaching $3,682 in 2024—68% higher than the national average. Here’s a quick overview:

Quick Answers: Finding Cheap Car Insurance in Florida

- Minimum Required Coverage: $10,000 Personal Injury Protection (PIP) + $10,000 Property Damage Liability (PDL)

- Average Cost: $2,208/year for minimum coverage, but rates vary widely.

- Top Ways to Save: Compare quotes, bundle policies, maintain a clean driving record, and ask about discounts.

- Best Practices: Shop annually, consider higher deductibles, and don’t skip optional coverages like Bodily Injury Liability.

- High-Risk Options: SR-22 and FR-44 filings are available for drivers with violations or DUIs.

Florida’s high costs stem from its no-fault system, a high rate of uninsured drivers, severe weather risks, and frequent insurance fraud. Your personal rate also depends on your driving record, location, vehicle, and credit score.

The good news is that you have control over what you pay. By understanding the market and shopping strategically, most drivers can save hundreds annually. I’m D.J. Hearsey, founder of Select Insurance Group. With over 30 years of experience, my team helps Florida drivers find affordable coverage by shopping more than 40 carriers for competitive rates that truly protect you.

Understanding Florida’s Car Insurance Essentials

To find cheap car insurance Florida, you first need to understand the state’s unique requirements. Knowing these essentials helps you stay legal, avoid penalties, and make smart coverage choices. This section covers mandatory coverage, penalties for being uninsured, and SR-22/FR-44 forms.

Florida’s Minimum Insurance Requirements

Florida is a no-fault state, meaning your own insurance covers your initial medical bills after an accident. To drive legally, you must have:

- $10,000 in Personal Injury Protection (PIP): Covers 80% of your medical bills and 60% of lost wages, regardless of fault.

- $10,000 in Property Damage Liability (PDL): Pays for damage you cause to someone else’s property.

While these minimums keep you legal, they are among the lowest in the nation and may not be enough in a serious accident. For official details, visit Florida’s official insurance requirements page.

Penalties for Driving Uninsured

Florida electronically monitors insurance coverage, so a lapse is detected quickly. Driving uninsured leads to severe penalties:

- Suspension of your driver’s license, vehicle registration, and tags for up to three years.

- Fines from $150 to $500.

- Reinstatement fees and a requirement to provide proof of new insurance.

Maintaining continuous coverage is crucial to avoid these expensive and inconvenient consequences.

What are SR-22 and FR-44 Forms?

SR-22 and FR-44 forms are not insurance policies but proof of financial responsibility filed by your insurer with the state.

- An SR-22 is required for violations like driving with a suspended license or causing an accident while uninsured. It must be maintained for about three years.

- An FR-44 is required for DUI/DWI convictions and mandates much higher liability limits: $100,000 per person for bodily injury, $300,000 per accident, and $50,000 for property damage. This results in higher premiums.

These requirements can be complex, but our team at Select Insurance Group has experience with these filings. We work with carriers that specialize in high-risk situations, making it possible to find cheap car insurance Florida options even with an SR-22 or FR-44.

Why is Car Insurance So Expensive in Florida?

Florida consistently ranks as one of the most expensive states for auto insurance, with drivers paying 68% more than the national average. This is due to a combination of unique factors. Understanding why rates are high is the first step toward finding cheap car insurance Florida.

Key Factors Driving Up Your Premiums

Several key factors contribute to Florida’s high insurance costs:

- Dense Population & Tourism: Crowded roads with millions of residents and tourists lead to more accidents and claims.

- Severe Weather: Hurricanes, tropical storms, and flooding cause widespread vehicle damage, leading to massive insurance payouts.

- High Rate of Uninsured Drivers: When an uninsured driver causes an accident, insured drivers’ policies often cover the costs, raising rates for everyone.

- PIP Fraud: Florida’s no-fault system is a target for fraudulent Personal Injury Protection (PIP) claims, increasing premiums for honest policyholders.

- Expensive Litigation: Costly legal battles over insurance claims drive up operational costs for insurers, which are passed on to customers.

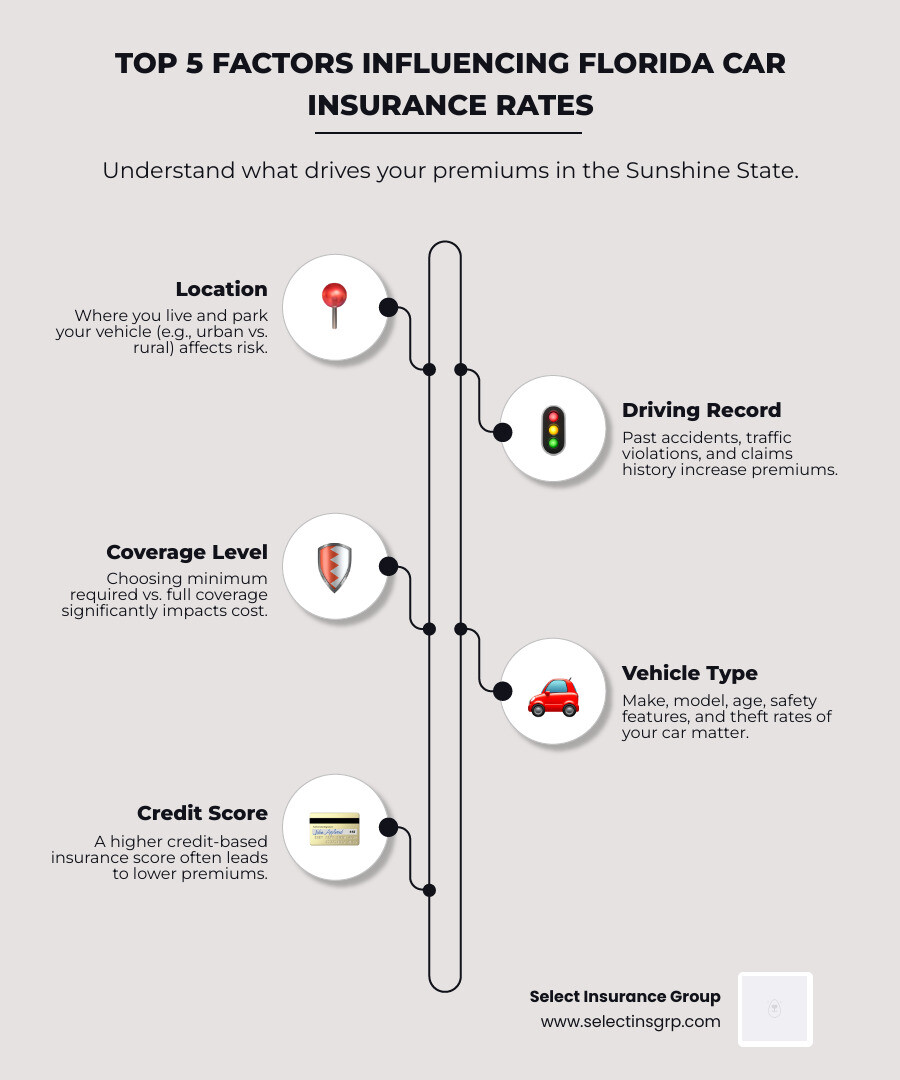

How Your Personal Profile Affects Your Rate

While statewide issues set a high baseline, your personal rate is determined by your unique risk profile:

- Driving Record: A clean record is the best way to get lower rates. Accidents, tickets, and DUIs will significantly increase your premium.

- Location: Your ZIP code matters. Urban areas with more traffic and crime have higher rates than quieter suburban or rural areas.

- Vehicle: The make, model, safety ratings, and repair costs of your car affect your rate. Safer, less expensive cars are cheaper to insure.

- Credit-Based Insurance Score: In Florida, insurers use your credit history to predict risk. Better credit often leads to lower premiums.

- Age and Gender: Younger, less experienced drivers pay the highest rates. Premiums typically decrease with age and a clean driving history.

The Average Cost of Car Insurance in Florida

On average, a Florida driver pays around $3,682 per year ($307/month), far above the national average. However, this number varies greatly:

- Minimum Coverage: Averages about $2,208 per year ($184/month).

- Full Coverage: Typically costs between $3,000 and $5,000 annually, providing much more protection.

Your actual rate depends on your personal profile. A low-risk driver might pay $150/month, while a high-risk driver could pay over $400/month. This variability means shopping around is key to finding cheap car insurance Florida. An independent agency can compare rates from dozens of carriers to find the best price for your specific situation.

How to Find Cheap Car Insurance in Florida

Now that you know why costs are high, let’s focus on how to lower your rates. Finding cheap car insurance Florida is about being strategic, not just cutting coverage.

Smart Strategies for Lowering Your Rates

Here are the most effective ways to lower your premium:

- Compare Quotes: This is the single most powerful tool. Rates vary widely between companies, so shop around at least once a year. An independent agent can compare dozens of carriers for you.

- Increase Your Deductible: Choosing a higher deductible (e.g., $1,000 instead of $500) will lower your premium. Ensure you can afford the deductible if you need to file a claim.

- Maintain a Clean Driving Record: Safe driving is your best asset. Avoiding accidents and tickets will keep your rates down. A defensive driving course may also help.

- Improve Your Credit Score: Insurers in Florida use credit-based scores to set rates. Better credit can lead to significant savings.

- Choose Your Vehicle Wisely: Before buying a car, check its insurance costs. Vehicles with high safety ratings and lower repair costs are cheaper to insure.

Open uping Discounts for Cheap Car Insurance in Florida

Most drivers qualify for discounts they don’t even know about. Ask your agent about these common ways to save:

- Multi-Policy/Bundling: Combine your auto insurance with a home, renters, or life policy for significant savings (often 15-25%).

- Multi-Car: Insure more than one vehicle on the same policy.

- Good Student: For young drivers who maintain a B average or better.

- Safe Driver: Earn discounts for a clean driving record or by participating in a telematics program that tracks safe driving habits.

- Low-Mileage: If you drive less than a certain number of miles per year, you may qualify.

- Vehicle Safety Features: Airbags, anti-lock brakes, and anti-theft systems can lower your premium.

- Payment Discounts: Save by paying your premium in full, setting up automatic payments, or going paperless.

Choosing the Right Coverage for Your Budget

Finding cheap car insurance Florida shouldn’t mean being underinsured. While Florida’s minimums are low, they often don’t provide enough protection. Consider these crucial optional coverages:

- Bodily Injury Liability (BI): This is vital. It covers injuries you cause to others in an accident, protecting your personal assets from lawsuits.

- Uninsured/Underinsured Motorist (UM/UIM): Essential in Florida due to the high number of uninsured drivers. It covers your expenses if you’re hit by a driver with little or no insurance.

- Collision and Comprehensive: Collision covers damage to your car from an accident, while Comprehensive covers non-collision events like theft or storm damage. These are usually required if you have a car loan or lease.

An agent can help you balance your budget with your coverage needs. For more details, visit the Florida Office of Insurance Regulation at Understanding your policy with FLOIR.

Frequently Asked Questions about Cheap Car Insurance in Florida

We’re here to provide clear answers to the most common questions about finding cheap car insurance Florida.

Is Bodily Injury Liability (BI) required in Florida?

Unlike most states, Florida does not require all drivers to carry Bodily Injury Liability (BI) coverage. However, it becomes mandatory under the Financial Responsibility Law if you cause an accident with injuries or are convicted of a major violation like a DUI.

Even when not required, we strongly recommend BI coverage. Without it, if you cause an accident that injures someone, you are personally liable for their medical bills and other costs. This could put your savings, home, and other assets at risk. The small additional premium is worth the critical financial protection it provides.

How much can I really save by shopping around for car insurance?

The savings can be substantial—often hundreds, and sometimes over a thousand dollars per year. Each insurance company rates risk differently, so the price for the exact same coverage can vary dramatically between carriers. Some drivers save over $1,000 annually just by comparing quotes.

Simply renewing your policy without shopping around often means you’re overpaying. An independent agency like ours does the comparison shopping for you, leveraging relationships with over 40 carriers to find the most competitive rate for your specific profile.

Can I get cheap car insurance in Florida with a bad driving record?

Yes, but it requires a strategic approach. A bad driving record (accidents, tickets, DUI) will increase your premiums, as you’re considered a higher risk. However, affordable coverage is still possible.

Your goal is to find the most affordable option among the higher rates. If you need an SR-22 or FR-44 filing, many standard insurers may not offer a policy. This is where working with an agency that has access to specialized, high-risk carriers is crucial. These insurers are more forgiving of past mistakes.

Additionally, taking an approved defensive driving course can sometimes help. The best long-term strategy is to drive safely going forward. As your record improves over time, your rates will decrease. We can help you find coverage that meets legal requirements and fits your budget, regardless of your driving history.

Your Next Step to Affordable Florida Car Insurance

You now have the knowledge to find cheap car insurance Florida that provides real protection. You know that while Florida’s rates are high, you can lower your premium by shopping smart, claiming discounts, and choosing the right balance of coverage.

Navigating insurance can be overwhelming, but you don’t have to do it alone. At Select Insurance Group, we use our 30+ years of experience and relationships with over 40 carriers to do the heavy lifting for you. We shop the market to find the best combination of price and protection, explaining your options in plain English.

Most Florida drivers are overpaying for car insurance because they don’t compare rates or miss out on discounts. Don’t let that be you.

Taking the next step is simple. Get a no-obligation quote and see how much you can save. Let us show you how easy it is to get quality coverage at a price that fits your budget.

Get a quote from an independent insurance agency in Tampa and start your journey to better rates and better protection today.