Why Motorcycle Insurance Henrico VA Matters for Every Rider

Motorcycle insurance Henrico VA is required by law and protects riders from financial loss after accidents, theft, or damage. Whether cruising Henrico’s scenic backroads or commuting on Route 64, the right coverage keeps you legally compliant and financially secure.

Here’s what you need to know about motorcycle insurance in Henrico, VA:

- Virginia requires minimum liability coverage of 25/50/25 ($25,000 bodily injury per person, $50,000 per accident, $25,000 property damage)

- Local independent agents shop multiple carriers to find you the best rates and coverage options

- Common discounts include multi-policy bundling, safety course completion, homeowner status, and anti-theft devices

- Coverage options go beyond liability to protect your bike with collision, comprehensive, and custom parts coverage

- You can get quotes immediately by providing your motorcycle VIN, license info, and desired coverage levels

Riding without insurance is illegal and puts your assets at risk. Penalties can include hefty fines, license suspension, and even jail time. Beyond legal compliance, insurance provides peace of mind, knowing you’re protected from the unexpected.

I’m D.J. Hearsey, and for over three decades, I’ve helped Virginia riders find affordable motorcycle insurance Henrico VA through our network of 20+ carriers. At Select Insurance Group, we help motorcyclists protect their rides and save money with comparison shopping and personalized service.

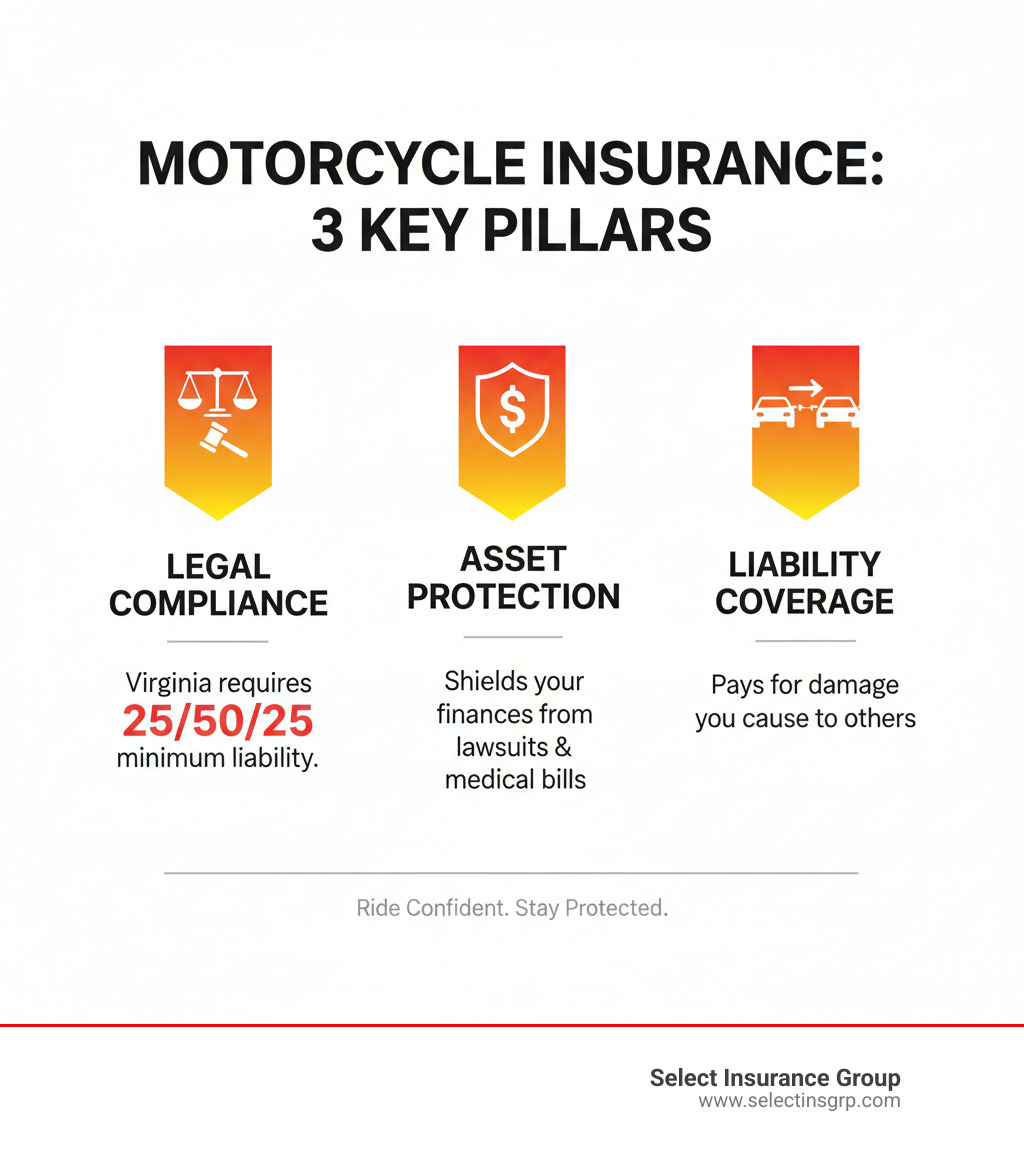

Virginia’s Motorcycle Insurance Laws: What Every Rider Must Know

Let’s review Virginia’s laws for motorcycle insurance Henrico VA to keep you legal and protected. Virginia requires riders to maintain financial responsibility, which for most people means carrying motorcycle insurance. You pay a premium, and your insurer agrees to cover specific financial losses during your policy period.

Virginia offers an Uninsured Motor Vehicle (UMV) fee as an alternative to insurance, but it provides zero coverage. It only allows you to legally operate an uninsured vehicle, leaving you personally liable for all damages and medical bills in an accident. This can wipe out savings, which is why we always recommend actual insurance over the UMV fee.

The risks of riding uninsured are severe, including hefty fines, license suspension, and even jail time.

An SR-22 or FR-44 is a certificate your insurer files with the DMV to prove you have liability coverage, often required after violations like a DUI or riding uninsured. We can provide immediate coverage and file these forms quickly to get you back on the road legally.

For the official details straight from the source, check out Virginia’s official insurance requirements from the DMV.

Understanding Virginia’s Minimum Liability Coverage

Virginia’s minimum insurance requirements follow the 25/50/25 rule:

Bodily Injury Liability covers injuries you cause to others. Virginia requires $25,000 per person and $50,000 per accident. If you’re at fault and injure multiple people, your policy pays up to $25,000 for one person’s injuries, with a $50,000 total for everyone involved.

Property Damage Liability pays for damage you cause to other people’s property, like their car or fence. The minimum is $25,000 per accident.

However, we advise every client that these minimums are often insufficient. Today’s medical costs can easily surpass $25,000, and a totaled vehicle can exceed property damage limits. Once your coverage is exhausted, you are personally responsible for the remaining costs, putting your savings, home, and future earnings at risk.

Investing in higher liability limits is a responsible choice that can save you from financial disaster without a significant increase in cost.

Decoding Your Coverage: A Guide to Motorcycle Insurance Policies

Motorcycle insurance Henrico VA is about customizing protection to fit your needs. It involves sharing the financial risks of riding with an insurer so you aren’t liable for everything after an accident, theft, or damage. You pay a premium, and your insurer handles major financial losses, giving you the freedom to ride without worrying about the “what ifs.”

Core Coverage Types Explained

Every solid policy is built on a foundation of core coverages that protect you and your bike.

Liability Coverage is required by Virginia law. It protects you financially when you’re at fault in an accident, covering bodily injury to others and damage to their property.

Collision Coverage pays for damage to your bike from a crash, regardless of fault. It helps repair or replace your motorcycle if you hit another vehicle or object.

Comprehensive Coverage covers non-collision incidents like theft, vandalism, fire, falling objects, and weather damage. If your bike is stolen or damaged by a storm, comprehensive has you covered.

Uninsured/Underinsured Motorist Coverage (UM/UIM) is a crucial protection. Many drivers have little or no insurance. If one of them hits you, UM/UIM covers your medical bills and repair costs.

Medical Payments Coverage (MedPay) covers medical expenses for you and your passengers after an accident, regardless of fault. It helps immediately with emergency room visits and other treatments.

Optional Add-Ons for Improved Protection

Optional add-ons can build an even stronger safety net.

Custom Parts & Equipment (CPE) is essential for aftermarket modifications. It ensures your custom exhaust, chrome, or paint job is protected at its true value.

Roadside Assistance is a lifesaver if your bike breaks down. It typically covers towing, flat tire service, fuel delivery, and battery jump-starts.

Trip Interruption helps pay for lodging, meals, and transportation if a breakdown interrupts a long trip far from home.

Total Loss Coverage protects your investment if your motorcycle is totaled. It can replace your bike with a new one or pay off your loan balance if you owe more than the bike’s current value.

What Types of Bikes Are Covered?

Motorcycle insurance Henrico VA is available for a wide variety of bikes, including:

- Road bikes and cruisers (e.g., Harley-Davidson, Indian)

- Sport bikes

- Touring bikes

- Trikes

- Scooters and mopeds

- Custom bikes and heavily modified motorcycles

- ATVs and other specialty vehicles

No matter what you ride, we can help you find the protection it deserves.

How Premiums for Motorcycle Insurance Henrico VA Are Calculated

Wonder why insurance rates vary between riders? It’s not random. Insurers use sophisticated calculations to assess risk and create personalized premiums based on your unique situation. Insurers estimate your likelihood of filing a claim. More risk factors mean a higher premium; fewer risk factors mean a lower rate.

Key Factors That Influence Your Rate

Your motorcycle insurance Henrico VA premium is based on multiple factors. Understanding them can help you find ways to save.

- Your age and experience: Younger, less experienced riders typically face higher premiums due to statistical risk.

- Your driving record: A clean record with no accidents or violations will earn you lower rates. We work to find the best rate for your situation, regardless of your history.

- Where you live: Your Henrico County location impacts your rate due to local traffic patterns, theft rates, and population density.

- Your motorcycle: The make, model, year, and engine size all influence your premium. A high-performance sport bike will cost more to insure than a small cruiser.

- How much you ride: Higher annual mileage means more time on the road and greater exposure to risk. Low-mileage riders often qualify for discounts.

- Your coverage choices: Higher liability limits and lower deductibles increase your premium but provide better protection. It’s about finding the right balance for your budget.

When navigating these factors, it helps to work with qualified professionals. You can always learn about your agent’s credentials to ensure you’re getting expert guidance.

Open uping Savings on Motorcycle Insurance Henrico VA

We make it our mission to find every discount you qualify for.

- Bundling multiple policies: Combining your motorcycle insurance with auto, home, or renters coverage is the easiest way to save.

- Homeownership: Owning a home can earn you a discount.

- Your driving record: A clean record can earn you a good driver discount.

- Safety course completion: An approved motorcycle safety course makes you a better rider and qualifies you for a discount.

- Anti-theft devices: Alarms, LoJack systems, or GPS trackers can reduce your premium.

- Motorcycle association memberships: Groups like the Harley Owners Group (HOG) may offer insurance perks.

- Modern safety features: Anti-lock brakes (ABS) can earn you additional discounts.

- Paying in full: Paying your annual premium upfront often qualifies you for a discount.

- Claim-free renewals: You are rewarded for not filing claims at renewal time.

We comparison shop your policy every year to ensure you’re always getting the best rate.

The Power of Bundling Your Policies

Bundling is one of the most effective money-saving strategies. When you combine your motorcycle insurance Henrico VA with your auto, home, or renters policy, insurers reward your loyalty with significant discounts, sometimes up to 50% on auto coverage.

Beyond savings, bundling simplifies your life. You get one bill, one renewal date, and one set of documents. You also get a single point of contact for all your needs. Whether updating your address or filing a claim, you call one number and speak to people who understand your entire insurance portfolio.

At Select Insurance Group, we specialize in finding these bundling opportunities. With access to over 40 carriers, we identify combinations that deliver maximum savings and comprehensive protection. It’s not just about cheaper insurance—it’s about smarter insurance.

Want to learn more about how we can streamline all your coverage needs? Check out our Virginia Insurance Agency services page to see the full range of ways we can help protect what matters most to you.

Finding Your Perfect Policy: Quotes, Claims, and Expert Guidance

Finding the right motorcycle insurance Henrico VA is about value, not just the cheapest price. You need coverage that truly protects you at a rate that fits your budget. Comparison shopping and personalized service are key.

At Select Insurance Group, we don’t just hand you a one-size-fits-all policy. We research multiple companies to find policies that fit your riding needs best. Even better, we comparison shop your current policy for you every year, making sure you never miss a discount opportunity or benefit from new savings. Ready to get started? We’re here to help you Get a Quote.

How to Get an Accurate Quote for Motorcycle Insurance Henrico VA

Getting an accurate quote for motorcycle insurance Henrico VA is quick if you have the right information. Providing details upfront ensures a precise quote with no surprises.

Have this information ready:

- Personal information: Full name, address, date of birth, contact details.

- Driver’s license number.

- Motorcycle information: VIN, make, model, year, and engine size.

- Details on any customizations or aftermarket parts.

- Your desired coverage levels, including liability limits and deductibles.

With this information, we can quickly provide a comprehensive quote reflecting your needs and potential discounts.

The Advantage of Working with an Independent Agent

For motorcycle insurance Henrico VA, choosing an independent agent like Select Insurance Group offers serious advantages.

First, with access to over 40 carriers, we aren’t tied to one company. We research multiple insurers to find policies that fit your needs and handle the comparison shopping to find you great savings, saving you from making dozens of calls.

Our loyalty is to you, not an insurance company. We provide unbiased advice to help you choose coverage that truly meets your needs.

We also bring local expertise. We’re familiar with Henrico, Richmond, and the surrounding areas, and we monitor changes in rates and local factors that might impact your coverage.

We help you customize a policy that fits your specific riding style, bike, and budget—finding the sweet spot between comprehensive protection and affordability.

Best of all, we don’t just set it and forget it. We review your policy annually to ensure you’re always getting the best deal and any new discounts.

We proudly serve many communities across Virginia, bringing our expertise to riders throughout the state. You can explore the full extent of our service areas here: We serve many areas in Virginia.

What to Do After an Accident: Filing a Claim

Knowing what to do after an accident can make a chaotic situation manageable.

- Safety first. Your immediate priority is safety. Move to a safe location if possible, check for injuries, and call 911 for emergencies and to get police on the scene.

- Document everything. Take photos of the accident scene, vehicle damage, and any relevant road conditions. This documentation is invaluable.

- Gather information. Get names, contact details, insurance information, and license plate numbers from everyone involved. If there are witnesses, get their contact information too.

- Contact your insurance provider. Call your insurer as soon as possible. Many providers we work with offer 24-hour claim service, so you can reach someone even after business hours.

You’ll typically have an assigned representative to guide you through the claims process. Having a dedicated person in your corner makes everything less stressful.

We’re always here to help you steer the claims process. Don’t hesitate to reach out for assistance: Contact Us for help.

Conclusion: Ride Protected in Henrico County

There’s nothing quite like the freedom of riding through Henrico County—the wind in your face, the rumble of your engine, and those beautiful Virginia backroads calling your name. But the riders who truly enjoy that freedom? They’re the ones who know they’re protected.

This guide covered what you need to know about motorcycle insurance Henrico VA: Virginia’s 25/50/25 minimums, comprehensive coverage options, how premiums are calculated, and how to save with discounts and bundling.

The right insurance is more than a legal requirement; it’s custom coverage for your bike, your riding style, and your budget. Whether protecting custom parts, getting roadside assistance, or shielding your assets, the right policy provides confidence every time you turn the key.

That’s where Select Insurance Group comes in. As an independent agent with 30+ years of experience, we shop over 40 carriers to find you the best rates and coverage. We review your policy annually and handle the comparison shopping so you can focus on the ride.

We know Henrico County, we understand Virginia’s insurance laws, and we’re committed to ensuring you’re always protected when it matters most.

So whether you’re a weekend warrior, a daily commuter, or someone who lives for cross-country tours, let’s get you the coverage you deserve. Your bike is ready. The roads are waiting. All you need is the peace of mind that comes from riding protected.

Ready to hit the road with confidence? Get your quote today and find the benefit of having an independent agent in your corner.