Why Box Truck Insurance Is Essential for Your Business

Box truck insurance is specialized commercial vehicle coverage that protects businesses using straight trucks or box trucks for transporting goods. If you’re looking for box truck insurance, here’s what you need to know:

What Box Truck Insurance Covers:

- Liability Protection – Covers bodily injury and property damage you cause to others (typically $750,000-$1,000,000 minimum)

- Physical Damage – Protects your truck from collision, theft, vandalism, and weather damage

- Cargo Coverage – Protects goods you’re transporting (often $100,000+)

- Medical Payments – Covers medical expenses for you and your passengers

Typical Cost: $3,000-$5,000 per year ($250-$417 per month) for a single box truck

Who Needs It: Delivery services, moving companies, retailers, contractors, food vendors, and any business using box trucks for commercial purposes

Box trucks are the backbone of countless businesses across the Southeast—from local delivery services hauling packages to moving companies transporting furniture and food vendors bringing fresh meals to events. But here’s the reality: roads can be treacherous, especially when you’re spending significant time on them delivering products day in and day out. A single accident without proper coverage can lead to financial ruin for your business.

Texas law generally requires insurance for commercial vehicles, and the federal government mandates a minimum of $750,000 in liability coverage for trucks over 10,000 pounds. Beyond meeting legal requirements, the right insurance protects your truck, your cargo, your drivers, and your business from lawsuits, property damage claims, and unexpected losses that could otherwise shut you down.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group, where we’ve spent over three decades helping businesses across the Southeast find the right box truck insurance coverage that balances cost-effectiveness with comprehensive protection. We work with more than 20 carriers to ensure our clients get competitive rates without sacrificing the coverage they need.

Box truck insurance glossary:

Who Needs Box Truck Insurance and What Does It Cover?

If your business depends on a box truck to move products or equipment, you need specialized insurance—period. Your personal auto policy won’t cut it when you’re using a vehicle for commercial purposes. Whether you’re delivering furniture across town or hauling equipment to job sites, box truck insurance is what stands between your business and financial disaster.

Think about all the businesses you see on the road every day. Local delivery services are constantly zipping around neighborhoods, dropping off packages and handling last-mile logistics. Moving companies are transporting someone’s entire life from one home to another—furniture, appliances, family heirlooms. Retailers like furniture stores and appliance dealers use box trucks to deliver purchases directly to customers or shuttle inventory between locations.

Contractors and trade professionals—plumbers, electricians, landscapers, and construction crews—treat their box trucks like mobile workshops, packed with expensive tools and equipment heading to different job sites each day. Food vendors and distributors rely on box trucks (especially refrigerated ones called “reefers”) to get fresh ingredients, baked goods, or craft beverages to restaurants and events. Event companies haul tents, tables, sound systems, and lighting equipment. Even junk removal services depend on these versatile vehicles to collect and transport unwanted items.

The common thread? If your business owns or operates at least one box truck for commercial purposes, you need specialized coverage. It’s not just about following the law—it’s about protecting your livelihood from the unexpected.

What Types of Box Trucks Can Be Covered?

Commercial box truck insurance covers virtually any straight truck, where the cab and cargo area sit on the same chassis. Cargo cutaways are smaller box trucks built on van chassis, perfect for urban deliveries and lighter loads. Classic moving trucks get the same protection, whether you’re running a professional moving company or a rental operation.

If you’re transporting perishable goods, refrigerated trucks (reefers) need coverage that often includes protection for refrigeration breakdown—because a failed cooling unit can mean thousands of dollars in spoiled inventory. Some larger straight trucks come with sleeper box trucks configurations for longer hauls, though these can be trickier to insure. That’s where working with experienced agents makes all the difference.

We can find coverage for tilt cab trucks, rack trucks, and any other box truck configuration your business uses. The key is matching the policy to how you actually use the vehicle.

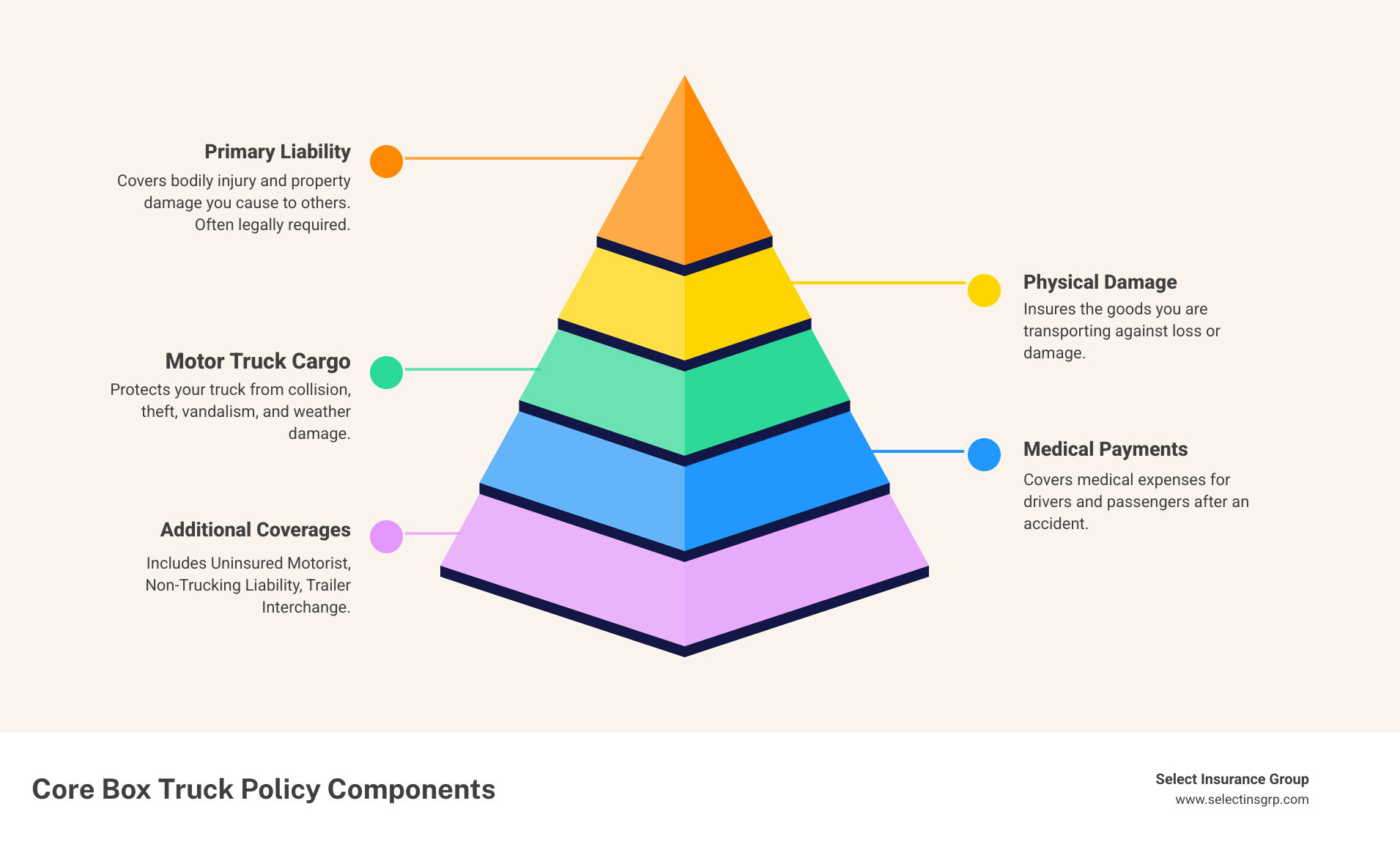

Essential Policy Coverages

Box truck insurance isn’t a single policy—it’s a combination of coverages working together to protect your business from different angles. Let’s break down what you actually need.

Primary Liability Insurance is legally required and absolutely essential. This protects you when your truck causes an accident that injures someone or damages their property. The bodily injury portion covers medical bills, lost wages, and pain and suffering for anyone hurt in an accident where you’re at fault. Property damage liability handles repairs or replacement costs for vehicles, buildings, fences, or anything else your truck damages.

Federal law requires motor carriers to carry at least $750,000 in liability coverage, though most insurers recommend $1,000,000 or more for heavier trucks. That might sound like a lot, but medical bills and property damage add up shockingly fast after a serious accident.

Physical damage coverage protects the truck itself. Collision insurance covers repairs or replacement if your truck hits another vehicle or object, regardless of who caused the accident. Comprehensive insurance steps in for everything else—theft, vandalism, fire, hail storms, floods, or even hitting a deer on a rural delivery route.

Uninsured/Underinsured Motorist coverage (UM/UIM) protects you when the other driver either has no insurance or not enough to cover the damage they caused. This happens more often than you’d think, and it can save your business from absorbing costs that should have been someone else’s responsibility.

Medical Payments coverage (MedPay) pays for medical expenses for you and your passengers after an accident, regardless of fault. In some states, this is called Personal Injury Protection (PIP). It ensures your drivers get medical care quickly without waiting for fault to be determined.

For more details on how these coverages work in your state, check out our North Carolina Business Auto page.

Specialized Protections for Trucking Operations

The basics keep you legal, but specialized coverages keep you in business when things go wrong.

Motor Truck Cargo Insurance protects the value of whatever you’re hauling. If cargo is stolen, damaged in a collision, destroyed by fire, or lost to other covered perils during transit, this coverage steps in. While not always legally required, many clients and shippers won’t work with you without proof of cargo insurance—often for at least $100,000. For refrigerated trucks, this can extend to losses from refrigeration breakdown, which is crucial when you’re hauling temperature-sensitive goods.

Loading/unloading coverage protects cargo during those risky moments when goods are being moved on or off your truck. Accidents don’t just happen on the highway—they happen in parking lots, loading docks, and driveways.

Non-Trucking Liability (sometimes called Bobtail insurance) covers you when the truck is being used for non-business purposes—running personal errands or driving home after your route. Your primary commercial policy might not cover these situations, leaving a dangerous gap.

Trailer interchange insurance protects trailers you don’t own but use through interchange agreements. If you’re operating with borrowed or leased trailers, this coverage is essential.

Here’s something important about subcontractor coverage: whether your policy covers subcontractors driving your business’s truck depends entirely on how the policy is written. Some policies automatically include all drivers, while others only cover specifically named individuals. If you use subcontractors, we need to address this explicitly to avoid nasty surprises after an accident.

Earned freight coverage compensates you for lost income when damaged or lost cargo means you can’t complete a delivery and collect payment for your work.

Depending on your specific operations, you might also need hazmat coverage for transporting hazardous materials, downtime coverage to replace lost income when your truck is being repaired, towing and storage to handle the costs of a disabled vehicle, or rental reimbursement to keep your business running while your truck is in the shop.

At Select Insurance Group, we work with more than 20 carriers to piece together exactly the coverage your business needs—nothing you don’t need, nothing missing that could leave you exposed. That’s the advantage of working with an independent agency that understands the unique challenges of operating commercial vehicles across the Southeast.

Understanding Box Truck Insurance Costs and Requirements

One of the first questions business owners ask us is, “How much is this going to cost me?” It’s a fair question—and honestly, one of the most important ones. While every business is unique, I can give you some realistic numbers to help you budget.

On average, box truck insurance will run you somewhere between $3,000 and $5,000 per year for a single truck. That breaks down to roughly $250 to $417 per month. Many box truck operators find themselves right in this sweet spot for comprehensive coverage. However, depending on your specific situation—the type of cargo you haul, your drivers’ records, your location, and the coverage limits you need—you might see costs climb toward $7,500 annually for one truck.

The good news? Working with an independent agent like us means we can shop multiple carriers to find you the best rate for the coverage you actually need. We’re not tied to just one insurer, so we have the flexibility to find competitive options that fit your budget.

Federal and State Requirements

Here’s the thing about box truck insurance: it’s not optional. Both federal and state laws mandate specific coverage levels, and operating without proper insurance can result in hefty fines, loss of your operating authority, and even criminal charges in some cases.

The Federal Motor Carrier Safety Administration (FMCSA) requires motor carriers to provide proof of financial responsibility before they can legally operate. For most box trucks used in interstate commerce, that means a minimum of $750,000 in liability coverage. However, many insurers recommend—and often require—limits of $1,000,000 or more, especially for heavier commercial vehicles. This higher limit provides better protection for your business and gives you more breathing room if a serious accident occurs.

FMCSA insurance filing requirements

Beyond federal requirements, each state sets its own minimum insurance standards for commercial vehicles. These can vary significantly based on factors like your truck’s Gross Vehicle Weight (GVW) and whether you’re operating intrastate or interstate.

Let’s take Texas as a real-world example. Texas is absolutely massive for trucking—and I mean massive. The state employs about 185,000 truck drivers working for more than 66,000 trucking companies. These drivers collectively move 1.5 billion tons of freight every year, valued at a staggering $1.2 trillion. In fact, 85 percent of trade between Texas and Mexico moves by truck. If you’re operating in Texas, you’re part of a huge, vital industry.

Texas commercial vehicle insurance requirements typically align with or exceed federal minimums, especially for interstate operations. The exact limits depend on your truck’s weight and what you’re hauling. Your insurance agent (that’s where we come in!) can help ensure you’ve filed the proper paperwork and secured adequate coverage to operate legally under your own authority in Texas—or any other state where you do business.

Understanding Gross Vehicle Weight (GVW): Your truck’s GVW plays a significant role in both your legal requirements and your insurance costs. Simply put, heavier trucks can cause more damage in an accident, which means insurers see them as higher risk. A 26-foot box truck, for instance, will typically cost more to insure than a smaller straight truck because of the increased potential for substantial property damage or serious injuries.

More info about Georgia Business Auto

Key Factors Influencing Your Box Truck Insurance Cost

So what actually determines your premium? Insurers look at a whole range of factors when calculating your box truck insurance cost. Understanding these variables can help you make smarter decisions—and potentially save you some serious money.

Your drivers’ records matter—a lot. Clean driving records mean lower premiums. If your drivers have a history of accidents, speeding tickets, DUIs, or other violations, expect to pay significantly more. Some violations can even make it difficult to find coverage at all. This is why many businesses implement strict hiring standards and ongoing driver monitoring programs.

The type and age of your vehicle directly impacts your cost. Newer trucks with modern safety features often qualify for discounts, while older vehicles might be more expensive to insure due to higher breakdown risk and lack of safety technology. A refrigerated truck (reefer) will cost more than a standard dry box truck because of the specialized equipment and higher cargo values involved.

Your travel radius is another big factor. Do you operate locally within a 50-mile radius, regionally within a few states, or nationwide? The farther you travel, the more exposure you have to different road conditions, weather hazards, and traffic patterns—all of which increase risk and cost.

What you’re hauling makes a huge difference. Transporting furniture for a moving company is very different from hauling electronics or food products. High-value cargo requires higher cargo insurance limits, which increases your premium. Hazardous materials require specialized coverage and come with significantly higher costs.

Your business’s claims history speaks volumes to insurers. Multiple claims in recent years signal higher risk, while a clean claims history demonstrates that you run a safe, well-managed operation. This is one reason why investing in driver training and safety programs pays off in the long run.

Coverage limits and deductibles are directly within your control. Higher liability limits and lower deductibles mean higher premiums, but they also provide better protection. It’s a balancing act between affordability and adequate coverage. We can help you find that sweet spot.

Your location of operation affects rates too. Urban areas with heavy traffic typically have higher accident rates than rural areas. States with higher costs of living and more expensive medical care also tend to have higher insurance premiums. Operating in multiple states? Your rates will reflect the riskiest areas where you operate.

At Select Insurance Group, we take all these factors into account when shopping your coverage across our network of more than 20 carriers. Our goal is to find you comprehensive protection at a competitive rate—because we know that every dollar counts when you’re running a business.