Why Finding Cheap Auto Insurance in Orlando FL Matters

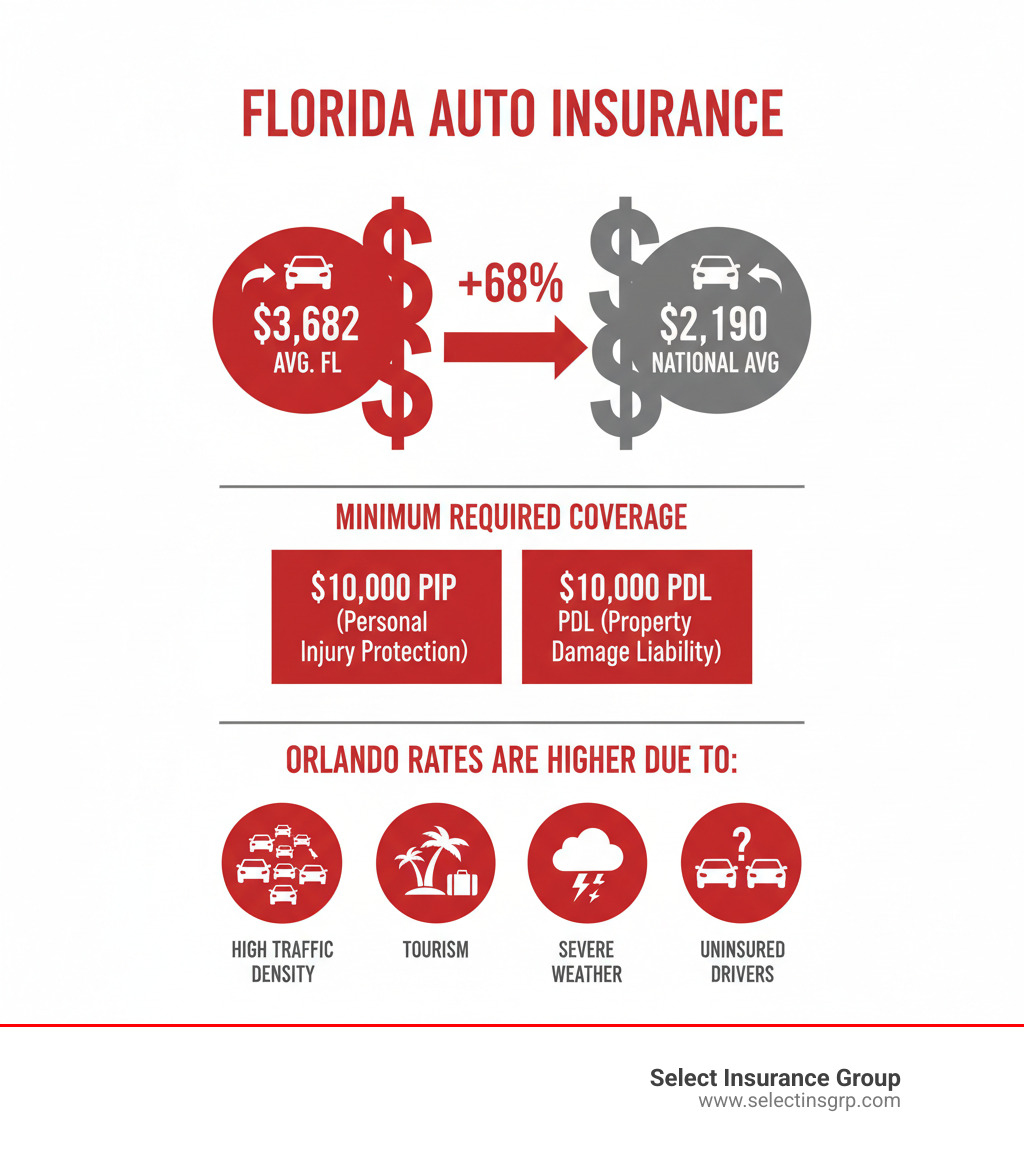

Cheap auto insurance orlando fl is more than a good deal—it’s essential for your wallet and peace of mind. Florida drivers pay an average of $3,682 per year for car insurance, 68% higher than the national average. In Orlando, rates are even higher due to heavy traffic, frequent storms, and a high number of uninsured drivers.

Quick Answer: How to Get Cheap Auto Insurance in Orlando:

- Meet Florida’s minimum requirements: $10,000 Personal Injury Protection (PIP) + $10,000 Property Damage Liability (PDL)

- Shop around and compare quotes from multiple carriers

- Ask about discounts: multi-policy, good driver, safe vehicle features, good student

- Work with an independent agent who can check 20+ carriers for you

- Increase your deductible to lower your premium

- Maintain a clean driving record and good credit score

The reality is simple: Orlando’s challenges—Interstate 4 congestion, over 60 million annual tourists, and hurricane season—make insurance expensive. But it doesn’t have to be unaffordable.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group. For over three decades, I’ve helped Southeastern drivers find cheap auto insurance orlando fl without sacrificing quality. Our agency shops over 20 carriers to find competitive rates custom to Orlando’s risks.

Understanding Orlando’s Auto Insurance Basics

To find cheap auto insurance orlando fl, you must first understand Florida’s requirements. Florida is a “no-fault” state, meaning your own insurance covers your initial medical bills and lost wages after an accident, regardless of who is at fault. This system, centered on Personal Injury Protection (PIP), speeds up claims. At Select Insurance Group, we ensure you understand what you’re buying.

For official details, see Florida’s official insurance requirements or our guide on Florida Auto Insurance.

What are the minimum requirements in Orlando, FL?

To drive legally in Orlando, you must have:

- $10,000 in Personal Injury Protection (PIP): Covers 80% of your medical bills and 60% of lost wages up to the limit, plus a $5,000 death benefit. It covers you and your passengers, regardless of fault.

- $10,000 in Property Damage Liability (PDL): Covers damage you cause to someone else’s property, like their car or fence, when you are at fault.

Surprisingly, Florida does not mandate Bodily Injury Liability, which covers injuries you cause to others. This creates a significant risk, as these minimums are often insufficient in a serious accident. They keep you legal but may not protect your financial future.

What are the consequences of driving without insurance?

Driving uninsured in Orlando is a risk with severe penalties:

- Fines: You’ll face fines from $150 to $500, which increase with subsequent offenses.

- Suspensions: The state will suspend your driver’s license, vehicle registration, and license plates until you pay reinstatement fees and show proof of insurance.

- SR-22 Requirement: You may need an SR-22 certificate, which labels you a high-risk driver and causes your insurance rates to skyrocket for three years, making cheap auto insurance orlando fl much harder to find.

- Personal Liability: Most importantly, you become personally liable for all damages and injuries you cause. A serious accident could lead to financial ruin, bankruptcy, and wage garnishment.

Continuous coverage isn’t just about avoiding fines; it’s about protecting your financial future.

What Drives Up Your Orlando Car Insurance Costs?

If you’re searching for cheap auto insurance orlando fl, you’ve likely noticed our city’s high rates. Understanding why can help you lower your premium. Several key factors drive up costs:

- High Traffic Density: As a major city, Orlando’s crowded roads, especially I-4, lead to more accidents. Insurers raise rates to cover this increased risk.

- Tourism: Over 60 million tourists visit annually, adding many unfamiliar drivers to our streets. This increases accident frequency and, consequently, insurance premiums for everyone.

- Uninsured Drivers: Florida has one of the nation’s highest rates of uninsured drivers. To offset this risk, insurance companies increase rates for insured drivers.

- Severe Weather: Hurricanes, tropical storms, and daily downpours cause frequent claims for flooding, hail, and storm-related accidents, making comprehensive coverage more expensive.

- Personal Driving Record: A history of tickets or at-fault accidents marks you as a higher risk, leading to higher premiums. A clean record is a powerful tool for securing cheap auto insurance orlando fl.

- Vehicle Type: Sports cars, luxury vehicles, and models with high theft rates are more expensive to insure. Safer, more affordable cars can lower your costs.

- Credit Score: In Florida, insurers use credit-based scores to predict risk. A better credit score can lead to lower premiums.

- ZIP Code: Rates vary by neighborhood based on local crime, traffic, and accident data.

While these factors contribute to high costs, knowing them is the first step to finding savings.

Your Guide to Finding Cheap Auto Insurance in Orlando FL

Finding cheap auto insurance orlando fl is achievable with the right strategy. Here’s how to secure quality coverage without overpaying.

- Shop Around: This is non-negotiable. Rates for the same driver and coverage can vary by hundreds of dollars between carriers. Always compare quotes from multiple providers.

- Use an Independent Agent: Instead of getting quotes one by one, let an independent agent shop the market for you. At Select Insurance Group, we work with over 40 carriers to compare dozens of options and find you the best price and coverage. We act as your personal insurance shopper, matching you with the right company for your needs. Ready to start? Get a Quote.

- Review Your Policy Annually: Your life changes, and your policy should too. Review your coverage each year or after major life events like buying a new car, moving, or adding a driver. This ensures you have the right coverage and all available discounts.

How to find cheap auto insurance orlando fl with discounts

Discounts are a powerful tool for lowering your premium. We make it our mission to find every discount you qualify for, including:

- Multi-Policy (Bundling): Combining auto and home or renters insurance with one company can save you 15-25%. We handle auto, home, and commercial policies, making bundling seamless.

- Multi-Car: Insuring multiple vehicles on one policy earns a discount.

- Good Driver/Accident-Free: A clean record for 3-5 years can significantly lower your rates.

- Good Student: Students with a “B” average or higher often qualify for a discount.

- Vehicle Safety Features: Cars with airbags, anti-lock brakes, and other safety tech earn discounts.

- Anti-Theft Devices: Alarms and tracking systems can reduce your premium.

- Pay-in-Full: Paying your entire premium upfront often comes with a small discount.

- Defensive Driving Course: Completing an approved course can sometimes lower your rate.

More ways to get cheap auto insurance orlando fl

Beyond discounts, other strategies can lower your premiums:

- Increase Your Deductible: Raising your deductible (e.g., from $500 to $1,000) will lower your premium. Just ensure you can afford the higher out-of-pocket cost if you file a claim.

- Choose the Right Coverage: Don’t pay for coverage you don’t need. For an older, low-value car, you might drop collision and comprehensive. For newer cars, full coverage is a wise investment.

- Maintain Good Credit: A strong credit history can lead to lower insurance rates in Florida.

- Consider Your Vehicle: Cars with high safety ratings, low repair costs, and low theft rates are cheaper to insure. Check insurance costs before buying a new car.

Combining these strategies with our agency’s shopping power makes finding cheap auto insurance orlando fl achievable.

Beyond the Basics: Recommended Coverage for Orlando Drivers

Florida’s minimum insurance requirements are just that—minimum. They keep you legal but often fail to provide financial security after a serious accident. At Select Insurance Group, we advise clients on coverage that goes beyond the basics to offer real protection, especially given Orlando’s unique risks.

- Bodily Injury Liability (BI): Though not required, BI is crucial. It covers injuries you cause to others in an accident. Without it, you could be sued for medical bills and lost wages, risking your savings and assets. We recommend at least $100,000 per person and $300,000 per accident.

- Uninsured/Underinsured Motorist (UM/UIM): This is essential in Florida. It protects you if an at-fault driver has no insurance or not enough to cover your medical bills.

- Collision Coverage: Pays for damage to your own car from an accident. It’s usually required for leased or financed vehicles and provides peace of mind for any car owner.

- Comprehensive Coverage: Protects against non-accident events like theft, vandalism, fire, and weather damage—a must-have in Orlando.

- Rental Reimbursement: A low-cost add-on that covers a rental car while yours is being repaired after a covered claim.

Finding cheap auto insurance orlando fl shouldn’t mean getting inadequate coverage. These options protect your financial future.

How does weather impact auto insurance in Orlando?

Orlando’s weather is unpredictable and poses significant risks to your vehicle:

- Hurricanes and Tropical Storms: High winds and flooding can cause catastrophic damage. A submerged car is often a total loss.

- Heavy Rain and Flooding: Daily summer storms create hazardous driving conditions and can flood vehicles, damaging engines and electrical systems.

- Hail: Severe thunderstorms can bring hail, causing dents and shattered glass.

This is why comprehensive coverage is essential for Orlando drivers. It is the only coverage that protects against these weather-related events. Collision coverage does not cover flood damage. To prepare for storms, park in a garage or away from trees and never drive through standing water. We help clients choose coverage that shields them from Florida’s volatile weather.

Frequently Asked Questions about Orlando Auto Insurance

We talk with Orlando drivers every day who are searching for cheap auto insurance orlando fl, and many of the same questions come up. Here are the answers to the most common ones.

Why is car insurance so expensive in Orlando?

Orlando’s high insurance rates are due to a combination of factors:

- High Population and Traffic: A dense population and congested roads like I-4 lead to more accidents and claims.

- Tourism: Millions of annual visitors, many unfamiliar with local roads, contribute to higher accident rates.

- Severe Weather: Frequent hurricanes, storms, and flooding result in a high volume of comprehensive claims.

- Uninsured Drivers: Florida has a high rate of uninsured drivers, which increases costs for everyone else.

- Insurance Fraud: Fraudulent claims contribute to higher premiums for all policyholders.

Despite these challenges, affordable coverage is possible with the right approach.

What types of coverage are most important in Orlando besides the minimum?

While Florida’s minimums keep you legal, they don’t offer full financial protection. For Orlando drivers, we consider these coverages essential:

- Comprehensive Coverage: This is non-negotiable in our climate. It covers damage from weather (hurricanes, floods), theft, and vandalism.

- Uninsured/Underinsured Motorist (UM/UIM): With so many uninsured drivers in Florida, this coverage is critical to pay for your injuries if the at-fault driver can’t.

- Bodily Injury (BI) Liability: Though not required, BI protects your personal assets (savings, home) if you cause an accident that injures someone else. We recommend limits of at least $100,000 per person and $300,000 per accident.

These coverages can prevent an accident from becoming a financial disaster.

How much can I save with a clean driving record?

A clean driving record is one of the most powerful tools you have for finding cheap auto insurance orlando fl. The savings are substantial.

- Good Driver Discounts: Most carriers offer discounts of 10% to 25% or more for drivers who are accident- and violation-free for three to five years.

- Avoiding Surcharges: A clean record helps you avoid costly surcharges. A single speeding ticket can raise your rates by 20-30% for three years, while an at-fault accident can cost you thousands over five years.

- Long-Term Benefits: Safe drivers consistently qualify for the best rates from all carriers. This allows us to shop for the lowest possible premiums for you.

Driving safely is a direct investment in lower insurance costs. We help our clients leverage their clean records to maximize savings across our 40+ carriers.

Conclusion: Find Your Best Rate in Orlando Today

Finding cheap auto insurance orlando fl is achievable, despite our city’s traffic and weather challenges. Affordable, protective coverage is within reach when you know the right strategies.

We’ve covered the key steps: understanding Florida’s minimums, knowing why Orlando’s rates are high, and using practical ways to lower your premiums. The most effective strategies are shopping around, maximizing discounts, maintaining a clean driving record, and choosing crucial coverages like Comprehensive, Uninsured Motorist, and Bodily Injury Liability.

This is where Select Insurance Group comes in. With over three decades of experience and partnerships with more than 40 carriers, we shop the entire market on your behalf. We act as your personal insurance advocates, finding the best combination of price and protection with no pressure or hassle.

Our team provides honest guidance and can answer your questions in plain English. We’re here to make finding the right insurance easy.

You deserve coverage that protects what matters most without breaking the bank. Let’s find your best rate together. That’s what we do best.