Why Choosing the Right Auto Insurance Matters for North Carolina Drivers

NC auto insurance companies offer widely varying rates and coverage options. Finding the right provider can save you hundreds of dollars each year while ensuring you’re properly protected on the road.

North Carolina mandates specific minimum coverage levels, and the penalties for driving without insurance are serious, including fines and license suspension. Fortunately, the average cost of car insurance in North Carolina was $1,523 in 2024, which is 30% lower than the national average. This means Tar Heel State drivers already benefit from relatively affordable rates.

The challenge isn’t just finding any insurance—it’s finding the right balance between price, coverage, and service. The “cheapest” option might cost you more down the road if claims service is poor or coverage falls short when you need it most. Some companies excel at affordability, while others shine in customer satisfaction or digital convenience.

As D.J. Hearsey, founder and CEO of Select Insurance Group with 12 locations across the Southeast, I’ve spent decades helping drivers steer NC auto insurance companies to find coverage that protects what matters most without overpaying. Our team shops across more than 20 carriers to deliver competitive quotes and personalized service custom to North Carolina drivers’ needs.

Understanding North Carolina’s Auto Insurance Requirements

Understanding North Carolina’s auto insurance requirements is essential for every driver. These rules act as a safety net, protecting you and others on the road from financial disaster after an accident.

State-Mandated Minimum Coverage

North Carolina law requires every driver to carry specific minimum coverage. According to the North Carolina Department of Insurance, these are the legal minimums, often called 30/60/25 limits:

- Bodily Injury Liability: $30,000 per person and $60,000 per accident.

- Property Damage Liability: $25,000 per accident.

- Uninsured/Underinsured Motorist Bodily Injury: $30,000 per person and $60,000 per accident.

- Uninsured Motorist Property Damage: $25,000 per accident.

These minimums are often not enough to cover the costs of a serious accident. Many insurance professionals recommend higher limits—such as 50/100/50 or 100/300/100—for better financial protection. When moving to the state, you must prove you have NC-compliant insurance to register your vehicle, as detailed by the NC DMV insurance requirements.

Liability vs. ‘Full Coverage’: What’s the Difference?

It’s important to know the difference between “liability-only” and “full coverage.”

Liability coverage is the state-mandated insurance that pays for damages and injuries you cause to others. It does not cover your own vehicle or injuries.

“Full coverage” is a common term for a policy that includes:

- Collision coverage: Pays to repair or replace your car after an accident, regardless of fault.

- Comprehensive coverage: Covers non-collision events like theft, vandalism, fire, hail, or hitting a deer.

If you finance or lease your vehicle, your lender will almost certainly require you to carry both collision and comprehensive coverage. You can also add optional protections like medical payments, rental reimbursement, and roadside assistance.

Penalties for Driving Uninsured in NC

Driving without insurance in North Carolina has severe consequences. If your insurance lapses, your provider notifies the DMV, and you have only 10 days to show proof of new coverage.

Failure to do so results in:

- Fines and suspension of your vehicle registration and driver’s license.

- Dramatically higher premiums when you get insurance again, as you’ll be classified as high-risk.

- Potential misdemeanor charges, jail time, and vehicle impoundment for repeated offenses.

Most importantly, if you cause an accident while uninsured, you are personally liable for all damages. The cost of basic insurance is a small price to pay compared to the financial ruin of driving uninsured.

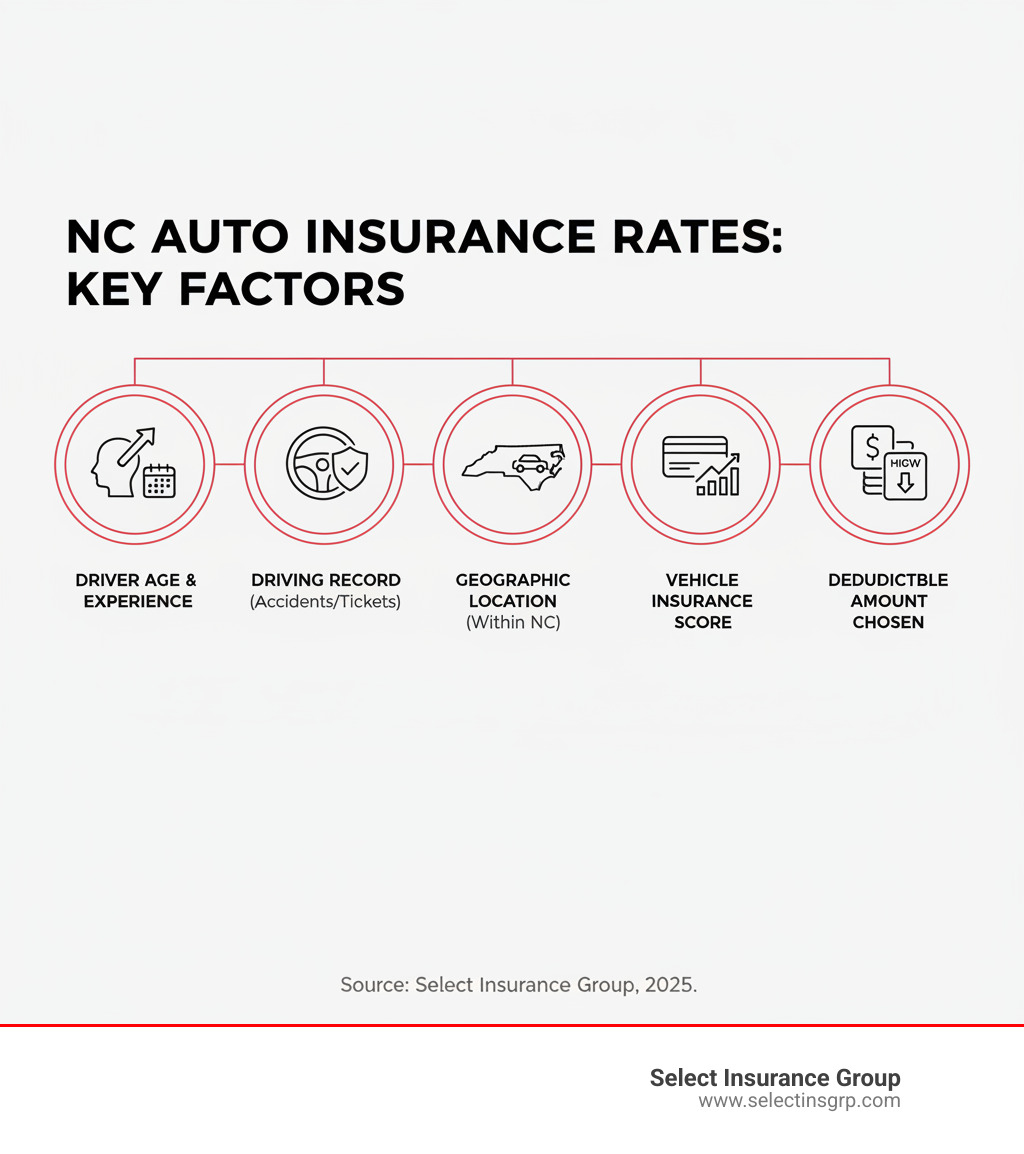

What Determines Your Car Insurance Rate in North Carolina?

Ever wonder why your insurance rate is what it is? NC auto insurance companies use a detailed formula to calculate your premium, weighing factors like your personal profile, driving history, vehicle, and coverage choices.

Key Personal Factors Affecting Your Premium

Your personal profile plays a major role in determining your insurance costs.

- Driver age: Young drivers under 25 face the highest premiums due to statistical risk. Rates typically decrease with experience, hitting a low point in middle age before sometimes rising again for senior drivers.

- Driving record: A clean record earns you the best rates. Speeding tickets, at-fault accidents, and other violations signal higher risk and increase your premium for several years.

- Geographic location: Living in an urban area like Charlotte with more traffic and theft generally costs more than living in a quiet, rural town. Insurers analyze accident and crime rates by zip code.

- Credit-based insurance score: Insurers have found a statistical link between financial responsibility and filing claims. A better credit history can lead to lower insurance costs.

Vehicle and Coverage Choices

The car you drive and the protection you choose also directly impact your premium.

- Car make and model: Sports cars and luxury SUVs cost more to insure than a standard sedan because they are more expensive to repair or replace and can be targets for theft.

- Vehicle age and safety features: Newer cars often cost more to insure due to higher value, but modern safety features like automatic emergency braking can earn you discounts.

- Annual mileage: The more you drive, the higher your risk of an accident. A long daily commute will likely result in a higher premium than if you work from home.

- Coverage limits and deductible: Choosing higher liability limits or adding comprehensive and collision coverage increases your premium. Opting for a higher deductible (the amount you pay out-of-pocket on a claim) will lower your premium.

For vehicles used for business, similar factors apply, though commercial policies have unique considerations. Our North Carolina Business Auto Insurance page has more details.

How to Evaluate NC Auto Insurance Companies

With so many NC auto insurance companies competing for your business, choosing the right one can feel overwhelming. The lowest price doesn’t always mean the best value. What matters is finding a provider that delivers reliable coverage, fair claims handling, and genuine support.

Key Criteria for Choosing the Best NC Auto Insurance Companies

When comparing insurance providers, look beyond the initial quote. These factors will tell you whether a company can deliver when it counts.

- Financial stability: An insurance company’s promise is only as good as its ability to pay claims. Check ratings from independent agencies like A.M. Best or Demotech Financial Stability Rating to ensure the company has the resources to handle claims.

- Customer complaint ratios: The National Association of Insurance Commissioners tracks complaints against insurers. A low complaint ratio is a strong indicator of customer satisfaction.

- Claims handling: This is where an insurer shows its true colors. Look for companies known for a smooth, fair, and responsive claims process.

- Available discounts: The best companies offer multiple ways to save, from bundling policies to rewarding safe driving habits.

- Digital tools: A quality website and mobile app are essential for managing your policy, making payments, and filing claims conveniently.

Comparing Insurance Providers: What to Consider

Beyond ratings and reviews, there’s real value in working with an established insurance provider who understands your local market.

At Select Insurance Group, we bring personalized service to every client. We take time to understand your specific situation—your commute, family needs, and budget—to recommend coverage that genuinely protects you.

Our local expertise makes a difference. We’ve served drivers throughout the Carolinas for over 30 years and understand the unique challenges here, from Charlotte traffic to coastal weather. Our deep roots in the Areas We Serve mean you’re working with people who understand your community.

When you work with us, you get the benefits of working with established insurance providers without being locked into just one company. We shop your policy across more than 40 carriers, comparing coverage and rates from reputable NC auto insurance companies to find your best match. This ensures you get competitive pricing backed by insurers with proven financial stability and reliable claims service.

How to Secure the Cheapest Rates and Best Discounts

While North Carolina drivers enjoy rates 30% lower than the national average, you can still find ways to save. There are plenty of smart strategies to lower your premium without compromising on protection.

Common Auto Insurance Discounts for NC Drivers

NC auto insurance companies offer numerous discounts that can add up quickly. Be sure to ask about:

- Multi-policy discount: Bundle your auto insurance with your North Carolina Home Insurance or renters policy.

- Good student discount: For young drivers who maintain a “B” average or better.

- Safe driver discount: For maintaining a clean record over several years. Some insurers also offer telematics programs that reward safe driving habits.

- Anti-theft device discount: For cars equipped with security systems.

- Pay-in-full discount: For paying your entire premium upfront.

- Multi-car discount: For insuring more than one vehicle.

- Low mileage discount: If you work from home or drive infrequently.

- Defensive driving course discount: For completing an approved course.

Actionable Steps to Lower Your Premium

Beyond discounts, these strategic moves can make a real difference in what you pay.

- Shop around annually: The insurance market is always changing. We can do the heavy lifting for you, comparing quotes from over 40 carriers to find your best option.

- Maintain a clean driving record: This is the most powerful way to keep rates low. Drive defensively and obey traffic laws.

- Choose a higher deductible: If you have an emergency fund, raising your deductible from $500 to $1,000 can significantly lower your premium.

- Improve your credit: Most insurers use a credit-based insurance score. Paying bills on time and keeping balances low can lead to lower rates.

- Re-evaluate your coverage: As your vehicle ages, the cost of comprehensive and collision coverage may outweigh the car’s value.

- Ask for every discount: Don’t assume discounts are applied automatically. Always ask your agent what you qualify for.

Ready to see how much you can save? We make it easy. Get a Quote from us, and we’ll shop across multiple NC auto insurance companies to find you the best combination of coverage and price.

Filing a Claim in North Carolina: A Step-by-Step Guide

No one plans to have an accident, but knowing what to do can make a stressful situation manageable. Understanding the claims process with NC auto insurance companies ensures you get the support and coverage you’ve been paying for.

After an Accident: What to Do First

In the moments after a crash, stay calm and follow these steps:

- Ensure safety first. Check for injuries and call 911 immediately if anyone is hurt. If possible, move vehicles out of traffic.

- Contact the police. An official police report is invaluable for your insurance claim, even for minor accidents.

- Exchange information. Get the other driver’s name, phone number, insurance company, and policy number. Provide your information as well.

- Document everything. Use your phone to take photos of all vehicle damage, the accident scene, road conditions, and any visible injuries.

- Do not admit fault. Avoid saying “I’m sorry” or “It was my fault.” Let the police and insurance adjusters determine liability.

- Seek medical attention. Some injuries aren’t immediately apparent. Getting checked out protects your health and your potential claim.

Notifying Your Insurer and Completing the Process

Once the scene is secure, begin the official claims process.

Contact your agent or insurance company as soon as possible, ideally within 24 hours. Most insurers have 24/7 claims hotlines or online portals. If you’re our client, you can Report a Claim through our website or call us for personal guidance.

Provide all necessary documentation, including photos and the police report number. You will work with a claims adjuster who will investigate the accident, assess the damage, and settle your claim. Cooperate with them and stick to the facts.

The repair process begins after the adjuster assesses the damage. Your insurer will issue payment for approved repairs, and you will be responsible for paying your deductible. The final settlement occurs once all repairs and medical bills are resolved. Stay in communication with your adjuster and keep records of all accident-related expenses.

Conclusion

We’ve covered the essentials of North Carolina auto insurance, from state-mandated coverage to the factors that shape your premium. You know that the state requires Bodily Injury Liability, Property Damage Liability, and Uninsured/Underinsured Motorist coverage, and that driving uninsured carries serious penalties.

The most important takeaway is to not just shop for the cheapest price. While NC drivers enjoy rates below the national average, the real value comes from finding the right balance of affordability, protection, and reliable service from NC auto insurance companies you can trust.

You can lower your costs by bundling policies, maintaining a clean driving record, choosing a higher deductible, and asking about every available discount. Remember to shop around annually, as rates and your needs can change. When an accident happens, knowing the steps to take—from documenting the scene to promptly notifying your insurer—makes all the difference.

This is where working with an independent agent provides a clear advantage. We shop across more than 40 carriers on your behalf. With over 30 years of experience, we understand the needs of North Carolina drivers and are here to help you find coverage that protects what matters most without overpaying.

Ready to get started? Reach out to Get a Quote today. Let’s make sure you’re covered, confident, and ready for whatever the road brings.