Why Orlando Businesses Can’t Ignore Flood Risk

Business flood insurance orlando fl is a separate, essential policy that protects your company from water damage that standard commercial property insurance won’t cover. Here’s what you need to know:

Quick Facts About Business Flood Insurance in Orlando:

- Not Included in Standard Policies: Your Commercial Package Policy (CPP) or Business Owners Policy (BOP) excludes flood damage.

- Two Main Options: The National Flood Insurance Program (NFIP) offers up to $500,000 for building and $500,000 for contents; private insurers offer higher limits and business interruption coverage.

- 30-Day Waiting Period: Most policies don’t take effect immediately, so plan ahead.

- Required in High-Risk Zones: Federal law mandates coverage if you have a federally-backed mortgage in a Special Flood Hazard Area.

- Critical for Recovery: At least 25% of businesses that close after floods never reopen.

Orlando sits in a highly flood-prone region. Between hurricane season, summer downpours, and the city’s low elevation, flooding is a matter of when, not if. Many business owners mistakenly believe their standard florida commercial insurance covers flood damage—it doesn’t.

The consequences are severe. Businesses face not just repair costs but also equipment replacement, inventory loss, and months of lost income. Without proper protection, a single flood can wipe out years of hard work.

As founder of Select Insurance Group, I’ve seen how the right business flood insurance orlando fl policy makes the difference between a temporary setback and permanent closure. Our team specializes in shopping multiple carriers to find comprehensive coverage that fits your budget and risk profile.

Understanding the Fundamentals of Commercial Flood Insurance

This section answers foundational questions about why flood insurance is a must-have for any Orlando enterprise.

Q1: What is commercial flood insurance and why is it crucial for Orlando businesses?

Commercial flood insurance protects your business from financial losses due to flood damage. A “flood” is typically defined as a temporary inundation of two or more acres or two or more properties from surface water. This includes overflowing rivers, storm surge, and rapid runoff from heavy rain.

For Orlando businesses, this is a critical reality. The city’s low-lying geography, lake systems, and hurricane season risk make it highly vulnerable to flooding. A flood can halt your operations, damage your building, destroy inventory, and ruin essential equipment. The financial impact can be catastrophic, and at least 25% of businesses that close after disasters like floods never reopen. Commercial flood insurance provides the financial protection needed to repair, rebuild, and get back to business.

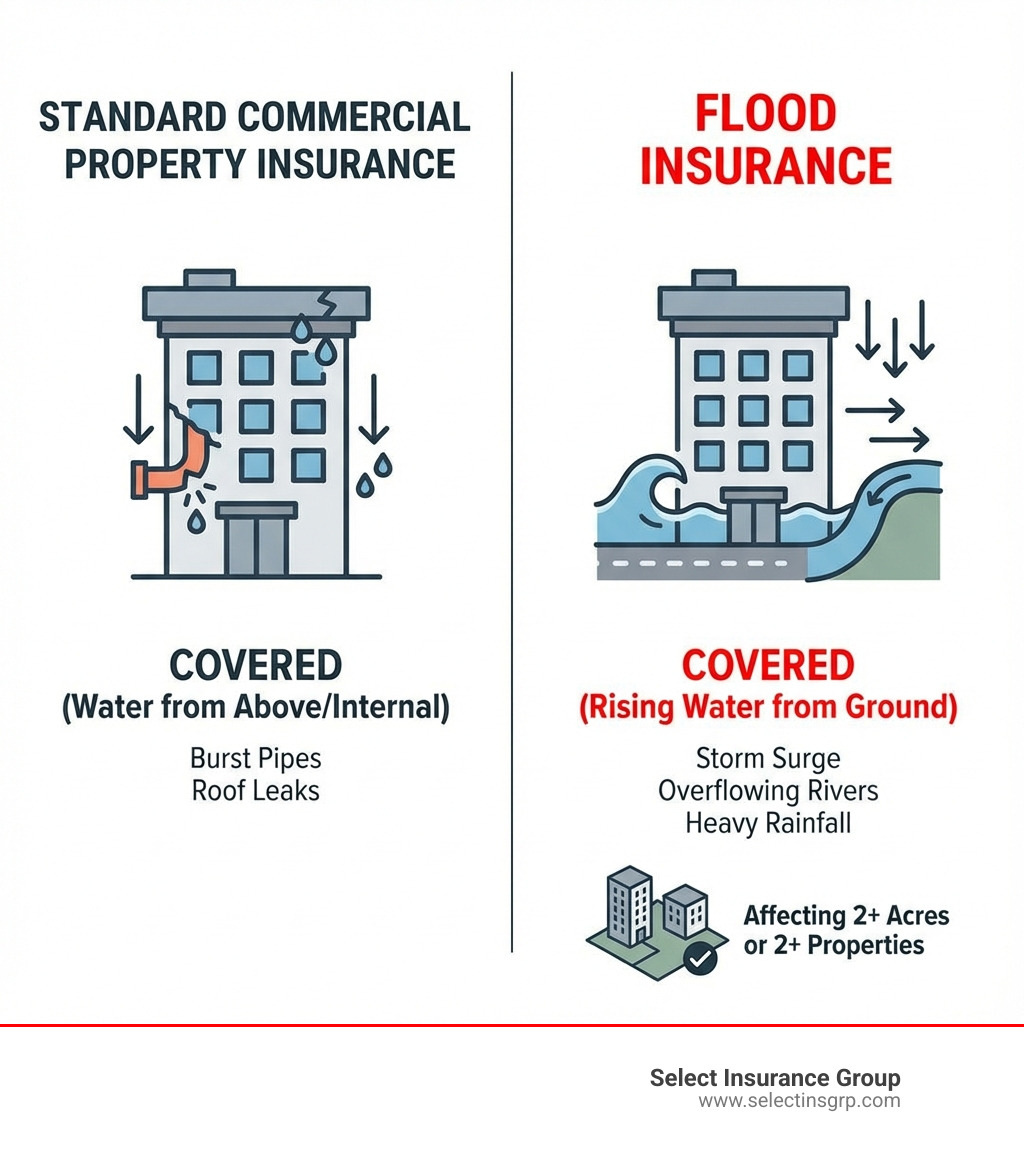

Q2: Does my standard commercial property insurance cover flood damage?

The short answer is no. Standard commercial property insurance policies, whether a Commercial Package Policy (CPP) or a Business Owners Policy (BOP), almost always specifically exclude damage caused by flooding.

These policies cover perils like fire, theft, and wind damage, but not damage from rising ground water. A simple rule is: if water comes from above (like a burst pipe or leaky roof), your standard policy might cover it. If water comes from the ground up, that’s a flood, and you need a separate flood insurance policy. Relying on your standard policy for flood protection is a significant risk for any Orlando business. To learn more, we encourage you to read What you need to know about flood coverage.

Q3: What are the risks of not having business flood insurance in Orlando, FL?

Operating without business flood insurance orlando fl exposes your enterprise to substantial risks that can lead to permanent closure.

Consider these potential consequences:

- Catastrophic Financial Loss: You would be solely responsible for all costs, including structural repairs, replacing ruined equipment, and replenishing destroyed inventory. These costs can easily run into the tens or hundreds of thousands of dollars.

- Extended Business Downtime: A flood can shut your doors for weeks or months. Without insurance, you’d lose income while still being responsible for ongoing expenses like rent, utilities, and payroll. This downtime can erode your customer base.

- Ineligibility for Federal Disaster Assistance: Federal aid after a disaster declaration often comes as low-interest loans, not grants, and is typically insufficient to cover all damages. If you are in a high-risk area and could have purchased flood insurance, your eligibility for federal assistance may be limited. Insurance is a far more reliable and comprehensive solution than relying on disaster relief.

Not having flood insurance leaves your business vulnerable to a single event that could wipe out years of hard work. We’ve seen how businesses struggle to recover and want to help you avoid that fate.

NFIP vs. Private Policies: Choosing Your Coverage

This section compares the two primary avenues for securing flood insurance, helping you decide which path is right for your Orlando business.

Q4: What are the key differences between NFIP and private flood insurance?

When seeking business flood insurance orlando fl, you have two main options: the National Flood Insurance Program (NFIP) and private flood insurance. Understanding their differences is key to making an informed decision.

The National Flood Insurance Program (NFIP) is a federal program managed by FEMA. It is sold through a network of insurers via the Write-Your-Own (WYO) program, but FEMA underwrites the coverage. NFIP policies are standardized, meaning coverage and pricing are consistent regardless of which company you buy from.

Private flood insurance comes from private carriers that offer their own flood products outside the NFIP. These policies provide greater flexibility and can offer broader coverage. Private insurers set their own rates and terms, which can lead to more customized policies and potentially more competitive pricing for certain properties.

Q5: What are the coverage limits for NFIP and private options?

Coverage limits are a major differentiator between NFIP and private flood insurance.

For commercial properties, the NFIP offers maximum limits of:

- Up to $500,000 for the building.

- Up to $500,000 for its contents.

These limits may not be sufficient for businesses with high-value buildings or extensive inventory. Importantly, standard NFIP policies do not cover business interruption or loss of income. Payouts for contents are typically based on Actual Cash Value (ACV), which factors in depreciation.

Private flood insurance often provides:

- Higher limits: Coverage for both building and contents can exceed the NFIP’s $500,000 caps.

- Excess insurance: You can purchase an excess policy from a private carrier to cover value above NFIP limits.

- Replacement Cost Value (RCV): Many private policies offer RCV for both building and contents, which does not deduct for depreciation.

- Business Interruption/Loss of Income: This vital coverage is often available as an add-on to private policies.

Here’s a quick comparison:

| Feature | NFIP (National Flood Insurance Program) | Private Flood Insurance |

|---|---|---|

| Building Coverage Limit | Up to $500,000 | Often higher, can exceed $500,000 |

| Contents Coverage Limit | Up to $500,000 | Often higher, can exceed $500,000 |

| Business Interruption | Generally NOT covered | Often available as an add-on |

| Replacement Cost (RCV) | Primarily for primary residences; commercial can be more complex/ACV | Often available for both building and contents |

| Policy Flexibility | Standardized | More flexible, can be customized |

| Waiting Period | Typically 30 days | Can vary, sometimes shorter |

For many Orlando businesses, private flood insurance or a combination of NFIP and private excess policies offers the most comprehensive solution.

Decoding Your Policy: What’s Covered and What’s Not

A detailed look at what your commercial flood insurance policy will and will not protect.

Q6: What specific types of damage does commercial flood insurance cover?

Commercial flood insurance protects the physical assets of your business directly damaged by floodwaters. While policies vary, coverage generally includes:

Building Structure:

- The building and its foundation.

- Electrical and plumbing systems.

- Central air, furnaces, and water heaters.

- Permanently installed fixtures like carpeting and built-in cabinets.

Business Personal Property (Contents):

- Inventory and merchandise.

- Machinery and equipment.

- Furniture and fixtures (desks, chairs, shelving).

- Certain appliances like portable air conditioners.

For coverage to apply, the damage must be a direct result of a flood as defined by your policy. For more details, you can refer to More on business coverage.

Q7: What is typically NOT covered by a standard policy?

It’s crucial to understand a policy’s limitations. Common exclusions include:

- Property Outside the Building: Landscaping, trees, driveways, fences, and swimming pools are generally not covered.

- Business Vehicles: Damage to business vehicles is not covered. For that, you need the optional “comprehensive” coverage on your business auto insurance orlando fl policy.

- Financial Losses from Business Interruption: Standard NFIP policies do not cover lost income or profits.

- Avoidable Mold/Mildew Damage: If mold develops due to failure to mitigate damage after a flood, it may not be covered.

- Underground Structures: Items like wells and septic tanks are typically excluded.

- Currency and Valuable Papers: Cash, precious metals, and stock certificates are not covered.

Q8: Can I get coverage for business interruption or loss of income?

Yes, but typically not through the standard NFIP policy. The financial impact of a flood extends beyond physical damage to lost revenue and ongoing expenses during closure.

Standard NFIP policies explicitly exclude coverage for business interruption or loss of income. It will help you rebuild, but it won’t compensate you for lost profits while your doors are closed.

This is a major advantage of private flood insurance. Many private carriers offer:

- Business Income Coverage: Reimburses you for lost profits and fixed expenses (like rent and payroll) during the shutdown period.

- Extra Expense Coverage: Pays for additional costs to minimize downtime, such as renting a temporary location.

For most businesses, this coverage is essential for surviving an extended closure.

Q9: How is mold and mildew damage handled after a flood?

Mold presents a significant health hazard and can cause further property damage after a flood. Coverage for mold is typically handled on a case-by-case basis.

For mold damage to be covered, it must be a direct result of the flood. Crucially, your policy expects you to take “reasonable and appropriate mitigation actions” to prevent mold growth. This means promptly cleaning, drying, and ventilating affected areas. If you neglect these steps, your insurer may deny or limit coverage for the resulting mold damage, arguing it was preventable. Pre-existing mold is not covered.

The Process: Securing Your Business Flood Insurance in Orlando, FL

A step-by-step guide to assessing your risk and purchasing a policy.

Q10: Are there situations that mandate business flood insurance in Orlando, FL?

Yes, federal law can mandate the purchase of business flood insurance orlando fl. This is a legal requirement, not just a recommendation.

Federal law requires flood insurance for buildings in Special Flood Hazard Areas (SFHAs)—high-risk flood zones—if you have a mortgage from a federally regulated or insured lender. Most banks and credit unions fall into this category. This requirement also applies if you are seeking certain types of federal financial assistance.

Even if not federally mandated, many commercial lenders require flood insurance as a condition of financing to protect their investment. We recommend checking your property’s flood zone status to understand your obligations.

Q11: How can I determine my business’s flood risk and coverage needs?

Understanding your flood risk is the first step in securing the right business flood insurance orlando fl. Here’s how to assess your risk and coverage needs:

- Check Your Flood Zone: Visit the FEMA Flood Map Service Center and check your flood risk online by entering your address. This will tell you if you’re in a high, moderate, or low-risk zone. 25% of flood claims come from moderate-to-low-risk areas.

- Obtain an Elevation Certificate (EC): For properties in or near a flood zone, an EC provides detailed elevation data that is critical for accurate risk assessment and can impact your premiums.

- Assess Your Property’s Value: Calculate the cost to replace your building, equipment, inventory, and any improvements you’ve made. This helps determine how much coverage you need.

- Consider Potential Downtime: Estimate how long your business might be closed after a flood to determine if you need business interruption coverage.

- Consult an Insurance Professional: As an experienced insurance agency east orlando, we can help you interpret flood maps, evaluate your assets, and recommend appropriate coverage limits, deductibles, and policy types (NFIP vs. private).

Q12: What is the typical waiting period for a policy to take effect?

This is a critical detail: you cannot buy flood insurance right before a storm and expect immediate coverage.

For NFIP policies, there is a standard 30-day waiting period from the date of purchase before coverage begins. This is designed to prevent people from buying insurance only when a flood is imminent.

Private flood insurance policies also have waiting periods, which can vary from 7 to 30 days. There are a few exceptions to the 30-day rule, such as when coverage is required for a loan closing. The key takeaway is to plan ahead. Securing your business flood insurance orlando fl well in advance is essential.

Q13: Where can I purchase a policy and get a quote?

Securing business flood insurance orlando fl is straightforward. Your best approach is to work with a licensed insurance agent who specializes in commercial flood policies.

- Licensed Insurance Agents (Like Us!): We can access both NFIP and private flood insurance options. Our expertise allows us to assess your needs, explain policy differences, and shop multiple carriers to find competitive rates and comprehensive coverage.

- NFIP Providers: You can find a list of providers on FEMA’s FloodSmart website or call the NFIP directly at (877) 336-2627. You can use their tool to find an NFIP provider.

To get an accurate quote, you’ll need your business address, building characteristics, desired coverage amounts, and your property’s flood zone. You can start the process on the FloodSmart website by using their Get a quote now tool, then bring that information to us so we can help you find the best plan.

After the Flood: Claims and Recovery

This section outlines how your policy helps you get back on your feet and the steps to take to ensure a smooth claims process.

Q14: How does flood insurance help a business recover financially?

When floodwaters recede, your business flood insurance orlando fl policy acts as a financial lifeline, turning a potential business-ending disaster into a manageable setback.

Here’s how it helps your business recover:

- Mitigating Catastrophic Loss: The policy provides the funds for repairs and replacements, preventing you from depleting cash reserves or taking on massive debt.

- Funding Repairs and Rebuilding: It covers the costs to restore your building’s structure, electrical systems, and flooring, getting your physical workspace operational again.

- Replacing Damaged Assets: It provides the capital to replace ruined inventory, machinery, and equipment, allowing you to resume operations.

- Reducing Downtime (with specific coverage): If you have private flood insurance with business interruption coverage, it compensates you for lost income and ongoing expenses, reducing the financial strain of a closure.

In short, flood insurance provides the financial stability to rebuild and reopen your doors.

Q15: What are the essential steps for filing a flood insurance claim?

Following a structured process can make filing a claim smoother. Here are the essential steps:

- Contact Your Insurer Immediately: As soon as it’s safe, notify your insurance agent or company to start the claims process.

- Separate Damaged from Undamaged Property: If possible, move undamaged items to a secure location. Do not dispose of damaged items until an adjuster has seen them.

- Document Everything: Before any cleanup, take extensive photos and videos of all flood damage, including water lines on walls, damaged structures, and ruined inventory and equipment.

- Create a Detailed List of Damaged Items: Compile an inventory of all damaged property with descriptions, purchase dates, and original costs. Keep any related receipts or invoices.

- Work with the Adjuster: Your insurer will assign an adjuster to evaluate the damage. Cooperate fully and provide all your documentation.

- File a Proof of Loss: This is your formal, sworn statement detailing the amount you are claiming. Your adjuster can help, but you are responsible for submitting it, typically within 60 days of the flood.

You have a responsibility to mitigate further damage by taking reasonable steps to clean and dry your property. Keep records of all cleanup costs, as they may be reimbursable.

Conclusion

For Orlando entrepreneurs, flooding is a real threat that standard commercial insurance does not cover. Understanding your options between the NFIP and private market, knowing your policy’s details, and being prepared for the claims process are all critical steps in safeguarding your business.

At Select Insurance Group, we empower business owners with knowledge and comprehensive coverage. With over three decades of experience, our team steers the complexities of business flood insurance orlando fl. We partner with you, leveraging our relationships with over 40 carriers to shop for competitive rates and tailor a solution to your specific needs.

Don’t wait for the storm to gather—secure your business’s future today. Protect your livelihood and hard-earned assets from the unpredictable forces of nature. Learn more about our comprehensive florida commercial insurance solutions and let us help you find the peace of mind you deserve.