Why Driving Without Owning Still Requires Coverage

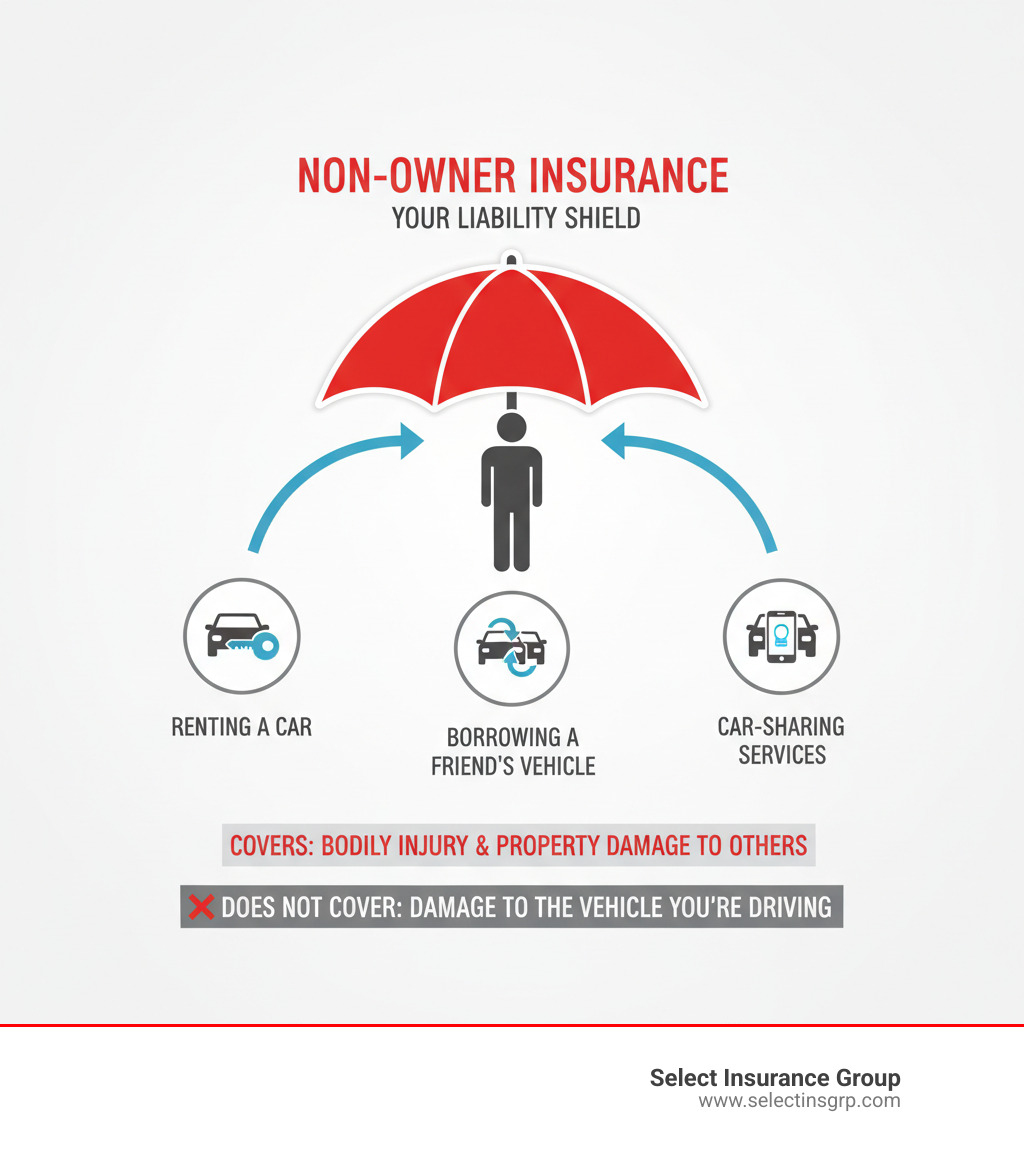

Getting insurance without a car might sound unusual, but it’s a practical solution for millions of Americans who drive regularly without owning a vehicle. Whether you frequently rent cars, borrow a friend’s vehicle, or rely on car-sharing services, you still face liability if you cause an accident—and that’s where non-owner car insurance comes in.

Here’s what you need to know:

- Non-owner car insurance provides liability coverage when you drive a vehicle you don’t own

- It covers bodily injury and property damage to others if you cause an accident

- Typical cost ranges from $200 to $500 annually, less than standard auto insurance

- You can purchase it through most major insurance carriers by contacting an agent

- It does NOT cover damage to the car you’re driving or your own injuries

You don’t own a car. But you still drive. Maybe you rent a sedan for weekend trips. Maybe you borrow your friend’s pickup to haul furniture. Maybe you use Zipcar to run errands around town.

Here’s the problem: If you cause an accident in any of those vehicles, you’re on the hook for damages and injuries to others. The car owner’s insurance kicks in first, but if their coverage isn’t enough—or if they deny the claim—you could face thousands of dollars in out-of-pocket costs.

That’s the financial gap non-owner car insurance fills. It acts as your personal liability safety net, following you from vehicle to vehicle instead of covering a specific car.

As D.J. Hearsey, founder of Select Insurance Group, I’ve helped countless clients across the Southeast steer the complexities of getting insurance without a car, especially those living in urban areas who rely on rentals and car-sharing services. This guide will walk you through everything you need to know about non-owner policies and how to secure the right coverage for your situation.

What is Non-Owner Car Insurance?

Getting insurance without a car might seem like a contradiction, but non-owner car insurance is designed specifically for this situation. It’s a special type of auto insurance policy that follows you, the driver, rather than attaching to a specific vehicle.

If you drive regularly but don’t own a car, you still need protection. Whether you’re behind the wheel of a rental, a borrowed vehicle, or a car-sharing service, you’re financially responsible if you cause an accident. Non-owner insurance provides crucial liability coverage, protecting you from potentially devastating costs if you’re at fault.

Think of it this way. You borrow your sister’s car to pick up supplies. You misjudge a turn and sideswipe another vehicle. The other driver has medical bills. Their car needs repairs. Someone has to pay for that. While your sister’s insurance might cover some of it, what happens if the damages exceed her policy limits? That’s where your non-owner policy steps in.

The coverage primarily includes bodily injury liability (which pays for other people’s medical expenses and lost wages when you’re at fault) and property damage liability (which covers repairs or replacement of other people’s property you damage in an accident).

Your non-owner policy typically acts as secondary coverage. This means the car owner’s insurance pays first. But if their policy runs out or doesn’t cover the situation, your policy picks up where theirs left off. This backup protection is exactly what makes non-owner insurance so valuable.

At Select Insurance Group, we help clients across the Southeast understand these nuances every day. If you’re curious about how liability protection works in other contexts, you can explore our resources on understanding general liability.

What It Covers vs. What It Doesn’t

Understanding what a non-owner policy covers helps you avoid surprises.

The core coverage is straightforward: Your non-owner policy covers your legal responsibility for injuries and property damage you cause to others. If you’re at fault in an accident, your policy pays for the other driver’s medical bills, lost wages, and vehicle repairs—up to your chosen liability limits.

Beyond basic liability, you can often add Medical Payments coverage (MedPay) or Personal Injury Protection (PIP), depending on your state. These coverages help pay for your own medical expenses and those of your passengers, regardless of who caused the accident. They’re relatively inexpensive additions that can save you thousands in medical bills.

Another smart addition is Uninsured/Underinsured Motorist coverage (UM/UIM). This protects you if you’re hit by a driver who has no insurance or not enough insurance to cover your damages. Given that roughly one in eight drivers on the road is uninsured, this coverage is worth serious consideration.

Now for the important limitations. Non-owner insurance does not include collision or comprehensive coverage. This means it won’t pay for damage to the car you’re driving. If you back that borrowed Honda into a pole, you’re paying for those repairs out of pocket. The policy protects others from you—not the vehicle you’re operating.

Similarly, if the car you’re driving gets stolen or damaged by hail, your non-owner policy won’t cover it. These situations would fall under the vehicle owner’s insurance (if they have comprehensive coverage) or become your personal financial responsibility.

There’s also typically no deductible with non-owner insurance. Why? Because you’re not filing claims for damage to a vehicle you own. The policy focuses on liability to others, which doesn’t involve deductibles the same way collision or comprehensive claims do.

The bottom line: Non-owner insurance is about protecting your wallet from lawsuits and liability claims, not about fixing damaged vehicles.

Non-Owner Insurance vs. Permissive Use

When you borrow a car with permission, you might assume the owner’s insurance covers you. While often true, that assumption can be costly.

Permissive use is the insurance industry’s term for when a car owner’s policy extends coverage to someone they allow to drive their vehicle. Most standard auto policies include this feature. Your friend hands you their keys, and their insurance generally covers you while you’re driving.

This works fine for occasional borrowing. You need to move your friend’s car from one side of the street to the other. You borrow your dad’s truck once to haul a couch. Their insurance has you covered as a permitted driver.

The problem emerges when things go wrong. The car owner’s policy becomes the primary coverage, meaning it pays first. But what if the damages exceed their limits? Let’s say you cause an accident that results in $40,000 in medical bills, but your friend only carries the state minimum of $25,000 in bodily injury liability. You’re now personally responsible for that $15,000 gap.

This is where non-owner insurance transforms from optional to essential. It acts as your secondary coverage, catching costs that exceed the owner’s policy limits. More importantly, it’s your coverage with your chosen limits. You’re not gambling on whether the car owner has adequate insurance.

Here’s how they compare:

| Feature | Non-Owner Car Insurance | Permissive Use (under car owner’s policy) |

|---|---|---|

| Who it covers | The driver (you) | The car owner and extends to the permitted driver |

| What it covers | Your liability for bodily injury and property damage to others | The car owner’s vehicle and liability to others |

| Primary/Secondary | Secondary (after owner’s policy, if applicable) | Primary (owner’s policy pays first) |

| Best for | Frequent borrowing/renting, gap in coverage, SR-22/FR-44 | Occasional, infrequent borrowing of a specific car |

| Coverage limits | Chosen by you | Determined by the car owner’s policy |

| Covers damage to car? | No (unless specifically added, which is rare) | Yes (if owner has collision/comprehensive) |

| Continuity | Provides continuous coverage history | Does not provide personal coverage history |

Another advantage of non-owner insurance: it establishes continuous coverage history. Insurance companies reward drivers who maintain coverage without gaps, even if they don’t own a vehicle. When you eventually buy a car, that history of continuous coverage can translate to lower rates.

If you’re regularly borrowing from different people or renting vehicles frequently, permissive use isn’t enough. You need your own policy—one that follows you from vehicle to vehicle, providing consistent protection regardless of whose car you’re driving.

Who Needs Non-Owner Insurance (And Who Doesn’t)?

Whether you need non-owner insurance depends on how often you drive vehicles you don’t own. Your driving habits and lifestyle are key factors.

At Select Insurance Group, we’ve helped thousands of clients across Florida, the Carolinas, Virginia, and Georgia steer this exact question. Some find they absolutely need non-owner coverage. Others realize they’re already protected through existing policies. And just like with our motorcycle insurance clients, there’s no one-size-fits-all answer.

Let’s break down who benefits most from this coverage and who can safely skip it.

Ideal Candidates for a Non-Owner Policy

If you drive regularly but don’t own a car, this policy is likely a good fit. If you fit any of these profiles, this policy is likely worth your time and money.

City dwellers often make perfect candidates. If you live in a place where owning a car means paying $300 a month for parking and sitting in gridlock, you’ve probably made the smart choice to skip car ownership. But you still need to drive sometimes. That’s exactly what this coverage is for.

Frequent renters get tremendous value from non-owner policies. Let’s say you rent a car twice a month for work trips. If you’re buying the rental company’s liability coverage each time, you’re probably spending more than the $200 to $500 annual cost of a non-owner policy. The math is simple: a year-round policy costs less than repeatedly purchasing daily rental insurance.

If you regularly borrow cars from friends or family, you’re relying on their insurance to cover you. That’s fine for occasional use, but what happens when an accident exceeds their policy limits? Your non-owner policy steps in as your personal safety net, protecting you from out-of-pocket expenses that could reach tens of thousands of dollars.

Car-sharing service users like those who rely on Zipcar or Turo also benefit significantly. These services typically provide basic liability coverage, but it might be minimal. Your non-owner policy supplements what they offer, giving you higher limits and better protection.

Here’s something many people don’t consider: maintaining continuous coverage matters to insurance companies. If you recently sold your car and plan to buy another in a few months, a gap in your insurance history can trigger rate hikes when you return to the market. A non-owner policy bridges that gap and keeps your insurance record clean, potentially saving you hundreds on your next standard auto policy.

If you need an SR-22 or FR-44 filing after a serious driving violation like a DUI, but you don’t own a car, non-owner insurance provides the proof of financial responsibility your state requires for license reinstatement. It’s often the only practical solution for high-risk drivers without vehicles.

The common thread? These are all drivers who don’t own a car but need personal liability coverage for the vehicles they operate. If that describes you, this policy is designed specifically for your situation.

When You Can Skip This Coverage

Not everyone needs non-owner insurance. In fact, in some situations, it’s an unnecessary expense.

If you own a car, you already have a standard auto insurance policy that provides liability coverage when you drive other vehicles. There’s no reason to purchase a separate non-owner policy on top of what you already have.

If you live with someone and regularly drive their car (like a spouse or roommate), being added as a named driver on their policy is the better solution. It provides primary coverage and is often simpler and cheaper.

Truly infrequent drivers can usually skip this coverage. If you borrow a car once or twice a year for special occasions, the annual cost of a non-owner policy might not make financial sense. In these rare cases, you can rely on the car owner’s permissive use coverage or purchase minimal liability from a rental company when needed.

If you drive a company car for work, your employer’s commercial auto insurance should cover you and the vehicle. You don’t need personal non-owner coverage on top of that. We help businesses across our service areas secure robust protection through Florida business auto insurance that covers both company vehicles and the employees who drive them.

Without a valid driver’s license, you generally can’t purchase non-owner insurance. While it’s sometimes possible to insure a car you own without a license, non-owner policies require you to be a licensed driver. We’ll address this specific question in more detail in our FAQ section.

The bottom line? If you already have adequate coverage through car ownership, a household policy, or your employer—or if you genuinely drive so rarely that the risk is minimal—you can safely pass on non-owner insurance. For everyone else who drives regularly without owning a vehicle, it’s one of the smartest financial protections you can buy.

Your Guide to Getting Insurance Without a Car

The process of getting insurance without a car might seem daunting, but it’s often simpler than you think. At Select Insurance Group, we pride ourselves on making insurance accessible and understandable. Whether you’re in Florida, the Carolinas, Virginia, or Georgia, we’re here to help you steer your options. You can always get a quote directly through our website.

The Process of Securing a Policy

Here’s the thing about non-owner policies: most insurance companies offer them, but they don’t exactly shout about it. You won’t find flashy ads or prominent website buttons. That’s why contacting an insurance agent is usually your best bet as a first step.

When you reach out, you’ll need to have your valid driver’s license handy, along with basic personal information like your name and address. The agent will also ask about your driving history—those accidents or speeding tickets from years past do matter, unfortunately. This information helps the insurer understand your risk profile and determine your rate.

Now comes the important part: comparing quotes. Just like shopping for any insurance product, you shouldn’t settle for the first number you hear. At Select Insurance Group, we work with over 40 carriers specifically so we can help you find the most competitive rate for your situation. Different insurers price non-owner policies differently based on their own calculations and appetite for risk.

Once you’ve seen a few options, you’ll need to choose your coverage limits. Yes, every state has minimum liability requirements. But here’s some friendly advice: consider going higher than the minimum. A serious accident can rack up costs frighteningly fast, and minimum coverage often isn’t enough to protect you from financial disaster. Think of it as buying a bigger umbrella—it costs a bit more upfront, but you’ll be grateful when the storm hits.

After you’ve selected your coverage and paid your premium, your policy activates, and you’re officially covered. The whole process typically takes less time than you’d expect—often just a single conversation or online session.

How Much Does Non-Owner Insurance Cost?

Here’s the good news: non-owner car insurance is genuinely affordable, especially compared to traditional auto insurance. Because you’re not insuring an actual vehicle (just your liability), the premiums are refreshingly reasonable.

Most drivers pay somewhere between $200 and $500 per year for non-owner coverage. That typically works out to around $300-$350 annually for someone with a decent driving record. Compare that to the potential cost of being personally liable for a serious accident, and it’s a bargain.

Your specific premium depends on several factors. Your driving record matters most—a clean history with no accidents or tickets will get you the best rates, while violations will push your cost higher. Your location also plays a role, since states have different regulations and accident rates. Where you live in our service area can make a noticeable difference in your quote.

The coverage amount you choose directly affects your premium. Higher liability limits mean a higher price, but they also mean stronger protection. Your age factors in too, particularly if you’re under 25, since younger drivers statistically have more accidents.

Think of it this way: for less than the cost of a nice dinner out each month, you can drive borrowed and rented cars with real peace of mind. That’s not a bad deal at all.

Frequently Asked Questions About Getting Insurance Without a Car

We understand that getting insurance without a car can raise a lot of specific questions. Over my years at Select Insurance Group, I’ve had countless conversations with clients who are navigating this unique insurance need. Let’s tackle some of the most common questions we hear. For more in-depth answers to your insurance queries, we encourage you to visit our learning center.

Can I get non-owner insurance if I don’t have a valid driver’s license?

The answer is nuanced. For a non-owner policy, you generally need a valid driver’s license. The insurance is designed to cover a licensed driver operating vehicles they don’t own. Without a license, an insurer cannot assess your driving history.

But here’s where things get interesting. There’s a difference between getting insurance without a car (non-owner insurance) and getting insurance for a car you own when you don’t have a license.

If you own a vehicle but don’t drive it—maybe due to medical reasons, age, or you simply prefer not to—you can usually still insure that car. In this situation, you’d list yourself as an “excluded driver” on the policy and name a licensed person (like a spouse, family member, or caregiver) as the primary driver. This ensures the vehicle is covered when someone else is driving it, and it satisfies any state requirements for vehicle registration.

Similarly, if your license is suspended but you own a car, you might need to maintain insurance on it to keep continuous coverage or meet SR-22 requirements. Again, this would involve having a licensed driver listed on the policy while you’re excluded from coverage.

So the bottom line? Getting non-owner insurance without a valid license is difficult and generally not possible. But getting insurance for a car you own without a license? That’s definitely doable under the right circumstances.

Does non-owner insurance help if I need an SR-22?

Absolutely, and this is actually one of the most important reasons people seek out non-owner insurance. If you’ve had a serious driving offense—a DUI, reckless driving, or driving without insurance—your state’s DMV may require you to file an SR-22 before they’ll reinstate your license. In Florida and Virginia, you might need an FR-44, which is similar but requires higher liability limits.

An SR-22 isn’t insurance itself. It’s a certificate of financial responsibility your insurer files with the state, proving you have the required liability coverage.

If you need to file an SR-22 but don’t own a car, you’re in a catch-22—you need insurance to prove financial responsibility, but you don’t have a vehicle to insure. That’s exactly where non-owner car insurance comes in. It provides the necessary liability coverage that the SR-22 form certifies, allowing you to meet your state’s requirements and get your license back.

We’ve helped countless clients across Florida, the Carolinas, Virginia, and Georgia steer these specific requirements. It’s a challenging situation to be in, but a non-owner policy makes the path to license reinstatement much clearer.

How does a non-owner policy work with the car owner’s insurance in an accident?

Understanding this interaction is crucial to seeing the value of a non-owner policy.

When you cause an accident while driving someone else’s car, the car owner’s insurance is always primary. Their policy pays first, covering damages and injuries up to their liability limits. This happens regardless of whether you have your own non-owner policy or not—it’s part of the standard “permissive use” coverage that most auto policies include.

Your non-owner insurance acts as secondary coverage. It only kicks in when the owner’s policy limits are exhausted or if their insurance denies coverage for some reason.

Let me paint you a real-world scenario. You borrow your neighbor’s car to pick up some supplies. Unfortunately, you misjudge a turn and cause a multi-car accident. The total damages—medical bills, car repairs, lost wages—come to $75,000. Your neighbor’s policy has a bodily injury liability limit of $50,000.

Here’s what happens: Your neighbor’s insurance pays the first $50,000. Then your non-owner policy steps in to cover the remaining $25,000 (assuming your limits are sufficient). Without that non-owner coverage, you’d be personally responsible for that $25,000—potentially facing wage garnishment, liens on your property, or even bankruptcy.

This layered approach is what makes non-owner insurance so valuable. You’re not putting all your financial trust in someone else’s policy limits. You’re creating your own safety net that travels with you, no matter whose car you’re driving.

At Select Insurance Group, we’ve seen how this secondary coverage has saved our clients from devastating financial consequences. It’s not just about meeting legal requirements—it’s about protecting everything you’ve worked for.

Conclusion: Drive with Confidence, Car or No Car

You don’t need to own a car to need car insurance. That’s the simple truth we’ve explored throughout this guide.

Whether you’re renting a sedan for a weekend getaway, borrowing your neighbor’s truck to move a couch, or using Zipcar to run errands across town, you’re taking on real financial risk every time you get behind the wheel. Getting insurance without a car isn’t just about checking a box—it’s about protecting yourself from potentially devastating costs that could follow you for years.

Non-owner car insurance offers that protection. It’s your personal safety net, following you from vehicle to vehicle and stepping in when the car owner’s policy isn’t enough. With typical annual costs between $200 and $500, it delivers enormous peace of mind without breaking the bank. You get essential liability coverage, maintain continuous insurance history (which saves you money down the road), and gain the confidence to drive knowing you’re protected.

For drivers facing license reinstatement after a serious violation, a non-owner policy becomes even more critical—it’s often the only way to file an SR-22 or FR-44 when you don’t own a vehicle.

At Select Insurance Group, we’ve spent over three decades helping drivers across Florida, the Carolinas, Virginia, and Georgia find the right coverage for their unique situations. We shop among more than 40 carriers to bring you competitive rates and personalized advice that actually makes sense for your life. No jargon, no pressure—just straightforward guidance from people who genuinely care about getting you the protection you need.

Don’t let the absence of a car in your driveway leave you exposed on the road. Take control of your financial future and drive with the confidence that comes from being properly insured.

Get your North Carolina auto insurance quote today and find how affordable peace of mind can be.