Why Location is the Secret to Cheaper Car Insurance in North Carolina

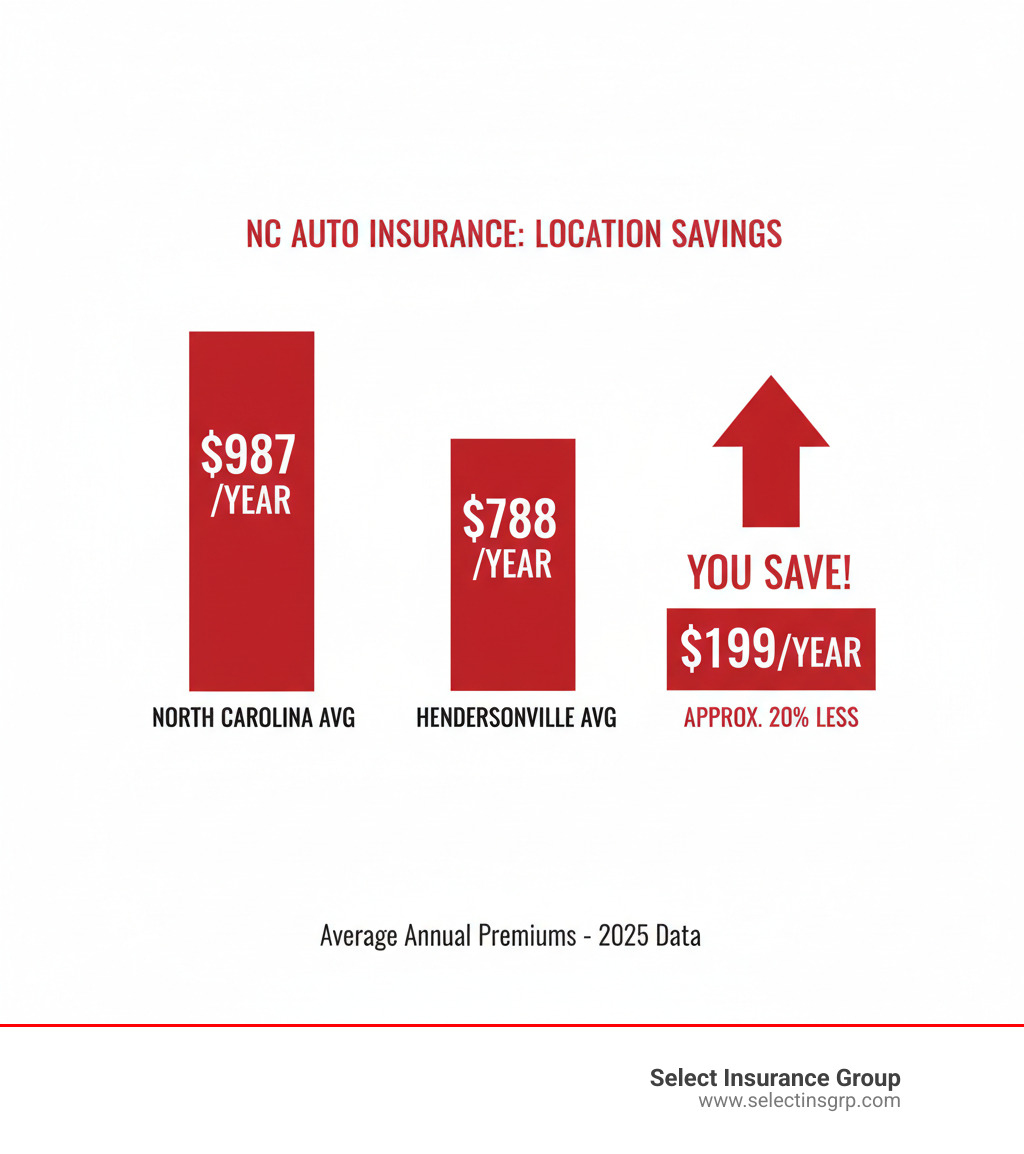

Where in North Carolina is auto insurance the least expensive? For many, the answer is Hendersonville, with an average annual premium of just $788. It’s followed closely by Asheville ($796), Burlington ($815), and Chapel Hill ($825)—all significantly below the state average of $987 per year.

Top 5 Cheapest Cities for NC Auto Insurance:

| Rank | City | Average Annual Premium |

|---|---|---|

| 1 | Hendersonville | $788 |

| 2 | Asheville | $796 |

| 3 | Burlington | $815 |

| 4 | Chapel Hill | $825 |

| 5 | Cary | ~$1,054 |

North Carolina already ranks as the seventh-cheapest state for car insurance, with premiums 28-35% below the national average. But the real secret to savings lies within the state’s borders. Where you live can change your annual bill by hundreds of dollars.

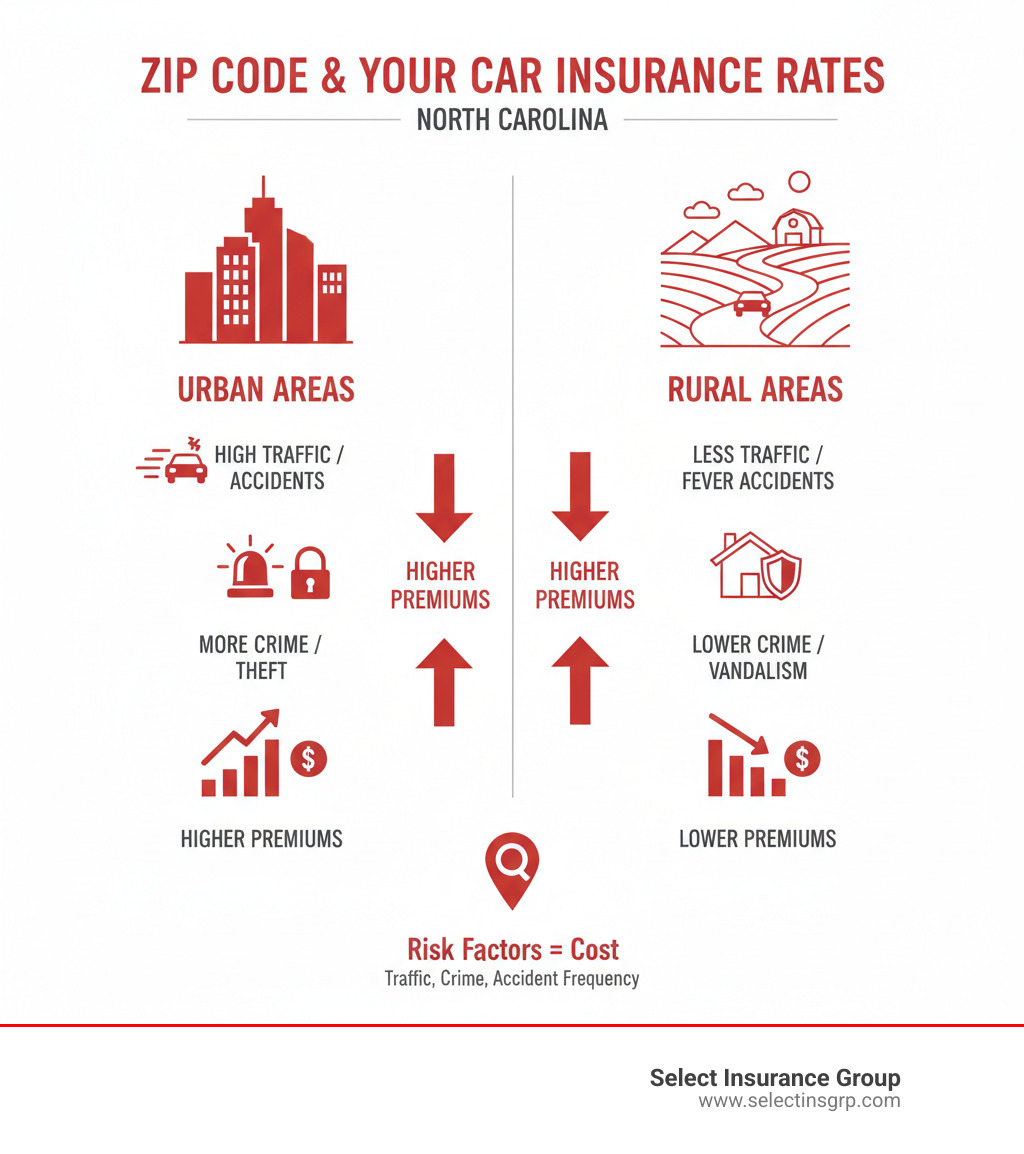

Your ZIP code acts as a pricing signal for insurers, reflecting local traffic, crime, and accident rates. That’s why a driver in Charlotte might pay $1,369 annually, while someone with the same profile in Cary pays just $1,054.

I’m D.J. Hearsey, founder of Select Insurance Group. With over 30 years of experience, I’ve seen how understanding these location-based differences can save drivers hundreds. In this guide, I’ll show you how to find those savings.

The Most Affordable Cities for Car Insurance in North Carolina

If you’re wondering where in North Carolina is auto insurance the least expensive, the good news is several cities offer premiums well below the state average. These areas combine geography and lifestyle to create lower insurance costs.

The state’s most affordable auto insurance markets are often found in less congested areas. Hendersonville leads at just $788 per year, with Asheville ($796), Burlington ($815), and Chapel Hill ($825) following close behind. For a family, saving $200 to $600 annually makes a real difference. Even a city like Cary, with an average premium of $1,054, offers significant savings compared to more expensive urban centers like Charlotte.

The pattern is clear: Western North Carolina and suburban areas often have the most competitive rates. We work with drivers across these regions and more, so check out the Areas We Serve to see if we can help you find savings where you live.

Why Certain Cities Offer Lower Rates

So what’s the secret in places like Hendersonville and Asheville? It’s a combination of risk factors that insurers analyze.

- Lower Population Density and Traffic: Fewer cars on the road means a lower probability of accidents compared to navigating uptown Charlotte during rush hour.

- Fewer Accidents and Claims: Insurers track accident frequency by location. Areas with consistently fewer claims are deemed lower risk, which translates directly into lower premiums for residents.

- Lower Crime Rates: Vehicle theft and vandalism are expensive claims. Communities with lower crime rates often see lower comprehensive coverage costs because a car is statistically safer when parked.

- Rural vs. Urban Dynamics: Urban centers have more intersections, pedestrians, and complexity, leading to higher risk. The more relaxed driving environment in suburban and rural areas is factored into insurance pricing.

In these cities, your location works in your favor. Understanding these advantages is key to getting the savings you deserve.

Why Your ZIP Code is a Game-Changer for NC Auto Insurance Rates

Your ZIP code might seem like just a mailing address, but to an insurance company, it tells a detailed story about risk. This is why where you live in North Carolina can mean a difference of hundreds of dollars on your annual premium.

For example, a driver in Charlotte might pay $1,369 per year, while someone with an identical profile in Hendersonville pays just $788. The pattern is clear: urban areas typically have higher premiums than rural and suburban communities. Understanding why your ZIP code matters is the first step to finding more affordable coverage. You can learn more about this and other topics in our Learning Center.

Key Geographic Risk Factors

Insurers analyze real-world data to create a risk profile for your ZIP code. Key factors include:

- Traffic Congestion and Accident Frequency: More cars in a small area, like in Charlotte or Raleigh during rush hour, lead to more accidents. Insurers track claim frequency in each area, and high-incident zones result in higher premiums for everyone living there.

- Vehicle Theft and Crime Rates: Comprehensive coverage costs are directly influenced by local crime. While NC’s overall theft rate is below the national average, hotspots like Greensboro-High Point (273 thefts per 100,000 residents) see higher rates.

- Weather Patterns: Areas prone to hurricanes, hail, or ice storms face higher comprehensive premiums to cover the increased risk of weather-related damage.

- Local Repair Costs: The cost of parts and labor in your city also affects your premium. Higher local repair costs mean higher potential claim payouts for the insurer.

The Population Density of the 50 States data highlights these varied patterns within North Carolina.

How Insurers Use Location Data

Insurance companies group ZIP codes with similar risk profiles into “rate territories.” They use statistical analysis to calculate the average cost and frequency of claims for each territory. This means your rate is influenced by the collective risk of your area, not just your personal driving habits.

For our clients at our Insurance Agency Charlotte office, we see this play out daily. As an independent agency, we can shop multiple carriers who may weigh these location factors differently, helping you find the most competitive rate for your specific ZIP code.

Beyond Location: Other Key Factors That Determine Your NC Insurance Premium

Even if you live in Hendersonville, the city where in North Carolina is auto insurance the least expensive, your rate could be higher than your neighbor’s. Location is just one ingredient in your premium. Your driving record, age, vehicle type, credit score, and coverage choices all play a major role.

At Select Insurance Group, we help drivers find the right North Carolina Auto Insurance to fit their needs and budget by navigating these factors.

The Impact of Your Driving Record

Your driving record is the biggest factor you control. A clean record earns lower premiums, while violations cause rates to soar.

- At-fault accidents: Can increase your rate by 67% on average ($1,843 per year).

- Speeding tickets: A single ticket can boost your rate by an average of 38%.

- DUIs: A conviction can raise your premium by a staggering 326% ($6,538 per year).

North Carolina’s Safe Driver Incentive Plan (SDIP) assigns insurance points for infractions. Just one point can mean a 30% rate increase, while a DUI (12 points) can lead to a 340% spike. The message is clear: safe driving pays.

How Coverage Choices Affect Your Premium

The coverage you select is a balance between protection and cost.

- Minimum Liability: This is the cheapest, state-required option, but it only covers damages you cause to others, leaving your own vehicle unprotected.

- Full Coverage: This bundles liability with collision (covers your car in an accident) and comprehensive (covers theft, hail, hitting a deer). With a 1-in-77 chance of a deer collision in NC, comprehensive is valuable. Lenders typically require full coverage for financed or leased cars.

- Deductible: This is what you pay out-of-pocket before insurance pays. Choosing a higher deductible (e.g., $1,000 instead of $500) lowers your premium, but be sure you can afford to pay it if you file a claim.

The goal is finding the right coverage at a fair price, which is where an experienced agent can make all the difference.

Where in North Carolina is Auto Insurance the Least Expensive for You? Actionable Steps to Lower Your Bill

While location is a key factor, the real answer to where in North Carolina is auto insurance the least expensive depends on your personal profile. The good news is you have significant control over your premium. While you can’t easily change your ZIP code, you can take these practical steps to lower your bill.

How to Find the Cheapest Insurance for Your Profile

- Shop Around and Compare Quotes: This is the most powerful tool you have. Rates vary dramatically between companies. Get fresh quotes from multiple providers every 6-12 months or after a major life change (moving, new car, marriage). Rates shift constantly, so it pays to Get a Quote and explore your options.

- Maintain a Clean Driving Record: Avoiding tickets and at-fault accidents is the best way to keep rates low. Under NC’s Safe Driver Incentive Plan, even one speeding ticket can raise your rate by 38%.

- Ask for Discounts: Don’t leave money on the table. Ask your agent about bundling auto with home/renters insurance (saves 15-25%), multi-car discounts, good student discounts, and telematics programs that reward safe driving habits.

- Choose a Higher Deductible: If you have an emergency fund, raising your deductible from $500 to $1,000 can lower your premium significantly. Just be sure you can cover the higher out-of-pocket cost.

- Improve Your Credit Score: In North Carolina, insurers use credit-based scores. Drivers with poor credit can pay nearly double what those with good credit pay. Improving your score has long-term benefits beyond just insurance.

- Consider Your Vehicle: Cars that are expensive to repair, have poor safety ratings, or are frequently stolen cost more to insure. Before buying a new car, get insurance quotes on your top choices.

- Review Your Policy Annually: As your life changes, so do your insurance needs. It may no longer make sense to carry full coverage on an older, paid-off car if its value is low.

Being proactive, asking questions, and comparing options are the keys to finding affordable coverage.

Frequently Asked Questions about NC Auto Insurance Costs

Here are answers to the most common questions we hear about auto insurance costs in North Carolina.

What are the minimum car insurance requirements in North Carolina?

North Carolina law requires all drivers to carry liability insurance. Driving without it can lead to fines and license suspension. The current minimums, known as 30/60/25, are:

- $30,000 for bodily injury liability per person.

- $60,000 for bodily injury liability per accident.

- $25,000 for property damage liability per accident.

Crucially, the state also requires uninsured/underinsured motorist coverage at the same 30/60/25 levels to protect you if you’re hit by a driver with little or no insurance. You can find official details at the NCDOT’s Insurance Requirements page.

Important: These minimums will increase to 50/100/50 in July 2025, which will likely affect premiums.

How does an at-fault accident affect my rates in NC?

An at-fault accident has a major impact due to two factors. First, North Carolina follows a strict “pure contributory negligence” law. If you are found even 1% at fault for a crash, you are barred from recovering any damages from the other party. You can read more about this at After an Accident.

Second, an at-fault accident adds points under the Safe Driver Incentive Plan (SDIP), leading to a rate increase of about 67% on average. This increase can last for several years.

Is full coverage worth it in North Carolina?

For most drivers, yes. While it costs more than minimum liability, full coverage (collision and comprehensive) is essential if your vehicle is new, financed, or would be expensive to replace out-of-pocket.

It protects your financial investment from accidents, theft, vandalism, and weather. Given that NC drivers have a 1-in-77 chance of a deer collision, comprehensive coverage is particularly valuable. Full coverage also allows you to select higher liability limits, which provide a crucial safety net against lawsuits if you cause a serious accident, especially given the state’s strict contributory negligence law. Considering the high cost of repairs, full coverage is often a smart investment in your financial security.

Conclusion

Finding affordable auto insurance in North Carolina is within your reach. While where in North Carolina is auto insurance the least expensive often points to cities like Hendersonville and Asheville, your ZIP code is just the starting point. Your personal factors—driving record, vehicle, and coverage choices—are just as important.

The real power comes from being proactive. Maintain a clean driving record, shop around regularly, and always ask about discounts. These steps can lead to substantial savings.

At Select Insurance Group, we’ve spent over 30 years helping drivers steer this landscape. We shop over 40 carriers to find the best value for you: the right coverage at a competitive price. Our goal is to find a policy that protects what matters most while fitting your budget.

The insurance market is always changing, and so are your needs. Ready to find out what affordable, comprehensive coverage looks like for you? We’d love to help you explore your options on our North Carolina Auto Insurance page and see how much you could save.