Why Navigating Florida’s Auto Insurance Market Requires Expert Help

Auto insurance agencies in florida provide essential guidance for drivers facing some of the nation’s highest car insurance costs. Here’s what you need to know if you’re looking for an agency:

- 2,371 independent agencies operate across Florida, offering access to multiple carriers

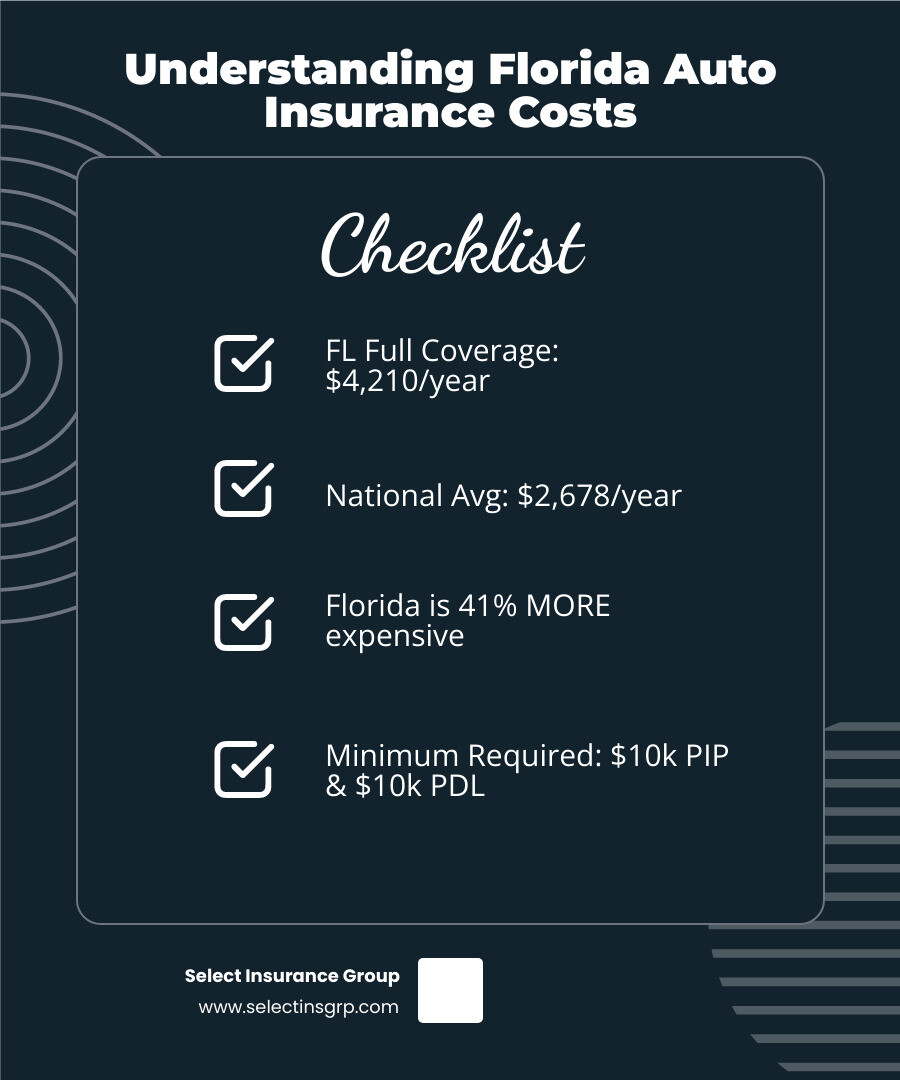

- Average costs: $4,210/year for full coverage vs. $1,136/year for minimum coverage

- Key benefit: Independent agents compare rates from 20+ carriers to find your best match

Florida drivers pay 41% more than the national average for full coverage car insurance. The state’s unique challenges—severe weather, high uninsured motorist rates (15.9%), congested urban areas, and frequent litigation—create a complex insurance landscape that’s difficult to steer alone.

Working with an experienced agency means getting personalized guidance through Florida’s no-fault insurance requirements, understanding the real cost of minimum coverage versus adequate protection, and finding carriers that won’t exit the market when claims rise.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group, where we’ve spent over 30 years helping Florida drivers steer auto insurance agencies in florida by shopping 40+ carriers to find affordable, reliable coverage. My team and I understand the Southeast insurance market inside and out, and we’re here to help you avoid overpaying while getting the protection you actually need.

Why Is Florida Car Insurance So Expensive?

If you’ve ever looked at your Florida car insurance bill and wondered why it’s so much higher than what your cousin in Ohio pays, you’re not alone. Florida drivers consistently pay some of the highest premiums in the nation, and it’s not just bad luck—there are real, measurable reasons behind those eye-watering numbers.

Let’s start with the obvious: Florida’s weather is spectacular most of the time, but it can also be downright dangerous. With 1,350 miles of coastline—more than any other state in the continental U.S.—we’re sitting ducks for hurricanes, tropical storms, and severe weather events. Every time a major hurricane rolls through, insurance companies face billions in claims. Those costs don’t just disappear; they get factored into everyone’s premiums the following year.

Then there’s the simple math of population density. Florida is the third most populous state, and our major cities like Miami, Orlando, and Tampa are packed with cars. More vehicles on the road means more accidents, plain and simple. Rush hour on I-4 or the Palmetto Expressway isn’t just stressful—it’s statistically risky.

Here’s where things get really frustrating for responsible drivers: Florida has the highest rate of uninsured motorists in the entire country. According to the Insurance Information Institute, Florida has a high rate of uninsured drivers at 15.9%. When you get hit by someone without insurance, your own coverage often has to step in and cover the costs. Insurance companies know this, and they price accordingly.

The state’s litigious environment doesn’t help either. Florida has earned a reputation for frequent crash-related lawsuits and higher-than-average payouts for injuries and damages. Insurance companies factor in the cost of potential legal battles when setting their rates, and unfortunately, we all end up paying for it.

Finally, Florida’s car theft rate adds another layer to the problem. Higher theft rates mean more comprehensive claims for stolen vehicles, which insurers include in their risk calculations.

All these factors create a perfect storm of high premiums. But understanding why Florida’s market is so expensive is actually empowering—it helps you know what to look for when shopping for coverage.

The Impact of Recent Market Changes

If you’ve noticed your insurance options shrinking lately, you’re not imagining things. The Florida insurance market has been going through some serious turbulence in recent years. We’ve watched multiple insurers either exit the state entirely or drastically reduce their footprint.

The property insurance crisis has grabbed most of the headlines, but the ripple effects reach into auto insurance too. When carriers leave or pull back, the remaining companies face less competition. Basic economics tells us what happens next: prices go up, and consumers have fewer choices.

This market instability isn’t just inconvenient—it’s genuinely concerning for Florida drivers. You might find a great policy one year, only to receive a non-renewal notice the next. Or your preferred carrier might simply stop writing new policies in your ZIP code.

This is exactly why working with auto insurance agencies in Florida that have access to multiple carriers is so critical right now. When the market shifts, you need someone who can pivot quickly and find you reliable coverage. At Select Insurance Group, we work with over 40 carriers, which means if one company exits or raises rates dramatically, we can shop your coverage with dozens of alternatives. We make it our business to track which carriers are stable, which ones are still actively writing policies in Florida, and which ones offer the best value in this uncertain environment.

Understanding Florida’s Minimum Requirements

Florida’s car insurance system works differently than most states, and understanding these differences can save you from expensive surprises down the road. Florida is a “no-fault” state, which means after an accident, your own insurance company pays your medical bills first, regardless of who caused the crash.

This system is built around two mandatory coverage types. Every registered vehicle in Florida must carry $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL). You can find all the details on Florida’s minimum required insurance coverage through the state’s official website.

Your PIP coverage handles 80% of your medical expenses, 60% of lost wages, and 100% of replacement services like childcare or housekeeping if you’re injured—up to that $10,000 limit. The PDL covers damage you cause to someone else’s property, like their car or that mailbox you accidentally demolished.

Here’s the tricky part: bodily injury liability coverage isn’t technically required by law, but Florida’s financial responsibility law essentially makes it necessary for most drivers. This law says if you cause an accident, you must be able to pay for any bodily injuries you cause to others. For most of us, the only practical way to prove we can do that is by carrying bodily injury liability coverage.

Now for the reality check: minimum coverage is rarely enough coverage. Think about it—$10,000 for medical bills sounds okay until you realize a single emergency room visit can easily exceed that. A serious accident with multiple injuries? You could be looking at hundreds of thousands in medical costs. If you’re carrying only the minimums and cause a serious accident, you could lose your savings, your home, and face wage garnishment for years.

That’s why we always recommend going beyond the bare minimum. Bodily injury liability protects your assets if you’re at fault for injuring someone else—we typically recommend limits of at least $100,000 per person and $300,000 per accident. Uninsured motorist coverage is absolutely essential in a state where nearly one in six drivers has no insurance at all. This coverage protects you and your family if an uninsured driver causes an accident.

Don’t forget collision coverage (which pays for damage to your vehicle after an accident, regardless of fault) and comprehensive coverage (which handles theft, vandalism, fire, falling objects, and yes, all that severe weather we talked about earlier).

The difference between minimum coverage and adequate protection might cost you a few hundred dollars more per year. But the difference in your financial security if something goes wrong? That’s priceless. When you work with us, we’ll help you understand exactly what coverage levels make sense for your situation—not just what the state requires, but what actually protects you and your family.

The Advantage of Using Independent Auto Insurance Agencies in Florida

When you’re shopping for car insurance, you’ll encounter two types of agents: captive agents who work for just one insurance company, and independent agents who partner with multiple carriers. Think of it like shopping at a store that only sells one brand versus a store with dozens of options on the shelves.

For Florida drivers facing some of the nation’s highest insurance costs, choosing an independent agent makes all the difference. With 2,371 independent agencies operating across our state, you have access to professionals who aren’t tied to a single company’s products or pricing. Instead, they work for you.

Here’s what makes auto insurance agencies in Florida so valuable for drivers like you. Independent agents bring personalized service grounded in local expertise. They know your neighborhood. They understand whether you live in a high-risk flood zone, a congested urban area with frequent accidents, or a quieter suburban community. This local knowledge means they can recommend coverage that actually fits your life, not just check boxes on a generic policy.

The real game-changer is their ability to shop multiple carriers on your behalf. Instead of you calling ten different companies for quotes—and spending hours repeating the same information—your independent agent does the heavy lifting. They compare rates, coverage options, and available discounts from numerous insurers simultaneously. At Select Insurance Group, we access more than 40 carriers, which means we can find you competitive pricing without sacrificing the protection you need.

Because independent agents aren’t pushing a single company’s agenda, you get unbiased advice. Their loyalty is to you, not to any particular insurer. When they recommend a policy, it’s because it genuinely fits your situation and budget, not because they’re trying to meet a sales quota for one specific carrier.

Many independent agencies also serve as a one-stop shop for all your insurance needs. You can bundle your auto policy with Florida Home Insurance, life insurance, or commercial coverage through the same trusted advisor. This not only simplifies your life but often qualifies you for multi-policy discounts that lower your overall costs.

In Florida’s challenging insurance market, having an expert who can steer dozens of carriers and find the best value for your specific situation isn’t just convenient—it’s essential.

How an Agency Simplifies Your Search

Let’s be honest: shopping for car insurance can feel overwhelming. The jargon, the fine print, the endless phone calls—it’s enough to make anyone’s head spin. That’s exactly where a good insurance agency transforms the experience from frustrating to straightforward.

We start with a thorough needs assessment. This isn’t a sales pitch; it’s a conversation. What do you drive? How far is your daily commute? Do you have teenage drivers on the policy? What assets are you protecting? By understanding your unique situation, we help you identify the right coverage levels—ensuring you’re neither paying for protection you don’t need nor leaving yourself vulnerable with too little.

Next comes quote comparison, and this is where an agency really shines. Instead of you spending your evening clicking through websites or sitting on hold, we gather quotes from multiple carriers and present them side-by-side. You can see clearly how different companies compare on price, coverage limits, deductibles, and available discounts. It’s like having a personal shopper who knows exactly where to find the best deals.

Insurance policies are notorious for confusing language, so we provide clear policy explanation. We break down what each coverage actually means, explain your deductible options, and point out any exclusions or limitations you should know about. No surprises, no fine print headaches—just straightforward information you can understand.

If you ever need to file a claim, we’re there for claims assistance. We’ll walk you through what information the carrier needs, help you understand the process, and advocate on your behalf to ensure fair treatment. You’re not navigating the claims maze alone. If you need to Report a Claim, we make sure you know exactly how to do it.

Your life doesn’t stand still, and neither should your insurance. That’s why we offer annual policy reviews to make sure your coverage still makes sense. Maybe you’ve paid off your car, added a new driver, or moved to a different neighborhood. We’ll check for new discounts you might qualify for and adjust your policy to keep it aligned with your current needs and budget.

Our ultimate goal is simple: finding the right fit for you. We take pride in matching you with a policy and carrier that offer both excellent protection and competitive rates. Don’t hesitate to Contact Us to experience the difference a knowledgeable agency makes.

Finding Local Auto Insurance Agencies in Florida

There’s something special about working with a local insurance agent who’s part of your community. You can buy a policy online from a faceless website, but can that website tell you about the traffic patterns on your morning commute or the specific weather risks in your neighborhood? A local agent brings that invaluable community knowledge to the table.

Local auto insurance agencies in Florida understand the nuances that matter to you. They know which intersections see the most accidents, which zip codes face higher theft rates, and how hurricane exposure varies even within the same county. This intimate understanding translates to personalized support that goes beyond generic coverage recommendations.

With 2,371 independent agencies throughout Florida, finding an agent near you is easier than you might think. Many agencies have multiple locations strategically placed to serve different communities. We’ve built our presence across Central Florida to make sure you have convenient access to experienced professionals who understand your local area.

You can visit our Insurance Agency in Tampa, Florida for personalized service in the Tampa Bay area. If you’re in the Orlando region, we have convenient locations including our Insurance Agency in East Orlando, Florida, Insurance Agency in Kissimmee, Florida, Insurance Agency in South Orlando, Florida, and Insurance Agency in West Orlando, Florida.

Curious if we serve your area? Check out all the Areas We Serve to find the office closest to you. When you choose a local independent agency, you’re not just getting an insurance policy—you’re gaining a trusted neighbor who’s invested in your community and ready to provide fast, friendly service when you need it most.

Strategies for Finding Affordable Car Insurance in Florida

Given Florida’s notoriously high car insurance rates, finding affordable coverage often requires a strategic approach. The good news? It’s not about cutting corners on protection—it’s about being smart and leveraging every option available to you.

One of the most powerful strategies is comparing rates from multiple insurers. This is where working with an independent agency truly pays off—we do the heavy lifting for you, presenting a range of options side by side. Never settle for the first quote you receive. With access to 40+ carriers, we can often find significant price differences for the exact same coverage.

Bundling policies is another effective way to save. When you combine your auto insurance with Florida Home Insurance, life insurance, or even business coverage, most carriers reward you with multi-policy discounts. These bundling discounts can add up to hundreds of dollars in annual savings across all your policies.

Your driving record plays a huge role in what you pay. Every accident, speeding ticket, or traffic violation can increase your premiums for three to five years. By maintaining a clean driving record—following speed limits, avoiding distracted driving, and practicing defensive driving—you demonstrate lower risk to insurers, which directly translates to lower rates.

Here’s something many Florida drivers don’t realize: your credit score can significantly impact your car insurance premiums. Insurers use credit-based insurance scores as one factor in determining your rates. Taking steps to improve your credit over time—paying bills on time, reducing debt, and monitoring your credit report—can lead to more favorable insurance rates down the road.

The vehicle you choose matters more than you might think. Cars that are expensive to repair, frequently targeted by thieves, or have high-performance engines typically cost more to insure. Before buying your next vehicle, consider researching insurance costs. Choosing a car with strong safety ratings, good theft-prevention features, and reasonable repair costs can help keep your premiums manageable.

Finally, always ask about discounts. Many insurers offer a wide array of discounts that you might qualify for without even realizing it. From safe driver rewards to good student discounts, these savings opportunities can significantly reduce your premium. We make it our mission to explore every possible discount for our clients—it’s one of the ways we ensure you’re getting the best value.

Key Factors That Influence Your Premium

Car insurance premiums aren’t arbitrary numbers. They’re calculated based on numerous individual risk factors that insurers have determined correlate with the likelihood of filing a claim. Understanding these factors helps you anticipate costs and identify areas where you might have some control.

Your driving record is one of the most significant factors. Accidents, speeding tickets, DUIs, and other violations signal higher risk to insurers. A clean driving record, on the other hand, demonstrates responsible behavior and typically results in lower premiums. Even a single at-fault accident can increase your rates by 20-40% or more.

Your credit-based insurance score is another major consideration in Florida. This isn’t your regular credit score, but rather a specialized score insurers use to predict the likelihood of filing claims. Studies have shown a correlation between credit behavior and insurance claims, which is why maintaining good credit can help lower your premiums.

Where you live—your ZIP code—has a substantial impact on your rates. Urban areas with heavy traffic, higher crime rates, and more frequent accidents typically have higher premiums than rural areas. Even moving from one neighborhood to another within the same city can affect your rates due to differences in theft rates, accident frequency, and claims history.

The type of vehicle you drive influences your premium in several ways. Expensive cars cost more to repair or replace. High-performance vehicles are associated with riskier driving. Cars that are frequently stolen lead to more comprehensive claims. Conversely, vehicles with excellent safety ratings and modern safety features like automatic emergency braking often qualify for discounts.

Your age and gender are also factored in. Younger drivers, especially those under 25, typically pay higher premiums due to inexperience and statistically higher accident rates. Gender can play a role too, with young male drivers often paying more than their female counterparts. As you age and gain more driving experience, rates generally decrease.

The coverage limits and deductibles you choose directly affect your premium. Higher coverage limits provide better protection but cost more. Choosing higher deductibles—the amount you pay out-of-pocket before insurance kicks in—lowers your premium but means you’ll pay more if you need to file a claim. It’s a balance between monthly affordability and financial protection.

Open uping Discounts and Savings Programs

Beyond the basic strategies, there are numerous specific discounts and programs that can help Florida drivers reduce their premiums. Many of these are underused simply because people don’t know they exist or don’t think to ask.

Telematics programs are becoming increasingly popular. These programs use a mobile app or a device plugged into your car to monitor your driving habits—things like speed, braking patterns, and time of day you drive. Safe drivers who participate can earn discounts of 10-30% or more. It’s a great option if you’re confident in your driving skills.

Safe driver discounts reward you for maintaining a clean driving record over time. If you’ve gone several years without accidents or violations, you likely qualify. Some insurers offer accident forgiveness programs that prevent your first at-fault accident from raising your rates.

If you have students in your household, good student discounts can provide meaningful savings. Students who maintain a B average or better (typically a 3.0 GPA) often qualify for discounts of 10-25%. This recognizes that responsible students tend to be responsible drivers.

Multi-policy bundles we mentioned earlier are one of the most substantial discount opportunities. By consolidating your auto, home, and other insurance policies with one carrier, you can save significantly on all of them.

Paying your premium in full rather than in monthly installments can also save you money. Many insurers charge fees for monthly payment plans, so paying annually or semi-annually eliminates these fees.

If you don’t drive much, a low mileage discount might be available. Drivers who commute short distances or work from home and drive fewer than 7,500-10,000 miles per year often qualify for reduced rates since less time on the road means lower accident risk.

Modern vehicle safety features can also earn you discounts. Anti-lock brakes, airbags, anti-theft devices, lane departure warnings, and automatic emergency braking systems all reduce the likelihood of serious accidents or theft, and insurers reward this with lower premiums.

Ready to find which discounts you qualify for? Get a Quote from us today, and we’ll make sure you’re taking advantage of every savings opportunity available to you.