Navigating Orlando’s Roads: An Insurance Primer

Car insurance companies in orlando florida offer many options, but finding the right fit can be overwhelming. Here’s what you need to know.

Key Facts for Orlando Drivers:

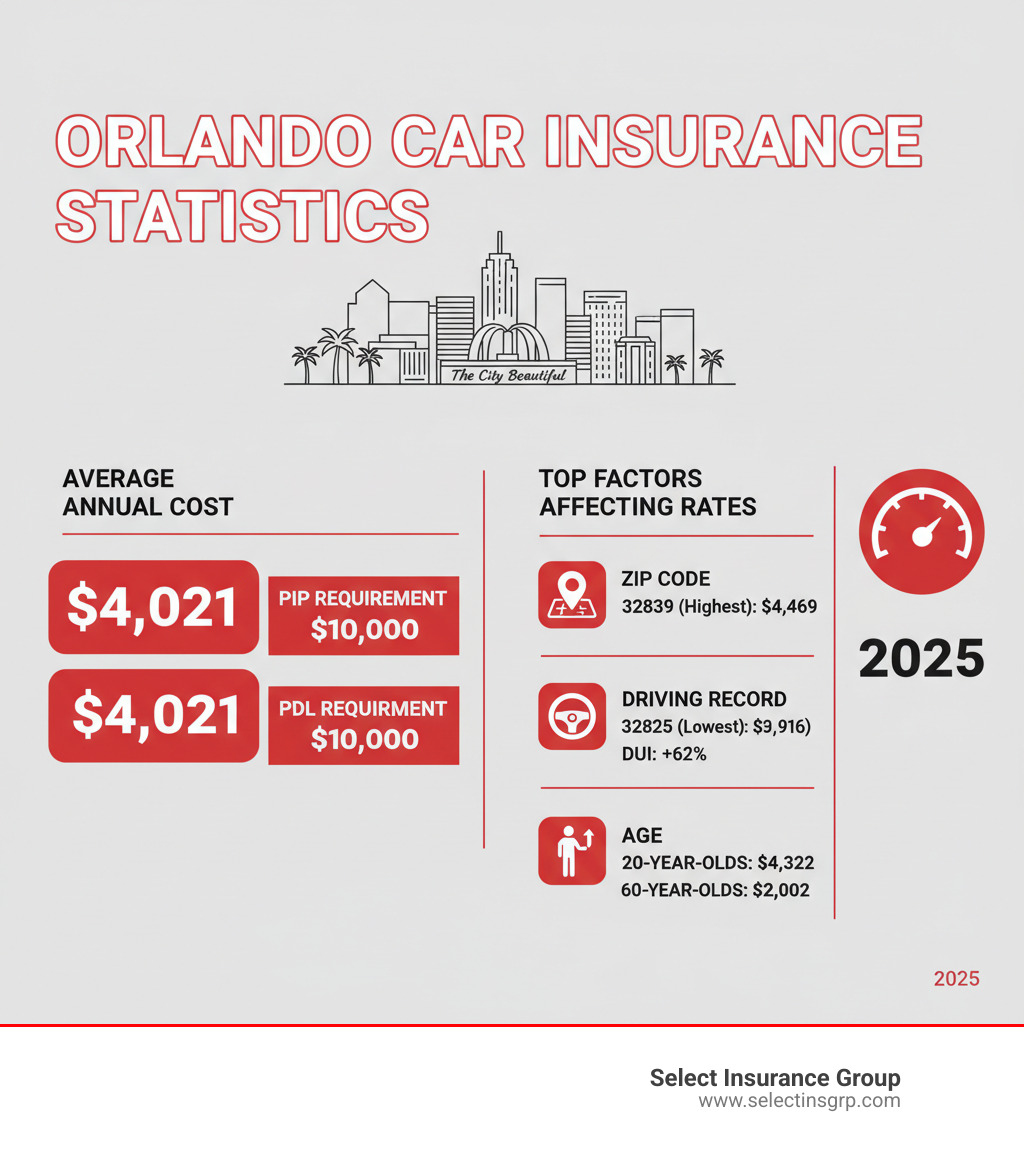

- Minimum Required Coverage: $10,000 PIP + $10,000 Property Damage Liability

- Average Cost in Orlando: $4,021/year (slightly higher than Florida’s $3,968 average)

- Driving Without Insurance: Fines from $150-$500, license suspension, SR-22 requirement

Orlando’s unique challenges, from tourist-heavy roads like I-4 to unpredictable weather, make the right car insurance essential. The average Orlando driver pays about $335 per month for full coverage, but rates vary dramatically by ZIP code, driving record, and insurer.

Understanding your options can save you thousands annually. You can work with a local independent agent who shops multiple carriers for you or go directly to a single insurance company. As the founder of Select Insurance Group, I’ve spent three decades helping drivers find the best rates and coverage by shopping across 40+ carriers. The right match between a driver and an insurer makes all the difference.

Quick car insurance companies in orlando florida definitions:

Understanding Florida’s Minimum Car Insurance Requirements

Florida operates under a “no-fault” system, meaning you turn to your own insurance first after an accident, regardless of who is at fault. This system is designed to speed up claims, but it’s crucial to understand the required coverages. While all car insurance companies in orlando florida must offer these minimums, they are often not enough to fully protect you.

What You Must Have to Drive Legally in Orlando

To drive legally in Orlando, you need two types of coverage:

Personal Injury Protection (PIP): This is the core of the no-fault system. It covers your medical bills and lost wages after an accident. The state requires at least $10,000 in PIP coverage. However, a single ER visit can exhaust this limit, which is why many drivers opt for higher coverage.

Property Damage Liability (PDL): This covers damage you cause to someone else’s property, like their car or fence. Florida requires a minimum of $10,000 per accident. If you cause more damage, you’re personally responsible for the rest.

Notably, Florida doesn’t require Bodily Injury Liability coverage for most drivers, though it may be mandated after serious violations. For official details, visit the Florida Department of Highway Safety and Motor Vehicles website. You can also explore more information about Florida Auto Insurance through our resources.

The High Cost of Driving Uninsured in Orlando

Driving without insurance in Orlando is a costly mistake. The penalties are severe and can have long-term financial consequences.

If caught, you face fines between $150 and $500, along with the suspension of your driver’s license and vehicle registration. To get reinstated, you’ll likely need to file an SR-22 certificate, which labels you as a high-risk driver and leads to much higher insurance premiums for at least three years.

The biggest risk is causing an accident while uninsured. You become personally responsible for all damages and injuries, which can lead to lawsuits and financial ruin. Florida has no grace period for a lapse in coverage; the state’s automated system detects gaps immediately, and penalties begin. Continuous coverage is the only way to protect yourself legally and financially.

Choosing the Right Path: Local Insurance Experts vs. Direct-to-Consumer Options

When shopping for car insurance companies in orlando florida, you have two main paths: working with a local independent agent or going directly to a single insurer. Think of an independent agent as a personal shopper who knows all the brands, versus shopping at a store that only sells one.

Comparing Your Options for Car Insurance in Orlando, Florida

Here’s how the two approaches differ:

| Feature | Local Independent Agent (e.g., Select Insurance Group) | Direct-to-Consumer Insurance Options |

|---|---|---|

| Choice of Carriers | Access to 40+ carriers, providing diverse options | Limited to offerings from a single company |

| Personalization | Highly personalized advice based on your unique needs | Standardized options, less customization |

| Claims Assistance | Acts as your advocate during the claims process | You deal directly with the carrier’s claims department |

| One-Stop Shopping | Can bundle multiple policies (auto, home, commercial) | Often requires separate policies from different providers |

| Local Expertise | Deep understanding of Orlando’s specific risks and needs | General knowledge, less localized insight |

| Long-Term Relationship | Builds a lasting relationship as your trusted advisor | Transactional, less consistent relationship |

Buying directly offers straightforward, direct-to-consumer service, but you’re limited to single carrier options. This can work for simple needs, but you may miss out on the competitive advantage of choice.

Why a Local Independent Agent Can Be Your Best Ally

With over 30 years in the business, we know the best coverage is about finding the right protection at a fair price, with an advocate in your corner.

As an independent agent, Select Insurance Group provides access to 40+ carriers. We shop dozens of car insurance companies in orlando florida for you, comparing rates and coverages to find the perfect fit. This allows for truly customized coverage custom to your life, not just your car. We educate our clients on protecting their assets, treating them like family.

Our local expertise is a key advantage in Orlando. We understand how tourist traffic, neighborhood theft rates, and hurricane risks affect your policy. If you’re in South Orlando, our team at Insurance Agency South Orlando knows your area’s specific needs.

Most importantly, we build a long-term relationship. We review your coverage annually and advocate for you during claims. When you call, you talk to someone who knows you. While the direct model works for some, an independent agent is hard to beat if you want an expert who shops the market for you and stands by you for the long haul.

Key Factors Influencing Rates from Car Insurance Providers in Orlando, Florida

Have you ever wondered why your car insurance premium is what it is? Car insurance companies in orlando florida use a complex formula to assess your risk. Understanding these factors can help you find significant savings.

Insurers calculate premiums based on the likelihood you’ll file a claim. Key factors include:

- Driving record: A clean history signals responsibility and leads to lower rates.

- Vehicle type: Sports cars or models with high theft rates cost more to insure than a family sedan with top safety ratings.

- Annual mileage: More time on the road means more risk, so higher mileage can increase rates.

- Age and experience: Young, inexperienced drivers pay more due to higher statistical accident rates. Rates typically drop around age 25.

- Marital status: Married drivers often receive lower rates as they tend to file fewer claims.

- Credit history: In Florida, insurers use a credit-based insurance score to predict claim likelihood. Good credit can lower your premium.

- Location: Your ZIP code can dramatically affect your rates based on local traffic, accidents, and theft data.

How Your Orlando ZIP Code Impacts Your Premium

Where you live in Orlando can change your insurance bill by hundreds of dollars a year. Insurers analyze localized data on traffic density, accident frequency, and theft rates to price risk by neighborhood.

For example, living in ZIP code 32825 might cost around $3,916 annually, while 32828 is closer to $4,034. In 32839, the average climbs to about $4,469. That’s a $500+ difference based on location alone. An agent who knows Orlando’s landscape, like our team at Insurance Agency East Orlando, can find carriers that rate your specific area more favorably.

Driving History: Your Biggest Lever for Savings

While you can’t change your age or ZIP code easily, you completely control your driving record—the most powerful factor in your insurance cost.

A clean driving record qualifies you for the best rates and discounts. Good drivers in Orlando can find full coverage for as low as $2,151 per year.

Conversely, an at-fault accident can cause rates to jump to around $2,880 annually, with the increase lasting for three to five years. Speeding tickets also add up.

A DUI conviction has the most severe impact, increasing rates by an average of 62%. An Orlando driver with a DUI might pay $3,484 or more and require a high-risk policy. Safe driving is the most reliable way to keep your premiums with car insurance companies in orlando florida as low as possible.

Beyond the Basics: Recommended Coverage for Orlando Drivers

Florida’s minimum insurance requirements—$10,000 in PIP and $10,000 in property damage liability—are often not enough to protect you financially after a serious accident. That $10,000 in property damage won’t cover totaling a new $40,000 SUV, leaving you responsible for the difference. Similarly, $10,000 in PIP can be quickly exhausted by a single hospital visit. These gaps can be financially devastating, which is why we advise clients to secure more robust protection.

Essential Coverages to Consider

We recommend several key coverages that car insurance companies in orlando florida offer to fill the gaps left by state minimums.

- Bodily Injury Liability (BI): Though not always required in Florida, this is crucial. If you cause an accident that injures someone, BI covers their medical bills, lost income, and pain and suffering beyond their PIP limits, protecting your assets from lawsuits. We suggest at least $100,000 per person and $300,000 per accident.

- Uninsured/Underinsured Motorist (UM): Florida has a high rate of uninsured drivers. UM coverage protects you and your passengers if you’re hit by a driver with no insurance or not enough coverage.

- Collision Coverage: This pays to repair or replace your vehicle after an accident, regardless of fault. It’s essential if your car is financed or leased, or if you couldn’t afford to replace it out-of-pocket.

- Comprehensive Coverage: This protects your car from non-accident events like hail, hurricane debris, theft, vandalism, or fire. It’s particularly important in Orlando’s climate and is also typically required for financed vehicles.

- Medical Payments (MedPay): This works with PIP to cover medical deductibles, copays, and other expenses for you and your passengers, minimizing your out-of-pocket costs.

What Your Orlando Auto Policy Typically Won’t Cover

It’s important to know what your policy excludes to avoid surprises. Standard auto insurance does not cover:

- Normal wear and tear or mechanical breakdowns.

- Intentional damage to your own or another’s property.

- Racing or speed contests, whether organized or informal.

- Using your personal vehicle for business like ridesharing or delivery. A standard policy won’t cover an accident while you’re working for services like Uber or DoorDash. We can help you find a Florida Business Auto policy or rideshare endorsement to close this gap.

- Personal belongings stolen from your car; these are covered by homeowners or renters insurance.

Talk with us to review your policy in plain English. We’ll identify any gaps and ensure you have the protection you need for your Orlando lifestyle.

Actionable Ways to Lower Your Orlando Car Insurance Premiums

With a few smart strategies, you can significantly lower your car insurance premiums while maintaining the protection you need. We’ve helped thousands of Orlando drivers do just that.

Open uping Common Car Insurance Discounts

Car insurance companies in orlando florida offer numerous discounts, but you often have to ask for them.

- Multi-policy discount: Bundling your auto insurance with a home or renters policy is one of the easiest ways to save.

- Good student discount: Most carriers reward students who maintain a B average or higher with a premium reduction.

- Safe driver programs: Many insurers offer telematics programs that monitor your driving via a mobile app. Safe habits like avoiding hard braking and speeding can earn you substantial discounts.

- Pay-in-full discount: Paying your entire premium upfront instead of monthly can often qualify you for savings.

- Vehicle safety features: Anti-lock brakes, airbags, and anti-theft devices can all lead to discounts.

- Other discounts: Look for multi-car, accident-free, and defensive driving course discounts.

The best way to maximize savings is to work with an agent who knows every carrier’s discount offerings. We can stack them for the biggest impact. Ready to see what you qualify for? Get A Quote and let’s find every available saving.

Finding the Best Car Insurance Providers in Orlando, Florida for Your Needs

Beyond discounts, several other strategies can lower what you pay for coverage from car insurance companies in orlando florida.

Shop around annually. Rates are always changing. What was a great deal last year might not be competitive now. We recommend comparing quotes at least once a year or after any major life event.

Compare quotes from multiple sources. This is where an independent agent excels. We automatically shop over 40 carriers for you, doing in minutes what would take you hours. Some carriers are known for competitive rates and discounts, but the only way to know if they’re best for you is to compare.

Increase your deductible. Raising your deductible from $500 to $1,000 can lower your premium, but make sure you can comfortably pay that amount out-of-pocket if you file a claim.

Maintain a good credit score. In Florida, a better credit score can lead to lower insurance rates. Pay bills on time and manage your debt to improve your score.

Choose your next car wisely. Vehicles with high safety ratings, lower repair costs, and low theft rates are cheaper to insure.

Look into usage-based insurance. If you’re a low-mileage driver, these programs can offer significant savings by tracking your mileage or driving habits.

Finding the best rates requires a combination of smart choices and an expert in your corner. That’s what we do for our clients across Orlando, from West Orlando to every other neighborhood. We simplify the process and ensure you get great coverage at a great price.

Conclusion: Your Partner in Finding the Right Orlando Coverage

Driving in Orlando presents unique challenges, from tourist traffic on I-4 to sudden summer storms. You need more than just minimum insurance; you need coverage that truly protects your assets.

We’ve covered the average costs (around $4,021 per year), the impact of your ZIP code and driving record, and the serious penalties for being uninsured. Most importantly, we’ve highlighted the necessity of going beyond the basic $10,000 PIP and $10,000 PDL requirements to include Bodily Injury Liability and Uninsured Motorist coverage.

The landscape of car insurance companies in orlando florida is vast. You could spend hours comparing single companies, or you could let us do the work for you. As an independent agency with over 30 years of experience, Select Insurance Group shops more than 40 carriers on your behalf. We’re not tied to one company, so our only goal is to find you the best combination of price and protection.

We are local experts who understand Orlando’s risks. We treat our clients like family, providing personalized advice and advocating for you at every step, from choosing a policy to filing a claim. As your life changes, we’ll be there to ensure your coverage evolves with you.

Don’t wonder if you’re overpaying or underprotected. Turn your knowledge into action. Whether you’re in the western part of the city and want to find your perfect match with an agent in West Orlando or located anywhere else in the area, we’re ready to help. Let’s have a conversation and find you the right coverage from the right carrier at the right price.