Why North Carolina Drivers Are Finding Better Rates Than Ever

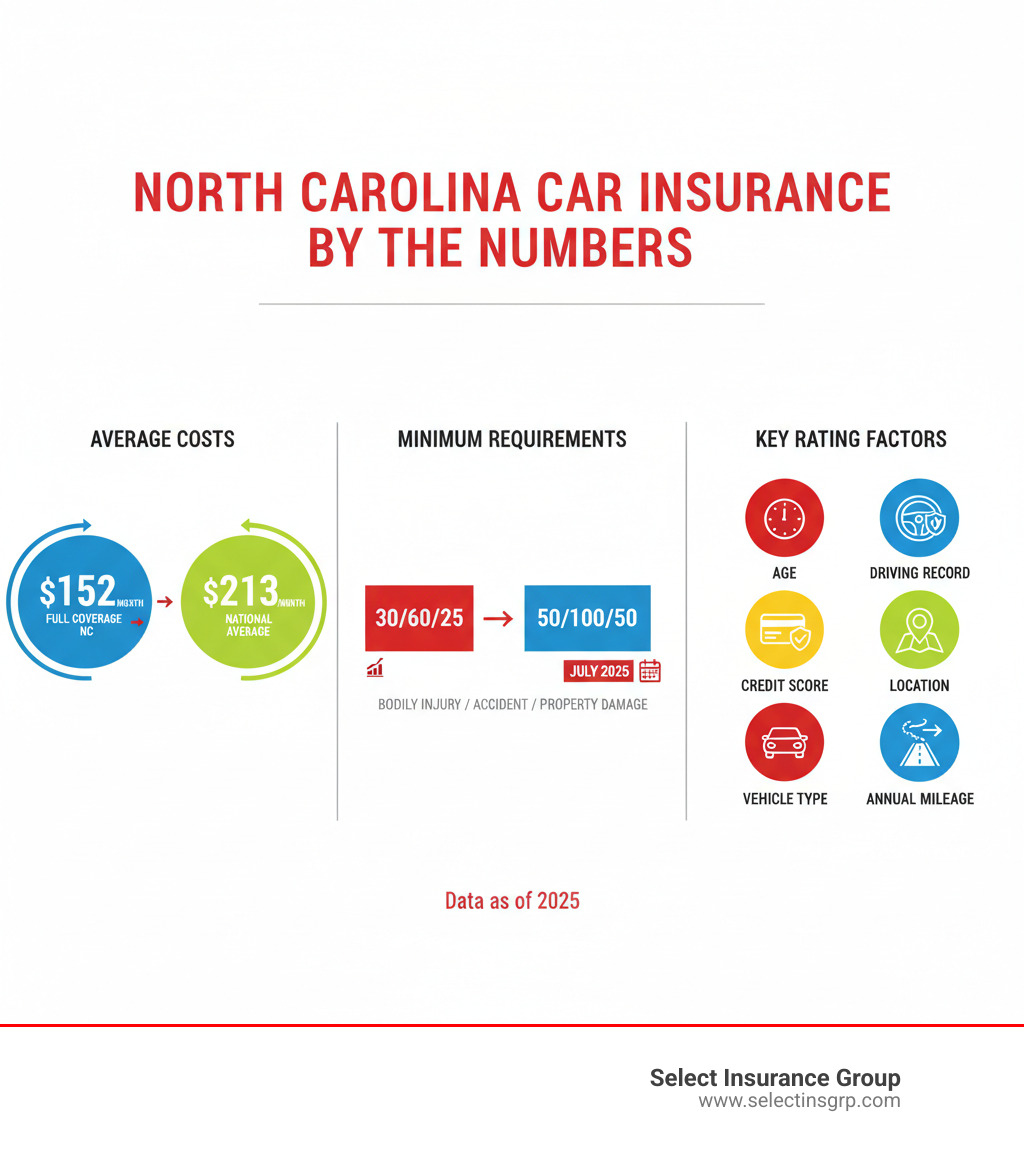

Affordable car insurance NC is more accessible than many drivers realize. The Tar Heel State boasts average car insurance rates that are 30% lower than the national average. Finding these savings requires understanding the state’s insurance landscape, comparing quotes, and using the right discounts.

Quick Answer: How to Find Affordable Car Insurance in NC

- Average Costs: $1,165-$1,523 annually for full coverage.

- Cheapest Minimum Coverage: Rates can be found from $40-$49/month.

- Cheapest Full Coverage: Rates can be found from $99-$141/month.

- Key Savings Strategies: Compare quotes from 3+ carriers, bundle policies, use telematics apps, and maintain a clean driving record.

- Important: NC minimum requirements increase to 50/100/50 in July 2025.

North Carolina is a relatively affordable state for auto insurance, but rates vary dramatically based on your age, driving record, location, and coverage. For example, young drivers under 25 may pay over $200 monthly, while seniors can find rates closer to $150. A clean driving record can keep annual rates below $1,900, while a DUI can push them over $7,000.

Location also matters. Drivers in Cary, Winston-Salem, and Wilmington often pay less than the statewide average, while Charlotte drivers face slightly higher premiums.

The difference between minimum and full coverage is significant. Minimum coverage meets the state’s legal requirements (currently 30/60/25) for about $48-$69 monthly. Full coverage, which adds collision and comprehensive protection for your own vehicle, averages $152-$213 monthly but provides crucial financial protection.

You don’t have to settle for high rates. Comparing quotes is the single best way to save, with some drivers saving over $800 when switching. Bundling auto with home or renters insurance can also lead to substantial savings.

As D.J. Hearsey, founder of Select Insurance Group, I’ve helped thousands of North Carolina drivers find affordable car insurance NC. Our approach is simple: we shop your coverage across 40+ carriers to ensure you get the best possible rate for your unique situation.

Terms related to Affordable car insurance NC:

Understanding North Carolina’s Car Insurance Essentials

Understanding car insurance basics is the first step toward finding affordable car insurance NC. When you know what coverage you need, you can make smart decisions that protect your finances without overpaying.

State Minimum Insurance Requirements: What You Absolutely Need

In North Carolina, every driver must have auto insurance to prove financial responsibility. The North Carolina Department of Insurance sets the legal minimums, currently known as 30/60/25 limits:

- Bodily Injury Liability: Covers injuries you cause to others. You need $30,000 per person and $60,000 per accident.

- Property Damage Liability: Pays for damage to others’ property. You need at least $25,000 per accident.

- Uninsured/Underinsured Motorist (UM/UIM): Protects you if the at-fault driver has no insurance or not enough. Your UM/UIM limits must match your liability limits.

Important Change: Starting July 1, 2025, these minimums will increase to 50/100/50 ($50,000 per person, $100,000 per accident for bodily injury, and $50,000 for property damage). This change will provide better protection but may slightly increase premiums.

“Full Coverage” vs. Minimum Coverage: Making the Right Choice

“Full coverage” isn’t a standard policy; it’s a term for a package that includes more than the state minimums.

- Minimum coverage only covers damages you cause to others. It offers no protection for your own vehicle if you are at fault.

- “Full coverage” adds two key protections for your own car:

- Collision coverage: Pays to repair or replace your car after a crash, regardless of fault.

- Comprehensive coverage: Protects against non-crash events like theft, vandalism, fire, hail, or hitting a deer.

Why choose more than the minimum? The financial risk of carrying only minimum coverage is enormous. If you cause a serious accident, medical bills and property damage can easily exceed the 30/60/25 limits, leaving you personally responsible for the rest. For your own vehicle, an at-fault accident with minimum coverage means you pay for all repairs or replacement out of pocket.

If you have a leased or financed vehicle, your lender will require you to carry collision and comprehensive coverage. Even if your car is paid off, these coverages are a smart investment if it’s worth more than you could afford to replace.

Explore your options in our guide to North Carolina Auto Insurance.

Average Car Insurance Costs in North Carolina

North Carolina drivers enjoy rates about 30% below the national average. In 2024, the average annual cost for full coverage was $1,165 to $1,523.

- Full coverage averages around $152 per month.

- Minimum coverage averages about $48 to $69 per month.

However, your actual rate depends on many individual rate factors, including age, driving record, credit, vehicle, and location. Rate variations by city are common. For instance, drivers in Cary pay some of the lowest rates (around $1,054 annually), while those in Charlotte pay more (around $1,369 annually). This difference is due to risk factors like traffic density and crime rates. These averages are a starting point, but your premium will be unique to you.

Key Factors That Drive Your NC Insurance Premiums

Your car insurance premium is a personalized risk assessment. Insurers in North Carolina evaluate several factors to determine how likely you are to file a claim. Understanding these factors is key to finding affordable car insurance NC.

How Your Driving Record and Credit History Impact Rates

Your driving record is the most significant factor. North Carolina’s Safe Driver Incentive Plan (NCSDIP) assigns points for violations, which can increase your rate from 40% to 340%.

- At-fault accidents and speeding tickets will raise your premium. A single accident can result in average premiums around $1,131 annually.

- DUI convictions cause the most severe rate hikes, with average premiums ranging from $2,857 to $7,480 annually. A DUI can impact your rates for up to 10 years.

Your credit history also plays a role. North Carolina allows insurers to use a credit-based insurance score, as statistics show a correlation between good credit and fewer claims. Maintaining a healthy credit score can lead to lower insurance rates. A clean driving record is paramount, but poor credit can still result in higher premiums than you might otherwise pay.

Personal, Vehicle, and Geographic Rating Factors

Beyond how you drive, insurers consider who you are, what you drive, and where you live.

-

Personal Factors: Driver age is a major factor. Teen drivers face the highest rates due to inexperience, with costs often exceeding $3,000 annually. Rates typically decrease with age, becoming most affordable for middle-aged drivers before potentially rising again for senior drivers around age 70. Married drivers also tend to receive lower rates.

-

Vehicle Factors: The make, model, and year of your vehicle affect your premium. Expensive cars or those with high repair costs are more costly to insure. Your annual mileage also matters; driving less often means lower risk and can qualify you for discounts.

-

Geographic Factors: Your garaging ZIP code has a significant impact. Urban areas like Charlotte ($1,369 average) have higher rates than smaller cities like Cary ($1,054 average) due to more traffic and crime. Coastal areas may also see higher rates due to natural disaster risk from hurricanes. Additionally, rising auto theft trends in North Carolina, which saw a 32% increase in 2023, can drive up comprehensive coverage costs in affected areas.

Your Guide to Finding Affordable car insurance NC

Finding affordable car insurance NC is achievable with the right strategies. By actively seeking discounts and comparing your options, you can significantly lower your rates.

How to Find Affordable Car Insurance NC with the Right Discounts

You may already qualify for discounts that could save you hundreds. The key is to ask your agent and stack as many as possible.

- Multi-Policy Discount: Bundling your auto policy with North Carolina Home Insurance or renters insurance can lead to major savings, potentially over $1,000 annually.

- Multi-Car Discount: Insuring all household vehicles with one company almost always lowers the premium for each car.

- Good Student Discount: A B average or higher can earn significant savings for young drivers on your policy.

- Telematics Programs: Allow an app to monitor your safe driving habits (braking, speed, mileage) and earn discounts up to 30%.

- Defensive Driving Course: Completing an approved course can provide a discount for up to three years.

- Other Discounts: Ask about savings for paying in full, setting up auto-pay, going paperless, or having vehicle safety features like anti-theft systems.

Programs from organizations like Safe Kids Worldwide® may also lead to discounts for young drivers. Always ask your agent to review all available discounts for you.

Comparing Quotes: The #1 Strategy for Affordable Car Insurance NC

If you do only one thing to find affordable car insurance NC, it should be this: compare quotes from multiple carriers. Rates for the exact same coverage can vary by hundreds of dollars between companies. Each insurer has its own risk formula, so what’s expensive with one may be a bargain with another.

We recommend shopping for quotes at least once a year. When comparing, ensure you’re requesting the same coverage limits and deductibles for an accurate, apples-to-apples comparison.

This is where an independent insurance agency like Select Insurance Group provides immense value. Instead of you spending hours contacting different companies, we do the work for you. We shop your coverage across over 40 carriers to find the best rate and policy for your needs.

Other strategies to lower your premium include:

- Choosing a higher deductible.

- Dropping collision/comprehensive on older, low-value cars.

- Reviewing your coverage annually to match your current needs.

- Improving your credit score over time.

Navigating Options for High-Risk Drivers

A history of DUIs, multiple violations, or lapses in coverage can place you in the “high-risk” category, making it difficult to find affordable insurance. If standard insurers turn you down, you still have options.

The North Carolina Reinsurance Facility is a state program that ensures all drivers can obtain the legally required minimum coverage. While rates may be higher, it guarantees you can stay insured and legally on the road.

Being high-risk isn’t permanent. As violations age off your record (typically 3 years for minor ones, up to 10 for major ones like a DUI), your options will improve. By maintaining continuous coverage and a clean driving record, you can eventually qualify for standard, more affordable rates again. Our agents can help you steer this process and find the best available option for your situation.

Frequently Asked Questions about NC Auto Insurance

Car insurance can be confusing. Here are quick answers to the most common questions we hear from North Carolina drivers.

How much car insurance do I really need in North Carolina?

While the state requires minimums (currently 30/60/25, increasing to 50/100/50 in 2025), they are often not enough to protect your assets in a serious accident. Medical bills and vehicle replacement costs can easily exceed these low limits, leaving you personally liable for the difference.

We typically recommend higher liability limits, such as 100/300/100 ($100k per person, $300k per accident for bodily injury, and $100k for property damage). This provides a much stronger financial safety net. For new, financed, or leased cars, Gap insurance is also a wise addition to cover the difference between your loan balance and the car’s actual value if it’s totaled.

Why are my car insurance rates going up even with a clean record?

It’s frustrating, but rate increases are often due to factors beyond your personal driving record.

- Inflation and Repair Costs: Modern cars are expensive to repair due to sensors and technology. Rising parts and labor costs push premiums up for everyone.

- Increased Claims: More accidents, weather damage, or theft in your area lead to higher rates for all drivers in that region.

- Auto Theft: North Carolina saw a 32% jump in vehicle thefts in 2023, increasing comprehensive claims and costs.

- Statewide Rate Adjustments: The NC Department of Insurance periodically approves average rate hikes that affect all drivers.

Even with a perfect record, these trends can raise your premium. This is why it’s crucial to compare quotes regularly to ensure you’re still getting the best deal.

Can I get car insurance in NC without a driver’s license?

Yes, it is possible, but you cannot legally drive the vehicle yourself. This situation typically applies if you own a vehicle but don’t drive it (e.g., due to a medical issue) or are insuring a car for a licensed household member (like a child). You can also purchase a non-owner policy for liability coverage when you borrow cars.

However, expect complications and higher costs. Insurers rely on driving records to assess risk, so not having a license makes you an unknown quantity, often resulting in higher premiums or denial of coverage from some companies. Honesty with your insurance agent is the best approach to find a carrier willing to work with your specific situation.

Partner with an Expert for Your North Carolina Insurance Needs

Finding affordable car insurance NC doesn’t have to feel overwhelming. We’ve covered a lot of ground together—from understanding North Carolina’s minimum requirements and the upcoming 2025 changes, to exploring the factors that shape your premium, to uncovering the discounts and strategies that can dramatically lower your costs. You now have the knowledge to make informed decisions about your coverage.

But here’s the thing: having all this information is one thing. Putting it into action to find the absolute best rate for your unique situation? That’s where the real work begins. And honestly, who has the time to contact dozens of insurance companies, fill out the same forms over and over, and try to decipher which policy truly offers the best value?

That’s exactly where we come in. We believe that navigating auto insurance should be simple, not stressful. The right partner doesn’t just hand you a quote and send you on your way. They take the time to understand your needs, your budget, and your concerns. They do the heavy lifting of shopping the market so you don’t have to.

As an independent agency, Select Insurance Group operates differently than captive agents who work for a single insurance company. We’re not tied to one carrier’s rates or products. Instead, we have relationships with over 40 insurance carriers across Florida, the Carolinas, Virginia, and Georgia. This gives us—and you—the power of choice. We shop your coverage across this entire network to find the policy that best fits your budget and coverage needs, whether you’re in Charlotte, Cary, Wilmington, or anywhere else in the Tar Heel State.

Our approach is straightforward: we compare options from multiple carriers, identify every discount you qualify for, and present you with real choices. We’ve been doing this for over 30 years, and we’ve helped thousands of North Carolina drivers find coverage that protects what matters most without draining their bank account. The single most effective way to ensure you’re not overpaying for car insurance is to compare options from a wide range of carriers, and that’s exactly what we do for you—every single time.

Whether you’re a young driver looking for your first policy, a family trying to bundle multiple cars and your home insurance, or someone navigating the high-risk market after a difficult period, we’re here to guide you through it. We understand that insurance isn’t just about numbers on a page—it’s about peace of mind, knowing you and your family are protected.

Ready to see how much you could save on your North Carolina auto insurance? We’d love to help you explore your options. Visit us at North Carolina Auto Insurance and get a personalized quote today. Let’s find you the affordable car insurance NC you deserve.