Why Commercial Truck Insurance Quotes Are Your First Step to Protecting Your Livelihood

Commercial truck insurance quotes are the starting point for any trucking business seeking proper coverage and legal compliance. Whether you operate a single semi-truck or a growing fleet, accurate quotes help you understand costs, compare options, and find the protection your business needs.

Here’s what you need to get commercial truck insurance quotes:

- Business Information: Your company name, address, DOT/MC number, and years in business.

- Vehicle Details: VIN, year, make, model, and gross vehicle weight (GVW) for each truck.

- Driver Information: Names, dates of birth, license numbers, and driving history for all operators.

- Operations Details: Radius of operation (local, regional, or long-haul) and types of cargo hauled.

- Coverage Needs: Desired liability limits and any additional coverages.

Typical premium ranges for commercial truck insurance in the Southeast run from $2,000 to $20,000+ annually per truck, depending on the vehicle, cargo, and driver experience.

Your trucks are the lifeline of your business, but every trip carries risks like collisions, cargo damage, and costly liability claims. Commercial truck insurance protects your business from these unique on-the-road risks. Proper coverage is essential for all operators—from new owner-operators to established carriers—to stay legal, operational, and financially secure.

Finding the right policy isn’t just about meeting legal requirements; it’s about protecting your assets, drivers, and your business’s future. The good news is that getting quotes and comparing options is more straightforward than you might think.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group. We’ve helped countless trucking businesses across the Southeast secure comprehensive coverage at competitive rates. With over 30 years of collective industry expertise and relationships with more than 20 carriers, I’ve guided businesses through obtaining commercial truck insurance quotes that truly fit their needs.

Related content about commercial truck insurance quotes:

Understanding Your Commercial Truck Insurance Foundation

High-quality transportation insurance is critical. With rising litigation and claims, trucking companies face risks with every mile, including major accidents, cargo damage, and multi-million dollar liability claims. Without the right protection, one incident could halt your entire operation.

Legal compliance is another huge piece of the puzzle. Federal and state regulations mandate specific insurance coverages for commercial trucks. The Federal Motor Carrier Safety Administration (FMCSA), for instance, requires certain coverages for interstate truckers. Failing to meet these requirements can lead to hefty fines and the loss of operating authority.

This insurance protects your assets. Your trucks, trailers, and cargo are significant investments. Commercial truck insurance safeguards them against physical damage, theft, and loss, while also protecting you from the financial burden of third-party bodily injury and property damage claims.

So, who needs commercial truck insurance? Any business that uses a truck for commercial purposes, including:

- Owner-operators: Individuals who own and operate their own truck or small fleet.

- Private carriers: Businesses that transport their own goods (e.g., a construction company hauling materials).

- For-hire trucking companies: Companies that move goods for others, from local to long-haul.

- Specialty haulers: Dump trucks, tow trucks, car haulers, hotshot drivers, and food trucks.

Even if you only own one commercial truck, you are legally required to carry proper insurance. It’s not just about the law; it’s about peace of mind.

For more detailed insights into liability coverage, explore our page on truck liability coverage.

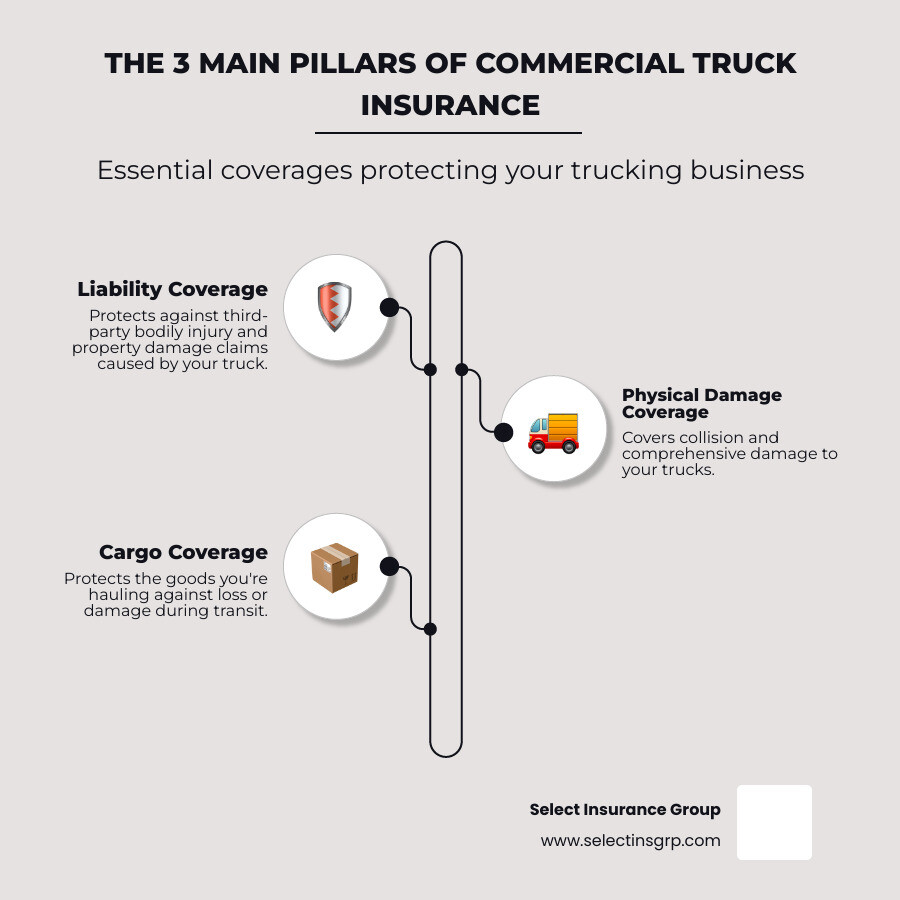

What Are the Core Coverages?

When we talk about commercial truck insurance quotes, we’re often looking at a few foundational coverages that form the bedrock of any good policy.

- Primary Liability (Commercial Auto Liability): This mandatory coverage pays for bodily injury and property damage your truck causes to others in an at-fault accident. While minimums vary by state, many businesses opt for $1–5 million in coverage to protect against costly accidents. This policy also typically covers legal defense costs.

- Physical Damage Coverage: This protects your own truck and is usually broken into two parts:

- Collision: Covers repair or replacement costs if your truck is damaged in a collision, regardless of fault.

- Comprehensive: Covers damage from non-collision events like fire, theft, vandalism, or natural disasters.

- Motor Truck Cargo Insurance: This is essential if you haul goods for others. It protects the freight you’re transporting from theft, damage, or loss and covers your liability for the cargo.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re in an accident with a driver who has no insurance or not enough to cover the damages they caused.

For more information on protecting the goods you haul, take a look at our guide on cargo insurance for truckers.

Commercial vs. Personal Auto Insurance

A common misconception is that personal auto insurance can cover a work truck. However, a vehicle’s use completely changes its insurance classification.

Here’s a quick comparison to highlight the key differences:

| Feature | Personal Auto Insurance | Commercial Auto Insurance |

|---|---|---|

| Coverage Limits | Lower, designed for individual liability and vehicle value | Higher, designed for significant liability and commercial assets |

| Vehicle Types | Cars, SUVs, pickup trucks (for personal use) | Semi-trucks, box trucks, dump trucks, delivery vans, pickup trucks (for business use) |

| Usage | Commuting, personal errands, recreational use | Transporting goods/equipment, business deliveries, professional services |

| Liability | Covers personal liability | Covers business liability, often higher minimums, cargo coverage |

| Cost | Generally lower, based on personal risk factors | Generally higher, based on commercial risk factors and higher limits |

The biggest takeaway is the “business use exclusion” in most personal auto policies. If you’re using your vehicle for business—making deliveries, transporting tools, or driving to job sites—your personal policy likely won’t cover an accident. This means you could be personally liable for all damages.

Commercial auto insurance is specifically designed to cover the greater risks of business operations, with higher liability limits that extend to business liability, employees, and cargo.

For a deeper dive into how these two types of insurance differ, check out our page on truck car insurance.

What Vehicles Qualify?

What constitutes a “commercial truck” to an insurer? It’s primarily about usage. If a vehicle is used for work to transport goods, materials, or equipment, it generally qualifies for commercial truck insurance.

This broad category includes:

- Semi-trucks: Tractor-trailers, 18-wheelers, and big rigs.

- Box trucks: Used for local deliveries, moving, and freight hauling.

- Dump trucks: Essential for construction and waste management.

- Tow trucks: Used for roadside assistance and vehicle recovery.

- Flatbed trucks: For transporting oversized or unusually shaped cargo.

- Delivery vans: Crucial for last-mile logistics and parcel delivery.

- Pickup trucks used for business: If your pickup is used for any work-related task, it needs commercial coverage. Even partial business use can classify it as a commercial vehicle.

How to Get the Best Commercial Truck Insurance Quotes

Getting the right commercial truck insurance quotes should be a smooth process. It typically involves gathering information, contacting professionals, and comparing offers.

While you can go directly to an insurance company, working with an independent insurance agency like Select Insurance Group offers several advantages. We partner with over 40 carriers, which means we shop around for you, comparing policies and prices to find the best fit. This saves you time and helps you find better rates and more comprehensive coverage.

What Information Do I Need for Commercial Truck Insurance Quotes?

To get accurate and competitive commercial truck insurance quotes, preparation is key. The more organized you are, the smoother the process will be. Here’s a list of what we’ll typically need:

- Business Information: Legal business name, address, Federal Employer Identification Number (FEIN) or Social Security Number (SSN), DOT/MC numbers, years in business, and annual revenue.

- Vehicle Details (for each truck): Vehicle Identification Number (VIN), year, make, model, Gross Vehicle Weight (GVW), current mileage, original cost, and any special equipment.

- Driver Information (for all operators): Legal name, date of birth, driver’s license number and state, and driving record (MVR) for the past 3-5 years. Years of commercial driving experience are also important.

- Operations Details: Primary garaging location, radius of operation (local, regional, long-haul), type of cargo hauled, and average annual mileage per vehicle.

- Loss History Report: Details of any commercial vehicle insurance claims from the past three years. A clean loss history usually results in more favorable rates.

Having this information ready ensures we can provide you with the most accurate and competitive quotes possible.

The Quoting Process: Step-by-Step

Here’s how we guide the process of securing your commercial truck insurance quotes:

- Gather Your Documents: Collect all necessary business, vehicle, driver, and operational information.

- Contact an Insurance Professional: Reach out to us at Select Insurance Group. We’re here to guide you and leverage our relationships with numerous carriers.

- Submit Your Application: We’ll help you complete an accurate application and submit it to multiple insurance providers in our network.

- Review and Compare Quotes: We’ll present the quotes to you, explaining the coverage limits, deductibles, and exclusions so you can make an informed choice.

- Bind Coverage: Once you choose a policy, we’ll help you finalize the paperwork to put your coverage into effect.

- Get Your Certificate of Insurance (COI): We’ll provide you with a COI as proof of coverage for regulatory compliance and client contracts.

Comparing Your Commercial Truck Insurance Quotes

When commercial truck insurance quotes arrive, it’s tempting to pick the cheapest one. However, we advise looking beyond just the price tag, as a low premium might mean insufficient coverage.

Here’s how to compare your quotes effectively:

- Look Beyond Price: The cheapest quote may offer insufficient coverage. Prioritize adequate protection for your specific risks; a slightly higher premium for better coverage is a wise investment.

- Compare Liability Limits: Ensure limits meet or exceed legal minimums and are high enough to protect your business assets.

- Check Deductibles: A higher deductible lowers your premium but increases your out-of-pocket cost per claim. Choose an amount you can comfortably afford.

- Review Included Coverages: Verify that all necessary core and specialized coverages are explicitly listed in the policy.

- Understand Exclusions: Read the policy’s exclusions carefully to know what situations or damages are not covered.

- Assess Insurer Reputation: Consider the insurer’s financial stability and reputation for customer service and claims processing.

Decoding the Cost: What Influences Your Premiums?

“How much does commercial truck insurance cost?” The answer varies widely. While premiums can be broad averages, the truth is that many factors influence your specific commercial truck insurance quotes.

Why such a wide range? Because insurance is all about risk assessment. Insurers evaluate how likely you are to file a claim and how expensive that claim might be by looking at your vehicles, drivers, and operational footprint.

For more information on what impacts your costs, head over to our page about average truck insurance cost.

Key Factors That Determine Your Insurance Rate

When we’re putting together your commercial truck insurance quotes, we’re building a unique risk profile for your business. Here are the key factors that influence your premium:

- Vehicle Type and Age: Larger, heavier, and newer vehicles typically cost more to insure due to higher repair/replacement costs and greater potential for damage in an accident.

- Cargo Hauled: Hauling general freight is less expensive to insure than hazardous materials, refrigerated goods, or other high-risk cargo.

- Radius of Operation: Local operations generally have lower premiums than regional or long-haul routes that cross state lines, which increase risk.

- Driver Experience and Record: This is a major factor. Experienced drivers with clean records are considered lower risk and can significantly reduce premiums.

- Claims History: A history of frequent or costly claims will increase your premiums, while a clean loss history can earn you discounts.

- Coverage Limits and Deductibles: Higher liability limits increase your premium, while higher deductibles can lower it. You must balance cost with adequate protection.

- State and Federal Requirements: Each state has minimum liability limits. The FMCSA also requires certain coverages for interstate travel. You can learn more from the Federal Motor Carrier Safety Administration (FMCSA).

How to Lower Your Commercial Trucking Insurance Costs

Here are some best practices we recommend to help you get more favorable commercial truck insurance quotes:

- Implement a Safety Program: Proactive safety measures, like regular vehicle maintenance and defensive driving courses, demonstrate a commitment to risk reduction.

- Hire Experienced Drivers: A team of responsible drivers with clean records is your best asset. Rigorous hiring and training practices can lower your rates.

- Maintain Good Driving Records: Fewer accidents and violations mean lower premiums over time.

- Increase Deductibles: If you have a solid emergency fund, a higher deductible can lower your annual premium.

- Pay Premium in Full: Many carriers offer a discount if you pay your annual premium upfront.

- Bundle Policies: Bundling with other business insurance policies (like general liability) can sometimes lead to discounts.

- Use Telematics: Some insurers offer discounts for using telematics devices that monitor and encourage safe driving behavior.

Beyond the Basics: Specialized and Optional Coverages

While core coverages form the foundation, commercial truck insurance quotes can be custom with specialized and optional coverages to close potential gaps and protect your business from its unique risks.

Essential Coverages for Owner-Operators

Owner-operators often face a unique set of circumstances. Here are some coverages designed for them:

- Non-Trucking Liability (NTL): Covers your truck when used for personal reasons while not under dispatch for a motor carrier. It protects against third-party bodily injury and property damage claims.

- Bobtail Insurance: Similar to NTL, this covers your semi-truck when it’s driven without a trailer (“bobtailing”) and not under dispatch.

- Occupational Accident Insurance (OAI): An alternative to workers’ compensation for independent contractors, OAI provides benefits for medical expenses, disability, and accidental death if you’re injured on the job.

For more in-depth information custom for owner-operators, please visit our page on owner-operator semi truck insurance.

Important Add-Ons for Trucking Businesses

Here are some additional coverages that provide crucial protection for many trucking operations:

- Trailer Interchange Coverage: If you haul trailers you don’t own under a written agreement, this covers physical damage to those non-owned trailers while in your possession.

- Hired and Non-Owned Auto (HNOA): Protects your business from liability if you use rented vehicles or if an employee uses their personal vehicle for business errands.

- Business Interruption Insurance: If a covered event halts your operations, this can cover lost income and ongoing expenses until you’re running again.

- Pollution Liability: This helps with cleanup costs, legal fees, and fines associated with spills or pollution caused by your operations.

- General Liability Insurance: Protects your business from non-auto risks, such as slip-and-fall accidents at your premises or property damage caused by your operations.

Frequently Asked Questions about Commercial Truck Insurance

We often get asked similar questions about commercial truck insurance quotes and policies. Here are some of the most common ones.

Is commercial truck insurance mandatory?

Yes, commercial truck insurance is mandatory. Operating without it is illegal and can result in severe penalties like fines and suspension of your operating authority.

- Federal Requirements (FMCSA): For interstate trucking, the FMCSA sets minimum liability limits, often from $750,000 to $5,000,000, depending on your cargo.

- State-Specific Laws: Each state has its own minimum insurance requirements. For example, South Carolina requires minimums of $25,000 per person, $50,000 per accident, and $25,000 for property damage.

It’s crucial to meet both federal and state requirements for your specific operations. We can help you steer the nuances in your operating regions.

For state-specific requirements, you can check out our resources:

- South Carolina business auto requirements

- Florida business auto requirements

- Virginia business auto requirements

- North Carolina business auto requirements

- Georgia business auto requirements

What is the difference between individual and fleet insurance?

It’s quite straightforward:

- Individual Policy: This policy covers a single commercial truck, ideal for owner-operators or small businesses with one vehicle.

- Fleet Insurance: If your business operates multiple vehicles—typically five or more—you may qualify for fleet insurance. This covers your entire fleet under a single policy, offering simplified management, potential cost savings, and consistent coverage across all vehicles.

Fleet insurance is a great way to streamline your insurance needs as your business grows.

What additional benefits can a policy include?

Beyond core coverages, many commercial truck insurance quotes can include additional benefits for greater protection:

- Roadside Assistance: Provides services like towing, fuel delivery, battery boosts, and tire changes for your commercial truck.

- Downtime Coverage / Rental Reimbursement: If your truck is out of commission due to a covered claim, this can help cover lost income or the cost of a rental to keep your business moving.

- Replacement Cost Coverage: For newer vehicles, this ensures that if your truck is totaled or stolen, you’ll receive funds to replace it with a new vehicle, not its depreciated value.

- Good Record Protection: Some policies offer “loss forgiveness,” meaning your premium won’t increase after a minor accident.

- Solution Programs: For businesses that may not qualify for standard insurance due to unique risks, some insurers offer specialized programs to provide necessary coverage.

Secure Your Business and Get on the Road with Confidence

Navigating commercial truck insurance quotes can seem daunting, but it doesn’t have to be. We’ve walked through why it’s critical, what core coverages entail, how it differs from personal auto insurance, what vehicles qualify, and the key factors influencing costs. We’ve also explored how to get the best quotes and even some valuable optional coverages.

Your trucks are more than just vehicles; they’re the engine of your business. Protecting them with comprehensive, custom insurance isn’t just a legal requirement—it’s a smart business decision that safeguards your investments, your livelihood, and your peace of mind.

The key takeaway? Don’t settle for a one-size-fits-all approach. Getting custom coverage is paramount. This is where the value of an independent insurance agency like Select Insurance Group truly shines. With over 30 years of experience and access to quotes from more than 40 carriers, we don’t just sell policies; we partner with you to understand your unique operations, mitigate your risks, and secure the most competitive rates without compromising on coverage.

We’re here to help you get on the road with confidence, knowing your business is well-protected.