Why Finding Affordable Auto Insurance in North Carolina Matters

Affordable auto insurance North Carolina is within reach for most drivers, with the state averaging around $1,165 per year for full coverage—well below the national average. However, your actual rate can vary dramatically based on where you live, your driving record, and the coverage you choose.

Quick Answer: How to Find Affordable Auto Insurance in North Carolina

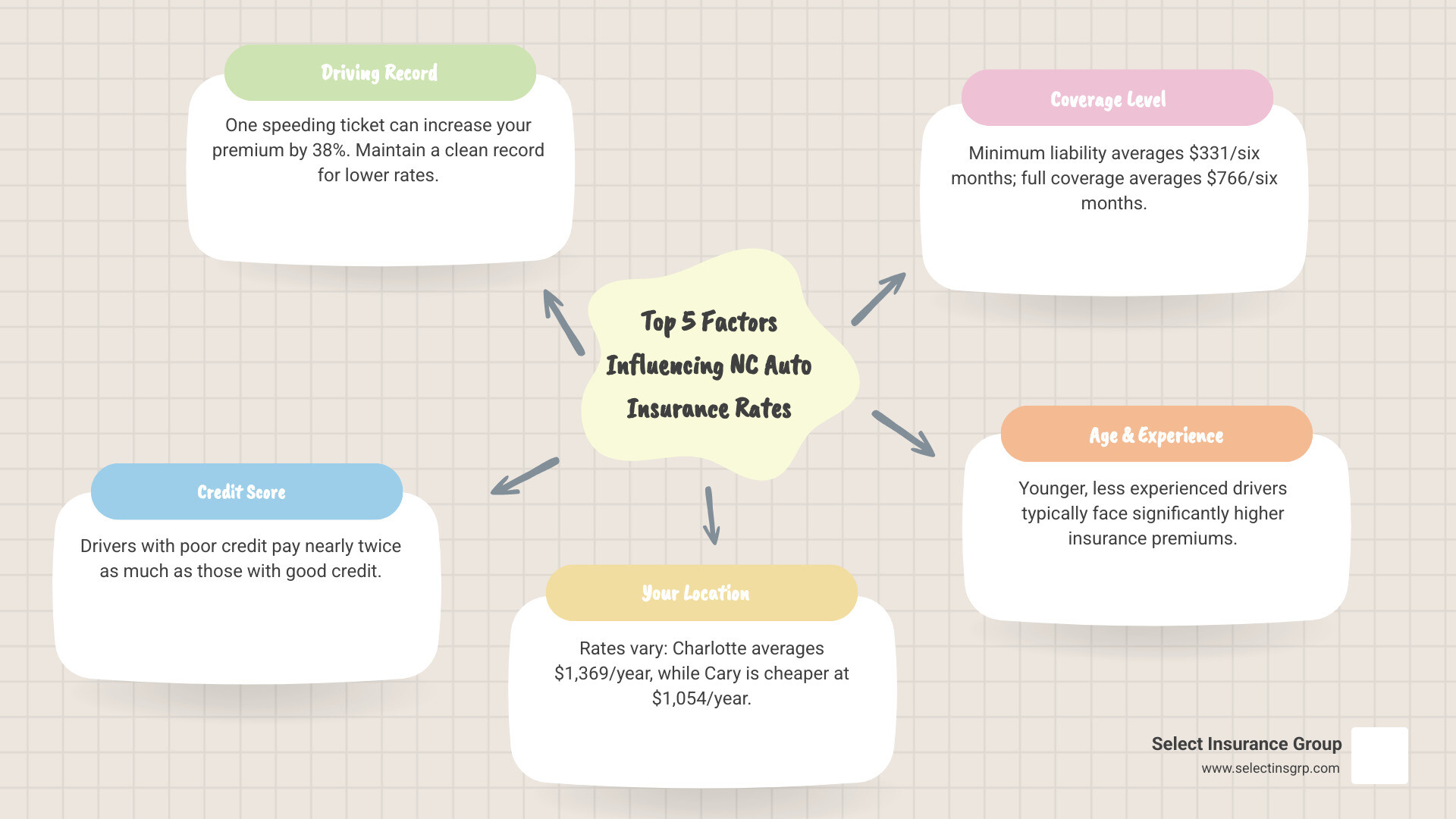

- Compare quotes from multiple insurers – Rates can differ by over $5,000 per year for the same coverage

- Choose the right coverage level – Minimum liability averages $331 per six months, while full coverage averages $766

- Maintain a clean driving record – One speeding ticket can increase your premium by 38%

- Improve your credit score – Drivers with poor credit pay nearly twice as much as those with good credit

- Consider your location – Cities like Cary ($1,054/year) are cheaper than Charlotte ($1,369/year)

- Work with an independent agent – Access to 20+ carriers helps you find the best rate

North Carolina drivers face unique considerations that directly impact their insurance costs. The state’s contributory negligence law means if you’re even 1% at fault in an accident, you can’t collect on a liability claim—making comprehensive coverage more important here than in many other states. Additionally, the North Carolina Safe Driver Incentive Plan assigns insurance points for violations that can increase your rates by 40% to 340%.

The state’s minimum coverage requirements are also changing. While North Carolina currently requires 30/60/25 liability limits, these will increase to 50/100/25 in July 2025, which will likely raise premiums for drivers carrying only minimum coverage.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group, and over the past three decades I’ve helped thousands of drivers across the Southeast find affordable auto insurance North Carolina residents can rely on. Our agency shops over 20 carriers to find competitive rates while ensuring you have the protection you need for your specific situation.

Know your affordable auto insurance North Carolina terms:

Understanding North Carolina Car Insurance Costs

When we talk about affordable auto insurance North Carolina, it’s crucial to understand the baseline costs and what influences them. North Carolina is often considered a relatively affordable state for car insurance compared to the national average. However, “affordable” is a subjective term, and what one driver pays can be vastly different from another, even within the same state.

Our rates for full coverage auto insurance in North Carolina typically average around $1,165 per year. This is significantly lower than the national average, making the Tar Heel State a pleasant surprise for many drivers. However, this is just an average, and your specific premium will hinge on a variety of factors, from the type of coverage you choose to where you park your car at night.

What is the Average Cost of Car Insurance in North Carolina?

Let’s break down the numbers to give you a clearer picture of what you might expect for affordable auto insurance North Carolina:

- Statewide Average Cost: North Carolina drivers pay an average of $1,165 annually for auto insurance. This makes us about 34% cheaper than the national average for full coverage.

- Average Full Coverage Premium: If you opt for full coverage, which typically includes liability, collision, and comprehensive insurance, the average cost is around $766 for a six-month policy, or about $109 per month.

- Average Minimum Liability Premium: For those seeking only the state-mandated minimum liability coverage, the average cost is approximately $331 for a six-month policy, or about $44 per month.

- Recent Rate Increases: These costs aren’t static. We’ve seen average annual auto insurance costs in North Carolina increase by $72 in the past year. Furthermore, the North Carolina Rate Bureau requested a rate increase of approximately 22.6%, which, if approved, would become effective later in 2025. This means that while rates are currently favorable, they are subject to change.

These figures illustrate that while North Carolina is generally more budget-friendly for car insurance, your choices in coverage significantly impact your annual outlay.

How Your Location in NC Affects Your Premium

Just like how the price of sweet tea varies across the state, your car insurance premium can change depending on which North Carolina city or town you call home. Why the discrepancy? Insurance companies assess risk based on several geographical factors:

- Why Cities Cost More: Densely populated urban areas typically have higher rates of traffic accidents, vehicle theft, and vandalism. More cars on the road mean a higher chance of a fender bender, and unfortunately, crime rates tend to be higher in urban centers. This increased risk translates to higher premiums for city dwellers.

- Higher Rates in Charlotte: As our state’s largest city, Charlotte often sees higher average premiums. For instance, Charlotte’s average annual sample premium was $1,369, and some data shows it can be as high as $140 per month for full coverage.

- Cheaper Rates in Cary and Winston-Salem: On the flip side, some cities enjoy rates below the statewide average. Drivers in Cary, for example, pay an average of $1,054 annually, and Winston-Salem drivers pay around $1,058. Wilmington ($1,145) and High Point ($1,159) also come in below the state average.

- Rural Area Benefits: If you live in one of North Carolina’s charming rural areas, you might find even more savings. Approximately 34% of North Carolina’s residents live in rural areas, which often translates to lower insurance costs due to less traffic, lower crime rates, and generally fewer drivers.

Understanding these geographical nuances can help you anticipate your costs and understand why your neighbor might pay a different rate for affordable auto insurance North Carolina than you do. For more specific information on how location impacts your rates, you can explore our resources on where in North Carolina is Auto Insurance the Least Expensive.

How Demographics and Personal Factors Influence Rates

Beyond your address, a handful of personal characteristics and decisions play a starring role in shaping your car insurance rates. These factors help insurers predict how likely you are to file a claim.

- Age Impact: Age is a significant factor, particularly for younger drivers. Inexperienced drivers, especially teens, statistically have more accidents, leading to higher premiums.

- Teen Driver Costs: Finding affordable auto insurance North Carolina for teens can be challenging. A 17-year-old male or female driver, for example, might see an average rate of $1,778 per year. Teen drivers overall can pay around $1,800 per six-month period, which is 235% above the state average.

- Young Adult Rates: As drivers gain experience, rates tend to drop. For young adults around 25 years old, average premiums might be closer to $827 per year.

- Adult Rates: A 35-year-old male or female driver with a clean record could see an average premium of $807 annually.

- Senior Driver Rates: Rates generally remain stable through middle age but might slightly increase for seniors as they enter their later years. A 60-year-old driver could average around $676 per year.

- Marital Status Benefits: We often find that married drivers pay less for car insurance than single drivers. Insurers generally view married individuals as more stable and less prone to risky driving behaviors.

- Credit History Influence: In North Carolina, insurers are permitted to use your credit history to help determine your rates. They use a “credit-based insurance score” to estimate the likelihood of you filing a claim. Drivers with poor credit can pay nearly twice as much for full coverage as those with good credit. For example, some data shows drivers with poor credit paying around $1,086 per year, while others report it can be as high as $70 per month.

- Vehicle Type and Safety Features: The car you drive also matters. More expensive vehicles, sports cars, or those with higher repair costs will typically have higher insurance premiums. Conversely, cars with excellent safety ratings and anti-theft devices can qualify for discounts, helping you secure more affordable auto insurance North Carolina.

Navigating North Carolina’s Unique Insurance Laws

North Carolina has some distinct laws and regulations that significantly impact your car insurance. Understanding these isn’t just about compliance; it’s about protecting your finances and ensuring you truly have affordable auto insurance North Carolina for your needs.

North Carolina’s Minimum Car Insurance Requirements

Every driver in North Carolina must carry a minimum amount of liability and uninsured/underinsured motorist (UM/UIM) coverage. These requirements are in place to ensure that victims of accidents can receive compensation, but they are also subject to change.

- Current 30/60/25 Liability Limits: Currently, North Carolina requires drivers to maintain:

- $30,000 for bodily injury per person

- $60,000 for bodily injury per accident

- $25,000 for property damage per accident

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: In addition to liability, North Carolina also requires uninsured and underinsured motorist coverage at the same 30/60/25 limits. This is a crucial protection, as it covers you if you’re hit by a driver who either has no insurance or not enough insurance to cover your damages.

- Upcoming 2025 Increase to 50/100/25: Mark your calendars! In July 2025, North Carolina’s minimum required auto insurance coverage will increase to:

- $50,000 for bodily injury per person

- $100,000 for bodily injury per accident

- $25,000 for property damage per accident

This change will automatically update policies for many drivers and will likely lead to an increase in premiums for those carrying only minimum coverage.

- Proof of Insurance: You must always be able to prove you have car insurance in North Carolina. This can typically be done with your insurance card, a digital copy on your phone, or other official documentation from your insurer.

The North Carolina Safe Driver Incentive Plan (NCSDIP)

North Carolina doesn’t use the SR-22 system like many other states. Instead, we have our own unique way of encouraging safe driving and adjusting insurance rates: the North Carolina Safe Driver Incentive Plan (NCSDIP).

- Insurance Point System: The NCSDIP assigns “insurance points” for certain driving infractions. The more serious the violation, the more points you receive.

- How Points Increase Rates: These points aren’t just for bragging rights (or lack thereof). Depending on the number of points you accumulate within a specific period, your car insurance rate can increase dramatically, anywhere from 40% to 340%. This plan acts as a strong financial incentive for being a safe driver.

- Common Violations and Points: While the specific points vary, violations like speeding tickets, at-fault accidents, and DUIs will add points to your record, making your insurance significantly more expensive.

For a detailed breakdown of how different violations affect your rates under this plan, you can refer to the North Carolina Safe Driver Incentive Plan.

Understanding Contributory Negligence in North Carolina

Here’s where North Carolina’s laws can get a little tricky, and it’s a major reason why we often recommend more than just minimum coverage for affordable auto insurance North Carolina residents.

- 1% Fault Rule Explained: North Carolina operates under a strict “contributory negligence” law. This means that if you are involved in an accident and are found to be even 1% at fault, you cannot collect on a liability claim from the other driver. Yes, you read that right – even a tiny bit of fault can prevent you from recovering damages.

- Impact on Liability Claims: This law has significant implications. If you’re injured or your vehicle is damaged in an accident, and a court determines you contributed even slightly to the cause, you could be left footing your own bills, even if the other driver was largely at fault.

- Importance of Collision Coverage: This is why collision coverage is so vital in North Carolina. If you’re found to be at fault (even 1%), your collision coverage would pay for the damage to your own vehicle, regardless of the contributory negligence rule. Without it, you could be out of luck.

- Why UM/UIM is Critical: Given the strict contributory negligence rule, and the fact that many drivers only carry minimum coverage (or none at all!), uninsured/underinsured motorist (UM/UIM) coverage becomes even more critical. It protects you and your passengers from drivers who are either uninsured or whose insurance is insufficient to cover your losses, providing a crucial safety net.

For further guidance on what to do after an accident and how this law might affect you, consult the NC Department of Insurance guidance After an Accident.

How to Find Affordable Auto Insurance in North Carolina

Finding truly affordable auto insurance North Carolina requires a bit of savvy shopping and an understanding of your coverage needs. It’s not just about finding the lowest price, but the best value that protects you adequately without breaking the bank.

Strategies for Finding Affordable Auto Insurance in North Carolina

We believe that being an informed consumer is your best tool for saving money. Here are our top strategies:

- Comparing Quotes: This is hands down the most effective way to find affordable auto insurance North Carolina. Rates can vary wildly between companies for the exact same coverage—sometimes by thousands of dollars annually! We recommend comparing quotes from multiple insurers at least once a year, or whenever your circumstances change (e.g., you buy a new car, move, or get married).

- Working with an Independent Agent: As an independent agency, we at Select Insurance Group shop over 40 carriers to find you the best rates and coverage options. This saves you time and ensures you’re seeing a broad spectrum of what’s available, rather than just quotes from a single company. We act as your advocate, finding policies that fit your budget and your life.

- Maintaining a Clean Driving Record: This might sound obvious, but a clean driving record is your golden ticket to lower premiums. Drivers with a clean record can enjoy significantly lower rates. For example, some companies offer average premiums as low as $770 per year for drivers with no infractions. Avoiding accidents and tickets keeps your NCSDIP points low, preventing those steep rate increases.

- Leverage Discounts: Insurance companies offer a treasure trove of discounts. Always ask your agent about all available options:

- Multi-Policy Discount: Bundling your auto insurance with home, renters, or other policies.

- Multi-Vehicle Discount: Insuring more than one car with the same company.

- Good Student Discount: For young drivers maintaining a certain GPA.

- Safe Driver/Good Driver Discount: For drivers with no recent accidents or violations.

- Defensive Driving/Driver Training Discount: Completing approved safety courses.

- New Car/Safe Car Discount: For vehicles with advanced safety features or that are less prone to theft.

- Paperless/Online Documents Discount: Signing up for electronic communications.

- Pay-in-Full Discount: Paying your annual or semi-annual premium upfront.

- Homeowners Discount: Simply owning a home can sometimes qualify you for a discount.

- Military Discount: For active-duty military personnel, veterans, and their families.

- Choosing a Higher Deductible: If you’re comfortable paying more out-of-pocket in the event of a claim, choosing a higher deductible for your collision and comprehensive coverage can significantly lower your premium. Just make sure you can realistically afford that deductible if an incident occurs.

- Annual Policy Review: Your life changes, and so should your insurance. Review your policy annually with your agent to ensure your coverage still meets your needs and that you’re getting all eligible discounts.

Choosing the Right Coverage: Minimum vs. Full Coverage

Deciding between minimum liability and full coverage is a critical decision when seeking affordable auto insurance North Carolina. While minimum coverage is cheaper upfront, it carries significant risks, especially given North Carolina’s unique laws.

- Risks of Minimum-Only Policies: While 38% of North Carolina drivers opt for minimum liability coverage only, this choice leaves you vulnerable. Minimum coverage only pays for damages and injuries you cause to others. It does not cover your own vehicle or medical expenses if you’re at fault, or if the other driver is uninsured.

- Financial Exposure in At-Fault Accidents: With North Carolina’s contributory negligence law, if you’re found even 1% at fault, you cannot collect from the other driver’s liability insurance. In this scenario, if you only have minimum liability, you’d be responsible for all damages to your own vehicle and any medical expenses. This can quickly turn a seemingly affordable auto insurance North Carolina policy into a financial nightmare.

- Benefits of Full Coverage: Full coverage typically includes:

- Liability: Covers damages and injuries you cause to others.

- Collision: Pays for damage to your own vehicle resulting from an accident, regardless of fault. This is especially important in North Carolina due to contributory negligence.

- Comprehensive: Covers damage to your vehicle from non-collision events like theft, vandalism, fire, natural disasters, or hitting an animal.

- Uninsured/Underinsured Motorist (UM/UIM): Protects you if you’re hit by a driver without enough insurance.

About 62% of North Carolina drivers choose full coverage, recognizing its importance in protecting their assets. If you have significant assets, full coverage helps protect them from lawsuits. If you have a car loan or lease, full coverage is almost always required by your lender.

- Additional Coverages to Consider: Beyond the basics, we recommend considering:

- Medical Payments (MedPay): Covers medical expenses for you and your passengers, regardless of fault.

Personal Injury Protection (PIP): Similar to MedPay but can also cover lost wages and other non-medical expenses (though less common in NC than other states). - Rental Reimbursement: Pays for a rental car while your vehicle is being repaired after a covered claim.

- Gap Coverage: If your car is totaled, this pays the difference between what you owe on your loan/lease and the car’s actual cash value.

- Roadside Assistance: For breakdowns, flat tires, or lockouts.

To dig deeper into specific coverage options and tailor a policy to your needs, explore our comprehensive guide on North Carolina Auto Insurance.

- Medical Payments (MedPay): Covers medical expenses for you and your passengers, regardless of fault.

Finding Affordable Auto Insurance in North Carolina with a Poor Driving Record

Life happens, and sometimes our driving records aren’t as pristine as we’d like. However, a less-than-perfect record doesn’t mean affordable auto insurance North Carolina is out of reach entirely. It just requires more diligent searching.

- Rate Impact of Tickets and Accidents: Any traffic violation or at-fault accident will likely increase your premiums.

- Speeding Ticket: One speeding ticket can cause your rates to increase by an average of 38%. However, some insurers might offer lower increases. For example, some data shows rates for drivers with one speeding ticket averaging $1,237 annually with certain providers.

- At-Fault Accident: An at-fault accident can significantly hike your rates, potentially increasing them to as much as $1,843 per year. Some insurers are more forgiving, with rates averaging $1,131 annually after one accident.

- DUI Consequences: A DUI offense is one of the most severe infractions and will drastically impact your insurance costs. A DUI in North Carolina can increase your annual car insurance premium by a staggering 326%, leading to an average of $6,538 per year. Some insurers specialize in offering more competitive rates even after a DUI, with some averages around $2,857 per year.

- High-Risk Driver Challenges: Drivers with multiple tickets, accidents, or a DUI are often classified as “high-risk.” Traditional insurance companies may be hesitant to offer them coverage or will do so at very high rates.

- The North Carolina Reinsurance Facility as an Option: If you’re struggling to find coverage through standard channels because of your driving record, North Carolina has a solution: the North Carolina Reinsurance Facility. This program helps ensure that high-risk drivers can still obtain the state-mandated minimum liability coverage. It’s a crucial safety net for those who might otherwise be uninsurable. You can find more detailed information on the reinsurance facility.

Frequently Asked Questions about NC Auto Insurance

We hear a lot of questions from North Carolina drivers about their auto insurance. Here are some of the most common ones we address to help you find affordable auto insurance North Carolina.

How much car insurance do I need in North Carolina?

This is a two-part answer, covering legal requirements and practical recommendations:

- Legal Minimums: By law, you need 30/60/25 liability and uninsured/underinsured motorist (UM/UIM) coverage. These limits increase to 50/100/25 in July 2025.

- Recommended Coverage: We recommend higher limits to protect your assets, especially given NC’s contributory negligence law. If you have a car loan or lease, your lender will require full coverage, which includes collision and comprehensive insurance.

What happens if I can’t find a company to insure me in North Carolina?

If you’re considered a high-risk driver and struggle to find coverage, North Carolina has a safety net: the North Carolina Reinsurance Facility. This program ensures that every licensed driver can get at least the state’s minimum required auto insurance. An independent agent can help you apply for coverage through the Facility.

How does a DUI affect car insurance in North Carolina?

A DUI is a severe offense that dramatically increases your insurance rates. In North Carolina, a DUI can increase your annual premium by an average of 326%, to an average of $6,538. The conviction adds a high number of points under the North Carolina Safe Driver Incentive Plan (NCSDIP), and the rate increase can last for three to five years or more, depending on the insurer.

Get the Right Coverage for Your Needs

Navigating car insurance, especially when looking for affordable auto insurance North Carolina, can feel like a maze. But with the right knowledge and strategies, you can find a policy that offers both protection and peace of mind without overpaying.

We’ve covered the average costs, how personal factors and your location influence rates, and the unique legal landscape of North Carolina, including the Safe Driver Incentive Plan and the critical contributory negligence law. We’ve also explored smart shopping strategies, the importance of choosing appropriate coverage levels, and options for high-risk drivers.

Understanding North Carolina’s specific laws, like contributory negligence and the upcoming increase in minimum limits, is paramount. These aren’t just bureaucratic details; they directly affect your financial exposure on the road.

Comparing quotes from multiple insurers is your most powerful tool. And that’s where we come in. As an independent agency, Select Insurance Group leverages over 30 years of experience and our relationships with over 40 carriers to do the heavy lifting for you. We’re dedicated to finding you competitive rates and ensuring you have the right coverage for your unique situation.

Don’t let the complexities of car insurance leave you unprotected or overpaying. Let us help you find the affordable auto insurance North Carolina residents deserve.