Why Businesses Can’t Afford to Ignore This Critical Coverage Gap

Hired and non owned automobile coverage is liability insurance that protects your business when employees use personal vehicles for work or when your company rents vehicles. It covers third-party bodily injury and property damage, but not physical damage to the employee’s or rented vehicle. This coverage is crucial because your business can be held liable for accidents caused by employees driving for work, even in cars you don’t own. It typically acts as secondary coverage after the vehicle owner’s personal insurance is exhausted.

If you think your employees’ personal auto insurance will protect your business, you’re wrong. That gap in coverage could cost you everything.

Consider this: one in eight U.S. motorists is uninsured, and many insured drivers carry only minimum state limits. Meanwhile, the average verdict in major personal injury cases has more than tripled from $64 million to $214 million between 2015 and 2019. Relying on an employee’s policy is a massive gamble.

Modern businesses often rely on employee-owned vehicles or rentals to save on fleet costs, but this creates a dangerous liability exposure. Commercial auto policies don’t cover vehicles your business doesn’t own, and personal auto policies typically exclude business use. This leaves a gap that can expose your business to devastating financial losses.

This is where hired and non owned automobile coverage becomes essential. As D.J. Hearsey, founder and CEO of Select Insurance Group, I’ve used my three decades of industry expertise to help countless businesses secure this proper coverage. Throughout this guide, I’ll walk you through everything you need to know to protect your business from this often-overlooked liability gap.

Handy hired and non owned automobile coverage terms:

Understanding Hired and Non-Owned Auto Insurance: The Basics

Hired and non owned automobile coverage is a crucial but often overlooked part of commercial insurance. It safeguards your business from liabilities when vehicles you don’t own are used for business operations. This coverage acts as a safety net where traditional policies fall short and can often be added as an endorsement to a general liability or commercial auto policy.

What is hired and non-owned auto insurance?

Hired and non owned automobile coverage (HNOA) is liability insurance protecting your business from losses involving vehicles it uses but doesn’t own, such as rented, leased, or employee-owned vehicles used for work.

Specifically, HNOA provides coverage for:

- Third-party bodily injury: If an employee causes an accident while driving a non-owned vehicle for business, and another person is injured, HNOA can cover the medical expenses and other related costs for that injured party.

- Third-party property damage: Should that accident also result in damage to another person’s vehicle or property, HNOA can cover the repair or replacement costs.

- Legal defense costs: In the event of a lawsuit from such an accident, HNOA coverage can help with attorney fees, court costs, and settlements or judgments against your company.

This is liability coverage, protecting your company’s assets from claims made by others. For more detailed insights, explore our guide on non-owner auto insurance.

The Difference Between ‘Hired’ and ‘Non-Owned’ Auto Coverage

While often grouped together, ‘hired’ and ‘non-owned’ refer to two distinct scenarios. Understanding the difference is key to assessing your needs.

Hired Autos: These are vehicles your business leases, hires, rents, or borrows for specific business purposes. Examples include:

- Renting a car for a business trip.

- Leasing a van to transport equipment to a job site.

- Borrowing a truck to move inventory.

Notably, vehicles rented or borrowed from your employees or partners are generally not considered hired autos.

Non-Owned Autos: This category refers to vehicles owned by your employees that are used for company business. Examples include an employee:

- Running to the bank or post office for the business.

- Driving their own vehicle to meet clients.

- Using their personal car to travel to a project site or pick up supplies.

When an employee drives their personal car for a business task, it’s considered a “non-owned auto” in the context of this coverage.

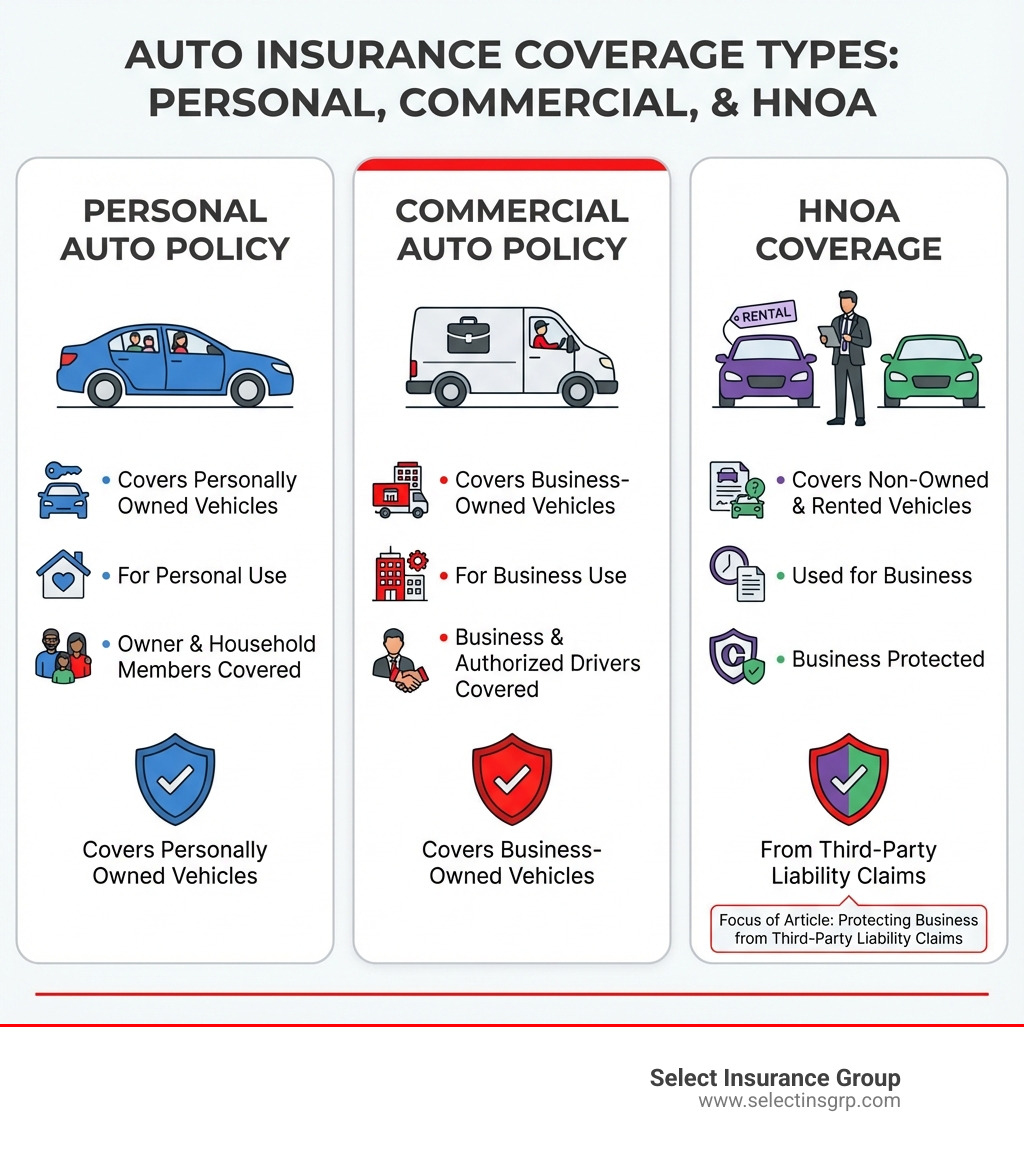

How HNOA Differs from Commercial and Personal Auto Policies

Don’t assume your commercial auto policy or your employees’ personal policies will cover these situations. Both typically have significant gaps that hired and non owned automobile coverage is designed to fill.

Let’s break down the key differences:

| Feature | Personal Auto Policy | Commercial Auto Policy | Hired and Non-Owned Auto (HNOA) Coverage |

|---|---|---|---|

| Vehicle Ownership | Personally owned vehicles | Business-owned vehicles | Vehicles rented, leased, borrowed, or employee-owned |

| Primary Use | Personal and household use | Business operations (e.g., company fleet, delivery trucks) | Business use of non-owned or rented vehicles |

| Who is Covered | Owner, household members, and authorized personal drivers | Business entity and authorized employees driving company vehicles | The business entity (for third-party liability) |

| Typical Exclusions | Business use (especially for hire/delivery), commercial activities | Non-owned vehicles, personal use of company vehicles | Physical damage to the non-owned vehicle, employee injuries, commuting, personal errands |

| Purpose | Protects individuals for personal driving risks | Protects businesses for their owned vehicle risks | Protects businesses for liability arising from non-owned vehicle use |

Personal auto policies often exclude business use, while standard commercial auto policies only cover vehicles your business owns. HNOA is vital because it bridges this critical gap. For businesses operating in Virginia, understanding specific auto insurance needs is paramount; learn more about Virginia business auto insurance.

Why Your Business Needs Hired and Non-Owned Automobile Coverage

Many businesses rely on employees’ personal vehicles or rentals to save costs, but this creates a significant risk: vicarious liability. If an employee has an accident while driving for work, your business can be held responsible for damages, leading to crippling lawsuits and financial risk. Hired and non owned automobile coverage shields your company from these liabilities.

Who Needs This Specialized Coverage?

If your employees ever use their personal vehicles for work, or if your business ever rents or borrows a vehicle for company tasks, you likely need hired and non owned automobile coverage. The scenarios are more common than you might think:

- Restaurants with delivery services: Even if drivers use their personal cars.

- Consultants, real estate agents, or salespeople: Regularly visiting clients or properties in their own vehicles.

- Construction contractors or trade professionals: Sending employees to pick up supplies, deliver tools, or run errands to job sites.

- Service-based businesses: Technicians or caregivers traveling to appointments.

- Any office-based business: Where employees occasionally run to the bank, post office, or pick up office supplies.

This list is not exhaustive. If any employee uses their personal vehicle for any work-related task, even once a year, you have an exposure that HNOA can protect.

The Legal Doctrine of ‘Respondeat Superior’

The reason your business can be held liable for an employee’s accident in a non-owned vehicle lies in a legal principle known as Respondeat Superior, a Latin phrase meaning “let the master answer.” This doctrine holds an employer legally responsible for the wrongful acts of an employee if such acts occur within the scope of employment.

According to Cornell Law, this means your business can be held vicariously liable for your employee’s actions even if you didn’t directly cause the accident. If an employee is driving their personal car to a client meeting and causes an accident, the injured third party can sue both the employee and your business. This is why every business needs to take hired and non owned automobile coverage seriously.

Potential Liabilities Without Hired and Non-Owned Automobile Coverage

Ignoring hired and non owned automobile coverage creates a dangerous gap, leaving your business vulnerable to severe financial consequences:

- Insufficient employee policy limits: Many employees carry only state-minimum liability limits. In a serious accident, these are quickly exhausted, leaving your business to cover the rest.

- Uninsured or underinsured employees: Relying on employee policies is a gamble, as many drivers are uninsured or underinsured. If your employee is at fault and lacks proper coverage, your business will likely be the next target for compensation.

- Business assets at risk: Without HNOA, your company’s assets—bank accounts, property, and future earnings—could be seized to pay for judgments, medical bills, and legal costs.

- Paying for damages out-of-pocket: Imagine an employee causes an accident with $500,000 in damages and their policy only covers $50,000. Your business could be on the hook for the remaining $450,000.

- Catastrophic legal judgments: Jury awards can reach into the millions, presenting an existential threat to businesses unprepared for such liabilities.

The financial fallout from a single accident can be devastating, potentially leading to bankruptcy. For a broader understanding of liability in states like Florida, review information on Florida general liability.

Deconstructing HNOA: Coverage, Risks, and How It Works

Now that we understand why hired and non owned automobile coverage is so vital, let’s dive deeper into what it specifically covers and how it functions as a crucial safety net for your business. Think of it as an essential layer of protection that kicks in when other policies either don’t apply or have exhausted their limits.

What Specific Risks Does HNOA Insurance Cover?

Hired and non owned automobile coverage is designed to address the liability risks your business faces when non-owned vehicles are used for work. It primarily focuses on third-party claims, meaning claims made by people outside your business who are injured or whose property is damaged due to an accident involving a vehicle used for your business.

The specific risks typically covered include:

- Third-party bodily injury: If your employee, while driving their personal car for a work errand, causes an accident that injures another driver, passenger, or pedestrian, HNOA can cover their medical expenses, lost wages, and other related costs.

- Third-party property damage: In the same scenario, if the accident damages another vehicle, a building, or other property belonging to a third party, HNOA can cover the repair or replacement costs.

- Lawsuit settlements, attorney fees, and court costs: If your business is sued as a result of such an accident, HNOA coverage will help pay for your legal defense, including attorney fees, court costs, and any settlements or judgments awarded against your company.

- Accidents caused by employees: Whether your employee is driving their own car or a vehicle rented by your business, HNOA steps in to protect your company’s financial interests.

- Accidents in rented vehicles: If your business rents a vehicle for a business trip or to transport goods, and an accident occurs, HNOA can provide liability coverage for your company.

It’s important to distinguish that HNOA protects your business from liability, not necessarily the employee or the vehicle itself.

How does hired and non-owned auto insurance work with other policies?

This is a critical point of understanding: hired and non owned automobile coverage almost always provides secondary or excess coverage. It doesn’t typically act as the primary insurer.

Here’s how it generally works:

- Primary Coverage: In the event of an accident involving an employee’s personal vehicle used for business, the employee’s personal auto insurance policy is typically the primary coverage. This means their policy would respond first to pay for damages up to its liability limits.

- Rental Company’s Insurance: If the accident involves a rented vehicle, the rental car company’s insurance (or any optional coverage purchased by the driver/business at the time of rental) would usually be primary.

- HNOA as Secondary/Excess: Once the primary policy’s limits are exhausted, or if the primary policy denies the claim (e.g., due to a “business use” exclusion in a personal policy), then your business’s hired and non owned automobile coverage would kick in as secondary or excess coverage. It covers the remaining liability up to its own limits, protecting your business from the financial gap.

Example Scenario: Let’s say your employee, Sarah, uses her personal car to deliver a package for your business. She causes an accident that results in $100,000 in third-party bodily injury and property damage. Sarah’s personal auto policy has a liability limit of $50,000.

- Sarah’s personal policy would pay the first $50,000.

- Your business’s HNOA policy would then cover the remaining $50,000, protecting your company from having to pay that amount out-of-pocket.

This tiered approach ensures that your business has a crucial layer of protection when faced with significant claims.

Common Exclusions and Misconceptions

Despite its vital role, hired and non owned automobile coverage isn’t a silver bullet, and there are common misconceptions about what it covers. Understanding its limitations is just as important as knowing its benefits.

Typical Exclusions and Limitations:

- Physical damage to the non-owned vehicle: HNOA typically does not pay for damage to the employee’s personal car or the rented vehicle itself. It’s strictly for third-party liability. If your employee’s car is damaged, their personal collision coverage would apply (if they have it). For rented vehicles, you might need “hired auto physical damage” coverage, often purchased separately or as an add-on.

- Employee injuries: Injuries to your employee, the driver of the non-owned vehicle, are generally not covered by HNOA. These would typically fall under your workers’ compensation policy, if applicable.

- Commuting to work: HNOA does not cover accidents that occur while employees are commuting to and from their regular place of work. This is considered personal travel.

- Personal errands: If an employee uses a company-rented vehicle or their personal car for a purely personal errand during the workday, HNOA will generally not cover any resulting accident. The accident must occur within the scope of their employment.

Common Misconceptions:

- “My employee’s insurance is enough.” This is perhaps the most dangerous misconception. As discussed, personal policies often have low limits and may deny claims if the vehicle was being used for business. With one in eight U.S. motorists uninsured (and over 20% in some states), relying on your employee’s policy is a risky strategy that can leave your business exposed.

- “My commercial auto policy covers everything.” As highlighted earlier, standard commercial auto policies are designed for vehicles owned by your business, not those that are hired, rented, or employee-owned.

- “It’s too expensive.” The cost of HNOA is typically a fraction of what a major lawsuit or “nuclear verdict” could cost your business. It’s an investment in your company’s financial stability.

The Rising Threat of ‘Nuclear Verdicts’ and Proactive Risk Management

In today’s legal landscape, businesses face an alarming trend: “nuclear verdicts.” These are extreme jury awards, often exceeding $10 million, that can have catastrophic consequences for companies, regardless of their size. This phenomenon presents an even greater risk for companies with hired and non owned automobile coverage exposures, as the potential for massive liability judgments underscores the critical need for robust insurance protection.

How HNOA Protects Against ‘Nuclear Verdicts’

Nuclear verdicts are not just a catchy term; they represent a significant shift in litigation outcomes. According to the Travelers Institute, the average verdict in the National Law Journal’s Top 100 Verdicts more than tripled from $64 million to $214 million between 2015 and 2019. These massive awards often stem from severe bodily injury or wrongful death claims, coupled with allegations of corporate negligence.

For businesses with hired and non owned automobile coverage exposures, a nuclear verdict could mean:

- Exceeding primary policy limits: If an employee causes a severe accident leading to a multi-million dollar judgment, their personal auto policy limits (and even your commercial auto policy’s underlying limits) will be quickly exhausted.

- Protecting business solvency: HNOA, especially when combined with a robust commercial umbrella policy, provides additional layers of liability coverage. This extra protection can be the difference between your business surviving a catastrophic claim or being forced to close its doors. An umbrella policy extends the limits of your underlying liability coverages, including HNOA, offering protection against those “runaway” jury awards.

- Covering legal defense: Beyond the settlement or judgment, the costs of defending against a multi-million dollar lawsuit can be astronomical. HNOA coverage helps with these legal expenses, regardless of the verdict outcome.

In an era where jury awards are escalating rapidly, having high liability limits through HNOA and umbrella coverage is not just a good idea—it’s a necessity for protecting your business’s future.

Factors That Influence the Cost of Your Policy

The cost of hired and non owned automobile coverage is not one-size-fits-all. Several factors come into play when calculating your premium, reflecting the unique risk profile of your business:

- Number of employees driving: The more employees who use personal or rented vehicles for business, the higher the exposure, and potentially the higher the cost.

- Frequency of vehicle use: Businesses where employees drive for work daily (e.g., delivery services, sales teams) will generally face higher premiums than those where it’s an occasional occurrence.

- Type of business: Certain industries inherently carry more risk. A restaurant with delivery drivers, for instance, typically faces higher exposure than a consulting firm where employees occasionally visit clients.

- Vehicle types used: While HNOA doesn’t cover physical damage to the non-owned vehicle, the type of vehicle (e.g., a small sedan vs. a large truck rented for business) can influence perceived liability risk.

- Required coverage limits: Higher liability limits, especially important in the age of nuclear verdicts, will naturally lead to higher premiums.

- Claims history: A history of previous auto-related claims can indicate a higher risk and impact your rates.

- Location of business: Insurance costs can vary by state and even by specific geographic areas, influenced by factors like traffic density, accident rates, and local legal environments.

Steps to Mitigate Risk Beyond Insurance

While hired and non owned automobile coverage is an indispensable safety net, proactive risk management can significantly reduce the likelihood of an accident and, consequently, a costly claim. Beyond purchasing insurance, we recommend businesses take the following steps:

- Develop a comprehensive driver safety policy: This policy should clearly outline expectations for employees using their vehicles for business. It should cover safe driving practices, mobile phone use (prohibiting distracted driving), vehicle maintenance standards, and accident reporting procedures.

- Check Motor Vehicle Records (MVRs): For any employee who drives for business (even in their personal car), regularly review their MVRs. This helps identify employees with poor driving records who may pose a higher risk. Employers can be found liable for “negligent entrustment” if they knowingly allow an employee with a history of reckless driving to operate a vehicle for business.

- Require proof of personal insurance: Mandate that all employees who use their personal vehicles for work provide proof of current personal auto insurance coverage.

- Set minimum personal policy limits for employees: Don’t just rely on state minimums. Encourage or require employees who drive for business to carry higher liability limits on their personal policies. This provides a stronger primary layer of protection before your HNOA coverage needs to kick in.

- Encourage regular vehicle maintenance checks: While you can’t control the maintenance of employee-owned vehicles, you can encourage employees to keep their cars in safe operating condition. A study of 2,000 American car owners found that 25% feel they “take a risk each time they hit the road, as their vehicle is currently in need of repair or no longer runs well,” with 68% of cars having at least one current issue. This highlights the hidden risks.

- Provide driver training: Consider offering or requiring defensive driving courses, especially for employees who drive frequently for business.

- Implement a clear reporting process: Ensure employees know exactly what to do in the event of an accident, including whom to contact and what information to gather.

By combining robust hired and non owned automobile coverage with these proactive risk mitigation strategies, your business can significantly reduce its exposure to auto-related liabilities.

Conclusion

In today’s dynamic business environment, where efficiency and flexibility often mean relying on resources we don’t directly own, hired and non owned automobile coverage has evolved from a niche product to a critical shield for modern businesses. We’ve explored how this specialized insurance fills dangerous liability gaps left by traditional commercial and personal auto policies, protecting your company from the potentially catastrophic financial fallout of an accident involving a rented vehicle or an employee’s personal car used for work.

From understanding the crucial distinction between ‘hired’ and ‘non-owned’ autos to recognizing the profound implications of Respondeat Superior and the rising threat of “nuclear verdicts,” it’s clear that neglecting this coverage is an unacceptable risk for any forward-thinking business. Your business assets, hard-earned reputation, and peace of mind depend on having comprehensive protection in place.

At Select Insurance Group, we leverage over 30 years of experience to help businesses like yours steer the complexities of commercial insurance. We understand the unique exposures in Florida, the Carolinas, Virginia, and Georgia, and we’re committed to providing personalized assessments and solutions. Don’t leave your business vulnerable to unforeseen auto liabilities.

Protect your business. Protect your future.

Get a North Carolina auto insurance quote today.