Why Understanding North Carolina’s Auto Insurance Laws Matters Now

If you drive in North Carolina, NC auto insurance requirements are a legal mandate and your financial safety net. You must carry specific coverage at minimum limits set by state law. Currently, this means 30/60/25 liability coverage plus matching uninsured/underinsured motorist protection, but significant changes in 2025 will increase these minimums.

Current NC Auto Insurance Requirements (Until July 1, 2025):

- $30,000 bodily injury liability per person

- $60,000 bodily injury liability per accident

- $25,000 property damage liability per accident

- Matching uninsured/underinsured motorist coverage (30/60/25)

- Continuous coverage required by law—no gaps allowed

New Requirements Starting July 1, 2025:

- $50,000 bodily injury liability per person

- $100,000 bodily injury liability per accident

- $50,000 property damage liability per accident

- Improved UIM benefits (elimination of liability setoff)

North Carolina strictly enforces these rules. A lapse in coverage leads to fines starting at $50, plus a $50 restoration fee. The state is also an at-fault state with a harsh contributory negligence rule: if you’re even 1% at fault in an accident, you cannot collect damages from the other driver.

I’m D.J. Hearsey, founder of Select Insurance Group. With over three decades of experience, I help drivers steer NC auto insurance requirements and find the right coverage. This guide will walk you through the current laws, the new 2025 rules, and how factors like SDIP points affect your rates.

Understanding the Core NC Auto Insurance Requirements

At its heart, NC auto insurance requirements are about liability—protecting others if you cause an accident. North Carolina is an “at-fault” state, meaning the responsible driver’s insurance pays for damages.

However, the state follows a “pure contributory negligence” rule, one of the harshest in the nation. If you are found even 1% at fault for an accident, you are barred from collecting any damages from the other driver. This rule makes having solid coverage for yourself just as important as having liability for others.

North Carolina mandates three key coverages:

Bodily Injury Liability covers medical bills and lost wages for people you injure. Property Damage Liability pays to repair or replace property you damage, like another car or a fence. Uninsured/Underinsured Motorist (UM/UIM) coverage protects you if you’re hit by a driver with no insurance or not enough insurance to cover your bills.

That last one is crucial, and its value increases significantly in 2025. For a complete look at how we can help you steer these requirements, check out more info about our auto insurance services.

What are the current minimum auto insurance requirements in North Carolina?

Until July 1, 2025, North Carolina requires “30/60/25” coverage: $30,000 for bodily injury per person, $60,000 for total bodily injury per accident, and $25,000 for property damage per accident.

In a real-world accident you cause, your insurance would pay up to $30,000 for one person’s injuries, with a $60,000 cap for everyone hurt in the crash. Your property damage coverage is limited to $25,000.

Crucially, North Carolina law (G.S. 20-279.21) also requires you to carry matching UM/UIM coverage. This provides a financial backstop if an uninsured or underinsured driver hits you.

These state minimums allow you to drive legally, but they often leave you financially exposed. A serious accident can easily surpass these limits, leaving you personally responsible for the remaining costs.

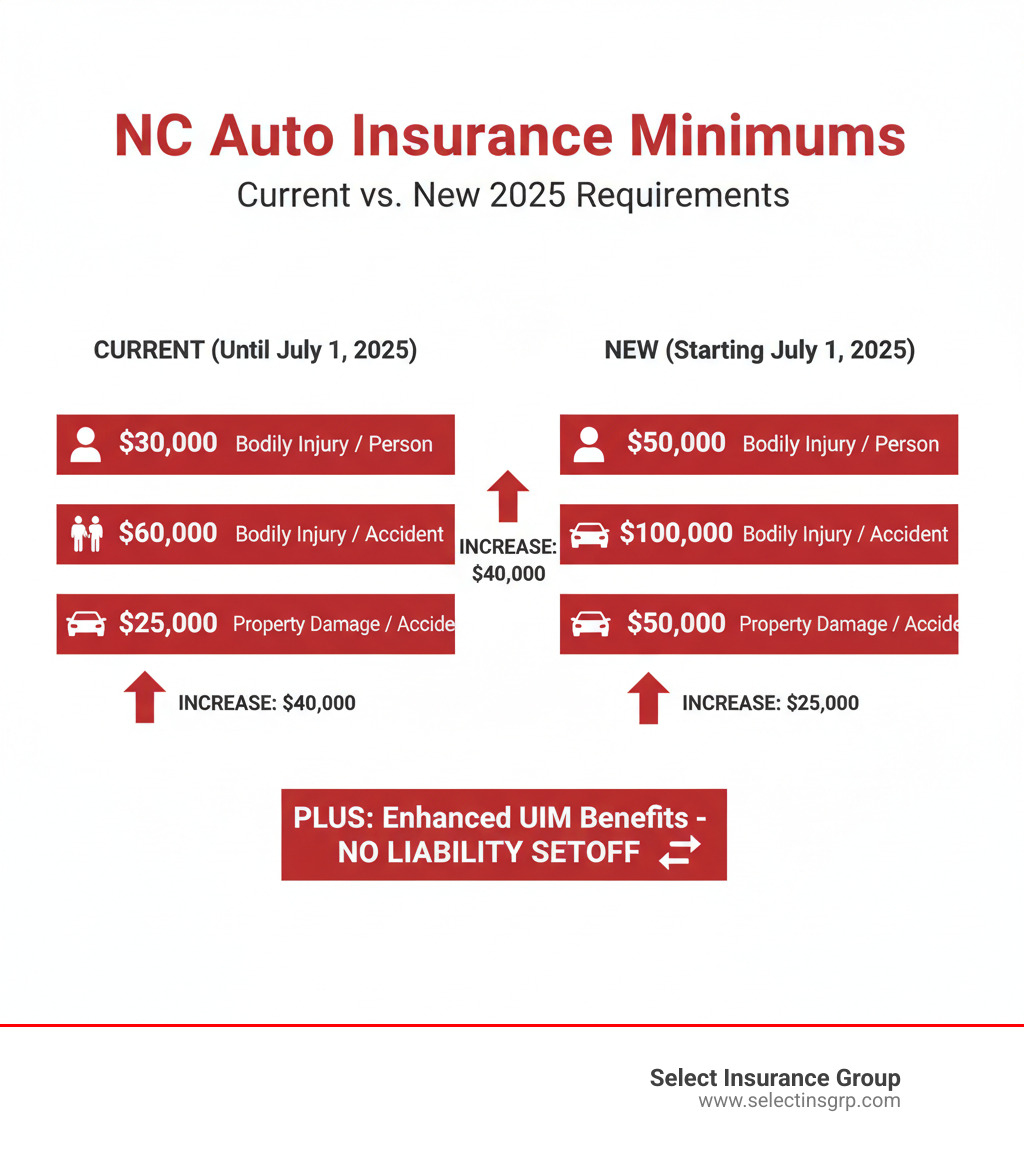

Big Changes Coming: New Liability Limits for 2025

Every North Carolina driver needs to know that NC auto insurance requirements are increasing significantly. Starting July 1, 2025, Senate Bill 452 raises the minimum coverage limits across the board.

The new “50/100/50” rule will require $50,000 for bodily injury per person, $100,000 for total bodily injury per accident, and $50,000 for property damage per accident.

| Coverage Type | Current Minimum Limits (Until July 1, 2025) | New Minimum Limits (Effective July 1, 2025) |

|---|---|---|

| Bodily Injury per Person | $30,000 | $50,000 |

| Bodily Injury per Accident | $60,000 | $100,000 |

| Property Damage per Accident | $25,000 | $50,000 |

These increases are long overdue, as the previous limits hadn’t changed since 1999. While the new limits better reflect modern medical and repair costs, they can still be insufficient in a major accident.

The real game-changer in the 2025 law is the elimination of the “liability setoff” for Underinsured Motorist (UIM) coverage. Previously, your UIM payout was reduced by whatever the at-fault driver’s insurance paid. For example, if you had $100,000 in damages and the at-fault driver’s $50,000 policy paid out, your UIM would only cover the remaining $50,000.

Starting July 1, 2025, your UIM coverage will stack on top. In the same scenario, you would collect $50,000 from their policy plus the full $100,000 from your UIM, for a total of $150,000. This makes buying as much UIM coverage as you can afford an even smarter investment in your financial security.

Penalties, Surcharges, and Proving Your Coverage

Failing to meet NC auto insurance requirements has serious consequences. Understanding the penalties and how your driving record affects your rates can save you significant money and hassle.

North Carolina requires continuous coverage with no gaps. Let your policy lapse, and you’ll face fines. Drive without insurance, and you could face criminal charges. The state also uses the Safe Driver Incentive Plan (SDIP) to assign points for violations, which directly increase your premiums. Upcoming 2025 changes will make these points costlier for longer.

The Consequences of Driving Without Insurance or Letting Coverage Lapse

If your vehicle has a valid North Carolina registration, it must have continuous liability insurance from a company licensed in the state. Out-of-state policies are not accepted.

Driving without insurance is a Class 3 misdemeanor, which can result in probation, community punishment, or jail time. If you cause an accident while uninsured, your registration can be suspended for 30 days.

Even without driving, letting your coverage lapse triggers an automatic notification to the NCDMV. You’ll receive a notice requiring proof of continuous coverage within 10 days to avoid civil penalties. The fines are tiered: $50 for a first offense, $100 for a second, and $150 for subsequent lapses. Each offense also includes a $50 restoration fee. Ignoring these penalties will lead to the revocation of your license plate.

Never drop coverage, even for a few weeks. If you move or take a vehicle off the road, surrender your license plates to the NCDMV first to stop the insurance requirement. For more details, visit the Official NCDMV: Vehicle Insurance Requirements page.

How Your Driving Record and Experience Affect Your Rates

Your driving record is a financial scorecard. North Carolina’s Safe Driver Incentive Plan (SDIP) assigns points for violations and at-fault accidents, leading to higher premiums. Starting July 1, 2025, these points will have a longer-lasting impact.

First, the inexperienced operator surcharge will be extended. For anyone licensed on or after July 1, 2025, this surcharge will apply to drivers with less than eight years of experience, up from the current three years. This means new drivers will face higher premiums for longer.

Second, serious violations will be more costly. If you get four or more SDIP points from a single conviction on or after July 1, 2025, the surcharge period increases from three to five years.

Third, the lookback period for minor speeding violations (10 mph or less over the limit) and Prayers for Judgment Continued (PJCs) will increase from three to five years for infractions after July 1, 2025. A clean driving record will be more valuable than ever.

Beyond the Minimum: Optional Coverages and Navigating Claims

Meeting minimum NC auto insurance requirements keeps you legal, but these limits are just a starting point. Optional coverages are crucial for protecting your own vehicle, finances, and peace of mind. And if you are in an accident, understanding the claims process is vital. If you operate a business, we can also help with North Carolina Business Auto insurance to ensure your fleet is protected.

Optional Car Insurance Coverages for Better Protection

Consider these valuable optional coverages:

- Collision coverage pays to repair or replace your vehicle after an accident, whether you hit another car or an object. It is almost always required if you are financing or leasing a vehicle.

- Comprehensive coverage handles damage from non-collision events like theft, vandalism, fire, hail, flooding, and hitting a deer—a common risk in North Carolina.

- Medical Payments coverage (MedPay) covers medical expenses for you and your passengers after an accident, regardless of fault. This is especially useful due to NC’s contributory negligence rule.

- Rental reimbursement coverage pays for a rental car while yours is being repaired after a covered claim.

- Roadside assistance coverage provides help for flat tires, dead batteries, lockouts, and breakdowns.

“Full coverage” typically refers to having both collision and comprehensive. If your car is newer, valuable, or financed, these coverages are essential. Even with an older car, consider if you could afford to replace it out-of-pocket. If not, these options may be worth the cost.

What Happens After an At-Fault Accident in North Carolina?

North Carolina is an at-fault state, but its pure contributory negligence rule is unforgiving. As mentioned, if you’re found even 1% at fault, you cannot recover damages from the other driver. This makes your own policy’s optional coverages critical.

When your car is totaled, it generally means repair costs exceed 75% of its Actual Cash Value (ACV). Your insurer will pay you the ACV minus your deductible. If you owe more on your loan than the ACV, you are responsible for the difference unless you have Gap coverage.

Crucially, your insurance company cannot force you to use a specific repair shop. You have the right to choose where your vehicle is repaired. Your insurer must pay the reasonable cost to restore your vehicle to its pre-accident condition, regardless of the shop you select.

After an accident, contact your insurer promptly. Document everything, take photos, and keep records of all expenses. If you face disputes, the NC Department of Insurance is a valuable resource for consumers.

Frequently Asked Questions about NC Auto Insurance

We understand that navigating NC auto insurance requirements can be confusing. Here are answers to the most common questions we hear.

What are the average costs for car insurance in North Carolina?

A common question is about cost. Fortunately, North Carolina drivers often have more affordable rates than in many other states.

For minimum coverage meeting basic NC auto insurance requirements, the average is around $68 per month, or $815 per year. For full coverage (liability plus collision and comprehensive), the average is about $189 per month, or $2,271 per year.

These are just averages. Your actual premium depends on your driving record, location, vehicle type, age, driving experience, and credit-based insurance score. A better driving and credit history typically leads to lower rates.

At Select Insurance Group, we shop over 40 carriers to find the best rate for your unique situation.

What is the difference between Uninsured (UM) and Underinsured (UIM) Motorist coverage?

This is a common point of confusion. Both coverages protect you, but in different situations.

Uninsured Motorist (UM) coverage pays for your expenses (medical bills, property damage) when you’re hit by a driver with no insurance at all.

Underinsured Motorist (UIM) coverage applies when the at-fault driver has insurance, but their limits aren’t high enough to cover all your damages. Your UIM coverage helps bridge that gap.

Crucially, starting July 1, 2025, the “liability setoff” for UIM is eliminated. Your UIM coverage will pay its full amount in addition to what the at-fault driver’s policy pays, offering significantly better protection. This change makes carrying robust UIM coverage more valuable than ever.

How do I get proof of insurance in North Carolina?

Proving you have insurance is as important as having it. When you buy a policy, your insurer electronically submits a Certificate of Insurance (Form FS-1) to the NCDMV. This happens automatically, but your insurer must be licensed in North Carolina.

The NCDMV maintains a database of insured vehicles. You can call them at 919-715-7000 to verify your status. While the state’s system is electronic, you must still carry an insurance identification card (physical or digital) in your vehicle as immediate proof of coverage for law enforcement.

North Carolina law (G.S. 20-309) requires continuous liability insurance. Even a brief lapse can trigger penalties. Ensuring your Form FS-1 is filed and your ID card is accessible keeps you compliant.

Conclusion: Securing the Right Coverage for Your Needs

Understanding NC auto insurance requirements is about protecting your financial future. This guide covered the essentials: North Carolina’s current 30/60/25 liability minimums, the upcoming increase to 50/100/50 on July 1, 2025, and the valuable elimination of the UIM liability setoff.

We also reviewed the penalties for a coverage lapse and how the Safe Driver Incentive Plan (SDIP) is changing in 2025, making a clean driving record more important than ever. The new state minimums are an improvement, but they may still not be enough to cover the costs of a serious accident.

Protecting your assets often requires more than the minimum. Collision, comprehensive, and medical payments coverage provide a critical safety net. Now is the perfect time to review your policy to ensure you’re prepared for the 2025 changes and adequately protected.

At Select Insurance Group, we’ve spent over three decades helping drivers find the right coverage at the right price. We shop over 40 carriers on your behalf, comparing rates and options so you don’t have to. Whether you’re preparing for the new laws or just looking for a better rate, we are here to guide you.

Get a personalized quote for your North Carolina Auto Insurance today and drive with confidence knowing you’ve got the right coverage in place.