Why Non-Owner Insurance Matters for Drivers Without a Car

Cheap non drivers insurance is for people who drive but don’t own a vehicle. It covers you when you borrow a friend’s car, rent vehicles, or use car-sharing services. Also known as non-owner car insurance, it provides liability protection (bodily injury and property damage) without insuring a specific car. It typically costs between $200-$500 per year, far less than standard auto insurance.

Quick Answer: Where to Find Cheap Non-Owner Insurance

- Independent insurance agents – They shop multiple carriers for the best rates.

- Direct insurers – Many major insurance companies offer non-owner policies.

- State programs – Some states offer low-cost options for eligible drivers.

It’s illegal to drive without insurance in most states, even in a borrowed car. If you cause an accident, you are financially responsible for any damage or injuries. While the car owner’s insurance provides primary coverage, it may not be enough to cover a serious accident. That’s where non-owner insurance comes in, acting as a secondary layer of protection.

This matters because without it, you could face devastating costs. Many drivers mistakenly assume they’re covered when borrowing a car or that expensive rental company insurance is their only choice. A non-owner policy is often a more affordable and comprehensive solution, protecting your finances and relationships.

As D.J. Hearsey, founder of Select Insurance Group with over three decades of industry experience, I’ve helped countless clients find affordable cheap non drivers insurance. Whether you’re a city dweller, a frequent renter, or an occasional borrower, understanding your options can save you money and stress.

What is Non-Owner Car Insurance?

Let’s clarify what cheap non drivers insurance is. Non-owner car insurance (or named non-owner coverage) is a policy for people who drive but don’t own a vehicle.

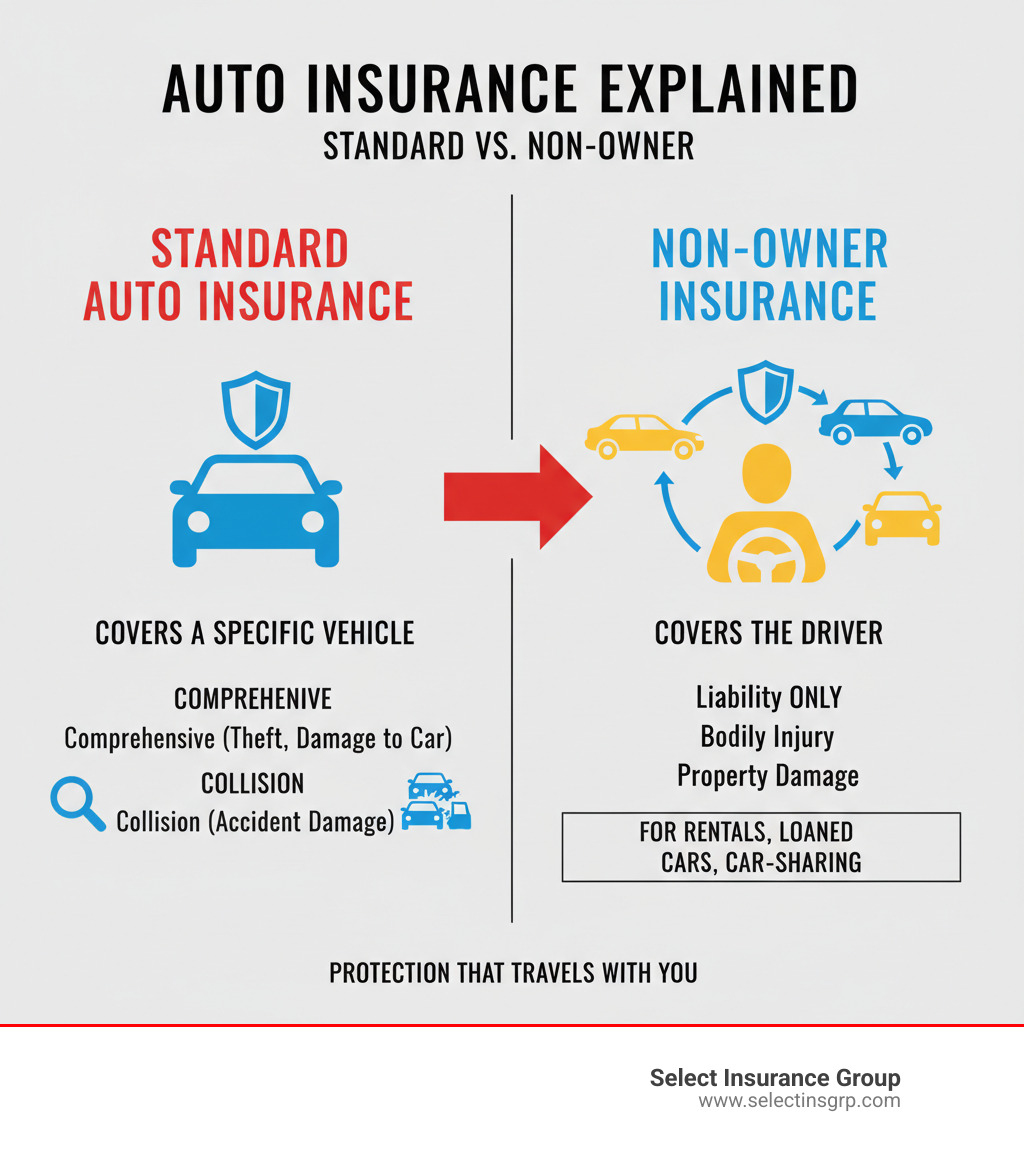

The key difference is that standard auto insurance follows a specific car, while non-owner insurance follows you, the driver. It’s your personal liability shield when you’re driving a friend’s car, a rental, or a car-share vehicle. It acts as secondary coverage, kicking in to cover injuries or property damage you cause if the costs exceed the vehicle owner’s insurance limits.

How It Differs from Standard Auto Insurance

Standard insurance is vehicle-specific, while non-owner insurance is driver-specific. A standard policy provides primary coverage for a particular car, including comprehensive and collision damage. Non-owner insurance follows you and acts as a secondary safety net. If you cause an accident in a borrowed car, the owner’s insurance pays first. If their limits are exhausted—which is common, as many people only carry state-minimum coverage—your non-owner policy covers the rest, protecting you from huge out-of-pocket expenses.

The Dangers of Driving a Borrowed Car Uninsured

Driving without insurance is illegal in most states, even in someone else’s car. The consequences are severe.

Legally, you could face hefty fines, points on your record, and license suspension. For example, South Carolina requires 25/50/25 liability coverage ($25,000 bodily injury per person, $50,000 per accident, $25,000 property damage). Failing to meet these requirements leads to serious trouble. You can find state-specific information from resources like South Carolina’s Department of Insurance or check out auto insurance requirements in Virginia.

Financially, the danger is even greater. If you cause an accident while uninsured, you are personally liable for all costs, including medical bills, repairs, and legal fees. A single accident could lead to financial ruin. It can also strain relationships with friends or family if you can’t cover the damages after borrowing their car. Cheap non drivers insurance is an affordable way to gain peace of mind and avoid this devastating risk.

Who Needs Non-Owner Insurance and Why?

Non-owner car insurance is a lifesaver for specific types of drivers. If you regularly drive vehicles you don’t own, cheap non drivers insurance offers protection without the cost of a standard auto policy.

This policy is ideal for:

- Frequent renters: Avoid expensive daily insurance from rental companies. A non-owner policy can be cheaper annually and offer better coverage.

- Car borrowers: If you often borrow a car from a friend or neighbor, this policy acts as crucial secondary coverage if their insurance limits are exceeded in a serious accident.

- Car-sharing users: Get consistent liability coverage across all the different vehicles you use from car-sharing services.

- City dwellers: If you’ve gone car-free but still drive occasionally, a non-owner policy ensures you’re covered when you do.

- Drivers maintaining continuous coverage: If you’ve sold your car but plan to buy another, a non-owner policy prevents a gap in your insurance history, which can help you get lower rates later.

Better Protection Than Rental Company Insurance

Rental car agencies offer insurance at the counter, but it’s often expensive and may only provide state-minimum liability limits. These daily charges can quickly add up. For example, renting a car for just two weeks a year could cost more than an annual non-owner policy, which typically runs between $200 and $500 per year.

With a non-owner policy from Select Insurance Group, you can choose higher liability limits that truly protect your assets. It provides consistent coverage every time you drive a non-owned vehicle, giving you peace of mind without having to decipher confusing rental agreements.

When You Don’t Need a Non-Owner Policy

This policy isn’t for everyone. You likely don’t need it if:

- You own a car and have a standard auto policy.

- You live with the person whose car you drive (you should be listed on their policy).

- You only borrow a car once or twice a year.

- You only drive a company car covered by a commercial policy.

It’s especially important that if you live with someone and regularly drive their car, you are listed on their policy. Using a non-owner policy in this case can lead to coverage gaps or claim denials. At Select Insurance Group, our job is to ensure you have the right protection without paying for what you don’t need.

What a Non-Owner Policy Covers (and What It Doesn’t)

Cheap non drivers insurance is a specialized tool designed to protect you from liability, not to cover the car you’re driving. Understanding what it covers—and what it doesn’t—is key.

| What’s Covered | What’s Not Covered |

|---|---|

| Bodily Injury Liability (to others) | Damages to the borrowed or rented vehicle (Collision coverage) |

| Property Damage Liability (to others’ property) | Theft, vandalism, fire, natural disasters, or falling objects damaging the borrowed vehicle (Comprehensive coverage) |

| Legal Defense Costs (if sued) | Your own medical bills (unless specific add-ons are purchased) |

| Uninsured/Underinsured Motorist (optional add-on) | Your personal belongings stolen from or damaged in the car |

| Medical Payments/Personal Injury Protection (optional add-on) | Roadside assistance, towing, or rental car expenses (unless specific add-ons are purchased, and even then, these are rare for non-owner policies) |

What’s Covered: Your Liability Shield

The core of a non-owner policy is liability coverage, which protects you financially if you’re at fault in an accident.

- Bodily Injury Liability: Covers medical bills and lost wages for others you injure.

- Property Damage Liability: Pays for repairs to other people’s property, like their car or a fence.

- Legal Defense Costs: Covers your legal fees if you’re sued after an accident.

You can often add optional coverages like medical payments (MedPay), personal injury protection (PIP), or uninsured/underinsured motorist coverage. We recommend choosing liability limits higher than your state’s minimums, as they are often insufficient for serious accidents. For example, South Carolina’s 25/50/25 minimums can be quickly exhausted. You can learn more about requirements from resources like South Carolina’s Department of Insurance.

What’s Not Covered: The Vehicle and Your Belongings

A non-owner policy does not cover damage to the car you are driving. It lacks collision and comprehensive coverage, so it won’t pay for repairs if you cause an accident or if the car is stolen or damaged by hail. The vehicle owner’s insurance would have to cover these costs.

Additionally, your personal belongings stolen from the car are not covered by this policy; you would need to file a claim with your homeowners or renters insurance. Extras like towing and roadside assistance are also typically excluded. A non-owner policy is a liability shield for you, not physical damage protection for the car.

How to Find Cheap Non Drivers Insurance

Finding cheap non drivers insurance is straightforward if you know where to look and what affects your rates. A strategic approach can help you secure great protection at an affordable price.

Eligibility Requirements for a Non-Owner Policy

Before seeking quotes, ensure you qualify. Most insurers require that you:

- Have a valid driver’s license.

- Do not own a vehicle.

- Do not live with the owner of a car you regularly borrow (in that case, you should be on their policy).

A clean driving record will also help you secure the best rates from more insurers.

What Are the Typical Costs of Cheap Non Drivers Insurance?

The good news is that non-owner insurance is very affordable, with most policies costing between $200 and $500 per year. It’s significantly cheaper than standard auto insurance because it only covers your liability as a driver, not physical damage to a specific vehicle.

Your exact cost will depend on factors like your driving history, location, age, and the amount of coverage you choose. A clean record will earn you the lowest rates, while higher liability limits (which we recommend for better protection) will slightly increase the premium.

At Select Insurance Group, we help you balance affordability with robust protection. Ready to see your rate? Get A Quote and we’ll compare options from over 40 carriers for you.

How to Compare Policies and Save Money

Smart shopping is key to finding the best deal.

- Comparison shop: Never take the first quote. Prices vary widely between companies. An independent agent like Select Insurance Group can shop over 40 carriers at once to find you the best rate.

- Bundle your policies: If you have renters or homeowners insurance, ask about a multi-policy discount, which can save you 10-20%.

- Maintain a clean driving record: This is the most effective way to keep your premiums low.

- Ask for discounts: Inquire about discounts for things like completing a defensive driving course or being a good student.

- Leverage an independent agent: Our 30+ years of experience means we know which carriers offer the best rates and service for non-owner policies. We work for you, not the insurance company.

Finding affordable non-owner insurance is about strategy, not luck. Let us put our experience to work for you. Get A Quote today.

Frequently Asked Questions about Non-Driver Insurance

We’ve been helping drivers for over 30 years and have heard every question about non-owner insurance. Here are the most common ones.

What’s the difference between non-owner insurance and insuring a car I own but don’t drive?

It’s a key distinction.

- Non-owner insurance covers you as a driver when you’re using a vehicle you don’t own (e.g., a rental or a friend’s car). It provides liability protection that follows you.

- Storage insurance (or a comprehensive-only policy) covers a car you own but is not being driven. It protects the parked vehicle from theft, vandalism, or storm damage, but provides no liability coverage for driving.

In short, non-owner insurance covers the driver, while storage insurance covers the parked car.

Can I get cheap non drivers insurance if my license is suspended?

Getting any auto insurance with a suspended license is extremely difficult and often not possible with standard carriers, who view you as a high-risk driver.

If you’re required to file an SR-22 (a certificate of financial responsibility), some specialized insurers may offer a non-owner SR-22 policy, but expect to pay significantly higher premiums.

Our advice is to focus on reinstating your license first. Once it’s valid, you’ll have access to far more affordable options. If you need guidance on finding coverage in this situation, contact us, and we’ll be upfront about your options.

Do I need non-owner insurance if I’m listed as an occasional driver on someone’s policy?

It depends. If you live with someone and are listed as a driver on their policy, you are covered when driving their car and generally don’t need a separate non-owner policy for that vehicle. In fact, insurers require household members who drive the car to be on the policy.

However, a non-owner policy could still be beneficial if you also frequently rent cars or borrow vehicles from people outside your household. In that case, it provides liability protection for those other driving situations and acts as secondary coverage, offering an extra layer of protection.

Get the Right Protection for the Way You Drive

Navigating auto insurance when you don’t own a car doesn’t have to be complicated. Cheap non drivers insurance is a practical, affordable solution that provides essential liability protection for the way you drive.

You get the freedom to drive when you need to—whether it’s a rental, a friend’s car, or a car-share vehicle—without the financial burden of owning a car. Most importantly, you get peace of mind knowing you’re protected from devastating costs if an accident occurs. For frequent renters, car borrowers, and city dwellers, a non-owner policy is simply smart planning. It’s liability coverage that follows you, not a specific vehicle, and costs far less than a standard policy.

At Select Insurance Group, we’ve spent over three decades helping drivers across the Southeast find insurance that fits their lives. As an independent agency, we work with over 40 carriers to shop on your behalf, finding you the best coverage at competitive rates. We work for you, not the insurance company.

We believe in making insurance straightforward. We’ll explain your options in plain language and help you make an informed decision. Don’t leave your financial future to chance. Getting protected is easier and more affordable than you think.

Ready to explore your options? We serve drivers throughout Florida, the Carolinas, Virginia, and Georgia. Find the best auto insurance for your needs in North Carolina, or reach out to us directly to discuss how we can help you get the right protection for the way you drive.