Is North Carolina a Budget-Friendly State for Drivers?

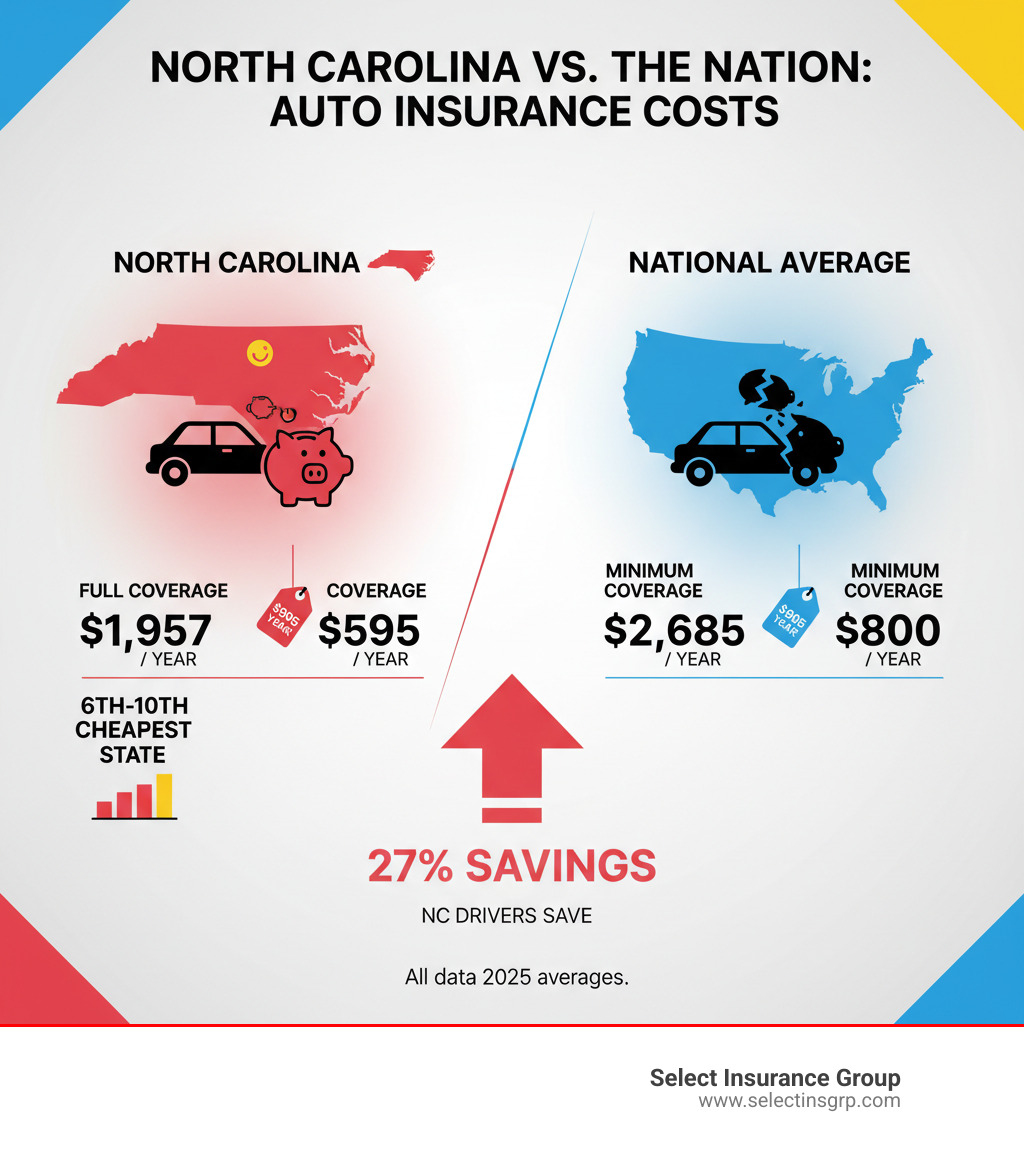

Is auto insurance less expensive in north carolina? Yes, it is. North Carolina drivers typically pay significantly less for auto insurance compared to the national average. Here’s a quick look at the numbers:

- Average Full Coverage in NC: $1,741–$1,957 per year

- Average Minimum Coverage in NC: $511–$630 per year

- National Average Full Coverage: $2,685 per year

- National Average Minimum Coverage: $800 per year

- NC Savings: 27%–35% below national average

- NC Ranking: 6th–10th cheapest state in the U.S.

Shopping for auto insurance in the Tar Heel State puts you in a great position. North Carolina is one of the most affordable states for car insurance, with drivers saving roughly $900 per year on full coverage compared to the national average.

However, your personal rate depends on more than just your state. Factors like your age, driving record, credit score, and vehicle are crucial. A safe 40-year-old in Asheville might pay $800 annually, while a 20-year-old with a speeding ticket in Charlotte could see rates over $2,000.

This guide explains why NC insurance is cheaper, how it ranks nationally, and how you can secure the lowest rate for your situation.

I’m D.J. Hearsey, founder of Select Insurance Group. With over 30 years of experience, I’ve helped countless drivers in the Southeast find affordable coverage. Understanding why is auto insurance less expensive in north carolina empowers you to make smarter decisions and save money.

North Carolina vs. The Nation: A Rate Showdown

If you’ve ever wondered is auto insurance less expensive in North Carolina, the numbers tell a compelling story. Our state consistently ranks as one of the most affordable places in America to insure your vehicle. This isn’t just good luck—it’s the result of smart regulations and a competitive market.

North Carolina drivers pay between $1,741 and $1,957 annually for full coverage, or about $145 to $163 monthly. For minimum coverage, the cost is even lower, typically between $511 and $630 per year, or $43 to $53 per month.

Compared to the national average of $2,685 for full coverage, NC drivers save around 27%, which is nearly $900 back in your pocket every year. This significant savings places North Carolina between the 6th and 10th cheapest states for car insurance nationwide.

Why is auto insurance less expensive in North Carolina on average?

Several factors work together to keep premiums low in the Tar Heel State:

A competitive insurance market: North Carolina’s insurance commissioner sets a cap on rates, which creates fierce competition among insurers. When companies have to fight for your business within those limits, you benefit from lower prices.

State regulations: NC is one of the few states that prohibits insurers from using gender as a rating factor. The state also bans telematics programs that could raise your rates based on driving data, removing a potential source of premium increases.

Lower population density: About 34% of North Carolinians live in rural areas with lighter traffic and fewer accidents, which lowers risk for insurers and costs for you.

Low rate of uninsured drivers: With only about 7% of drivers uninsured, the costs of accidents are spread more evenly, and you’re not subsidizing as many uninsured motorist claims.

Pure contributory negligence rule: This legal rule means if you’re even 1% at fault in an accident, you can’t recover damages from the other driver. While tough on some, it limits insurer payouts and helps keep premiums down for everyone.

Low total loss threshold: At 75%, if repair costs exceed this percentage of your car’s value, it’s declared a total loss. This often leads to quicker, less expensive settlements.

These factors combine to answer the question is auto insurance less expensive in North Carolina with a resounding yes. Want to learn more? Check out our Learning Center for additional insights.

So, Is Auto Insurance Less Expensive in North Carolina? A Cost Breakdown

We’ve established that North Carolina is affordable for car insurance, but your actual rate depends heavily on where you live. A driver in Winston-Salem might pay significantly less than someone in Fayetteville, even with an identical profile.

Let’s look at how average annual full coverage rates vary across our major cities:

| City in North Carolina | Average Annual Full Coverage |

|---|---|

| Charlotte | $824 – $1,172 |

| Raleigh | $752 |

| Greensboro | $771 |

| Fayetteville | $1,103 – $2,230 |

| Asheville | $796 |

| Hendersonville | $788 |

| Carrboro | $1,607 |

| Winston Salem | $702 |

| Durham | $781 |

Note: Averages can vary by source and methodology. We’ve compiled data from various reputable sources to provide a comprehensive overview.

The spread is notable. Winston-Salem comes in at an impressively low $702 annually for full coverage, while Fayetteville can climb as high as $2,230. Understanding these local differences helps you set realistic expectations.

How Rates Vary Across North Carolina Cities

Think of car insurance rates like real estate—location matters. Even though is auto insurance less expensive in north carolina overall, your specific address plays a starring role in what you’ll pay.

The urban versus rural divide is measurable. Drivers in busy cities typically pay more because more traffic, higher population density, and increased crime risk lead to more claims. Insurers factor this into their risk assessments.

Charlotte, our largest city, sees full coverage rates from $824 to $1,172 annually. While higher than quieter towns, this is still reasonable compared to major cities in other states.

Fayetteville tends to be our most expensive city, with premiums from $1,103 to over $2,230 annually, reflecting local traffic patterns and accident rates.

On the flip side, some cities offer the best deals. Winston-Salem is one of the cheapest at around $702 per year. Hendersonville is similarly affordable at about $788. Our state capital, Raleigh, offers solid value at around $752 per year, as do Greensboro ($771) and Durham ($781).

Asheville sees average rates around $796—well below both Charlotte and the national average. Even Carrboro, at around $1,607, remains competitive with similar college towns nationwide.

The takeaway? Where you park your car at night matters. If you’re considering a move within North Carolina, checking local insurance rates could save you hundreds of dollars annually.

Key Factors That Determine Your Personal Rate

While North Carolina offers great average rates, your personal premium is just that—personal. Insurance companies are professional risk assessors, trying to determine how likely you are to file a claim. The answer to that question determines your premium.

So while is auto insurance less expensive in north carolina on average? Absolutely. But your specific rate depends on a unique combination of factors. Let’s break down what insurers look at.

How your driving record impacts whether auto insurance is less expensive in North Carolina for you

Your driving record is the most important factor. A clean history is your golden ticket to low rates, with some insurers offering liability-only coverage for as little as $27 to $30 per month.

Here’s what happens when your record isn’t clean:

- A single speeding ticket can increase your premium by an average of 49%.

- An at-fault accident can cause a rate increase of 38% to 70%, depending on severity.

- A DUI conviction is the most severe violation, signaling maximum risk. It can lead to rate increases of 290% to 310%, potentially tripling your premium. A policy that was $1,202 annually could jump to $4,760.

North Carolina is one of 12 states that doesn’t require high-risk drivers to file an SR-22 form, but the financial penalties for serious violations remain severe.

Your Driver Profile: Age and Credit Score

Your age and credit score also play significant roles.

Age is a dramatic factor. Young drivers pay more due to higher statistical accident rates. A 16-year-old added to a parent’s policy might cost around $4,545 annually. The Centers for Disease Control and Prevention provides detailed statistics on why young drivers represent higher risk. Rates drop steadily with experience, with drivers in their 30s, 40s, and 50s enjoying the lowest premiums. Senior drivers (60+) may see a slight increase, but many discounts are available.

Credit score is another major factor. North Carolina allows insurers to use credit history in pricing. Drivers with excellent credit may pay 4% below the state average, while those with poor credit could pay 41% above average. The difference can amount to hundreds of dollars per year.

One factor that doesn’t affect your rate in North Carolina is your gender, as state law prohibits its use in pricing.

Your Vehicle and Other Influences

The car you drive matters just as much as how you drive it.

- Vehicle Make and Model: Luxury vehicles cost more to repair and insure. A BMW 330i might cost 11% more than average to insure, while a Ford F-150 could cost 8% less.

- Vehicle Age: Newer cars are worth more and generally cost more to insure. A 2023 model might average $1,304 annually, while a 10-year-old car could be closer to $925.

- Homeownership: Homeowners in NC often pay less for auto insurance than renters, as they are viewed as more stable. Bundling home and auto policies also open ups significant discounts.

- Marital Status: Data is mixed, but married households sometimes pay slightly more, likely due to insuring multiple vehicles or teen drivers.

- Continuous Coverage: Maintaining insurance without any gaps makes you a lower risk and results in lower premiums.

Your rate is a combination of all these factors. Understanding them is the first step toward finding the most affordable coverage.

Understanding North Carolina’s Insurance Rules of the Road

While is auto insurance less expensive in north carolina is a key question, it’s crucial to meet the state’s legal requirements. North Carolina has specific laws to ensure all drivers are financially responsible. Failing to comply can lead to fines, license suspension, and other penalties.

Let’s walk through what you need to know about North Carolina’s insurance requirements. For a comprehensive look at your options, see our page on North Carolina Auto Insurance.

State Minimum Coverage Requirements

Every registered vehicle in North Carolina must carry liability and uninsured/underinsured motorist coverage. The state follows a 30/60/25 minimum structure:

- Bodily Injury Liability: $30,000 per person and $60,000 per accident. This covers injuries you cause to others.

- Property Damage Liability: $25,000 per accident. This covers damage you cause to someone else’s property.

- Uninsured/Underinsured Motorist (UM/UIM): $30,000 per person, $60,000 per accident for bodily injury, and $25,000 for property damage. This protects you if you’re hit by a driver with little or no insurance.

While these minimums satisfy the law, they may not fully protect you in a serious accident. Medical bills can easily top $30,000, and replacing a newer car can exceed the $25,000 property limit. You would be personally liable for any costs beyond your coverage. Many drivers opt for higher limits (e.g., 100/300/100) and add comprehensive and collision coverage for better protection.

For official details, check the state requirements from the NC Division of Motor Vehicles.

Options for High-Risk Drivers

What if your driving record isn’t perfect? North Carolina ensures high-risk drivers can still get coverage through the North Carolina Reinsurance Facility (NCRF).

The NCRF guarantees that every licensed driver can obtain mandatory minimum coverage, regardless of their history. If standard insurers deny you, the NCRF provides a backstop. All insurers in NC participate, sharing the risk. You’ll still buy your policy from a regular company, but it will be backed by the NCRF pool. Policies through the NCRF are more expensive, but they ensure you can drive legally.

Uniquely, North Carolina does not require SR-22 filings for high-risk drivers. While this simplifies paperwork, the financial penalties for violations like a DUI remain severe, often tripling your insurance costs.

Even if you’re considered high-risk, it’s still essential to shop around, as some insurers specialize in this market and may offer more competitive rates.

If you need coverage for business vehicles, learn more about North Carolina Business Auto Insurance to ensure your company is properly protected.

How to Secure the Most Affordable Rates in the Tar Heel State

While is auto insurance less expensive in north carolina is true on average, you have significant control over your personal rate. With a savvy approach, you can reduce what you pay for coverage.

Think of finding affordable insurance like any major purchase—comparison is key. Let’s walk through the proven strategies that can put money back in your pocket.

Smart Strategies for Lowering Your Premium

-

Compare quotes from multiple insurers. This is the single most effective way to save. Rates for the same driver can vary by hundreds or even thousands of dollars between companies. Get at least three to five quotes.

-

Bundle your policies. Combining your auto insurance with a homeowners or renters policy from the same company can open up discounts of 10% to 25%. It also simplifies your insurance management.

-

Evaluate your deductible. A higher deductible (e.g., $1,000 instead of $500) will lower your premium. Just ensure you have that amount saved in an emergency fund to cover it if you need to file a claim.

-

Protect your driving record. A clean record is the best long-term strategy for affordable insurance. A single speeding ticket can raise your premium by 49%, while a DUI can cause a 290% increase. Driving safely qualifies you for the best rates and discounts.

-

Ask about all available discounts. Insurers offer a wide variety, but you often have to ask. Inquire about discounts for being a safe driver, insuring multiple cars, having anti-theft devices, completing a defensive driving course, low annual mileage, paying in full, or being a member of certain organizations.

-

Consider insurance costs when buying a car. Vehicles with strong safety ratings, low theft rates, and cheaper repair parts generally cost less to insure. Get insurance quotes on your top vehicle choices before you buy.

By using these strategies, you can take active control of your insurance costs in North Carolina’s already affordable market.

Conclusion: Get Your Personalized North Carolina Rate

So, is auto insurance less expensive in north carolina? The answer is a clear yes. Our state consistently ranks as one of the most affordable in the nation due to a competitive market, smart regulations, and other unique factors.

But state averages are just a starting point. Your personal rate is shaped by your unique profile, and the single most powerful tool you have to secure the best price is comparison shopping. The difference between what insurers quote for identical coverage can be hundreds or even thousands of dollars per year.

This is where Select Insurance Group makes all the difference. With over 30 years of experience, we shop more than 40 top carriers to find you the most competitive rates available. We know the ins and outs of North Carolina’s insurance landscape and are committed to matching you with coverage that fits your needs and budget.

We believe insurance should be straightforward and affordable. Whether you’re a new driver or have a complex history, we’re here to help you steer your options with confidence.

Don’t settle for the first quote you receive. Let us put our expertise to work for you. Find out exactly how much you can save in the Tar Heel State.

Get a Quote for your North Carolina Auto Insurance today, and let’s get you on the road with the right coverage at the right price!