Why Orlando Drivers Need the Right Car Insurance Coverage

Car insurance orlando florida requirements can be complex, given the city’s heavy tourist traffic, frequent accidents on I-4, and Florida’s no-fault laws. Here’s a quick overview:

- Minimum Required Coverage: Florida law requires $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL).

- Average Cost: Expect around $1,573/year for minimum coverage or $4,021-$4,641/year for full coverage.

- Key Savings Tip: Comparing quotes is crucial. Orlando drivers can save an average of $1,515 annually by shopping around.

Orlando presents unique challenges. With over 60 million annual visitors, highways like Interstate 4 are heavily congested. This mix of local and tourist traffic increases accident risks, making adequate car insurance essential.

As D.J. Hearsey, Principal Agent and CEO of Select Insurance Group, I have over three decades of experience helping Orlando-area drivers find affordable, comprehensive coverage. Our agency shops over 20 carriers to secure competitive rates custom to Orlando’s driving environment.

Car insurance orlando florida terminology:

Florida’s Minimum Car Insurance Requirements

Florida operates under a “no-fault” insurance system. This means after an accident, you file a claim with your own insurance company first to cover medical expenses, regardless of who was at fault. This unique approach shapes the requirements for car insurance orlando florida drivers.

What is Required to Legally Drive in Orlando?

To drive legally in Florida, you need two types of coverage:

-

Personal Injury Protection (PIP): A minimum of $10,000. This is the core of the no-fault system. It pays for 80% of your medical bills and 60% of lost wages up to your policy limit, covering you and your passengers regardless of fault.

-

Property Damage Liability (PDL): A minimum of $10,000. This covers damage you cause to someone else’s property, such as their car or a fence.

You must maintain this coverage continuously and carry proof of insurance in your vehicle. Drivers with serious violations like a DUI may need an FR-44 filing, which requires higher liability limits. For official rules, visit the Florida Highway Safety and Motor Vehicles website.

Penalties for Driving Without Insurance

Driving without car insurance orlando florida coverage is a costly gamble. The penalties are severe and can impact you for years.

If caught, you face fines from $150 to $500, but that’s just the start. Your driver’s license, vehicle registration, and license plates will be suspended, making it illegal to drive. To restore your driving privileges, you must pay reinstatement fees on top of the fines.

Worst of all, you’ll likely need to file an SR-22 form for three years. This certificate proves to the state that you have insurance but also flags you as a high-risk driver. As a result, your insurance premiums will skyrocket, often doubling or tripling. The cost of being caught uninsured far outweighs the cost of a basic policy.

Understanding the Average Cost of Car Insurance in Orlando, Florida

When shopping for car insurance orlando florida, a key question is cost. For state minimum liability coverage, Orlando drivers pay an average of $1,573 per year (about $131/month). For full coverage, which includes collision and comprehensive protection, the average is between $4,021 and $4,641 per year ($337 to $387/month).

Florida’s car insurance rates are about 68% higher than the national average, and Orlando’s costs reflect this trend. Factors like heavy tourism, congested roads like I-4, a high number of uninsured motorists, and hurricane risk all contribute to higher premiums. However, these are just averages. Your actual rate depends on your specific profile, and shopping around can lead to significant savings.

What Factors Influence Car Insurance Rates in Orlando, Florida?

Insurers analyze several factors to determine your risk and calculate your premium:

- Driving Record: A clean history with no accidents or tickets earns the best rates. A single violation can raise your premium for years.

- Age and Gender: Young drivers under 25 face the highest premiums due to statistical risk. Rates typically drop in your 30s and 40s.

- Vehicle: A new sports car will cost more to insure than a sedan with high safety ratings due to its value, repair costs, and theft risk.

- ZIP Code: Rates can vary within Orlando based on local crime, traffic, and accident frequency.

- Annual Mileage: More time on the road equals higher risk. A short commute or working from home can lower your premium.

- Credit History: In Florida, insurers use a credit-based score to predict claim likelihood. A strong credit score can lead to lower rates.

- Coverage and Deductibles: Higher liability limits increase your premium, while a higher deductible (your out-of-pocket cost) lowers it.

How Driving Record and Age Impact Your Premiums

Your driving history and age cause significant rate variations for car insurance orlando florida.

- Good drivers with clean records enjoy the lowest rates, with some policies as low as $440 per year.

- A speeding ticket can increase your annual premium to around $734, an increase that typically lasts for three to five years.

- An at-fault accident will result in a steeper increase, with minimum coverage costing between $660 and $802 per year.

- A DUI conviction has the most severe impact, increasing rates by an average of 62% and requiring an SR-22 filing.

- Young drivers (e.g., a 20-year-old) face the highest premiums, potentially around $4,322 per year. Rates usually drop significantly after age 25.

- Middle-aged drivers (25-55) with clean records often find the best rates, with full coverage averaging around $2,151 annually.

- Senior drivers (60+) with good records maintain competitive rates, often around $2,002 per year for full coverage.

Since every insurer weighs these factors differently, comparing quotes is essential to finding the best rate.

Choosing the Right Coverage Beyond the Minimum

While Florida only requires PIP and PDL, relying on minimum coverage in Orlando is risky. The city’s congested highways and unpredictable weather demand more robust protection. For example, the minimum $10,000 in property damage coverage is insufficient when the average new car costs over $48,000. A single accident could leave you personally liable for tens of thousands of dollars.

What Do Different Types of Car Insurance Cover?

Here are additional coverages that provide real peace of mind for car insurance orlando florida drivers:

- Bodily Injury Liability (BIL): Though not required, it’s essential. It pays for medical costs, lost wages, and legal defense if you injure someone in an accident.

- Collision Coverage: Pays for damage to your own vehicle from an accident, regardless of fault. It’s usually required if you have a car loan or lease.

- Comprehensive Coverage: Protects your car from non-collision events like theft, vandalism, fire, hail, or hitting an animal. Also required for financed vehicles.

- Uninsured/Underinsured Motorist (UM/UIM): Critical in Florida, this covers your expenses if you’re hit by a driver with no insurance or not enough insurance.

- Medical Payments (MedPay): Works with PIP to cover remaining medical bills, deductibles, and co-pays for you and your passengers.

- Rental Reimbursement: Covers the cost of a rental car while yours is being repaired after a covered claim.

- Roadside Assistance: Provides help for flat tires, dead batteries, lockouts, and towing.

| Coverage Type | Minimum Coverage (FL) | Recommended Full Coverage |

|---|---|---|

| Personal Injury Protection (PIP) | $10,000 | $10,000+ |

| Property Damage Liability (PDL) | $10,000 | $25,000-$50,000+ |

| Bodily Injury Liability (BIL) | Not required | $25,000/$50,000 minimum |

| Collision | Not required | Actual cash value of vehicle |

| Comprehensive | Not required | Actual cash value of vehicle |

| Uninsured/Underinsured Motorist | $10,000/$20,000 | $25,000/$50,000+ |

| Medical Payments (MedPay) | Not required | $5,000-$10,000 |

| Rental Reimbursement | Not required | $30-$50 per day |

| Roadside Assistance | Not required | Included or ~$10-$20/year |

Other Vehicle Insurance Options

Florida’s diverse lifestyle often requires specialized coverage. We can also help with:

- Florida Motorcycle Insurance: While not legally required, liability and physical damage coverage are highly recommended for riders.

- Florida RV Insurance: Protects your home-on-wheels with a policy that combines auto and home insurance elements.

- Florida Business Auto: A personal auto policy won’t cover business use, so this specialized coverage is essential for commercial vehicles.

Smart Strategies to Lower Your Orlando Car Insurance Premiums

No one wants to overpay for car insurance orlando florida. Fortunately, there are proven ways to reduce your premiums. The single most effective strategy is to shop around and compare quotes from multiple companies, especially when your policy is up for renewal or after a major life change.

How to Find the Cheapest Car Insurance in Orlando, Florida

Beyond comparison shopping, several tactics can help you secure lower rates. Maintaining a clean driving record free of accidents and tickets is your most valuable asset. In Florida, a good credit score can also lead to significant savings. The type of vehicle you drive also matters; cars with high safety ratings and anti-theft systems are cheaper to insure.

Consider usage-based insurance programs, which use an app to monitor your driving habits. Safe drivers who log fewer miles can earn substantial discounts. For more statewide tips, see our guide on Low Cost Auto Insurance Florida.

Bundling and Other Available Discounts

Don’t overlook available discounts. They can add up to significant savings:

- Multi-Policy (Bundling): Combine your auto policy with your Florida Home Insurance or renters policy.

- Good Student: Available for students who maintain a B average or higher.

- Safe Driver: A reward for staying accident-free for a set period (usually 3-5 years).

- Vehicle Safety Features: Discounts for airbags, anti-lock brakes, and anti-theft systems.

- Pay-in-Full: Save money by paying your entire premium upfront.

- Low-Mileage: Ideal for those who work from home or have a short commute.

- Multi-Car: Insuring more than one vehicle with the same company typically earns a discount.

- Defensive Driving Course: Completing an approved course can lower your premium.

- Affiliation Discounts: Check for special rates through your employer, alumni association, or other groups.

At Select Insurance Group, we search for every discount you qualify for across our network of over 40 carriers to maximize your savings on car insurance orlando florida.

Frequently Asked Questions about Orlando Car Insurance

Navigating car insurance orlando florida can be confusing. Here are straight answers to common questions we hear from clients.

How much car insurance is truly enough in Orlando?

Florida’s minimums ($10k PIP, $10k PDL) will keep you legal, but they are rarely enough to cover costs in a serious accident. A single collision can easily exceed these limits, leaving you personally liable. Given Orlando’s heavy traffic and high accident risk on roads like I-4, we strongly recommend higher liability limits to protect your assets. Consider at least $100,000 per person and $300,000 per accident for bodily injury, plus $50,000 for property damage. For homeowners, an umbrella policy offers an extra layer of protection. The goal is to safeguard your financial future, not just meet the legal minimum.

Is car insurance more expensive in Orlando than in other Florida cities?

Yes, Orlando is one of the pricier cities for car insurance orlando florida. Major factors include high population density, heavy traffic congestion from over 60 million annual tourists, and higher accident rates, particularly on I-4. Florida’s large population of uninsured motorists and risks from severe weather like hurricanes also contribute to higher costs for everyone. While cities like Miami may sometimes be more expensive, Orlando consistently ranks on the higher end compared to smaller cities like Tallahassee or Gainesville.

How can an independent insurance agent help me find the best rates?

Working with an independent agent like Select Insurance Group means we work for you, not a single insurance company. Here’s how we help:

- We Shop for You: With access to over 40 carriers, we compare quotes to find the best combination of price and protection, saving you time and effort.

- Personalized, Unbiased Advice: We take the time to understand your needs and recommend coverage that fits your budget and protects your assets, without trying to upsell you.

- Claims Assistance: If you have an accident, we act as your advocate, guiding you through the claims process and helping resolve issues.

- Local Expertise: As a local agency, whether you’re in Insurance Agency East Orlando or elsewhere, we understand the unique driving challenges in Central Florida.

With over 30 years of experience, we simplify the process, save you money, and ensure you get the right coverage.

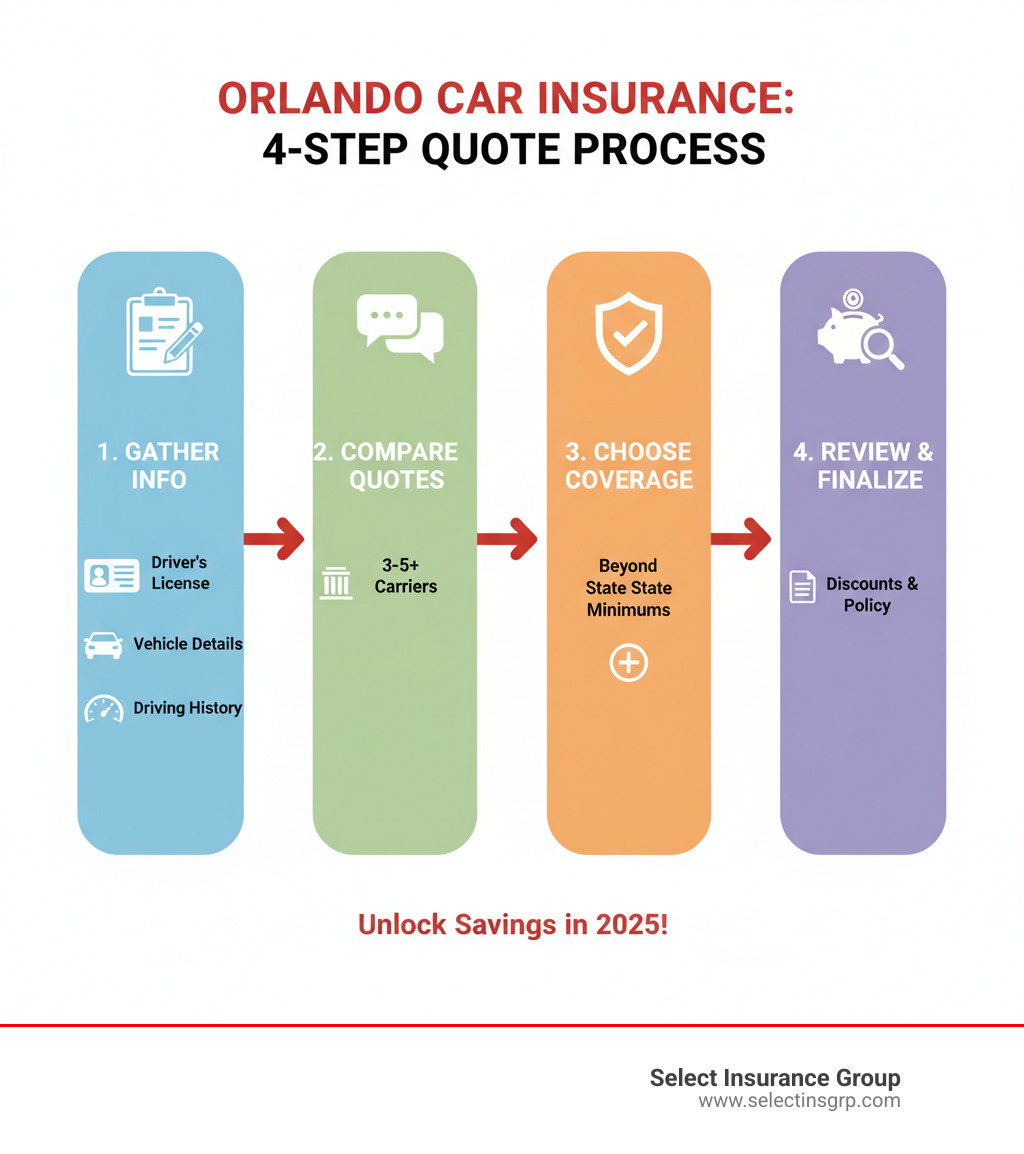

Your Next Steps to Affordable Car Insurance in Orlando

You are now equipped with the knowledge to make smart decisions about your car insurance orlando florida. Let’s recap the key takeaways. Florida’s minimum insurance requirements often fall short in Orlando’s high-traffic environment. To truly protect yourself, consider higher liability limits and coverages like Collision, Comprehensive, and Uninsured Motorist. Your rates are influenced by factors like your driving record and vehicle, but you can lower them by driving safely and asking for discounts.

The most important takeaway is that comparing quotes from multiple carriers is the single best way to save money. This is where working with an independent agent makes all the difference.

At Select Insurance Group, we are not tied to any single insurance company. We work with more than 40 top-rated carriers, allowing us to shop the market on your behalf to find the most competitive rates for car insurance orlando florida. With over 30 years of experience, we understand the unique challenges Orlando drivers face.

We don’t just sell policies; we build relationships. We’re here to answer your questions and advocate for you if you ever need to file a claim. Whether you’re in Insurance Agency East Orlando or anywhere in the metro area, we are your local insurance partner.

Ready to see how much you could save? It takes just a few minutes to get a quote. Let us put our experience and carrier relationships to work for you.