Why North Carolina Car Insurance Laws Matter More Than Ever in 2025

North Carolina car insurance laws are undergoing their most significant changes in over two decades. Effective July 1, 2025, mandatory liability limits will increase for the first time since 1999, a move driven by rising medical and vehicle repair costs. Every driver needs to understand what’s required to stay legal and protected.

Quick Answer: North Carolina Car Insurance Laws Requirements

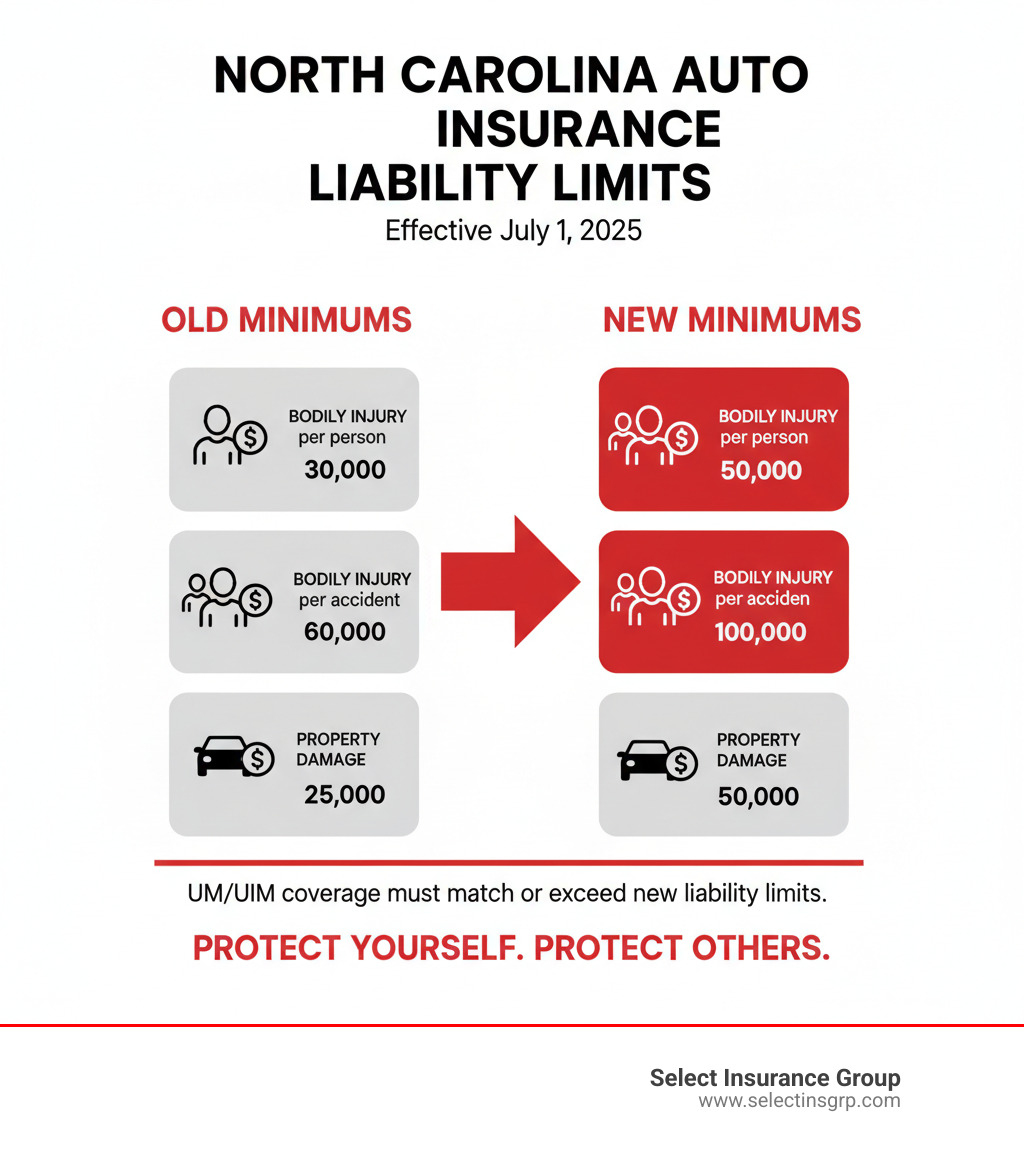

Current Minimums (until June 30, 2025):

- $30,000 Bodily Injury per person

- $60,000 Bodily Injury per accident

- $25,000 Property Damage

- Uninsured/Underinsured Motorist (UM/UIM) coverage required

NEW Minimums (effective July 1, 2025):

- $50,000 Bodily Injury per person

- $100,000 Bodily Injury per accident

- $50,000 Property Damage

- UM/UIM coverage must match or exceed new liability limits

Key Facts:

- North Carolina is an at-fault state (not no-fault)

- Continuous coverage is mandatory by law

- Insurance follows the car, not the driver

- Penalties for non-compliance include civil fines, license plate revocation, and restoration fees

These aren’t minor adjustments. The new law also eliminates the ‘liability setoff’ for underinsured motorist claims and extends surcharge periods for certain drivers. Understanding these changes is about protecting yourself financially. If you cause an accident and the costs exceed your policy limits, you could face wage garnishment or seizure of assets.

North Carolina is an at-fault state, meaning the driver who causes an accident is responsible for damages. The state also enforces a strict contributory negligence rule, which can bar you from collecting damages if you’re found even partially at fault. This makes having adequate coverage even more critical.

As D.J. Hearsey, founder and CEO of Select Insurance Group with over three decades of industry experience, I’ve helped thousands of drivers steer North Carolina car insurance laws. This guide will walk you through everything you need to know about the upcoming changes and how to ensure you’re properly covered.

Quick links related to North Carolina car insurance laws:

- Auto insurance Wilmington NC

- is auto insurance less expensive in north carolina

- where in north carolina is auto insurance the least expensive

Understanding North Carolina’s Mandatory Coverage

Understanding auto insurance in North Carolina isn’t optional–it’s essential. The North Carolina car insurance laws operate differently than in many other states, and knowing these differences can prevent serious financial trouble.

First, North Carolina is an at-fault state. If you cause an accident, you are responsible for paying for the other party’s damages and injuries. This differs from no-fault states, where each party’s own insurance covers their injuries regardless of who caused the crash.

North Carolina also follows a strict contributory negligence rule. If you are found to be even 1% at fault for an accident, you can be completely barred from recovering any damages from the other driver. This harsh standard makes having solid insurance coverage absolutely critical.

The state also requires continuous coverage for every registered vehicle. If your car has North Carolina plates, it must be insured by a company licensed to do business here; an out-of-state policy is not sufficient. You can find official details at the Official NCDMV: Vehicle Insurance Requirements.

At Select Insurance Group, we help North Carolina drivers find coverage that meets these requirements. Learn more about your options at North Carolina Auto Insurance.

What is Liability Coverage?

Liability coverage is the foundation of your policy, paying for damage you cause to others when you’re at fault. It’s mandatory under North Carolina car insurance laws and has two parts:

Bodily Injury (BI) liability covers physical harm to other people, including their medical bills, lost wages, and pain and suffering. Until July 1, 2025, the minimum BI limits are $30,000 per person and $60,000 per accident.

Property Damage (PD) liability covers the cost of repairing or replacing other people’s property you damage, such as their vehicle, a fence, or a building. The current minimum PD limit is $25,000 per accident.

For example, if you rear-end another car, your PD coverage pays to repair that car, while your BI coverage handles medical expenses for any injured occupants. Without adequate coverage, these bills could put your savings and future earnings at risk.

Uninsured/Underinsured Motorist (UM/UIM) Coverage Explained

Beyond liability, Uninsured/Underinsured Motorist (UM/UIM) coverage is also mandatory. This protects you when other drivers can’t pay for the damage they cause.

Uninsured Motorist (UM) coverage applies when you’re hit by a driver with no insurance or in a hit-and-run accident. The UM bodily injury portion covers your medical bills and lost income, while UM property damage covers your vehicle repairs, usually with a $100 deductible.

Underinsured Motorist (UIM) coverage is for when an at-fault driver has insurance, but their limits are too low to cover all your damages. For instance, if your medical bills are $75,000 but the at-fault driver only has $30,000 in coverage, your UIM coverage helps pay the difference. UIM only covers bodily injury, not property damage.

According to North Carolina law (G.S. 20-279.21), every auto policy must include UM/UIM coverage. This coverage is your shield against irresponsible drivers.

Major 2025 Changes to North Carolina Car Insurance Laws

July 1, 2025, marks a watershed moment for auto insurance in North Carolina: the first increase in mandatory liability limits since 1999. Over the last two decades, the costs of medical care and vehicle repairs have skyrocketed, making the old minimums dangerously inadequate.

In response, the legislature passed Senate Bill 452 and Senate Bill 319, bringing North Carolina car insurance laws into the 21st century to better reflect the true cost of accidents. These changes apply to all new policies and renewals on or after July 1, 2025. If your policy renews before that date, you’ll remain under the old limits until your next renewal. However, we at Select Insurance Group advise reviewing your coverage now to ensure you are adequately protected.

New Minimum Liability Limits (Effective July 1, 2025)

The most immediate change is the increase in minimum liability limits. These are substantial adjustments that provide greater financial protection.

| Coverage Type | Current Minimum (Until June 30, 2025) | New Minimum (Effective July 1, 2025) |

|---|---|---|

| Bodily Injury (Per Person) | $30,000 | $50,000 |

| Bodily Injury (Per Accident) | $60,000 | $100,000 |

| Property Damage (Per Accident) | $25,000 | $50,000 |

Bodily injury per person is increasing by $20,000 to better cover modern medical costs. The bodily injury per accident limit is nearly doubling to $100,000, providing crucial protection if multiple people are injured. Finally, property damage coverage doubles to $50,000, reflecting the high cost of modern vehicles. These higher limits mean you’re far less likely to face out-of-pocket expenses if you’re at fault in a serious accident.

Critical Updates to UM/UIM Coverage

The changes to Uninsured/Underinsured Motorist coverage represent a significant consumer protection improvement. Starting July 1, 2025, all new and renewed policies must include UM/UIM coverage that matches or exceeds the new liability limits ($50k/$100k/$50k). This ensures everyone has better protection from uninsured or underinsured drivers.

The biggest game-changer is the elimination of the ‘liability setoff’ provision. Previously, any amount paid by an at-fault driver’s insurance was subtracted from your UIM coverage. Now, you can collect from both policies.

For example, imagine your damages total $150,000, and the at-fault driver has a $50,000 limit. You also have $100,000 in UIM coverage.

- Old Rule: You’d get $50,000 from the at-fault driver, and your UIM payout would be reduced by that amount, leaving you with only another $50,000. Total recovery: $100,000, leaving you $50,000 short.

- New Rule: You get the full $50,000 from the at-fault driver AND the full $100,000 from your UIM policy. Total recovery: $150,000, covering all your damages.

This change dramatically increases your potential recovery. The law also updates the definition of ‘underinsured’ to better reflect the total damages you face. These updates make UM/UIM coverage a more powerful tool, and similar protections apply to motorcycles. Learn more at North Carolina Motorcycle Insurance.

How the Safe Driver Incentive Plan (SDIP) is Changing

The Safe Driver Incentive Plan (SDIP) assigns points for violations and at-fault accidents, leading to higher premiums. The 2025 updates to North Carolina car insurance laws make these surcharges last longer.

- Inexperienced Drivers: For anyone licensed on or after July 1, 2025, the surcharge period extends from 3 to 8 years. While the surcharge decreases in later years, it’s a significant change for those adding new drivers to a policy.

- Major Violations: Accumulating 4 or more SDIP points will now result in a 5-year premium surcharge, up from 3 years.

- Minor Violations: Even minor speeding tickets and Prayers for Judgment Continued (PJCs) will now have a 5-year lookback period for determining insurance points, up from 3 years, for any convictions on or after July 1, 2025.

These changes emphasize road safety and mean that infractions will impact your rates for a longer period. Safe driving has never been more financially rewarding.

The Consequences of Non-Compliance

Failing to maintain the insurance required by North Carolina car insurance laws has real, immediate consequences for your finances and your ability to drive legally. The North Carolina DMV has systems to detect coverage lapses quickly, and penalties can accumulate fast.

Meeting the minimum requirements keeps you legal, but it may not keep you financially safe in a serious accident. It’s crucial to review your policy to ensure you’re not just compliant, but truly protected.

Penalties for Driving Without Continuous Insurance

When your policy lapses, your insurer is required to notify the NCDMV. The DMV then sends you a termination notice, giving you 10 days to provide proof of new coverage or surrender your license plate. If you miss this window, penalties are automatic.

- Civil Penalties: A first lapse results in a $50 fine, a second within three years is $100, and a third is $150.

- License Plate Revocation: Your plate will be revoked, making it illegal to drive. To get it back, you must pay the civil penalty plus a $50 restoration fee.

- Additional Consequences: Unpaid fines can accrue late fees and interest and may be sent to collections, damaging your credit score.

A pro tip: If you sell a vehicle or move out of state, surrender your license plate to the DMV before canceling your insurance to avoid penalties. The details are in state law (G.S. 20-309), but we’re happy to walk you through the process.

The Financial Risks of Being Underinsured

Being underinsured means you’re legally compliant, but your coverage limits are too low to protect you in a serious accident. This is a scenario that can lead to financial ruin.

Imagine you cause an accident resulting in $200,000 of medical bills for the other driver. If you only carry the new minimum of $50,000 in bodily injury coverage, your insurance pays that amount, and you are personally liable for the remaining $150,000.

To collect that debt, the injured party can pursue a legal judgment against you, leading to:

- Wage Garnishment: A portion of your paycheck is withheld.

- Asset Seizure: Your savings, home equity, and even retirement funds can be at risk.

This kind of debt can affect your ability to get loans, buy a house, or rent an apartment for years. While the new 2025 minimums are an improvement, they may not be enough to protect your assets. At Select Insurance Group, we help you determine a level of protection that makes sense for your life, not just one that meets the bare minimum legal requirement. The point of insurance is to protect everything you’ve worked to build.

Practical Guide to Your NC Auto Policy

Understanding your auto insurance policy is critical, especially with the new North Carolina car insurance laws taking effect in 2025. Knowing what you’re paying for helps you make smart choices that can save you money without leaving you vulnerable.

Think of your policy as a financial safety net. Reviewing it now, before the law changes, is the best way to ensure you’re prepared. Ready to see how the new requirements affect you? We can provide a personalized quote reflecting all these updates. Just visit Get a Quote to get started.

Key Factors Affecting Your Premiums Under North Carolina Car Insurance Laws

In North Carolina, insurance generally follows the car, not the driver. This is called “permissive use.” If you give someone permission to drive your car and they have an accident, your insurance policy is typically the first to respond.

Your premium is calculated based on several factors. Understanding them can help you find ways to lower your costs:

- Your age and driving experience: Younger, less experienced drivers face higher premiums. The new SDIP rules extend the inexperienced driver surcharge period from 3 to 8 years.

- Your driving record: At-fault accidents and traffic violations add points that directly increase premiums. Some surcharges will now last for five years instead of three.

- The vehicle you drive: Luxury cars and sports cars cost more to insure than economy cars or minivans. Vehicles with advanced safety features may earn you a discount.

- Where you live: Urban areas with more traffic and higher crime rates typically have higher premiums than rural areas.

- How much you drive: High annual mileage increases your risk exposure and your rate. Low-mileage drivers may qualify for discounts.

- Your credit history: North Carolina allows insurers to use a credit-based insurance score when setting rates.

- Your marital status: Married drivers often receive lower rates due to statistically filing fewer claims.

According to a report by WalletHub, minimum coverage in NC averages around $477 annually, while full coverage is about $1,366 per year. Your actual premium will depend on your unique combination of these factors, which is why we shop across multiple carriers to find the best fit for you.

Legal and Procedural Aspects Under the New North Carolina Car Insurance Laws

The new North Carolina car insurance laws also update some legal procedures that can be important after a serious accident. One key change involves service of process on UM/UIM carriers, which affects how your insurer is notified of a legal claim.

Under the new rules, there is more flexibility for serving an insurer in a UM/UIM claim. An insurer can now be served as an unnamed party, and service is allowed even after the statute of limitations on the initial lawsuit has passed, as long as the suit was filed on time. This provides more breathing room for accident victims and helps prevent valid claims from being dismissed on a technicality.

While these procedural updates are subtle, they join the elimination of the liability setoff to create a more favorable environment for accident victims seeking fair compensation. If you ever find yourself in a complex accident situation, these nuances become critical. While we aren’t attorneys, we can help you understand your coverage and connect you with the right resources. Contact us directly for guidance.

Frequently Asked Questions about NC Auto Insurance

After three decades in this business, I’ve heard just about every question imaginable about North Carolina car insurance laws. Here are answers to the most common ones, especially with the big 2025 changes on the horizon.

What are the new minimum insurance limits in NC starting July 1, 2025?

Starting July 1, 2025, all policies issued or renewed must have at least $50,000 for bodily injury per person, $100,000 for bodily injury per accident, and $50,000 for property damage. Additionally, your Uninsured/Underinsured Motorist (UM/UIM) coverage must match or exceed these new liability limits. The state wants to ensure you’re protected not just from your own mistakes, but from other drivers’ lack of coverage as well.

Is North Carolina a no-fault state?

No, North Carolina is an at-fault (or tort) state. This means the driver who causes an accident is legally and financially responsible for the damages and injuries they inflict on others. In a no-fault state, your own insurance covers your injuries regardless of who is at fault. Here, we must determine fault, and that driver’s liability insurance pays. This is why having adequate liability coverage is so critical to protect your assets.

What happens if I let someone borrow my car and they have an accident?

In North Carolina, car insurance generally follows the car, not the driver. This is called “permissive use.” If you give someone permission to drive your vehicle and they cause an accident, your auto insurance policy is typically the primary coverage that responds, not the driver’s. Their driving mistake could impact your insurance rates and claims history, so it’s important to understand this principle of North Carolina car insurance laws.

Conclusion

The upcoming changes to North Carolina car insurance laws are the most significant in over 25 years. It’s essential to understand them to ensure you remain both legal and financially secure.

To recap, on July 1, 2025, minimum liability limits will rise to $50,000 per person, $100,000 per accident for bodily injury, and $50,000 for property damage. Uninsured/Underinsured Motorist coverage must match these new limits, and the elimination of the ‘liability setoff’ will allow for greater recovery in UIM claims. These changes are a direct response to the rising costs of medical care and vehicle repairs.

Meeting the new minimums is mandatory, but it may not be enough to fully protect your assets. If you cause an accident where damages exceed your policy limits, you are personally responsible for the difference. Proactively reviewing your policy is the best way to safeguard your financial future.

At Select Insurance Group, we have over three decades of experience helping drivers steer these kinds of changes across the Southeast. We shop over 40 carriers to find you competitive rates without sacrificing the coverage you actually need. We’re here to be your trusted advisor.

Compliance with the new North Carolina car insurance laws isn’t something to stress about. With the right guidance, you can be properly covered. The worst time to find you’re underinsured is after an accident. The best time to review your policy is now.

Review your North Carolina auto insurance policy today and let’s make sure you’re ready for 2025 with confidence and peace of mind.