Why Small Business Insurance Florida Matters for Your Success

Small business insurance Florida is essential protection that helps your company survive unexpected events like hurricanes, customer lawsuits, employee injuries, and property damage. Here’s what Florida business owners need to know:

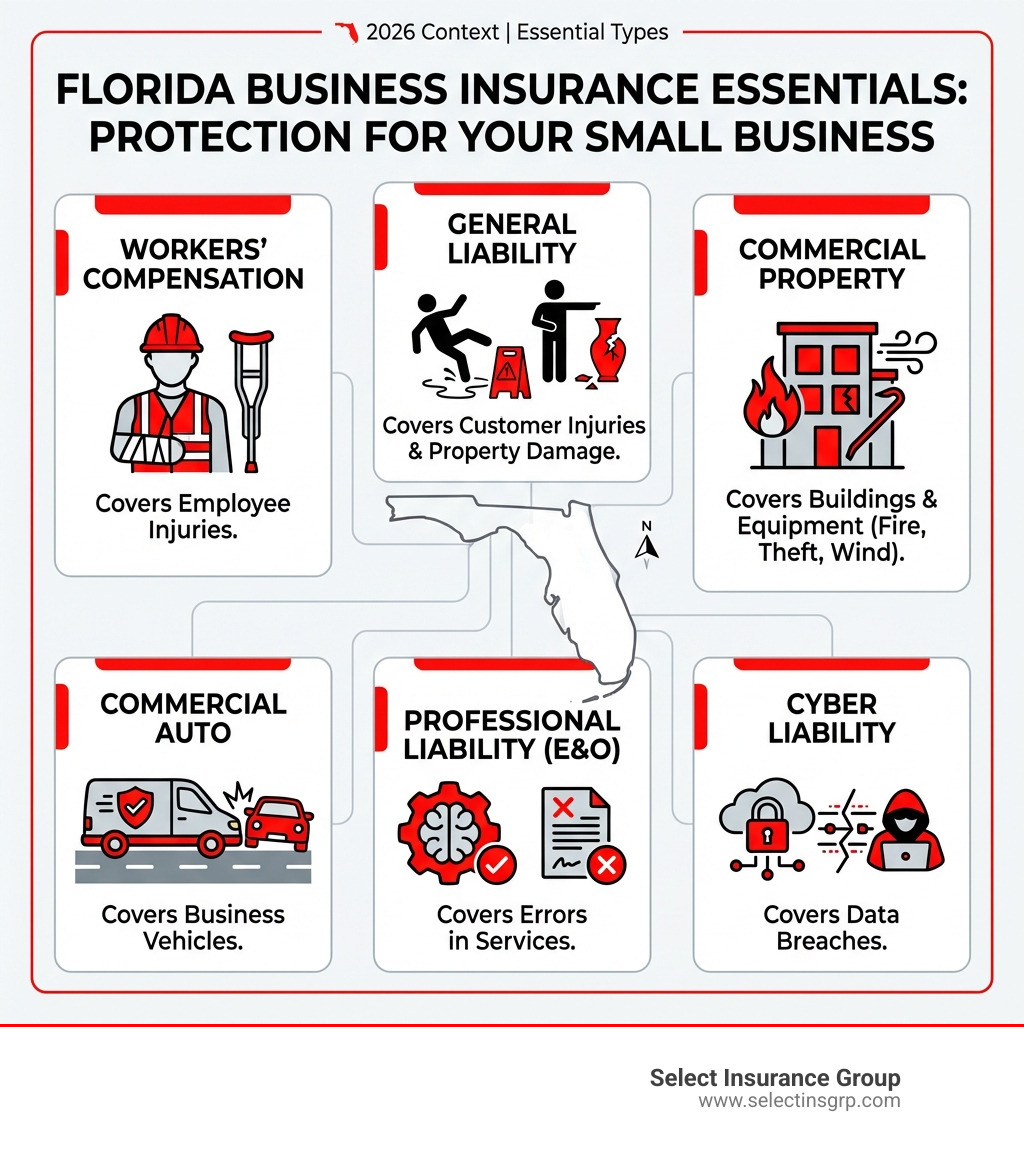

Quick Overview: Florida Business Insurance Essentials

| Insurance Type | Required by Law? | Who Needs It |

|---|---|---|

| Workers’ Compensation | Yes (with 4+ employees, or 1+ for construction) | Most businesses with employees |

| Commercial Auto | Yes (if using vehicles for business) | Any business operating vehicles |

| General Liability | No (but often required by landlords/contracts) | Nearly all businesses |

| Commercial Property | No | Businesses with physical locations or equipment |

| Professional Liability (E&O) | No | Service providers, consultants, professionals |

| Cyber Liability | No | Businesses storing customer data |

Florida’s business landscape is massive—2.8 million small businesses employ 3.6 million people across the state. From Miami’s coast to Tallahassee’s inland regions, each business faces unique risks. Hurricane season threatens property. Lawsuits can drain your savings. A single workplace injury without proper coverage could shut your doors permanently.

The good news? Understanding your insurance options doesn’t have to be complicated. This guide breaks down exactly what coverage you need, what it costs, and how to get it—without the insurance jargon.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group, where we’ve spent over three decades helping businesses across the Southeast—including Florida—steer their insurance needs. Our team specializes in finding affordable small business insurance Florida solutions that actually protect what you’ve built, whether you’re running a construction company in Tampa or a consulting firm in Orlando.

Florida’s Business Insurance Landscape: Required vs. Recommended Coverage

When it comes to small business insurance Florida, it’s crucial to understand the difference between what’s legally mandated and what’s simply a smart move for comprehensive risk management. While some policies are non-negotiable for compliance, others are essential for truly protecting your assets and ensuring your business’s long-term stability. Let’s explore both.

Legally Required Business Insurance in Florida

Florida, like many states, has specific requirements for certain types of business insurance, primarily focused on employee safety and vehicle operation. Failing to comply can lead to hefty fines, stop-work orders, and significant legal liabilities.

-

Workers’ Compensation Insurance

This is often the first type of insurance that comes to mind when discussing legal requirements. Workers’ compensation provides medical treatment, wage replacement, and other benefits to employees who are injured or become ill as a direct result of their job duties. In Florida, the rules for this coverage depend on your industry and the number of employees you have:- Construction Industry: If your business is in the construction industry, you are required to carry Workers’ Compensation insurance if you have one or more employees, including corporate officers and LLC members. This strict requirement reflects the higher risks associated with construction work.

- Non-Construction Industries: For most other businesses, Workers’ Compensation is mandatory if you have four or more employees, whether they are full-time or part-time. This threshold includes corporate officers and LLC members. Agricultural businesses have a slightly different rule, requiring coverage with six or more regular employees, or twelve or more seasonal employees who work for more than 30 days.

- Exemptions: While many businesses need this coverage, some sole proprietors and certain officers in non-construction industries can elect exemptions. However, construction industry officer exemptions are much more limited and require specific ownership and filing criteria.

Understanding these nuances is vital for compliance. You can find detailed information and requirements from the Florida Department of Financial Services, Division of Workers’ Compensation, at Workers’ Compensation Requirements in Florida. We also have more information on our site about Florida Workers Compensation.

-

Commercial Auto Insurance

If your business owns, leases, or regularly uses vehicles for business purposes in Florida, you are legally required to carry Commercial Auto insurance. This isn’t just about covering your company’s fleet; it also applies if employees use their personal vehicles for work-related tasks. While personal auto policies typically exclude business use, a commercial policy ensures you’re protected.

Florida’s minimum commercial auto insurance requirements include:- $10,000 Personal Injury Protection (PIP): This covers medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident.

- $10,000 Property Damage Liability (PDL): This covers damage your vehicle causes to another person’s property.

While Bodily Injury Liability (BIL) is not always legally required by Florida law for private passenger autos, it’s almost always a good idea and often contractually required by clients or vendors. We strongly recommend higher limits to adequately protect your business from potential lawsuits. For more in-depth information, explore our guide on Florida Business Auto.

Essential Insurance Policies for Florida Businesses

Beyond the legal mandates, there’s a suite of insurance policies that, while not always required by law, are absolutely critical for protecting your business from the myriad of risks it faces daily in Florida’s dynamic environment. These are the policies that truly build resilience and safeguard your investment.

-

General Liability Insurance

Often considered foundational, General Liability insurance protects your business from claims of bodily injury, property damage, and personal or advertising injury caused by your business operations, products, or services. Imagine a customer slipping and falling in your lobby, or your employee accidentally damaging a client’s property on-site. General Liability steps in to cover medical expenses, repair costs, and legal defense fees.

Even though it’s not legally required by the state of Florida, General Liability is almost universally essential. Commercial landlords often require proof of General Liability coverage before offering a lease, and many clients will insist on it before signing a contract. It’s truly the bedrock of your liability protection. Learn more about it on our Florida General Liability page. -

Commercial Property Insurance

This policy protects your business’s physical assets—your building (if you own it), equipment, inventory, furniture, and other business personal property—from perils like fire, theft, vandalism, and wind damage. For Florida businesses, commercial property insurance is particularly vital due to our state’s unique weather exposures, especially during hurricane season.

A crucial point for Florida businesses: Standard commercial property insurance policies generally exclude flood damage. Given Florida’s vulnerability to flooding, even well beyond designated high-risk zones, a separate flood insurance policy is almost always recommended. You can often purchase this through the FEMA National Flood Insurance Program (NFIP) or private markets. Additionally, windstorm exposure is a central concern, and many policies will have special wind or named-storm deductibles. We recommend carefully evaluating your flood risk and considering Ordinance or Law coverage, which helps pay for additional costs to demolish and rebuild to current code after a covered loss, a common requirement in Florida’s evolving building codes. -

Business Owner’s Policy (BOP)

For many small to mid-sized businesses with relatively straightforward risk profiles, a Business Owner’s Policy (BOP) is a fantastic option. It bundles General Liability, Commercial Property, and often Business Income (Business Interruption) insurance into a single, convenient package. This typically results in cost savings compared to purchasing each policy separately. Business Income coverage is particularly important in Florida, as it replaces lost income and covers ongoing expenses if your business operations are suspended due to a covered peril, like hurricane damage. -

Professional Liability Insurance (Errors & Omissions – E&O)

If your business provides professional advice, services, or expertise, Professional Liability (also known as Errors & Omissions or E&O) insurance is a must-have. It protects you from claims alleging financial harm to a client due to mistakes, negligence, or omissions in the professional services you provide. For example, if an accountant makes a tax error that costs a client money, or a consultant provides flawed advice, E&O coverage can cover legal defense costs and potential settlement payments. This is distinct from General Liability, which covers physical injury or property damage. -

Cyber Liability Insurance

Cyber threats are a reality for businesses of all sizes. Cyber Liability insurance helps your business deal with the devastating costs associated with data breaches and other cyber incidents. This can include expenses for forensic investigations, legal defense, notifying affected individuals (a requirement under Florida’s data-breach notification laws, like the Florida Information Protection Act), credit monitoring, data restoration, extortion payments, and even regulatory penalties. For any business that stores sensitive customer data, processes online payments, or relies on digital systems, cyber insurance is a practical necessity, not a luxury.

Understanding the Cost of Small Business Insurance Florida

One of the most common questions we hear is, “How much does small business insurance Florida cost?” The honest answer is: it varies significantly. Just like no two businesses are exactly alike, neither are their insurance premiums. However, we can help you understand the key factors that influence these costs and how you can work towards an affordable policy.

Key Factors That Influence Your Insurance Premiums

Insurance providers assess a multitude of factors to determine your premium. Understanding these can help you anticipate costs and identify areas where you might be able to save.

- Industry Risk: This is a major factor. Businesses in high-risk industries, like construction or manufacturing, will generally pay more for insurance than those in lower-risk sectors, such as office-based professional services. Professions are rated based on their unique exposures, with the potential for injuries or property damage directly impacting rates.

- Business Location: Where your business operates within Florida plays a significant role. For instance, a business located on the coast near Miami will likely have higher property insurance rates due to increased hurricane and flood exposure compared to a business located inland near Gainesville. Urban areas might also see higher liability or commercial auto rates due to increased traffic and population density.

- Number of Employees: More employees often mean a higher payroll, which directly impacts Workers’ Compensation premiums. It also increases the potential for liability claims.

- Annual Revenue/Payroll: Higher revenue or payroll can indicate a larger operation with more exposure, potentially leading to higher premiums. For workers’ compensation, premiums are directly tied to payroll.

- Claims History: A business with a history of frequent or large claims will almost always face higher premiums. A clean claims record, conversely, can lead to better terms and potential discounts.

- Coverage Limits and Deductibles: The higher your coverage limits (the maximum amount an insurer will pay for a claim), the higher your premium. Conversely, choosing a higher deductible (the amount you pay out-of-pocket before insurance kicks in) can lower your premium. It’s a balance between managing your upfront costs and your potential out-of-pocket expenses during a claim.

Average baseline costs for low-risk Florida businesses might look something like this: General Liability insurance around $49 per month, Workers’ Compensation insurance about $54 per month, and Professional Liability insurance typically around $71 per month. However, these are just averages, and your specific costs will depend on your unique situation.

How to Get an Affordable Small Business Insurance Florida Policy

We know that managing costs is crucial for any small business. Here are some practical steps you can take to secure affordable small business insurance Florida without sacrificing essential protection:

- Bundling Policies (Business Owner’s Policy – BOP): As mentioned earlier, a BOP combines General Liability, Commercial Property, and Business Income coverage. This bundling often comes with a discount compared to purchasing each policy separately, making it a cost-effective choice for eligible businesses.

- Implement Safety Programs and Risk Management Practices: Proactive risk management can significantly impact your premiums. For example, implementing comprehensive safety programs, fleet safety policies, and robust cybersecurity protocols demonstrates to insurers that you are actively working to mitigate risks. This can lead to lower rates and potential credits.

- Maintain a Clean Claims Record: A strong track record of no or few claims shows insurers that your business is less risky to cover, often resulting in more favorable premiums.

- Compare Quotes from Multiple Carriers: Don’t settle for the first quote you receive. We work with over 40 carriers to shop for the best rates and coverage options for our clients. Comparing quotes ensures you’re getting competitive pricing for the coverage you need.

- Work with an Independent Insurance Agent: This is where we shine! An independent agent, like those at Select Insurance Group, isn’t tied to a single insurance company. We can assess your unique business needs, explain complex policy details in simple terms, and shop the market on your behalf to find the best value and coverage for your small business insurance Florida needs.

The best way to know exactly what you’ll pay for business insurance and explore your coverage options is to reach out. Get a Quote from us today, and let’s find the right fit for your business.

Top Florida Industries and Their Specific Insurance Needs

Florida’s economy is incredibly diverse, boasting a wide array of thriving small businesses. However, each industry comes with its own unique set of risks and, consequently, its own specific insurance needs. What works for a tech startup in Orlando won’t necessarily protect a restaurant in Miami Beach or a construction company in Tampa. Let’s look at some of Florida’s top industries and their specialized insurance requirements.

Construction and Contracting

The construction industry in Florida is booming, but it’s also inherently risky. Contractors face daily hazards, from worksite accidents to property damage and liability claims. Proper insurance is not just a legal requirement; it’s a lifeline.

- Workers’ Compensation: As we discussed, if you have one or more employees in construction, this is legally required. It covers medical expenses and lost wages for workers injured on the job, like an employee falling from a ladder on a Cocoa Beach painting project. For more details, consult our Florida Workers Compensation page.

- General Liability: This is crucial for covering third-party bodily injury or property damage claims, such as a tree trimmer accidentally dropping a tree on a customer’s home or a visitor getting injured on your job site. Many clients and general contractors will require proof of high general liability limits.

- Builder’s Risk Insurance: This policy protects structures under construction, materials, and supplies from perils like fire, theft, or vandalism during the building process. It’s essential for new builds or major renovations.

- Inland Marine Insurance: Often called “tools and equipment” coverage, Inland Marine protects your movable property (tools, equipment, materials) while it’s in transit or at a job site, not just at your primary business location. This is vital for contractors whose gear is constantly on the move.

Restaurants, Retail, and Hospitality

Florida’s vibrant tourism industry fuels a massive sector of restaurants, retail shops, and hospitality venues. These businesses face high foot traffic, perishable goods, and unique liability exposures.

- General Liability: This is paramount for covering customer slips and falls, foodborne illness claims, or property damage caused by your operations.

- Commercial Property Insurance: Protects your building, kitchen equipment, inventory, and fixtures from perils like fire, theft, and wind. For restaurants, consider spoilage coverage for lost perishable stock due to power outages (a common concern during storms in Florida) or equipment breakdown.

- Spoilage Coverage: An essential add-on for restaurants, ensuring that if your walk-in freezer breaks down or a power outage occurs, the cost of your spoiled food inventory is covered.

- Liquor Liability Insurance: If your restaurant or bar serves alcohol, this policy protects you from claims arising from intoxicated patrons, such as property damage or bodily injury they cause after being served.

- Employment Practices Liability Insurance (EPLI): With a large workforce, these businesses are susceptible to claims of wrongful termination, discrimination, or harassment. EPLI covers legal costs associated with such allegations.

Professional Services (Consultants, Accountants, Real Estate)

Professionals who offer advice, manage finances, or facilitate transactions face distinct risks related to errors, omissions, and data handling rather than physical injury.

- Professional Liability (E&O) Insurance: This is the cornerstone for professional services. It protects against allegations of financial loss due to your professional advice, designs, or services. For example, if a real estate agent makes an error in a contract, or an accountant gives incorrect tax advice, E&O covers the legal defense and potential damages.

- Cyber Liability Insurance: Professionals often handle sensitive client data. Cyber Liability is crucial for covering data breaches, ransomware attacks, and other cyber incidents that could compromise client information. Florida’s data breach laws make this particularly important.

- General Liability: While less prominent than for other industries, General Liability still covers basic risks like a client tripping in your office or accidental property damage during a client visit.

- Hired and Non-Owned Auto Coverage: If you or your employees use personal vehicles for business travel (e.g., a real estate agent driving to an open house in Miami, or a consultant visiting a client), this coverage protects your business from liability if an accident occurs, as personal auto policies typically exclude business use.

Your Guide to Securing and Managing Business Insurance

Navigating small business insurance Florida might seem daunting, but with the right resources and a clear understanding of the process, it’s entirely manageable. Our goal is to empower you with the knowledge to make informed decisions for your business’s protection.

Finding Resources and Getting a Quote

Knowledge is power, especially when it comes to insurance. Florida offers several excellent resources for small business owners seeking information and assistance.

- Florida Small Business Development Center (SBDC): The SBDC network provides free consulting and training to help small businesses start, grow, and succeed. They can offer guidance on business planning, risk management, and understanding regulatory requirements, which indirectly impacts your insurance needs. Visit them at Florida Small Business Development Center.

- U.S. Small Business Administration (SBA) Florida District: The SBA is a fantastic federal resource for small businesses, offering support with funding, government contracting, and counseling. Their Florida District office can provide broader business guidance that ties into risk management strategies. Find more information at U.S. Small Business Administration Florida District.

- Florida Department of Financial Services (DFS) and Office of Insurance Regulation (OIR): These state agencies are your go-to for official guidance on insurance regulations, consumer information, and updates on the Florida insurance market. They publish helpful overviews on various types of commercial property insurance and workers’ compensation requirements. The OIR’s mission is “To promote a stable and competitive insurance market for consumers.” You can contact the Florida Office of Insurance Regulation at 200 East Gaines St., Tallahassee, FL 32399-0301, by phone at (850) 413-3140, or visit their website at https://www.floir.com/.

- Independent Insurance Agents (Like Us!): We are perhaps your most valuable resource. As independent agents, we represent multiple insurance carriers. This means we can shop around for you, comparing policies and prices from over 40 providers to find the best coverage that fits your specific needs and budget. We understand the nuances of Florida’s insurance market, including its unique risks and regulations. Instead of spending hours researching and contacting multiple companies yourself, let us do the heavy lifting. Contact us today for personalized advice and a free, no-obligation quote.

The Consequences of Not Having Business Insurance

While the thought of paying for insurance might not be exciting, the financial and legal consequences of not having adequate small business insurance Florida can be catastrophic. It’s often not a matter of if something will go wrong, but when.

- Legal Penalties and Fines: For legally required coverages like Workers’ Compensation, failing to comply can result in severe penalties. Florida can impose fines, issue stop-work orders, and even pursue criminal charges in some cases. These fines can be substantial and accumulate daily.

- Direct Financial Liability: Without insurance, your business is directly responsible for any costs arising from covered events. A single customer injury or property damage claim could lead to medical bills, repair costs, and legal fees that can quickly deplete your business savings or force you to sell assets.

- Lawsuit Costs and Asset Seizure: If your business is sued for liability, you’ll bear the full cost of legal defense, court fees, and any awarded damages. Lawsuits can easily reach into the millions of dollars. Without proper insurance, your business assets—and in some cases, even your personal assets if your business structure doesn’t fully protect you—could be at risk of seizure to satisfy judgments.

- Reputational Damage: Word travels fast, especially in the age of social media. A business that fails to cover its employees’ injuries or can’t compensate for damages due to lack of insurance can suffer irreparable harm to its reputation. This can lead to loss of customer trust, difficulty attracting talent, and decreased sales.

- Loss of Contracts and Opportunities: Many clients, landlords, and partners require proof of insurance before doing business with you. Without the necessary certificates of insurance (COIs), you could lose out on valuable contracts and growth opportunities.

- Business Interruption: A major incident like a fire, storm damage, or a significant lawsuit can force your business to temporarily close its doors. Without business interruption insurance, you’ll not only face repair costs but also lost income and ongoing expenses during the downtime, potentially leading to permanent closure.

Choosing to forgo essential small business insurance Florida isn’t saving money; it’s taking an enormous, unnecessary gamble with everything you’ve worked so hard to build.

Conclusion

Protecting your small business in Florida is about more than just day-to-day operations; it’s about safeguarding your future against the unexpected. From the unique weather challenges of our Sunshine State to the everyday risks of liability and employee well-being, having the right small business insurance Florida is the cornerstone of business continuity and sustainable growth.

We understand that every business is unique, and so are its insurance needs. That’s why at Select Insurance Group, we dedicate our three decades of experience to providing expert guidance, personalized service, and competitive rates by shopping over 40 carriers on your behalf. We’re here to help you steer the complexities of insurance, ensuring you have the robust protection you need to thrive.

Don’t leave your business vulnerable to unforeseen circumstances. Invest in the peace of mind that comes with comprehensive coverage. Learn more about your Florida commercial insurance options and let us help you build a resilient foundation for your success.