Why Classic Car Insurance Florida Is Different from Standard Auto Coverage

Classic car insurance Florida is specialized coverage for vehicles that are investments, hobbies, and pieces of automotive history. Unlike standard insurance, which pays a depreciated cash value after a claim, classic car insurance offers Agreed Value coverage. You and your insurer agree on the car’s value upfront, and that’s what you receive in a total loss (minus your deductible). Here’s what makes it different:

- Lower premiums: Classic car insurance costs an average of 36% less than traditional auto insurance.

- Agreed Value coverage: Get the full agreed-upon amount in a total loss, not a depreciated value.

- Usage restrictions: Designed for pleasure driving, car shows, and club events—not daily commuting.

- Specialized benefits: Coverage for spare parts, trip interruption, and guaranteed flatbed towing.

- Qualification requirements: Typically requires vehicles 25+ years old, secure storage, mileage limits under 5,000 miles/year, and a clean driving record.

In Florida specifically, risks like hurricanes and coastal flooding make proper coverage critical. Despite this, classic car insurance is significantly more affordable than standard policies because insurers know these vehicles are driven less and are carefully maintained.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group. With over three decades in the insurance industry, I’ve helped countless collectors find the right protection for their prized vehicles. Understanding Classic car insurance Florida options is essential to safeguarding your investment and your passion.

Classic car insurance Florida terms to learn:

What Makes a Car ‘Classic’ and How Is Its Insurance Different?

Classic cars are more than just vehicles—they’re rolling pieces of history and investments that often appreciate in value. Because they occupy a special place in our garages, they need protection that’s just as unique. That’s what classic car insurance Florida provides: coverage designed specifically for vehicles that are cherished, not just driven.

What Defines a Classic Car for Classic Car Insurance in Florida?

While enthusiasts may have different definitions, insurance companies have clearer guidelines. For most classic car insurance Florida policies, a vehicle qualifies if it’s 25 years or older. However, how the car is used and valued is more important. Classic cars are driven for pleasure rather than daily transportation and tend to hold or increase in value.

Types of vehicles that often qualify include:

- Antique cars (45+ years old)

- Classic cars (20-40 years old)

- Exotic and high-performance vehicles

- Muscle cars and hot rods

- Modern collector cars with limited production runs

- Replica vehicles

- Classic trucks, utility, and military vehicles

These are all vehicles worth preserving and protecting with specialized coverage.

Standard vs. Classic Policies: A Head-to-Head Comparison

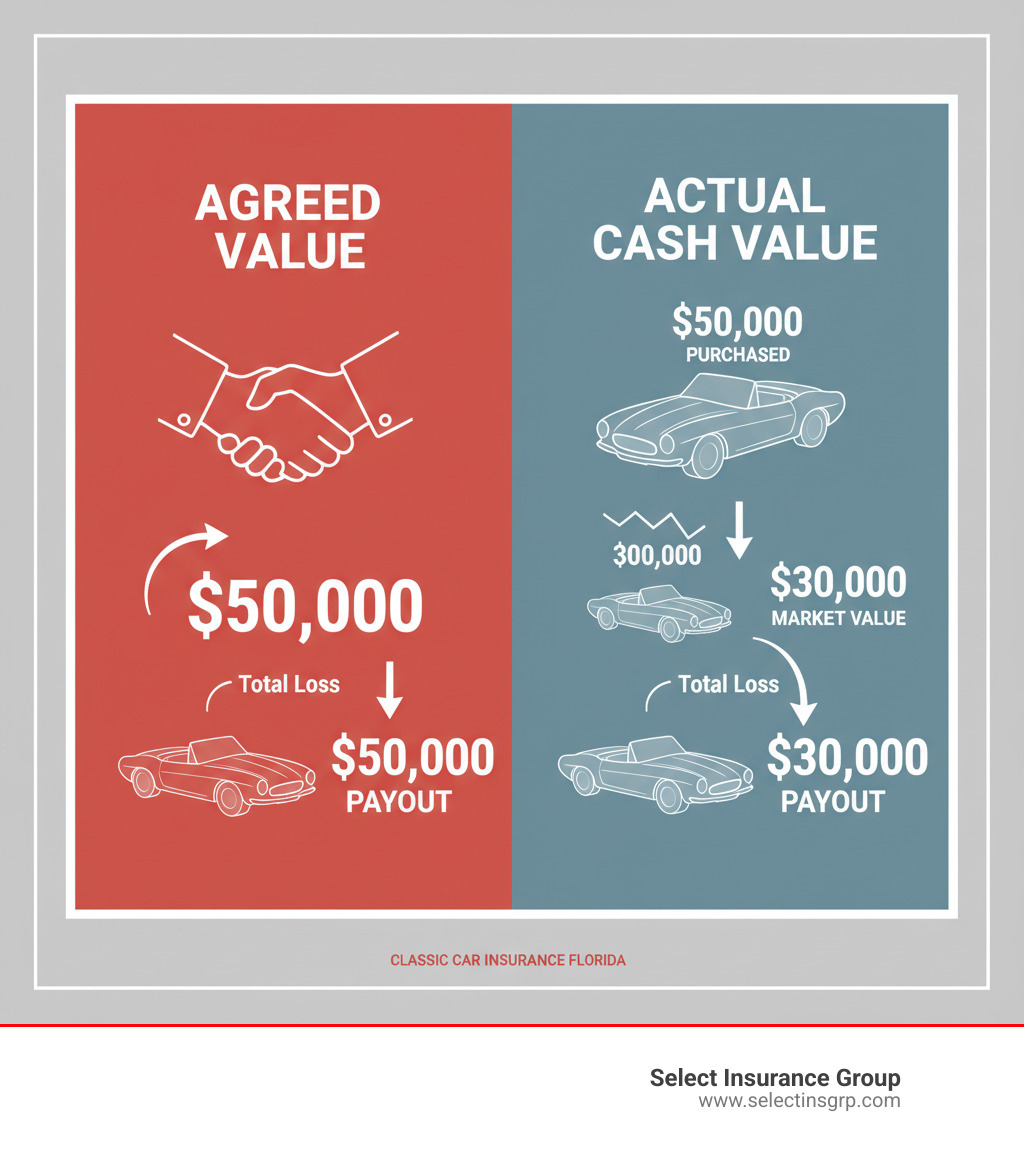

Insuring a classic on a standard auto policy is a significant risk. The two policies operate on different principles, especially regarding valuation.

Standard policies use Actual Cash Value (ACV), which pays the market value of your car at the time of a claim after factoring in depreciation. For an appreciating classic, ACV could leave you with a fraction of its true worth.

Classic car insurance Florida uses Agreed Value coverage. Before the policy starts, you and the insurer agree on your car’s value. If it’s totaled in a covered claim, you receive that full agreed-upon amount (minus your deductible). There’s no depreciation and no surprises.

Despite covering more valuable vehicles, classic car insurance typically costs 36% less than traditional auto insurance. This is because insurers know these cars are driven carefully, stored securely, and carefully maintained, which reduces risk.

These lower premiums come with usage restrictions. Classic policies are for pleasure driving, like car shows and weekend cruises, and usually have mileage limits (often under 5,000 miles per year). Daily commuting is excluded. For your everyday vehicle, you might explore low cost auto insurance Florida options.

Finally, specialized claims handling is a key benefit. Classic car adjusters understand the unique needs of these vehicles, from sourcing rare parts to working with restoration shops. This expertise ensures your car is repaired correctly and efficiently.

Key Coverage Features and Qualification Requirements

The right classic car insurance Florida policy includes specialized features to protect your investment and passion. Let’s review the essential coverages and what it takes to qualify.

Must-Have Coverage for Your Collector Vehicle

Look for these features when shopping for classic car insurance Florida:

- Agreed Value Coverage: This is the foundation of any classic policy. It guarantees you’ll receive the full, pre-agreed value of your car in a covered total loss, with no depreciation applied.

- Inflation Guard: This feature automatically increases your car’s value annually to keep pace with market appreciation, often at no extra cost.

- Spare Parts Coverage: Many policies include coverage for your collection of spare parts, which are often just as valuable and hard to find as the car itself.

- Guaranteed Flatbed Towing: This ensures your classic is transported safely via a flatbed tow truck, preventing damage that can occur with standard towing.

- Additional Benefits: Other valuable coverages can include auto show medical reimbursement if you’re injured at an event and trip interruption coverage to help with lodging and transportation if your car breaks down far from home.

These features are designed by people who understand the unique world of classic car ownership.

Do You and Your Car Qualify?

Not every car or driver will qualify for specialized insurance. These requirements keep risks low and premiums affordable.

- Usage: Your classic must be for pleasure use, not daily commuting. Policies have mileage limitations, typically under 5,000 miles per year.

- Storage: The vehicle must be kept in a secure, enclosed, and locked structure like a private garage or dedicated storage unit. Street parking is generally not permitted.

- Driving Record: A clean driving record for the last 3-5 years is required. Serious infractions like reckless driving may disqualify you.

- Driver Age: Most insurers require drivers to be at least 25 years old due to the higher risk associated with younger drivers.

- Daily Driver: You must own and insure a separate vehicle for daily use. This proves the classic is a secondary, recreational vehicle.

If you need coverage for your daily driver, learn more about low cost auto insurance Florida options.

Meeting these requirements makes you eligible for the superior coverage and attractive rates that classic car insurance Florida provides.

Navigating the Costs of Classic Car Insurance in Florida

One of the best surprises for classic car owners is how affordable classic car insurance Florida can be. However, your specific premium depends on several factors related to your vehicle, driving habits, and location.

Factors That Influence Your Premium

Understanding what goes into your classic car insurance Florida premium can help you make informed decisions.

- Vehicle Value and Type: Your premium is primarily based on the vehicle’s Agreed Value and type. A rare exotic may cost more to insure than a common muscle car, even at similar values, due to parts availability.

- Age and Driving Record: While you must be at least 25, younger drivers may see higher rates. A clean driving record with no recent accidents will always earn you a better premium.

- Location in Florida: Where you live matters. Storing your car in a high-theft area or a coastal region prone to hurricanes will increase your rate. The table below shows how much location can impact average auto insurance rates.

| City in Florida | Average Rate Compared to State Average |

|---|---|

| Brownsville, Westview | 49% higher |

| Pinewood, West Little River | 48% higher |

| Santa Rosa Beach, Freeport | 28% less |

| Defuniak Springs, Miramar Beach | 27% less |

- Credit History: In Florida, a good credit history is seen as an indicator of responsibility and can help lower your premium.

- Usage and Storage: Lower annual mileage and secure, enclosed storage reduce risk and your rate.

Open uping Discounts for Your Prized Possession

Insurers offer various discounts that can lead to significant savings on your classic car insurance Florida.

- Car Club Membership: Active members of recognized classic car clubs often qualify for a discount.

- Bundling Policies: Combining your classic car policy with your home, daily driver, or even Florida motorcycle insurance can open up multi-policy discounts.

- Anti-Theft Devices: Approved alarms, GPS trackers, and other security devices can earn you a discount.

- Secure Storage: Superior storage, such as using a garage lift, may qualify for additional discounts beyond the basic requirement.

- Driver Safety Course: Completing an approved defensive driving course can provide a small discount.

At Select Insurance Group, we shop over 40 carriers to find the best combination of coverage and price. With three decades of experience, we know how to find every discount you qualify for to maximize your savings.

The Florida Classic Car Community: Resources and Connections

Florida is home to a thriving community of classic car enthusiasts, thanks to its year-round sunshine and scenic roads. Being part of this community means finding resources, connecting with collectors, and protecting your investment with the right classic car insurance Florida.

Finding the Right Classic Car Insurance in Florida

Your classic car deserves more than a generic policy. Finding the right insurance partner is crucial.

- Work with Specialized Insurers: Companies that focus on classic cars understand the market. They offer superior coverage like Agreed Value and flatbed towing at prices up to 36 percent less than standard insurers.

- Use an Independent Agent: An independent agent like Select Insurance Group works for you, not a single company. We shop your coverage across more than 40 carriers to find the perfect policy to match your needs and budget.

- Customize Your Policy: Your car is unique, and your policy should be too. We help you customize your classic car insurance Florida with options like Inflation Guard, spare parts coverage, and flexible mileage plans.

Florida’s Top Car Clubs and Resources

Connecting with Florida’s classic car community enriches the ownership experience and can even lead to insurance discounts. Here are a few resources:

Notable Car Clubs:

- South Florida Region of the Antique Automobile Club: A chapter of the AACA with local and national events.

- Cool Cruisers of Southwest Florida: A Naples-based club that supports local charities.

- South East Classics: A family-oriented club with regular shows and meetings.

- Cape Kennedy Corvette Club: A club for Corvette enthusiasts in eastern and central Florida.

Reputable Restoration Shops:

- Graveyard Classics (Hollywood): Known for high-quality restorations.

- Classic Car Restorations (Bradenton): Offers extensive restoration services.

- MasterClass Automotive (Miami): Provides maintenance from master technicians.

- L & J Auto and Street Rods (Orlando): Offers diagnosis, repairs, and custom work.

Attending local car shows and events is a great way to connect with fellow enthusiasts who share your passion. Protecting that passion is our job. Contact our Tampa insurance agency for a personalized quote and let us help you get the right coverage.

Frequently Asked Questions about Florida Classic Car Insurance

Understanding the specifics of classic car insurance Florida can be confusing. Here are answers to some of the most common questions we receive from enthusiasts.

How is my classic car’s value determined for an Agreed Value policy?

The Agreed Value is determined through a mutual agreement between you and the insurer. You provide documentation—such as professional appraisals, detailed photographs, and restoration records—to support your vehicle’s worth. The insurer reviews this information to agree on a value that gets locked into your policy. This is the exact amount you will receive in a covered total loss, minus your deductible.

What happens if my classic car is a total loss?

This is where an Agreed Value policy shines. In a covered total loss, you receive the full Agreed Value that was established at the start of your policy, minus your deductible. There is no deduction for depreciation, which gives you the financial security to replace your cherished vehicle or start a new project without the stress of a low payout.

Can I use my classic car for occasional errands?

Classic car insurance Florida policies are designed for pleasure use, such as car shows, club events, and weekend drives. They are not intended for daily commuting or regular errands. While some policies offer flexible usage options that may allow for an infrequent, occasional errand, routine use is prohibited and could jeopardize your coverage. The best approach is to be honest about how you plan to use your vehicle so your agent can ensure your policy aligns with your needs.

Conclusion: Protect Your Passion with the Right Partner

Owning a classic car in Florida is a passion that deserves special protection. These vehicles are investments in history and joy, and they require more than simple transportation coverage.

As we’ve covered, classic car insurance Florida is superior to standard auto insurance, offering Agreed Value coverage, specialized benefits, and premiums that are often 36% lower. While Florida’s weather is great for driving, risks like hurricanes and theft make proper coverage essential.

At Select Insurance Group, our 30+ years of experience and access to over 40 carriers mean we can find the best classic car insurance Florida policy for you. We understand your classic is more than a car—it’s an investment and a passion. We’ll help you craft a policy that provides complete peace of mind, fitting your vehicle, budget, and lifestyle.

Your classic car represents a significant investment of time, money, and memories. It deserves protection from people who genuinely understand its value.

Ready to give your classic the protection it deserves? Contact our Tampa insurance agency for a personalized quote today. Let’s work together to keep your passion protected for years to come.