Why Orlando Business Owners Can’t Afford to Skip Property Insurance

Business property insurance Orlando FL is commercial coverage that protects your company’s physical assets—including buildings, equipment, inventory, and furniture—from damage caused by fire, theft, windstorms, and other covered perils. It also typically includes business interruption coverage to replace lost income if your operations are forced to shut down temporarily due to covered damage.

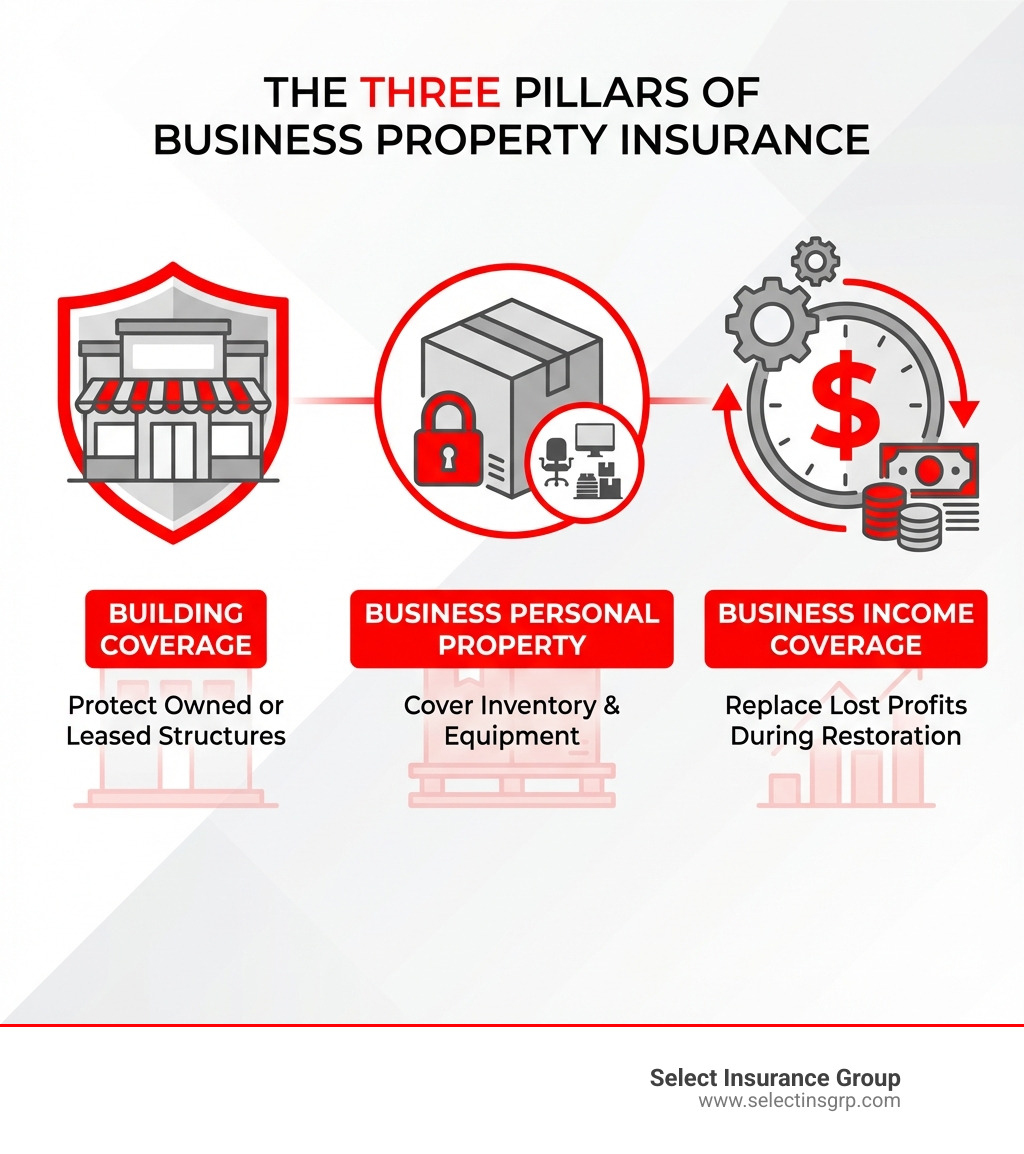

What Business Property Insurance Orlando FL Covers:

- Buildings and Structures – Protection for owned or leased commercial properties

- Business Personal Property – Coverage for inventory, equipment, furniture, and fixtures

- Business Income – Reimbursement for lost profits and fixed expenses during restoration

- Covered Perils – Fire, theft, vandalism, wind damage, and other disasters

- Additional Coverages – Options for inland marine (off-site equipment), flood insurance (separate policy), and Electronic Data Processing (EDP) for computer systems

Orlando ranks as one of the best large U.S. cities to start a small business. But that success comes with risk. Florida’s weather—from hurricane season to sudden storms—combined with everyday threats like theft and fire, means your business assets are constantly exposed to potential loss.

The financial stakes are real. Without adequate commercial property insurance, a single disaster could force you to pay out of pocket to rebuild, replace damaged inventory, and cover lost income. For many small businesses, that’s simply not survivable.

As D.J. Hearsey, founder and CEO of Select Insurance Group, I’ve helped countless businesses secure comprehensive business property insurance Orlando FL coverage. Our team understands the unique risks Orlando business owners face and works with more than 40 carriers to find the right solution for your specific needs.

The Foundation: What Commercial Property Insurance Covers

Commercial property insurance safeguards your business’s physical assets against a wide array of unforeseen events. It’s a crucial type of business insurance designed to help you recover financially after a disaster, ensuring business continuity. Without it, a fire, severe storm, or break-in could end your operations.

This coverage helps you repair or replace damaged property, allowing you to get back to business quickly. It minimizes the financial impact and stress when the unexpected happens. We help Orlando businesses find custom solutions that fit their needs. Learn more about our comprehensive offerings on our Florida commercial insurance page.

What Physical Assets Are Covered?

Commercial property insurance covers the tangible items that make up your business, ensuring you have funds to replace or repair them if they’re damaged by a covered peril.

Typically, this includes:

- Buildings and Structures: Covers the physical structure you own, including attached fixtures. If you rent, it can cover improvements you’ve made.

- Inventory and Stock: From products on your shelves to raw materials in your warehouse, this coverage ensures you can replace stock if it’s damaged or stolen.

- Furniture and Fixtures: Includes office desks, chairs, display cases, shelving units, and built-in cabinetry.

- Machinery and Equipment: Covers manufacturing equipment, kitchen appliances, contractor tools, or office computers and printers.

- Signage and Fencing: Exterior signs and fences that secure your property are also covered.

- Property of Others in Your Care: If a customer’s item (e.g., a vehicle being serviced or a laptop being repaired) is damaged under your care, your policy can help cover the costs.

What Perils Are Commonly Included?

“Perils” are the events or disasters that cause damage. Business property insurance Orlando FL is designed to protect against a wide variety of these occurrences. Common covered perils include:

- Fire: From small electrical fires to a major blaze.

- Theft: Helps you replace stolen inventory, equipment, or other assets.

- Vandalism: Covers malicious damage like graffiti or broken windows.

- Windstorms: Extremely important in Florida, this covers damage from hurricanes and other high-wind events.

- Lightning: Covers direct strikes or damage from power surges.

- Manmade Disasters: Includes events like riots or damage from vehicles.

- Other Natural Disasters: May include hail, explosions, or smoke damage, depending on your policy.

Some perils, like floods, are typically excluded and require separate policies. For a general overview, the Florida Department of Financial Services provides a helpful Commercial Property Insurance Overview.

Understanding Business Personal Property (BPP)

Business Personal Property (BPP) coverage protects the tangible property inside your business that isn’t part of the building itself. Think of it as everything you’d take with you if you moved locations. This includes:

- Furniture (desks, chairs)

- Fixtures (movable display racks)

- Equipment (computers, machinery, tools)

- Inventory (products, raw materials)

- Supplies (office and cleaning supplies)

BPP coverage applies to property at a specified location. This is vital for business owners who rent their commercial space in Orlando. Your landlord’s insurance likely won’t cover your business personal property. Without BPP, you’d have to replace all your operational items out of pocket after a loss. Even if you own your building, BPP is essential to protect your contents.

Tailoring Your Policy: Special Considerations for Orlando Businesses

Orlando’s location in Florida presents unique environmental challenges, meaning a standard commercial property policy might not be enough. To truly protect your enterprise, you need to consider coverages that address specific risks like hurricanes and flooding.

We work with you to understand these challenges and ensure your business property insurance Orlando FL is robust enough to handle unforeseen events.

Business Interruption Coverage: A Lifeline When Disaster Strikes

Imagine a fire or hurricane forces your business to close for months. How do you pay your bills and employees? This is where Business Income or Business Interruption Coverage becomes a lifeline.

This crucial coverage reimburses you for lost profits and helps cover fixed operating expenses while your business is shut down due to a covered loss. These expenses can include:

- Rent or mortgage payments

- Employee salaries

- Loan payments

- Utilities

- Taxes

This coverage can also include Civil Authority Coverage. If a government agency restricts access to your area due to nearby damage (even if your property is untouched), your policy can still cover your lost income. This is vital in Orlando, where a hurricane could lead to widespread access restrictions. We strongly recommend this coverage to safeguard your ability to recover.

The Flood Insurance Gap: Why It’s a Separate Policy

A critical fact for Florida business owners: standard commercial property insurance policies typically exclude flood damage. Damage from rising water is not covered, even if your policy includes windstorms.

Flood risk is so widespread in Florida that it requires a separate, specialized policy. To protect your Orlando business, you’ll need to purchase flood insurance, often through the National Flood Insurance Program (NFIP) or private insurers. Inland flooding from heavy rainfall is a real threat, even away from the coast.

Don’t assume you’re covered. We advise clients to review their policies and consider a separate flood insurance policy. For more on protecting property from water, see our page on Florida home insurance.

Essential Add-Ons: Inland Marine and EDP Insurance

Sometimes your business property isn’t confined to your building. Add-on coverages like Inland Marine and Electronic Data Processing (EDP) insurance fill these gaps.

-

Inland Marine Insurance: Despite the name, this covers property that is moved or transported away from your primary location.

- For Contractors: An “equipment floater” under an inland marine policy protects your tools and machinery while in transit or at a job site, where a standard policy may offer limited coverage.

- For Other Businesses: This is smart for businesses with valuable samples or demo equipment that travels with a sales team.

-

Electronic Data Processing (EDP) Insurance: Standard policies often have limited coverage for computer networks. EDP insurance is designed to protect your computer-related equipment and data.

- It broadens coverage to include risks like power surges, electrical disturbances, and sometimes even virus attacks.

- If a server crashes or a virus renders workstations unusable, EDP insurance can help cover repair or replacement costs and data restoration.

These additions help ensure your business property insurance Orlando FL policy is comprehensive.

Decoding the Cost and Requirements for Business Property Insurance in Orlando, FL

The cost of business property insurance Orlando FL is a common concern, but there’s no one-size-fits-all price. Premiums are highly customized based on your business’s specific risk profile. Our goal is to find the right balance between adequate coverage and affordability.

While costs vary, some average monthly insurance costs for Florida small businesses include general liability ($49), workers’ comp ($54), and professional liability ($71). Commercial property insurance costs are determined by their own set of variables, but the key is balancing cost with the need for critical coverage.

Key Factors That Influence Your Premium

When calculating your premium for business property insurance Orlando FL, we assess several risk factors to tailor a cost-effective policy:

- Location and Flood/Wind Risk: Your Orlando zip code, elevation, and proximity to water affect risk. Areas prone to hurricanes or flooding will have higher premiums.

- Building Construction Type and Age: Newer buildings made of robust materials (e.g., concrete block) with modern updates (new roof, hurricane-resistant windows) generally have lower premiums than older, wood-frame structures.

- Industry and Operations: A restaurant with a commercial kitchen has different fire risks than a consulting firm. A manufacturer with heavy machinery has different replacement costs than a retail boutique.

- Coverage Limits and Deductibles: Higher coverage limits increase your premium. Choosing a higher deductible (the amount you pay out-of-pocket) can lower your premium.

- Claims History: A history of property claims can indicate higher future risk and lead to higher premiums.

- Safety and Prevention Measures: Businesses with fire suppression systems, security alarms, and surveillance cameras may qualify for discounts.

Industry-Specific Needs for Business Property Insurance in Orlando, FL

Different industries in Orlando have unique property insurance needs. Tailoring your business property insurance Orlando FL to your sector is crucial.

- Restaurants and Food Service: Need coverage for kitchen equipment, furniture, and perishable inventory. They face high fire risks, making business interruption coverage essential.

- Retailers: Inventory is the biggest asset. Retailers need robust coverage for stock, display fixtures, and point-of-sale systems. Security systems are important for mitigating theft.

- General Contractors and Construction Companies: Often have storage for tools and materials. Inland marine coverage is essential for protecting expensive equipment taken to job sites. Florida requires contractors to carry public liability, property damage, and workers’ compensation insurance.

- Professional Offices (Law Firms, Accountants): Rely heavily on computer systems, office furniture, and sensitive data. EDP insurance is particularly important.

- Manufacturers: Typically have large, specialized machinery and significant inventory of raw materials and finished goods, requiring higher coverage limits and robust business interruption coverage.

- Hotels and Hospitality: Have unique needs for guest property coverage, extensive building coverage, and specialized equipment for amenities.

We assess your specific operations to ensure your policy is aligned with your industry’s demands. For more on liability, explore our Florida general liability page.

Navigating the Process: From Quote to Claim

Navigating insurance can feel complex, but it doesn’t have to be. Our goal is to make securing and managing your business property insurance Orlando FL simple and transparent. As an independent agent, we act as your partner, advocating on your behalf and ensuring you understand your coverage.

We guide you through every step, from selecting coverage to understanding policy details. Learn more about our work on our insurance agency in Orlando page.

How to Get a Business Property Insurance in Orlando, FL Quote

Getting a quote is the first step. We make this process straightforward.

Here’s the information you’ll typically need:

-

Gather Your Business Information:

- Business Details: Legal name, address, and business type.

- Property Information: For owners, we need building age, construction type, and square footage. For renters, we focus on your business personal property.

- Asset Valuation: An estimated value of your inventory, equipment, and furniture.

- Safety Features: Details on fire suppression, security alarms, or sprinkler systems.

- Claims History: Information on any previous property claims.

-

The Role of an Independent Agent: As independent agents, we shop your needs across more than 40 carriers. We compare offers and analyze policy details to find options that fit your budget and coverage needs, saving you time and ensuring competitive rates.

-

Comparing Offers: We’ll walk you through the quotes, explaining coverage limits, deductibles, and any specific endorsements or exclusions so you can make a confident decision.

Ready to see how affordable comprehensive coverage can be? Start the process today by visiting our get a quote page.

Understanding Policy Cancellation and Non-Renewal in Florida

It’s important to understand the rules around policy cancellation and non-renewal. Florida law, outlined in statutes like 627.4133 and 626.9201, provides specific notice requirements for insurers.

Key Notice Requirements:

- Non-Payment of Premium: Insurers must provide 10 days’ advance notice before cancellation.

- Cancellation (Early Term): Within the first 60-90 days, insurers generally have more flexibility to cancel but must provide advance notice (often 20 days).

- Cancellation (After 60 Days): After this period, an admitted insurer can only cancel for limited reasons, such as material misstatement, non-payment, or a substantial change in risk.

- Non-Renewal: For most commercial policies, insurers must provide 45 days’ advance notice of non-renewal. This extends to 120 days for commercial residential policies (like apartment buildings).

- Emergency Declarations: During a declared emergency like a hurricane, temporary prohibitions on cancellation or non-renewal may apply to give owners time to make repairs.

Understanding these rules is crucial for Orlando business owners. It ensures you know your rights and have time to find alternative coverage if needed. We can help you steer these regulations.

Frequently Asked Questions About Orlando Business Property Insurance

We often hear similar questions from Orlando business owners. Here are answers to some of the most common ones.

How much business property insurance do I need?

Getting the right amount of business property insurance Orlando FL is vital to avoid being underinsured. The amount depends on your asset value.

Here’s what to consider:

- Replacement Cost vs. Actual Cash Value (ACV):

- Replacement Cost: We almost always recommend this. It covers replacing damaged property with new items of similar quality, without deducting for depreciation. This ensures you can fully rebuild.

- Actual Cash Value (ACV): This covers replacement cost minus depreciation. It results in lower premiums but can leave you with a significant out-of-pocket expense.

- Valuing Your Property:

- Buildings: A professional appraisal is the best way to determine your building’s current replacement cost, ensuring your coverage limit is accurate.

- Contents: Conduct a thorough inventory of your business personal property, including equipment, furniture, and stock, to determine its replacement value.

- Avoiding Co-Insurance Penalties: If your policy limits are too low, an insurer may only pay a percentage of your loss, even if the loss is below your limit. This is a common and costly mistake.

We work with you to value your assets, ensuring your coverage reflects the true cost of getting your business back on its feet.

Can I bundle property insurance with other coverages?

Yes. For many small to medium-sized businesses, bundling is a smart and cost-effective strategy, typically through a Business Owner’s Policy (BOP).

A BOP is a package that combines essential coverages into one policy, usually including:

- Commercial Property Insurance: Covers your building and contents.

- General Liability Insurance: Protects against claims of bodily injury or property damage.

Benefits of a BOP:

- Cost Savings: Insurers often offer a discount for bundling.

- Convenience: One policy, one premium, and one renewal date simplifies management.

- Comprehensive Protection: A BOP provides a solid foundation of coverage for common small business risks.

We can help you determine if a BOP is the right fit for your Orlando business.

What is a hurricane deductible?

For any Florida business, understanding the hurricane deductible is critical. It’s different from your standard deductible and applies specifically to damage from a named hurricane.

Here’s how it works:

- Percentage-Based: Unlike a fixed-dollar standard deductible, a hurricane deductible is a percentage (e.g., 2% to 10%) of your property’s insured value.

- Example: If your property is insured for $500,000 with a 5% hurricane deductible, you are responsible for the first $25,000 of hurricane damage.

- When It Applies: It is only triggered by damage from a declared hurricane. Other perils, like a regular thunderstorm, fall under your standard deductible.

Given Orlando’s location, this deductible can represent a significant out-of-pocket expense. We ensure our clients are fully aware of their hurricane deductible and its potential impact.

Conclusion: Secure Your Orlando Business with the Right Partner

Navigating business property insurance Orlando FL is a non-negotiable step toward safeguarding your business. We’ve covered the essentials: protecting your physical assets, inventory, and income stream, while also highlighting the need for specialized coverages like flood and inland marine insurance for Orlando’s unique environment.

A “one-size-fits-all” approach won’t work. Your business needs a custom policy designed with Orlando’s specific risks in mind. This is a proactive business strategy that provides confidence for the future.

At Select Insurance Group, we leverage over 30 years of experience and shop across more than 40 carriers to find the ideal business property insurance Orlando FL solution for you. We understand the local market and are dedicated to providing superior customer service and competitive rates.

Don’t let unexpected damage derail your hard work. Take the next step to secure your assets and ensure your business thrives.

Learn more about our Florida commercial insurance solutions and let us help you build a resilient future for your Orlando business.