Why Finding the Right Motorcycle Insurance in Virginia Matters

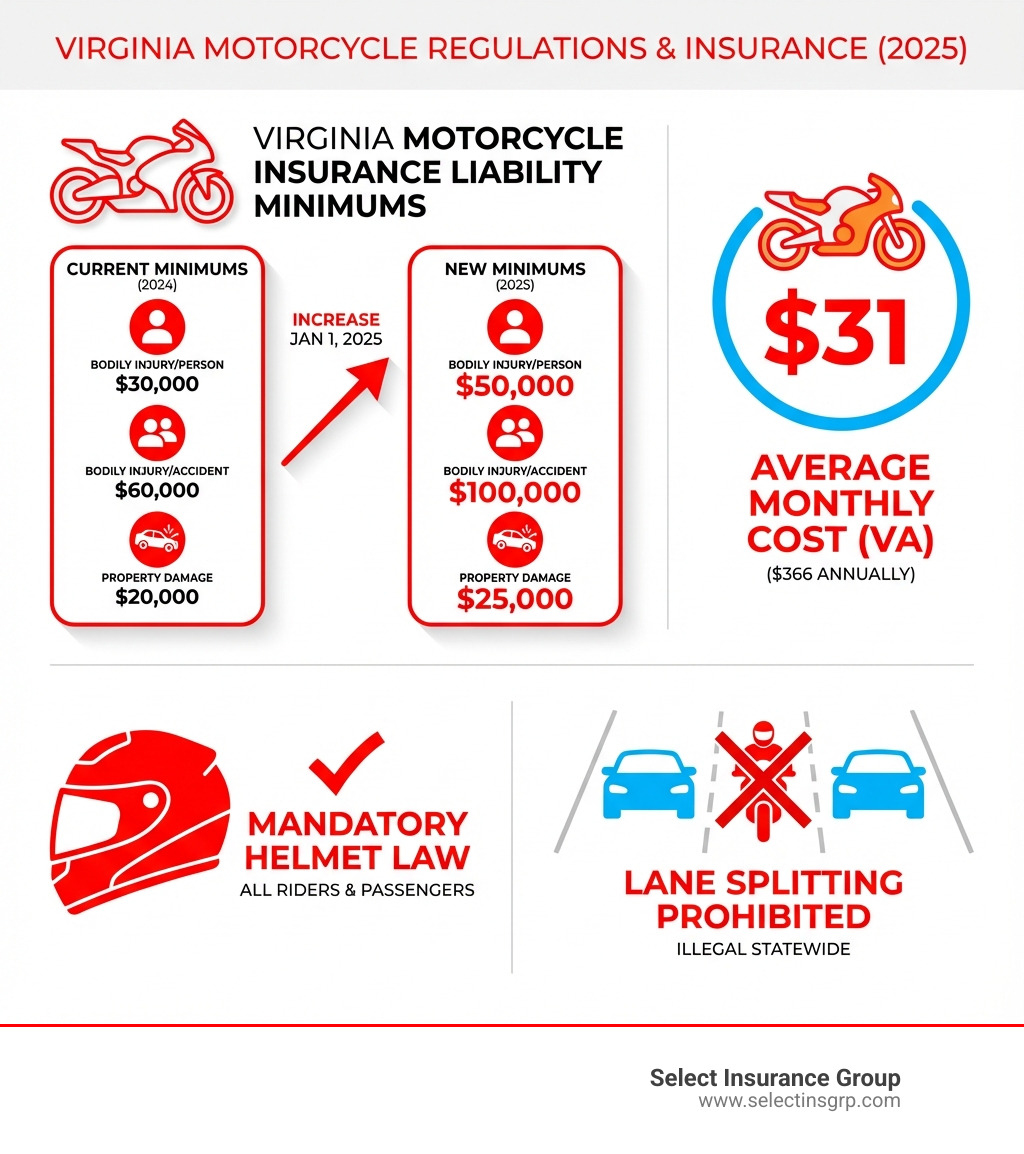

Motorcycle insurance companies in virginia offer a wide range of coverage options, but not all policies are created equal. As of July 1, 2024, Virginia law requires all motorcycle riders to carry insurance—no more paying an uninsured motor vehicle fee as an alternative. The state mandates minimum liability coverage of $30,000 per person and $60,000 per accident for bodily injury, plus $20,000 for property damage (increasing to 50/100/25 on January 1, 2025). Beyond meeting legal requirements, the right policy protects you from financial devastation if you’re in an accident, whether that’s on the winding roads of the Blue Ridge Parkway or navigating traffic in Richmond.

While many providers serve Virginia, finding the best fit involves comparing options for rates, customer service, and specialized coverage like roadside assistance or multi-policy discounts. The key is to find a policy that matches your riding style and budget, which is where working with an independent agency can provide a significant advantage.

The average cost of motorcycle insurance in Virginia is $31 per month ($366 annually), which is slightly below the national average of $33 per month. Costs vary significantly based on your location within the state—Bristol and Harrisonburg average $26/month while Norfolk can reach $65/month due to higher theft rates.

Virginia also has specific riding regulations you need to know. All operators and passengers must wear helmets, and lane splitting is illegal statewide. Riding without insurance can result in fines, license suspension, and a three-year SR-22 filing requirement.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group, where I’ve spent over three decades helping riders across the Southeast find the right coverage for their needs. Working with motorcycle insurance companies in Virginia, I’ve seen how the right policy can make the difference between a minor inconvenience and a financial disaster when the unexpected happens.

Motorcycle insurance companies in virginia further reading:

Understanding Virginia’s Motorcycle Insurance Laws

Navigating the open road in Virginia is a joy, but it comes with responsibilities. Just like the beautiful landscapes, the state’s laws are clear, and understanding them is your first step toward a safe and compliant ride. Here, we’ll break down the legal landscape for riders in the Old Dominion, from what the law requires for your policy to the rules of the road.

Minimum Motorcycle Insurance Requirements in Virginia

Virginia’s commitment to road safety means all motorcycle riders must carry insurance. This isn’t just a suggestion; it’s a legal mandate that took full effect on July 1, 2024, replacing the previous option of paying an uninsured motor vehicle fee. As of now, the minimum liability coverage you need is:

- Bodily Injury Liability: $30,000 per person and $60,000 per accident. This coverage steps in to pay for medical expenses and lost wages for others if you’re at fault in an accident.

- Property Damage Liability: $20,000 per accident. This covers damage to other people’s property, like their vehicle or a fence, if you’re responsible for an incident.

- Uninsured/Underinsured Motorist (UM/UIM) coverage: Virginia also requires UM/UIM coverage, which protects you if an at-fault driver has no insurance or not enough insurance to cover your damages. The minimums are $50,000 per person and $100,000 per accident for bodily injury, and $25,000 per accident for property damage.

But here’s a crucial heads-up: these minimums are set to increase! On January 1, 2025, Virginia will raise the minimum insurance requirement to 50/100/25. This means $50,000 for bodily injury per person, $100,000 for bodily injury per accident, and $25,000 for property damage. It’s always wise to stay ahead of these changes, and frankly, carrying more than the minimum is often a smart move to protect your assets adequately.

For more detailed information on what Virginia requires, you can always visit our page on minimum motorcycle insurance in Virginia.

Essential Virginia Motorcycle Riding Regulations

Beyond insurance, Virginia has specific rules that shape how you ride. These aren’t just bureaucratic problems; they’re designed to keep everyone safer on the road.

First and foremost, to legally operate a motorcycle in Virginia, you must hold a valid motorcycle classification designation on your driver’s license or have a driver’s license restricted to the operation of a motorcycle. This ensures you’ve proven your competence on two wheels. You can find more details on Virginia motorcycle laws through the DMV.

One of the most critical regulations, and one we can’t stress enough, is the mandatory helmet law. In Virginia, all operators and passengers are required to wear a helmet—no exceptions, no age limits. This simple piece of gear is your best friend in an accident, significantly reducing the risk of severe head injuries.

Now, for a rule that often sparks debate among riders: lane splitting and lane filtering are illegal in Virginia. While some states permit motorcycles to ride between lanes of stopped or slow-moving traffic, Virginia does not. If you’re caught doing so, you’re likely to be charged with reckless driving. So, keep it between the lines, folks!

Penalties for Riding Uninsured

Riding without the proper motorcycle insurance in Virginia isn’t just risky; it carries significant legal and financial consequences. The state takes its insurance requirements seriously, and for good reason—uninsured riders pose a threat to themselves and everyone else on the road.

If you’re caught riding without insurance, you could face:

- Fines: These can be substantial and quickly add up.

- License Suspension: Your riding privileges could be revoked, leaving your bike parked and you without legal transportation.

- SR-22 Filing Requirement: This isn’t a penalty itself, but a certificate of financial responsibility that your insurance provider must file with the DMV. It signals that you’re a high-risk driver, which can lead to significantly higher insurance premiums for up to three years.

- Personal Financial Liability: Perhaps the most daunting penalty is the out-of-pocket expense. If you cause an accident while uninsured, you’ll be personally responsible for all damages and injuries, which could amount to tens or even hundreds of thousands of dollars. Imagine having to pay for someone’s medical bills, vehicle repairs, and lost wages entirely out of your own pocket—it’s a financial nightmare.

You’ll also need to show proof of insurance to register your motorcycle in Virginia. Don’t let a lapse in coverage turn your passion into a costly problem.

Decoding Your Motorcycle Insurance Policy

While meeting Virginia’s minimum requirements keeps you legal, a truly great policy goes far beyond. It’s about ensuring you have comprehensive protection that offers true peace of mind, whether you’re cruising through the countryside or parked safely at home. Let’s explore the essential and optional coverages that can make all the difference.

Standard vs. Optional Coverages

When we talk about motorcycle insurance, we often start with the basics, but the real magic happens when you customize your coverage to fit your unique riding style and bike.

- Liability Coverage: As we discussed, this is the legal minimum. It protects you financially if you cause an accident, covering bodily injury and property damage to others. It’s the baseline for responsible riding.

- Collision Coverage: This is where you start protecting your own ride. Collision coverage pays for damage to your motorcycle if you hit another vehicle or object, or if you flip your bike, regardless of who is at fault. For newer bikes or those with loans, this is often non-negotiable.

- Comprehensive Coverage (Other Than Collision): Think of this as your “act of nature and theft” coverage. It steps in when your bike is damaged by things other than a collision, such as theft, vandalism, fire, floods, falling objects, or even hitting an animal. Given how easy motorcycles can be to steal, this is a crucial layer of protection.

- Medical Payments (MedPay): This coverage helps pay for medical expenses for you and your passengers, regardless of who caused the accident. It can be a real lifesaver, covering hospital visits, ambulance fees, and other medical costs, often acting as a buffer for your health insurance deductible.

Specialized Coverage for Serious Riders

For those who love their bikes a little extra, or who simply want maximum protection, there are specialized options designed with the serious rider in mind.

- Custom Parts & Equipment (CPE) / Accessory Coverage: If you’ve invested in custom paint, chrome, saddlebags, unique exhausts, or other aftermarket parts, standard policies might not cover their full value. CPE coverage specifically protects these upgrades. Some policies offer a base amount (e.g., up to $3,000) at no extra cost, with options to increase coverage up to $10,000 or more. This also often extends to personal belongings carried on your bike, sometimes called “carried contents.”

- Roadside Assistance / Towing & Labor: Picture this: you’re miles from home, and your bike breaks down. Roadside assistance comes to the rescue, covering towing, gas delivery, tire changes, jump-starts, and other minor repairs that get you back on the road. It’s a small add-on that can save you a huge headache (and tow bill!). Some policies offer benefits of up to $300 per breakdown.

- Total Loss Coverage: For riders with newer motorcycles, this is a fantastic option. If your bike is totaled (usually within its first year or two, depending on the policy), this coverage ensures you get a brand-new replacement motorcycle or the full original purchase price, rather than just the depreciated actual cash value. It’s like a reset button for your ride.

By understanding and selecting these coverages, you can build a policy that truly protects you and your prized possession, allowing you to focus on the thrill of the ride.

How Much Does Motorcycle Insurance Cost in Virginia?

The thrill of riding often comes with questions about cost, and motorcycle insurance is no exception. We understand that budget is a key factor for many riders. Here, we’ll break down the average costs in Virginia and explore the specific factors that determine your final premium.

Average Premiums in the Old Dominion

Good news for Virginia riders! The average cost of motorcycle insurance in our state is actually quite competitive.

- Average Monthly Cost: On average, motorcycle insurance in Virginia costs around $31 per month.

- Average Annual Cost: This translates to roughly $366 per year.

- Comparison to National Average: This is slightly below the national average of $33 per month, making Virginia a relatively affordable state for motorcycle coverage.

However, these are just averages, and your specific cost can vary significantly based on the type of coverage you choose. A basic liability-only policy will cost less than a full coverage policy that includes collision and comprehensive protection for your own motorcycle. The difference in premium reflects the added financial security.

Key Factors That Influence Your Insurance Rate

So, why does one rider pay $26 a month while another pays $65? Several factors come into play when calculating your motorcycle insurance premium:

- Rider Age and Experience: Younger, less experienced riders typically pay more because they are statistically at a higher risk of accidents. As you gain years of riding experience and maintain a clean record, your rates tend to decrease.

- Driving Record: A clean driving history with no accidents or traffic violations is your best friend when it comes to insurance costs. Tickets, at-fault accidents, or DUIs will almost certainly lead to higher premiums.

- Motorcycle Type: The make, model, engine size, and style of your bike have a big impact. Sport bikes, with their higher performance capabilities, often have higher rates than cruisers or touring bikes. A brand new, expensive motorcycle will also cost more to insure than an older, less valuable one.

- Location: Where you live and primarily ride in Virginia plays a significant role. For example, riders in cities like Bristol and Harrisonburg might see average monthly costs around $26, while those in more densely populated areas with higher theft rates, like Norfolk, could face rates as high as $65 per month. Local accident rates and vehicle theft statistics are heavily factored in.

- Coverage Limits and Deductibles: Choosing higher liability limits (beyond the state minimums) or adding comprehensive and collision coverage will increase your premium, but also your protection. Conversely, opting for a higher deductible (the amount you pay out-of-pocket before your insurance kicks in) can lower your premium.

How to Find the Most Affordable Motorcycle Insurance in Virginia

Finding affordable motorcycle insurance doesn’t mean sacrificing protection. It’s about being strategic and proactive.

- Comparing Quotes: This is perhaps the most effective step. Different providers use different formulas to calculate risk, leading to varied quotes for the same coverage. We always recommend getting multiple quotes to ensure you’re getting the best rate.

- Raising Deductibles: If you’re comfortable paying more out-of-pocket in the event of a claim, increasing your deductible can significantly lower your monthly or annual premium.

- Maintaining a Clean Record: As mentioned, a spotless driving record is invaluable. Drive safely, avoid tickets, and stay accident-free.

- Taking a Safety Course: Many providers offer discounts for completing approved motorcycle safety courses, like those offered by the Motorcycle Safety Foundation. Not only does it save you money, but it also makes you a safer, more skilled rider—a win-win!

- Bundling Policies: Many insurance providers offer discounts if you bundle your motorcycle policy with other insurance products, such as auto, home, or renters insurance. This can lead to substantial savings across all your policies.

For more helpful strategies, check out our tips for finding the cheapest motorcycle insurance in Virginia.

How to Choose the Right Motorcycle Insurance Provider in Virginia

Choosing the right motorcycle insurance companies in virginia is as important as choosing your coverage. It’s not just about the price; it’s about reliability, customer service, and finding a partner who truly understands your needs as a rider. Here’s how to identify trustworthy motorcycle insurance options in Virginia.

The Value of Working with an Independent Insurance Agency

When it comes to insurance, you have choices. You could go directly to a single insurance provider, or you could work with an independent insurance agency like us. We believe the latter offers a distinct advantage.

- Single-Carrier Limitations: When you approach a direct provider, they can only offer you their products. Their focus is on selling you their policy, whether or not it’s the absolute best fit or value for you.

- The Advantage of Choice: As an independent agency, we aren’t tied to any single insurance provider. Instead, we have partnerships with over 40 carriers. This means we can shop around on your behalf, comparing policies, coverages, and prices from a wide range of options.

- How Independent Agents Shop Multiple Carriers: We take the time to understand your unique riding habits, your specific motorcycle, and your budget. Then, we leverage our relationships with multiple providers to find policies that truly match your needs. This eliminates the need for you to spend hours getting quotes from individual companies yourself.

- Finding the Best Fit for Your Needs: Our goal isn’t just to find you a policy, but to find you the right policy. We act as your advocate, ensuring you get comprehensive coverage at a competitive rate, custom to your lifestyle. It’s like having a personal shopper for your insurance!

What to Look for in a Motorcycle Insurance Provider in Virginia

When we’re evaluating insurance providers for our clients, we look for several key attributes that indicate reliability and value:

- Financial Stability Ratings: We prioritize providers with strong financial ratings. This assures us (and you) that they have the financial strength to pay out claims, even large ones, when you need them most.

- Claims Process Satisfaction: A smooth and fair claims process is paramount. We look for providers known for their efficiency, transparency, and customer satisfaction during what can often be a stressful time. Reviews and industry complaint indexes (like the NAIC complaint index) can offer insight here.

- Range of Coverage Options: The best providers offer a wide array of coverage options, from basic liability to specialized protection for custom parts, roadside assistance, and total loss coverage. This flexibility allows us to tailor a policy perfectly.

- Available Discounts: We seek out providers who offer a variety of discounts, rewarding safe riding, loyalty, and other factors that can help lower your premium.

- Positive Customer Service Reviews: Beyond claims, overall customer service matters. We look for providers who are responsive, helpful, and easy to work with, ensuring you have support whenever questions arise.

The Process for Getting a Motorcycle Insurance Quote in Virginia

Getting a motorcycle insurance quote in Virginia with us is a straightforward process designed to get you the best coverage efficiently.

- Gather Your Information: To start, we’ll need a few details:

- Your driver’s license information (including your motorcycle endorsement).

- Details about your motorcycle, such as the VIN, make, model, year, and any significant modifications.

- Your riding history, including any past accidents or violations.

- Information about where your motorcycle is stored.

- Deciding on Coverage: We’ll discuss your riding habits and needs to help you determine the appropriate types of coverage, liability limits, and deductibles that make sense for your situation. Do you need just the minimum, or are you looking for comprehensive protection for your custom cruiser?

- Comparing Quotes: This is where we shine! We take all your information and shop it across our network of providers. We present you with clear, easy-to-understand quotes, highlighting the differences in coverage and price.

- Speaking with an Agent: One of our experienced agents will walk you through your options, answer any questions, and help you select the policy that offers the best value and protection for you.

Ready to see how simple it can be? You can get a personalized Virginia motorcycle insurance quote from us today!

Opening up Discounts and Savings on Your Policy

Who doesn’t love a good discount? We certainly do! Don’t overpay for your policy. Most riders qualify for at least one discount that can significantly lower their premium, making your ride even more enjoyable. We make it our business to find every discount you’re eligible for.

Common Discounts for Virginia Riders

Insurance providers offer various ways to save, and we’ll help you explore all of them. Here are some of the most common discounts available for Virginia motorcycle riders:

- Multi-Policy Bundling: This is one of the biggest money-savers. If you insure your motorcycle, car, and virginia-home-insurance (or renters insurance) with the same provider, you can often save up to 20% or more across all your policies. It’s a win-win for convenience and your wallet.

- Motorcycle Safety Course Completion: As we mentioned earlier, taking an approved motorcycle safety course (like those from the Motorcycle Safety Foundation) not only makes you a better rider but also often earns you a discount. It shows providers you’re committed to safe practices.

- Good Rider/Claims-Free History: If you maintain a clean driving record free of accidents and violations, providers will reward you with lower rates. The longer your claims-free history, the better your discount can be.

- Rider Group Affiliations: Belonging to certain motorcycle clubs or associations (such as H.O.G. for Harley-Davidson owners, or the AMA) can sometimes qualify you for a special discount. It’s a nod to the community aspect of riding.

- Anti-Theft Devices: Installing an alarm system, GPS tracker, or other anti-theft devices on your motorcycle can deter thieves and, in turn, earn you a discount on your comprehensive coverage.

- Paid-in-Full Option: Many providers offer a discount if you pay your entire annual premium upfront rather than in monthly installments.

- Mature Rider Discount: Experienced riders, particularly those over a certain age (e.g., 55+), often receive discounts due to their proven record of safe riding.

- Multiple Motorcycles: If you’re lucky enough to own more than one bike, insuring them all on a single policy can often lead to a multi-bike discount.

We pride ourselves on digging deep to find every possible discount for our clients, helping you get the most protection for your dollar.

Conclusion

Riding a motorcycle in Virginia offers unparalleled freedom and exhilaration, but it’s crucial to ensure that your adventures are backed by robust protection. Understanding the intricacies of motorcycle insurance companies in virginia, from mandatory minimums to specialized coverages, is not just about compliance—it’s about safeguarding your financial future and your peace of mind.

Key takeaways from our guide emphasize the importance of:

- Adhering to Virginia’s evolving minimum liability requirements, which will increase to 50/100/25 on January 1, 2025.

- Understanding and complying with essential riding regulations, including the mandatory helmet law and the prohibition of lane splitting.

- Recognizing the severe penalties for riding uninsured, which can lead to hefty fines, license suspension, and significant personal financial liability.

- Exploring optional coverages like comprehensive, collision, custom parts, and roadside assistance to tailor a policy that truly protects your unique ride and lifestyle.

- Knowing that the cost of your premium is influenced by factors like your age, riding history, motorcycle type, and location within Virginia.

- Actively seeking out and utilizing available discounts to make your coverage more affordable.

The value of expert guidance in this complex landscape cannot be overstated. That’s where Select Insurance Group comes in. As an independent agency, we pride ourselves on shopping over 40 carriers to find you the best coverage at a competitive rate, ensuring your policy is a perfect fit for your bike and your budget. We believe that finding the right insurance shouldn’t be a chore; it should be a partnership that gives you confidence on every journey.

Ready to hit the road with confidence? Get your personalized Virginia motorcycle insurance quote today, and let us help you find the peace of mind you deserve.