Why Trucking Liability Insurance Matters for Your Business

Trucking liability insurance is a specialized policy that protects your trucking operation from financial loss when your vehicles cause injury to others or damage someone else’s property. Here’s what you need to know:

What It Covers:

- Bodily injury to third parties from at-fault accidents

- Property damage to other vehicles, buildings, or infrastructure

- Legal defense costs, settlements, and judgments

- Both on-road incidents (primary auto liability) and off-road exposures (general liability)

Why It’s Required:

- Federal law mandates minimum coverage ($750,000 to $5,000,000 depending on cargo type)

- You cannot activate FMCSA operating authority without proper filings

- Shippers and brokers require proof of coverage before dispatching loads

- One serious accident can result in claims reaching six or seven figures

Your trucks keep goods moving and your business running. But without proper liability protection, a single accident could wipe out everything you’ve built. The right insurance doesn’t just satisfy legal requirements—it protects your livelihood.

I’m D.J. Hearsey, Principal Agent and founder of Select Insurance Group, where we’ve spent over three decades helping trucking operations across the Southeast secure comprehensive trucking liability insurance that balances protection with affordability. Our team works with more than 40 carriers to ensure you get coverage that fits your specific operation—whether you’re an owner-operator or managing a growing fleet.

Related content about trucking liability insurance:

What is Trucking Liability Insurance and Why is it Essential?

At its core, trucking liability insurance is the bedrock of financial protection for any business that operates commercial vehicles. It safeguards your company against the enormous costs that can arise from accidents where your truck is deemed at fault, causing injury to others or damage to their property. Think of it as your financial backbone, ensuring that a single incident doesn’t derail your entire operation.

Why is this not just a good idea, but essential?

- Financial Backbone: Claims for trucking liability can easily reach six or seven figures after a serious crash. Without adequate coverage, your business would be responsible for these costs, potentially leading to bankruptcy.

- Legal Mandate: Operating commercial vehicles comes with strict legal requirements. Federal and state regulations mandate minimum levels of liability coverage. Without meeting these, your business simply cannot operate legally.

- Shipper Requirements: Many shippers and brokers won’t even consider working with you unless you can demonstrate sufficient trucking liability insurance. They need assurance that their goods, and anyone involved in their transport, are protected. Many shippers expect $1,000,000 in primary liability and $100,000 in cargo coverage.

- Third-Party Claims: This insurance specifically addresses claims from third parties—people or entities outside your business. This includes covering medical expenses for those injured (bodily injury) and repair or replacement costs for damaged property.

As an Essential Guide to Trucking Insurance Coverage states, this type of insurance is fundamental to protecting your business from potential legal challenges. We understand the critical importance of this coverage, which is why we offer More info about truck liability coverage.

Understanding Primary Auto Liability

Primary auto liability is the cornerstone of your trucking liability insurance policy. This is the coverage that kicks in when your commercial truck is involved in an at-fault accident on the road. It’s designed to pay for the bodily injury and property damage you cause to others.

Let’s break down what that means:

- At-Fault Accidents: If your driver is determined to be responsible for a collision, primary auto liability will cover the expenses incurred by the other parties.

- On-Road Incidents: This coverage specifically applies to incidents that occur while your truck is actively being driven, whether it’s hauling a load, deadheading, or traveling to a pickup.

- Covers Injuries to Others: This includes medical bills, lost wages, pain and suffering, and other related costs for anyone injured in an accident you cause. This is often referred to as bodily injury liability.

- Covers Damage to Other People’s Property: If your truck damages another vehicle, a building, a guardrail, or any other property belonging to someone else, primary auto liability will cover the repair or replacement costs.

The Federal Motor Carrier Safety Administration (FMCSA) mandates this coverage for most for-hire carriers operating across state lines. Without it, you simply cannot activate your operating authority or legally haul freight. It’s the “price of admission” for the open road.

Understanding General Liability

While primary auto liability covers incidents involving your truck on the road, general liability insurance steps in to protect your business from a different set of risks—those that occur off the road. Many new trucking businesses often confuse these two, but both are crucial for comprehensive protection.

General liability addresses non-driving business exposures, such as:

- Premises Liability (Slips and Falls): If a visitor, customer, or vendor slips and falls at your business office, yard, or loading dock, general liability would cover their medical expenses and any legal costs if they decide to sue.

- Loading/Unloading Accidents: While primary auto liability covers incidents involving the truck in motion, general liability can cover injuries or property damage that occur during the loading or unloading process if not directly caused by the truck’s movement.

- Contractual Liability: This can cover liabilities you assume through certain contracts or agreements with other parties.

- Personal and Advertising Injury: This often overlooked component can protect your business against claims of libel, slander, copyright infringement in your advertising, or even false arrest. For example, advertising injury liability can help pay legal fees if a competitor sues your business over the content of your marketing.

As a business operating in the Southeast, understanding state-specific nuances for these coverages is important. You can find More info about general liability in Virginia and other states where we operate.

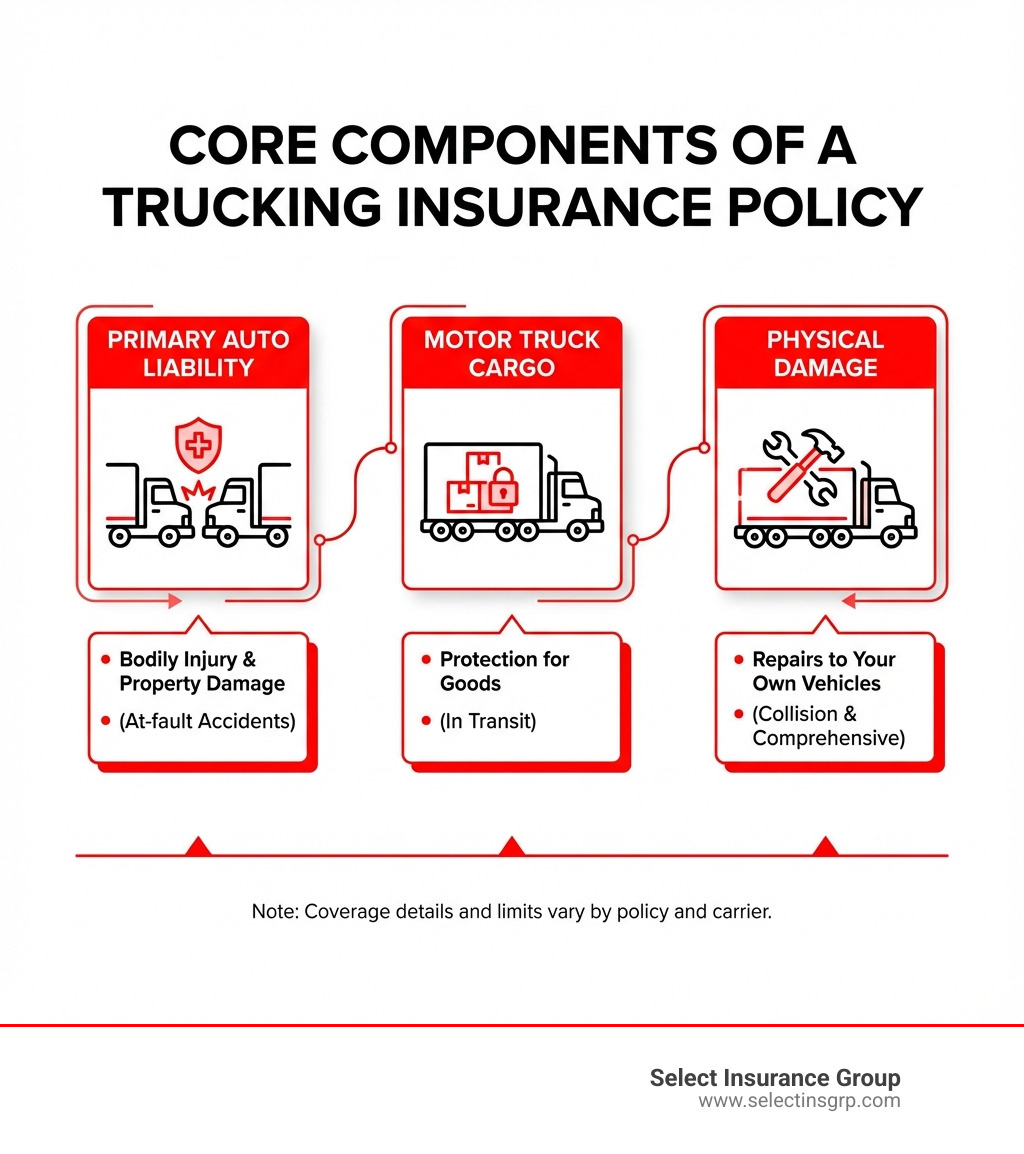

Decoding Your Coverage: Key Types of Trucking Insurance

Navigating trucking liability insurance can feel like deciphering a complex code, but we’re here to help you understand each piece of the puzzle. Beyond the core liability coverages, a robust insurance program for your trucking business involves several other essential policy components and endorsements to ensure you don’t have unexpected coverage gaps.

Understanding these different types of insurance is crucial, as they work together to form a comprehensive safety net for your operations. We offer More info about truck and car insurance to help you get started.

Essential Add-ons: Cargo, Physical Damage, and More

While liability coverage protects you from claims involving others, these essential add-ons protect your own assets and the goods you’re hauling.

-

Motor Truck Cargo: This coverage is vital for protecting the goods you’re transporting. It pays for loss or damage to the cargo itself due to perils like theft, collision, fire, or even breakdown of refrigeration units. While not always federally mandated for all property carriers, shippers and brokers almost universally require it by contract. Many often specify a minimum of $100,000 in cargo coverage. For specific commodities like household goods, federal filings (BMC-34 and BMC-35) are required. We can help you secure robust More info about cargo insurance for truckers.

-

Physical Damage (Collision & Comprehensive): This protects your own equipment—your truck and trailer—from damage.

- Collision covers repair or replacement costs if your truck is damaged in an accident, regardless of who is at fault.

- Comprehensive covers non-collision events like theft, vandalism, fire, natural disasters, or hitting an animal.

This is especially important given the high value of commercial trucks and trailers.

-

Trailer Interchange: If you participate in “drop-and-hook” operations and pull non-owned trailers under a written interchange agreement, this coverage protects those trailers from physical damage.

-

Uninsured/Underinsured Motorist (UM/UIM): This steps in when an at-fault driver who causes damage to your truck or injury to your driver either has no insurance (uninsured) or insufficient insurance (underinsured) to cover the costs. It’s a critical protection for your team and assets.

Specialized Hauling Needs: Some types of cargo or operations require even more specific coverages:

- Hazardous Materials (Hazmat) Coverage: Hauling hazardous materials (flammable liquids, chemicals, etc.) significantly increases your risk exposure. This requires higher liability limits (often $1,000,000 or $5,000,000 depending on the specific materials) and specialized endorsements to cover pollution, cleanup costs, and environmental damage. The MCS-90 endorsement, for instance, is a federal requirement for interstate carriers, certifying financial responsibility for environmental restoration.

- Refrigerated Goods Insurance (Reefer Breakdown): If you transport perishable goods, a reefer breakdown endorsement is essential. It covers losses due to mechanical failure or power outages of your refrigeration unit, which could lead to massive spoilage claims. Often, this requires documented maintenance and temperature logs.

- Oversized Loads Insurance: Transporting oversized or overweight loads comes with unique risks, including potential damage to infrastructure (bridges, roads) or accidents due to the load’s size. Specialized coverage addresses these higher liability exposures and potential property damage claims.

The Difference Between Primary, Non-Trucking Liability (NTL), and Bobtail Insurance

Understanding the nuances between primary liability, Non-Trucking Liability (NTL), and bobtail insurance is crucial, especially for owner-operators. These coverages apply in different scenarios, and confusing them can lead to significant coverage gaps.

Here’s a breakdown:

| Coverage Type | When Coverage Applies | Who Needs It Most |

|---|---|---|

| Primary Liability | All times when the truck is under contract or on duty. This is the bedrock of trucking liability insurance. | For-hire carriers operating under their own authority. Owner-operators who are leased to a carrier will likely have this provided by the carrier while under dispatch. |

| Non-Trucking Liability (NTL) | When the truck is not under dispatch, but being used for personal or non-business purposes (e.g., going to the grocery store, visiting family). The truck is off-duty and not hauling a load. | Leased owner-operators whose carrier provides primary liability while under dispatch. NTL fills the gap for personal use. |

| Bobtail Insurance | When the truck is being driven without a trailer (bobtailing), regardless of whether it’s under dispatch or not. This often covers “deadhead” trips, like returning from a drop-off or driving to a pickup point without a load. | Leased owner-operators. It’s often required by carriers to ensure coverage for the truck when it’s not pulling their loaded trailer, even if still technically “under dispatch” for the next haul. |

It’s crucial for owner-operators, especially those leased to a motor carrier, to clearly understand which coverages the carrier provides and when. We advise getting this in writing. For more detailed information on insuring your independent operations, check out More info about owner-operator insurance.

Common Exclusions in Trucking Liability Policies

Even the most comprehensive trucking liability insurance policies have exclusions—situations or damages they won’t cover. It’s vital to be aware of these so you can address potential gaps with additional endorsements or separate policies.

Here are some common exclusions you might find:

- Intentional acts: Policies typically won’t cover damages or injuries resulting from intentional acts by the driver or business owner.

- Pollution or Environmental Damage (without specific endorsement): Standard liability policies often exclude coverage for pollution or environmental contamination unless a specific pollution liability endorsement is added. This is especially critical for hazmat haulers.

- Employee Injuries: Injuries to your employees are generally not covered by trucking liability insurance (or general liability). These fall under Workers’ Compensation insurance.

- Damage to Your Own Property: Your primary auto liability and general liability policies are for third-party claims. Damage to your own truck, trailer, or business premises requires separate physical damage or commercial property insurance.

- Contractual Liability (without specific endorsement): While general liability can cover some contractual liabilities, some agreements you enter into might transfer specific risks that require a contractual liability endorsement to be covered.

- Professional Services: If your business offers services beyond pure transportation (e.g., logistics consulting, freight brokering), professional liability (Errors & Omissions) would be needed, as general liability won’t cover claims arising from your professional advice or services.

- Liquor Liability: If your business is involved in the sale or serving of alcohol, this would be excluded and require a separate liquor liability policy.

- Cyber Liability: Data breaches or cyberattacks are not covered by traditional liability policies and require specialized cyber insurance.

- Fines or Penalties: Insurance typically does not cover fines or penalties imposed by regulatory bodies.

We always recommend requesting specimen policy forms from us and reviewing exclusions line by line. Understanding these gaps allows us to help you add the necessary endorsements to ensure your business is fully protected.

Navigating Compliance, Costs, and Filings

Operating a trucking business isn’t just about moving goods; it’s also about navigating a complex web of regulations, managing costs, and ensuring all necessary paperwork is filed. This is particularly true for trucking liability insurance, which is heavily regulated at both federal and state levels. The Federal Motor Carrier Safety Administration (FMCSA) and the United States Department of Transportation (USDOT) play significant roles in setting these requirements.

Understanding these aspects is key to both compliance and financial health. For insights into typical expenses, you can explore More info about average truck insurance costs.

Federal and State Minimum Liability Requirements

The minimum liability requirements for trucking companies are not arbitrary; they are set to protect the public from the potentially devastating financial impact of a serious commercial vehicle accident.

The Federal Motor Carrier Safety Administration (FMCSA), part of the United States Department of Transportation, oversees these regulations for interstate trucking operations. As highlighted in their section on Minimum Truck Liability, these minimums are considered a safety issue, directly linking adequate coverage to public safety.

Here are the federal minimums for primary liability:

- Nonhazardous Property Carriers: At least $750,000 in primary liability. However, many shippers expect higher, often $1,000,000.

- Certain Oil Commodities: $1,000,000 in liability coverage.

- Specified Hazardous Materials: $5,000,000 in liability coverage, reflecting the much higher risk involved.

State-Specific Rules: While federal regulations apply to interstate commerce, states also have their own minimum requirements for intrastate operations. These can vary significantly, and comply with the rules in every state you operate within. We understand the specific requirements for our clients across the Southeast:

- More info about North Carolina requirements

- More info about South Carolina requirements

- More info about Georgia requirements

- More info about Florida requirements

Meeting these minimums is non-negotiable for legal operation.

FMCSA Filing Requirements Explained

Beyond simply having the right insurance, trucking companies must also demonstrate proof of that coverage to the FMCSA through specific filings. These filings are critical for activating and maintaining your operating authority.

The FMCSA’s insurance filing requirements detail these necessary documents:

- BMC-91 / BMC-91X: These forms are proof of liability coverage filed with the FMCSA for carriers with operating authority. The BMC-91 is for a single coverage amount, while BMC-91X is for varying amounts. Your insurance provider typically submits these electronically, often within 24 to 72 hours of binding your policy.

- MCS-90 Endorsement: This is a crucial endorsement attached to your auto liability policy. It ensures that the public is protected up to the federal minimum liability limits, even if your policy has exclusions or limits that are less than the federal minimum. It’s a guarantee of financial responsibility to the FMCSA, not an additional grant of coverage.

- BOC-3 (Designation of Process Agent): This filing designates a process agent in each state where you operate or have offices. A process agent is an individual or company authorized to receive legal documents on your behalf. This ensures that if legal action is taken against your company, there’s always someone available to receive the notice.

Completing these filings correctly and promptly is essential. Without them, your operating authority cannot be activated, which means you cannot legally operate in interstate commerce. We work closely with our clients to ensure all necessary filings are handled efficiently, so you can focus on driving.

Factors That Influence Your Trucking Insurance Costs

The cost of your trucking liability insurance isn’t a one-size-fits-all figure. Many variables come into play, and understanding them can help you manage your premiums effectively. For example, the average cost for heavy truck insurance in Ontario can range from $2,000 to $10,000 per year, but this can vary wildly based on the following factors:

- Fleet Size: Generally, the more trucks you operate, the higher your overall premium will be, though larger fleets may qualify for volume discounts or fleet policies.

- Cargo Type: What you haul significantly impacts risk.

- Hazardous materials (hazmat) or high-value goods will lead to higher premiums due to the increased potential for severe damages or theft.

- Refrigerated goods carry additional risks related to spoilage if equipment fails, influencing costs.

- Operating Radius: How far and where your trucks travel matters.

- Long-haul operations typically face higher premiums than local or regional routes due to increased time on the road and exposure to diverse conditions.

- Operating in dense metropolitan areas or litigation-heavy states can also increase costs.

- Driver History (MVRs): The experience and safety records (Motor Vehicle Records – MVRs) of your drivers are paramount. Drivers with clean records, more experience, and consistent training will generally result in lower premiums. Conversely, a history of accidents or violations will drive costs up.

- Loss History: Your company’s past claims record is a major factor. A clean loss history demonstrates lower risk to insurers, while frequent or severe claims will likely lead to higher premiums.

- Equipment Age and Value: Newer, more expensive trucks cost more to repair or replace, leading to higher physical damage premiums. The type of truck (semi-truck, box truck, dump truck, etc.) also plays a role.

- Credit Score: For smaller operations or owner-operators, the business owner’s personal credit score can sometimes influence insurance rates.

We leverage our relationships with over 40 carriers to shop the market and present your unique risk profile in the best possible light, helping you secure competitive rates custom to your specific operation.

Frequently Asked Questions about Trucking Liability Insurance

We frequently receive questions from new and experienced truckers alike about the intricacies of trucking liability insurance. Here are some of the most common inquiries we address:

What’s the difference between general liability and primary auto liability?

This is one of the most common points of confusion!

- Primary Auto Liability covers injuries and property damage you cause to others while driving the truck. This means if your truck is involved in an accident on the road, this policy is what responds to claims from the other party. It’s directly tied to the operation of your commercial vehicle.

- General Liability addresses non-driving business exposures. Think of it as covering the “premises” and “operations” of your business outside of the actual driving of the truck. This includes scenarios like a customer slipping and falling at your business office or loading dock (if not caused by a truck’s movement), or claims of advertising injury. Most carriers need both types of coverage to fully protect against both on-road and off-road exposures.

Is cargo insurance required by law?

For most property carriers, cargo insurance is not federally mandated by law. The main exceptions are household goods carriers, who have specific federal filing requirements (BMC-34 and BMC-35).

However, while not legally required for most, operating without cargo insurance will severely limit your opportunities. Shippers and brokers almost always require it by contract to protect their goods. Without it, you won’t be able to secure desirable freight. It’s a practical necessity rather than a legal one for the vast majority of trucking operations.

How can I lower my trucking insurance premiums?

Lowering your premiums while maintaining adequate coverage is a smart business move. Here are some proven strategies:

- Focus on Driver Quality and Training: This is paramount. Hire drivers with clean MVRs and verifiable experience. Implement consistent training programs, including defensive driving and compliance with safety regulations.

- Implement Safety Programs with Dashcams and Telematics: Technology is your friend! Dashcams can provide invaluable evidence in case of an accident, often exonerating your driver. Telematics can help identify risky driving behaviors, allowing for targeted coaching and demonstrating a commitment to safety to underwriters.

- Maintain Clean MVRs: Regularly review your drivers’ MVRs and address any issues promptly. A clean driving record for your fleet is one of the biggest factors in reducing premiums.

- Increase Deductibles if Cash Flow Allows: Opting for a higher deductible means you take on more of the initial risk in a claim, which can significantly lower your premium. Just ensure your business has the cash flow to cover that deductible if a claim occurs.

- Avoid Small Claims: Filing numerous small claims can negatively impact your loss history and drive up future premiums. Consider covering minor damages out-of-pocket if it makes financial sense.

- Work with a Specialist Broker: Partnering with an independent insurance broker who specializes in commercial transportation, like us, is crucial. We understand the industry, know which carriers offer the best rates for your specific needs, and can effectively present your safety performance to underwriters. We can also help you compare apples-to-apples quotes and identify potential discounts.

Conclusion: Securing the Right Protection for Your Business

Navigating the complexities of trucking liability insurance can be a daunting task, but it’s an absolutely critical component of a successful and sustainable trucking business. From understanding the nuances of primary auto liability versus general liability to ensuring compliance with federal and state regulations, a proactive approach to your insurance strategy is essential.

Your insurance policy isn’t just a piece of paper; it’s a living document that needs regular attention. We recommend an annual policy review to ensure your coverage aligns with your evolving business operations—whether you’ve expanded your fleet, changed your operating lanes, or started hauling new types of cargo. This proactive management helps prevent costly coverage gaps and ensures you’re always adequately protected.

This is where the role of an experienced insurance broker becomes invaluable. We don’t just sell policies; we act as your trusted advisors, helping you understand your risks, steer the intricate regulatory landscape, and secure the right coverage for your unique needs. At Select Insurance Group, our experienced agents leverage over 30 years of experience and shop over 40 carriers to find you not just a policy, but a strategic partnership that offers competitive rates and superior customer service. We’re here to guide you through the market, ensuring your business stays on the road, safely and profitably.

Ready to optimize your trucking liability insurance? Get a personalized quote for your North Carolina commercial insurance needs today, or reach out to us to discuss your specific requirements across Florida, the Carolinas, Virginia, and Georgia.