Why Choosing the Right Auto Insurance Agency Florida Matters

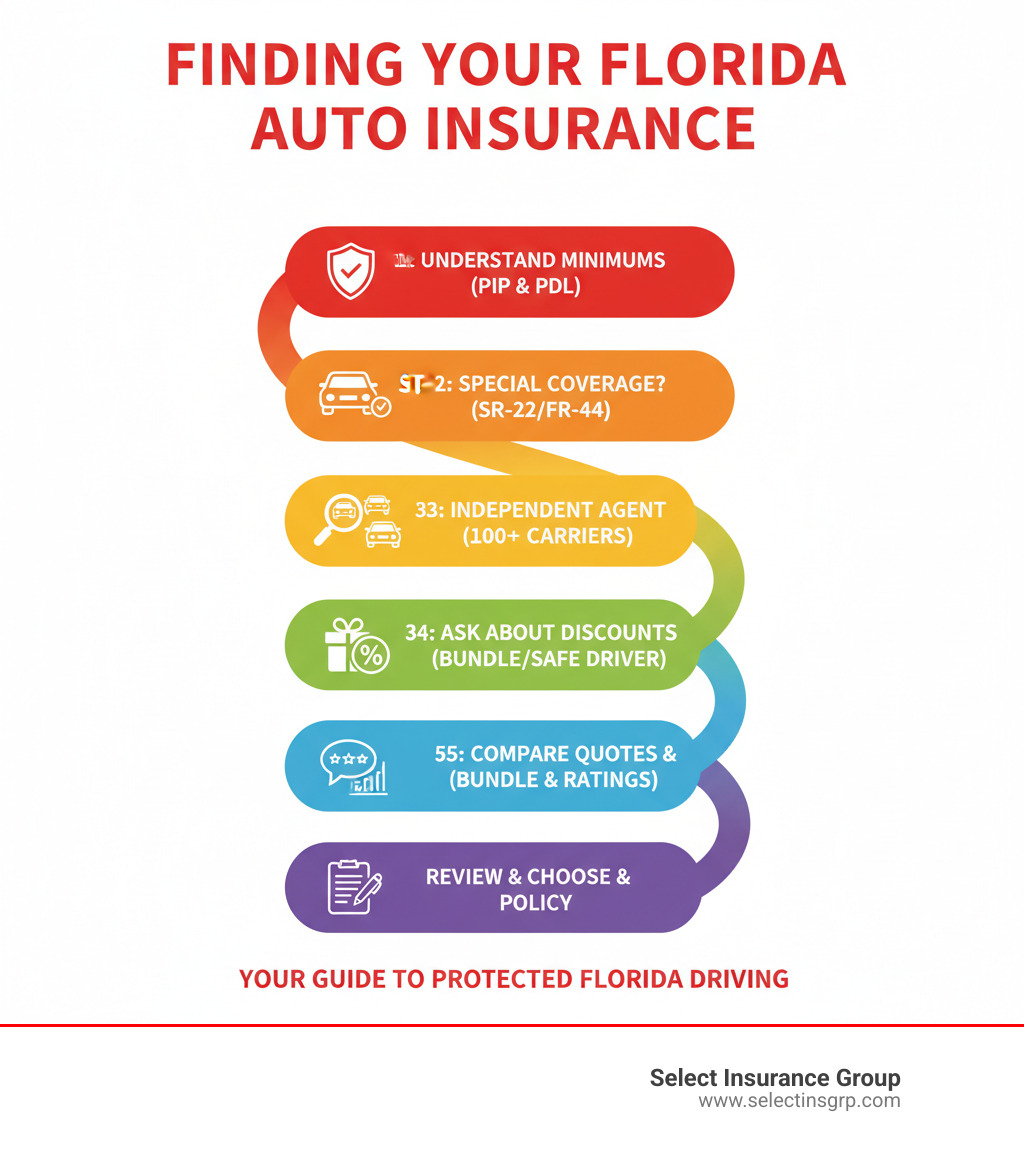

Finding the right auto insurance agency florida can save you hundreds of dollars annually while ensuring you have the proper coverage. The key is to work with an independent agent who can compare rates from multiple carriers, understands Florida’s unique no-fault laws (like PIP and PDL), and has excellent customer service ratings.

Florida’s insurance market is complex due to its no-fault system, high number of uninsured drivers, and weather risks. These factors contribute to some of the highest premiums in the nation, making the choice of agency critical. Drivers who switch to an independent agency that shops multiple carriers can save an average of $638 per year.

Whether you’re a new driver, a business owner, or need specialized coverage like an FR-44 after a DUI, the right agency guides you to a policy that protects your assets without overpaying.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group. For over 30 years, we’ve helped drivers steer Florida’s insurance complexities. As a Principal Agent working with 40+ carriers, I know a great agency partnership makes the process effortless.

This guide will break down how to find a top auto insurance agency in Florida, from understanding coverage requirements to knowing which questions to ask.

Understanding Florida’s Auto Insurance Landscape

Florida’s “no-fault” auto insurance system means your own insurer covers your initial medical bills after an accident, regardless of who is at fault. Understanding this system is the first step to getting the right coverage. For a neutral primer on how no-fault works, see No-fault insurance.

What types of auto insurance coverage are available in Florida?

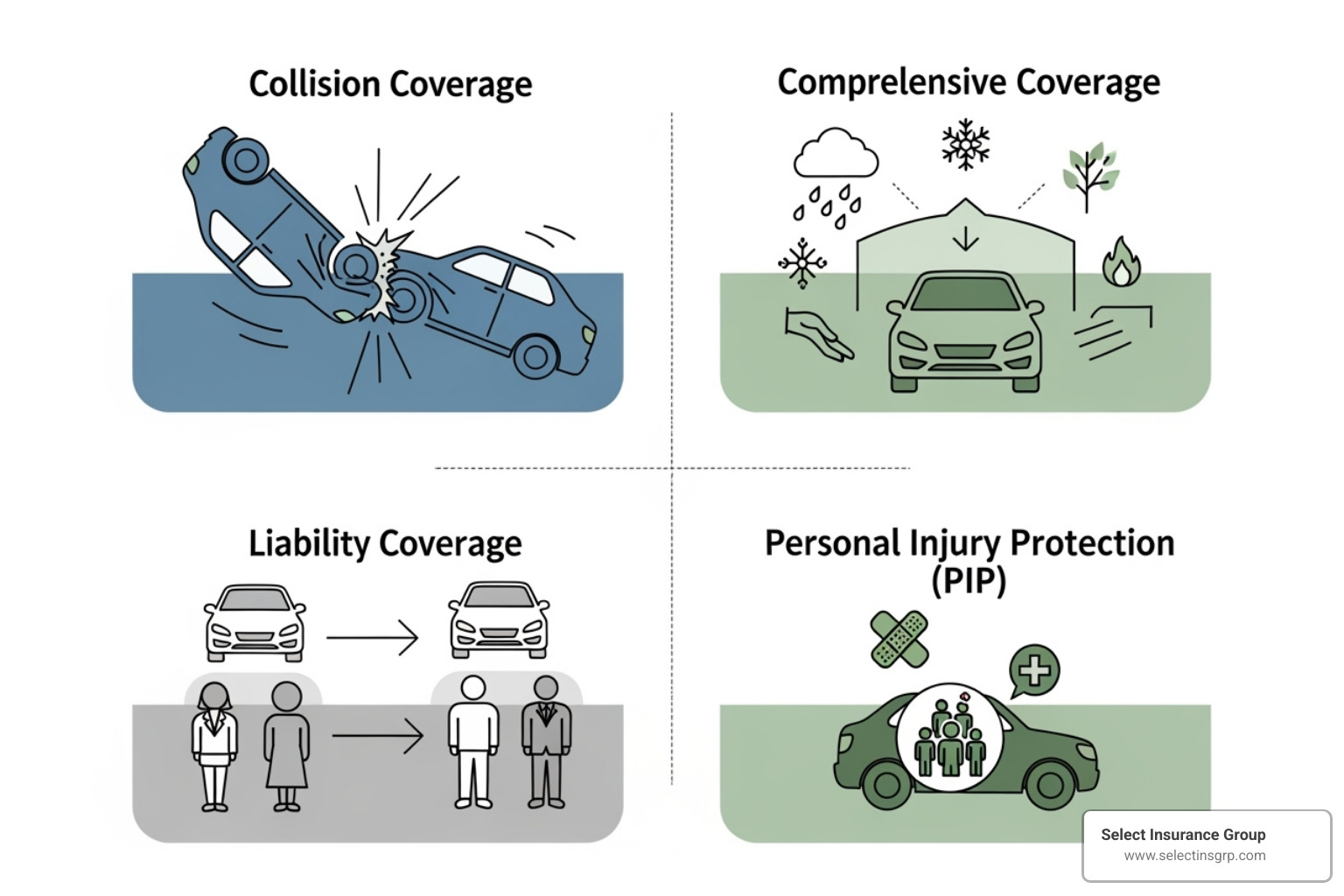

Think of your policy as layers of protection. Here are the main types:

- Personal Injury Protection (PIP): Required in Florida, this covers 80% of your medical bills and 60% of lost wages up to $10,000, no matter who caused the accident.

- Property Damage Liability (PDL): Also required, this covers damage you cause to someone else’s property, with a minimum of $10,000.

- Bodily Injury Liability (BIL): While not always required, BIL is crucial. It covers medical expenses and lost wages for others if you cause an accident. Without it, you are personally liable for these costs.

- Uninsured/Underinsured Motorist (UM/UIM): This optional coverage protects you if you’re hit by a driver with little or no insurance. Given Florida’s high rate of uninsured drivers, it’s a smart investment.

- Collision: This pays to repair or replace your car after a crash with another object or vehicle.

- Comprehensive: This covers non-collision damage from events like theft, fire, storms, or vandalism.

For a deeper dive into Florida’s specific requirements, check out our guide on Florida Auto Insurance.

Minimum Requirements vs. Full Coverage

Florida’s legal minimum is just $10,000 in PIP and $10,000 in PDL. This is dangerously inadequate. A serious at-fault accident could easily result in damages and medical bills far exceeding these limits, leaving you personally responsible for tens or even hundreds of thousands of dollars.

Full coverage typically includes higher liability limits (we recommend at least $100,000/$300,000), collision, comprehensive, and UM/UIM. It costs more monthly but protects your savings, home, and future from a devastating lawsuit.

Special Coverage Needs in Florida

Certain situations require special filings to prove you have insurance.

- SR-22: This is a certificate of financial responsibility, often required after driving without insurance, accumulating too many points, or other violations. It proves you are carrying the state-minimum coverage.

- FR-44: This is required for a DUI or DWI conviction. It’s similar to an SR-22 but mandates much higher liability limits: $100,000/$300,000 for bodily injury and $50,000 for property damage.

- High-Risk Drivers: If you have multiple accidents, tickets, or a DUI, you’ll face higher premiums. An experienced auto insurance agency florida can help find carriers that specialize in high-risk policies.

If you’re a business owner, our Florida Commercial Auto Insurance options can cover your unique needs.

What Defines a Top Auto Insurance Agency Florida?

Finding the right auto insurance agency florida is about partnering with a trusted advisor who offers real choices and expert guidance, not just the lowest price.

How do independent insurance agents in Florida help customers find auto insurance?

There are two types of agents: captive agents, who work for a single company, and independent agents, who work for you. Captive agents can only offer one brand’s products. Independent agents partner with numerous carriers, allowing them to shop the market on your behalf to find the best fit.

This access to multiple carriers is a huge advantage. At Select Insurance Group, we work with over 40 providers, giving you a wide range of options. This approach, combined with personalized service and local expertise, ensures you get a policy custom to your needs. We understand Florida’s unique risks, from hurricanes to high rates of uninsured drivers, and help you find coverage gaps you might otherwise miss. We also provide claims support and modern policy management options to make your life easier.

The Power of an Independent Agent

An independent agent’s network is your advantage. Instead of spending weeks getting quotes yourself, we can compare dozens of companies in minutes.

- Unbiased Advice: Our goal is to find the right policy for you, not to meet a quota for a specific carrier.

- Finding the Best Rates: We know which discounts you qualify for and how to structure a policy to maximize value.

- Customizing Policies: As your life changes, we adjust your coverage to match, whether you buy a new car or add a teen driver.

- One-Stop Shop: We can bundle your auto policy with other coverage like Florida Home Insurance for significant savings.

Key Questions to Ask a Potential auto insurance agency florida

Before choosing an agency, ask these questions:

- How many carriers do you represent? More carriers mean more options and better rates.

- How do you handle claims? A good agent will guide you through the process and act as your advocate.

- What discounts can I qualify for? They should proactively search for savings like bundling, safe driver, and multi-car discounts.

- Can you help me bundle policies? Bundling auto, home, and other insurance is a primary way to save money.

- What are your service fees? Independent agents are typically paid by the insurance companies, so there should be no direct cost to you.

How to Find the Cheapest Auto Insurance in Florida

The goal isn’t just finding the “cheapest” policy, but the most affordable coverage that properly protects you. Understanding the factors that influence your premium is key to finding that balance.

What factors influence the cost of auto insurance in Florida?

Insurers calculate your premium based on a variety of risk factors. The most significant ones include:

- Driving Record: A clean record is the best way to get lower rates. Accidents and tickets will increase your premium.

- Vehicle: The make, model, age, safety features, and repair costs of your car all affect your rate.

- Location (ZIP Code): Urban areas with more traffic and crime typically have higher premiums than rural areas.

- Age and Gender: Younger drivers, particularly males under 25, face higher rates due to statistical risk.

- Credit Score: Florida allows insurers to use a credit-based insurance score; a higher score often leads to lower rates.

- Coverage Choices: Higher liability limits and lower deductibles increase your premium but provide more protection.

- Annual Mileage: Driving less means lower risk, which can lead to a low-mileage discount.

These same principles apply when insuring other vehicles, and you can find More info about Florida Motorcycle Insurance on our site.

What discounts are typically available for auto insurance in Florida?

Discounts are the easiest way to lower your premium. An independent agent’s job is to find every one you qualify for. Here are some of the most common:

- Bundling Policies: Combining your auto and home (or renters) insurance with the same carrier can lead to savings of 15-25%.

- Safe Driver Programs: Many insurers offer telematics programs that use a smartphone app to monitor your driving. Safe habits can earn you significant discounts.

- Good Student Discount: Students who maintain a B average or higher often qualify for reduced premiums.

- Defensive Driving Course: Completing an approved course can lower your rates.

- Multi-Vehicle Discount: Insuring more than one car on the same policy almost always results in savings.

- Homeowner Discount: Insurers often offer a discount simply for owning a home, even if it’s not insured with them.

- Payment Discounts: Paying your premium in full or setting up automatic payments can often earn you a small discount.

Working with an auto insurance agency florida that shops multiple carriers is the best way to ensure you’re getting all the discounts available to you, as offers vary between companies.

The Step-by-Step Process to Get Your Policy

Getting auto insurance in Florida is straightforward with the right agency. The process, from getting a quote to managing your policy, can be simple and efficient.

Information Needed for an Accurate auto insurance agency florida Quote

To get a fast and accurate quote, have the following information ready for all drivers on the policy:

- Personal Information: Full names, current addresses, and dates of birth.

- Driver’s License Number: For each driver.

- Vehicle Information: The Vehicle Identification Number (VIN) is best, but make, model, and year will also work.

- Driving History: Be prepared to discuss any accidents, tickets, or claims from the last 3-5 years. Honesty here ensures an accurate quote.

- Desired Coverage Levels: Have an idea of what protection you want, or we can help you decide.

- Current Policy Details: If you’re currently insured, this helps us make an apples-to-apples comparison.

Ready to see your options? The process to Get a Quote with us is quick and provides multiple options from our network of carriers.

Managing Your Policy and Payments with Ease

Once your policy is active, managing it should be simple. Most carriers we partner with offer convenient digital tools:

- Online Account Portals: These allow you to view policy documents, print ID cards, and make payments 24/7 from your computer.

- Mobile Apps: Many insurers provide apps that let you manage your policy, report a claim, or request roadside assistance directly from your phone.

- Automatic Payments: Setting up autopay from a bank account or credit card is a great way to avoid missed payments and may even earn you a small discount.

When it comes to reporting a claim, you can call us for guidance or contact the carrier directly through their website, app, or claims hotline. We are always here to act as your advocate and help you through the process.

Most importantly, contacting your agent should be easy. We believe in personalized service from local agents who know you. If you have a question or need to make a change, simply Contact Us. We’re here to help.

Frequently Asked Questions about Florida Auto Insurance

After three decades in the business, we’ve heard just about every question. Here are answers to some of the most common concerns about Florida auto insurance.

Why is auto insurance so expensive in Florida?

Florida consistently ranks as one of the most expensive states for auto insurance for several reasons:

- No-Fault System & PIP Fraud: The required Personal Injury Protection (PIP) coverage has unfortunately led to widespread medical billing fraud, driving up costs for everyone.

- High Rate of Uninsured Drivers: Florida has one of the nation’s highest percentages of uninsured motorists. The costs from accidents they cause are passed on to insured drivers.

- Severe Weather: Frequent hurricanes and tropical storms lead to a high volume of comprehensive claims for vehicle damage.

- High Litigation Costs: The state’s legal environment can lead to expensive lawsuits following auto accidents, which insurers factor into premiums.

What is the difference between an SR-22 and an FR-44 in Florida?

Both are certificates filed with the state to prove you have insurance, but they are for different offenses.

- An SR-22 is typically required for non-alcohol-related violations, such as driving without insurance or causing an accident while uninsured. It requires you to carry at least Florida’s minimum liability coverage.

- An FR-44 is specifically for DUI or DWI convictions. It requires much higher liability limits ($100,000/$300,000 in bodily injury and $50,000 in property damage) due to the increased risk associated with impaired driving.

Can I get auto insurance with a bad driving record in Florida?

Yes, you can. While you should expect to pay higher premiums, coverage is available. An independent agent is your best resource in this situation. We partner with carriers that specialize in high-risk policies and can find options you might not find on your own. If your record includes a license suspension, you will likely need an SR-22 or FR-44 filing, which we can handle for you. The most important step is to be upfront about your history so we can find the right carrier to help you get back on the road legally.

Conclusion

Finding the right auto insurance agency florida transforms an overwhelming task into a simple one. The difference between having just any insurance and the right insurance means saving money and gaining true peace of mind.

We’ve covered Florida’s no-fault system, the importance of full coverage over state minimums, and what defines a top-tier independent agency. The best agencies offer access to dozens of carriers, provide expert local knowledge, and are committed to personalized service. By comparing rates and finding all available discounts, a good agent can save you hundreds annually.

When life presents challenges like a DUI requiring an FR-44, the right agency stands by you and helps you steer the requirements.

At Select Insurance Group, we’ve spent over 30 years building relationships with our clients across Florida and the Southeast. With 12 locations and access to over 40 top-rated carriers, our team has the leverage and local knowledge to find you exceptional coverage at a competitive rate.

Insurance doesn’t have to be complicated. We believe in building long-term relationships, not just making a sale. Ready to experience the difference? Let’s work together to find the coverage that protects what matters most to you, at a price that fits your budget.