Why Getting the Right Homeowners Insurance Quote Matters in Florida

A homeowners insurance quote is your first step toward protecting your home from financial loss. While often required by mortgage lenders, the right policy is crucial for shielding you from Florida-specific risks like hurricanes and water damage, which can lead to devastating repair costs.

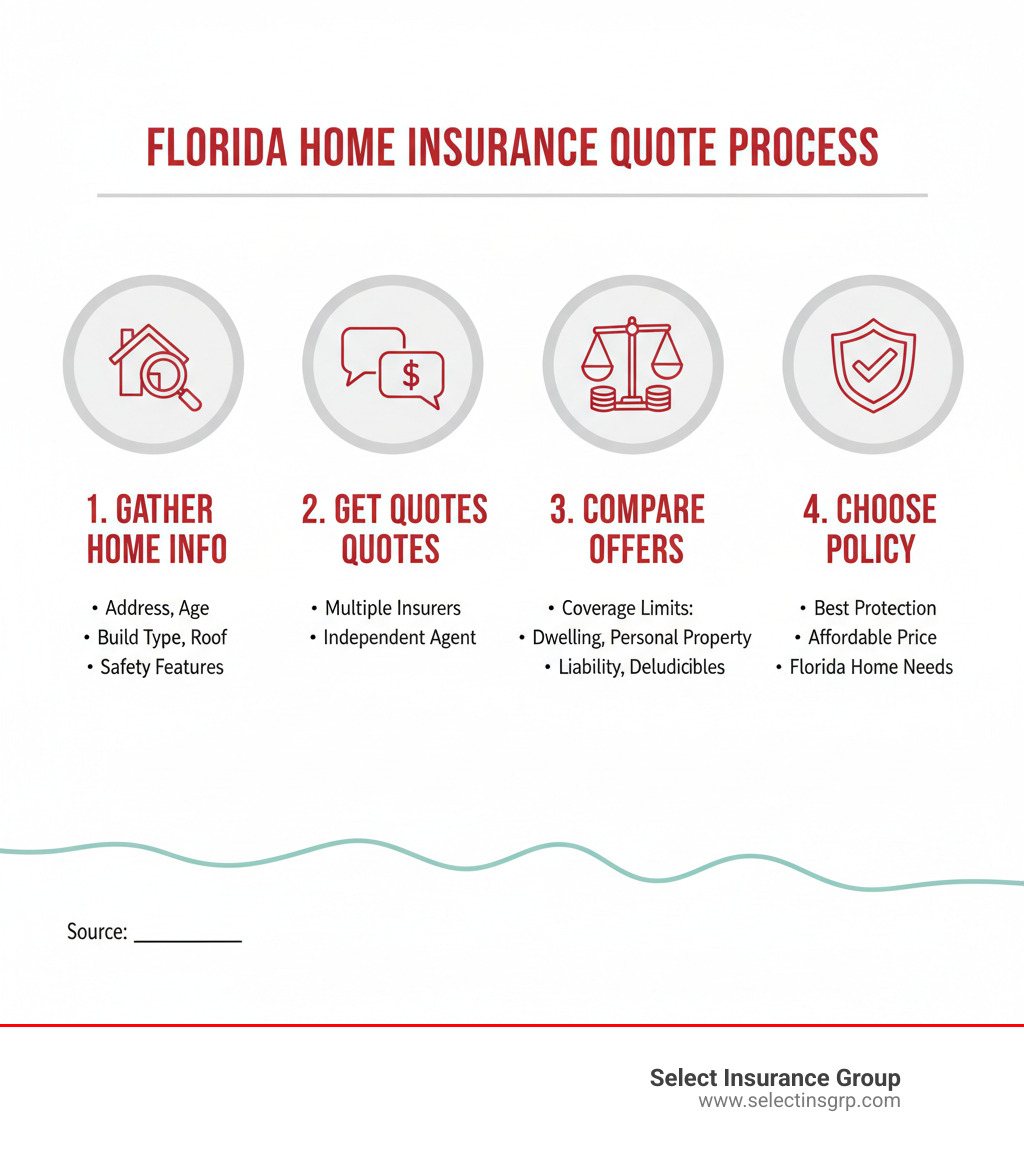

Quick Steps to Get a Homeowners Insurance Quote:

- Gather your home details – address, year built, square footage, roof age, construction type

- Contact multiple insurers – compare at least 3 quotes from different carriers

- Review coverage amounts – ensure dwelling, personal property, and liability limits meet your needs

- Check deductibles – balance premium savings against what you can afford out-of-pocket

The average cost of homeowners insurance in Florida is $2,207 per year, far exceeding the national average. This makes comparing quotes essential. Insurers evaluate risk differently, so premiums and coverage limits can vary dramatically between companies.

Many homeowners don’t realize their policy may exclude flood damage, sinkholes, or certain hurricane-related losses without special endorsements. Understanding what’s in your quote—and what isn’t—is key to avoiding massive out-of-pocket expenses when disaster strikes.

I’m D.J. Hearsey, founder of Select Insurance Group. For over three decades, I’ve helped thousands of homeowners find homeowners insurance quotes that balance comprehensive coverage with competitive pricing. Working with 40+ carriers across Florida, Georgia, and the Carolinas has given me deep insight into what makes a quote truly valuable.

Homeowners insurance quote vocab to learn:

Understanding Homeowners Insurance in Florida

Homeowners insurance is a financial safety net for your biggest investment. You pay a regular premium, and in return, your insurance company helps cover the costs if something goes wrong with your home or belongings. In Florida, with its unique risks like hurricanes and tropical storms, having the right coverage is essential.

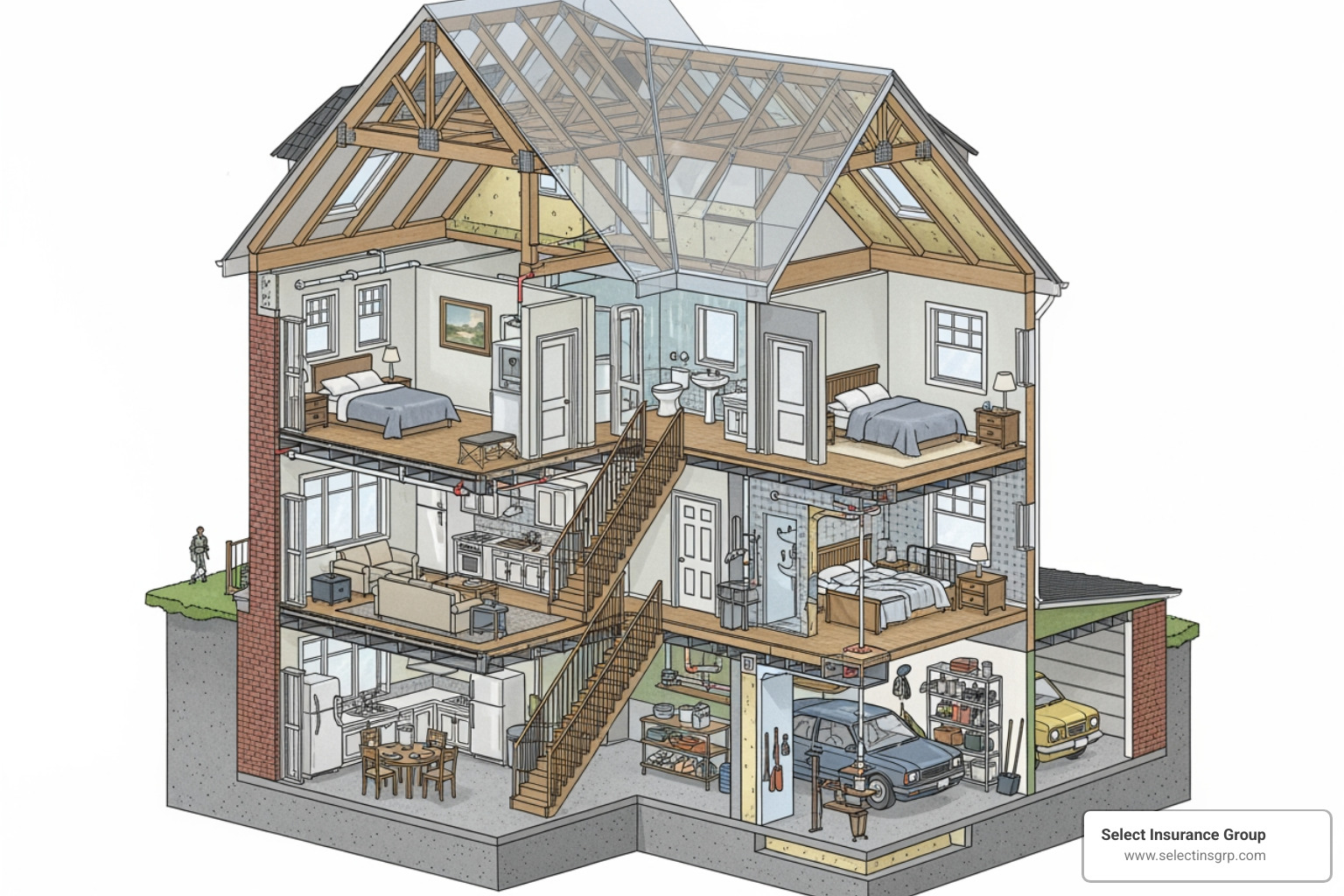

A typical policy includes six main protections. Understanding these is key to evaluating any homeowners insurance quote.

- Dwelling protection (Coverage A): Covers your home’s physical structure—walls, roof, and foundation.

- Other structures (Coverage B): Protects structures not attached to your house, like a fence or detached shed.

- Personal property (Coverage C): Covers your belongings, such as furniture, electronics, and clothes.

- Loss of use (Coverage D): Pays for temporary living expenses (hotel, meals) if your home is unlivable after a covered event.

- Personal liability (Coverage E): Protects you financially if someone is injured on your property or if you damage someone else’s property.

- Medical payments to others (Coverage F): Covers minor medical bills for guests injured on your property, regardless of fault.

For a deeper dive, see our Florida Home Insurance guide.

Basic vs. Optional Coverages

Every homeowners insurance quote includes standard coverages, but you can add optional endorsements (or riders) to customize your policy. Most Florida policies are HO-3 (open perils), which covers your home’s structure for all events except those specifically excluded. For maximum protection, an HO-5 policy extends open perils coverage to your personal property as well.

Standard policies have gaps. Consider these common endorsements:

- Scheduled Personal Property: Provides higher, specific coverage for valuables like jewelry, art, or collectibles that exceed standard policy limits.

- Water Backup Coverage: A must-have in Florida, this covers damage from water backing up through sewers or drains, which is excluded from standard policies.

- Identity Theft Protection: Helps cover costs associated with restoring your identity if it’s stolen.

According to a recent study by the Insurance Information Institute, policy costs vary widely based on coverage choices. Tailoring your quote is crucial.

What Standard Florida Policies Don’t Cover

It’s critical to know what your standard homeowners insurance quote excludes, as these gaps can be costly in Florida.

- Flood Damage: This is the biggest surprise for many. Damage from rising water—whether from storm surge, overflowing rivers, or heavy rain—is not covered. You need a separate flood insurance policy, available through the National Flood Insurance Program (NFIP) or private insurers.

-

Earthquake Coverage: While less common in Florida, damage from earthquakes requires a separate policy.

-

Sinkholes: Florida’s geology makes sinkholes a real risk. Standard policies rarely include this coverage automatically. You may need to add it as an optional endorsement, especially in high-risk areas.

What Determines the Cost of Your Florida Home Insurance?

Your homeowners insurance quote is based on dozens of factors. While the national average is around $1,758 annually, Florida residents pay approximately $2,207, largely due to hurricane risk. Here’s what insurers look at:

- Replacement Cost: This is the single biggest factor—what it would cost to rebuild your home from scratch, including labor and materials. It’s not the same as market value.

- Location: Proximity to the coast, flood zones, local crime rates, and distance to the nearest fire station all impact your premium.

- Home’s Age and Condition: Older homes with outdated plumbing, electrical systems, or roofs are considered higher risk. Recent updates, especially to the roof, can lower your rate.

- Construction Materials: Concrete block homes generally cost less to insure in Florida than wood-frame structures because they are more wind-resistant.

- Claims History: A history of filing claims can increase your rates, as insurers see you as a higher risk.

- Credit-Based Insurance Score: In Florida, insurers use a score derived from your credit history to predict the likelihood of a claim. A higher score typically means a lower premium.

- Safety Features: Discounts are often available for features like burglar alarms, smoke detectors, and water leak detection systems.

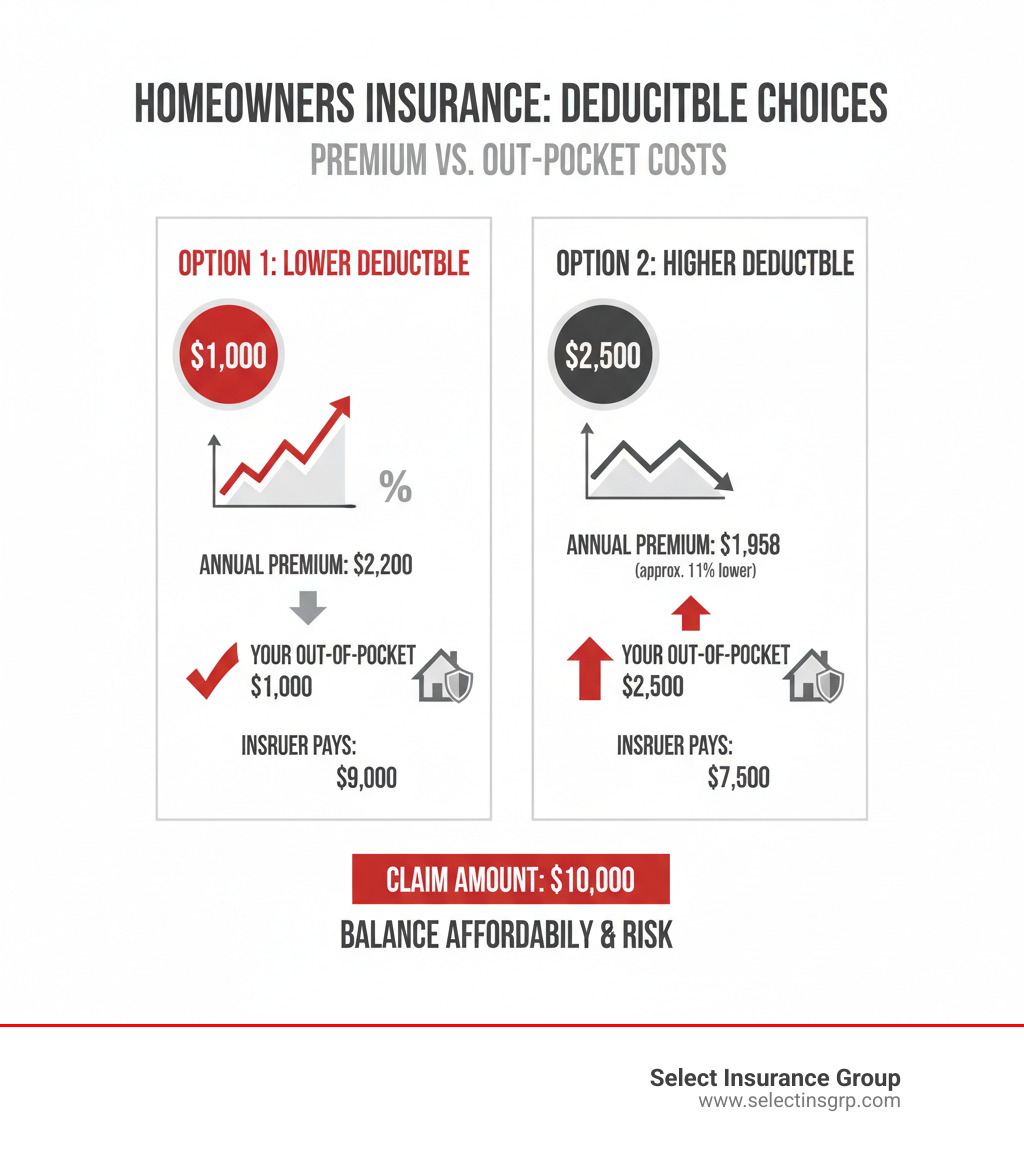

Deductibles and Premiums Explained

When reviewing a homeowners insurance quote, you’ll see two key numbers: the premium and the deductible.

- The premium is the amount you pay for your policy (annually, quarterly, or monthly).

- The deductible is the amount you pay out-of-pocket on a claim before your insurance coverage begins.

These two have an inverse relationship: a higher deductible leads to a lower premium, and vice versa. By choosing a higher deductible, you agree to take on more financial risk, and the insurer rewards you with a lower rate. The right choice depends on your financial comfort level and whether you can afford the higher out-of-pocket cost if you need to file a claim.

Hurricane Deductibles in Florida: This is critical. Unlike standard flat-dollar deductibles, a hurricane deductible is usually a percentage (2%, 5%, or 10%) of your home’s insured value. For a $300,000 home with a 5% hurricane deductible, you would be responsible for the first $15,000 of damage from a named hurricane. Be sure you know this amount.

| Scenario | Deductible Chosen | Annual Premium (Illustrative) | Claim Amount ($10,000) | Your Out-of-Pocket | Insurer Pays |

|---|---|---|---|---|---|

| Option 1: Lower Deductible | $1,000 | $2,200 | $10,000 | $1,000 | $9,000 |

| Option 2: Higher Deductible | $2,500 | $1,958 (approx. 11% lower) | $10,000 | $2,500 | $7,500 |

Note: Increasing your deductible from $1,000 to $2,500 can lower your rate by an average of 11% according to research.

The table illustrates how raising your deductible can lower your annual premium, but increases your out-of-pocket cost during a claim. For many who don’t file frequent claims, the long-term savings can be worthwhile.

How to Get Your Best Homeowners Insurance Quote

Finding the right homeowners insurance quote is about securing comprehensive coverage at a competitive price. Knowing when to shop and what information to have ready makes the process smooth and effective.

When to Get a Homeowners Insurance Quote

Certain moments are ideal for getting a fresh homeowners insurance quote:

- When buying a new home: Your mortgage lender will require proof of insurance before closing, so start your search early.

- Before your policy renews: Shop around 60 days before your current policy expires. Rates change, and you can switch providers penalty-free at renewal.

- After a significant life change: Major home improvements (like a new roof), adding a pool, or even getting a pet can affect your rates and coverage needs.

- If your rate increases: Don’t automatically accept a large premium hike. It’s a perfect time to see if competitors can offer a better deal.

We recommend comparing quotes at least once a year to ensure you still have the best value. Ready to start? Get A Quote here.

What Information Do You Need for a Homeowners Insurance Quote?

To get an accurate homeowners insurance quote, you’ll need to provide specific details. Having this information ready will speed up the process.

- Personal Information: Name, date of birth, and Social Security Number (for the credit-based insurance score).

- Property Details: The address, year built, square footage, and construction type (e.g., concrete block vs. wood frame).

- Roof Details: The type of material (shingle, tile, metal) and, most importantly, its age (year of last replacement).

- Safety Features: Mention any security systems, smoke detectors, fire extinguishers, or automatic water shut-off valves.

- Claims History: Be prepared to share any homeowners claims you’ve filed in the last 3-5 years.

- Additional Coverage Needs: Note if you need extra protection for valuables, or are interested in flood or water backup coverage.

How to Compare Different Homeowners Insurance Quotes

Once you have several homeowners insurance quotes, it’s time to compare them. The lowest price isn’t always the best deal. Look for the best value.

- Compare Identical Coverage Limits: Ensure the dwelling (Coverage A), personal property, and liability limits are the same across all quotes. A cheap quote might be underinsuring you.

- Check Personal Property Valuation: Look for Replacement Cost coverage, which pays to buy new items. This is superior to Actual Cash Value (ACV), which only pays the depreciated value of your belongings.

- Scrutinize Deductibles: Compare both the standard deductible and the separate hurricane deductible. A low premium might be hiding a high hurricane deductible that you can’t afford to pay.

- Verify Optional Coverages: If you asked for add-ons like water backup coverage, confirm they are included in the quote.

- Research the Insurer: Price is meaningless if the company is unreliable. Check financial strength ratings from A.M. Best and customer service reviews. At Select Insurance Group, we only work with A-rated carriers to ensure they can pay claims when you need them most.

Advanced Strategies: Maximizing Savings and Understanding Your Policy

Getting a great homeowners insurance quote is about more than just the initial price. By understanding available discounts and key policy terms, you can secure better protection for less money over the long term.

Available Discounts for Homeowners

Insurance companies offer many discounts, but you often have to ask for them. When getting a homeowners insurance quote, inquire about these common savings opportunities:

- Bundling: The biggest money-saver. Combining your home and auto insurance with the same provider can save you up to 20%—often over $1,000 per year.

- Home Safety Devices: Installing a central burglar alarm, smoke detectors, or automatic water shut-off devices can lower your premium.

- New Home or Recent Purchase: Insurers may offer discounts for newly built homes or if you’re a new homebuyer.

- Claims-Free History: If you haven’t filed a claim in several years, you may qualify for a discount.

- Advance Quote Discount: Purchasing your policy a week or more before it needs to start can earn you savings.

- Other Discounts: Ask about savings for being a non-smoker, having an impact-resistant roof (a big one in Florida), or living in a gated community.

Key Policy Terms and Rules to Know

Insurance policies can be dense, but understanding a few key concepts is crucial when reviewing your homeowners insurance quote.

- The 80% Rule: This is critical. You must insure your home for at least 80% of its full replacement cost. If you insure it for less, the insurer can impose a “coinsurance penalty” and not pay the full amount of a claim, leaving you with a significant bill. We always recommend insuring for 100% of the replacement cost to be safe.

- Declarations Page: This is your policy’s one-page summary. It lists your coverage limits, deductibles, endorsements, and premium. Keep it handy.

- Exclusions: This section lists what your policy doesn’t cover, such as floods and earthquakes. Knowing these gaps is essential.

- Endorsements: These are add-ons that customize your policy, like adding extra coverage for jewelry or for water backup damage.

- Filing a Claim: The general process involves securing the property to prevent more damage, documenting everything with photos, contacting your insurer promptly, and working with an adjuster to process the claim.

For more detailed explanations, visit our Learning Center.

Frequently Asked Questions about Florida Home Insurance

Navigating Florida homeowners insurance can be confusing. Here are straight answers to the most common questions we hear from homeowners.

Is homeowners insurance required by law in Florida?

No, Florida state law does not require you to have homeowners insurance. However, if you have a mortgage, your lender will almost certainly require it to protect their investment. If you let your policy lapse, your lender can buy a very expensive “force-placed” policy and charge you for it. Even if you own your home outright, insurance is the best way to protect your most valuable asset from a catastrophic loss like a fire or hurricane.

Does homeowners insurance cover floods or hurricanes?

This is a critical question in Florida, and the answer is complex.

-

Floods: Standard homeowners policies do not cover flood damage. This includes damage from storm surge, overflowing rivers, or heavy rain pooling on the ground. You must purchase a separate flood insurance policy, either from the National Flood Insurance Program (NFIP) or a private insurer.

-

Hurricanes: Standard policies generally cover wind damage from a hurricane. However, most Florida policies have a separate, higher hurricane deductible. Instead of a flat amount, it’s typically a percentage (e.g., 2% or 5%) of your home’s insured value. On a $300,000 home, a 5% deductible means you pay the first $15,000 of hurricane wind damage. Any flood damage from the hurricane’s storm surge would still require a separate flood policy.

When reviewing a homeowners insurance quote, always check your hurricane deductible and confirm you have separate flood coverage.

How does bundling home and auto insurance work?

Bundling is a simple way to save money and simplify your life. It means buying your homeowners insurance and auto insurance from the same company. In return for your loyalty, the insurer gives you a multi-policy discount on both premiums.

The savings are significant, with many customers saving over $1,000 per year. Bundling also offers the convenience of having one point of contact, one bill, and one online portal for both policies.

At Select Insurance Group, we shop over 40 carriers to find you the best bundled rate, saving you the time and hassle of calling multiple companies yourself. It’s one of the easiest ways to maximize your insurance value.

Conclusion

You now have the knowledge to get a homeowners insurance quote that truly protects your home and financial future in Florida. This is no small feat in a state with risks like hurricanes and floods.

The most important takeaways are:

- Compare for Value, Not Just Price: Ensure quotes have identical coverage limits and look for replacement cost coverage for your belongings.

- Understand Florida Risks: Standard policies don’t cover floods, and hurricane deductibles are much higher than standard ones. You need the right protection for both wind and water.

- Save with Discounts and Smart Choices: Bundling home and auto insurance is the easiest way to save, and insuring your home for 100% of its replacement cost avoids the dreaded 80% rule penalty.

At Select Insurance Group, we’ve spent over three decades helping homeowners across Florida, the Carolinas, Virginia, and Georgia. We don’t work for one insurance company; we shop with more than 40 carriers on your behalf to find the best combination of protection and price from A-rated insurers.

Your home is your biggest investment. Protecting it with the right insurance is essential. Whether you’re buying a new home or just want to ensure your current policy is adequate, we’re here to help.

Ready to get started? Contact our insurance agency in Tampa for a personalized quote today. Let’s find you coverage that brings real peace of mind.