Why Tampa Homeowners Face Rising Insurance Costs

Cheap homeowners insurance tampa fl is increasingly hard to find, but it’s not impossible. Tampa homeowners pay an average of $6,066 per year for a $300,000 policy with a $1,000 deductible—significantly higher than the national average. However, rates can vary dramatically by insurer. While the average is high, some of the most affordable policies can be found for as low as $396 annually, with other competitive options available for under $1,500 per year.

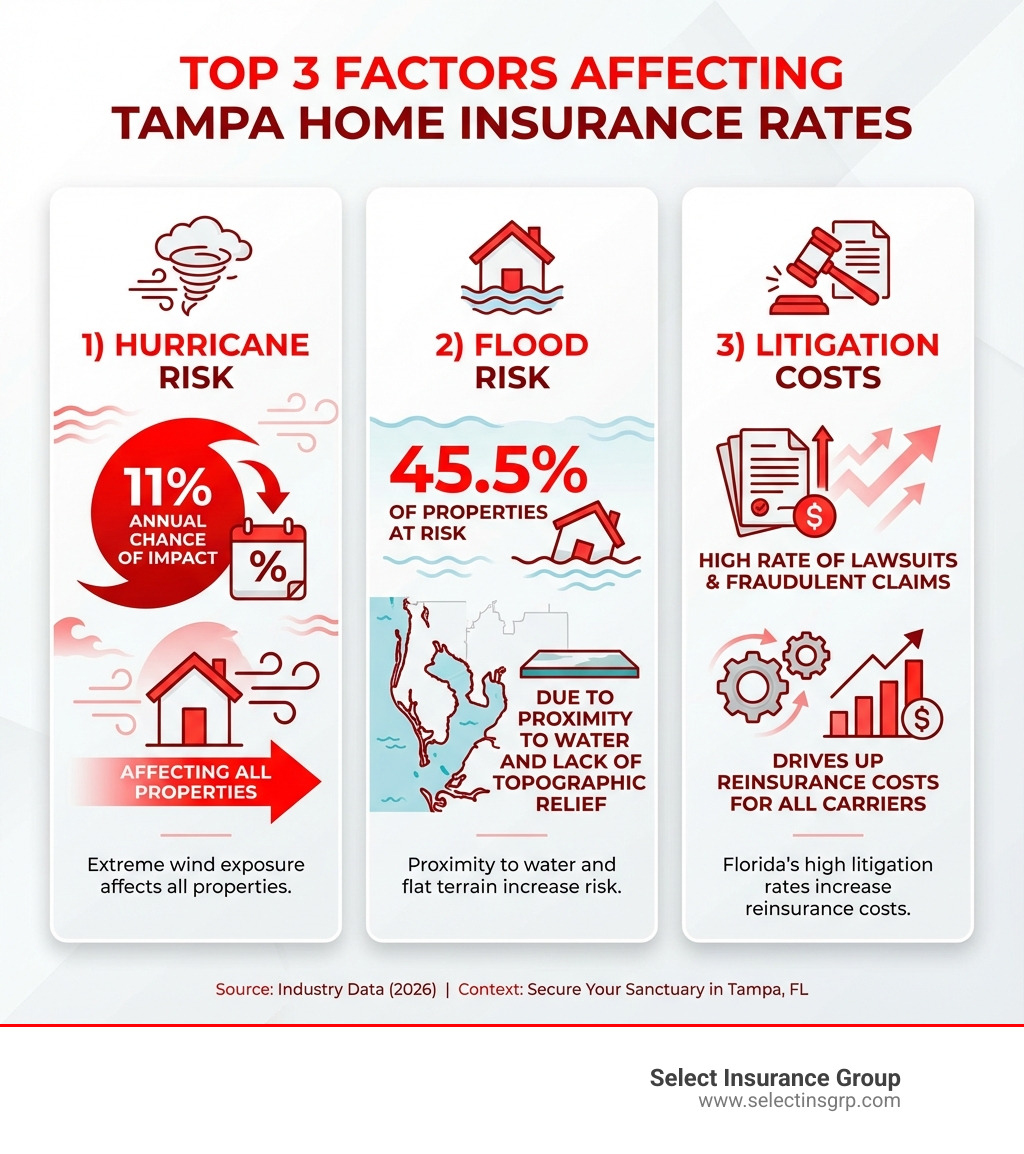

Tampa’s unique location brings both beauty and risk. The city faces an 11% annual chance of hurricane impact, sits in multiple flood zones, and rests on limestone bedrock prone to sinkholes. These factors have driven Florida’s insurance market into turbulence, with many carriers withdrawing or dramatically raising rates.

But here’s the good news: understanding what drives your premium gives you the power to lower it. Your ZIP code, home age, roof condition, and even your credit score all play a role. More importantly, strategic choices like bundling policies, raising deductibles, and installing wind mitigation features can save you hundreds or even thousands of dollars annually.

As D.J. Hearsey, founder of Select Insurance Group, I’ve helped thousands of Southeastern homeowners steer the complex insurance market to find cheap homeowners insurance tampa fl residents can actually afford. My team shops across 20+ carriers to find you the best combination of price and protection.

Understanding the Cost of Homeowners Insurance in Tampa

When we talk about homeowners insurance in Tampa, we’re discussing some of the highest rates in the country. While the average cost of homeowners insurance in Florida is over $2,100 per year, Tampa’s average for a $300,000 policy with a $1,000 deductible soars to $6,066 annually. For a $500 deductible, it’s a slightly higher $6,104 per year. This means the average Tampa homeowner could be paying around $506 per month.

However, these averages can be misleading. Some companies offer significantly lower rates, making it possible to find cheap homeowners insurance tampa fl if you know where to look.

To illustrate how dwelling coverage impacts your premiums, let’s look at some average annual costs for different coverage amounts in Tampa (note: these figures may come from different datasets and illustrate relative impact rather than exact figures for the $6k average):

| Dwelling Coverage Amount | Average Annual Premium in Tampa |

|---|---|

| $200,000 | $1,110 |

| $300,000 (with $1k deductible) | $6,066 |

| $400,000 | $1,910 |

As you can see, higher coverage generally leads to higher premiums, but the relationship isn’t always linear, and other factors come into play.

How Coverage Levels Affect Your Premium

The amount of coverage you choose directly influences your homeowners insurance premium. It’s not just about the dwelling itself; it’s about protecting your entire investment.

- Dwelling Coverage Impact: This is the core of your policy, covering the cost to rebuild or repair your home’s structure. As shown above, increasing your dwelling coverage typically increases your premium. It’s crucial to insure your home for its replacement cost, not its market value. Why? Because the cost to rebuild after a disaster can often exceed what you paid for the home, especially with rising material and labor costs.

- Personal Property Limits: Your policy also covers your belongings. Standard policies often provide coverage for personal property as a percentage of your dwelling coverage (e.g., 50-70%). For valuable items like jewelry, art, or collectibles, you might need to add specific endorsements or scheduled personal property coverage, which will increase your premium.

- Liability Coverage Costs: This protects you financially if someone is injured on your property or if you accidentally cause damage to someone else’s property. Higher liability limits offer greater protection but come with a higher cost. We always recommend adequate liability coverage to safeguard your assets.

- Policy Types (HO-3 vs HO-5): Most homeowners in Tampa will have an HO-3 policy, which is the most common type. It provides “open peril” coverage for your home’s structure (meaning it covers all causes of damage unless specifically excluded) and “named peril” coverage for your personal belongings (meaning only the risks explicitly listed in the policy are covered). An HO-5 policy, on the other hand, offers “open peril” coverage for both your dwelling and your personal property, providing broader protection but typically at a higher cost. Understanding these distinctions is key to ensuring you have the right coverage for your needs.

Why Your Tampa ZIP Code Matters

Location, location, location! Your home’s address, down to the specific ZIP code, can significantly impact your homeowners insurance rates in Tampa. Insurance companies assess risk based on geographic factors, and Tampa has its fair share of unique risks.

- Geographic Rate Differences: Different ZIP codes within Tampa can have varying average rates. For instance, some data suggests ZIP codes like 33714 (average annual cost of $1,524), 33716 ($1,531), and 33713 ($1,536) might see slightly lower average premiums compared to the city’s overall average (note: these figures are from a dataset with a lower overall city average, but they illustrate relative differences).

- Proximity to Coast: Homes closer to the Gulf or Tampa Bay are at higher risk for wind damage and storm surge during hurricanes, leading to higher premiums.

- Flood Zones: Tampa’s proximity to water and its unique geography mean many areas are prone to flooding. The city’s “lack of topographic relief” exacerbates draining issues, especially during the rainy season. Storm surge is a major concern, even for areas that don’t experience a direct hit from a hurricane. Flood maps show areas designated as Flood Zone AE and Flood Zone VE, which carry higher flood risks and, consequently, higher insurance costs.

- Crime Statistics: Believe it or not, local crime rates also play a role. A higher property crime rate can indicate a greater risk of theft or vandalism, which insurers factor into your premium. Tampa’s property crime rate is “16 incidents per 1,000 residents,” another factor that influences overall rates.

Key Factors That Drive Up Tampa Insurance Premiums

Tampa’s allure comes with its challenges, especially when it comes to homeowners insurance. Several factors beyond your control, and some within it, contribute to the city’s higher-than-average premiums.

- Home’s Age and Construction: Older homes, while charming, can sometimes be more expensive to insure due to outdated building codes, materials, or systems that are more prone to damage. Newer homes, especially those built to stricter hurricane-resistant codes, may qualify for discounts.

- Roof Age and Shape: The age and condition of your roof are critical. An older roof is more susceptible to wind damage, a significant concern in Florida. Insurers will often charge higher premiums for roofs nearing the end of their lifespan. Hip roofs (sloping on all four sides) are generally considered more wind-resistant than gable roofs (triangular ends) and can sometimes lead to lower rates.

- Claims History: Your personal claims history, and sometimes even the claims history of previous owners, can influence your rates. Filing multiple claims, especially for smaller incidents, can signal higher risk to insurers.

- Credit-Based Insurance Score: In Florida, insurers may use a credit-based insurance score as one factor in determining your premium. A higher score often indicates a lower risk, potentially leading to better rates.

- Hurricane Risk: This is a big one. Tampa has an “11% chance of experiencing a hurricane in any given year.” This constant threat significantly drives up reinsurance costs for insurers, which then gets passed on to policyholders.

- Wind Risk: Beyond direct hurricane hits, “Tampa’s extreme wind risk” is a major factor. All properties in Tampa are vulnerable to severe wind exposure, leading insurers to price this risk into every policy.

- Florida’s Turbulent Insurance Market: The state’s overall insurance landscape is challenging. Rising reinsurance costs, frequent litigation, and a high risk of natural disasters mean many insurers have withdrawn from Florida or are raising rates significantly. This market instability impacts every homeowner in Tampa.

How to Get Cheap Homeowners Insurance in Tampa, FL

Finding cheap homeowners insurance tampa fl doesn’t have to be a scavenger hunt. With a strategic approach and the right guidance, you can secure robust coverage without breaking the bank.

- Shopping Around: This is arguably the most impactful step. Rates vary widely between companies, even for identical coverage. Don’t settle for the first quote you receive. We recommend getting multiple quotes every year or two to ensure you’re getting the best deal.

- Working with an Independent Agent: This is where we shine! As Select Insurance Group, we’re an independent agency, meaning we don’t work for one specific insurance company. Instead, we shop policies from over 40 carriers to find the best rates and coverage custom to your needs. With over 30 years of experience, our team understands the nuances of the Florida market and can help you steer the options efficiently.

- Improving Your Home’s Resilience: Investing in your home’s safety and durability can lead to significant savings. Think about upgrades that reduce risk.

- Maintaining a Good Credit Score: While it might not seem directly related to your home, a strong credit history can positively influence your insurance score, potentially leading to lower premiums.

Maximize Savings with Home Insurance Discounts

Who doesn’t love a good discount? Insurance companies offer various ways to lower your premium, especially if you’re proactive about protecting your home.

- Wind Mitigation: This is a big one in Florida. Features that make your home more resistant to wind damage, such as roof-to-wall connections, secondary water resistance, storm protection devices (like hurricane shutters or impact-resistant windows), hip roof shapes, gable end bracing, and secure roof coverings, can lead to substantial discounts. If you’ve made improvements in the last 5 years, consider a new wind mitigation inspection!

- Monitored Security Systems: Installing a professionally monitored burglar alarm system can reduce your risk of theft and earn you a discount.

- Fire Alarms: Similar to security systems, having monitored fire alarms or sprinkler systems can also lead to savings.

- New Roof Discount: If you’ve recently replaced your roof, especially with materials designed for durability in Florida’s climate, you might qualify for a discount.

- Senior Discount: Some insurers offer discounts for homeowners aged 55 and older, which can be a valuable way for seniors to save on their policy.

- Claims-Free History: If you’ve maintained a long history without filing claims, you may be rewarded with lower rates.

- Water Detection Devices: Installing smart leak detectors can prevent costly water damage and might qualify you for a discount.

The Impact of Deductibles on Your Premium

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in for a claim. Choosing the right deductible is a balancing act between your annual premium and your potential out-of-pocket costs.

- Standard Deductible vs. Hurricane Deductible: In Florida, you’ll typically have two types of deductibles: a standard deductible for most perils (fire, theft, etc.) and a separate hurricane deductible for damage specifically caused by named storms. We’ll dig deeper into hurricane deductibles later.

- Higher Deductible for Lower Premium: Generally, opting for a higher deductible will lower your annual premium. This is because you’re agreeing to take on more of the initial financial risk.

- Choosing an Affordable Deductible Amount: While a higher deductible can save you money upfront, it’s crucial to choose an amount you can comfortably afford to pay if you need to file a claim. You don’t want to save $200 a year on your premium only to find you can’t cover a $5,000 deductible when disaster strikes.

To give you an idea of how deductibles can influence rates, here are some average annual rates in Tampa based on different deductible levels (note: these figures are from a dataset with a lower overall city average, but they illustrate the impact):

| Deductible Level | Average Annual Rate in Tampa |

|---|---|

| $500 | $1,329 |

| $1,000 | $1,229 |

| $1,500 | $1,214 |

| $2,000 | $1,100 |

| $5,000 | $1,058 |

Bundling Home and Auto Insurance for a Better Rate

One of the easiest ways to find cheap homeowners insurance tampa fl is by bundling your home and auto policies with the same provider.

- Multi-Policy Discounts: Almost all major insurance companies offer a discount for combining multiple policies. This “multi-policy discount” can lead to significant savings on both your home and auto insurance.

- Average Savings Percentage: In Tampa, bundling home and auto insurance can lead to average annual savings of 6%. That might not sound like much, but it can add up to hundreds of dollars a year!

- Convenience of One Provider: Beyond the savings, bundling offers the convenience of managing all your insurance needs through a single company, often with one bill and one point of contact for claims or questions.

- More Information: If you’re looking to save on your car insurance too, check out our guide on cheap car insurance in Florida.

Essential Coverage Options for Tampa Homeowners

A standard homeowners insurance policy (typically an HO-3) provides crucial protection for your dwelling, personal property, and liability. However, in a place like Tampa, with its unique risks, “standard” might not be enough. It’s essential to review your policy carefully and consider additional coverages.

When selecting coverage, you’ll often encounter “Replacement Cost” and “Actual Cash Value.” Replacement cost coverage pays to rebuild or repair your home and replace belongings with new ones, without deducting for depreciation. Actual cash value, on the other hand, factors in depreciation, meaning you’ll get less for older items. For comprehensive protection, we always recommend replacement cost coverage.

For a deeper dive into general Florida home insurance, explore our Florida home insurance guide.

Should You Add Flood Insurance?

If you live in Tampa, the answer to this question is almost certainly YES.

- Standard Policy Exclusion: It’s a common misconception that homeowners insurance covers flood damage. A standard homeowners policy explicitly excludes damage from floods.

- Tampa’s Flood Risk: Tampa’s geography makes it highly susceptible to flooding. Its “lack of topographic relief” means water has nowhere to go during heavy rains. Storm surge is a significant concern, and low-lying areas are vulnerable even if a hurricane doesn’t make a direct hit. In fact, flood maps show areas designated as Flood Zone AE and Flood Zone VE, indicating high-risk areas. A staggering 45.5% of all properties in Tampa are at risk of flooding.

- National Flood Insurance Program (NFIP): The NFIP, managed by FEMA, is the primary source of flood insurance for most homeowners in flood-prone areas.

- Private Flood Insurance: In recent years, private insurance companies have also begun offering flood insurance, sometimes providing broader coverage or higher limits than the NFIP. Given Tampa’s vulnerability, getting a quote for flood insurance is a wise decision.

Understanding Sinkhole and Catastrophic Ground Cover Collapse

Florida is known for its beautiful beaches, theme parks, and…sinkholes. Yes, unfortunately, sinkholes are a very real risk, and Tampa is no exception.

- Florida’s Limestone Geology: The majority of Florida rests on limestone, which is porous and can be eroded by groundwater, creating subterranean caverns. When the ground above these caverns collapses, a sinkhole forms.

- Sinkhole Risk: Due to its susceptibility to flooding, Tampa is also at risk for sinkholes, as water erosion is a key factor. Florida experiences “more than 17 sinkholes per day,” making this a significant concern for homeowners.

- Catastrophic Ground Cover Collapse Coverage: This is often included in Florida homeowners policies, but it has a very high bar to meet for a claim. It typically requires:

- The abrupt collapse of the ground cover.

- A depression in the ground cover clearly visible to the naked eye.

- Structural damage to the building, including the foundation.

- The governmental agency having jurisdiction has condemned the structure and ordered its evacuation.

If all these conditions aren’t met, your claim might be denied.

- Optional Sinkhole Coverage: For broader protection, you can purchase optional sinkhole coverage. This covers damage from sinkholes that don’t meet the strict criteria for catastrophic ground cover collapse, offering more peace of mind. We highly recommend discussing this option with our team to assess your property’s specific risk.

Frequently Asked Questions about Tampa Home Insurance

We know you have questions, and we’re here to provide clear answers to help you steer the complexities of cheap homeowners insurance tampa fl.

Is homeowners insurance required in Tampa, FL?

While homeowners insurance isn’t legally mandated by the state of Florida, it’s almost always required by your mortgage lender.

- Legal Requirements vs. Lender Requirements: The state won’t fine you for not having it, but your lender will. If you have a mortgage, your lender considers your home collateral for the loan and requires insurance to protect their investment.

- Mortgage Clauses: Most mortgage agreements include a clause stipulating that you must maintain homeowners insurance for the life of the loan. If you don’t, the lender can “force-place” insurance on your property, which is typically much more expensive and offers less comprehensive coverage than a policy you’d purchase yourself.

- Protection for Your Asset: Even if you own your home outright, homeowners insurance is a smart investment. It protects your most valuable asset from unforeseen disasters, liability claims, and other financial burdens. Think of it as a financial safety net for your sanctuary.

Why are homeowners insurance rates so high in Florida?

Florida’s homeowners insurance market is a tough nut to crack, and rates are notoriously high – the highest in the country, in fact. Several converging factors contribute to this challenging environment:

- Reinsurance Costs: Insurers don’t carry all the risk themselves; they buy “reinsurance” from other companies to protect themselves from massive losses, especially after catastrophic events. Florida’s high risk of natural disasters means reinsurance is incredibly expensive for companies operating here, and those costs are passed on to policyholders.

- Frequent Litigation: Florida has unfortunately become a hotspot for insurance-related lawsuits. The high volume of litigation, including fraudulent claims, drives up costs for insurers, leading to higher premiums for everyone.

- High Risk of Natural Disasters: We’ve touched on this, but it bears repeating: Florida is ground zero for hurricanes, floods, and even sinkholes. This inherent vulnerability to severe weather and geological events makes insuring homes a high-stakes game for companies.

- Recent Weather-Related Damage: The increasing frequency and intensity of hurricanes and other weather events have led to billions of dollars in damage in recent years. These massive payouts deplete insurer reserves and force them to raise rates to maintain solvency.

What is a hurricane deductible?

A hurricane deductible is a specific type of deductible that applies only when damage to your home is caused by a named tropical storm or hurricane. It’s separate from your standard “all-peril” deductible.

- Separate Deductible for Named Storms: While your standard deductible might be a flat dollar amount (e.g., $1,000), a hurricane deductible is almost always a percentage of your dwelling coverage amount (e.g., 2%, 5%, or 10%).

- Triggering Events: This deductible is triggered by an official hurricane warning, a named tropical storm, or when wind speeds in your area reach a certain threshold, as defined by your policy.

- Percentage-Based vs. Flat Dollar Amount: For example, if your home is insured for $300,000 and you have a 2% hurricane deductible, you would be responsible for the first $6,000 in hurricane-related damage before your insurance pays out.

- How It Affects Out-of-Pocket Costs: It’s crucial to understand your hurricane deductible, as it represents a potentially significant out-of-pocket expense if Tampa experiences a hurricane. We always make sure our clients understand this critical component of their policy.

Your Next Steps to Affordable Tampa Home Insurance

Navigating the homeowners insurance market in Tampa can feel like a daunting task, but it’s a challenge you don’t have to face alone. Finding cheap homeowners insurance tampa fl requires a proactive approach and a knowledgeable guide.

Here’s a quick recap of our key takeaways:

- Tampa homeowners insurance rates are significantly higher than national averages, driven by unique risks like hurricanes, floods, and sinkholes, as well as the state’s challenging insurance market.

- Your premiums are influenced by many factors, including your home’s characteristics, location, claims history, and even your credit score.

- You can significantly lower your costs by shopping around, leveraging discounts (especially wind mitigation!), choosing appropriate deductibles, and bundling your policies.

- Crucial additional coverages like flood insurance and optional sinkhole coverage are often necessary for comprehensive protection in Tampa.

We understand that choosing the right policy is about more than just finding the lowest price; it’s about securing your sanctuary and ensuring you’re adequately protected when it matters most. That’s where Select Insurance Group comes in.

With over 30 years of experience and access to more than 40 top insurance carriers, our team is uniquely positioned to help you find the best value. We’ll take the time to understand your specific needs, explain your options in plain language, and do the heavy lifting of comparing quotes for you. We’re committed to providing competitive rates and superior customer service.

Don’t let the complexities of the Tampa insurance market keep you from finding the protection you deserve. Take the first step towards securing your home and your peace of mind.

Contact a Tampa insurance expert today to get a personalized quote and find how much you can save!