Understanding the Real Cost of Driving in Orlando

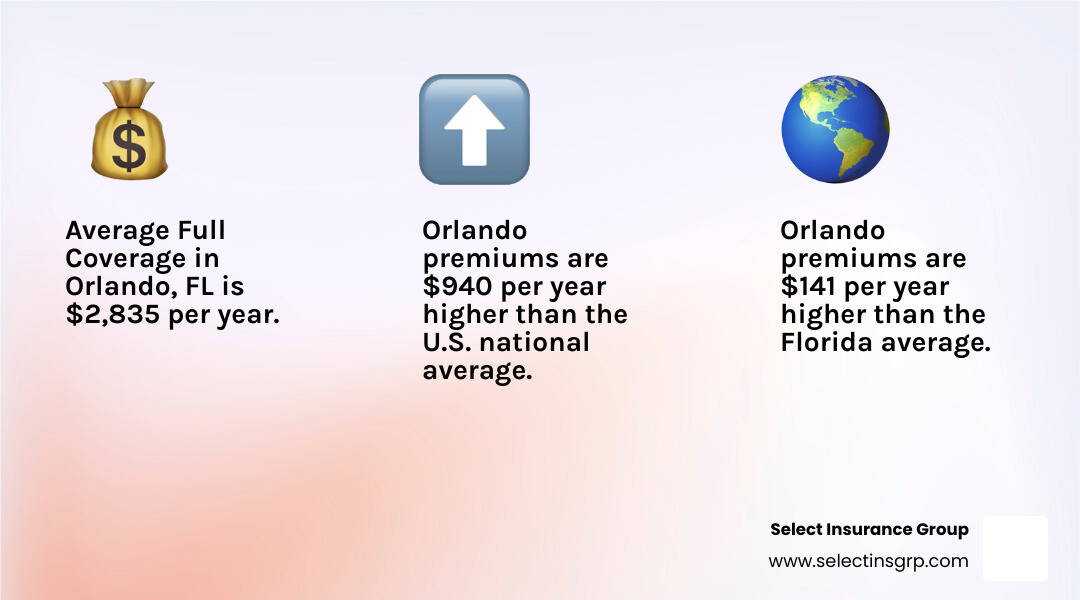

The average cost of car insurance in Orlando FL is $2,835 per year (or about $236 per month) for full coverage. That is $141 more than the Florida state average and $940 more than the national average. Here is a quick look:

- State Minimum Coverage: $1,096/year ($91/month)

- Full Coverage: $2,835/year ($236/month)

- Orlando vs. Florida Average: $141 more per year

- Orlando vs. National Average: $940 more per year

- Cheapest Provider: Rates start around $2,086/year

If you drive on Orlando’s busy roads, from I-4 gridlock to tourist-heavy areas, you have probably noticed your insurance bill creeping up. Between 2022 and 2023 alone, Orlando rates jumped 6% (about $162). You are not imagining it.

Why are costs so high? Orlando’s insurance prices reflect a combination of dense population, tourist traffic, Florida’s no-fault laws, severe weather, and a legal environment that drives up claim costs. Understanding these numbers is the first step toward finding better rates.

I am D.J. Hearsey, founder of Select Insurance Group. For over three decades, I have helped thousands of drivers in Orlando and across the Southeast find coverage that fits their budget. My agency shops more than 20 carriers to help you find the best balance between price and protection.

Average cost of car insurance in orlando fl terms you need:

- auto insurance agents in orlando fl

- auto insurance companies orlando fl

- auto insurance quote orlando fl

What is the Average Cost of Car Insurance in Orlando, FL?

The average cost of car insurance in Orlando FL is higher than many drivers expect. The average annual premium for full coverage is $2,835, or about $236 per month. This figure is not static; it is influenced by many factors and has been rising. For instance, between 2022 and 2023, Orlando rates increased by 6% (about $162). Average rates have climbed steadily from $1,774 in 2016 to $2,835 in 2023.

These fluctuations show the insurance landscape is always shifting, making it vital for Orlando drivers to stay informed and regularly review their coverage.

How Coverage Levels Impact the Average Cost of Car Insurance in Orlando, FL

The coverage you choose significantly impacts your costs. In Orlando, prices differ based on whether you select state minimum, liability-only, or full coverage.

Here is how coverage levels affect average costs in Orlando:

| Coverage Level | Average Annual Cost | Average Monthly Cost |

|---|---|---|

| State Minimum Coverage | $1,096 | $91 |

| Liability Only Coverage | $1,817 | $151 |

| Full Coverage | $2,835 | $236 |

State Minimum Coverage: This is the legal minimum to drive in Florida. It is the cheapest but offers minimal protection. Learn more in our Minimum Auto Insurance Florida Guide.

Liability Only Coverage: This provides higher liability limits than the state minimum (for example, 50/100/50) for more financial protection, but it does not cover your own vehicle’s damage.

Full Coverage: This is the most comprehensive option, including liability plus:

- Collision coverage: Pays for damage to your car from a collision.

- Comprehensive coverage: Covers non-collision damage from events like theft, fire, or natural disasters.

- Personal Injury Protection (PIP): As a no-fault state, Florida requires PIP to cover your medical expenses and lost wages after an accident, regardless of fault.

Full coverage offers greater peace of mind, especially for newer or financed vehicles where lenders often require it.

Average Costs by Driver Age and Gender

Age and experience are key factors. Insurers group drivers by age to assess risk.

-

Young drivers (especially teens): Teens (16-19) face the highest premiums, averaging around $7,166 per year for full coverage due to inexperience. Young adults (20-24) pay an average of $4,238. While some companies offer cheaper rates for this group (around $5,712 annually for teens), the cost is still high.

-

Adult drivers: Rates typically decrease with a clean driving record. Adult drivers (25-55) in Orlando average $2,908 per year.

-

Senior drivers: Senior drivers (60-75) in Orlando average $2,816 per year, slightly less than the general adult average. Some insurers offer competitive rates for this group, with full coverage available for around $1,998 per year.

Male vs. Female Driver Rates: In Orlando, male drivers pay an average of $2,853 annually, while female drivers pay $2,815. This can vary, as statewide data sometimes shows the reverse. These differences stem from statistical accident data, though some states prohibit using gender in rate calculations.

Comparing the Average Cost of Car Insurance in Orlando, FL to State and National Averages

Orlando’s premiums are noticeably higher than broader averages.

-

Orlando vs. Florida average: Orlando’s car insurance is $141 more expensive than the Florida state average of $2,636 annually.

-

Orlando vs. U.S. average: The difference is even more pronounced compared to the national average. Orlando’s rates are $940 more than the U.S. average of about $1,895 annually for full coverage.

Why is Orlando more expensive? Several factors contribute:

- Population density: More cars on the road mean a higher chance of accidents.

- Tourist traffic: Millions of visitors, often unfamiliar with local roads, increase congestion and accident risk.

- Accident rates: High traffic volume leads to more accidents and claims.

- Theft and vandalism: Urban areas see higher rates of vehicle crime.

- Severe weather: Florida’s hurricanes and storms lead to more comprehensive claims.

Key Factors That Influence Your Orlando Car Insurance Premium

Your car insurance premium is not a random number; it is a complex risk assessment based on many personal and external factors. These elements help insurers predict your likelihood of filing a claim. This is why personalized quotes are so important, because what is cheap for one driver might be expensive for another.

Your Driving Record

Your driving record is one of the most significant factors in your insurance rates. Insurers review your history to predict future behavior.

- Clean driving record: Florida drivers with a clean history pay an average of $2,367 annually. A spotless record signals you are a low-risk driver.

- At-fault accidents: An at-fault accident will almost certainly increase your rates, with some sources indicating a 39% rise in premiums.

- Speeding tickets: A single speeding ticket can raise rates by 31%.

- DUI conviction: A DUI is a severe infraction and leads to major rate increases, sometimes 50% or more.

- How long violations affect rates: Minor violations typically impact rates for three to five years. Serious offenses like a DUI can affect premiums for up to ten years.

Your Credit Score

In Florida, insurers can use a credit-based insurance score as a rating factor. They believe there is a correlation between credit history and the likelihood of filing a claim.

- Excellent credit savings: Drivers with excellent credit in Florida could pay 20% less than the state average.

- Poor credit surcharge: A poor credit score can lead to much higher rates. In Orlando, drivers with poor credit (300-579) might see a 96% increase in costs compared to those with excellent credit. Some insurers are more forgiving, with competitive rates around $2,709 per year for this group.

Your Vehicle

The car you drive directly affects your insurance cost.

- Vehicle make and model: High-performance or luxury cars often have higher premiums due to repair costs and theft risk.

- Repair costs: Cars that are expensive to repair will cost more to insure.

- Safety ratings: Vehicles with excellent safety ratings may qualify for discounts.

- Vehicle age: For older cars (valued under $4,000 or over 8 years old), you might consider dropping collision and comprehensive coverage, as the cost may outweigh the car’s value.

- Car theft rates in the U.S.: Florida has the third-highest rate of motor vehicle thefts. If your car is a common target, your comprehensive premium may be higher.

Florida’s Car Insurance Laws and Requirements

Florida has specific legal obligations for car insurance. Understanding these laws is essential for compliance and financial protection. Florida is a no-fault state, meaning your own Personal Injury Protection (PIP) is your primary source for medical expenses and lost wages after an accident, regardless of who is at fault.

Drivers must maintain continuous financial responsibility. For a complete overview, see our Ultimate Florida Auto Insurance Guide.

Minimum Car Insurance Requirements in Orlando

To drive legally in Florida, you must carry:

- Personal Injury Protection (PIP): A minimum of $10,000. This covers 80% of medical expenses and 60% of lost wages up to the limit.

- Property Damage Liability (PDL): A minimum of $10,000. This pays for damage you cause to another person’s property.

These $10,000 minimums are often insufficient for a serious accident.

- Bodily Injury Liability (optional for most): Florida does not require most drivers to carry Bodily Injury Liability (BIL), but it is highly recommended. BIL protects your assets if you injure someone in an at-fault accident. Without it, you could be personally sued for their medical bills. More details on bodily injury liability are available.

- Uninsured Motorist Coverage (optional): We strongly recommend Uninsured/Underinsured Motorist (UM/UIM) coverage. With Florida’s high rate of uninsured drivers (estimated at 15.9% to 20.4%), this coverage protects you if you are hit by a driver with little or no insurance.

Consequences of Driving Uninsured in Orlando

Driving without required insurance in Orlando leads to severe penalties.

- License and registration suspension: Both can be suspended, taking your car off the road.

- Fines up to $500: Fines range from $150 to $500 for a first offense.

- Reinstatement fees: You will pay significant fees to get your license and registration back.

- SR-22 requirement: You may be required to file an SR-22, which flags you as a high-risk driver and leads to much higher insurance premiums for up to three years.

Beyond legal penalties, driving uninsured leaves you financially vulnerable. If you cause an accident, you are personally responsible for all damages and injuries, which could lead to bankruptcy. It is a risk not worth taking.

How to Get a Lower Car Insurance Rate in Orlando

While Orlando car insurance can be costly, there are proactive steps you can take to save money. With smart shopping and some know-how, finding affordable rates is possible.

Shop Around and Compare Quotes

This is the most effective way to lower your premium. Rates vary widely between providers because each uses its own formula to assess risk.

- Compare multiple insurers: Always compare quotes from at least three to five different companies. Reports show 43% of customers compare rates because they feel they are overpaying.

- Independent insurance agents: As an independent agency, Select Insurance Group works for you, not one company. We access policies from over 40 carriers to compare quotes on your behalf, finding the best balance of coverage and cost. Let us help you get an auto insurance quote in Orlando.

- Annual policy review: Review your policy and compare quotes at least once a year or after a major life event (like moving, buying a car, or improving your credit).

Ask About Available Discounts

Insurers offer many discounts that can significantly reduce your premiums. Always ask if you qualify for:

- Good student discount: For young drivers with good grades.

- Safe driver discount: For having a clean driving record. Telematics programs can also offer rewards.

- Multi-policy (bundling) discount: Bundle auto with home or renters insurance for savings of 10% or more.

- Pay-in-full discount: Pay your premium upfront for a discount.

- Vehicle safety features discount: For cars with anti-lock brakes, airbags, or anti-theft devices.

- Low-mileage discount: If you do not drive much, you may be eligible.

- Affiliation discounts: For members of certain professional groups or alumni associations.

- Defensive driving course discount: Completing a course can sometimes lead to a small discount.

Adjust Your Coverage and Deductibles

You can adjust your coverage to save money without being underinsured.

- Choose a higher deductible: Your deductible is what you pay out-of-pocket on a claim. Raising it from $500 to $1,000 can lower your premium. Just be sure you can afford the higher amount if needed.

- Drop collision and comprehensive on older cars: If your car is paid off and has a low market value (for example, under $4,000), the cost of this coverage might not be worth it. Dropping it can be a sensible way to save.

- Assess actual cash value: Check your car’s value on a site like Kelley Blue Book before dropping coverage. If it is low, you might be better off saving the premium money.

For more tips, explore our guide on finding low-cost auto insurance in Florida.

Frequently Asked Questions about Orlando Car Insurance Costs

Why is car insurance in Orlando so expensive?

The high average cost of car insurance in Orlando FL is due to a combination of factors:

- High population density: More cars on the road lead to a higher probability of accidents.

- Heavy tourist traffic: Millions of visitors unfamiliar with local roads increase congestion and collision risk.

- Frequent severe weather: Hurricanes and storms lead to more comprehensive claims for flood and other damage, which insurers factor into rates.

- High litigation rates: Florida has a reputation for high litigation in insurance claims. Data shows a large percentage of claim payouts go to attorneys, driving up costs for insurers and policyholders.

- Florida’s no-fault laws: The state’s PIP system can sometimes lead to higher overall medical claims costs.

- High uninsured motorist rate: Florida has one of the nation’s highest rates of uninsured drivers (15.9% to 20.4%). This forces insured drivers to bear more of the financial burden, often through higher premiums for UM/UIM coverage.

Which ZIP codes in Orlando have the highest and lowest rates?

Rates can vary significantly by ZIP code within Orlando. Insurers assess risk based on local factors like accident frequency, traffic, and vehicle theft rates.

- Higher risk areas: Denser urban areas with more traffic and crime often have higher rates. Examples of potentially more expensive Orlando ZIP codes include: 32808, 32805, 32811, 32818, 32839.

- Lower risk areas: ZIP codes with less traffic and lower crime statistics often have more affordable rates. Examples of potentially cheaper Orlando ZIP codes include: 32789, 32827, 32832, 32831, 32828.

Your specific address plays a role, highlighting the need for a personalized quote.

How much coverage should I actually get in Orlando?

The answer is almost always more than the state minimum. While Florida’s minimums ($10,000 PIP and $10,000 PDL) are legal, they offer little protection in a serious accident.

- State minimum vs. recommended coverage: Minimum coverage is often insufficient, leaving you personally responsible for costs exceeding those limits. We recommend higher liability limits to protect your assets.

- 100/300/100 liability limits: A commonly recommended package is 100/300/100 ($100k per person/$300k per accident for bodily injury, $100k for property damage). This offers a much stronger safety net.

- Asset protection: If you own a home or have significant savings, higher liability limits are crucial to protect your assets from a lawsuit.

- Uninsured motorist coverage importance: Given Florida’s high rate of uninsured drivers, Uninsured/Underinsured Motorist (UM/UIM) coverage is vital. It protects you if you are hit by a driver with insufficient insurance.

The right amount of coverage depends on your financial situation and risk tolerance. We can help you find a policy that balances protection with affordability.

Find Your Best Rate for Orlando Car Insurance Today

Navigating Orlando’s car insurance costs can be complex, but you do not have to do it alone. While the average cost of car insurance in Orlando FL is high, understanding the factors that influence your rates is the first step to making informed decisions.

At Select Insurance Group, we use our 30+ years of experience to provide expert guidance. We know every driver’s needs are unique. That is why we leverage our relationships with over 40 carriers to shop the market for you, comparing policies to find the right balance of coverage and cost.

Our goal is to ensure you have the right coverage at a price that fits your budget. Do not let the Orlando average deter you; let us help you find a policy that works for you.

Ready to find your ideal car insurance solution? Contact an insurance agent in West Orlando today and get on the road with confidence.