Explaining Insurance for Drivers Without a Car

When you don’t own a vehicle, staying protected on the road can feel like a puzzle. Insurance for a driver without car, often called non-owner car insurance, is a specific policy providing essential liability coverage for people who drive cars they don’t own.

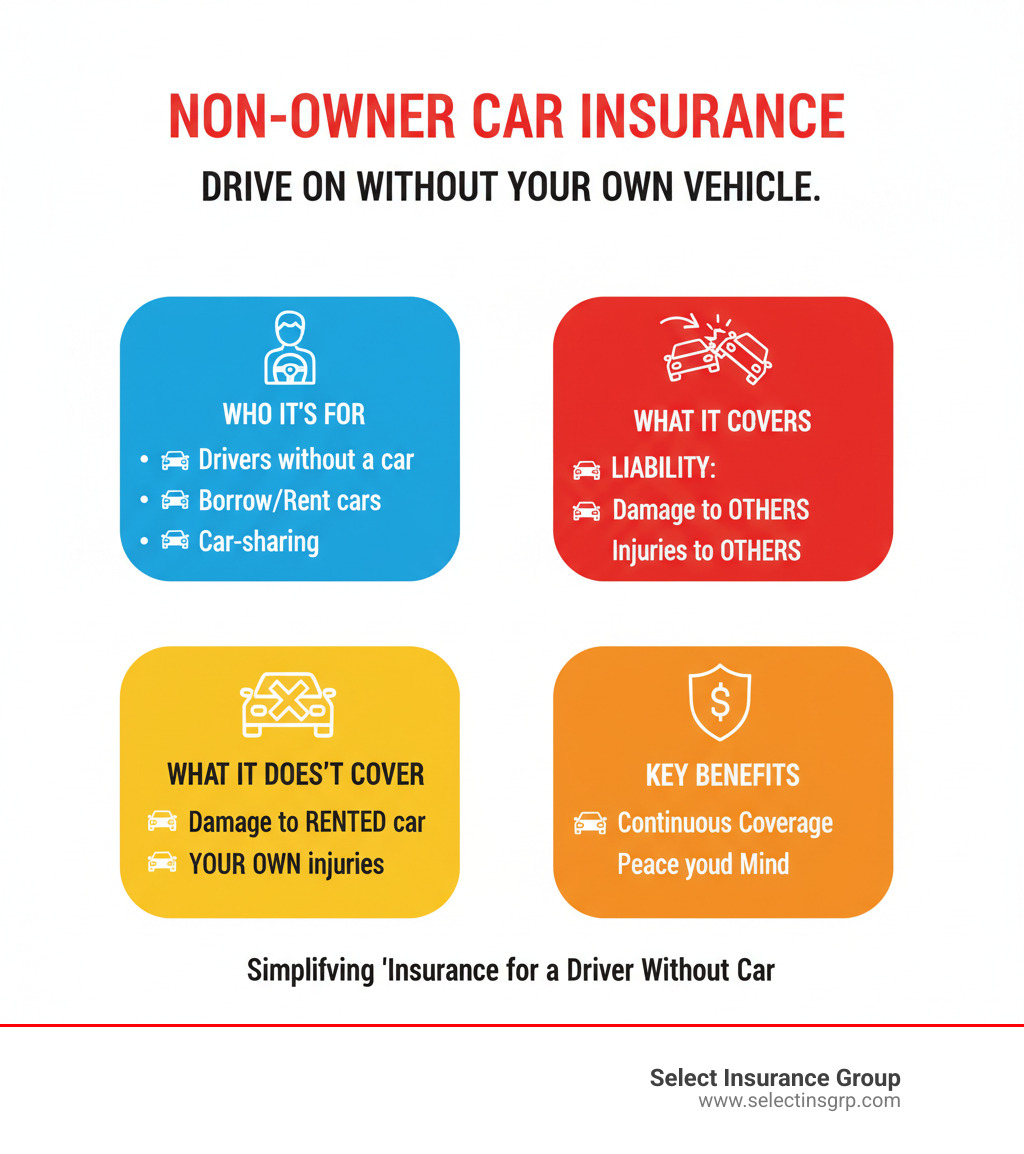

Here’s a quick look at what non-owner car insurance means:

- Who it’s for: Drivers who don’t own a car but regularly borrow, rent, or use car-sharing services.

- What it covers: Your liability for injuries or property damage you cause to others in an accident.

- What it doesn’t cover: Damage to the vehicle you’re driving, or your own injuries.

- Key benefit: Protects your finances and helps maintain a continuous insurance history.

Many people drive without owning a car, whether they borrow a friend’s vehicle, use car-sharing services, or frequently rent for travel. In these cases, an accident without proper coverage could lead to huge financial problems. Non-owner car insurance offers a smart way to get the protection you need and drive with peace of mind.

As Principal Agent and CEO of Select Insurance Group, D.J. Hearsey brings decades of experience helping clients understand complex topics like insurance for a driver without car. He specializes in balancing cost-effective solutions with excellent customer service, ensuring you get the right coverage for your unique needs.

Insurance for a driver without car terminology:

- cheap non drivers insurance

- getting liability insurance without a car

- getting sr22 insurance without a car

What is Non-Owner Car Insurance?

Ever wondered how you can drive a car you don’t own and still be protected? That’s where insurance for a driver without car comes in. This special type of auto insurance, sometimes called a “named non-owner policy,” is designed for drivers who don’t have their own vehicle.

Instead of covering a specific car, a non-owner policy is tied directly to you. This means it provides crucial liability coverage whenever you’re behind the wheel of a car you don’t own, whether it’s a friend’s car, a rental, or a car-sharing vehicle. Your non-owner policy acts as your personal safety net.

Think of it as a personal shield of financial responsibility. Most states require drivers to carry liability insurance, and a non-owner policy helps you meet these rules. It’s a more focused policy than full-coverage car insurance, concentrating on protecting you from the financial hit if you cause an accident.

What It Covers

The main goal of insurance for a driver without car is to give you liability coverage. This means it covers the costs for damages and injuries you accidentally cause to others in an accident. Here’s the protection you typically get:

- Bodily Injury Liability: This pays for medical bills, lost wages, and pain and suffering for anyone you injure in an accident. This protection can save your personal savings from potential lawsuits.

- Property Damage Liability: This covers costs to fix or replace property you damage, such as another car, a fence, or a building.

- Uninsured/Underinsured Motorist (UM/UIM): While optional, we highly recommend it. This protects you if you’re in an accident with a driver who has no insurance, or not enough, to cover your damages.

- Medical Payments (MedPay) or Personal Injury Protection (PIP): Depending on your state, you might add these to cover medical expenses for you and your passengers, regardless of who was at fault.

These coverages shield you financially from the fallout of an accident you cause. For more details on how liability works, you can visit the Insurance Information Institute. To dive deeper into how liability insurance works, check out our guide on getting liability insurance without a car.

What It Doesn’t Cover

It’s also important to know what insurance for a driver without car typically doesn’t cover:

Most importantly, it will not cover damage to the vehicle you’re driving. If the borrowed or rented car is damaged, your non-owner policy won’t pay for repairs. For a rental, you’d need a Collision Damage Waiver (CDW). For a borrowed car, the owner’s policy would need collision coverage.

Your non-owner policy won’t include Collision Coverage or Comprehensive Coverage, as these are for cars you own.

Unless you’ve added MedPay or PIP, your policy also won’t cover your own injuries from an accident.

You also won’t find Towing and Rental Reimbursement or coverage for your personal belongings in a non-owner policy.

Knowing these limitations is key to making smart choices about your coverage.

Who Needs Insurance for a Driver Without a Car?

You might think insurance for a driver without car is a niche topic, but it applies to more people than you’d expect. It’s a smart plan for anyone who finds themselves driving other people’s cars regularly, whether you’re between cars or just love the flexibility of renting or sharing.

So, who really benefits? If you’re a frequent renter, a savvy car-sharing user, or someone who frequently borrows a friend’s vehicle, this policy is for you. It’s also a lifesaver for drivers who need to maintain continuous coverage or high-risk drivers needing to file an SR-22 or FR-44.

Let’s dive a little deeper into some of these specific situations.

You Frequently Rent or Use Car-Sharing Services

If you frequently rent cars or use car-sharing services, relying on their minimal coverage can be a gamble. While these services include some basic insurance, the limits are often very low and may not fully cover you in a serious accident.

A non-owner policy provides your own layer of liability coverage that can step in if the primary coverage on the rental or shared vehicle isn’t enough. It can also be a smart financial move. The daily fees for liability coverage from a rental car company can quickly add up to more than the annual cost of a non-owner policy, making it a budget-friendly alternative for frequent users.

To ensure you’re fully protected, consider your options. Learn more about comprehensive rental coverage by speaking with our experts at Select Insurance Group.

You Need to File an SR-22 or FR-44

An SR-22 or FR-44 is a form that proves you have enough insurance, often required for drivers with serious infractions like a DUI or reckless driving. You need this proof to get your driver’s license back, even if you don’t own a car.

This is where insurance for a driver without car becomes essential. It allows you to fulfill the SR-22 or FR-44 requirement without buying a vehicle. Without it, you might be unable to get your license reinstated. Navigating these requirements can be tricky, but we’re here to help. For more detailed information, check out our guide on getting SR-22 insurance without a car.

You Want to Avoid a Lapse in Coverage

Insurance companies prefer consistency. A gap in your auto insurance history can lead to significantly higher premiums later, as you may be viewed as a higher risk. A non-owner policy helps you maintain continuous insurance coverage, even if you sell your car and don’t immediately buy another. This proactive step keeps your insurance history active and can save you money by avoiding the “high-risk” label that often comes with coverage lapses.

Non-Owner vs. Permissive Use: What’s the Difference?

This is a common point of confusion, and understanding the distinction is key to knowing whether you need insurance for a driver without car.

| Feature | Non-Owner Car Insurance | Permissive Use Coverage (Owner’s Policy) | Rental Car Collision Damage Waiver (CDW) |

|---|---|---|---|

| Primary/Secondary | Typically primary for your liability when driving non-owned cars | Primary (owner’s policy is primary for the vehicle) | Primary (covers damage to the rental car) |

| Who is Covered | The driver (you) | The driver (you, if given permission) and the vehicle | The rental car (for physical damage) |

| What is Covered | Your liability for bodily injury and property damage to others | Liability for damages caused by the vehicle; damage to the vehicle (if owner has collision/comprehensive) | Physical damage to the rental car (collision, theft, etc.) |

| Covers Damage to Driven Vehicle | No | Yes (if owner has collision/comprehensive) | Yes |

| Covers Your Injuries | Only if MedPay/PIP is added | Only if MedPay/PIP is on owner’s policy | No |

| Cost | Annual premium (typically lower than standard policies) | Included in owner’s premium | Daily fee (often expensive if bought repeatedly) |

Understanding Permissive Use

“Permissive use” is when you borrow someone’s car with their permission. In most cases, their car insurance policy will extend to cover you. This means if you have an accident, the owner’s policy is primary and will cover damages up to its limits.

However, there are nuances:

- Occasional vs. Regular Use: Permissive use is for occasional borrowing. If you regularly drive a car owned by someone outside your household, their insurer might expect you to be listed on their policy.

- Household Members: If you live with someone and regularly drive their car, you generally need to be listed as a driver on their policy.

- Coverage Limits: The owner’s policy limits apply. If you cause an accident that exceeds those limits, you could be personally responsible for the difference. A non-owner policy can act as secondary coverage, kicking in when the owner’s policy is exhausted.

When You Might NOT Need Insurance for a Driver Without a Car

While non-owner insurance is a smart choice for many, it’s not always necessary. Here are scenarios where you might not need it:

- You Rarely Drive: If you drive only once or twice a year and always get a Collision Damage Waiver (CDW) from the rental company, the cost might not be justified.

- You’re Covered by a Household Member’s Policy: If you regularly drive a car owned by someone you live with, you should be listed on their policy.

- You Drive a Company Car: If your employer provides a company vehicle with a commercial auto policy that covers you for business and personal use, your needs might already be met. Always verify the policy specifics.

- You Rely on Public Transport or Rideshares: If you mostly use services like Uber or Lyft, or public transportation, a non-owner policy might be overkill. However, some specialized policies can offer broader protection, such as for passengers in rideshares or even as a pedestrian, so it’s worth checking if these coverages align with your lifestyle.

How to Get a Non-Owner Policy and What to Expect

Getting insurance for a driver without car is usually quite straightforward. Since the policy focuses on you, the driver, rather than a specific vehicle, the process is designed to gather information about your driving history and needs.

Here’s a friendly guide to what you can expect:

First, gather your basic information, including your driver’s license number and driving history. Having everything handy makes the process smoother.

Next, you’ll reach out to insurance providers. Calling an insurance agent directly is often the quickest way to get a quote for a non-owner policy. Unlike standard auto insurance, these policies sometimes require a more personalized touch. Be sure to clearly state that you’re looking for a “non-owner car insurance policy.”

Once you’ve provided your information and chosen your coverage, your policy will be issued. At Select Insurance Group, we bring over 30 years of experience to this process. We work with more than 40 carriers to help our clients in Florida, the Carolinas, Virginia, and Georgia find the perfect non-owner policy.

How Much Does Insurance for a Driver Without a Car Cost?

Here’s some good news: insurance for a driver without car is typically more budget-friendly than a standard auto policy. Since the insurer isn’t covering the value of a specific vehicle, the costs are lower.

On average, a non-owner policy can cost between $200 and $700 annually, or roughly $16 to $58 per month. This is often significantly cheaper than even minimum coverage on an owned vehicle. It’s a “bare-bones” policy, which is why it’s so affordable.

Of course, your specific premium will depend on several factors:

- Your Driving Record: A clean driving history will land you the best rates.

- Your Location: Rates can vary by state, county, and even zip code.

- Coverage Limits: Higher liability limits mean more protection but will slightly increase your premium.

- Your Age and Experience: Newer drivers sometimes face higher premiums.

- Credit History: In many states, your credit score can influence your insurance cost.

Where to Find a Policy

So, where do you go to find this special kind of insurance? While many major insurers offer non-owner policies, they might not be front and center on their websites. You may need to call their customer service or, even better, connect with a local insurance agent.

Our top recommendation is to reach out to an independent insurance agent, like us at Select Insurance Group. Independent agents don’t work for just one company. We partner with multiple carriers, which means we can shop around on your behalf to find you the best rates and coverage options. We’re here to offer personalized advice and make sure you fully understand your coverage.

Ready to explore your options? Get a quote from Select Insurance Group today!

Frequently Asked Questions about Non-Owner Insurance

It’s natural to have questions when you’re exploring a unique insurance product like insurance for a driver without car. We hear a lot of similar questions from our clients, and we’re happy to clear up some of the most common confusions right here. Let’s explore what you need to know to drive confidently.

Does non-owner insurance cover damage to the car I’m driving?

This is perhaps the most important point to understand: No, non-owner car insurance does not cover damage to the car you are driving. It’s crucial to remember that this type of policy is all about liability. That means it steps in to cover the costs of injuries and property damage you might cause to other people and their property in an accident. It offers you a shield against financial responsibility for others, but it doesn’t protect the vehicle you’re borrowing or renting.

So, what about the car itself?

- If you’re driving a rental car and want protection for physical damage to that vehicle, you’ll typically need to purchase a Collision Damage Waiver (CDW) from the rental company. Sometimes, your credit card might offer this coverage as a benefit, but it’s always wise to confirm.

- If you’re driving a borrowed car from a friend or family member, any damage to their vehicle would need to be covered by their own collision insurance policy. Your non-owner policy simply won’t step in for that.

Can I get a policy if I live with someone who owns a car?

Generally, if you live with someone who owns a car and you regularly drive that vehicle, a non-owner policy is not the right solution for you. Most insurance companies expect all licensed drivers residing in a household to be listed as named drivers on the existing auto insurance policy for any vehicles they might operate.

Trying to use a non-owner policy when you should be on a household member’s policy could lead to big problems, including the denial of a claim if an accident occurs. While “permissive use” often covers occasional driving by friends, it usually doesn’t apply to regular driving by household members. The best approach is always to be transparent with your insurer and ensure you’re correctly listed on the policy that covers the car you regularly drive at home.

Does a non-owner policy cover me in any car I drive?

For the most part, yes, your non-owner policy is designed to provide you with liability coverage when you’re behind the wheel of most personal vehicles you don’t own. This includes cars you borrow from friends or family (who don’t live with you), as well as rental cars. It’s your personal liability safety net, following you as the driver.

However, there are some important situations where your non-owner policy typically won’t apply:

- Commercial Use: If you’re driving a vehicle for work purposes, like delivering pizzas or as a rideshare driver, your personal non-owner policy usually won’t cover you. Commercial activities generally require a commercial auto insurance policy.

- Regularly Used Cars: If you frequently drive a specific vehicle that you don’t own, and it’s not a rental or an occasional borrow, your insurer might expect you to be added to that vehicle’s owner’s policy.

- Household Cars: As we just discussed, vehicles owned by someone in your household are generally excluded. You should be listed on their policy instead.

Because policy specifics can vary, it’s always a good idea to review your own policy documents carefully or chat with an expert at Select Insurance Group. We can help you understand the exact scope of your insurance for a driver without car and any specific exclusions.

Conclusion: Drive with Confidence, Even Without a Car

In our world, driving habits are always changing. Maybe you don’t own a car, but you still need to get around. That’s where insurance for a driver without car truly shines! It’s a clever, flexible way to keep you protected on the road.

Think of it this way: whether you’re often renting a car for adventures, zipping around town with a car-sharing service, or simply want to keep your insurance history spotless, a non-owner policy is your secret weapon. It gives you that essential liability shield. This means you can drive with genuine peace of mind, knowing that if a little mishap occurs while you’re behind the wheel of someone else’s vehicle, your financial future is safe.

This special kind of policy is usually easier on your wallet than a standard car insurance plan. Yet, it offers priceless protection against the huge costs that can come with injuries or property damage to others in an accident. Why let the lack of car ownership leave you vulnerable? Accept the freedom of driving, without the worry of unexpected financial burdens.

Here at Select Insurance Group, we get it. We understand today’s unique driving needs. Our friendly team is here to give you top-notch service and help you find competitive rates for exactly the right coverage. Let us guide you through your options, so you can hit the road with absolute confidence.

Ready to explore your options for insurance for a driver without car? Don’t hesitate to reach out today! If you’re in North Carolina, you can easily get a quote for your North Carolina auto insurance needs right now!