Why Finding Affordable Car Insurance in Tampa Matters

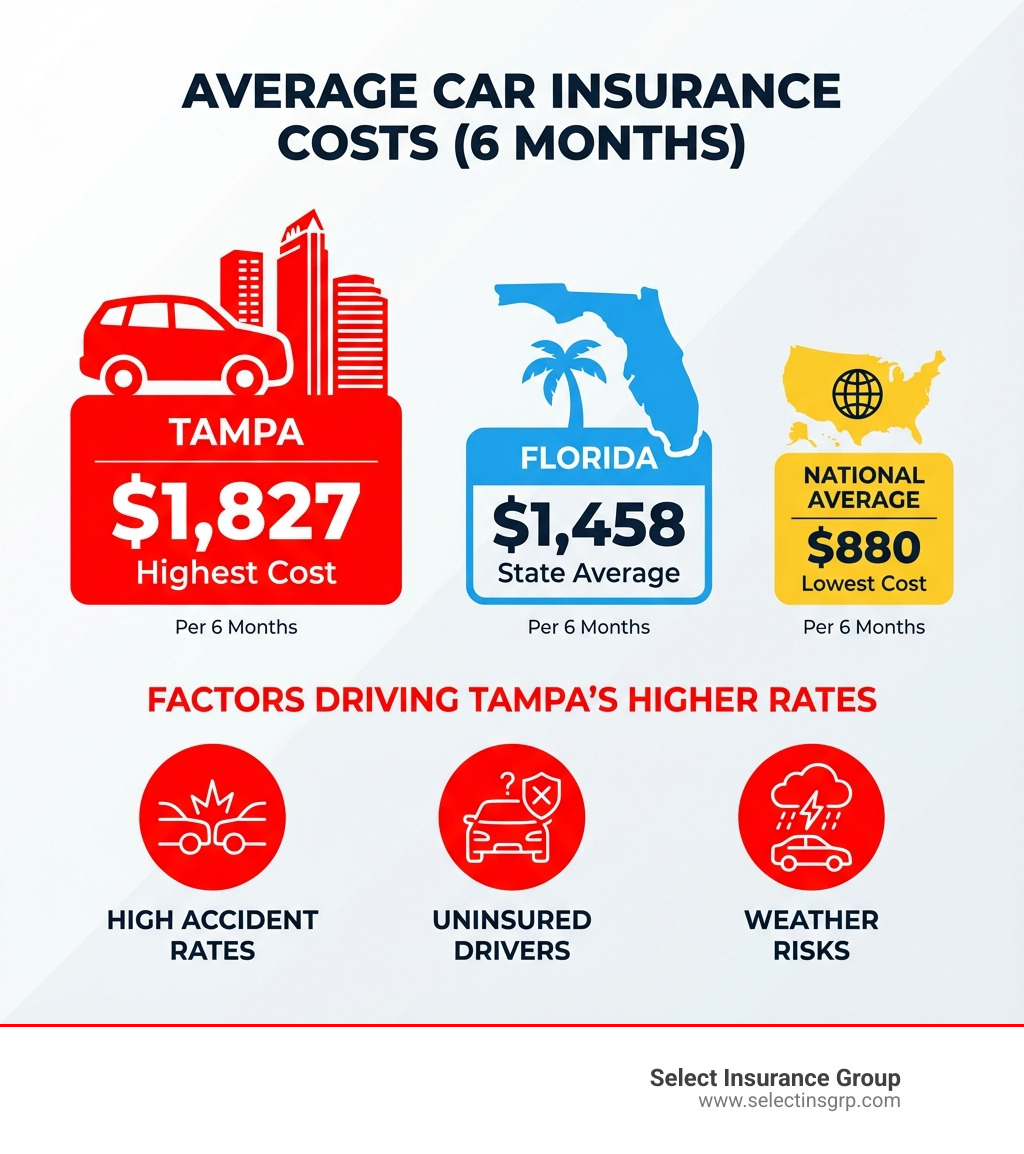

Affordable car insurance tampa fl is a critical concern for drivers in the Bay area, where rates significantly exceed both state and national averages. The average Tampa driver pays $304 per month (or $1,827 for six months) for auto insurance—that’s substantially higher than Florida’s average of $1,458 and more than double the national average of $880. With over 28,000 reported car accidents in Hillsborough County in 2023 alone, insurance is essential, but it doesn’t have to drain your budget.

Quick Answer: How to Find Affordable Car Insurance in Tampa

- Shop around – Compare quotes from multiple carriers; drivers save 20-30% on average

- Ask about discounts – Multi-car, good driver, bundling, and defensive driving can cut costs significantly

- Choose the right coverage – Balance between minimum ($1,230/year) and full coverage ($2,470/year)

- Maintain a clean record – Accidents and violations dramatically increase premiums

- Work with an independent agent – Get access to 20+ carriers in one place

The good news? You can find comprehensive, budget-friendly coverage if you know where to look and what questions to ask. This guide breaks down exactly how Tampa drivers can reduce their insurance costs without sacrificing the protection they need. As D.J. Hearsey, founder of Select Insurance Group with over three decades of industry experience, I’ve helped thousands of drivers across the Southeast—including many in Tampa—find affordable car insurance tampa fl options that fit their budgets while providing the coverage they truly need.

Why Are Tampa Car Insurance Rates Higher Than Average?

It’s no secret that car insurance in Tampa can feel like a hefty expense, often surpassing what drivers pay in other Florida cities and well above the national average. But why exactly is this the case? Several factors converge to create this liftd cost environment, making it crucial for us to understand them as we seek affordable car insurance tampa fl.

Firstly, Tampa’s booming population plays a significant role. With an estimated population of almost 400,000 in 2022, a 3.5% increase from 2020, more people mean more cars on the road. This naturally leads to increased traffic volume and, unfortunately, a higher likelihood of accidents. In fact, Hillsborough County saw over 28,000 reported car accidents in 2023 alone, averaging more than 75 crashes per day. Navigating busy thoroughfares like I-275, I-4, Brandon Boulevard, and Hillsborough Avenue during rush hour is a daily challenge for many, and unfortunately, accident hotspots like Habana Ave contribute to the city’s overall risk profile.

Another significant concern is the prevalence of uninsured drivers. Florida has long struggled with a high percentage of motorists driving without insurance. Research indicates that nearly one in four Florida motorists may be driving without car insurance, and specifically in Tampa, approximately 28% of drivers are uninsured. This statistic is alarming because when an insured driver is involved in an accident with an uninsured driver, the costs often fall back on the insured driver’s policy (especially if they have uninsured motorist coverage), driving up premiums for everyone. This makes robust coverage even more critical in our state. You can learn more about this issue by reviewing the Uninsured Motorists Facts & Statistics.

Then there’s the weather. Being a coastal city, Tampa is no stranger to severe weather risks, particularly hurricanes and flooding. The Tampa metro area was ranked #3 for storm surge and #7 for hurricane wind risk in 2021. While our beautiful sunshine is famous, these powerful storms can cause extensive property damage to vehicles, leading to more comprehensive claims. Insurers factor in these environmental risks when setting rates, making comprehensive coverage particularly valuable—and potentially more expensive—in our area.

Lastly, the general cost of vehicle repairs and medical expenses also contributes. Even minor fender-benders can be costly to fix, especially with modern vehicle technology. When combined with the higher frequency of accidents and the state’s no-fault insurance system (which means our own insurance covers medical expenses regardless of fault), these factors create a challenging landscape for finding truly cheap car insurance. For more in-depth information on Florida’s auto insurance landscape, we invite you to explore our More about Florida auto insurance.

Your 5-Step Guide to Finding Affordable Car Insurance in Tampa, FL

Finding affordable car insurance tampa fl doesn’t have to be a scavenger hunt. While the average costs might seem daunting, we’ve found that Tampa drivers who compare quotes and explore discounts regularly save 20-30% or even more. Our proactive approach to securing the best rates means smart shopping and understanding how to leverage every advantage. Here’s our comprehensive 5-step guide to help you open up those savings.

1. Compare Quotes from Multiple Providers

This is arguably the most impactful step you can take. Insurance rates are highly individualized, and what’s cheap for one driver might be expensive for another, even from the same company. Insurers use complex algorithms that weigh various factors differently, meaning quotes can vary wildly between providers for the exact same coverage.

We strongly recommend obtaining quotes from at least three different companies. Better yet, work with an independent insurance agency like ours. We have access to over 40 carriers, allowing us to shop around for you and present you with the most competitive rates without you having to spend hours on the phone or filling out endless online forms. This ensures you’re always securing the most favorable rates in Tampa. For personalized assistance, you can always Find an insurance agency in Tampa.

2. Ask About Every Available Discount

Discounts are your secret weapon in the quest for affordable car insurance tampa fl. Most insurance companies offer a wide array of discounts, but they won’t always apply them automatically. You need to ask! Here are some common discounts to inquire about:

- Multi-Policy (Bundling) Discount: This is one of the easiest ways to save. If you combine your auto insurance with other policies like homeowners, renters, or even life insurance, you can often save up to 10% on your combined premiums. Some multi-car discounts can even save you up to 25% if you insure more than one vehicle with the same provider. Learn more about how bundling can help with your Florida Home Insurance.

- Good Driver/Accident-Free Discount: If you maintain a clean driving record for a certain period (often three to five years without accidents or violations), you can qualify for significant savings, sometimes up to 8%.

- Good Student Discount: Students with good grades (typically a B average or higher) can often receive a discount, recognizing their responsible behavior extends beyond the classroom.

- Defensive Driving Course Discount: Completing an approved defensive driving course can not only make you a safer driver but also earn you a discount on your premium.

- Vehicle Safety Features Discount: Cars equipped with anti-lock brakes, airbags, anti-theft devices, or advanced safety features like lane-departure warnings can often qualify for lower rates.

- Low Mileage Discount: If you drive less than the average person (perhaps you work from home or use public transport), some insurers offer discounts or even “pay-per-mile” policies.

- Paid-in-Full Discount: Paying your entire premium upfront, rather than monthly installments, can often net you a discount of up to 15%.

- Automatic Payment Discount: Setting up automatic payments from your bank account can secure you a small but welcome discount, typically around 4%.

- E-Signature Discount: Some companies offer a small incentive, often 3%, for signing documents electronically.

- Loyalty Discount: If you’ve been with the same insurer for a long time, don’t hesitate to ask about a loyalty discount.

3. Adjust Your Coverage and Deductibles

While we never recommend being underinsured, there’s a smart way to balance coverage with cost.

- Minimum vs. Full Coverage: Florida requires minimum coverage (which we’ll detail below), but this often isn’t enough to protect your assets. Full coverage, which includes comprehensive and collision, is more expensive (average $2,470/year in Tampa vs. $1,230/year for minimum) but offers far greater protection. We can help you assess your needs.

- Assessing Vehicle Value: If your car is older and paid off, consider its actual cash value. If it’s below a certain threshold (e.g., $4,000), dropping collision and comprehensive coverage might be a viable option, as the cost of the premium might outweigh the potential payout. However, be aware that you’d be responsible for repair costs in an accident. Always consult reliable sources like Kelley Blue Book to determine your car’s value.

- Raising Deductibles: Your deductible is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible typically means a lower premium. If you have a solid emergency fund, raising your deductible from, say, $500 to $1,000 could noticeably reduce your monthly payments. Just ensure you can comfortably afford the higher deductible if you need to file a claim.

- Balancing Premium vs. Out-of-Pocket Costs: It’s a trade-off. We help our clients find the sweet spot where their premiums are manageable, but their out-of-pocket risk in case of an incident doesn’t cause financial strain.

4. Maintain a Good Driving Record

This might seem obvious, but a clean driving record is hands down one of the most significant factors in securing affordable car insurance tampa fl. Insurers love responsible drivers!

- Impact of a Clean Record: Drivers without any marks on their records consistently pay the lowest premiums because they’re considered the least risky.

- Avoiding Accidents and Violations: Even a single at-fault accident can increase your average Tampa insurance premium by about $135 per month. Speeding tickets can increase rates by 19% ($353), while a DUI can skyrocket them by 55% ($1,011), and reckless driving by 61% ($1,117). A hit-and-run could raise your rates by a staggering 63% ($1,155). The financial repercussions extend far beyond the initial fines.

- Long-Term Savings: Consistently driving safely and avoiding infractions leads to long-term savings and eligibility for those coveted good driver discounts.

5. Improve Your Credit Score

In Florida, insurance companies can use credit-based insurance scores to help determine your rates. This isn’t just about financial responsibility; statistics show a correlation between credit score and the likelihood of filing a claim.

- Credit-Based Insurance Score Explained: This score is a unique rating used by insurers, often similar to a traditional credit score, but custom to predict insurance risk.

- Impact on Rates: The difference can be dramatic. Tampa drivers with sub-par credit scores (300-579) can face a 94% increase in premiums compared to those with outstanding credit (800-850). Drivers with ‘Fair’ credit could save $1,774 annually compared to those with ‘Poor’ credit.

- Tips for Improving Credit: Paying bills on time, keeping credit utilization low, and regularly checking your credit report for errors can help improve your score over time, potentially leading to lower insurance premiums.

Key Factors That Determine Your Tampa Insurance Premium

When we calculate your insurance premium, it’s not just a random number. It’s a complex equation based on a multitude of factors, all designed to assess your individual risk level. Understanding these elements is key to finding affordable car insurance tampa fl.

How Your Driving History Shapes Your Rate

Your driving history is a direct reflection of your risk profile. Insurers look closely at:

- At-Fault Accidents: These are major red flags. An at-fault accident can increase your average Tampa insurance premium by about $135 per month. Some companies may be more forgiving than others after an accident, but your premium will still be higher than with a clean record.

- Speeding Tickets: Minor infractions like speeding (e.g., 11-15 MPH over the limit) can lead to a roughly 19% increase ($353) in your annual premium. More severe speeding tickets will have an even greater impact.

- DUI/DWI Convictions: A DUI is one of the most serious violations, signaling high risk to insurers. You can expect a massive increase, potentially around $1,011 (55% increase), making it significantly harder to find affordable car insurance tampa fl. While some insurers might still offer you a policy, the rates will be substantially higher than for a clean driver.

- How Long Violations Stay on Your Record: The impact of a citation on your insurance policy typically lasts anywhere from three to five years, though serious offenses like DUIs can follow you for much longer.

The Role of Demographics in finding affordable car insurance tampa fl

Certain personal characteristics, while seemingly unrelated to driving skill, are statistically correlated with risk:

- Age and Experience: This is a huge factor. Younger drivers, especially teenagers and those in their early 20s, pay significantly more due to their lack of experience and higher accident rates. The disparity between teenage drivers and those in their 20s in Tampa can be as high as $6,078 per year! Rates generally stabilize and decrease as drivers enter their 30s, 40s, and 50s, assuming a clean record. For example, a 20-year-old in Tampa might pay as much as $5,568 annually, while a 35-year-old with a clean record could pay around $2,768, and a 60-year-old might pay closer to $2,483.

- Location (ZIP Code Variations): Even within Tampa, your specific ZIP code matters. Areas with higher traffic density, crime rates (theft), or accident frequency will have higher premiums. For instance, ZIP codes like 33614, 33603, and 33602 tend to be more expensive, while 33621, 33616, and 33611 often see cheaper rates.

- Marital Status: Married drivers often receive slightly lower rates than single drivers. This is due to statistical data suggesting married individuals are generally perceived as more stable and less prone to risky driving behaviors.

How Your Vehicle Affects Your Premium

The car you drive also plays a big part in your insurance costs:

- Vehicle Make and Model: Certain cars are more expensive to repair, more likely to be stolen, or have higher performance capabilities that correlate with increased accident risk.

- Age of Car: Newer, more expensive vehicles often cost more to insure due to higher repair or replacement costs. Older, paid-off vehicles, especially if they have lower market value, might lead to lower premiums.

- Anti-Theft and Safety Features: As mentioned, features like anti-lock brakes, airbags, automatic seatbelts, and advanced driver-assistance systems (ADAS) can qualify you for discounts, reducing your premium.

- Cost of Repairs: If your vehicle has expensive, specialized parts or is known for costly repairs, your comprehensive and collision premiums will likely be higher.

Understanding Florida’s Minimum Insurance Requirements

In Florida, driving without insurance isn’t just risky; it’s illegal. We operate under a “no-fault” system, which significantly impacts what coverage you’re legally required to carry. Auto insurance is mandatory in the state of Florida for all vehicles with four or more wheels that are registered in the state. You can verify this on the Florida Highway Safety and Motor Vehicles website.

Under Florida’s no-fault law, if you’re involved in an accident, your own insurance company is primarily responsible for covering your medical expenses and lost wages, regardless of who was at fault. This is why Personal Injury Protection (PIP) is a cornerstone of our state’s requirements.

The penalties for driving without auto insurance in Tampa, Florida, are severe. For a first offense, you could face a $150 fee for license and registration reinstatement. Repeat offenses escalate, potentially leading to a $250 reinstatement fee and a three-year suspension of your license, plates, and registration. In severe scenarios, you could face even heftier fines and a longer suspension, plus you’d be personally liable for any damages or injuries you cause. Given that nearly one in four Florida motorists may be driving without car insurance, it’s a risk we strongly advise against taking.

What is the minimum affordable car insurance tampa fl drivers need?

Florida’s minimum car insurance requirements are designed to ensure basic protection, especially under the no-fault system. However, “minimum” doesn’t always mean “adequate,” especially when we’re talking about protecting your assets.

Here’s a breakdown of the minimum requirements versus what we often recommend for comprehensive protection:

| Coverage Type | Florida Minimum Requirement | Recommended Full Coverage (Example) |

|---|---|---|

| Personal Injury Protection (PIP) | $10,000 per person | $10,000 per person |

| Property Damage Liability (PDL) | $10,000 per accident | $50,000 per accident |

| Bodily Injury Liability (BIL) | Not mandatory | $100,000 per person / $300,000 per accident |

| Uninsured Motorist (UM) | Not mandatory | $100,000 per person / $300,000 per accident |

| Collision | Not mandatory | $1,000 deductible |

| Comprehensive | Not mandatory | $1,000 deductible |

Let’s unpack these:

- $10,000 Personal Injury Protection (PIP): This is mandatory and covers 80% of your medical expenses and 60% of lost wages (up to your limit) regardless of who caused the accident. It also extends to your passengers and certain pedestrians.

- $10,000 Property Damage Liability (PDL): Also mandatory, this covers damage you cause to other people’s property (like their car, fence, or mailbox).

Why minimum coverage may not be enough:

While these are the legal minimums, they offer very limited protection. $10,000 in PIP might not cover extensive medical bills from a serious accident, and $10,000 in PDL can quickly be exhausted if you damage a newer, more expensive vehicle. If you only carry minimum coverage and cause an accident where damages exceed your policy limits, you could be personally sued for the difference, potentially putting your assets (like your home or savings) at risk.

We strongly advise considering additional coverage like Bodily Injury Liability (BIL) to protect your assets if you cause injuries to others, and Uninsured Motorist (UM) coverage, which is crucial given the high number of uninsured drivers in Florida. Comprehensive and Collision coverage are also vital for protecting your own vehicle from damage, theft, or natural disasters. For a more detailed look at Florida’s minimum requirements and why more coverage might be right for you, check out our Minimum Auto Insurance Florida Guide.

Frequently Asked Questions About Tampa Auto Insurance

We hear a lot of questions from drivers in the Tampa Bay area. Here are some of the most common, helping you steer affordable car insurance tampa fl.

How much should I be paying for car insurance in Tampa?

This is the golden question, and the answer, unfortunately, is “it depends!” While we know the average cost of car insurance in Tampa is around $1,827 for a six-month policy (or $304 per month), and roughly $2,470/year for full coverage vs. $1,230/year for minimum coverage, these are just averages.

Your actual premium will be highly personalized based on the factors we’ve discussed: your age, driving record, credit score, the specific ZIP code you live in, the type of car you drive, and the coverage levels and deductibles you choose. A 20-year-old with a new sports car and a speeding ticket will pay significantly more than a 45-year-old with a clean record driving an older sedan.

The best way to know how much you should be paying is to get personalized quotes from multiple carriers. That’s where we come in – we help you compare options custom to your unique profile.

Is car insurance cheaper in Tampa or Orlando?

Between the two major Central Florida cities, Tampa generally tends to be more expensive for car insurance than Orlando. For a six-month policy, Orlando’s average rate is about $1,479, while Tampa’s average rate is $1,827. Both cities, however, are more expensive than the overall Florida state average of $1,458 for six months.

Why the difference? Factors like population density, traffic congestion, and accident rates can vary between the two cities. For example, Tampa’s higher accident rates in Hillsborough County and its greater number of uninsured drivers contribute to its higher premiums. While both are busy cities, these nuances can tip the scales. If you’re curious about insurance in the City Beautiful, you can Compare with Orlando auto insurance.

Does bundling home and auto insurance save money in Tampa?

Absolutely, and we can’t stress this enough! Bundling your home (or renters) and auto insurance policies with the same provider is one of the easiest and most effective ways to save money.

Insurers typically offer a “multi-policy discount” because they value customers who bring them more business. These bundling discounts can offer savings of up to 10% on your combined premiums. Beyond the direct savings, bundling also offers incredible convenience: you deal with one company, potentially one agent, and often have a single bill. It simplifies your insurance life while keeping more money in your pocket, making it a smart strategy for finding affordable car insurance tampa fl.

Conclusion: Take Control of Your Tampa Car Insurance Costs

Finding affordable car insurance tampa fl doesn’t have to be an uphill battle. While the city’s unique driving landscape, from busy highways to severe weather risks, contributes to higher-than-average premiums, you are not powerless. By being proactive and informed, you can significantly reduce your insurance costs without compromising the crucial protection you need.

Remember our key strategies:

- Always compare quotes from multiple providers.

- Actively seek out every available discount.

- Adjust your coverage and deductibles to fit your specific needs and budget.

- Prioritize maintaining a clean driving record.

- Work to improve your credit score.

The journey to affordable car insurance tampa fl is about making smart choices. It’s about understanding the factors that influence your rates and then leveraging that knowledge to your advantage.

At Select Insurance Group, we believe in empowering our clients. With over 30 years of industry experience, we act as your trusted advisor, shopping across more than 40 carriers to find you the most competitive rates and superior customer service. We make insurance surprisingly painless, simple, and transparent. We’re here to help you steer the complexities of Florida’s insurance market and tailor a policy that offers both peace of mind and financial savings.

Don’t let high insurance costs keep you from enjoying all that Tampa has to offer. Take control of your car insurance costs today. Get your personalized quote from our Tampa insurance agency today, and let us help you drive confidently with budget-friendly wheels.