Why Understanding Florida Auto Insurance Matters

Auto insurance FL is not just a legal requirement—it’s among the most expensive in the nation, and the rules can be confusing. Here’s what you need to know:

Quick Facts About Florida Auto Insurance:

- Required Minimum Coverage: $10,000 Personal Injury Protection (PIP) + $10,000 Property Damage Liability (PDL)

- Average Annual Cost: $3,682 (68% higher than the national average)

- Unique System: Florida is a “No-Fault” state—your own insurance pays your medical bills first, regardless of who caused the accident

- Serious Penalties: Driving without insurance can suspend your license for up to 3 years and cost up to $500 in reinstatement fees

Florida’s insurance landscape is unique. You aren’t required to carry bodily injury liability initially, but you must have PIP coverage for your own medical bills. The state also mandates continuous coverage, meaning your vehicle must stay insured as long as it’s registered.

The high cost of auto insurance FL is driven by factors like frequent hurricanes, a high rate of uninsured drivers, and a litigation-friendly environment. However, understanding your options and shopping around can save you hundreds or even thousands per year.

I’m D.J. Hearsey, founder and CEO of Select Insurance Group. With over 30 years of experience, I’ve helped thousands of Florida drivers steer the complexities of auto insurance FL to find affordable, reliable coverage. This guide will walk you through everything you need to know, whether you’re a new resident, a high-risk driver, or just shopping for a better rate.

Understanding Florida’s Mandatory Auto Insurance Laws

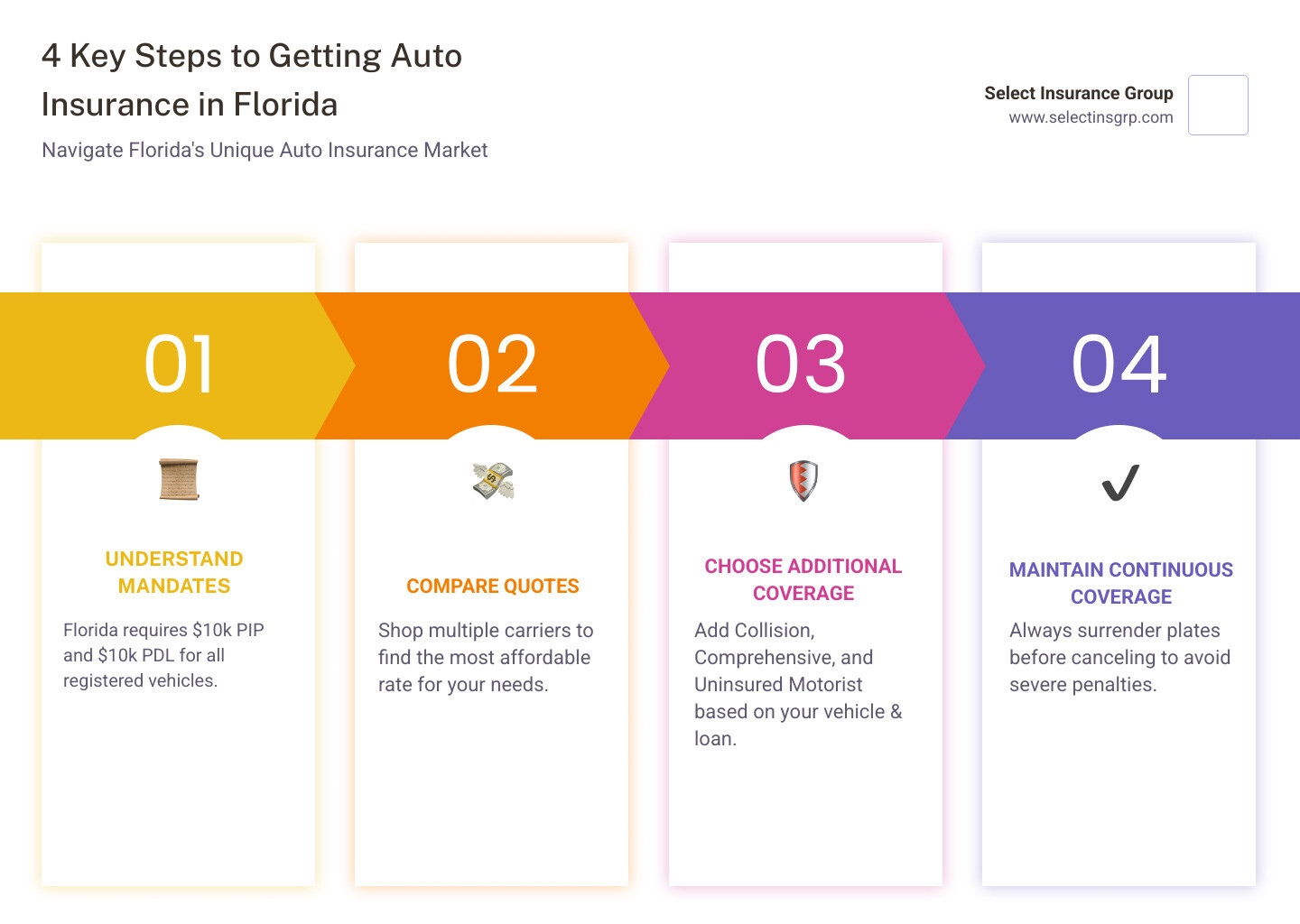

This section breaks down the essential legal requirements every Florida driver must know, from minimum coverages to the state’s unique “No-Fault” system. Staying informed is the first step to staying protected and compliant.

Florida’s Minimum Insurance Requirements

To legally register and drive a vehicle with four or more wheels in Florida, you must have proof of this minimum auto insurance FL coverage:

- Personal Injury Protection (PIP): A minimum of $10,000. This pays for your own medical expenses and lost wages if you’re injured in an accident, regardless of who was at fault.

- Property Damage Liability (PDL): A minimum of $10,000. This covers damage you cause to another person’s property in an accident.

Florida law requires continuous coverage. If your vehicle has a current Florida registration, it must always be insured, even if it’s not being driven. Don’t let your coverage lapse!

For more detailed information, refer to the Florida Highway Safety and Motor Vehicles website. You can also dive deeper with our minimum-auto-insurance-florida-guide.

The Florida No-Fault Law and PIP Explained

Florida’s “No-Fault” system is a key part of its auto insurance FL laws. It requires all drivers to carry Personal Injury Protection (PIP) to streamline claims for minor injuries. The core concept of the Florida No-Fault Law is that your own insurance company pays for your initial medical expenses and lost wages, regardless of who caused the accident. Specifically, your PIP coverage will pay:

- 80% of necessary medical expenses up to your policy limit (typically $10,000).

- 60% of lost wages if your injuries prevent you from working.

- Replacement services for tasks you can no longer perform (e.g., childcare, housekeeping).

While the No-Fault law ensures prompt medical care via your own PIP, it doesn’t prevent you from suing an at-fault driver for serious injuries that exceed legal thresholds. It simply means your PIP is the primary source for immediate care.

Bodily Injury Liability vs. PIP

Understanding the difference between Personal Injury Protection (PIP) and Bodily Injury Liability (BI) is crucial for auto insurance FL. They both deal with injuries but protect different parties:

| Feature | Personal Injury Protection (PIP) | Bodily Injury Liability (BI) |

|---|---|---|

| Whom it covers | You, your household members, and passengers in your vehicle who don’t have their own PIP, regardless of who caused the accident. | Others (the “other party”) whom you injure in an accident where you are at fault. |

| What it covers | 80% of your medical expenses, 60% of lost wages, and replacement services up to your policy limit (minimum $10,000). | Medical expenses, lost wages, pain and suffering, and other damages for the injured parties you are responsible for. |

| Is it mandatory? | Yes, a minimum of $10,000 is required for all registered vehicles with four or more wheels in Florida. | Not always initially mandatory. It can become mandatory under Florida’s Financial Responsibility Law. |

| Purpose | Ensures immediate medical care for you and your passengers after an accident, regardless of fault. | Protects your assets from lawsuits if you cause an accident that results in injuries or death to others. |

In short, PIP covers your immediate well-being, while BI covers your financial responsibility to others. While not always initially required, lacking BI creates significant financial risk and can trigger the Financial Responsibility Law, forcing you to carry it.

The Financial Responsibility Law for High-Risk Drivers

Florida’s Financial Responsibility Law ensures that high-risk drivers carry more than the minimum auto insurance FL. This law is designed to protect the public from those with a history of unsafe driving. You may be subject to it if you:

- Are found at fault for an accident that results in injuries.

- Are convicted of a DUI.

- Accumulate an excessive number of points on your license.

- Are involved in a serious accident while uninsured.

If this law applies, you’ll typically need to add Bodily Injury Liability (BI) coverage of at least $10,000 per person and $20,000 per accident to your policy. You may also need to file an SR-22 certificate with the state to prove you have the required coverage. This requirement can last for three or more years.

Understanding The Financial Responsibility Law is vital for high-risk drivers, as non-compliance can lead to severe penalties. Our team is experienced in helping drivers find suitable coverage for these complex requirements.

Decoding Coverage Options and Costs for Auto Insurance FL

Florida’s insurance costs are high, but understanding your options and how to save can make a big difference. Let’s explore what “full coverage” means and how to find affordable solutions.

What Does ‘Full Coverage’ Mean in Florida?

“Full coverage” isn’t a legal term but a common phrase for policies that go beyond Florida’s minimum PIP and PDL requirements. It typically includes:

- Collision Coverage: Pays to repair or replace your vehicle after a collision with another car or object, regardless of fault.

- Comprehensive Coverage: Protects your vehicle from non-collision incidents like theft, vandalism, fire, natural disasters, or hitting an animal.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This is highly recommended in Florida due to the high number of uninsured drivers. It protects you if an at-fault driver has little or no insurance to cover your medical bills or vehicle damage. If you opt-in, Florida law requires minimums of $10,000 per person and $20,000 per accident.

Why opt for “full coverage”? Lenders for car loans or leases almost always require collision and comprehensive. Even if you own your car outright, these coverages protect your investment from costly out-of-pocket repairs or replacement.

We advise clients to consider comprehensive protection that safeguards their assets. Learn more on the Florida Department of Financial Services website.

The Average Cost of Florida Car Insurance and How to Lower It

The cost of auto insurance FL is high. The 2024 average was $3,682, a staggering 68% higher than the national average. Several factors contribute to these rates:

- High population density and tourism

- Frequent severe weather like hurricanes

- High rates of uninsured drivers

- A litigation-friendly environment

- Vehicle theft and vandalism

Here are several ways to lower your auto insurance FL costs:

- Shop Around: We compare quotes from over 40 carriers to find you the best rates. Insurers weigh risk differently, so prices vary significantly.

- Adjust Your Deductibles: A higher deductible (your out-of-pocket share of a claim) can lower your premium. Just ensure it’s an amount you can comfortably afford.

- Maintain a Clean Driving Record: Safe driving without accidents or violations keeps your rates down.

- Consider Your Vehicle: Expensive or high-performance cars cost more to insure.

- Use Discounts: Take advantage of every available discount.

Finding cheap car insurance in Florida and low-cost auto insurance in Florida is our specialty. We make the process affordable and painless.

Opening up Discounts on Your Florida Auto Policy

Discounts are a great way to save on auto insurance FL. Here are some of the most common ones we help our clients find:

- Bundling Policies: Combining your auto insurance with other policies like florida-home-insurance or renters insurance often provides a significant multi-policy discount.

- Safe Driver Programs: Many insurers offer telematics programs that monitor your driving. Safe habits can earn you a discount of up to 30%.

- Multi-Car Discount: Insuring more than one vehicle with the same company saves money.

- Good Student Discount: Young drivers with good grades may qualify for a discount.

- Defensive Driving Course Discount: Completing an approved course can lower your premium.

- Payment Discounts: Paying your premium in full, using auto-pay, or going paperless can lead to savings.

- Anti-Theft Device Discount: Alarms or tracking systems on your car can earn you a discount.

- New Car Discount: Newer vehicles, especially with advanced safety features, may qualify for a discount.

- Low Mileage Discount: If you don’t drive often, you might be eligible for savings.

We’ll help you find every discount you’re eligible for by matching you with carriers that offer the best savings for your needs.

Penalties, Lapses, and Special Circumstances

Failing to follow Florida’s strict insurance laws leads to severe penalties that are far more costly than maintaining coverage. Here’s what you need to know to stay compliant.

The High Cost of Driving Without Insurance in Florida

Driving without the required auto insurance FL is a serious offense with harsh financial and legal consequences. If you let your coverage lapse on a registered vehicle, the Florida Department of Highway Safety and Motor Vehicles (FLHSMV) will impose penalties. You could face:

- Driver’s License Suspension: Your license can be suspended for up to three years.

- Vehicle Registration Suspension: Your registration and license plate can also be suspended for up to three years.

- Hefty Reinstatement Fees: To get your license and registration back, you’ll pay reinstatement fees up to $500.

- Proof of Insurance Requirement: You’ll be required to provide proof of current Florida insurance, often with an SR-22 filing.

These penalties are a strong deterrent. The simple solution is to always maintain your required auto insurance FL. For official details, check the FLHSMV website.

Consequences of Canceling Your Policy Incorrectly

Due to Florida’s continuous coverage law, canceling your auto insurance FL policy incorrectly triggers immediate penalties. This is a common and costly mistake.

Here’s the critical rule: If you plan to cancel your insurance and won’t be immediately replacing it, you must surrender your license plates BEFORE canceling.

If the FLHSMV detects a coverage lapse on a registered vehicle, it will suspend your license and registration. You’ll face reinstatement fees up to $500, even if you quickly get new insurance. To avoid this, if you’re selling a car, moving out of state, or taking a vehicle off the road, visit a motor vehicle service center to turn in your plates first. This simple step saves a lot of grief and money.

Can You Get Auto Insurance FL Without a Driver’s License?

Yes, it’s possible to get auto insurance FL without a driver’s license. There are several legitimate reasons why you might need to insure a vehicle you don’t personally drive:

- Vehicle Owner with a Designated Driver: You own a car but have a spouse, child, or caregiver who is the primary driver.

- Excluded Driver Policies: You or a household member with a poor driving record is listed as an “excluded driver,” meaning they are not covered to drive the car, but the vehicle remains insured for others.

- Insuring a Parked or Stored Vehicle: You own a registered vehicle that isn’t being driven (like a classic car) and need to maintain continuous coverage.

- International Drivers: You are a new resident with a valid international license but have not yet obtained a Florida license.

These situations can be complex, so we recommend contacting one of our expert agents. We’ll guide you through the process to find the right policy for your unique circumstances.

Finding the Right Provider and Resources

Choosing the right insurance company is just as important as choosing the right coverage. Here’s how to evaluate providers and find official information for your auto insurance FL.

How to Choose the Best Florida Auto Insurance Company

Choosing the best company for your auto insurance FL isn’t just about price; it’s about value and reliability. Here’s what to consider:

- Financial Stability Ratings: Check if an insurer can pay claims, especially after a hurricane. Look for an “A” rating or better from agencies like A.M. Best or Demotech.

- Customer Service Reviews: See what current customers say about claims handling, responsiveness, and overall satisfaction.

- Claims Process Efficiency: Research how easy it is to file a claim and how quickly the company pays out.

- Local Agent Availability: A local agent can offer personalized advice and help you steer complex claims.

- Range of Coverage Options: Ensure the company offers the full spectrum of coverages and discounts you need.

- Pricing and Discounts: Compare quotes for similar coverage levels and deductibles to find the true best price.

At Select Insurance Group, we are your trusted partner. With over 30 years of experience, we shop over 40 carriers to find the best fit based on all these factors. For a deeper dive, check out our florida-auto-insurance-companies-guide-2025.

Helpful Resources for Florida Drivers

Navigating auto insurance FL is easier with reliable resources. We encourage clients to stay informed using these official sites:

- Florida Highway Safety & Motor Vehicles (FLHSMV): Your go-to for official information on licenses, registration, and insurance requirements. Visit their insurance information page here.

- The Florida Bar: Offers excellent consumer pamphlets on legal topics related to auto accidents and insurance. Their consumer tips section is a great starting point.

- Florida Office of Insurance Regulation (FLOIR): Provides insights into insurance laws and market data.

- Florida Department of Financial Services (DFS) – Division of Consumer Services: A consumer advocate that helps with insurance questions and complaints. Their personal automobile insurance overview is a valuable resource.

Frequently Asked Questions about Florida Auto Insurance

We know you’ve got questions, and we’ve got answers! Here are some of the most common inquiries we receive about auto insurance FL.

What are the absolute minimum coverages I need to drive legally in Florida?

To legally register and drive a vehicle with four or more wheels in Florida, you must have:

- $10,000 in Personal Injury Protection (PIP)

- $10,000 in Property Damage Liability (PDL)

While legal, this minimum coverage offers limited protection. We advise considering higher limits to protect your assets.

Is there a grace period for my car insurance payment in Florida?

Yes. After your first premium payment, Florida law provides a 30-day grace period to make a payment after the due date without your policy lapsing. However, it’s always best to pay on time to avoid any issues.

How does being a “No-Fault” state affect me after an accident?

As a “No-Fault” state, your own Personal Injury Protection (PIP) is your first source for medical bills and lost wages after an accident, regardless of who was at fault. This ensures you get immediate care. However, fault still matters. If your injuries are serious and meet a legal threshold, you can still sue the at-fault driver for damages your PIP doesn’t cover, like pain and suffering.

Conclusion: Get Your Personalized Florida Auto Insurance Quote

Navigating Florida’s auto insurance rules is complex, but with the right partner, you can find affordable coverage. Understanding PIP, PDL, and continuous coverage laws is the first step to protecting yourself on the Sunshine State’s roads.

At Select Insurance Group, we simplify this process. With over 30 years of experience and access to over 40 carriers, we find you personalized, affordable auto insurance FL solutions. Our goal is to offer transparency and competitive rates custom to your needs.

Don’t let high costs or complex rules deter you. Our team is here to walk you through every step and find a policy that gives you peace of mind.

Ready to see how much you can save? Contact a Tampa insurance agent today to get started!