Understanding Truck Car Insurance: The Basics

Truck car insurance can feel like a puzzle, but whether you need a personal or commercial policy depends entirely on how you use your vehicle.

Quick Answer: Do You Need Personal or Commercial Coverage?

- Personal Auto Policy – If you use your truck for commuting, weekend projects, hauling your own stuff, or recreational activities.

- Commercial Truck Insurance – If you haul goods for hire, transport materials between job sites, or use your truck primarily for business.

- Hybrid Solution – If employees occasionally use their personal trucks for work, consider Hired & Non-Owned Auto Coverage to fill gaps.

The confusion is understandable. A pickup truck can be a family vehicle on Saturday and a work vehicle on Monday. Since most personal auto policies exclude business use, you could be driving without coverage and not even know it.

This guide breaks down when you need each type of coverage, what the law requires, and how to avoid costly gaps in protection across Florida, Georgia, the Carolinas, and Virginia.

The stakes are high. Commercial truck incidents can result in losses from $100,000 to over $1,000,000. Without the right coverage, your personal assets and business are at risk.

I’m D.J. Hearsey, founder of Select Insurance Group. With over three decades of experience helping truck owners across the Southeast, I’ll help you understand exactly what truck car insurance coverage you need.

Personal vs. Commercial Use: The Deciding Factor

The type of truck car insurance you need depends entirely on how you use your truck. Driving to the grocery store is personal use; hauling furniture for money is a business activity, and your insurer sees a major difference between the two.

Many trucks do double duty, serving as work vehicles during the week and family vehicles on weekends. This versatility becomes a problem when you realize your personal auto policy likely doesn’t cover business use.

A personal auto policy is sufficient for personal activities like commuting to an office, weekend DIY projects, or family trips. However, nearly every personal policy has a business use exclusion. This means if you have an accident while using your truck for work, your claim could be denied, leaving you personally liable for all costs.

When Do You Need Commercial Truck Car Insurance?

The line between personal and commercial use can be blurry, but these situations clearly require commercial coverage:

- Making Money: If your truck is primarily used to generate income, you need commercial insurance. This includes hauling goods for hire, making deliveries, or transporting materials to job sites.

- Employee Drivers: As soon as an employee drives your truck for business purposes, you’ve entered commercial territory.

- Transporting Goods for a Fee: Even helping someone move for a small fee technically makes you a for-hire vehicle operator.

- Business Ownership: If the vehicle is registered in your company’s name or owned by the business, it requires a commercial policy.

- Specialized Trucks: Vehicles like box trucks, dump trucks, food trucks, and semi-trucks are designed for business and almost always need commercial coverage.

Whether you’re an owner-operator or manage a fleet, commercial insurance is non-negotiable. We help businesses get the right protection in North Carolina Business Auto Insurance and South Carolina Business Auto Insurance.

What if I Use My Personal Truck for Work Occasionally?

This is a common scenario: your truck is mostly for personal use, but you occasionally run a work errand. Even infrequent business use can void a personal policy.

However, you may not need a full commercial policy. A smart middle-ground solution is Hired & Non-Owned Auto Coverage. This is an endorsement added to your business insurance, not a separate policy. It protects your company from liability when you or an employee uses a personal vehicle for work errands.

It’s a cost-effective way for small business owners to fill the gap between a personal policy’s exclusions and the expense of a full commercial policy. We help clients in Virginia and other states determine if this is the right fit. Learn more about our Virginia Business Auto Insurance solutions.

If your truck is involved with your business in any way, speak with an insurance professional to avoid a financially devastating coverage gap.

Decoding Your Coverage: Key Policy Types

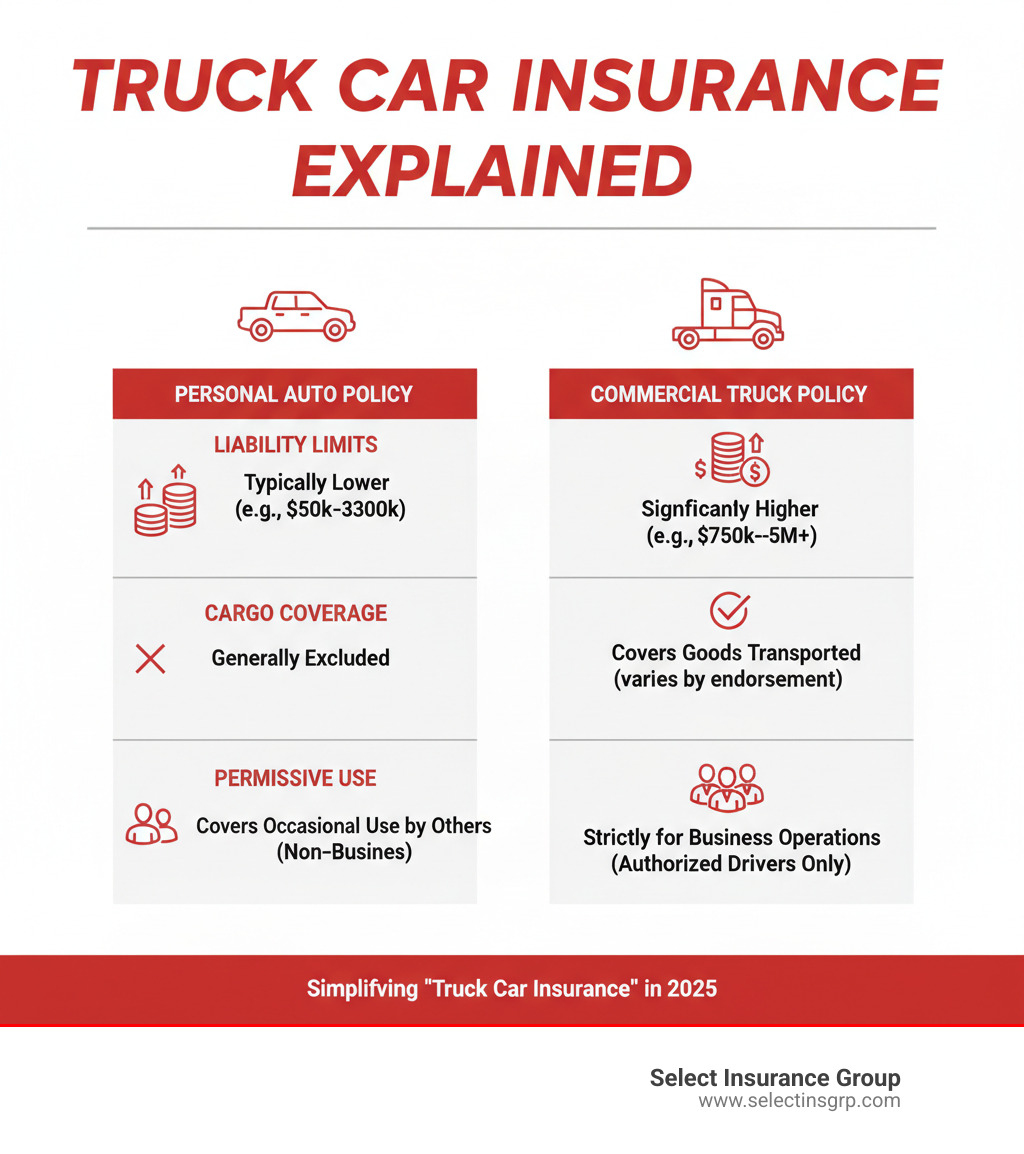

Once you know if you need personal or commercial truck car insurance, you need to understand what’s in the policy. Every policy is built from core coverages like liability, physical damage, medical payments, and uninsured motorist protection. The main differences are the coverage limits and how they apply to business risks.

Two key terms are policy limits (the maximum your insurer will pay) and deductibles (your out-of-pocket cost before insurance pays). Commercial truck accidents can cause losses from $100,000 to $1,000,000, so having adequate limits is critical. A higher deductible can lower your premium, but you must be able to pay it after a claim.

Personal Auto Insurance for Your Truck

If your truck is for personal transportation and non-business activities, a personal auto policy is likely the right choice. These policies include:

- Liability Coverage: This is the foundation, covering injuries and property damage you cause to others. Each state sets minimums (e.g., South Carolina requires 25/50/25), but most drivers choose higher limits for better protection.

- Collision Coverage: Pays to repair or replace your truck after an accident, regardless of fault. Lenders typically require it for financed vehicles.

- Comprehensive Coverage: Handles non-accident damage from theft, vandalism, fire, hail, or hitting an animal.

- Uninsured/Underinsured Motorist Coverage: Protects you if the at-fault driver has no insurance or not enough to cover your losses. It’s required in some states, like South Carolina.

We tailor personal auto policies for truck owners across the Carolinas. See our options for North Carolina Auto Insurance and South Carolina Auto Insurance.

Essential Commercial Truck Insurance Coverages

When your truck is a business tool, you need commercial truck car insurance to cover the significant risks involved. Key coverages include:

- Primary Liability: This is non-negotiable, covering bodily injury and property damage you cause. The FMCSA sets federal minimums, starting at $750,000 for general freight and climbing to $5 million for hazardous materials.

- Motor Truck Cargo Insurance: Protects the goods you are hauling from damage or theft. The FMCSA requires at least $5,000 per vehicle, but shippers often demand much higher limits.

- Trailer Interchange Coverage: Covers physical damage to trailers you don’t own but are hauling under an interchange agreement.

- Non-Trucking Liability (NTL) & Bobtail Insurance: NTL provides liability coverage when using your truck for personal, non-business reasons. Bobtail is similar but covers driving your truck without a trailer for business purposes (e.g., after a drop-off).

- Physical Damage Coverage: This is the commercial equivalent of collision and comprehensive, protecting your expensive truck from accidents, theft, and other damage.

- General Liability for Truckers: Covers other business risks not directly related to driving, such as injuries at your facility or issues with cargo handling.

We help trucking operations of all sizes in the Southeast build the right coverage. Explore our solutions for Florida Business Auto Insurance and Georgia Business Auto Insurance.

The Legal Lowdown on Commercial Truck Car Insurance

Operating a commercial truck involves a different set of rules than personal driving. Federal and state regulations exist to ensure there is adequate financial protection for everyone in the event of an accident. Compliance is your license to operate—without it, you risk fines or even having your business shut down.

Federal Mandates: The FMCSA Rules

The Federal Motor Carrier Safety Administration (FMCSA) regulates commercial vehicles involved in interstate commerce. Key requirements include:

- USDOT Number: Most commercial vehicles crossing state lines need this unique identifier, which allows the FMCSA to track a company’s safety record.

- Minimum Liability Coverage: The FMCSA mandates high liability limits. For trucks over 10,001 pounds carrying non-hazardous cargo, the minimum is $750,000. This increases to $1,000,000 for many hazardous materials and up to $5,000,000 for others. You can review the official minimum coverage limits in federal regulations.

- Cargo Insurance: A minimum of $5,000 per vehicle and $10,000 per incident is required to protect the goods you haul.

- Safety Rating: The FMCSA assigns carriers a safety rating based on compliance and performance. A poor rating can increase your truck car insurance premiums.

State-Specific Insurance Requirements

In addition to federal rules, each state has its own insurance requirements for trucks operating within its borders (intrastate commerce). These state mandates can sometimes exceed federal minimums.

For example, states in the Southeast like Florida, Georgia, Virginia, and the Carolinas each have specific liability limits for commercial vehicles based on type, weight, and operation. If you operate in multiple states, your policy must meet the highest requirement of any state you travel through.

Navigating this web of regulations can be challenging, which is why an experienced insurance partner is so valuable. We ensure our clients’ truck car insurance policies meet all federal and state requirements. For more on local requirements, visit our pages for Florida Auto Insurance, Georgia Auto Insurance, and Virginia Auto Insurance.

Legal compliance isn’t optional, but with the right guidance, it doesn’t have to be a headache.

What Drives the Cost and How Can You Save?

If you’ve shopped for truck car insurance, you’ve noticed it’s more expensive than a standard auto policy. The median cost is around $147 per month for a $1 million policy, but your rate depends on your specific risk profile.

Commercial truck insurance costs more because the risk is higher. A fully loaded 80,000-pound truck can cause far more damage than a 4,000-pound car, with potential losses easily exceeding $500,000. The vehicles are more expensive to repair, and the cargo itself adds another layer of financial risk. These factors lead to higher premiums.

Key Factors in Truck Car Insurance Costs

Insurers look at many factors to calculate your premium. The most significant include:

- Driving Record: A clean record is your best asset. Accidents, tickets, and DUIs will raise your rates. Insurers check every driver on your policy, and the FMCSA provides a portal for checking past driving records.

- Vehicle Type and Value: A new refrigerated truck costs more to insure than an older pickup. The risk profile and repair costs vary by vehicle type.

- Cargo: Hauling hazardous materials or high-value electronics is riskier and more expensive to insure than hauling gravel.

- Operating Radius: Local routes (under 50 miles) are typically cheaper to insure than long-haul, cross-country routes due to lower mileage and risk exposure.

- Location: Driving and garaging your truck in areas with high rates of accidents, theft, or severe weather will increase premiums.

- Coverage Limits and Deductibles: Higher limits cost more, while a higher deductible can lower your premium.

- Credit History: Good personal and business credit can often lead to lower insurance rates.

- Years in Business: An established company with a proven safety record usually gets better rates than a startup.

Smart Ways to Lower Your Insurance Premiums

You have control over your truck car insurance costs. Use these strategies to lower your premiums:

- Shop Around: As an independent agency, we shop over 40 carriers for you. Prices for the same coverage can vary by thousands of dollars between insurers.

- Raise Your Deductibles: If you can afford a higher out-of-pocket expense, increasing your deductible will lower your monthly premium.

- Maintain a Clean Driving Record: Safe driving is the most effective way to keep rates low. Defensive driving courses can also help.

- Pay Annually: Many insurers offer a discount of up to 15% for paying your premium in full upfront.

- Accept Safety Technology: Telematics and Electronic Logging Devices (ELDs) prove you’re a safe operator. Programs like Smart Haul® or Snapshot ProView® can offer initial and ongoing discounts, sometimes up to 30%, for demonstrated safe driving.

- Bundle Policies: Combining your commercial auto with other policies like general liability or workers’ comp can open up multi-policy discounts.

- Leverage Your Experience: Companies with over three years of safe operations and drivers with a Commercial Driver’s License (CDL) often qualify for discounts.

Frequently Asked Questions about Truck Insurance

After three decades in the business, certain questions about truck car insurance come up again and again. Here are the answers to the most common ones.

Why is commercial truck insurance more expensive than personal auto insurance?

It comes down to risk. Commercial trucks are larger, heavier, and can cause much more severe accidents. They also carry valuable cargo, and the vehicles themselves are expensive to repair. Furthermore, federal regulations mandate much higher liability limits (often $750,000 or more) compared to personal policies. This combination of high risk and high coverage requirements increases the cost.

Does a commercial truck policy cover personal use?

It depends on your situation. If you’re an owner-operator with your own motor carrier authority, your commercial policy typically covers both business and personal use. However, if you are leased to a motor carrier, their insurance only covers you when you’re under dispatch. For personal driving, you will need Non-Trucking Liability (NTL) coverage to fill that gap and avoid being uninsured.

What is the difference between bobtail and non-trucking liability insurance?

These terms are often confused but cover different scenarios for drivers leased to a motor carrier.

-

Bobtail Coverage applies when you are driving your tractor without a trailer for a business purpose. For example, driving to the terminal after dropping off a load.

-

Non-Trucking Liability (NTL) applies when you are using your truck for purely personal reasons, completely off-duty and not under dispatch. For example, driving home for the weekend or running errands.

Both are crucial for preventing dangerous coverage gaps when you’re not actively hauling a load for your carrier.

Finding the Right Protection for Your Truck

Choosing the right truck car insurance is about protecting your livelihood, your assets, and your peace of mind. With different state requirements and policy types, the process can feel complex. An independent agency like Select Insurance Group simplifies it by shopping over 40 carriers to find the best fit for you.

We don’t work for one insurance company—we work for you, ensuring you get a policy custom to your unique operation, whether you’re a long-haul trucker or a local contractor.

What to Look for in an Insurance Company

When choosing an insurer for your truck car insurance, prioritize these factors:

- Financial Stability: Check the insurer’s A.M. Best rating. An ‘A’ rating or higher indicates they have the financial strength to pay claims.

- 24/7 Claims Service: Accidents don’t keep business hours. You need an insurer with round-the-clock support. We make it easy for our clients to Report a Claim anytime.

- Industry Experience: Work with a company that understands the trucking business, from FMCSA rules to the difference between bobtail and NTL coverage.

- Flexible Payment Options: Look for insurers who offer payment plans that align with your business’s cash flow.

- Knowledgeable Agents: A great agent acts as your partner, asking the right questions to customize your policy, prevent coverage gaps, and find savings.

The Final Step: Securing Your Quote

You’ve done the research and understand the stakes. Now it’s time to take action.

Getting the right truck car insurance is a critical step, and you don’t have to do it alone. An independent agency like Select Insurance Group compares coverage options from over 40 carriers to find a policy that matches your unique personal or commercial needs. We explain everything in plain English, ensuring your vehicle, business, and financial future are protected on every journey.

Whether you’re operating in Florida, Georgia, the Carolinas, or Virginia, we’ve got you covered. Contact us today for a comprehensive review of your options and a custom quote to make sure you have the right protection before you hit the road.