Why Understanding Florida’s Auto Insurance Laws Matters

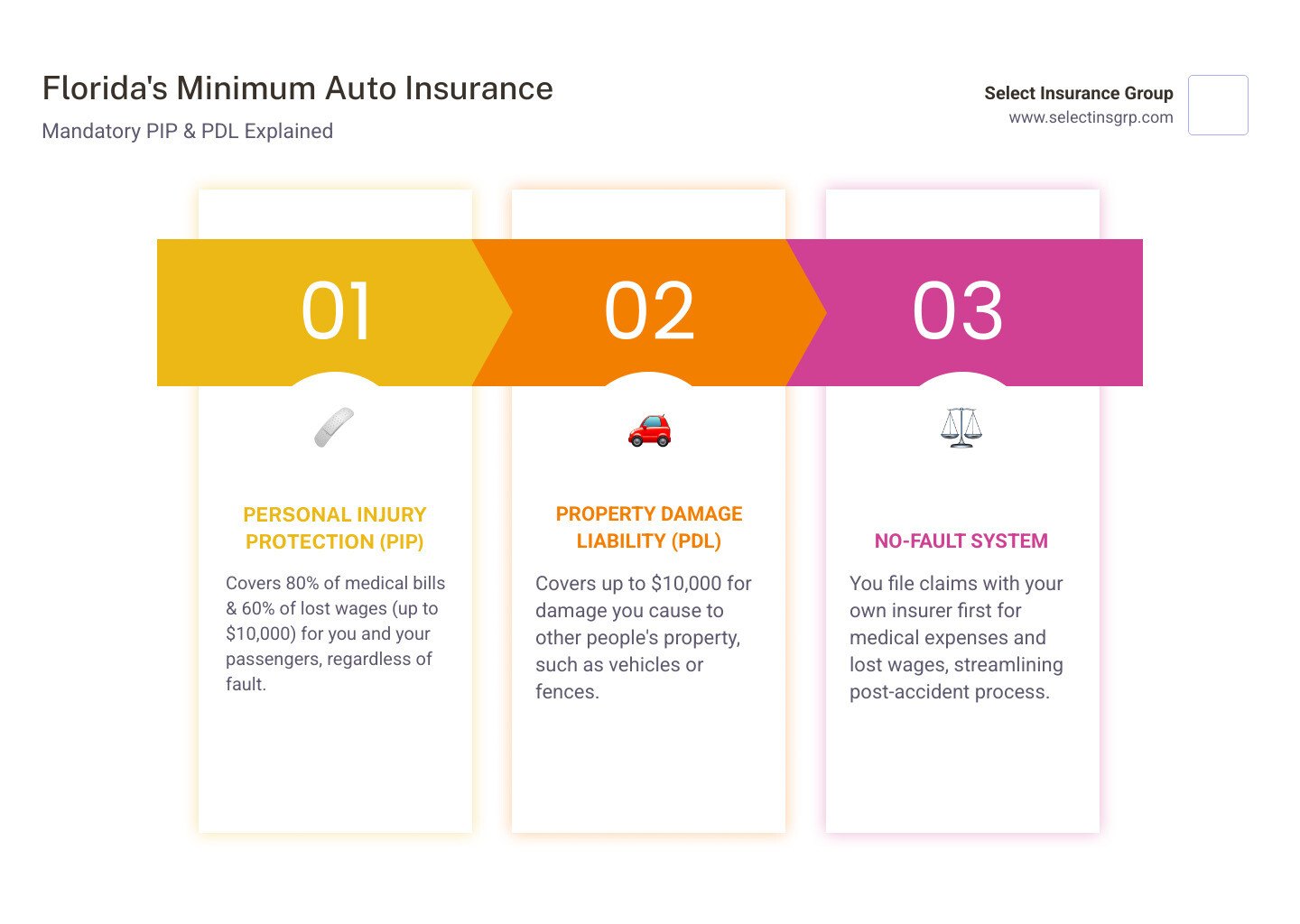

Florida’s minimum auto insurance law requires every driver with a registered vehicle to carry at least $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL). Here’s a quick overview:

Florida’s Mandatory Minimum Coverage:

- $10,000 Personal Injury Protection (PIP) – Covers 80% of your medical bills and 60% of lost wages, regardless of who caused the accident.

- $10,000 Property Damage Liability (PDL) – Pays for damage you cause to other people’s property.

- Bodily Injury Liability (BIL) – Not required for most drivers, but highly recommended.

- Proof of insurance must be carried at all times.

Florida operates under a no-fault insurance system, meaning you file claims with your own insurance company first after an accident. This makes PIP coverage mandatory but often leaves drivers financially exposed when accidents exceed these minimum limits.

The consequences of driving without insurance are severe: license suspension for up to three years, fines from $150 to $500, and no option for a hardship license. With nearly 1 in 5 Florida drivers uninsured and over 401,000 crashes in 2021, understanding these laws is about protecting yourself financially.

I’m D.J. Hearsey, founder of Select Insurance Group. With over three decades of experience helping Florida drivers, I’ve seen that most people don’t realize how vulnerable the state minimums leave them until it’s too late.

Understanding Florida’s Unique No-Fault Insurance System

Florida is one of a few states with a no-fault insurance system. The core principle is that after an accident, you file a claim with your own insurance company first, regardless of who caused the crash. This system was designed to speed up the claims process and reduce minor injury lawsuits, giving you immediate access to financial support through your own policy.

For example, in a minor accident, each driver turns to their own Personal Injury Protection (PIP) coverage for their medical bills and lost wages. This avoids lengthy investigations and disputes over fault, allowing you to focus on recovery.

What “No-Fault” Means for You

After an accident in Florida, your own insurance company pays first via your PIP coverage. However, “no-fault” does not mean no one is held responsible. For accidents resulting in significant damages or injuries that meet the state’s serious injury threshold (e.g., permanent disability, significant scarring), you can step outside the no-fault system and pursue a claim or lawsuit against the at-fault driver for additional compensation.

The Role of Personal Injury Protection (PIP)

PIP is the foundation of the no-fault system and is the minimum auto insurance Florida requires. It ensures you, your passengers, and resident family members receive immediate support.

Your PIP coverage pays for:

- 80% of necessary medical expenses

- 60% of lost wages

- A $5,000 death benefit

These benefits are paid up to your policy limit, which is typically $10,000 for minimum coverage. A critical detail is the 14-day rule: you must seek initial medical treatment within 14 days of the accident for your PIP benefits to apply. Miss this window, and your coverage could be denied.

PIP also covers you if you’re hit by a vehicle while walking or biking. While this coverage is comprehensive, the $10,000 limit can be exhausted quickly. For more information on building a complete protection strategy, visit our Florida Auto Insurance page.

What is the Minimum Auto Insurance Florida Requires?

To legally drive in Florida, your vehicle must meet the state’s mandatory insurance requirements, which are tied directly to your vehicle registration. You must provide proof of Personal Injury Protection (PIP) and Property Damage Liability (PDL) insurance to register any vehicle with four or more wheels.

Proof of insurance, either a physical card or a digital version on your phone, must be accessible whenever you drive. Florida also requires continuous coverage for any vehicle with an active registration, even if it’s not being driven. A lapse in coverage, even for one day, can lead to penalties from the Department of Highway Safety and Motor Vehicles.

A Closer Look at the Minimum Mandates

The minimum auto insurance Florida mandates are $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL). Florida law requires proof of this coverage for vehicle registration.

-

Personal Injury Protection (PIP): As your first line of defense after an accident, PIP covers your own medical bills and lost wages, regardless of fault. Remember the 14-day rule for seeking treatment to ensure your benefits apply.

-

Property Damage Liability (PDL): This covers damage you cause to someone else’s property in an at-fault accident, such as their vehicle, a fence, or a building. The minimum required is $10,000. Importantly, PDL does not cover damage to your own vehicle; for that, you need optional Collision coverage.

Are There Exceptions or Different Requirements?

Yes, certain vehicles and situations have different requirements:

-

Taxis and Commercial Vehicles: These face higher limits due to increased risk. Taxis, for example, must carry bodily injury liability (BIL) of $125,000 per person and $250,000 per occurrence, plus $50,000 in PDL.

-

Motorcycles: Standard PIP coverage does not apply. Riders need specialized motorcycle insurance, though some insurers offer optional medical payment coverage.

-

Business Vehicles: If you use vehicles for your business, you’ll need a commercial auto policy. We offer custom business auto insurance options available through Select Insurance Group.

-

Self-Insurance: A rare alternative for qualifying businesses or individuals who can prove significant financial net worth to cover potential claims out of pocket.

Penalties and Special Requirements for Florida Drivers

Driving without insurance in Florida carries serious penalties. When your insurance policy is terminated, your provider is required to notify the Florida Department of Highway Safety and Motor Vehicles (FLHSMV). The state knows almost immediately when a vehicle is uninsured, and penalties are applied swiftly.

The High Cost of Driving Uninsured

A first offense for driving uninsured can result in fines from $150 to $500. More significantly, your driver’s license and vehicle registration will be suspended for up to three years. To restore your driving privileges, you must pay reinstatement fees (up to $500) in addition to the initial fines.

Crucially, Florida offers no hardship license for insurance-related suspensions. This means you cannot legally drive for any reason—not to work, school, or for any other necessity. An insurance lapse also leads to much higher premiums in the future, as insurers view it as a major risk.

For drivers with certain violations like a DUI, the state requires an SR-22 or FR-44 certificate, which is proof of higher liability coverage, adding further cost and complexity.

Rules for Non-Residents and Relocating

-

Visiting Florida: You can drive on your out-of-state insurance for up to 90 days in a 365-day period.

-

Becoming a Resident: If you start a job or enroll children in a Florida school, you have just 10 days to get Florida registration and insurance.

-

Moving Out of Florida: This is a common pitfall. You must surrender your Florida license plates to a motor vehicle service center before canceling your Florida insurance policy. If you cancel first, the state will suspend your license, even if you no longer live there.

Why Minimum Coverage Often Isn’t Enough

While the minimum auto insurance Florida requires will keep you legal, it rarely keeps you financially protected. Florida’s busy roads, high accident rates, and large number of uninsured drivers (nearly 1 in 5) create a high-risk environment. When combined with skyrocketing medical and vehicle repair costs, the state’s $10,000 minimums are often insufficient.

The Risks of Carrying Only Minimum Coverage

Those $10,000 limits can disappear quickly. For example, if you cause an accident, your $10,000 in Property Damage Liability may not cover the full repair cost of a modern vehicle, leaving you to pay the difference. If someone is seriously injured, their medical bills can far exceed what PIP covers. Without Bodily Injury Liability coverage, they can sue you personally, putting your home, savings, and future wages at risk.

Your own $10,000 in PIP benefits can also be exhausted by a single emergency room visit or a few days of missed work. Once that money is gone, you’re paying out of pocket. Protecting your assets means having enough insurance, not just the legal minimum.

Recommended Optional Coverages for Full Protection

Smart drivers go beyond the bare minimum. A few extra dollars on your premium can provide real peace of mind. Here’s what we recommend:

-

Bodily Injury Liability (BIL): This is crucial. It protects your assets by covering injuries you cause to others in an at-fault accident. Without it, you are personally exposed to lawsuits. We recommend limits of at least $100,000 per person and $300,000 per accident.

-

Uninsured/Underinsured Motorist (UM/UIM): Essential in Florida, this covers your injuries when you’re hit by a driver with no insurance or not enough to cover your bills. We recommend matching your UM/UIM limits to your BIL limits.

-

Collision Coverage: This pays to repair or replace your own vehicle after an accident, regardless of fault. It’s typically required for financed or leased cars but is wise for any vehicle of value.

-

Comprehensive Coverage: This protects your vehicle from non-collision events like theft, vandalism, fire, storms, and hitting an animal. Given Florida’s weather, this coverage is a must-have.

At Select Insurance Group, we shop over 40 carriers to build a policy that actually protects you, not just one that meets the legal minimum.

Frequently Asked Questions about Florida Auto Insurance

Here are answers to some of the most common questions we hear about minimum auto insurance Florida requirements.

Is Bodily Injury Liability (BIL) insurance required in Florida?

No, Bodily Injury Liability (BIL) is not required for most Florida drivers. However, we strongly recommend it to protect your personal assets from lawsuits if you cause an accident that injures someone. BIL is mandatory in certain situations, such as after a DUI conviction, which requires filing an FR-44 certificate with higher liability limits.

What happens if I let my car insurance lapse?

Your insurance company will notify the state (FLHSMV), which will then suspend your driver’s license, vehicle registration, and license plate. To restore your driving privileges, you must show proof of new insurance and pay reinstatement fees, which start at $150. No hardship license is available for an insurance-related suspension.

Do I need insurance if I have a license but don’t own a car?

No, Florida law does not require you to carry insurance if you don’t own a vehicle. However, if you frequently borrow or rent cars, you should consider a non-owner car insurance policy. This provides liability protection when you’re driving a car you don’t own and helps you maintain a continuous coverage history, which can lead to lower rates when you do buy a car. Select Insurance Group can help you find a non-owner policy that fits your needs.

Secure Your Peace of Mind on Florida’s Roads

By now, you understand that Florida’s minimum auto insurance requirement—$10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL)—is just a starting point. These minimums keep you legal, but with high accident rates and rising costs, they rarely provide enough protection in a serious accident, leaving your personal assets vulnerable.

The difference between carrying the minimums and having comprehensive protection is the difference between financial risk and security. Your home, savings, and future earnings are what’s at stake when you’re underinsured.

At Select Insurance Group, we’ve spent over three decades helping Florida drivers find the right balance between affordable premiums and real protection. We shop more than 40 carriers to find competitive rates for coverage that truly secures your financial well-being, not just what the state requires. Our team knows Florida’s insurance landscape inside and out, and we’re ready to put that expertise to work for you.

Don’t wait until after an accident to find you’re underinsured. Get a personalized Florida auto insurance quote today and drive with the confidence that you’re truly covered when it matters most.